TSLA printing a nice wedgeThis here is a really nice wedge that Tesla is printing. I think the stock will range now for most of the year.

Without Corona, I am very sure, we would be at prices of over 1000 USD now, but as it is, the stock must range and stabilize for a while.

Then, at the end of 2020, we will either see a large pump, or a dump, and the later pumps.

This will of course highly depend on the economic situation and how the Corona crisis will develop until then.

Knowing Tesla, I wouldn't be surprised if it would dump again, just to kill many shorters again, who will then short again like crazy.

Then, the ensuing rally to 1000+ will again, as always, totally destroy them, hahahaha. Every time again, just too funny to watch.

In any case, this wedge is an excellent opportunity to enter a longterm trade.

Tslausd

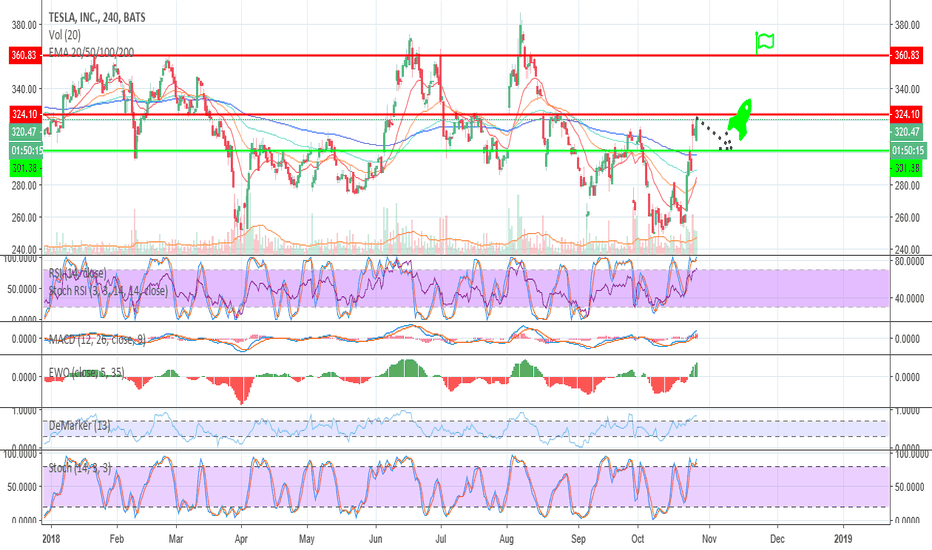

TSLA LONG SET UP ON PULLBACKGet READY FOR A ROCKET

A Peek Into Tesla's Price/Earnings Ratio

Looking into the current session, Tesla Inc. (NASDAQ: TSLA) is trading at $494.45, after a 5.64% drop. Over the past month, the stock decreased by 34.02%, but over the past year, it actually went up by 84.67%. With questionable short-term performance like this, and great long-term performance, long-term shareholders might want to start looking into the company's price-to-earnings ratio.Assuming that all other factors are held constant, this could present itself as an opportunity for shareholders

"SpaceX identified a valve motor on the second stage engine behaving not as expected and determined the safest and most expedient path to launch is to utilize the next second stage in line that was already at the Cape and ready for flight."

Only noobs are shorting TSLA here. It will go above 1000.First of all I like to emphasize how extremely happy I am about this rally.

The shorters really had it coming. The incredible amount of arrogance they displayed just had to be punished. And a severe punishment they did receive.

Now of course everyone is thinking that this here has been the top. However, if it would have been the top, the correction would have been much more severe.

Instead, we saw a correction pattern in a huge continued rally.

It really is very similar to the huge runup in 2013. Therefore I think we'll continue up above 1000, much to the dismay of the poor shorters, who are really poor now

in the truest sense of the word.

Anyone who doesn't understand why Tesla has this rally, why they are so disruptive, why they will grow much more, should really do some reading on disruptive

technologies and Kondratiev cycles. This company marks the beginning of a new era of rapid innovation. Tesla is much more than a car company. They build

solar arrays. They build energy storage batteries for renewable energy farms. They are also a software company. They are soon an autonomous carsharing fleet

company. They have the most advanced AI neuralnet, years ahead of anyone else. They have by far the biggest supercharger network. The lead to the other carmakers

who are struggling to even build the first generation Model S, is just INCREASING, not decreasing.

Tesla is going to change the world. It already is doing so. Anyone who doesn't understand that, should really do some proper research, and not only read CNBC clickbait news

headlines and FUD.

TAKE YOUR PROFITS END LEAVE WITHOUT LOOKING BACK!!Hi Everyone! Its been a while since my last post, so lets dive in to the point, without losing time!

So what we are seeing here is a parabolic move with hype will end in a big crash!! When we look at the fundamentals we are still not able to see PE ratio due to earnings being negative and the PB is close to 20. It is a crazy thing to see that an manufacturing company(automotive, energy etc., however you would want to categorization it),which would have a high capital cost, would have it self priced at 20 times it book value!!! I would have hoped other fundamental ratios would have been great while seeing these two so bad. However the quick ratio being at 0.7 and debt to equity not showing good signs as well i do not believe price movement represents the "current" value of tesla!

And if we take a look at the technical side of things.... We could see that the price has been increasing with dropping volume and the RSI is over stretched.I believe it is the perfect time to take profits and watch it fall. There might be a little more upper movement but it is not worth taking the risk since in the near future i believe the price will be lower than where it is.

As always this is not an financial advice , this is just a thought!

Stay Safe

💎 TESLA vs BTC - Projection price falling!Thumb UP👍 if you like this chart!

I took the BITFINEX:BTCUSD candle drop pattern in 2018 and applied it to NASDAQ:TSLA shares. It turned out that exactly the same drop will lead the company's price to its fair valuation in the range of $240-$210. Why this assessment???

The forward P/E is still more than 90!!! Thats incredible in motor vehicles field! And this is all assuming perfect execution, production capacity that does not exist yet, and that income from regulatory credits will stay the same. With this P/E investors should not expect a good return. Under these idealized assumptions rational investors could expect a decent return at a P/E of 12, so at a share price of $217 or less.

Write in comment how do you think what the fair price for TESLA Motors?

______________________________________________________________________________________________

Subscribe to my channel and receive fruitful recommendation regularly!

😎 Here just clear and accurate ideas🎯! Max profit idea in crypto - 20%(BTC), Max profit in stock - 40%. Total profit more 300%. Trade my own funds. Consult privately🎩. Link to table with summary results: clck.ru

TSLA ultra longterm predictionChamath Palihatipiyah formulated it perfectly: People who bet against this company are incredibly short sighted. They don't see the bigger picture here.

Tesla is a company like Amazon in the early 2000s.

Tesla is like Bitcoin 8 years ago.

It is one of the companies with the greatest upside potential ever.

The shorters get caught up in all the FUD stories, proudly sponsored by Big Oil, old Auto, and anti Tesla shorters like the idiot Jim Chanos.

They start to believe all the FUD.

If I would have believed all the FUD about bitcoin, I would never have bought my first bitcoin back in 2013.

I gained financial freedem by NOT listening to other people, especially not the damn news media. They are just a propaganda tool of the old industries, who are desperate, because they

know deep down that Tesla will succeed and destroy them.

We are now still in the second phase, the "then they fight you" phase.

But all new disruptive technologies win in the end, ALWAYS !!!!

So Tesla will see highs in the coming 10-15 years, that we cannot even imagine yet.

Think Amazon's growth after 2000.

This is a company by a man who WANTS TO COLONIZE MARS, for god's sake.

How people can be so short sighted, I will never understand.

If you see the bigger picture here, then you know that TSLA is going to succeed and become one of the biggest automakers worldwide by 2030.

And by then, maybe we'll even have the mars colony thanks to Elon Musks SpaceX, and have specially adapted Teslas also driving on Mars, hehe.

TSLA - Short Swing TradeTSLA has been in a range and a pattern is repeating itself.

R/R: 2.44

Duration: Days-Weeks

Tip:

For more confidence wait for signs of price weakness.

Good opportunities for better entries, more confirmation and better R/R.

Good luck and be patient.

Remember to have small risk, (I usually stick to 0.1-0.5%) It's better to be comfortable taking a loss than not taking it at all.

This is not a financial advise, just expressing my own opinion.

Leave a comment or a like if you agree.

Naturex

TESLA STOCK OPPORTUNITY!Tesla, stock has been retracing lately and it is one of the companies which I have a believe in the future so its time to check the charts. Tesla looks like it getting back on track and wants to test 350+ USD prices however I think a short-mid term retrace is coming and we are going to test 300 USD as our support area after which we should take off and go to 350 USD+ area where if we break 400 USD resistance then we might really be taking off!

Good Luck, Traders! #moon #mooncommunity #turtlestyletrading ;)

Be a turtle my friend © Farhad Jafarov

TSLA Short; Weekly Close under Heffae Clouds - MTF Analysis TSLA is closing underneath the Weekly Cloud bottom for the first time since inception.

I believe this means more than consolidation, as the path-fitting has given extremely valid signals on bottoms running up the Monthly so far.

This is an extremely strong signal given the prior path validity and being a longer time frame in agreement with repeated signals from shorter timeframes on Heffae Clouds.

The Monthly provides a target for closing short at 217:

Hybrid Timeframe is showing resistance at 285.

Ideal Entry: 295-300

Target: 218

TSLA Analysis pt.2Elliot Wave analysis of TSLA stock pt.2, this chart is based solely on technicals and not fundamentals.

This is pt.2 of my Elliot Wave analysis, if you haven't seen pt.1 I would implore you to check it out below. Let's get started. There are 2 major scenarios at play, since both scenarios have similiar substructures, there have been 2 analysis' made; one bearish and one bullish . We will know soon since we are at a decision point. In this scenario we have already finished our wave 2 correction to 0.50% and are now on wave (4) of our wave 3. There is much confluence at 2.618x, the path drawn will hold valid if we continue our ascent upwards. It is a safer bet to enter on the the breakout since we are very close to it there is no point in risking entering below the resistance, this will save you sitting in a position waiting for it to move.

STOP/BUY: $405

S/L after STOP/BUY triggered: $270

T/P: $870

One of these counts will be invalidated in the coming weeks so I will update both with which direction we are most likely to continue.

TSLA Analysis pt.1Elliot Wave analysis of TSLA stock pt.1, this chart is based solely on technicals and not fundamentals (Besides me noting that Elon is getting euphoric)

It seems we might be in a Expanding flat correction, where B wave goes above A wave by 1.236 - 1.382%, the substructure for this is a bit hard to count since it stopped at 1.618x of the preceding impulse wave, however this can either be a zig-zag to the upside (5-3-5) or a (2) of 3 (5-3-5). We are at a decision point on the monthly so price action should show us the right direction fairly soon, if we fail to break and close above the 1.382% this scenario is more likely; especially if we start to make New Structure Lows and Lower Highs. You can start counting along if you are familiar in EWT - This would be a 5 wave descent (3-3-5). Our target zone would be somewhere in the area of $150.

Entry: $340-$390

S/L: $420

T/P: $150