Tyson Foods TSN Herd Mentality Bounce on Bottom Trend LineHello Traders,

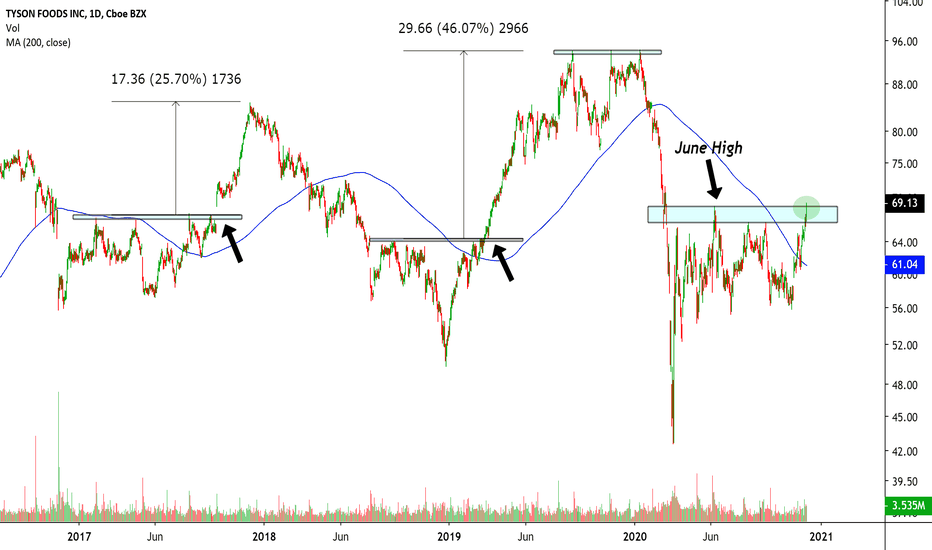

Here is my chart for Tyson Foods TSN. You can see the price is bouncing around inside a rising wedge and is about to touch the bottom trendline. The RSI is oversold with bull div. I expect a generic herd mentality bounce on the trendline with a target being the top trend line.

Lets see.

TSN

Tyson Foods (TSN) Analysis Company Overview:

Tyson Foods, a global leader in meat production and distribution, is well-positioned to benefit as the economy shows signs of slowing. In times of economic uncertainty, investors often turn to consumer staples like Tyson Foods as a defensive play due to their steady demand and generous dividends.

Key Highlights:

Economic Hedge: As fears of a hard landing grow, Tyson Foods stands out as a safe investment option. The company's products remain in demand even during economic downturns, making it a reliable choice for risk-averse investors.

Insider Confidence: Significant insider activity, including stock accumulation by Congress members in 2024, signals strong confidence in the company's future performance. Insiders with an informational edge are betting on Tyson’s continued success.

Dividend Growth: Tyson Foods' CEO recently announced an increase in the company’s quarterly dividend, with the 2024 dividend expected to be 2% higher than in 2023. This dividend boost reflects the board's confidence in the company’s financial health and growth prospects.

Investment Outlook:

Bullish Outlook: We are bullish on NYSE:TSN above the $54.00-$55.00 range.

Upside Potential: With an upside target of $85.00-$86.00, Tyson Foods offers a combination of defensive stability, income generation through dividends, and potential for capital appreciation, making it an attractive investment in uncertain economic times.

📈🍗 Tyson Foods—feeding your portfolio with dividends and growth potential! #TSN #Dividends 🍗💼

Just look for what is outperforming the S&P 500The market started to rotate in early July to more conservative sectors and AMEX:DBA is showing that agricultural commodities have been outperforming stocks.

The ratio SP:SPX / AMEX:DBA made a lower high starting August and then just days later broke a key support level.

Then the AMEX:DBA broke above a downward trendline.

Is this the start of new trend? At least it is in the short term.

The are some stocks in the food industry that are looking good like NYSE:TSN and $INGR.

Even NYSE:PPT is doing all time highs after a 20-year base!

Tyson Foods Beats Profit Estimates After Earnings ReportTyson Foods, ( NYSE:TSN ) the largest US meat company by sales, has surpassed Wall Street expectations for second-quarter profit as it begins to reduce costs by shutting some chicken processing plants. The company's adjusted earnings of 62 cents per share for the second quarter were higher than analysts' average estimate of 39 cents. However, Tyson ( NYSE:TSN ) has been struggling with slowing demand over the last few quarters. Price-conscious customers cut back on expensive purchases and look for affordable options amid high food prices and borrowing costs.

Tyson's second-quarter net sales fell 0.5% to $13.07 billion, compared with estimates of $13.16 billion. Sales in the chicken segment, which struggled with excess supply during 2023, were down 8.3% in the quarter, even though prices fell 2.1%. Volumes dropped by 6.1%. However, volumes at the beef segment, its largest, grew for the first time in five quarters, logging a 2.8% increase. The company's pork segment also saw volumes increase by 2.9%.

The operating margin in Tyson's beef business dropped by 0.7% in the quarter, as the business has grappled with limited U.S. cattle supplies since last year. The company expects total sales to be flat in fiscal 2024, compared with the previous year's $52.88 billion.

Adjusted net income in the three months ended March 30 was 62 cents a share, exceeding even the highest of analyst estimates compiled by Bloomberg. Tyson ( NYSE:TSN ) is now making $1.4 billion to $1.8 billion in operating income in fiscal 2024, up from a previous forecast range between $1 billion and $1.5 billion. Most of Tyson's second-quarter operating profits came from its prepared foods business.

Technical Outlook

Tyson ( NYSE:TSN ) Closed Friday's trading session on a clean slate up by 1.76% with a Relative Strength Index (RSI) of 67.97 which is perfect for a good start for the week.

GIS weekly Cup formation progress LONGGIS a consumer staples is set up long and is a good defensive play for recession or black swan

events. The idea is on the chart. I am long since the first of the year. Adding for small dips

on the daily or 180 minute chart. Food is about as basic as it gets. GIS is a market leader.

TSN idea also. What about McDonalds?

Long Tyson TSNThis is a weird one for me. Saw a x post about them heavily investing in bug proteins and had to check the chart out. Monster megaphone pattern. Beautiful chart. F the bugs but have to punt. Buying some here for the culture. At this time I am allocating most of my capitol now to btc and high beta crypto shit coins and stocks ill probably lose everything on....but this is to good a long not to get in on. Not advise, good luck.

TSN recovering from drop and pullback after Earning Miss LONGTSN is shown here on a 4H Chart. It upended for a month into earnings and then

disappointed with a miss. Following a drop from the miss, it has struggled to

regain its price level. At this point, price has crossed over the POC line on the

volume profile suggesting a preponderance of selling pressure Likewise in confluence

price has crossed over the mean basis line of the Bollinger bands while the RS

indicator shows lines at above the 50 level. I see this as suitable for a long entry

while expecting the price to gradually more up as traders consider whether to take

a position after the retrace from the earnings miss. While this is not in a glamorous or

hot sector, the food industry seems well suited to grind out some profits while

the general market recalibrates and corrects.

TSN ShortEarly morning TSN will release quarterly earnings results. Friday before the market closed I saw some bearish contract flows on the 18 Nov 2022 expiry date for this underlying stock. Personally, I am not a big fan of playing earnings for the short term. Based on my quantitative analysis model I found that TSN stock is now at one of the lowest volatility levels. Earnings calls could increase volatility and stock could go either direction. With a tight stop, I think a bearish case is possible.

$NVDA Bearish candlesticks pattern targeting 650 620Shooting star or big doji its bearish pattern on daily candles - Bearish signal can be triggered below 720 - Overbought indicators - Expected Split at 20 Jul so its risky trade to short prior to the split process but technically its overbought and can be corrected to the level of previous major breakout levels. cancel short idea above ATH Only!

Tyson Foods $TSN breaksout, but I'm not convincedNYSE:TSN looks great, is clearly in an uptrend breaking out of a second base after beating EPS estimates last week. The thing is that I don't see volume action, or a good follow-through. Still, I keep my eye on this one. Industrials have been leading the market for the last weeks and NYSE:TSN is one of the leaders of the Food Production Industry, is rank 3th by IBD, and has a Relative Strenght Rating of 69. Ussually I'd like it better if it had a higher number regarding its relative strength.

I'd like to add that I'm watching NYSE:DAR and have a small position in NYSE:INGR . All leaders in the Food Industry.