YRI : Long SetupThere are 3 reasons why I chose YRI Stock :

I am looking forward to a downward movement in USDCAD . (More explanation on Related Ideas.)

I also follow up the stocks related to the precious metal sector traded in the S&P 500 Index .

I think that precious metals are discounted according to the World indices.This is the most important reason. (More explanation on Related

Ideas.)

Technically, this chart is suitable for long position too.

Parameters

Position Size : I recommend a small portfolio weight just in case.

Risk/Reward Ratio : 1/3.49

Stop-Loss : 4.16

Goal : 6.36

S&P/TSX Composite

Exchange Income Fund: One of my Top Monthly Income StocksEIF is a rare stock where you get decent capital appreciation alongside passive income. Not only are these two factors attractive in itself, but they have also increased their dividend virtually every year for ages with no decreases.

Their diversified portfolio and continued record revenues makes this stock an amazing buy and buy off dips. There can be some pullbacks on dividend stocks so you never want to throw "in" all your cash at once.

Exchange Income Fund (EIF) and A&W Royalty (AW.UN) are two of my top monthly dividend stocks that have sound technicals and will continue to provide investors with strong value over the long-term. In my opinion these two aforementioned picks represent some of the top monthly dividend stocks both in the TSX and NYSE/NASDAQ; strong charts and a remarkable dividend hike history is exactly what investors should be looking at for passive income.

If you look around the market, monthly dividend stocks are very rare. Its even more rare to find monthly dividend-paying stocks that actually have "nice charts": these two are my favourites.

- zSplit

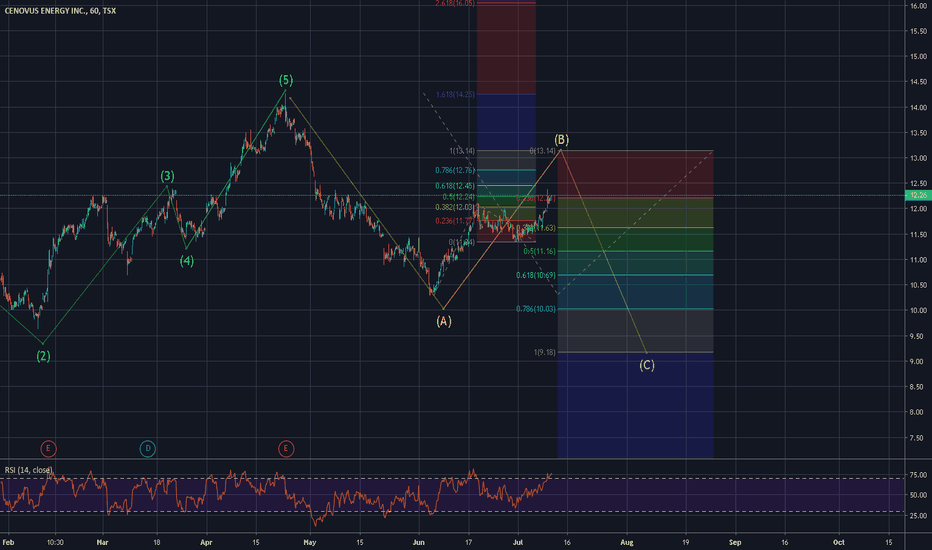

Charlotte's Web Holdings (TSX: CWEB.TO) Dec 12, 2019Currently the entire cannabinoid industry is in a downturn. The sky high valuations that these companies have been commanding past few months have clashed with reality, leaving investors scrambling for cover.

The whole premise for the high valuations was the high growth rate. However, as recent events in Canada show, legitimate cannabinoid companies still cannot compete with the black market given the high taxes and the costs of compliance with regulatory requirements. Furthermore, with the government allowing private citizens to grow cannabis, a chunk of the retail market has vanished for these big players. Now the competition among the bigger players is among niche and value added products.

Coming to CWEB, it's revenue has grown in the double digits but so has the costs. Currently, the stock commands a PE of 213 (Yahoo Finance), which would theoretically take an investor more than 2 centuries to recoup his/her investment (assuming no growth rate). Critics may point out the impressive rate of growth, but the key question to ask: Is the company generating any money?

A quick glance at the Cash Flow statement reveals that although CF was positive from FY17 to FY18; however in the TTM the company has spent 44,000K from its reserves. Furthermore, in the company's short life span, FCF was positive only in 2017.

Based on the analysis, CWEB would not find a space in my personal portfolio. It seems that the company is funding it's growth from shareholder equity. In the absence of shareholders pouring in money coupled with a negative FCF, the company would find it challenging to sustain its growth.

Possible Cup & Handle Formation (BULLISH) TSX:RNX - Full Pattern formation yet to be confirmed (Risky)

- Chart is currently sitting at a sloppy head and shoulders top (Bearish pattern)

- wait for head and shoulders top pattern to fail before considering taking a position

Target: $0.51

Buy Range: $0.37-$0.42

I am not a professional

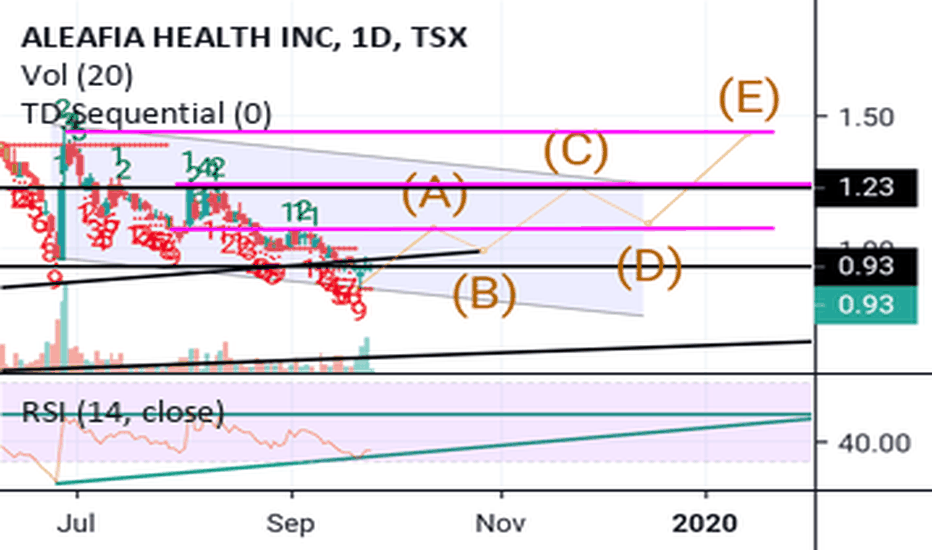

Possible scenario for ALEFThis is roughly what I am looking at right now. A lower low would invalidate this.

Time for an Aleafia bounce?Aleafia looks like it is ready for a bounce at the very least.

The RSI is also forming an ascending triangle.

Easy risk to reward on this one. Either it breaks out from a $1 entry with a target around $1.50 or it breaks down from the $1 level, invalidating this trade idea.

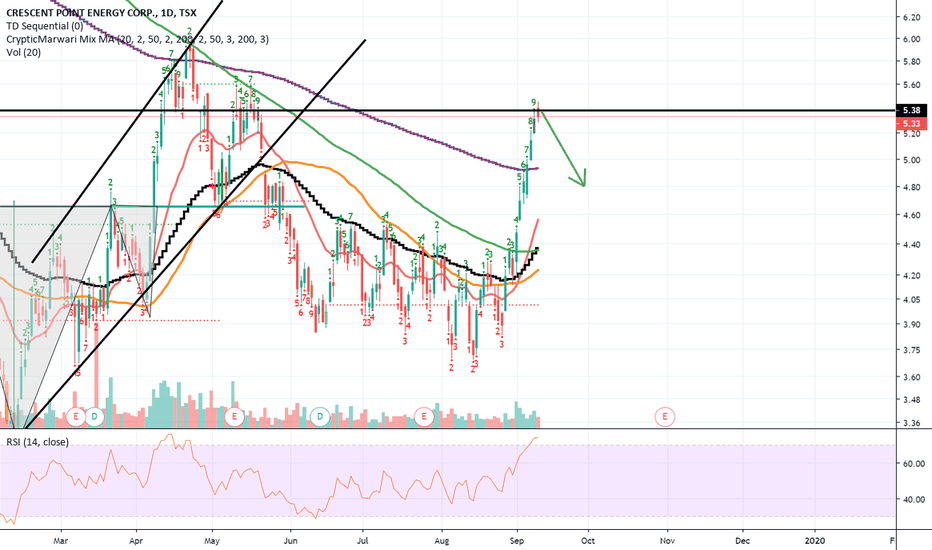

Short term pullback on Crescent Point Energy likelyDaily 9 on the TD Sequential. CPG has gone up exponentially so I am expecting a pullback at the very least the prior support level. A daily close above 5.6 would invalidate this trade idea.

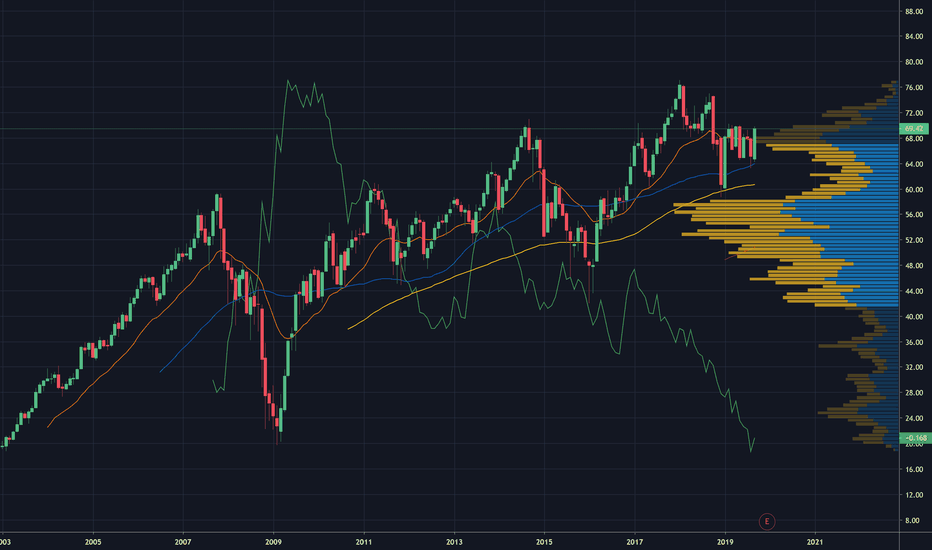

SRU.UN Monitoring LongWeekly candle blew by support indicating more down movement to come.

Monitoring support zone outlined. Great company anchored by Walmart and a great group of holdings.

Upside potential includes massive apartment tower currently under construction in northern GTA. Superb management/ leadership/ company.

waiting patiently to buy.

I JUST LOVE A MONTHLY DIVIDENDgonna park some of my money in this gem with strong growth, this is my type of real estate investing

TSX: Slow Decline; CDN Dollar To Rise Noticeably through 2020As we continue to slowly tip-toe in a global recession likely sometime in 2020, with a bear market in the stock market set to happen at anytime within the next year, the TSX will only follow suit. As always, nothing goes up and down in a linear straight line. There will always be fake outs for bulls and bears, but the overall trend of markets around the world will be in the decline - even if we re-test ATHs at some point.

The TSX. compared to the USA indice counterparts are typically delayed by 3-6 months from troughing out, and losses are typically muted somewhat (comparatively speaking).

As history takes us back to 2008, the USA typically sets the bar between Canada and the USA for cutting interest rates. Because the USA cuts rates typically 2-4 quarters before Canada, usually the DXY falls, while the CXY rises. I would not be surprised before the end of Q1 2020 if the Canadian Dollar is back near 90 cents US. By Q4 2020 or Q1 2021 the CXY may be back on par and potentially worth more (again, temporarily) before falling in 2022.

As I have said in many of my ideas: long gold, long silver and buy and hold weed stocks (for now) as they are a sector guaranteed to rebound in the near-term. Which ones do I recommend? CWEB, VGW and Planet 13 for direct players; ENW and GRWG for auxiliary players. Always choose your entries wisely and never chase break-outs; wait for pullbacks.

It is important to hedge accordingly. The overall market has overextended and I would refrain from investing in the big stocks in the Dow, SP500 and Nas100. Pick your entries accordingly and I recommend 50-60% of your portfolio should encompass gold and silver with an additional 20% in weed/weed auxiliaries and 20% held for any potential entries on stocks set to rebound or for shorting leveraged funds like the HUV and TVIX.

- zSplit

VFF Bull Continuation Possible Soon VFF has pulled back in two legs sideways to down after a strong bull rally. The bulls have a 60% chance of a second bull leg up before there is a strong bear reversal. Last week broke below the 14 first leg down. This is where the bears need to be the strongest. This is also where strong bulls (and bears) will start looking to buy for trend continuation. However there is not yet a strong buy setup. If this week closes on its high, it could signal the end of the correction and soon enter a bull channel phase for a second leg up.

There are many bull gaps below, and the rally contained strong buying pressure. Furthermore, the sell off has not been all that strong. Last week was one of the strongest bear bars, and created a gap around 14. Since there are no previous open bear gaps, this one will likely be filled as well, and may act as an exhaustion gap. The bears need to keep the gap open and create strong follow through selling to increase their probability to 50% for a test of the bull breakout.

To learn more about how to determine the directional probability and how to structure a trade based on this with a positive traders equation, please see below.

If you found this helpful please like! Feel free to comment or ask questions.