TTD Swing Trade Plan – 2025-06-06🐻 TTD Swing Trade Plan – 2025-06-06

Bias: Moderately Bearish

Timeframe: 5–7 trading days

Catalysts: Weak daily trend, below EMAs, oversold conditions may delay move

Trade Type: Naked put option

🧠 Model Summary Table

Model Bias Strategy Strike Premium Target(s) Stop-Loss Confidence

Grok Moderately Bearish $71 PUT $1.00 +50% –25% 75%

Claude Moderately Bearish $67 PUT $0.93 $2.50 $0.65 75%

Llama Moderately Bearish $67 PUT $0.94 $1.13 $0.47 72%

Gemini Moderately Bullish $75 CALL $1.04 $1.55 / $2.10 $0.50 70%

DeepSeek Moderately Bullish $75 CALL $1.06 $1.60 $0.75 75%

✅ Consensus: Short-term oversold, but longer-term bias remains bearish

⚠️ Disagreements: Bounce vs. continuation; call vs. put structure

🔍 Technical & Sentiment Summary

Trend: Daily/weekly charts bearish (below EMAs); 15m shows divergence

Support Zones: $70.34–$70.68

Resistance / Max Pain: $73.90 and $75

Volatility: VIX at 17.6 – supports risk-taking

News: Neutral to slightly negative; no strong catalyst noted

✅ Final Trade Setup

Parameter Value

Instrument TTD

Strategy PUT (SHORT)

Strike $67

Expiry 2025-06-20

Entry Price $0.94

Profit Target $1.40

Stop Loss $0.65

Size 1 contract

Entry Timing At open

Confidence 75%

💡 Rationale: Daily bearish structure supported by three models. Downside continuation setup if oversold bounce fails to hold $71.

⚠️ Key Risks & Considerations

Short-term bounce may occur from 15m bullish divergence

Max Pain at $75 may cause gravitational upward drift

Liquidity Note: $67 put has low OI and volume → wider spreads

Theta decay increases rapidly next week — act fast if trade stalls

Unexpected news could invalidate bearish setup quickly

📊 TRADE DETAILS SNAPSHOT

🎯 Instrument: TTD

🔀 Direction: PUT (SHORT)

🎯 Strike: $67.00

💵 Entry Price: $0.94

🎯 Profit Target: $1.40

🛑 Stop Loss: $0.65

📅 Expiry: 2025-06-20

📏 Size: 1 contract

📈 Confidence: 75%

⏰ Entry Timing: Open

🕒 Signal Time: 2025-06-06 13:13:23 EDT

TTD

Long on $TTD ; It should test 75-80 range- Many good news have come for NASDAQ:TTD in the last 2 weeks and one of that is Judge ruling against Google Ad business which might lead to relaxed rules by Google which will help other advertisers expand their TAM

- Netflix ads should allow DSPs like NASDAQ:TTD to get more investment dollars flowing through their platform.

- EPS is growing massively in FY 2027/2028.

- I'm not sure if we could get all time high before 2027 but firmly believe NASDAQ:TTD should test 200 weekly SMA.

$TTD Breakout After Earnings | Gapped Up w/ Volume Surge📊 Summary for TradingView Post:

NASDAQ:TTD exploded +11% post-earnings, gapping above key resistance and closing strong with massive volume.

Price cleared multiple supply zones with conviction, now sitting above $79 with eyes on $82.74 and $86.43.

Buyers showed up heavy. This is no random push—structure confirms strength.

Still bullish unless it fills the gap below. Watching for continuation or controlled retest.

TTD The Trade Desk Options Ahead of EarningsIf you haven`t bought TTD before the recent rally:

Now analyzing the options chain and the chart patterns of TTD The Trade Desk prior to the earnings report this week,

I would consider purchasing the 55usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $6.70.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Google Ruling Could Be Very Bullish for TTDA U.S. judge has found Google guilty of illegally monopolizing the digital advertising technology markets. The monopolization of both the demand and supply sides has been a long-standing concern for the rest of the digital advertising sector.

This ruling may significantly benefit The Trade Desk (TTD), as it operates as an independent demand-side platform. The digital advertising market is projected to exceed $600 billion in 2025, and Google currently believed to be controls nearly 30% of that. Even a 5% slip in Google’s market share, with TTD capturing just 10% of that shift, could nearly double TTD's revenue. As a result, this ruling is can be considered very bullish for TTD, both in the medium and long term.

Technically, TTD recently tested the $40 level, a key support that has held since Q4 of 2020, indicating the stock is currently in a strong demand zone. With this news, the likelihood of that support holding and a bullish reversal increases.

Analyst consensus reflects an 85.8% upside potential. If the bullish scenario plays out, the horizontal level at $60 and the 200-day moving average could serve as key medium-term targets. From current levels to the 200-day SMA, the potential return is close to 50%.

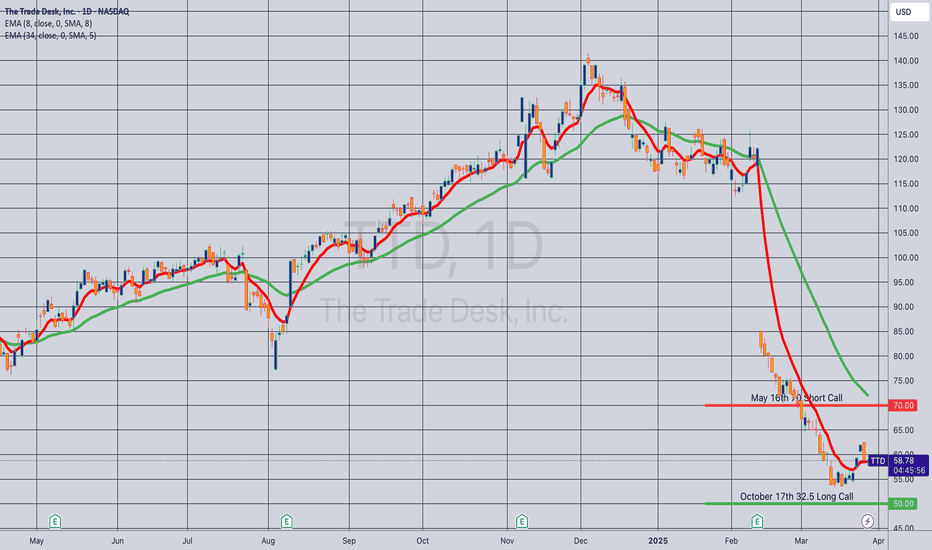

Opening (IRA): TTD May 16th -70C/October 17th 32.5C LCD*... for a 26.10 debit.

Comments: At or near 52-week lows. Buying the back month 90 delta and selling the front month that pays for all of the extrinsic in the long. (The October 17th 32.5C is shown at the 50 strike to fit it on the chart).

Metrics:

Buying Power Effect: 26.10 debit

Break Even: 58.60/share

Max Profit: 11.40

ROC at Max: 43.7%

10% Max: 2.61

ROC at 10% Max: 10.0%

In this particular case, I'll look to take profit at 110% of what I put it on for and/or roll out the short call if it hits 50% max. Earnings are on 5/14, so my preference would be to take it off before then ... .

* -- Long Call Diagonal.

$TTD to go below $60- Investors were paying too much for growth in NASDAQ:TTD

- It operates in a very competitive space.

- Leadership is solid however eps growth and gaap eps tells a different story. EPS growth is impressive but gaap eps is terrible. Stock based comp remain consistent but somehow gaap eps isn't growing as fast as non-gaap eps.

- Nonetheless, here's fair value for NASDAQ:TTD

Year | 2025 | 2026 | 2027 | 2028

EPS | 1.79 | 2.21 | 2.85 | 3.89

EPS growth | 9.54% | 23.13% | 28.92% | 36.66%

For eps growth of 20%+ and company with a moat. Fair forward EPS is 30

Year | 2025 | 2026 | 2027 | 2028

Bear Case ( p/e 20 ) | $35 | $44 | $57 | $77

Base Case (p/e 30 ) | $53.7 | $66.3 | 85.5 | $116

Bull Case (p/e 35 ) | $62 | $77 | $99 | $136

Idea is to buy close to fair value and hold it for period when there is optimism in the market or euphoria and/or valuation expansion where stock is assigned higher forward p/e multiple.

For me, NASDAQ:TTD is a buy under $65. However, I have started with a starter position at 80s because you many times good stocks bottom above its fair value.

I plan to build a position in increments because you never know how much stock will undercut on pessimism. However, the above intrinsic value based on EPS should help to identify the ranges

Undervalued Stock TTD The Trade Desk buy IdeaDo not believe me when I say this stock is undervalued, do your own research.

Do not believe me when I say this stock has shown very high properbility for good upside moves from around end of March until mid of August for the last 10 years, do your own research.

Good upmove today, I am in.

Leave a like or comment, hit the bell, eat some birthday cake, and love what you are doing!

Cheers!

TTD, where do we go from here?A significant sell-off in The Trade Desk (TTD) followed its earnings report, driving the price toward a critical technical zone. The 76.45 - 80.16 range has historically acted as a strong support area, with multiple price interactions suggesting institutional buying interest in the past.

If the price holds this zone as support and RSI begins to recover, a potential bounce toward the 96.50 resistance level could occur. Price action at in this zone will be key—if buyers step in, a short-term rebound may follow. However, a break below 76 with rising volume could indicate further downside, potentially leading to lower support levels.

Disclaimer:

This analysis is for educational purposes only and should not be considered financial advice. Trading and investing involve risk, and independent research or consultation with a professional is recommended before making any financial decisions.

TTD The Trade Desk Options Ahead of EarningsIf you haven`t bought the dip on TTD:

Now analyzing the options chain and the chart patterns of TTD The Trade Desk prior to the earnings report this week,

I would consider purchasing the 87usd strike price Calls with

an expiration date of 2024-8-16,

for a premium of approximately $4.85.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Trade Desk Forecasts Robust Q3 Revenue on Strong Ad DemandThe Trade Desk ( NASDAQ:TTD ), a leading player in the ad tech industry, has set a bullish tone for the third quarter of 2024, forecasting revenue that surpasses analysts' expectations. The company projected at least $618 million in revenue, significantly higher than the average estimate of $604.2 million, according to data from LSEG. This optimistic outlook has driven Trade Desk's shares up by 5% in extended trading.

Trade Desk's strong performance is fueled by rising demand for automated ad-buying technologies, particularly from connected TV companies. The company’s platform, which offers advertisers access to an extensive network of publishers and media partners, allows for highly precise targeting of ad campaigns. This capability is becoming increasingly valuable as the digital advertising landscape evolves.

A key factor behind Trade Desk's continued success is its leadership in developing Unified ID 2 (UID2), a privacy-focused advertising identifier designed to replace third-party cookies. UID2 enables targeted advertising without compromising user privacy, making it an attractive solution in a market where privacy concerns are paramount.

The second quarter of 2024 saw several major companies, including FOX, Roku, and SiriusXM, adopting UID2, further solidifying Trade Desk’s dominant position in the industry. Additionally, Netflix announced its intention to expand its ad-buying capabilities by including Trade Desk as one of its primary programmatic partners, a significant endorsement of the platform’s capabilities.

With 2024 being an election year in the United States, political advertisers are expected to leverage Trade Desk’s sophisticated ad-buying tools as they ramp up their campaigns. This, combined with the company’s strong data integration and widespread adoption of UID2, positions Trade Desk to maintain its leadership in the digital advertising sector.

In the second quarter, Trade Desk ( NASDAQ:TTD ) reported revenue of $585 million, exceeding estimates of $577.8 million. The company also delivered an adjusted earnings per share of 39 cents, beating analysts' expectations of 35 cents.

Technical Outlook

As of the current writing, Trade Desk ( NASDAQ:TTD ) has experienced an 8.61% increase, exhibiting a bullish Relative Strength Index (RSI) of 56.29. Despite the prevailing market downturn, this indicates promising potential for further growth. Notably, the daily price chart illustrates a golden cross pattern which promptly instigated an 8.76% surge. It is prudent to closely monitor the pivot point in response to any significant fundamental developments.

As Trade Desk continues to innovate and expand its influence across the digital advertising landscape, its future looks promising. Investors and advertisers alike are keeping a close eye on the company as it navigates the complexities of a rapidly changing industry.

Earnings Watch: August 7th - 8thInvestors, mark your calendars! A mix of high-profile companies are set to report their quarterly results on Wednesday and Thursday. Let's take a quick dive into what's expected:

Wednesday, August 7th

Dutch Bros (BROS ☕)

Expected to post an EPS of 0.13 and revenue of 316.8M, Dutch Bros holds a beat rate of 63%. Last year, they reported an EPS of 0.13 and revenue of 249.87M.

Robinhood (HOOD 📈)

The fintech company is set to announce an EPS of 0.15 and revenue of 643.33M. With a beat rate of 66%, can Robinhood exceed expectations? Last year, they reported an EPS of 0.03 and revenue of 486M.

Fastly (FSLY 🌐)

Expected to post an EPS of -0.08 and revenue of 131M, Fastly has a mixed outlook with a beat rate of 55%. Last year, they reported an EPS of -0.04 and revenue of 122.83M.

Bumble (BMBL 💕)

Bumble is anticipated to deliver an EPS of 0.13 and revenue of 273.12M. With a beat rate of 50%, can Bumble surpass these forecasts? Last year, they reported an EPS of 0.05 and revenue of 259.73M.

HubSpot (HUBS 💼)

The company is set to report an EPS of 1.63 and revenue of 619.43M. With a strong beat rate of 85%, will HubSpot impress the market? Last year, they delivered an EPS of 1.34 and revenue of 529.13M.

Beyond Meat (BYND 🍔)

Expected to post an EPS of -0.51 and revenue of 87.8M, Beyond Meat has a mixed outlook with a beat rate of 23%. Last year, they reported an EPS of -0.83 and revenue of 102.14M.

Monster Beverage (MNST 🥤)

The beverage company is anticipated to report an EPS of 0.45 and revenue of 2.01B. With a beat rate of 55%, will Monster manage to impress the market? Last year, they delivered an EPS of 0.39 and revenue of 1.87B.

AppLovin (APP 📱)

AppLovin is projected to deliver an EPS of 0.75 and revenue of 1.08B. Last year, they reported an EPS of 0.22 and revenue of 750.16M.

Thursday, August 8th

Eli Lilly (LLY 💊)

The healthcare giant is set to announce an EPS of 2.70 and revenue of 9.94B. With a beat rate of 71%, can Eli Lilly continue to exceed expectations? Last year, they reported an EPS of 2.11 and revenue of 8.31B.

Datadog (DDOG 🐶)

Expected to post an EPS of 0.37 and revenue of 624.88M, Datadog holds a beat rate of 78%. Last year, they reported an EPS of 0.36 and revenue of 509.46M.

Kohl's (KSS 🛒)

The retailer is anticipated to deliver an EPS of 0.48 and revenue of 3.62B. With a beat rate of 73%, will Kohl's surpass these forecasts? Last year, they reported an EPS of 0.52 and revenue of 3.89B.

Under Armour (UAA 👟)

Under Armour is projected to deliver an EPS of -0.08 and revenue of 1.14B. Last year, they reported an EPS of 0.02 and revenue of 1.31B.

SoundHound (SOUN 🎤)

The AI company is set to announce an EPS of -0.09 and revenue of 13.08M. With a beat rate of 55%, can SoundHound impress the market? Last year, they reported an EPS of -0.10 and revenue of 8.75M.

Unity (U 🎮)

Unity is expected to report an EPS of -0.42 and revenue of 439.45M. With a beat rate of 40%, will Unity manage to meet expectations? Last year, they delivered an EPS of -0.51 and revenue of 533.47M.

Dropbox (DBX 📦)

Dropbox is anticipated to deliver an EPS of 0.52 and revenue of 629.81M. With a beat rate of 84%, investors are keen to see if they can maintain their streak. Last year, they reported an EPS of 0.51 and revenue of 622.50M.

Trade Desk (TTD 📊)

The Trade Desk is projected to deliver an EPS of 0.35 and revenue of 577.79M. With a beat rate of 60%, can they exceed expectations? Last year, they reported an EPS of 0.28 and revenue of 464.25M.

Expedia (EXPE 🌍)

Expected to post an EPS of 3.06 and revenue of 3.53B, Expedia has a beat rate of 55%. Last year, they reported an EPS of 2.89 and revenue of 3.35B.

Gilead Sciences (GILD 💉)

Gilead is set to announce an EPS of 1.60 and revenue of 6.71B. With a beat rate of 68%, can they continue to exceed expectations? Last year, they delivered an EPS of 1.34 and revenue of 6.59B.

🔍 As these giants reveal their financial health, it's not just about the numbers but also the story they tell about the consumer market and economic trends. Keep your portfolios ready for any surprises!

#EarningsSeason #StockMarket #InvestmentInsights

TTD The Trade Desk Options Ahead of EarningsIf you haven`t bought TTD before the previous earnings:

Then analyzing the options chain and the chart patterns of TTD The Trade Desk prior to the earnings report this week,

I would consider purchasing the 90usd strike price Puts with

an expiration date of 2024-6-21,

for a premium of approximately $5.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

📈 Bullish Outlook on The Trade Desk (TTD) 🚀🔍 Analysis:

Industry Resurgence: NASDAQ:TTD operates in the digital advertising sector, poised for growth in 2024.

Strong Forecasts: Q1 2024 forecasts predict a robust 25% year-over-year revenue increase.

Investment in Innovation: TTD's significant investment of $411 million in R&D in 2023 highlights its commitment to innovation.

💼 Trade Plan:

Entry: Consider entry above the $68.00-$70.00 range, signaling bullish sentiment.

Upside Target: Aim for profits in the range of $140.00-$145.00, reflecting confidence in TTD's growth potential.

Risk Management: Set stop-loss levels to manage downside risk and protect profits.

📈 Note: Monitor market conditions and company developments for optimal trade execution. Stay informed about industry trends and news impacting TTD's performance. #TTD #Bullish 🚀

TTD The Trade Desk Options Ahead of EarningsIf you haven`t sold TTD ahead of the previous earnings:

Then analyzing the options chain and the chart patterns of TTD The Trade Desk prior to the earnings report this week,

I would consider purchasing the 75usd strike price Calls with

an expiration date of 2024-2-16,

for a premium of approximately $4.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.