Turkish-lira

ridethepig | TRY Capitulating...The struggle for democracy is being carried out and as long as Erdogan remains at the helm there is only one direction for TRY. Autocrats are typically sticky in nature and difficult to remove, the attack should first be aimed at the currency which will be the base of the capitulation. Attacking the 7.8 will break local bank and looks imminent as markets receive the USD via safe haven flows. Example:

After the technical break of the resistance the swing formation seems to be self fulfilling. So, according to the plan we attacked immediately and that is now clear in the outflows by...

If you wish to undermine democracy; you tend to try to blow up the foundations of capitalism. The natural restructuring of markets will always follow automatically and hence it is only a matter of time before we see 7.80 and Turkish banks capitulating. After Erdogan, the IMF bailouts will have different possibilities. Turkey's plan can be seen at its clearest now that fears of coronavirus have coupled alongside the Saudi / Russia oil action. Remember, Turkey is an importer of Oil ... so with Oil now flirting with a break towards $20 (see diagram) the logical development will be to destroy the highs in USDTRY.

Very simple. Continue to work longs on the first dip you see. Thanks as usual for keeping the likes and comments coming, jump into the discussion with your views on TRY!

USDTRY is near Buy Zone!The price is near the Support/Resistance Zone.

We can open Buy if daily candle will close above.

Potential profit will be in 3...5 times bigger than risk.

Push like if you think this is a useful idea!

Before to trade my ideas make your own analyze.

Write your comments and questions here!

Thanks for your support!

USDTRY - LONG (Gradual)Our risk / reward ratio is 0.28 in the first field and 0.09 in the second field.

There was a close above 5.84.

Long positions can be tried in small lots.

However, losses can be a bit high since the bar cannot be sure without closing, so stoploss should be placed directly at 5.81 or 5.84.

Our sales level for the first area is 6.095.

If the first area breaks down, our sales level is 6.56.

USDTRY 4H Long buy opportunity We can take a long buy trade

from recent levels :

5.5730 - 5.6200

TP1 : 5.7700

TP2 : 5.9630

TP3 : 6.1830

Stop Loss : 5.4000

This is not an investment recommendation or any call to buy or sell

It is just an analysis based on a study of the history of price action

Behavior , that may not be a necessarily reason for the success of

the structure or repetition. So please make your decision based on your vision .

To protect capital and manage your deals and trading successfully

the maximum loss in each transaction for the same currency or

commodity in the same direction should not exceed ( 2% ) of the capital .

Good luck

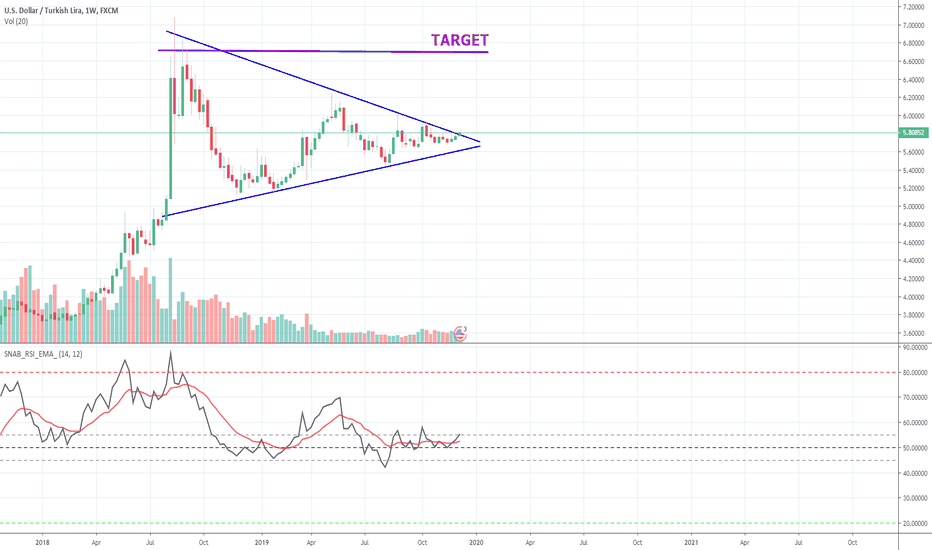

Market News and Charts for August 12, 2019USD/TRY

The pair was seen trading at the tip of the “Falling Wedge” pattern and was expected to continue going down in the following days. The 2016 failed Turkish coup attempt started the end of the relationship between the United States and Turkey. The coup was led by U.S.-based preacher Fethullah Gulen within the Turkish military. Three (3) years after the failed coup, Turkey had its first delivery of the Russian S-400 missile defense system, which the U.S. allies said will compromise the defense sharing agreement of the NATO (North Atlantic Treaty Organization) Alliance. The second batch of delivery was expected to be finish this August. Aside from this, Turkey is mulling to purchase Russian SU-35 fighter jets after the U.S. expelled Turkey from the F-35 fighter jet program in response to its acquisition of Russia’s S-400. However, the Turkey-U.S. relationship might enter into a new low after Turkey loaned $1 billion from China.

TOPSY-TURVY TURKEY? $TURInteresting to note that despite the nice gains Turkish equities saw in January 2019 (+15.7%) to make up for December 2018 (-6.87%), the asset class has experienced some nasty losses in February (-3.63%) and March (-4.36% so far) - all of which are quickly eroding all YTD gains.

Its the only EM market to have suffered such losses so far (rivaling that of South Africa). To add insult to injury, it appears that Turkish equities have had great difficult trying to break through its 50-Day EMA as well, indicating global equity investors are loosing faith in Turkish equities.

To complicate matters even further, the Turkisk Lira (USD/TRY) has been down 3.46% against the US Dollar so far in 2019, putting further stress on the currency.

In continuation from last year, it may mean that markets are trying to tell us something about the health of the Turkish economy for 2019. As global investors continue to shed Turkish assets throughout 2019, this is one space investors should be very wary of investing in over the next little while.

We recommend caution against Turkish assets.

TOPSY-TURVY TURKEY? $TUR $TRYUSDInteresting to note that despite the nice gains Turkish equities saw in January 2019 (+15.7%) to make up for December 2018 (-6.87%), the asset class has experienced some nasty losses in February (-3.63%) and March (-4.36% so far) - all of which are quickly eroding all YTD gains.

Its the only EM market to have suffered such losses so far (rivaling that of South Africa). To add insult to injury, it appears that Turkish equities have had great difficult trying to break through its 50-Day EMA as well, indicating global equity investors are loosing faith in Turkish equities.

To complicate matters even further, the Turkisk Lira (USD/TRY) has been down 3.46% against the US Dollar so far in 2019, putting further stress on the currency.

In continuation from last year, it may mean that markets are trying to tell us something about the health of the Turkish economy for 2019. As global investors continue to shed Turkish assets throughout 2019, this is one space investors should be very wary of investing in over the next little while.

We recommend caution against Turkish assets.