Turkishlira

USDTRY: Bullish on symmetrical Targets.The pair is on a strong uptrend on 1D (RSI = 58.592, MACD = 0.072, Highs/Lows = 0.0000) forming the right side of the 1W cup formation. It appears that the uptrend targets the Lower Highs of the previous downtrend in the form of Resistance Levels. Based on this we are long with 6.38740 our next TP and 6.64497 the extension.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

USDTRY - Future of USDTRY Turkish LiraExpecting USDTRY to end correction around 4.80-5.00 and consolidate there for a while and start a new rally in 2019.

This is how trends works, never use straight lines or channels to forecast future of financial instruments. Trends are not linear, trends are exponential.

USD/TRY 4H Looking for long tradeA .

We can get a long trade if the price close

above strong resistance channel at 5.8600

To:

TP1: 5.9500

TP2 : 6.2000

stop lose : 5.7800

B.

If the price breakdown upward channel

we can get short trade or wait for new

long trades from

5.64500 and 5.5100

with small stop lose

This is not an investment recommendation or any call to buy or sell

It is just an analysis based on a study of the history of price action

Behavior , that may not be a necessarily reason for the success of

the structure or repetition. So please make your decision based on your vision .

To protect capital and manage your deals and trading successfully

the maximum loss in each transaction for the same currency or

commodity in the same direction should not exceed ( 2% ) of the capital .

Good luck

TURKISH LIRA Forecast: Great short trade!

Market sentiment:

Bullish trend

Market is approaching significant resistance

Weakening bullish momentum

RSI overbought + divergence

Head and shoulders pattern formation

Wait and sell breakout of the neckline.

Targets are based on structure!

Please, check my signature!

TIK TAK FOR USDTRY AND ELECTION Hi TRADERS

As fundamental aspect ,there is no chance for TURKISH LIRA (TRY) to win this battle.there were election in turkey couple days ago and it had a massive effect on the country because the party that does belong the president( Erdogan ) lose the election who doesn't like and want that and the instability already have started.

I indicate the Eliot wave clearly and you can see that we are in the fourth wave and the fifth one will come in the second half of this year. (picture below)

In couple of days we will reach the 5.7 again and can have a profit on it .

Please share your idea and leave a LIKE .I'd really appreciate it.

Good Luck and Good Profit.

ELIOT WAVE

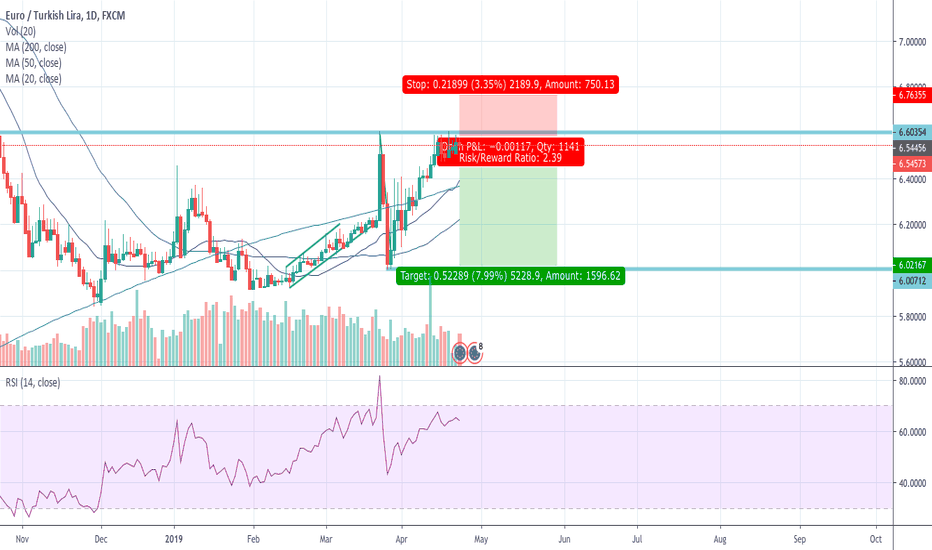

How Bad is Turkey Doing?Almost six months after the rate hike which pushed Turkish interest rates to 24%, the Turkish Central Bank wants local banks to use one of two more expensive funding windows, standing at 25.5% and 27% respectively, as it suspended one-week repo auctions for an unspecified period, as it announced on March 22. The announcement came less than a year after the Central Bank said one-week repos would be its main funding tool.

The Lira slumped at the announcement, dropping 2,800 pips on the day. While the Lira recovered in the next couple of days, there are still signs of weakening, as the USDTRY has been on rally since the first days of February, gaining approximately 5% year-to-date.

Signs of economic deterioration can be found in the country’s data announcements, with a contraction of 3% recorded in 2018Q4. Despite registering growth for the year, mainly based on the first two quarters’ performance, and even though the Finance Minister commented that the country has left the worst behind, recent data releases have not been good: the average unemployment rate increased to 13.5% from 12.3%, Retail Sales are down 6.7% y/y, and the state budget balance recorded a 16.8 Billion deficit compared to a 5.1 Billion surplus in January. Most importantly, the March CPI release on April 3 sees expectations of a rise to 19.9%, compared to 19.67% in February.

In the banking sector, things are not doing so well either. As a result of the depreciation, FX deposits increased by 45% y/y, of which 11.9% took place since the beginning of the year. This increase is due to have caused a further depreciation of the Lira, especially considering that resident deposits in TRY are declining. The depreciation caused a major part of the 34% increase in FX loans, while loans in TRY increased marginally. Non-performing loans are also up 39%, reaching 5.3% of total loans, compared to 3.9% a year ago for Deposit Banks.

As commented back in August, the Turkish crisis reflects endemic factors, the first being the country’s high dependence on external financing, which appears to have been waning as foreign investors are either pulling out or rethinking investments in the country. This became evident last week as the Central Bank’s international reserves declined by $6.3 billion, to $28.5 billion, or $2.5 billion more than the expected foreign debt repayments, hinting that these funds may have been used to stabilize the currency. As Black Monday showed, forcing the Bank of England to learn fast and the hard way, Central Banks cannot go against the market for a long time. Thus, it is not at all surprising that investment banks such as JP Morgan set the target for the Turkish Lira at 5.90 stating that the pace of FX reserve reductions will be unsustainable.

The second endemic factor is none other than the political situation. Recep Tayyip Erdogan is running the country with an iron fist, going as far as probing JP Morgan for its statements, and warning other investors against predicting that the Lira would weaken. Municipal elections on Sunday could turn the tables on Erdogan, who hopes for a win which will allow him to deal more with restoring foreign confidence. However, Erdogan’s usually arrogant stance has put more pressure on the country, with the CDS on the 5-year bond rising to more than 460 bps, a 50% increase from mid-March.

In a nutshell, all of the above continue to weigh negatively on the economy, with the government likely to increase spending in order to prevent further deterioration. However, given that the economic situation in Turkey is more linked to political developments than ever, it would take a big turn in country’s approach to foreigners in order to satisfy the markets.

Technically, USDTRY just moved past its 200DMA at 5.47 and is trading north of the weak 5.484 Resistance point. Strong Resistance is at 5.60 (Fib. 23.6%), with the next coming at 5.88 (Fib. 38.2%), close to the JP Morgan level of 5.90. Indicators are also showing signs of a rise, as Stochastics appear to have bottomed.

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.