Turkishlira

#USDTRY - 200 BPS EtkisiTam burada 200bps faiz artırdık

Etkisi ne olacak? Esas sorumuz bu.

Düzeltme tetiklenirse aşağıda destek olarak 7.26

Tepe aşılırsa yukarıda 8.25 bizi bekliyor.

Right here we raised 200bps interest rate

Our main question is what will be the effect?

7.26 as support below if correction triggered

If USDTRY hit and pass the higher-high 8.25 above awaits us.

USDTRY Short After Surprising Rate Hike on Sept 24, 2020After a series of stealth measures by the central bank to contain the lira's weakness: such as ceasing to provide funding at its cheapest benchmark rate which began in August, Gov Uysal increased the benchmartk one-week repo rate to 10.25% from 8.25% on Sept 24, 2020. He assessed that such tightening steps should be reinforced with the rate hike to contain inflation expectation and risks to the inflation outlook.

Back on August 10, 2020, Gov Uysel took a measure to raise the cost of money for its primary dealers (firms that trade directly with the Turkish central bank) which had already experienced a halve of their liquidity limits. The decision was made to increase the weighted average cost of funding. This type of stealth tightening was seen by the market as flexible and temporary, which is why we saw a sharp depreciation of the lira until now coupled with the recent strength this week of the USD as equities liquidity gets into it. The market needs to believe that the central bank will keep policy tightened for an extended period. With the base rate being increased now, this also means there was a huge waste of FX reserves as Turkey state-owned lenders sold dollars to support the lira.

Why tightening might ease the inflation outlook and strengthen the lira?

1. The benchmark 1-week repo rate stands now at 10.25% which is still BELOW the bank's weighted average cost of funding which stands at 10.65% currently.

Risks:

A. We do not know the full extent of the tightening: If policymakers still refuse to provide funding to its commercial banks at the 1-week repo rate of now 10.25% and instead redirects them to borrow at their late liquidity window rate which is its highest rate at 13.25%.

B. President Erdogan appeals for lower borrowing costs. In Turkey the president has the power to fire the head of the central bank so it is possible that the rate hike is done to increase bullish sentiment on the lira while still playing around its rate corridor which goes from 13.25% for the late liquidity rate, to 10.25% for the 1-week repo rate. Gov Uysal could be playing politics with the rate tightening and easing which would be a repetition of what has been happening ever since the beginning of August 2020.

C. Geopolitical risk: EU Summit was posponed to 1-2 Oct, 2020. During this summit, EU leaders were going to discuss imposing potential sanctions on Turkey, but on Sept 24, Greece and Turkey agreed to diplomatic talks making the probability of sanctions very unlikely.

Counter-argument for risks:

A. Gov Uysal performed the rate hike from 8.25% to 10.25% as a measure to start giving back its commercial banks the option to borrow at their lowest benchmark rate. Banks had the only option of borrowing at the previous late liquidity window rate of 11.25% so the rate hike could be viewed as a way to encourage investors and banks to hold the nation's asset.

B. Most economists and central bankers believe that lower rates cause inflation as capital outflows increase since investors are demanding higher returns for holding the lira as a risky asset. Higher rates compensates investors for the risk and would strengthen the lira easing borrowing cost pressures on the central bank's own obligations. This would avoid a potential balance of payments crisis.

Technical analysis:

After price broke from the trendline, once the rate hike decision was made, price dipped with more buyers showing up after bouncing on the 4HMA. This leads me to believe there is a consolidation to happen over the coming days and possibly weeks before we see price initiating a bearish trend. This could be the result of investors waiting to see that the Turkish central bank is serious about providing higher rates and as investors start getting attracted to the higher return on their money for holding the lira. For this the horizon on this trade is of around 3 weeks.

Stop loss level has been placed at 7.71687 which is a 200 points risk, give or take since this pair counts points differently.

TP1 is at 6.68000

TP2 is at 6.42169

Will continue to monitor future geopolitic and economic events as they develop.

Two great Buy opportunities on this chart for USDTRYMid-Term Forecast

Trading suggestion:

. There is a possibility of temporary retracement to suggested support line (7.4086). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. USDTRY is in a range bound and the beginning of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 41.

Take Profits:

TP1= @ 7.4086

TP2= @ 8.0000

SL= Break below S2

----------------------------------------------------------------------------------------------------------------------------

Short-Term Forecast

Trading suggestion:

. There is a possibility of temporary retracement to suggested support line (7.4123). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. USDTRY is in a range bound and the beginning of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 70.

Take Profits:

TP1= @ 7.4530

TP2= @ 7.7210

TP3= @ 8.0000

SL= Break below S2

❤️ If you find this helpful and want more FREE forecasts in TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . . Drop some feedback below in the comment!

❤️ Your Support is very much 🙏 appreciated! ❤️

💎 Want us to help you become a better Forex trader ?

Now, It's your turn !

Be sure to leave a comment let us know how do you see this opportunity and forecast.

Trade well, ❤️

ForecastCity English Support Team ❤️

Are Turkish Banks creating opportunities? (XBANK.IS) In dollar terms, the Turkish Banking Index is in a long-term squeeze.

With the new works that started to arrive, albeit late, after the Lira's compression, we can see that the index can throw itself back to the upper band at the end of 2020 and at the beginning of 2021.

The estimated return on a rise up to horizontal resistance will also be over 200%...

Only personal opinions and ideas. Does not Include Legal Investment advice...

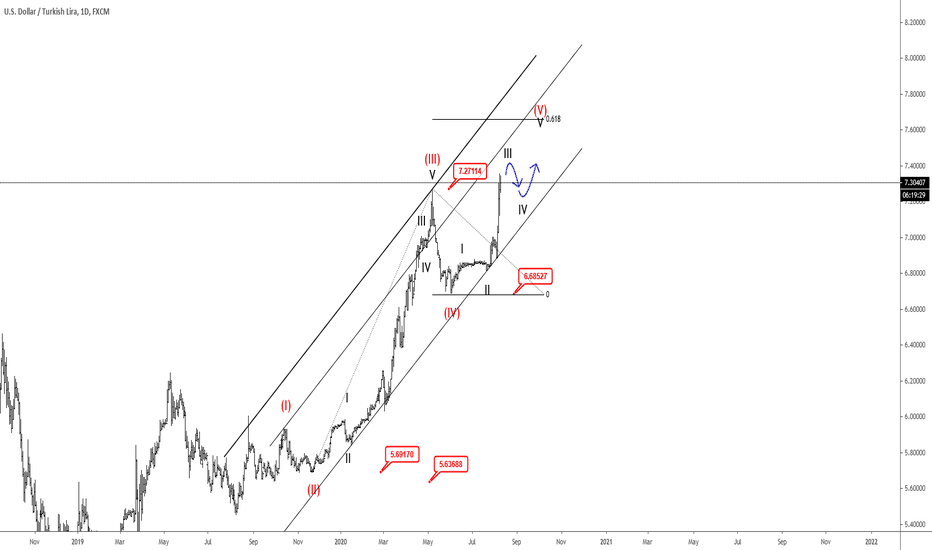

USDTRY In A Bullish Move! - Elliott wave analysisHello traders,

USDTRY is bullish, clearly in a five-wave move, up from 5.64 level. We can see waves (I), (II), (III) and (IV) as completed, so recovery from 6.68 can be part of a final wave (V). Wave (V) is an impulse itself, therefore five legs within is must be seen, before resistance, and a reversal in three legs may show up. Now there are only three legs seen, within a wave (V).

Possible resistance for wave (V) is at 7.5/7.8 level.

EURTRY waiting for a trigger to sellon DAILY: EURTRY is sitting around a strong supply zone in green so we will be looking for objective sell setups on lower timeframes.

on H1: EURTRY formed a head and shoulders pattern so we are waiting for a momentum candle close below its neckline to sell. (conservative)

Moreover, we are waiting for a new swing to form around our lower red trendline and then enter on its break downward.

USDTRY waiting for our trigger to sellon DAILY: USDTRY is sitting around a strong supply zone in blue and around all-time-high, so we will be looking for objective sell setups on lower timeframes.

on H4: we are waiting for a momentum break below 6.830 in green as our confirmation and trigger.

as usual, we target a 2/1 risk/reward ratio.

Don't miss the great buy opportunity in EURTRYTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (7.4706). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. EURTRY is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 71.

Take Profits:

TP1= @ 7.5998

TP2= @ 7.6507

TP3= @ 7.8517

SL= Break below S2

XAU/TRY Currency Chart. Gold Ounce to Lira Policymakers in emerging markets frequently complain that foreign capital is fickle. But foreign capital could be forgiven for having a similar gripe about emerging markets. On a conference call on May 6th Turkey’s finance minister, Berat Albayrak, was solicitous and reassuring, telling nervous overseas investors that the country’s dollar reserves were adequate and its commitment to market principles was firm. But the next day the banking regulator turned cold, reprimanding three foreign banks, BNP Paribas, UBS and even Citigroup, which helped host the call, for failing to meet their lira obligations on time. As punishment, it barred them from the country’s currency market. Four days later, the mood changed and the ban was lifted.

#USDTRY #USDTL #USD #TL $ #ELLIOTWAVEusdtry elliottwave perspective view

Alternative 1) If it sees around 6.50 (green area) and turns up and is permanent on the red line (above 7.30), the rise started.

Alternative 2) If it falls below the green area, it sees around 6.00 (pink area), the rise begins. 7.30 is also important in this. 7.30 must be exceeded for real rise.

Alternative 3) Cannot hold in the 1st Pink area. It falls to around 4.50 (2nd Pink area). After this fall, the journey to AY begins.

my favorite 2nd alternative

USDTRY LongIt has just surpassed the 6.79 level, and is now heading to the next level at 7.10.

The MACD is also showing us some bull strenght, and it the candlesticks were strong surpassing the 6.79 lvl (forming two white soldiers, on the 4H chart, and i believe it'll get to three white soldiers)

We can also see a strong bullish trend starting around the early days of March, which was tested a second time in the end of this month and a third time 5 days ago.

The 6.79 level was tested a few times since the start of April.

ridethepig | Squeeze!Recognise that this demand for USD is squeezing USDTRY into the secondary macro swing targets at 6.60xx. This is completely inline with the forecasts and all those in leveraged positions are inclined to take profits. We are not out of the woods (yet) and large hands will continue to buy dips in USDTRY as long as we remain in risk-off flows.

As widely mentioned "local banks will come under pressure and show severe distress above 7" ...increasingly this is becoming the target as weak fundamentals and dictators limit ability to invest in the currency. Expect some consolidation over the coming days before further funding issues add upward pressure via USD demand.

Good luck all those buying the dips, highly recommend tracking TRY as a good benchmark to health in EM FX. Thanks for keeping the support coming with likes, as usual jump into the comments with your charts, view and etc!