Bites Of Trading Knowledge For New TOP Traders #15 (short read)Bites Of Trading Knowledge For New TOP Traders #15

----------------------------------------------------------------

What is an Interest Rate Differential? -

An interest rate differential is a change in the interest rates between the currencies of two countries. It is a measure of how money from two countries compares to each other.

What is the Carry Trade? -

The carry trade is where an investor borrows in a currency where the interest rate is low and converts those funds into a currency where the interest rate is higher.

For example, if one currency has an interest rate of 5% and the other has a rate of 1%, it has a 4% interest rate differential. If you were to buy the currency that pays 5% against one that pays 1%, you would be paid on the difference with daily interest payments.

RISKS AND OPPORTUNITIES FOR CORPORATES AND INDIVIDUAL INVESTORS -

Common application of financial market instruments for managing risk and opportunities.

Diversification: Portfolio Risk Using FX Futures

Portfolio diversification is the process of investing your money in different asset classes and securities in order to minimize the overall risk of the portfolio.

For both corporate and individual investors, having access to markets that enable the building of a diversified portfolio is an important consideration when managing futures focused accounts.

Similar to managing risk, the market to trade would be a key variable to clearly state and support with reasons for trading or investing. Reasons for selecting one market over another could include price volatility, liquidity, daily volume traded, size of the minimum price increment, and value of the minimum price increment. Comparing these variables between markets will help decide the suitability and/or risk of each.

For example, the parameters for a price driven strategy may be designed to be applied to any market whether it be index equity futures or forex futures. However, the signals for entry may not always trigger if a trader were just to focus on a single index equity futures. Having access to markets such as the Micro MSCI USA Index futures could add diversification to a portfolio in an efficient manner.

Having access to other futures markets to apply the strategy to allow for the creation of a diversified portfolio with varying entry and exit points or the ability for more trading oriented investors increased opportunities to execute price driven strategies more often across a range of futures markets.

TRADDICTIV · Research Team

--------

Disclaimer:

We do not provide investment advice, nor provide any personalized investment recommendations and/or advice in making a decision to trade. Before you start trading, please make sure you have considered your entire financial situation, including financial commitments and you understand that trading is highly speculative and that you could sustain significant losses.

Tutorial

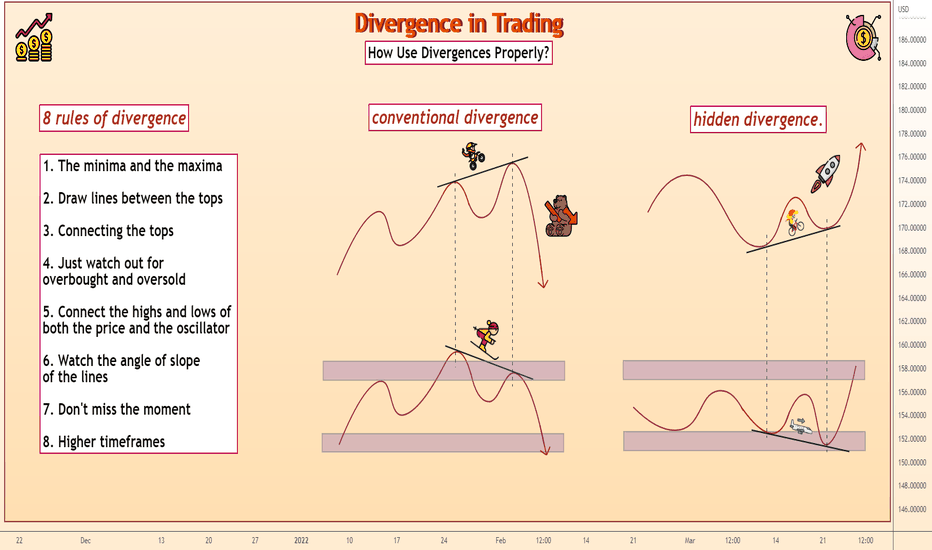

Divergence in TradingThe essence of divergence is very simple: The divergence of price and indicator movements.

When price updates higher highs and the oscillator updates lower highs, it is divergence in its classic form. It could be stochastic, RSI, MACD, CCI and hundreds of other oscillators. Some traders believe divergence is the only oscillatory signal worth looking at.

From stochastics creator George Lane to Alexander Elder, hundreds of professional traders have described divergence in their books.

What is the essence of the divergence?

When the price reaches its maximum value, the oscillator should reach it too. The same is true for the minimum values. This is how it works in a normal situation. If the oscillator and price decide to mark different values - we're talking about divergence.

It can be used in two main cases:

conventional divergence;

hidden divergence.

Let us now analyze them.

The classic divergence

The simplest and clearest signal, which hints at a future trend reversal. If price makes a lower low and the oscillator makes a higher low, we have a traditional bullish divergence. In other words, if the oscillator is up and the price is down, that is a hint of a reversal of the price in the direction of the oscillator.

The opposite situation is also true. The trend is going upward and the price is updating the maximums and if the oscillator is not then it’s a divergence.

The optimal use of divergence is on the maximum and minimum values of the price. This is the easiest way to find the reversal zone. The oscillator directly indicates that the momentum is changing and although the price keeps updating levels, it will not last.

We have considered the conventional divergence, now let's look at its evil cousin, the hidden divergence. It is not so secret that it is just a divergence hidden within the trend.

Hidden divergence

A divergence does not always indicate a trend reversal. Sometimes it is, on the contrary, a clear indication that the trend will continue. Remember, you should be friends with the trend, so any signal that the trend will continue is a good signal.

Hidden divergence is quite simple. The price updates the upper low and the oscillator updates the lower low. It is easy to see. When the price has updated the maximum, check if the oscillator has done the same. If it doesn't and goes in the opposite direction, it's a divergence.

And there is the hidden bearish divergence. The price updates lower highs on a downward move and the oscillator, on the other hand, it is trending upwards and updating the higher highs. If the general trend is downward, it is an indication that this trend will continue and quite possibly double its efforts.

How Use Divergences Properly?

Divergences are a great tool. However, it often raises the question of when exactly to open the trade so that it does not happen that the trade is opened too early or too late. For this purpose, we need a confirmation: some method allowing us to filter the false entries in the divergence. We will consider several such methods.

Oscillator crossing

The first thing we usually look at is a trivial crossing of oscillator lines, say, stochastics. This is an additional indication that the trend may soon change. Therefore, when the price approaches the upper or lower zone, the crossing can give a good signal.

Patience and confirmation of signals are the main qualities of a trader. Divergence is a great tool, but you need to confirm it with additional tools to achieve really good results.

Oscillator exits the overbought/oversold zone

Well, we took our time and waited for additional confirmations of the divergence. Strong enough to indicate a reversal of the trend. Which ones? Remember the basics of technical analysis. A trend line would show that the trend is steadily descending and it is too early to enter the reversal.

This technique is very valuable for finding a reversal or breakdown of a trend line. If the price bounces from the trend line, draw it for the oscillator as well.

8 rules of divergence

To use divergence successfully, it is advisable to adhere to the following rules.

1. The minima and the maxima

The following conditions are necessary for divergence

price updates higher highs or lower lows;

a double top;

double bottom.

When the price updates these highs and lows, there is a trend and this is the feeding ground for divergence. If there is no trend and all you see is a consolidation, the divergence can be missed.

2. Draw lines between the tops

The price is in only two states: trend or consolidation. Connect its tops with lines in order to figure out what is going on. If one peak is lower or higher than the other, it is trending and the market is sweet and available for trades. If there are no clear new highs and lows, it means that there is a consolidation, and divergences do not play a significant role in it.

3. Connecting the tops

Let's be more specific. The price reached the new maximums? Connect the tops. If it made lower lows, connect them. And don't get confused. A very common mistake the price makes new highs and the trader connects the previous lows for some reason.

4. Just watch out for overbought and oversold.

We have connected the tops with trend lines. Now we study the oscillator readings. Remember we are only comparing highs and lows. It doesn't matter what the MACD or stochastic is showing in the middle of the chart. What difference does it make? It makes no difference. We are only interested in their boundary values.

5. Connect the highs and lows of both the price and the oscillator

If we have connected the highs/minimums of the price, we have to do the same for the oscillator. And not somewhere, but for the current values.

6. Watch the angle of slope of the lines.

Divergence when the angle of lines for the price and the oscillator is different. The more this difference, the better. The line can be upward, downward or flat.

7. Don't miss the moment

If you notice the divergence too late and the price reverses, it means the train has already left. The divergence has worked out, it will not be relevant forever. The one who missed it is too late. Wait for the next price divergence with the oscillator and a new divergence will not keep you waiting.

8. Longer timeframes

Divergence works better on higher timeframes. Simply because there are fewer false signals. That's why it's recommended to use them on 1-hour charts or more. Yes, some people like 5- and 15-minute charts, but in these timeframes, divergences often lead to false ones.

These are the rules for dealing with divergence. It's a cool tool. If you specialize on it, it is one of the most powerful methods of technical analysis. Certainly, you will need practice and a bottle of good wine to understand all its peculiarities.

Trading on a demo accountHello everyone!

Today I want to discuss a topic that worries everyone: to trade or not to trade on a demo account.

The demo account itself is a useful tool, but it also has a couple of disadvantages.

Let's deal with everything in order.

Advantages of a demo account

Perhaps the most important plus is that you do not need to deposit your money into the account.

The demo account is created for training, and you can use it for free! There are no risks and you will not lose your money.

The ability to test your strategies. Thanks to a demo account, you can try to trade your strategy in real time on a real market and understand whether it works or not and whether you are able to follow the rules.

The experience is priceless, and you can get it thanks to a demo account. You can open demo accounts as much as you want and trade all day long, filling your hand on the real market.

Thanks to the demo account, you can try all the free indicators and understand which ones are suitable for you and which ones do not work at all.

Disadvantages of a demo account

Perhaps the most important disadvantage is that you will definitely behave differently than on a real account. Psychology is not to do anywhere and when trading for real money, you will immediately notice it. There is no tension on demo accounts, because you will not lose your money, but as soon as the question concerns your real money, you lose your head.

In addition, transactions are executed instantly on a demo account, this is not always possible on a real account, because there is slippage. Because of this, strategies that were profitable on a demo account may be unprofitable on a real one.

On demo accounts, traders choose the maximum deposit and trade the maximum lots . With an infinite deposit, it's hard to lose all the money. In real trading, the account is usually always smaller and therefore you need to trade a smaller lot, which is not so easy.

Spread. A narrow spread on a demo account is a feature of brokers trying to attract as many clients as possible. In real trading, this parameter will be wider.

The number of transactions. On demo accounts, traders tend to execute a much larger number of orders than they actually need. This habit is transferred to real money. But it is much more important to approach the evaluation of each transaction carefully and chase not the number of orders, but their quality.

Conclusion

A demo account is certainly a very useful tool for a trader.

But you need to approach the matter wisely and understand the difference between a demo and a real account.

Practice trading on a demo account the same way as if you were managing real money and then the benefits will be much greater.

Good luck!

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

📖 STEP 4 to MASTER TRADING: Focus on One Pattern 📖

"I fear not the man who has practiced 10,000 kicks once, but I fear the man who has practiced one kick 10,000 times." - Bruce Lee

We, traders, have a natural passion for learning and that’s really great and helps us build that foundation for trading. However, a moment comes when enough is enough and it’s time to focus on something more specific. But very often, we can make the unconscious mistake of trying to learn as much as possible, without even questioning if we really need it at the moment.

🟩 TOO MUCH INFORMATION

For anyone eager to learn, the information is there. In fact, too much information, and naturally, it can be hard to stop learning. Sometimes we just feel we need to learn about one more pattern, one more strategy, one more approach. And it may seem that more knowledge will bring quality. And that’s true when you just start trading, however, later in your career, it makes sense to think and ask yourself: “Do I really need one more strategy which I know on an average level, or should I maybe focus on one strategy, or one pattern of any given strategy - and really master it, and refine it to the very deep level of understanding?”

🟩 IT’S UNCOMFORTABLE TO LET GO

This part can be discussed for a long time, but based on what was said before, it’s literally uncomfortable for traders to let go of this habit of trying to trade multiple patterns, and learn more patterns in between. I’m not sure why this is so, there must be some psychological reasoning for this, but in simple words, every new trading pattern can be treated by us as a new opportunity to make profits in the market. And so when we stop learning more patterns - it can feel like we’re missing something.

And it may seem that the more we trade, the more patterns we can use - the more profit we can bank because we can enter into the market based on different patterns. And while that may be true to some genius traders, for most of us it doesn’t work that well. More importantly - we don’t need to do it. It’s enough to master 1-2 patterns of a given system we believe in and tested, and so have confidence in it.

I propose you consider “cutting off” 90% of your trading knowledge and focus only on executing 1-2 patterns max. Think about it. If you’re like me, you should feel really uncomfortable or even scared to do this. It may even seem stupid. Because it means you should let go of all the time you dedicated to learning, and maybe even trading with some systems before. But it’s an illusion because that time and effort - they are not lost, you can’t lose them, they are part of you now, part of your experience, something that led you to finally choose something you will work with really closely. But if you will attach to everything you learned before – this will confuse you and spray your focus all over the place, making it much harder to become a specialized, professional trader.

🟩 FOCUS ON YOUR BEST PATTERN ONLY

When the time comes, and you’ve tried several strategies, it now makes sense to stop exploring additional systems and just focus on one system and learn everything about it. For example, if you’re trading head and shoulders, then stop trading double tops and bottoms, break and retest, and diamond patterns. Why? Because head and shoulders are not just 5 lines on the chart, it has numerous variations in how it plays out in the market, in different markets, sessions, and contexts. And you have to know it, see it, test it, and refine it. Become a master of head and shoulders, or any other specific pattern and trading approach, and be profitable with it. And if profitability is there - you can move on to another pattern, but at that stage, you will not need it probably.

🟩 HINDSIGHT TEST, BACKTEST, FORWARDTEST, REFINE

It’s a great practice to have a “hindsight journal” and your backtesting journal, that will only be about that pattern you chose to trade. And there could be several reasons for choosing some particular pattern. But usually, it comes from your mentor or anyone else that you saw who reached sustainable profitability with it, and you believed in this pattern. But that would not be enough. You can’t tell your brain - believe in this. You need to actually show and prove it to your brain and to yourself.

So you need to backtest this pattern, and only this pattern for at least 150 trades. This will help you to develop real confidence in the system.

🟩 YES, IT CAN BE HARD TO FIND “YOUR” SYSTEM

I spent almost 3 years before I really found something I was willing to stick to long-term. Not sure if there’s actually good advice on how to find the system for yourself. It depends on your personality, your lifestyle, etc. Based on my experience, I would say just continue to learn and listen to yourself. Most likely you’ll find some trader or a mentor and you’ll like his trading style. Try to replicate it, and stick to his system. With time, and during journaling and live testing, it will all develop into your own system. Yes, it may look similar to your mentor’s but it will be your system.

And once again, a trading system can have different kinds of entry confirmations, but it makes big sense to choose 1 or 2 confirmations and master them.

🎁 For those who are still reading :), thank you, and here’s BONUS trading hack for you. Next time during your trading day, when you'll feel something is wrong, maybe you're frustrated or just feel like your discipline starts to slip away, or maybe even you catch yourself thinking about entering without entry pattern or risk more than usual - realize that's your "monkey brain" stepping in. It's very hard to control, but easy to trick. Here's what you should do. Say to yourself: "Ok, I'll do whatever I like, place any kind of trade with the risk of half of the account if I want, BUT after 20 min. pass." Then you just start a timer (you can google "timer 20 min.") and do whatever you like after that 20 minutes. Usually what happens is you calm down and don't do stupid things. It very simple but effective technique.

🚀Thanks for your BOOSTS and support🚀

💬Send your comments and questions below, I'll be glad to talk to you💬

Dima

Environment Dictates PerformanceHello, fellow Forex traders! Successful trading on the currency market is not only about having a trading strategy that suits you, emotional composure and risk control. Your work environment, where and how you trade, also plays an important role. So, what should be a trader's workplace?

A computer

You don't need super powerful hardware for the trading terminal. But when all of your programs, including the terminal, work quickly, nothing hangs and the computer does not "freeze", if you suddenly decide to take your mind off the charts and watch videos with cats on youtube, it's quite pleasant and comfortable. And it does not disturb your emotional state. And you still need nerves. If you trade on a desktop PC, I advise you to keep a laptop nearby. Since the electricity can theoretically cut out at any time, and the laptop runs on battery power - at least to close the position you will have enough charge.

Monitor

It is better if it will be large. 19-24 inches. It's just more comfortable. A lot of monitors, as in the movies about cool traders, you do not need, believe me. At least it will not make you trade better directly. But you will be able to watch a movie, play a game and trade Forex at the same time.

Internet

The faster, the better. Also, you need to think about what you will do if it suddenly turns off. "Backup plan" can be either pre-internet from another provider (just pay every month for 2 networks), or a 3g modem, or a modern smartphone, such as iPhone, with a modem function (more than once helped me out).

Chair

The spine is directly related to brain function, headaches and overall human health. So do not skimp on normal computer chair. You will get a hundredfold return of the money spent and you'll save your health.

Printer

Printer/scanner/copier. You probably saw these hybrid devices at offices of different companies. Buy one of these and you can print out charts, use pens to draw on them, scan them back into your computer, make yourself important data posters, etc. Printed out charts with examples of difficult situations, tables with lot sizes for positions, examples of shapes, new rules to implement in the TS are very helpful in your work. Try it.

But most importantly, try not to mix work and personal life. If possible, it is better to allocate a separate room for trade, or even rent an office (for those who do not have problems with money). This way you will not be distracted by anything, and you will not disturb anyone.

YOU SHOULD KNOW THISYOU SHOULD KNOW THIS

Hello everyone!

Today I would like to remind you of a couple of things, the understanding of which will definitely take you to a new level.

Let's go!

1. 99% of newbies come to trading with a desire to make quick money and that's the problem. Trading is a long game. It's worth understanding right away and remembering. In trading, it is impossible to consistently make a double-digit increase in capital and at the same time follow reasonable risk management.

2. Without reasonable risk management, sooner or later you will lose ALL your capital. All professional traders follow risk management and as a rule do not risk more than 1% of the capital in one transaction.

3. Small capital will be a problem. As a rule, 90% of small capitals are burned in the forex market in the first week. All because it is difficult to follow the rules of risk management with a small account, largely because the profit will be scanty, and the time spent will be too much. Over time, you will get tired of wasting time and getting nothing in return, and you will start taking risks, thereby bringing your account to $ 0.

4. You will not be able to correctly predict the exact direction of the market every time. If you think it's possible, the market will kill you. No one can know the future and nitko cannot predict all market movements. But the good news is, you don't have to be right in every trade.

5. The right risk-to-profit ratio will take you to the top. In the market, it is enough to be right in 40% of cases if your RR in transactions is equal to 1:4. Only 4 deals out of 10 will help your account grow steadily. And the higher the RR, the better for your score, but don't flirt.

Understand these principles now, and your trading will become more profitable today.

Good luck.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Strong Trading Strategy, Do not trust all the pin barsThe pin bar pattern is one of the best signals on any market for predicting the next move. But should you trust all pin bars? In my humble opinion, NO, and I’m explaining this idea below and the approach I take to distinguish valid pin bars from invalid ones.

I suppose you already know what is a pin bar, so I’ll not explain its basic details here. If you don’t know please, do a search and read its basics first.

I have 3 filters for my pin bars. Find them below and boost the idea if you liked it :)

1- What should it look like?

In my opinion, having a candle with a shadow (wick) longer than the other and a small body is not the only factor to call it a pin bar. I filter pin bars by expecting some pre-defined proportions and ratios between body size and shadow lengths. Here are my rules:

The body must be at least 2% of the candle height.

The long shadow must be at least 4 times bigger than the body.

The long shadow must be at least 2 times bigger than the short shadow.

I know you are rightly thinking about how to calculate them, but do not! There is a simple indicator that does this calculation and highlights the pin bars for you, the Abnormal Pin Bar indicator . You just need to set it up with your values. You can even set up an alert to let you know when a pin bar is shaped.

These are my rules and values that fit my strategy, you can use them. Also you can do your own tests to find the values that fit your psychology and your strategy. You can say you prefer a pin bar that has a bigger body than yours! it’s okay, just do your own tests to make sure it works for you.

2- What is behind that?

Always inspect the smaller timeframe to check if the sub-candles that shaped the pin bar confirm its bearishness or bullishness. Yes, you should always see the big picture but remember, all the moves start from smaller timeframes. You shouldn't expect too much from a movement with bad groundwork.

For a bullish pin bar, its bullish sub-candles must overcome the price action and volumes of its bearish ones, and on the other hand, for a bearish pin bar, its bearish sub-candles must surpass the price action and volumes of its bullish sub-candles.

It would be nice to write a long and detailed article about bearish and bullish sub-candles competition and when they overcome each other. It's not something you decide just by comparing the number of bullish and bearish sub-candles! Long story short, it’s all Price Action and Volume Analysis. and my favorite one is when the volume of sub-candles in one direction surpasses the volume of the candles in the opposite direction. Or you can look for volume and price anomalies.

What is the volume and price anomaly?

The volume and price anomaly is a simple pattern that occurs in two consecutive candles. Assuming two descending candles or two ascending candles in a row, if the body of one candle is bigger than the other one, we expect its volume to be larger, or if the body of one of them is smaller, we expect its volume to be small. Now, if this pattern is not observed for two consecutive candles, we call it a volume and price anomaly.

For example, a candle has a larger body than the previous candle, but its volume is smaller than the previous candle. Or a candle that has a smaller body than the previous candle, but its volume is greater than the volume of the previous candle!

Anomaly Confirmation Candle:

In most cases, after the volume anomaly, I wait for a confirmation candle. This candle will be a bearish candle for a bullish anomaly and will be a bullish candle for a bearish anomaly. The volume of the confirmation candle is very important in anomaly, and in addition to its shape and size, you should also pay attention to its volume.

I just explained the anomaly here to give you a point of view and perspective. I don't want to make this idea overlong so I do not go into more details. Maybe it would be a subject for another idea ;)

In which timeframe should the inspection be done?

You will understand which timeframe you should choose to inspect a pin bar sub-candles by experiencing it over time, but I personally consider two things:

1- The timeframe must be well-known and be used by not only me but also by most traders.

2- It must contain at least 4 sub-candles. e.g. for a daily pin bar, 12h reveals only 2 sub-candles while 4h reveals 6.

For example, for a closed daily pin bar, it would be a good check to inspect candles for the 4h timeframe. or after a weekly pin bar close, you can check the candles of the last 7 days.

Consider this instruction and practice on the chart to see the result.

If one of the pin bars in sub-candles is also a pin bar, do the same inspection for it.

3- On there any key level around?

A pin bar is an important pattern but one that touches a trend line or any important level is leading! The combination of a key level and a valid pin bar is something very valuable and instructive. It's definitely not to be missed, provided you do your own analyses.

Prioritising trend lines and important levels always makes my decision easier when a pin bar spawns near to more than one significant level.

Check twice if you face a pin bar in peaks, troughs, resistance or support areas, supply and demand zones, or as a rejection from a trend line.

You can use the Trend Key Point indicator to highlight important levels. Additionally, there is a guide about its usage .

Bonus Tips:

Pin bars on bigger timeframes are more reliable.

If there are lots of pin bars shaped on a chart, think twice, select a bigger timeframe, or do not use this strategy on that specific asset.

For two valid pin bars in a row, the one with a bigger volume is more important to me.

Check twice if the volume of a pin bar is bigger than the volume average.

Check twice if the volume of a pin bar is bigger than the volume of its previous candle.

Do you have any questions? ask in the comments.

Do not hesitate to write your opinion about this idea.

I'd appreciate if you share this idea with your network.

ARE YOU A GAMBLER OR ARE YOU A TRADER?Hello everyone

Today we will touch on a serious topic, at the end of which you will be able to determine who you are in the market.

Let's go!

Two types of people

There are a large number of people in the forex market and they are all different.

But, even considering the diversity, there are still common features by which people can be divided.

Some come with a desire to earn quickly, while spending not much time and effort.

Others come to the market as a job.

The first are simple players, mostly they lose money and eventually leave with nothing.

The second are professionals. They know how to trade, they follow the rules and their discipline is at the highest level.

How to determine which group you belong to?

There are a couple of factors that distinguish an ordinary player from a real trader:

1. Risk management. The player, as a rule, does not follow the rules of risk management. The player's risk is equal to his capital. That is why players lose all their capital.

Real traders rarely risk more than 1% of the capital. Such traders follow the rules of risk management in EACH position. Therefore, they never lose all their capital.

2. Trading plan. Players have not tested strategies and rarely study them to the end. They superficially learn new trading methods and run to the market to use them and therefore lose everything. Professionals know everything about their strategy, when to open, when to close, why and how much. A professional will have an answer to all questions and will have a plan.

3. Emotions and money. Do you trade for emotions? Do you like roller coasters at the market? If the answer is yes, then you are a player. Players come to the market to experience the full range of emotions and the market gives them this, but takes money in return. Professionals do not experience emotions, they are here to earn a living. Chasing emotions is not for them.

4. What do you want or what do you see? The player trades what he wants from the market. A player may see something on the street or some news and now he wants to open long positions without paying attention to the context of the market. A professional is not set up to trade long or short, he is set up to trade what the market is trying to show. If the market shows signs of growth, a professional will open long and vice versa. There are no desires here, there is only a plan, strategy and discipline.

Conclusion

Everyone should answer these questions to understand who they are in the market.

Having defined yourself, you will be able to improve yourself, admitting mistakes is already half the case.

This article also indicates the further path that will help you from an ordinary player to become a professional trader.

Good luck!

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Dietary Supplements For TradersLong sitting at the computer, constant stress, bad ecology in the cities, unbalanced nutrition all this is detrimental to the health of forex trader, as well as any intellectual worker.

Today is not going to be a typical post. We're going to talk about supplements that help improve mental and physical vitality under emotional pressure from the market. I will share with you those remedies that I myself use.

What are dietary supplements?

Nutritional supplements are supplements, usually based on natural ingredients. They are not medicines, but act similarly to vitamins. There are universal nutritional supplements, and there are specialized ones for bones, brain, heart, etc. Consider dietary supplements not as something magical, but as a kind of bonus, "+1 to HP", if we put it in computer game terms.

There are opponents of supplements, there are supporters. Personally, I have tried various supplements for many years, and below is a list of what I think are the best. Of course, it all depends on the individual, for example, I have problems with the stomach and cervical spine, so, let's say, joint supplements for the average person needs less than I do. Try to try everything on your body, diseases (if any) and preferences. My experience is just my experience, not the fact that what works for you is what works for me.

Omega Fatty Acids

Omega-3, omega-6, omega-7, and omega-9. These are all varieties of fatty acids found in foods such as fish, nuts, some fruits and vegetables.

Omega's are healthy bones, immune system, breasts, cardiovascular system, intestines and pancreas as well as improve memory and brain function. I recommend unconditionally to all. I myself have been drinking for many years. Omega-7 is generally rare, and here it is in a complex, perfectly balanced, also containing astaxanthin - the most powerful antioxidant in the world.

Cordyceps

I use it when I need a lot of energy. When flights, busy days. This is a parasitic fungus that sucks the life juices out of insects that it encounters: grasshoppers, ants, etc. In China, cordyceps has been used medicinally for 5000 years.

In addition to energy, it stimulates brain activity by improving blood circulation, strengthens the walls of blood vessels, as well as the immune system.

Unfortunately, there are a lot of fakes, be careful. One rule of thumb - cordyceps can't be cheap, as very little of it is extracted.

Ginseng

Ginseng has long been known for its healing powers. Unlike cordyceps, it gives a deeper energy, not so pronounced, the effect is noticeable a little later. In addition to physical energy helps with mental fatigue.

In dietary supplements is usually used artificially grown ginseng, as it is cheaper. Wild ginseng is considered more powerful, I can't recommend any particular supplement, so please try it. If you feel the effect, it means that it is suitable for you. Now I take this one.

Ginkgo Biloba

Ginkgo Biloba is the plant whose leaf extract is closest to those "NZT pills" from the famous movie " Limitless ".

It nourishes the brain, improves memory, attention, mental performance, and slows the aging process of the brain. Result is not instant; miracles is not going to happen.

Garlic.

Garlic kills a lot of pathogens inside the body, a couple of times a year I take a course.

What is interesting, everyone knows about the properties of garlic as an anti-cold and immune boosting agent, but it also helps to reduce cholesterol and improve male potency. Garlic is a dietary supplement in a concentrated form and in large quantities. This will not make your breath stink.

Hyaluronic Acid

Hyaluronic acid is a constituent of many tissues in our body. Hyaluronic acid is commonly advertised as an anti-wrinkle cosmetic, for younger looking skin, etc. But it is also excellent for joints, muscles and ligaments. Scientists are predicting that in the future, this acid will form the basis of cancer fighting agents.

In this way, it is an excellent remedy for the mobility of the joints and has an aesthetic effect on the skin.

Blueberries

Although modern monitors don't strain our eyes as much, there's still nothing good for vision in the glowing screens of laptops, cell phones and tablets that we all often look at. And it doesn't hurt to take preventive care.

Blueberries are very good for vision. And in combination with the substance Lutein, the effect is enhanced. I try to remember to take a course of blueberry extract with lutein once a year to prevent good vision.

Calm

You also need to drink a soothing magnesium-based mixture. It promotes better sleep and relieves stress, of which there is so much in a trader's job. I drink it at night.

How to use supplements?

The most important rule is not to overdo it. Make sure that you do not overdose on any components/vitamins. For example, if you drink something with vitamin E, you should not take a supplement at the same time, where vitamin E is also present, albeit as an auxiliary component.

Also, watch your own well-being. What works for one person won't necessarily work for another.

Conclusion

Various supplements help, but they are not a panacea. If you have, God forbid, any diseases, be sure to see a doctor. Also, supplements work many times better when you combine them with physical activity. Yes, that's right: you have to get off the couch and go to the gym. Choose what you like: yoga, aerobics, tennis. It's your business, but physical activity has to be, without it there is no way.

ATOM We accumulate large positions and get profit without risks.ATOM/BTC Everything is shown and painted on the graph. On the chart, the main trend of this cryptocurrency. This coin of the second group is suitable for accumulating large positions. This technological solution has great potential, especially when ETH goes green, then a small ATOM will turn into a big COSMOS. Accumulation is an increase in the number of coins (output to profit) through trading and working with a complex%, and not by the "hamster" method of re-buying at the expense of new funds.

Coin at Coenmarket: Cosmos (ATOM)

A local situation on a larger scale on this trading instrument.

My previous trading idea for this trading pair.

ATOM / BTC Mid-term work. Potential rising flag

Allocation of funds / positions in work.

An example of work for less experienced traders with small deposits.

1) 60-70% in work in the main direction. Increases the "working volume body" due to the complex% summation of transactions. Your working amount will grow steadily.

a) From each purchase from the bottom of the channel, 10% -30% coins to the upper orders or wallet.

b) From each sale near the resistance of the channel, transfer 10% -30% of money (BTC, USDT) into an "safety cushion".

It is worth noting that if you are sure that there will be an exit from the channel in the near future, the percentage in the upper orders is higher, if you are more inclined to the fact that the accumulation will continue, then it will be lower. This is logical.

In this way, you accumulate coins and at the same time increase the part of the position (coins) that is not involved in the work, as well as the "airbag" itself (money).

"Safety cushion" (accumulation of money) initially 10-30% in money. In this example, BTC acts like money (its price against the dollar shouldn't bother you too much). Additional profit from working with compound interest at a distance of several local trends more than covers all fluctuations in the price of BTC. While these fluctuations can be exploited, inexperienced traders are better off not complicating their work. An easier way is to work in the same way with alt / dollar pairs.

PS. For experienced traders.

All the same + partial or full influence on the price. As the position grows, your potential influence on the price will also grow, it is rational to help the price move in a local direction favorable to you.

When increasing a position, consider the liquidity of the instrument. Remember that when the coin is pumped, it decreases several times, therefore, the probability of entering the market at reasonable prices without falling prices will not be possible. Hence, adequate position sizing matters.

If you are more experienced and play the "trading games", you should under no circumstances work against the general direction of the market. This is irrational and unprofitable. The market is pouring - take this chance. Use panic to your advantage. Market down - load the glass from above, unload from the bottom. Market growth is a mirror image.

Also remember that your large orders controlling price movements should always be protected by small orders given the liquidity and volatility of the instrument.

Make fake sets and dumps to guide the price and draw charts where it is rational, the volume should be adequate. It makes no sense to draw a large volume at a narrow price value on a small liquid instrument. There are people who have not yet forgotten how to think and adequately analyze the "imprint of actions on the chart." Do it wisely and remember to follow the beautiful realistic buying / selling history during this action.

Also, you should always remember. If you are earning too much compared to other market participants, it is very likely that you will run into problems up to the banning of your account (the name of the exchange does not matter). The less liquid the exchange is, the less the “critical amount” of earnings, and vice versa. Exchanges greet those who are losing money and are unhappy with those who are making money. This does not apply to small amounts, but if you multiply a large amount several times in a short period of time, you are likely to run into problems. Therefore, if the trade is going very well, do not forget to withdraw profits.

Below I have attached all my trading and training / trading ideas for almost 2 years.

Pump your mind and improve your experience - it will reward you.

Winrate and risk reward ratioHi everyone. In the pursuit of success in forex, traders tend to focus on finding a strategy that gives the highest accuracy of entry. The pursuit of perfectionism in trading blinds their eyes and does not let them see the "forest for the trees". So, what are you missing out on? What important detail is missing from your trading plan?

The profit/risk ratio is your advantage.

In this article, we will look at how you should calculate your risk-to-profit ratio for your working trading system. A Forex trading system should include a well-defined equity management system that is easy to follow. Money management is one of the most important aspects of any trading strategy (TS) today, but most traders neglect the whole concept of money management in their trading. Most forex traders want to focus on the entry points provided to them by their trading systems. Their dream is to find a TS that gives a buy entry signal at the lowest point on the chart and a sell signal at the very top!

The entry point is undoubtedly important. But do not forget that at the moment of entry, we can create an advantage not only in the exact entry into the trade, but also in creating a favorable statistical expectation. Specifically, by putting a good profit to risk ratio into the trade. Trading is a game of probability. We know that in N% of trades we will lose and that in X% of trades we will win. But we need to remember that we can easily improve our stats by simply ignoring trades where the profit potential does not exceed the potential loss by at least a factor of two.

It is the presence of money management in your trading strategy that reduces your losses and makes you hold on as a winner. I say "makes you" because you have built into your trading system a certain percentage of profitable trades, the knowledge of which will screen out your emotions in the process of trading.

Applying this simple money management system will give you a general idea of how to propel your trading exponentially forward and in a positive way. In this article, I will explain how, by developing your trading system, you will determine the size of a position before you open it. Please remember that these are the basics to help you think properly. The exact calculations, specifically for your strategy, you will need to do on your own.

"We've all heard the famous trading axiom: cut your losses, and let the profits run. This is the aspect of money management in your trading system that produces big winners. Money management puts aside the subjective feelings that are present in people. "

Richard Dennis

“I'll say it again: I never made my money by trading; I made my big money by waiting and letting my profits grow."

Jesse Livermore

The first aspect we have to understand about our trading system is that our system gives us a positive expectation. We can only do that by testing, but sometimes testing can give a negative result if you forget to set a profit to risk ratio for each trade of at least 1:1.5 in the rules of the strategy. All beginners say that a forex trading system without 90% of profitable trades sucks, and they will surely develop their own holy grail to the envy of others. They are wrong, of course.

In Pursuit of Perfection

For all the trading systems really working in the Forex market, it is important to note that:

- Professional traders are looking for performance, while novice traders are looking for perfection.

- Beginner traders are looking for quick profits.

Most novice traders get hung up on the number (percentage) of successful trades rather than total profits. They all buy into a system that is advertised as 90% winning. The question is, "What good is a system that provides 90% winning trades with an average win of 12 pips if you have to tolerate 60 pips of risk to achieve a win?" Do you see where I'm going with this? It's like your best friend after taking 3 karate classes is ready to fight 6 muzzleloaders in an alleyway. He's obviously going to lose)

Probability of bankruptcy of a trading account as a function of the percentage of profitable trades and the profit to risk ratio.

The table above shows the dependence of the probability of "losing" the deposit on the percentage of profitable trades in your trading system and the profit/risk ratio in each trade. Thus, we can see that even if your strategy works 60% of the time but the profit/risk ratio is kept at least at 1.5:1, you can already be sure that you will not lose all your money. But if the ratio of profit to risk is 1:1 with the same 60% of profitable trades, the probability of losing the deposit in a series of losing trades is 12%.

A profit/risk ratio of 1.5:1 or more is the right way to think about trading. The minimum characteristics of a profitable strategy is 40% of winning trades with a profit/loss ratio of 2:1 (see the table above). According to this table, if you make 100 trades (each one following the same rules) and you have a 40% winning trade with a 2:1 profit/loss ratio, your risk of ruin would be about 14%. This is the minimum point from which the system can be considered working.

What is the most important piece of information regarding risk of loss?

Let me help you out. Having a high winning percentage is not an indication that you'll come out a clear winner. If you have 55% winning trades with a 1:1 risk to profit ratio, then your risk of going broke will be in the neighborhood of 27%. So, if you're trading in a similar way, in addition to that it's better to have fewer positions with higher profits!

Overall, 42% winning trades with a 1.6:1 profit to risk ratio would also be a good option. That means you would take 1.60 pips out of the market for every 1 pip you risk. For example, by risking 40 pips, you get 64 pips. If the market turns against you (when volatility occurs), you adjust your stop up or down.

If your stop-losses and take-profits vary from trade to trade, try skipping trades where the profit/risk ratio is less than 1.5:1. And you'll see how your overall trading statistics will improve.

Conclusion

I hope this article will help you in forming and optimizing your own trading strategy. Don't get hung up on perfection, but search for and work through profitable trading patterns and profit will come to you.

Bites Of Trading Knowledge For New TOP Traders #14 (short read)Bites Of Trading Knowledge For New TOP Traders #14

----------------------------------------------------------------

What defines a Bear Market? -

A bear market is when a market or even individual securities experiences extended price declines. The condition observed in the equity markets is where securities prices fall 20% or more from recent highs triggered by negative investor sentiment and/or overall pessimism in the markets.

What defines a Bull Market? -

A bull market is the condition seen in a financial market or individual security in which prices are rising and/or are expected to rise. Commonly the rise in price is observed over an extended period of time and can last months or years.

What is Inflation? -

Inflation is a rise in prices and is often expressed as a percentage change over a period of time. Inflation could also be interpreted as a decline of purchasing power over time, meaning that a unit of currency buys less than it did in prior periods.

RISKS AND OPPORTUNITIES FOR CORPORATES AND INDIVIDUAL INVESTORS -

Common application of financial market instruments for managing risk and opportunities.

Diversification: Portfolio Risk Using FX Futures

Individual investors taking a portfolio approach with managed futures and spot foreign exchange could be entering into emerging market currency positions including for example Hong Kong Dollar, Singapore Dollar or South Korean Won.

Depending on the view of each of the currencies in the portfolio, it could be constructed to eliminate exposure to the U.S. Dollar. However, there may be a time during which investors would like to introduce U.S. Dollar exposure and they could do so by using Mini US Dollar Index ® Futures with a contract value of $10,000. For example, the U.S. Dollar Index ® may be observed to be in a medium term uptrend and an investor may want to consider entering into a long position in the Mini US Dollar Index ® Futures based on their strategy of choice and exit the position when either their profit target is achieved or their loss limits are triggered.

TRADDICTIV · Research Team

--------

Disclaimer:

We do not provide investment advice, nor provide any personalized investment recommendations and/or advice in making a decision to trade. Before you start trading, please make sure you have considered your entire financial situation, including financial commitments and you understand that trading is highly speculative and that you could sustain significant losses.

How To Lose ProperlyOne of the few aspects of forex trading where you can experience some certainty is that you will have losses. Losses are a part of trading, and one of the key differences between successful traders and the rest is not how much they lose, but how they handle those losses. Being able to lose is key to being a winner in the long run.

How are you currently coping with your losses in trading? How do they affect you? What effect do they have on your performance and trading results?

Let's break down three steps that can help you better manage your Forex trading losses.

Step 1: Reduce losses

The first step in effectively dealing with losses is " Reducing losses". It is a key aspect because if you get this step right, you will have to use step 2 and 3 less in the future. The first step can be seen as a kind of "disease prevention".

There are three aspects that will help you reduce your trading losses and have an impact on how you deal with them.

1. Reduce your losses

When I talk about reducing your losses, I do not mean trying to reduce your losses per se, as it is not realistic, I mean focusing on your trading strategy, maintaining trading discipline and reducing loss-making trades that, for example, arise from trading that is not part of your strategy and that you can therefore avoid.

Losses that occur as a result of orderly trading are nothing more than losing trades that are part of the trade. Losses incurred from opening trades that go against your trading strategy, when "something seemed there" to you, can be seen as bad trading or something else that could have been avoided. In short, don't be fooled. Follow your forex strategy.

2. Reduce the value of your losses.

Obviously, it all comes down to risk management again. It's important to recognize that large losses have a significant impact on our emotional state, and can often have an impact on our trading behavior, usually not in the best way, such as trying to "get back at the market. Never increase the lot size after a losing trade.

3. Reduce the mental and emotional impact these losses have on you

Your reaction to losses is a factor in how you got those losses (whether you followed your strategy strictly or not), their magnitude, as well as your perception and belief about those losses. If you don't like to suffer losses, and feel that you shouldn't have losing trades or dealing with a trade where losing trades are possible, then your reaction will be very different from those people whose thinking is more realistic and who realize that losses are an inevitable part of trading, that results are probabilistic and that not every trade is a winning trade.

Are you fully aware of the fact that losses are a part of trading?

Are you fully aware of the fact that every trade is not lossless and has a probabilistic outcome?

Step 2: Reacting to losing trades

Knowing how to lose is the key to becoming a winner.

This step comes down to how you actually handle yourself the moment you realize that you may have to accept a loss. Dealing with loss is extremely difficult, it has to do with factors such as our ego, our desire to win and our human nature of aversion to loss, and that is why the "loss reduction" phase is so important. However, even that one step in terms of accepting losses can still be difficult, even more so if we have had losses or losses before. Because of this, it would be helpful to have some strategies that could help you stay calm, focused and disciplined while in the heat.

Many people are stopped or taken out of the trade by feelings of anxiety or anger. Their behavior begins to be driven by the emotions they are feeling in that moment, causing them to lose control and discipline. The whole point is to be able to manage your emotional state in real time and keep your mental faculties open to trading, as well as to be able to own yourself and keep a tight discipline.

The only quick and easy way to learn how to manage your emotional state is to learn how to manage your breathing. When you are stressed, your breathing usually changes. It becomes ten times more frequent and intermittent, so you need to breathe deeper and longer. This will help you overcome the stress response and keep yourself calm, composed and, most importantly, disciplined.

It also helps me to connect the palms of my hands using my fingers. This is a simple ancient Indian technique for calming the nerves.

Also, taking the cognitive aspect, keep your sanity in these situations. What thoughts usually visit you the moment you execute a losing trade? "The market always goes against me." "It shouldn't have happened," etc. ...

These are unhelpful thoughts because they only increase your stress level. A better question to ask yourself is the following: "What would a successful trader say to himself in a situation like this?" This may help you to direct your thinking in the right direction, and as a result affect your feelings and lead to more positive behavior.

Another way to manage your mindset is to actually create some affirmations, phrases that you can repeat to yourself when you are in a situation that will probably bring you a loss, and channel your thoughts, feelings and emotions and override any unconscious and habitual reactions that you might have developed in yourself. Remember that what you focus your attention on will determine your emotional state and discipline.

It can be very helpful to focus on phrases that help you concentrate on your trading process and do the right things (which is probably not easy) at the right times and for the right reasons; for example: "I'm a winner because I follow my trading plan."

Step 3: Recovering from losses

It's helpful to have some strategies that can help you stay calm, focused and disciplined while in the heat.

At the end of your trade, take stock of your losses today. What can you do to do this?

1.Evaluate your state of mind

How do you feel? On a scale of 10, evaluate your overall trading condition, with 10 being the other end of the scale, and 1 being the other end. Where are you now?

2. Evaluate and analyze the cause of your losses.

What type of loss occurred - a losing trade or a bad trade? Can you learn a lesson from the trade? Is there anything you can do about it in the future?

Evaluate and analyze the cause of the loss. What lesson can you learn from it?

3. Control your reactions.

There are a number of ways in which you can manage your reactions to losses.

On a cognitive level, you want to be fully accountable for your thoughts, your perceptions, and the meaning you give to your losses. Your losses have the meaning you give them. Loss does not mean, for example, that you are a loser. You can take a different perspective by looking at things more broadly, what lesson can I learn from this? How will I feel about it at the end of the day, at the end of the week, at the end of the month, after 6 months, after a year, after 5 years?

On a behavioral level, you could use a breathing or relaxation technique, go for a walk, or do some physical exercise to help you deal with feelings of loss.

Sometimes it's just a matter of time. One trading session or day can often be enough to help you get rid of some emotions, regain some perspective, and be ready to start trading again.

4. Get it together.

Come back and be ready to start trading forex again emotionally and strategically. Remember your trading plan, focus on your breathing, and then act.

Bottom line.

If you want to learn to lose like a winner, and develop skills that will help you improve your chances of becoming a successful Forex trader in the long run, remember:

- Reduce your losses: develop the ability to avoid strong reactions to losing trades, by reducing avoidable losses and bad trades; by managing position size and trade outcomes; and by developing a mindset that has a more positive view of losses.

- Properly respond to your losses by directing your thoughts and focusing your attention on controlling your breathing to create a state that will enable you to conduct yourself in the proper manner necessary for orderly trading.

- Learn to recover from your losses by assessing your condition, analyzing, controlling your reactions, and focusing on trading again.

Margin callWhen there are not enough available funds in your account to meet margin requirements, the broker issues you a warning, which is called a Margin Call.

Your broker automatically sends a margin call when your free margin reaches $0 and your margin level reaches 100%. From now on, it will be impossible to open new positions.

Thanks to leverage, traders get leverage that allows them to open positions that are several times larger than the size of their trading account. This helps to earn much more, but losses are also growing. It is at such moments, when you hold too large a position and the market goes against you, that you can get a margin call. This will trigger the automatic closing of all stop-out positions if the market continues to move against you.

An example of a margin call.

You open a forex trading deposit of $4000 and use a leverage of 1:100. As we know, the lot size on forex is equal to 100,000 units of the base currency ($ 100,000). When using the leverage of 1:100, you must deposit $ 1000 of your money as collateral for each open transaction in the amount of one lot.

After analyzing the EUR/USD currency pair, you decide that the price will rise. You open a long position for two standard lots at EUR/USD. This means that you are using $2,000 of your funds as collateral. At the same time, the free margin will also be $ 2000. The cost of one item when trading one lot of software will be equal to $ 10. This means that if the price drops by 200 points, the free margin will reach $ 0, the equity level will be equal to the margin used, and you get a margin call.

How can margin calls be avoided?

To avoid margin calls, you need to follow the rules of risk management. Before opening positions, you need to know where your stop loss will be and how much it will equal as a percentage of capital. The distance from your entry point to your stop loss should determine the size of your position and, accordingly, your risk level. Do not do the opposite: the size of your position should not determine the size of the stop loss.

You may have heard that it is not worth risking more than 5% of the capital in one transaction. Trading according to this rule is, of course, better than trading without rules, but an experienced trader will still say that it is too dangerous to risk 5%. Using the 5% rule, you can lose 20% of your capital in just 4 trades, which is too much.

The more money you lose, the more difficult it will be for you to return to the previous level of your trading capital. Serious drawdowns are also psychologically difficult for most novice traders. You may even start trading out of a desire to recoup and start opening even bigger positions to try to recoup your losses. But this will no longer be a trade, but a gambling game.

Never risk more than 2% of your trading account in any transaction. If you are just starting to trade forex, 1% risk will be even more appropriate. After you become confident in yourself and your trading strategy, you can slightly increase the size of your position. In any case, 5% is too much for most trading strategies. Even the best traders can make 4 or 5 losing trades in a row.

If you want to trade using large lots, you must have the appropriate amount of capital. This is the only safe way to trade for large amounts.

The number of positions you open at the same time determines your risk at any given time. If you risk only 2% of your trading account in one trade, do not think that you can open 10 positions at once — this is a sure way to get a margin call.

Even if you only open two positions, but you are trading correlated currencies, you are still risking 2% in one trade. An example of this could be a risk of 1% on a long EURUSD position and a simultaneous risk of 1% on a long GBPUSD position. If there is a sharp jump in the market due to the US dollar, you will receive a loss on two positions and lose 2%.

Therefore, try not to open multiple positions on correlating currency pairs, or at least be aware of the possible risks.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

How To Create Your Own Trading StrategySooner or later every trader comes to the understanding that he needs his own trading system. It is possible to use others’ forex strategies, but they should also be adjusted and suit to you: to your own trading style. In this lesson we will talk about the necessary components of a trading strategy (TS), why a trader needs it, and what questions should be asked when developing a system.

What is a trading strategy?

A trading strategy is a set of rules allowing to systematize trading, to give a trader a clear notion of when it is better to enter the trade, when it is better to exit it and when it is better to abstain from trading. Also, the system specifies the time and time frame for trading, currency pairs to use and the lot to trade. TS helps to switch off emotions and protect against their negative impact on trading.

Why create your own TS?

There are many ready-made trading systems on the market, both simple and quite complex and understandable only to professionals. Beginners, as a rule, start trading using ready-made TS, and not the most complex one. However, with time almost each of them understands that trading is really effective only with a strategy, developed personally, based on one's own experience and preferences.

Not always the TS is developed from scratch. Often (especially if it is the trader's first experience in creation of a strategy) a ready-made system is taken and some changes are made to it: some indicators are added, parameters of already installed instruments are changed, etc.

Regardless of whether the trader creates a strategy from scratch or modifies a ready-made one, it must be suitable for his/her character: scalping is unlikely to suit a thoughtful and rational person, while long-term trading is not suitable for other people due to their nature.

Essential components of a trading strategy

Each strategy must include certain points, which together will ensure the stability of trading:

• Logical reasoning. This is the basic idea on which the trading strategy is built. It is the foundation on which all other components are based;

• Currency pairs;

• Timeframe and time of trade.

• Rules of entry

• Rules of exit. How stop-loss and take-profit are set;

• Trading lot volume and risk limitation.

• If all of these parameters are taken into consideration, you can start testing the strategy on a history or demo account.

Timeframe

The timeframe choice depends on the time the trader is ready to devote to trading. While on the daily charts, the formation of a candle takes a whole day, and therefore only a few minutes a day will be required to assess the situation and make a decision, on M1, everything changes every minute, and the trader will need to be constantly present in the trading terminal. The smaller is the timeframe, the more signals will be received and the bigger is the potential profit. However, not everyone has the opportunity to devote all the day to trading, and for working people the daily chart will be the best option.

It is also believed that technical analysis works better on the daily charts than on the hourly and especially on the minute charts, so D1 will be the best choice for beginners. Most traders use D1-M15 charts, the five-minute and 1-minute charts are too unpredictable and only highly specialized professionals are able to make stable profits on them.

Currency pairs

In most cases it is optimal to choose EURUSD or another currency pair as a trading asset. In the trading terminal MetaTrader 4, you can select to display only the desired assets by right-clicking on the "Market Watch" field and selecting "Symbol Set"-"Forex".

If the idea is focused on a particular asset (for example, gold or the S&P 500 Index), the choice is even more obvious.

Choice of tools for analysis

Once the trading idea is clear, and timeframe and currency pairs for trading are selected, it is necessary to determine the tools for analysis and determination of entry/exit points. The main rule here is not to go overboard. As a rule, simple systems prove to be the most efficient in real trading. In the same TS, which are overloaded with indicators, various constructions and other signals, these tools often contradict each other, only confusing the trader and provoking him to make mistakes.

If the strategy is an indicator one, as a rule, it must contain from 2 to 5 instruments. The minimum required is one trend indicator which determines the trade opening direction and one overbought/oversold indicator (oscillator) which helps to avoid false entries.

If the strategy is focused on candlestick analysis, then the trader needs to be well-versed in Price Action patterns. If it is planned to use graphical analysis - a good knowledge of shapes (triangles, flags and pennants, double tops, etc.) is required.

It is also necessary to decide whether news and important economic events will be taken into account (if the TS itself is built on the analysis). If the system is based on fundamental analysis, you need to decide what kind of news to trade. News can be tracked with the economic calendar and special indicators.

Rules of entry and exit

First of all, you need to decide on what type of orders you will enter the market: pending or market orders. Pending orders, on the one hand, help to avoid false entries, but, on the other hand, take away a part of the profit due to the fact that the price passes a certain distance before the moment when the order is activated.

It is also necessary to decide in advance on what principle take profit and stop loss will be set. In some TC exposition of take profit is not necessary (for example, when using the trailing stop), but stop loss must always be exposed. Stop Loss is primarily a risk limiter, and protects the trader's capital from force majeure, such as from Internet or power outage.

Once all of the rules are defined, they must be necessarily recorded on paper or in a separate file - that is, a checklist is needed. Then you can begin testing the TC.

Testing on the history and on a demo account

First of all, the strategy should be tested on the history. It will give statistics and primary understanding of its profitability. However historical data loses its relevance over time, so the strategy behavior on the real market will give more useful information.

Before entering the real account, the TS should be tested on a demo account. The time of testing depends on the time frame: when trading on H1-H4 or, moreover, D1, it will take at least several months to determine the profitability, while the scalping strategy effectiveness can be determined in a week.

Conclusion

Every trader should have a trading system. Sometimes beginners think they can trade based solely on their intuition, especially if this delusion is confirmed by a couple of successful trades. Moreover, there are cases when experienced traders have opened deals based on intuition or against the rules of the system and earned huge money.

However, the key factor in this exception is experience. A professional trader is able to understand when intuition can be activated and when it is necessary to work strictly according to the system. As a rule, intuition is used very seldom, and rather not to enter the market by a signal than to open a trade against the rules and get a loss.

In any case, only professionals with years or even dozens of years of experience can afford such actions without serious risk for capital. There is only one correct way for beginners who are determined to learn how to earn on Forex - the way of systematic trading.

Besides, there is one point that is very often missed in their trading, even by experienced traders. This is the Logical Rationale for the trading strategy.

When to switch from a demo to a live account?An important part of trading is trading on demo account, at least in the initial stages. But, after all, what's the point of earning fake dollars? After practicing on the demo, you need to switch to the live account with real money. You are going to find out when and how to do it correctly after reading this article.

To begin with we would like to point out that technically demo and real accounts are virtually the same. Except that order execution on the demo is a little bit better. But if you are not opening trades every minute with a couple of points, the speed of order execution will not play any significant role. That's why the decisive factor in the difference between trading on a demo and a real account is psychology: the fear and greed that people write so much about. When working with real money all of this is felt many times stronger and if you earn on a demo account, but lose on a real one, then trust me it’s all about you not the stop hunters.

Two groups of traders

As for the transition from demo to live account, we can distinguish 2 groups of people:

1) those who switch to real account too late;

2) those who switch to real account too early.

First group. I know some people who have been trading on a demo account for a year or two and haven't even tried to trade on the real account. And they have a stable profit, a well-established system, risk management and emotion control. When asked "Why aren't you trading on the real account?" they vaguely answer something like "I need to check everything, allocate the amount of money from the budget, calculate the risks etc.".

I do not know what it is called from a psychological point of view, but a similar fear of action, fear of making a mistake, indecision, is present in many people. A large number of people dream of opening their own business someday, read books, forums, come up with ideas, but do not start their own business. Not even trying. It's the same with the demo account: many people get stuck on it and prefer to think that they will move on to a real account "someday".

In my opinion, you just have to decide and do it. There is no other way.

Second group. There is also the opposite of the "dreamers" traders who, after closing a couple of successful trades, immediately get into the real account.

The market will not run away from you! And all possible mistakes are better to make on the demo account, because on the real one you will have to pay for them from your own pocket. That is why you should first take part in education, choose a system or develop your own strategy, gain experience by using the demo account and only then switch to the live account.

3 signs that it's time for you to move to the real world

1. There are more profitable trades than losing ones.

You have to learn how to extract profit from the market, and to do it steadily. It is not so important how many dollars you have earned, it is much more important what percentage of all your trades are profitable. Of course, this all depends on your particular strategy, the ratio of average profit/loss, etc., but in general 6-7 trades out of 10 you have to be successful.

2. You know how to management your capital

Position size management is one of the main factors of success. There is no Forex strategy, which gives 100% of profitable trades. There will be periods when you will definitely incur losses, there is no other way. So, we need to select the size of trading lots so that in case of losing trades, not to lose too much, and in case of successful positions to earn an attention-worthy profit. That is the purpose of any method of risk management. As for specific numbers, I would not advise anyone to risk more than 3% of the deposit in one trade.

3. You Control Your Emotions

No matter what they say, but emotions play a very important role in trading and you must learn to control them. Of course, when trading on a live account emotion is much more emotional than when trading on demo accounts (because there is real money at risk), but you can still build up some experience.

You must be comfortable with losses, because you know that losses are a part of trading, and the most important thing is to have more profitable trades. But you must also take profits calmly: do not fall into euphoria, to keep a sober judgment in market analysis. Excessive optimism often leads to bad decisions. How to be calm in the presence of losses and profits? Very easy: trading must become a routine for you, an ordinary job, for the execution of which you will get a salary.

How much time should I trade on the demo?

Turning to the question of time, you need to understand that the purpose of trading on a demo account is to gain experience. You need to identify all the standard and non-standard points in your strategy, and for that you need to make a substantial number of trades.

So, for different tactics, the time needed to gain experience will be different. Agree, when trading on hourly charts you will get a lot more signals in a week than on daily charts.

But if we call any specific numbers, it is as follows:

- Trade on hourly charts for 2-3 weeks minimum

- Trade on 4-hour and daily charts roughly for 3 months.

Alternative to Demo Accounts

A good alternative to Demo accounts are cent accounts. With a deposit of just some 20-30 dollars, which you do not regret to lose, you will get the opportunity to trade with real money using precise money management. Of course, you will not earn much from these pennies, but it will be a good training in the "combat" conditions.

3 paradoxes in tradingIn life, as in trading, there are many paradoxes.

Some things are obvious, some are not.

With experience comes awareness, and we begin to see what we have not seen before.

Understanding the fundamental principles will help you move on correctly.

Paradox #1: The more you need money, the longer you won't have it

Everyone who came to trading needs money.

Often a new trader is a person who has recently lost his job and now hopes to earn them by trading.

Here they will be disappointed. After all, trading is a very risky activity, and if you still do not have knowledge and experience, the risks increase to the skies.