BSVUSDT is the best choice to open a position todaymost of the tokens are going somehow exactly as bitcoin is going, so I analyse BTCUSDT chart first then I choose the token with more movement (based on the percent it has gone up or down) so today BSV is the best choice for higher gains

everything is on the chart, if the price comes below 146 I will open a short position after a pullback and if the price goes above 155 I will open a long position after a pullback.

My Bet is On the Downward movement based on my analyses.

Tutorial

TRADING PRINCIPLES THAT EVERYONE SHOULD KNOW. PART 2.Hello traders!

Today we will continue to explore the principles that every trader should know and do.

READ THE NEWS.

The impact of news on ALL markets is enormous.

Every news can turn the market against you and break any trading plan.

Read news, professional analytics, reports, any information that may be useful.

You should always be up to date with the latest news in order to correctly assess future movements.

MAKE A TRADING PLAN.

Every trader should have a well-built strategy and a clear plan of action.

Before each trading session, the trader analyzes the market and outlines the possible direction of the market and opportunities for opening positions.

Even before the market opens, you should be ready and know what you will do.

After each trading day, you have to analyze positions and work on mistakes.

BE RESTRAINED AND DISCIPLINED.

Do not give in to emotions.

Don't go into a new position often.

Don't change your mind every five minutes.

Don't forget about the risks!

A good strategy will help you not to drown in this emotional storm.

ACCEPT YOUR LOSSES AND MOVE ON.

There are thousands of profit opportunities on the market every day.

But if you lose all your money in the pursuit of winning back the lost money, you will not have the opportunity to trade for a long time and will not have the opportunity to become a successful trader.

Trading is a long distance where you need to be able to stay on track, be able to accept losses and move on.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

UNSUCCESSFUL vs. SUCCESSFUL TRADERUnsuccessful Trader

You are trading without a Specific Trading Strategy

The main reason for opening positions for you is not clear strategy rules, but your own intuition. And even after several failures, you continue to repeat your mistakes due to the lack of discipline and the lack of a trader's trading journal.

You often over-trade and get Margin Calls

Your instincts make you trade too much, open new positions again and again, forgetting about the risk and thus getting frequent margin calls. Because of such disorderly market entries, you become very emotional, lose control and lose money quickly.

You get attached to Open Positions

Following your own emotions, you often hold on to an open position for too long, hoping that the profit will become even greater, while forgetting about the take profit that you set yourself. As a result, a profitable position becomes unprofitable, and you begin to believe and expect that it will become profitable again, overstaying the unprofitable position.

You're Too Emotional

Your mood changes with every price reversal. Forgetting about the analysis, you often open new positions and lose more than your risk management can afford.

Successful Trader

You have an Effective Trading Plan

You have written on a piece of paper a strategy of actions for any market situation and always follow the rules prescribed in the strategy. You often analyze your trades in a trade journal and always remember your mistakes and hits.

You Understand What Risk Is

You have clear rules of risk management. Even before opening a position, you know how much you can lose in this trade and do not lose more than allowed by the rules of risk management. You don't move your stop loss and you don't act emotionally.

You Control Your Emotions

You clearly follow your strategy, leaving no room for emotions. Even before opening a deal, you have analyzed everything and know exactly what to do – you have a plan of action.

You always fix a part of the profit

You do not forget to protect your capital, so you close part of the position in plus or zero, and let the rest of the position grow further. Now you will not only not lose your money, but you can also earn.

-------------------

Share your opinion in the comments and support the idea with Like.

Thanks for your support!

Bites Of Trading Knowledge For New TOP Traders #6 (short read)Bites Of Trading Knowledge For New TOP Traders #6

---------------------------------------------------------------

What is Hedging? –

Hedging is the action taken through the use of a financial instrument to minimize the loss or risk of the loss of value of an asset due to adverse asset price movements.

Who are Hedgers? –

Hedgers are market participants such as commodity producers who want to lock in selling prices of commodities they produce, or food manufacturers who want to lock in buying prices of raw materials purchased.

Market participants also include financial institutions handling financial assets and use derivative products such as futures to manage the risk of a portfolio of financial assets.

What is the difference between Physically Delivered vs Cash Settled Futures Contracts? –

Physical delivery is a term in a futures contract which requires the actual underlying asset to be “physically delivered” upon the specified delivery date, rather than being traded out with an offsetting contract.

Cash settled futures on the other hand allows for the net cash amount to be paid or received on the settlement date of the futures contract.

Futures exchanges may offer both types of contracts to market participants who have different purposes for trading futures contracts.

RISKS AND OPPORTUNITIES FOR CORPORATES AND INDIVIDUAL INVESTORS –

Diversification: Correlation in Futures –

Investors could allocate a portion of their portfolio to establish a managed futures position to deliver non-correlated results under most market conditions, which may serve as a risk mediator within an overall portfolio. This may deliver lower relative returns during periods of price stability. However, during periods of market stress, managed futures could outperform the broad market.

For example, the Asia Tech 30 index which has no Thai companies as a component stock would not be expected to have any Thai Baht (USDTHB) currency exposure and which could be included in a managed futures portfolio at times where there is no or low correlation between the two markets and could be used as a hedge during times of negative correlation.

Source: ICE Connect

Diversification: Portfolio Focused on Asset Returns –

Individual investors who have a portfolio of foreign stocks will have a return that is composed of the return of the foreign currency-denominated stock plus the change in currency exchange rates. Therefore, investing abroad means having exposure to two different sources of risk and return made up of the underlying asset and the exchange rate.

For a long-term investor, the focus on return-generating assets may be the priority rather than returns from currency exchange rates. This could imply removing currency risk through a clearly defined hedging strategy process initially, and then adding back currency exposure at a later stage if it is determined that currency exposures could improve a portfolio’s return.

Investors would need to analyze their expected returns with and without currency exposures and determine their net currency exposure to be removed. U.S. Dollar based portfolios could use futures contracts such as the Mini US Dollar Index ® Futures to hedge a basket of foreign stocks denominated in their respective domestic currencies.

TRADDICTIV · Research Team

--------

Disclaimer:

We do not provide investment advice, nor provide any personalized investment recommendations and/or advice in making a decision to trade. Before you start trading, please make sure you have considered your entire financial situation, including financial commitments and you understand that trading is highly speculative and that you could sustain significant losses.

btcusd in short trend It’s a short term analysis for the scalper.In this technical analysis,I use some technical tools like fibonacci retreament,pivot points and parabolic sar.

In the chart , I see a bearish trend but it’s not so strong.There is two cross line .If the price cross 1st line in one candle, it will toch the resistance. If btc price cross 2nd cross line , it will touch the support.

TRADING PRINCIPLES THAT EVERYONE SHOULD KNOW. PART 1.Hello traders!

For a long time, the Forex market has created a large number of trading methods.

Finding your strategy that suits you specifically is one of the main steps in achieving success in the Forex market.

And it is worth remembering that successful traders do not use anything magical in their trading. Everything has been invented for a long time for both a novice trader and a successful trader.

The main task of beginners is to choose a fairly easy strategy and strictly follow its principles and rules.

So what does a beginner need to know in order to trade profitably?

Price levels.

It is difficult for a beginner to determine price levels and trade them correctly.

There are no specific rules in this topic, since the price does not draw clear points, but forms zones.

Many traders use support and resistance levels in their trading and for beginners, the main task at the beginning of the journey will be the concept of selling from resistance and buying from support.

There are three types of trading systems based on price levels.

1. If the price moves within the framework of a sideways movement, the trader can sell from resistance and buy from support.

2. If there is a prevailing trend in the market, for example, bearish, a trader can sell from resistance and expect support to break through.

3. The same rules work in the bull market, only in a different direction. If the price breaks through the resistance, then this zone becomes a support from which you can buy.

Consider the principles of trading from price levels.

#1 Understanding the market context.

The key to profitable trading from the levels is the ability to correctly understand the market context.

Bearish pressure leads the market movement through an impulse movement that breaks through support and creates new lows – in this context, selling strategies will not work well.

That is why it is so important to follow the concept of the market context:

When the market falls, creating new highs and lows, we are talking about an impulsive bearish context.

The correction is created by an impulse that is weaker than the main trend.

A sideways movement occurs when both demand and supply are approximately equal and the price cannot move in a certain direction.

As soon as the bulls or bears take over, the price will make an impulse in the direction of the strong side.

#2 Top-Down Analysis

The market is ruled by big money, which pays great importance to large timelines.

And it is vital for an ordinary trader to know where smart money is pushing the market.

To do this, it is worth noting strong levels on the monthly-weekly-daily timeframes in order to know exactly where the price is most likely to rebound.

On the other hand, if the price is above the key levels, then the market is bullish.

#3 Candlestick Patterns

Almost every trader uses candlestick patterns in his analysis, which are a very strong analysis tool.

Reversal candlestick patterns create an excellent opportunity to enter a trend reversal.

The higher the timeframe on which the pattern was formed, the stronger its signal will be.

Knowing candlestick formations is a very important part of a trader's professional growth.

#4 Risk Management

Any trader should be aware of the risks and be able to control them.

Although this topic goes beyond the definition of the market context, it is still very important.

There are many ways to control risks.

An important rule is to set a stop loss and risk in each position, as recommended, no more than 2% percent.

Hedge fund managers risk an even smaller percentage in each transaction, sometimes 1% or even lower.

It is better to grow slowly than to fall quickly.

If you lose 2% of the capital, in the next transaction, in order to get your money back, you will already need to make 4%, which in general is not difficult to do.

But if you lose 50%, you will need to make 100% profit already, which is almost unrealistic.

Conclusions

Summarizing the above, you can make the following sequence of actions:

Identify the key support and resistance levels.

Wait for the candle to form in the desired direction.

Stop loss above or below the candlestick pattern.

Take profit is placed at the following support or resistance levels.

Always make sure to use proper money management for each trade, and never take on a risk that exceeds the return.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

The Shark Pattern Tutorial (Basic) #BitcoinThe Shark pattern is a relatively new addition to the Harmonic collection which was discovered and defined by Scott Carney in 2010.

As a trend continuation structure, the expectation at the completion point of the Shark is for price to continue in the direction of the trend.

The Shark, like all continuation structures, begins with an initial impulsive move ( X - A ) in the direction of the trend.

Draw the Fib retracement tool from the low point ( X ) to the high point ( A ) using the levels 0%, 38.2%, 61.8% and 100%.

The A-B leg must retrace a minimum 38.2% and maximum 61.8% of the X-A leg.

Reverse the fib tool in situ then add the 113% and 127.2% levels.

Price must break the 113% level but must not exceed 127.2%.

Draw the fib tool from point X to Point C using levels 0%,88.6%, 100% and 113%.

After all confirmations are met, price is expected to reverse between the 88.6% and 113% retracement of XC

Draw the long position tool with entry at 88.6%, Stop at 113% and TP at 2R (risk to reward ratio 1-2).

At TP close at least 50% of your position.

Psychology of the market circle Hello traders!

Euphoria and Anxiety, Fear and Greed

Psychology of the market cycle

Any trader finds himself under the influence of changing market cycles. At favorable moments, investors feel joy and are overwhelmed with self-confidence. On dark days, the investor falls into despair and feels anxiety attacks.

The only way not to succumb to such an emotional influence is to follow the clear rules of a properly compiled system. Unfortunately, most traders have no plan and no strategy. In order not to become a victim of emotions, a trader must have an idea of the emotional stages of the market cycle.

Psychological stages of trading

An uptrend is a trader's emotions.

Optimism

When the market is growing, the trader sees an opportunity to earn and invests money. The economy is growing, the price is rising, profits are growing. At such a moment, the trader feels confident, begins to open new positions after each pullback, which eventually turns into a kind of instinct. At this stage, the trader begins to forget about the risks.

Enthusiasm and Abundance

The market is starting to accelerate. Traders experience pleasant feelings of joy and enthusiasm. The trader begins to lose his head, confidence overwhelms him.

Euphoria

After that, the last stage of the upward trend comes - Euphoria. Money comes very easily, the trader is overwhelmed with confidence in his actions and decides to open positions using leverage. At some point, the trader begins to think that he is a professional analyst, and it is not he who is following the market, but the market is following him. This stage in the market helps large investors to discount their shares to self-confident traders who buy everything in a row, believing in the continuation of the upward trend. In fact, this phase is the most risky, after which the trend is reversed.

Emotional stages of a Downtrend in the market

Anxiety

The price is starting to slow down, there are fewer and fewer sellers, bears are gaining momentum. For a trader blinded by luck, this phase looks like another correction. But the market can no longer create new highs and falls, forming new lows. Such a fall creates anxiety in the trader's soul, easy profits begin to melt.

Denial and Fear

Fear fills the market, traders are afraid to be wrong, because recently they ruled the market. At this stage, the trader denies that he is wrong and tries in every way to justify holding unprofitable positions. Like any beginner, a trader believes that sooner or later the price will not only return, but also go beyond the maximum. Denial brings the trader to a state of helplessness and inaction, from misunderstanding of the situation on the market. The trader gets lost, not knowing what to do and waits without knowing what, without closing unprofitable positions.

Despair and Panic

The price continues to fall, and the trader falls into despair, because the confidence in holding a losing position is already beginning to disappear. This phase is the most painful, because the severity of losses presses too hard to stay calm.

Surrender

The unprofitability of the position is increasing, traders can no longer tolerate this pain. In this phase, traders have to capitulate just to stop these torments. Traders are starting to close positions and it is here that large companies are included, for which this moment gives a new opportunity for large profits. Asset buying begins, because a reversal is possible soon.

Despondency and Confusion

As it often happens, as soon as a trader has closed a position, the market begins to grow. It looks like the law of meanness. This phase drives the trader into despondency, because the position was closed a moment before the rise. It is here that newcomers begin to think about whether it is worth investing further.

Hope

The market is starting to revive. The price shows new highs and the investor has hope. It seems that here it is, a new opportunity. The trader begins to enter the market, forgetting about the past, without drawing conclusions. A trader enters the market when the price has already accelerated, at points where the risk is again close to a critical value, the cycle begins again.

Traders should keep this cycle in mind. Such emotional roller coasters can ruin anyone. A well-designed strategy can help avoid these painful blows.

Remember the risks, remember the cycles, work on the mistakes, and victory will not take long to wait.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

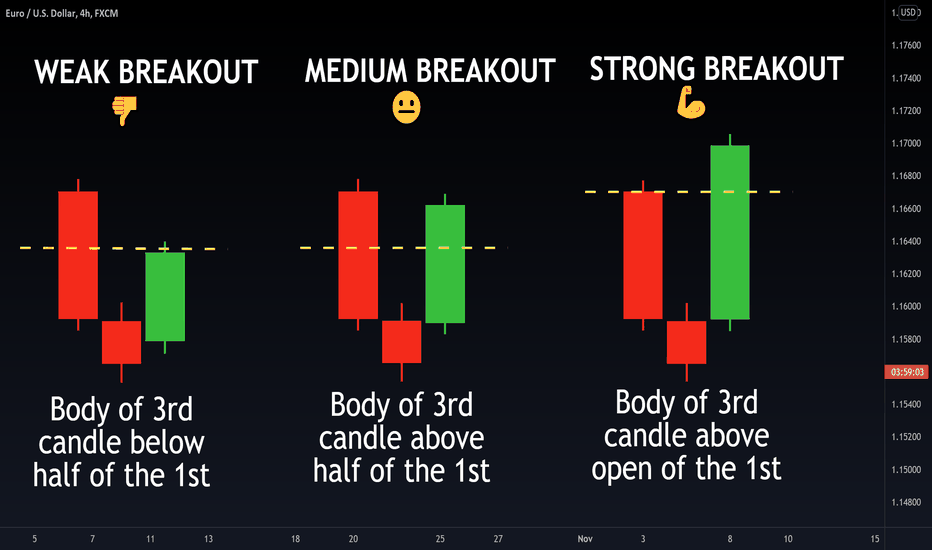

FALSE BREAKOUTS | SPOT/AVOID/TRADE THEM LIKE PRO📈📉

FALSE BREAKOUTS | SPOT/AVOID/TRADE THEM LIKE PRO📈📉

How often have you opened a key level breakout trade, and then the price turned against you? False breakout happens quite often and it is a problem for many traders who buy at highs and sell at lows.

❗️Breakout trading is a fairly popular and viable trading strategy. However, some breakouts often turn out to be false. This can be quite frustrating, not to mention that it can often lead to a losing trade.

However, in many cases, an experienced trader can analyze the market situation and react to it accordingly. False breakouts can make a profit if you know how to trade them correctly.

⚠️A false breakdown is a situation when the price violates an obvious level, but then suddenly changes direction. When the initial breakout of the level occurs, many traders open a trade in the direction of the breakdown. These traders are trapped when the price reverses, which triggers a series of stop losses. New traders are also entering the market, and this puts additional pressure on the price. This often turns the price into a new trend, the opposite of the initial breakout.

A breakout that turns out to be false is a sign of strength in a downtrend or weakness in an uptrend.

As you can see, a false breakout can easily cause significant losses for any trader.

Some traders develop their entire strategy around trading false breakouts, as this can be a very powerful trading approach. Some of the best trades happen when market players fall into a trap and their stops start to work.

✅How to find patterns of false breakouts?

🟢If you do not learn how to correctly identify false breakouts, you will not be able to trade them profitably. For example, there will be situations when the price returns to the breakout point, and only then continues its movement.

🟢One of the ways to detect false breakouts is to monitor the volume. Real breakouts are usually accompanied by strong indications of trading volume at the time of the breakout. When this volume is absent, there is a higher probability that the breakout will not happen.

🟢Thus, if the trading volume is low or it decreases during the breakout, a false breakout is likely to occur. In contrast, if the volume is large or it increases, a real breakdown is likely.

🟢It is also useful to monitor not only the trading volume but also the price movement on the lower timeframe. In many cases, you will see that the price makes a very sharp pullback on the lower timeframe, which is not visible on the higher timeframe.

✅False Breakout Trap

🔴After all, many trading textbooks say that a breakout can be considered confirmed when a candle closes above the resistance level. However, the price moves in your direction for a while and then turns 180 degrees. As a result, you have a stop loss triggered.

🔴The false breakout trap includes several candlesticks, usually 1-4, that go beyond the key support or resistance level. Such breakouts occur after a strong movement, as the market has reached an important level, but the price momentum still retains its strength.

Have you ever been trapped by a false breakout?

BTC UpdateThe Anchored VWAP is a modified version of VWAP. It ties calculations to a specific price bar decided by the trader. It is similar to the traditional VWAP, as it incorporates price and trading volume in a weighted average. Like VWAP, it can also identify the areas of support and resistance on the chart. This indicator can warn you of a heavy price drop. Take a look at the bitcoin chart. If around 54000, the price breaks this line. This will be a serious warning for a heavy fall.

BTC poor bearsJust a very fast update to demonstrate something. Don't take this idea as an analyze , Timeframe is only 4H.

consider it more like a tutorial to optimize your chart reading.

- now it's been 5 times that the bears are trying to push TheKing under 60k.

- Results : 5 Fails. (can see on chart attempts)

What does it could means ?

Going up is same as going down but just reversed :

- When BTC goes up and attempts to break the last ATH and fails many times , then the probability to go down is higher.

- When BTC Goes down, if bears fail many times to push TheKing down, then it creates some divergences with time, then probability increase to go up.

- Right now TheKing stays very strong, it's very hard with the Fomo for bears to back from their caverns.

- Anyway if we break down 60k the next Supports are around 55k$, followed by 52k$.

Happy Tr4Ding !

GOOD REACTION IN DUMP AND CORRECTION 😍when market have correction or dump people scared and sell portfolio and same place market come back and who sell portfolio, buy again in pump and this happen repeat and repeat to zero portfolio...

Please read this part carefully , When market have a correction you must buy more and wait for come back and get profit to this correction instead of sell portfolio and think market will have bear season to this time , So now buy more and wait just this no more .

Remember market in any time have new trend and never Fixed in one trend , You must smart and think about market and news and charts next select good position !

NOW If we can't understand chart or market condition , what we must to do ???

Answer : You have nothing to do , Sometimes we must just watch and wait to good place for login and each time feel market have bad trend and you can't understand that , just sit down and noting to do just watch !!!!

Cryptocurrency market have a more than 12.000 coins and token and we can't keep all and get all profit , So make your watchlist about 10 to 20 for starts and check that .

Have a good times guys :)

Breaking down WTXUSDT @blockchain_maneHow I pull fibs

first look for retracements, then from within retracements, look for a range, a reversal pattern, support and resistance.

next, pull long fibs within the range, use volume and moving averages as your guide.

Use your long fibs to check to see if it's respecting price action.

Finally, look for entry and exit idea's, what may happen with price action, scenario A and Scenario B. create a game plane, stick to it.

Morning Star Candlestick Pattern: Trading strategy!🌟🕯️

✳️The Morning Star candlestick pattern is a candle formation that can often be seen on price action charts. It has a bullish character and can often determine the main minimum of market fluctuations.

✳️Three candles in a figure are one of the mandatory conditions of the pattern. Nevertheless, it is quite easy to find the morning star on the chart. It's easy to make sure of this – just look at the shape and location of the “Morning Star" figure.

⚠️ The shape of the Morning Star pattern

So, the formation consists of three Japanese candlesticks. Each of them must meet certain requirements.

🔵 The first candle is a bearish one with a rather large body and the absence of wicks or their presence with a very small length (no more than 10% of the body);

🔵The second candle is with a small body or completely without it. The candle should be with small wicks. The color of the second candle does not matter;

🔵The third candle is bullish with a large body. The body of the third candle should cover most of the body of the first candle (or engulf the whole body). Also, the candle should be without shadows (ribose) or with very small shadows;

🔵There should be a gap between the central candle and the other two. But, as practice shows, it is not always a prerequisite.

❗ Location of the candle model "Morning Star" ❗

The morning star is a bullish formation. Therefore, it is located at the end of a downtrend. The central candle is the local minimum of the downtrend. After the formation of this Price Action pattern, you should buy an asset.

❗ Signal amplification of the Morning Star model ❗

🔴If the central candle was formed without a body, then the pattern gives almost 100% about the change of the downtrend to an uptrend. This model is also called the "morning star Doji" or "abandoned baby";

🔴The presence of a gap between the central candle and the other two candles strengthens the trading signal;

🔴The bullish central candle is stronger than the bearish one. But the strongest is bodiless;

The third candle completely covers the first candle;

🔴The presence of a small trading volume at the first candle and a large volume at the third candle strengthens the model.

✅ When to enter into a transaction

We enter into the transaction after the closing of the third candle. It is confirmatory in the "Morning Star" pattern. This is a kind of guarantor of the model.

✅ When not to enter into a transaction

Everything is simple here. If the pattern does not satisfy the main conditions, then we do not enter into the transaction. It will no longer be a morning star model, but something else.

❤️Friends, If you want more of these articles, like comment and subscribe❤️

The Opening Range TradeThis is one of my favorite trades to make because of the outsized risk reward ratio that it can offer. We're talking 10:1 or better some days. We are going to look at an example of an opening range trade in the S&P 500 E-mini this past Friday, October 29, 2021.

What is the opening range? In the days of screen trading, the opening range can be considered the first 60 seconds of the normal cash session. This is when all the orders that were set to trigger on market open come flooding in. You can think of this as the moment when ALL of the institutional traders begin to step in and have an opinion about what happened in the overnight session. It is very telling therefore to see how big of a bite this opening range carves out of the orderbook. On a very directional day, this opening range will be left as the high or low of the session. This is even more likely to happen if we are opening with a gap from the previous day's range and value.

When to take an opening range trade:

1. The opening 1 minute range is narrower than 2x your risk tolerance for stop loss placement.

2. The opening range is left at the high or low of the session.

3. The opening range leaves a gap from the previous day's cash session.

Rule 1 and 2 must always be true, while you can think of rule 3 as an additional validator.

How to take an opening range trade:

See the chart above for reference. We are opening within yesterday's range, so no gap. We wait for the 08:30(central) 1 minute candle to paint itself as the market opens. As soon as the candle is complete we mark it's high and low. We have a fairly large range of 20 ticks. The next 1 minute candle dips back into the opening range before extending above it. Because this candle does not reach the center of the opening range, we can go long when it begins to extend above. We set our stop loss at the center of the opening range.

A note about stop placement: For what it's worth, I was taught, (and most traders I know do it this way) to use the ENTIRE opening range for my stop loss. What I've noticed however, is that if price action returns to the center of the range, there is a high probability of it violating the other side. Therefore, you can use half the opening range, thus cutting your risk in half, and the money saved will by far outweigh the handful of trades per year that you miss due to being stopped out.

You could have taken this trade for very little risk and carried it all the way to the close for a 10:1 reward over risk.

The opening range trade is simple to implement, and you won't have to wait very long to find out if you're right or not. Typically, if this trade is wrong then you'll be stopped out in a few minutes and can move on. If the opening range IS left as the high or low of the session, then you can expect a substantial move in your favor.

Now you have one more tool to keep in your toolbox. I hope it helps.

Trade well everyone.

De-Annualizing IVImplied Volatility is the expected volatility of a given asset and can be used for ones advantage

De-Annualizing IV allows one to apply annualized IV and alter it towards ones desired time frame

As some may know, Implied Volatility or IV is an annualized figure, meaning we have to do extra work to get what we want

Applying IV

To gain a greater understanding of this topic we will be applying this method to SPY(461.90) as of 11/3/21

In order to get IV of our desired time, we first have to get the 1-day expected volatility and to do so we use the formula as follows

IV ÷ √256(256 trading days in a year) and will be 0.1245 ÷ 16 for our case, which gives us a 1-day expected volatility of 0.00778 or .78%

After getting our 1-day expected volatility we then use the formula as follows

IV ÷ √256 x √Number of Trading days in period and once applied to SPY will become 0.00778 x √22 which gives us 0.036497298 or a monthly expected volatility of 3.65%. We are using 22 in our formula since there is 22 trading days in a month.

Conclusion

After calculating our monthly volatility we can then multiply the desired asset by it to receive the range in which this asset will most likely stay at

For example, regarding SPY at 461.90 we can multiply it by 1.0365 or 0.9635 to receive the prices in which there is a 68% chance that the desired

asset will stay at. Regarding SPY this means there is a 68% chance of SPY closing between 478.75 and 445.

Bites Of Trading Knowledge For New TOP Traders #5 (short read)Bites Of Trading Knowledge For New TOP Traders #5

---------------------------------------------------------------

What is the bid-ask spread? –

Bid-ask spread is the amount by which the ask price exceeds the bid price for a market. The bid-ask spread is the difference between the highest price that a buyer is willing to pay and the lowest price that a seller is willing to accept. An individual looking to sell will receive the bid price while the one looking to buy will pay the ask price.

A wide spread may indicate low supply or demand for a market at that point of time during the trading period, while a narrow spread would indicate sufficient supply and demand for a market meaning strong buying and selling competition is at play.

What is the role of a market maker in the financial markets? –

Market makers are market participants who ensure there is enough liquidity and volume of trading in the markets and offer to sell a market at the ask price and will also bid to purchase a market at the bid price to traders and investors.

How does the bid-ask spread relate to liquidity of a market? –

The size of the bid-ask spread from one market to another differs mainly because of the difference in liquidity of each market. Certain markets are more liquid than others and that commonly is reflected in their lower spreads. Price takers demand liquidity while market makers supply liquidity.

For example, foreign currency futures would have very low spreads during the trading day given the use of currencies as a medium of exchange to do business globally compared to live cattle futures, which relates more to businesses in the United States domestic market.

RISKS AND OPPORTUNITIES FOR CORPORATES AND INDIVIDUAL INVESTORS –

Diversification: Futures Spreads with Currency Futures –

A futures spread is usually created when one futures contract is sold simultaneously to the buying of a second related futures contract in order to capitalize on a discrepancy in price. Currency futures spreads combine the use of different currencies usually paired to the U.S. Dollar with the same contract month to express a relationship between the two currencies usually taking into account their strength or weakness relative to each other.

For example, the Singapore Dollar (USDSGD) may be seen to be strengthening (price movement is downward) while the South Korean Won (USDKRW) may be seen as being very weak (price movement is upward). To take advantage of this observation, we would want to buy Singapore Dollar (sell the USDSGD future) and sell the South Korean Won (buy the USDKRW future) and as a result eliminate the U.S. Dollar.

However, it must be noted that not all currencies are quoted in the same way like the Australian Dollar futures is quoted “AUDUSD”. It means then that to take advantage of a strong Australian Dollar and a weak South Korean Won quoted as “USDKRW”, an investor would need to buy both the AUDUSD future and the USDKRW future.

Diversification: Portfolio Risk Using FX Futures –

Individual investors taking a portfolio approach with managed futures and spot foreign exchange could be entering into emerging market currency positions including for example Hong Kong Dollar, Singapore Dollar or South Korean Won.

Depending on the view of each of the currencies in the portfolio, it could be constructed to eliminate exposure to the U.S. Dollar. However, there may be a time during which investors would like to introduce U.S. Dollar exposure and they could do so by using Mini U.S. Dollar Index ® Futures with a contract value of $10,000.

For example, the U.S. Dollar Index ® may be observed to be in a medium term uptrend and an investor may want to consider entering into a long position in the Mini U.S. Dollar Index ® Futures based on their strategy of choice and exit the position when either their profit target is achieved or their loss limits are triggered.

TRADDICTIV · Research Team

--------

Disclaimer:

We do not provide investment advice, nor provide any personalized investment recommendations and/or advice in making a decision to trade. Before you start trading, please make sure you have considered your entire financial situation, including financial commitments and you understand that trading is highly speculative and that you could sustain significant losses.

Triangle breakout PredictionWe can predict the direction of the breakout with a cumulative indicator such as the OBV.

Here you see the OBV increase from the first high to the breakout candle, this proves significantly accurate.

so OBV rising can be used as another step for verifying the congruency of your prediction.