EDUCATION: Ichimoku - Part 2Today we continue to study Ichimoku Indicator trading strategies. Last time we analysed in details the conversion, base and lagging span lines. In this article we apply Kumo cloud which is formed by Leading Spans A and B. The formulas for the calculation you can see on the chart.

The Strategy

Before considering the strategy we should understand that the Kumo cloud is projected forward for 26 periods. The simpliest version of the Ichimoku strategy employs just the Kumo cloud. We just should define the point where the Lagging Span A crossed the Span B from down to up and execute the long position.

It is also recommended to define the long positions entry points more strictly. The price should be above the Kumo cloud and the conversion line should cross the base line from down to up near the Span A and Span B crossover.

When to exit? You can exit long positions with three possible ways on your own preferences:

1)When the price crossed the Kumo

2)When the Span A crossed the Span B from up to down

3)When the conversion line crossed the base line from up to down

You should test it by yourself.

Tutorial

EDUCATION: MACDHello, dear subscribers!

Today we will examine another one lagging indicator - MACD. It is very useful indicator but you need to use it carefully because usually it is just adds other indicators and can to generate a lot of fake signals.

What is MACD?

MACD consists of:

1)MACD (blue) = EMA(12) - EMA(26)

2)Signal (red) = EMA(9)

3)Histogram = MACD - Signal

The MACD line is the long EMA value substracted from fast EMA value. It shows the trend direction. If the MACD>0 the market is bullish, if MACD<0 - bearish. The difference between MACD and Signal line is the proxy of trend strength.

How to trade with MACD?

The classical approach to MACD is to search the MACD and Signal line crossovers: when the MACD crossed the signal line from down to up it is the bullish signal, in opposite case - bearish. The MACD and zero line crossover means the trend confirmation. But this approach is not good enough to make profit. As you can see on the chart it can generate fake signals or signals which are too late - the price have already grown. If you want to use only MACD, please, find really strong signals. For example, if the price demonstrated higher low and MACD - lower low, it is the hidden bullish divergence. With the further MACD and signal lines crossover it gave a really nice long signal.

Summary

1)Find the price/MACD divergence

2)Wait for the MACD and signal line crossover

3)Enter an appropriate position

4)Be careful about weak signals

5)Use MACD with other indicators as an addition confirmation sign

PPT / BTC I have been trading this crypto coin for 1 year.Working on a pair PPT / BTC for 1 year

a) PPT / BTC 24 09 2019 + 66% + 38% (102%)

b) PPT / BTC 6 11 2019 + 64% + 22% + 37% (+ 73%)

c) PPT / BTC 14 01 2020 + 85% + 44% (+ 85%)

d) PPT / BTC 26 05 2020 + 43% + 140% (+ 140%) + 60%

e) PPT / BTC 17 10 2020 (in progress, this learning / trading idea).

All trading ideas (4) for this work were published on this site and are freely available. Anyone can easily check the real work. Every local trend and important price movement was accompanied by updates in the trading idea.

It is worth noting that due to the low liquidity of this pair, the real profit from 100% of the movement is less than 50%, because the work is averaging due to liquidity. Real profit from 100% becomes in the region of 30-50%, depending on a certain price movement. Unfortunately, there is no other way. Many do not understand this.

Falling wedge. The price broke through the support with which local pumping started constantly for 1 year.

Potential points (zones) of entry into the market are shown on the price chart.

The downtrend line of the small trend (purple). If the price overcomes it, it is a potential entry point (there is a risk).

If the price breaks the downward trend line (red), this can serve as a reversal zone for the secondary, and then the main trend.

EDUCATION: Commodity Channel Index (CCI)Hello, dear subscribers!

Today's topic is the Commodity Channel Index (CCI). To be honest, in sole use it is almost useless indicator but a lot of profitable strategies and indicators contain it, this is the reason we need to understand how does it work.

Definition

The CCI formula demonstrated on the chart. To make it clear it is the some math manipulation with the typical price momentum, the same as in momentum oscillators calculation, but here we have unbounded value. The CCI value higher than 100 associated with asset overbought condition, lower than -100 - oversold. It measures the strength of the trend, but usually this information is not actual.

How to trade with CCI?

According to fact that CCI is lagged indicator we are not recommended you to trade with it in sole use, because it generates a lot of fake signals or does it when it's too late. We can give you some signals which help you to build the complex strategy. When the CCI in overbought zone it can be the evidence of future price drop, in opposite case - the price increase. You can see on the chart the potential short and long exit and entry points, but keep in mind that there are a lot of cases when this analysis is invalid.

Summary

1)Don't use CCI as sole indicator

2)The main feature of this indicator is overbought and oversold conditions. When the other indicator demonstrates the potential price movement direction you can use CCI as confirmation.

EDUCATION: Williams Alligator IndicatorHello, dear subscribers!

Today's topic is Williams Alligator (WA) Indicator, which is very important and efficient trading tool at any timeframe.

Definition

WA consists of three lines:

Jaw = Moving average with length 13 and offset 8

Teeth = Moving average with length 8 and offset 5

Lips = Moving average with length 5 and offset 3

But you can choose your own settings.

This indicator usually use for trend confirmation and works perfect with other indicators, which will be examined in next topics.

How to trade with Williams Alligator?

Alligator has 2 states: slleping and feeding time. The yellow areas demonstrate the sleeping time, when the lines are intertwined. During this period is not recommended to trade. When the lips start rapidly move down it means the downtrend start. After this the jaw starts open and the feeding time confirmed. When the red candle closed lower than all three MA lines, this is the perfect moment to entry short position. The exit condition is the crossover the lips and teeth lined, but you can do it earlier - when the price broke up the lips or teeth lines.

For the long position the opposite is true, the lips line have to rapidly move up and be above other MA lines.

Summary

1)Define the alligator sleeping time

2)Find the moment when lips line starts to move down and below other lines for short and move up and above for long

3)Wait the candle close below/above all three lines for short/long and entry position

4)Exit the position when the lips line crossed the teeth line

This indicator is also has not perfect performance in sole use, but with other indicators it can bring a great profit. We will talk about it next time.

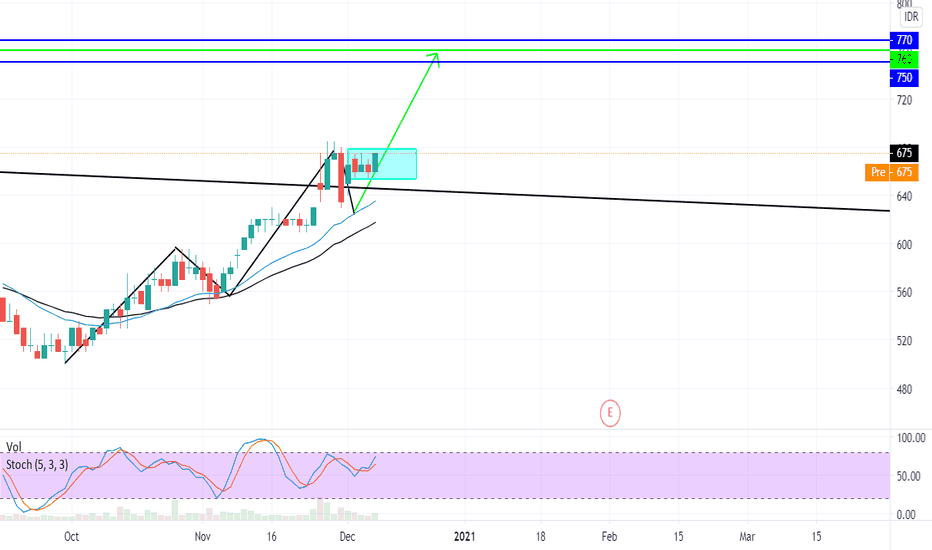

BJTM 13%+ INDONESIA STOCKS EXCHANGEWE KNOW THAT DOW THEORY IS PRIMARY SECONDARY AND PRIMARY AGAIN

THE MARKET ALREADY SECONDARY REACTION AND NOW BJTM IS MAKING A BASE, A BASE IS LIKE A CAGE WHICH THE PRICE TRAP INSIDE THE CAGE, WE HAVE TO WAIT THE CONFIRMATION OF THE BREAKOUT OF THE CAGE, IF BREAKOUT THAN THE PRICE WILL RALLY MAKING HIS PRIMARY REACTION AGAIN,

THE TARGET PRICE AREA WILL BE 750 - 770

AND WHY A GREEN LINE AT 720? WHY THE TARGET PRICCE 750 - 770?

THE REASON IS SIMPLE,

THE GREEN LINE PRICE PROFIT AREA IS BY USING FIBONACCI PRICE PROJECTION (AB = CD) AND IT STOP AT 720, SO IS THE GAP AREA, WE CAN SEE 750 - 770 IS AN OPEN AND CLOSING GAP AREA WHICH CLUSTER TO FIBONACCI AB = CD

STOPLOSS AREA

630

WHY? BECAUSE IF WE BUY AT BREAK OUT AREA, AND THE PRICE ISNT CAPABLE TO RISE, AND DROP TO THE BASE (CAGE) AGAIN AND ALSO BREK THE BOTTOM OF THE BASE WE CAN ASSUME THAT SUPPLY IS MUCH HIGHER THAN THE DEMAND

DISCLAIMER ON!

EDUCATION: Volume-Weighted Average Price Hello, dear subscribers!

The next topic is the Volume-Weighted Average Price (VWAP) indicator. The vo;ume based indicators are very significant for full price movement analysis.

Definition

The VWAP is a measurement of ratio of value traded to total volume traded for the particular time period. The calculation formula is represented on the chart. This indicator helps to know whether the market is bullish (price above the VWAP) or bearish (below the VWAP) now.

How to trade with VWAP?

The classic approach to VWAP is the execution long position when the price clearly broke up over the VWAP, the short position - if the opposite is true. The 15 min timeframe is usually used but you can use shorter timeframes, but not longer. The VWAP is not good for the sole use because it generates a lot of fake signals, which need to be filtered with the another indicators. The particular strategy we will examine later.

Summary

1)Set 15 min or shorter timeframe

2)Long when price broke up the VWAP

3)Short when the price broke down the VWAP

4)Use another indicator for entry point confirmation

EDUCATION: Pivot LevelsHello, dear subscribers!

Today we are going to talk about one of the most useful indicators in cryptotrading - pivot levels(points). We have already considered the lagging and leading indicators and decided that the second one is the most valuable.

Definition

Pivot levels is the leading indicator which define the potential pivot levels for the next trading period (in our example - month). The formulas for the levels calculation you can see on the picture. It is known that when the price is up of the central pivot - the market is in the uptrend, if the opposite - in the downtrend.

How to trade with pivot levels

It is great to use pivot level with some lagging indicator to confirm the entry points. This indicator can give the information about levels when the price can bounce off or reverse. You can see the points with small red arrows where the price bounced off pivot levels and went down after it - this points can be used for the short position. The green arrows demonstrate the potential price growth points. But there are also a lot of breakpoints (blue circles), to avoid the trade execution next to these point you need to use some confirmation with lagging indicator.

Summary

1)Define the trend direction

2)Open short if downtrend, long - if uptrend

3)Define the entry points next to pivots

4)Find the confirmation with some lagging indicator to avoid the pivot break points

5)Execute the trade, set the sloploss level

Good luck!

IDX PGAS : ELLIOTT WAVE ANALYSIS EXPLANATION AND HOW TO USE IT.ELLIOTT WAVE HAVE 5 WAVE BEFORE DO HIS CORRECTIVE WAVE,

PGAS CURRENTLY IN WAVE 3 TO 4

ELLIOTT WAVE, WAVE 1 - 2 ALREADY VALID @0.618

ELLIOT WAVE, WAVE 2-3 VALID 1.618

WE HAVE TO WAIT THE SECONDARY REACTION OF WAVE 3 - 4 @0.382 AND WE CAN ENTER AT THAT POINT WITH BULLISH HARAMI CANDLESTICK (THE INSIDE BAR) OR HAMMER, ENGULFING WHATEVER IT IS FOR THE ENTRY

AND WAVE 4 - 5 LENGTH HAVE TO BE SAME WITH WAVE 1 - 2 (AB = CD)

WE CAN MEASURE WITH FIBONACCI EXTENSION (HARMONIC PRICE PROJECTION) FROM WAVE 0 = A - WAVE 1 = B , AND THE WAVE 4 = C WE CAN SEE THE PRICE WILL STOP AT 2185

AFTER REACHING THAT POINT SHOULD BE A CORRECTIVE WAVE

THIS IS A TUTORIAL OR A SIMPLE WAY TO KNOW OR USE ELLIOTT WAVE

NO POINT OF ENTRY!

JUST A LESSON FOR WAVE ANALYSIS

EDUCATION: Double Bottom PatternHello, dear subscribers!

Today we discuss a very important special case of support line - the Double Bottom chart pattern.

Definition

The double bottom usually occurs when price is in the downtrend and bounced off some level (First bottom). After this bounce it seems that the price is going to fall down, but bounces off this level again (Second bottom). If the price reached the neck line (purple line), the probability of the trend reverse is high.

How to trade with double bottom?

You need to specify that price now is in downtrend. After the double bottom is formed, you can wait the price and neck line crossover and enter a long position with some stoploss to eliminate the possible downtrend continuation. Be careful to sole use this pattern, in case of trend reverse it is also confirmed by technical indicators, which we will examine in next posts.

Summary

1)To wait the full double bottom pattern formed

2)To entry a position on the price and neckline crossover

3)To take a stoploss for the downtrend continuation

Calculating psychological pressure in close or open deltasThis is a bit of an odd one. I just thought it may be interesting to consider whether the percent movement required to get to 20k had a pattern or specific values that helped it grow or shrink.

I think there is a better way of analyzing this; mostly in the deltas of the open/closes themselves without regard to '20,000', as the number is meaningless in a market sense, and only a value 1 below 20,001 and 1 above 19,999

quiz included. Take what you want from it.

The important part is that you think differently, but not so differently that you begin to make decisions that ignore your more trusted signals, or whateveryoumayhave.

edit: nvm you can't see info lines in these I guess lol

just trust the %

Bit OK and Crypt (Not Grave) Theater Performance 2013-2015.For smart people only. Today is a very important day for the "addicts" of this project. 99.9% of people see this only as a material benefit. But only in this way it was possible to translate everything into reality. Although the whole final meaning of the idea is the opposite. People have become "drug addicts" without realizing that they are simply inflated with money from the air in order to develop and test a number of technologies. Many are not satisfied with little, start to "play in the casino", naturally, in the end result, thanks to greed, they are zeroed out. As desires and thoughts are destructive for them. Together with BITcoin (for many it has become like electronic cocaine), other test projects are simultaneously developing, which at first glance seem to be completely unrelated to the world of finance. In one moment, everything will be united into one whole.

Faith is a terrible force, it can translate into reality both logical and completely devoid of logic beliefs. Whoever controls faith controls the world.

Look closely at the graph. I showed only what is on the surface itself. The time is drawing near. Many "secrets" that were never secrets will be revealed. Today is 2 12 2020. Look what happened exactly 7 years ago. There is a clear plan and logic in the numerical values of lows, highs and times. Also, there is a logical relationship with the number of days between lows and highs. I didn’t show. Everything is very accurate, no coincidences. The future is related to the past, and the past is related to the future. Plan.

Coincidences are what a person does not understand at a certain stage of his development, the incomprehensible is called an accident, a coincidence. In our world, there can be no physical coincidence.

I am sure that the majority see this as only material benefit, and it will ruin them. Many are looking for ways to understand everything and become a "fabulously rich bummer." As long as you think so, you will not understand anything and you will not get anything. This is the whole genius and immunity from "viruses". The system will not give you a lot of resources, since you will not use it for the benefit of the world. I am sure that even if someone makes money in this market due to their greed and insatiable desire to have more and more inapplicable, they lose everything. Psychological behavior and, as a consequence, the actions of most people are quite predictable. Some want to become "lazy millionaires" so much that they don't want to spend even a penny of what they earn in the market not only for someone, but even for themselves. Greed breeds poverty. Everything is in the head.

Collect good deeds throughout your life. Unlike material things, they are not corruptible, always in fashion and do not lose their values and relevance at different historical times. This is something you can take with you when their collection time is up. This is the essence that is hidden openly. This is the first row ticket to the new world.

Most people naively dream of making huge profits while keeping a potentially expensive electronic miracle in order. The price of which is zero without technology and people's faith. The higher the faith, the higher the price. The cryptocurrency market brand is likely to be costly, even insanely expensive, if the project needs it, but that will only happen when the critical amount of bitcoin is not in the mainstream. It doesn't matter where you store it, everything is calculated in advance. It's like a thief gives you a "safe" and says that only in it you can store valuable things. The safest place, but the thief has a key that he will use when you collect your valuables. Everything is brilliant, simple.

No matter how confusing the event algorithm is, it always has one end, namely the one that its creators originally laid down for it.

How can a test subject outwit the creators of the game? Many people believe in the fairy tale given to them about the kind grandfather Satoshi Nakamoto. It is comparable to how children believe in Santa Claus, realizing that he is not there, but playing along with adults in order to receive gifts.

Gifts will be received by everyone equally, even those who do not know about the existence of the crypto market and in excess of the profit that it gives now out of the blue. But those who want to become a "millionaire" and accumulate their "wealth" long before this "freebie" will find that their potential expected "millions" have disappeared instantly and unexpectedly. There is absolutely no way you can outwit the creators of the game. After all, the arena for the game, its rules, chips, were not created by you. Everything is thought out in advance to the smallest detail. Even your reaction and behavior to certain events and act.

Many people do not even suspect how controlled and predictable they really are in their free choices and actions. By shaping people's thinking, reality is being shaped.

The whole project develops thanks to human weaknesses and the desire to have what cannot be. At least at this stage in the development of civilization. There is no worldwide cohesion and full-fledged gain without selfish gain. The only important thing is technology and its widespread introduction. All for the sake of control and order. There is no other way, the person has become very selfish. Unfortunately, some parasites of society can only be re-educated with a whip. When such characters become a critical mass of society, a very dangerous situation arises that can cause uncontrollable chaos and, as a result, outside interference. Can we ourselves put things in order in our temporary home until the “time of reason” 8 08 2023?

Most people are only interested in temporary material gratification of the lower animal desires, and not in the future of the world. Including they are not interested in the life of his future generations. Change yourself - the world will change, otherwise the world will change you .

EXAMPLE WHY ADA CAN PUMP!Here is a prime example of what could happen to ADA but in a greater scale.

Comparing ADA/USD : BNB/USDT

If you take a look at BNB, you can see the down fall trend. The red line graph is an actual line graph of that section. It is flipped in green and it follows the same exact patter. We can see here BNB/USDT is holding on to that parabolic support.

Looking at ADA/USD in line graph format gives it a better perspective. We can see its pretty identical when you flip the down trend from 2019. We can expect to see huge gains for ADA.

Great Strategy for even Beginners! Need help? AskThis strategy uses a EMA Crossover of 5 &10 on the short side and both a 100 & 150 EMA Trendlines to as kind of testing levels

It also uses a Bollinger Band of 100 on the hl2 source instead of closing price

It also features an RSI of BOTH 10 and 100 EMA lines and a stochastic of K 14 D 3 and Smooth of 1

Using both the RSI and Stochastic can determine whena trade is both OVERBOUGHT/OVERSOLD & when the pair is about to or beginning to reverse

Please message me if you need any assistance in using this.

GOOD LUCK TRADERS!

Tips for Beginners When Trading CryptoOver the years I have made many common mistakes, and so I hope that by listing what I have learned, it may help someone speed up their journey to becoming a successful cryptocurrency trader:

Don’t jump into trades without consideration. Evaluate, set buy/sell orders, and use stop losses!

Remove emotion, look to buy during periods of fear. Go against the instinct of only buying when the price is in green.

Analyse Micro & Macro trend - Look for historical support & resistance.

Close positions/set stop losses before bed - to avoid overnight surprises.

Take profits along the way at predetermined price points. (i,e 25%, 50% etc).

Calculate risk/reward ratio using measure tool.

Become familiar with the following formations as some can be deceiving (i.e look bullish but tend to break to the downside).

- Bull-flag (bullish)

- Bear-flag (bearish)

- Head and shoulders (bearish)

- Inverse head and shoulders (bullish)

- Rising wedge (bearish breakout)

- Descending wedge bullish breakout)

- Double top (bearish)

- Double bottom (bullish)

Use indicators to help with your decision making. Primarily:

MACD - this is a momentum indicator and can show signs of a trend reversal.

Moving Averages (MA) - Lines that plot the average price of an asset. (calculated in different time frames i.e 1-day moving average, 1-week moving average etc.)

Look for crosses in your indicators, often referred to as a ‘bullish cross’ or a ‘bearish cross’.

Summary: Don’t open a position if there is no position to be taken. Like poker, it’s a game of favoring a win by taking in the available data, to place a bet that is statistically in your favor. By considering all of the points above before each decision, you can maximize the number of wins you make, and reduce the amount that you lose on the turns that you do not win.

Note: I know much of this has become common knowledge to many of us, but I recently was asked for advice by a friend and I believed this to be a comprehensive list of everything he needed to know. Please feel free to add any additional advice in the comments below.

XAUUSD / Channel This is probably by far the best example of what a channel looks like.

A channel means, price could break up, which means we'd be able to get into a LONG position or it could mean it breaks down, which would indicate we jump into a SHORT position.

OANDA:XAUUSD is extremely volatile .

Volatile - Adjective

1. liable to change rapidly and unpredictably, especially for the worse.

"The market is becoming extremely volatile"

As you can see, this channel was indeed broken 16th November 11:00pm AEST when the price broke down over 2700 Pips. Where price stopped and rejected from 1865.xx and quickly rose back up into the channel again.

Pip - Acronym

1. Percentage in point(s)

"The market dropped 2700 pips!"

From what we can see and clearly identify in this chart tutorial is that 1865 is a price that's been visited and rejected from multiple times. Meaning a lot of big buy orders from Banks, Liquidity Pools and other firms are buying gold.

If we see a pull back or rejection at 1885 or the bottom of the channel: Bottom Black Line then we can confidently risk a trade to the middle of the channel 1892 ( Dotted black line ) or top of the channel, Upper Black Line. You can see the dotted line marked where it's been a price that's respected and disrespected, so if you did enter a position to LONG from the bottom, you could set your stoploss above your entry and ride it further if it shows price moving higher and move your TP to the top of the channel. If you see price starting to pull back you can either manually close your position or move your TP a little closer.

Right now, price is expected to fall and break the channel again. But we shall see what price does. Lock and load.

It's not about getting every pip, it's about making sure you're safely securing the positions you've analyzed continuously.

If you want more tutorials or would like me to do a video, show a thumbs up, throw a comment. Let me know.

I do enjoy constructive feedback.

Coding Indicator in Tradingview from InspirationSo today is rest and research Sunday and I wanted to share with folks how I go about creating new strategies and indicators. Hopefully this can teach traders to fish rather than giving them just the fish (of a buy/sell signal!)

I was inspired by watching a Youtube podcast Desiretotrade by Etienne Crane where I saw on his chart arrows indicating where price closed outside of a Bollinger Band followed by price closing back inside. This made me want to test such a price action phenomenon myself and to do that I needed to code it up.

I'm really a hacker when it comes to programming and Pine Script but I began coding from ZERO knowledge and my tricks, which I share, should hopefully help new Tradingview/Pine Script coders. GOOGLE IS YOUR FRIEND!!! It has all the answers if you just type the correct search :)

Unfortunately, I did not realize that Tradingview cuts off videos at 20 minutes. Oops! I got the meat of the indicator and process of using it all recorded and got cut off as I was cleaning up the code to make it more user friendly. I'll know to keep track of time for the next video!

Please let me know if this was helpful to traders... I get motivated by positive vibes to do more teaching!

NASDAQ100 drops WHILE SPX500 goes up? Here is WHY!Hey tradomaniacs,

the current sell-off in NASDAQ100 and climb indicies such as SPX500 can be a bit confusing.

The pump is basically caused by news from Pfizer (PFE) and Biontech (BTNX) saying that the vaccine is 90% effective in combating COVID-19!

It`s kinda hard to evaluate the situation now as NASDAQ100 drops while growth-stocks go up.

This is kinda tricky for the US-DOLLAR which is very volatile for now.

FAANG-Stocks are suffering by the outlook t hat Corona is done with an upcoming vaccine.

Why is that?

Because FAANG -Stocks ( Facebook (FB), Amazon (AMZN), Apple (AAPL), Netflix (NFLX); and Alphabet (GOOG) had their benefits from Corona as everyone was stuck at home, means people order a lot, watch Netflix and check social-medias.

Last week Jeff Bezos has sold is own Amazon-Stocks aswell so there might be more potential to the downside.

The TEC-HYPE could be over as prices are partially way too high.

❗️BE CAREFULL trading now as cashflow can be very chaotic❗️

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

Trading strategy using the DeMarker indicatorThe DeMarker indicator, also known as DeM, is a technical analysis tool that compares the most recent maximum and minimum prices to the previous period's equivalent price to measure the demand of the underlying asset. From this comparison, it aims to assess the directional bias of the market. It is a member of the oscillator family of technical indicators and based on principles promoted by technical analyst Thomas DeMark.

The DeMarker indicator helps traders determine when to enter a market, or when to buy or sell an asset, to capitalize on probable imminent price trends. It is considered a “leading” indicator because its signals forecast an imminent change in price trend. This indicator is often used in combination with other signals and is generally used to determine price exhaustion, identify market tops and bottoms and assess risk levels. Although the DeMarker indicator was originally created with daily price bars in mind, it can be applied to any time frame, since it is based on relative price data.

Unlike the Relative Strength Index (RSI), which is perhaps the best-known oscillator, the DeMarker indicator focuses on intra-period highs and lows rather than closing levels. One of its main benefits is that, like the RSI, it is less prone to distortions like those seen in indicators like the Rate of Change (ROC), in which erratic price movements at the start of the analysis window can cause sudden shifts in the momentum line, even if the current price has barely changed.

How does the indicator itself work? When the curve line moves below 0.7 from top to bottom it means that we are in a overbought zone and we have a potential sell scenario. When the curve line moves trough the minimum 0.3 level from bottom to top it means we are in oversold zone and we may have a potential buy opportunity. But! There is a catch.

It is not recommended to short or buy aggressively when the curve crosses both of the levels for the first time. Usually when the curve crosses from the top the 0.3 level, indeed, it means we are heading to oversold zone, but there is going to be additional sell impulse. That's why the curve can have readings above 0.7 or below 0.3.

I personally use DeM on the daily chart and this is my only oscillator. Usually Demarker indicators are payed and are very expensive. The free versions of the indicator which are massively distributed are not truly mathematically perfect, but they do fine job.

Here with USD/CAD example I have placed my DeM on the daily chart for the pair. I will highlight the period from September till now with the latest signals.

EUR/USD and USD/JPY on watch for me today.EUR/USD:

• If price pushes down to and ideally just below our lower outer structure trend line and the last part of the move is corrective, then I'll be looking for a risk entry after a phase line break on either the fifteen minute or the one hour chart.

• If price only pushes down to our rayline, then regardless of how price does so I'll be waiting for a convincing push back up followed by a tight flag where I'll be looking for a reduced risk entry on the break of the flag.

• If price only pushes down to our rayline, then regardless of how price does so I'll be waiting for a convincing push back up followed by a tight flag where I'll be looking for a reduced risk entry on the break of the flag. But if the flag forms close to our rayline, then I'll be hiding my stop loss below it as illustrated for extra protection.

• If none of these setups present themselves then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place any of these trades.

USD/JPY:

• If price pushes down to and ideally just below our lower outer structure trend line and the last part of the move is corrective, then I'll be looking for a risk entry after a phase line break on either the fifteen minute or the one hour chart.

• If price only pushes down to our rayline, then regardless of how price does so I'll be waiting for a convincing push back up followed by a tight flag where I'll be looking for a reduced risk entry on the break of the flag.

• If neither of these setups present themselves then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place any of these trades.

USD/JPY and GBP/JPY on watch for me today.USD/JPY:

• If price pushes down to and ideally just below our lower outer structure trend line and the last part of the move is corrective, then I'll be looking for a reduced risk entry after a phase line break on either the fifteen minute or the one hour chart.

• If price only pushes down to our rayline, then regardless of how price does so I'll be waiting for a convincing push back up followed by a tight flag where I'll be looking for a reduced risk entry on the break of the flag.

• If neither of these setups present themselves then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place any of these trades.

GBP/JPY:

• If price pushes up to and ideally just above our upper trend line and the last part of the move is corrective, then I'll be looking for a risk entry after a phase line break on either the one hour or the fifteen minute chart.

• If price pushes up impulsively to and ideally just above our upper trend line, then I'll be waiting for a convincing push back down below our rayline followed by a tight flag where I'll be looking for a reduced risk entry on the break of the flag.

• If price pushes up to and ideally just above our upper rayline, then regardless of how price does so I'll be waiting for a convincing push back down followed by a tight flag where I'll be looking for a reduced risk entry on the break of the flag.

• If none of these setups present themselves then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place any of these trades.

NZD/USD, GBP/JPY, USD/CAD and USD/JPY on watch for me today.NZD/USD:

• If price impulses pushes back down below our lower rayline and a subsequent tight flag forms, then I'll be looking for a reduced risk entry on the break of the flag. But if the flag forms close to our rayline, then I'll be hiding my stop loss above the rayline as illustrated for extra protection.

• If this setup doesn't present itself then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place this trade.

GBP/JPY:

• If price pushes up to and ideally just above our upper trend line and the last part of the move is corrective, then I'll be looking for a risk entry after a phase line break on either the one hour or the fifteen minute chart.

• If price pushes up impulsively to and ideally just above our upper trend line, then I'll be waiting for a convincing push back down below our rayline followed by a tight flag where I'll be looking for a reduced risk entry on the break of the flag.

• If price pushes up to and ideally just above our upper rayline, then regardless of how price does so I'll be waiting for a convincing push back down followed by a tight flag where I'll be looking for a reduced risk entry on the break of the flag.

• If none of these setups present themselves then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place any of these trades.

USD/CAD:

• If price pushes down to and ideally just below our lower rayline, then regardless of how price does so I'll be waiting for a convincing push back up followed by a tight flag where I'll be looking for a reduced risk entry on the break of the flag.

• If price only pushes down to our upper rayline, then again regardless of how price does so I'll be waiting for a convincing push back up followed by a tight flag where I'll again be looking for a reduced risk entry on the break of the flag.

• If price pushes down to just below our lower rayline and this is followed by an impulsive push back up, I'll not be looking for an entry above a subsequent tight flag if the flag forms either through or below our upper rayline.

• If neither of these setups present themselves then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place any of these trades.

USD/JPY:

• If price pushes down to and ideally just below our lower outer structure trend line and the last part of the move is corrective, then I'll be looking for a reduced risk entry after a phase line break on either the fifteen minute or the one hour chart.

• If price only pushes down to either our inner structure lower trend line or our rayline, then regardless of how price does so I'll be waiting for a convincing push back up followed by a tight flag where I'll be looking for a reduced risk entry on the break of the flag.

• If neither of these setups present themselves then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place any of these trades.