Twtrlong

#TWT/USDT Ready to go higher#TWT

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 1.23

We have a downtrend on the RSI indicator that is about to break, which supports the rise

We have a trend to stabilize above the 100 moving average

Entry price 1.24

First target 1.268

Second target 1.288

Third target 1.31

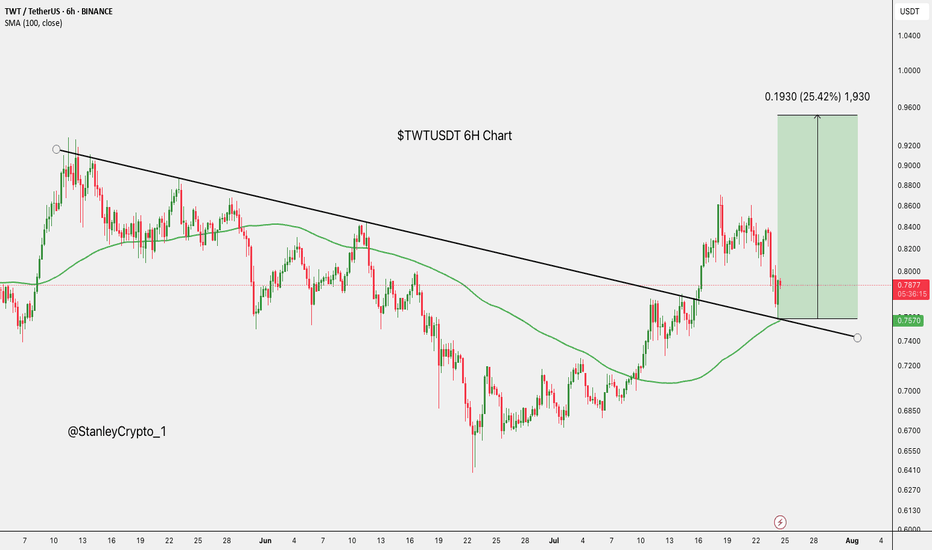

Potential GrowthIn the TWT chart, a triangular pattern has formed, with the upper resistance line being particularly significant. According to the current analysis, there is a high likelihood of breaking through this resistance. If this breakout occurs, it is anticipated that the price could potentially increase by around 15% from this range. It is recommended to closely monitor this movement to take advantage of emerging opportunities.

🚨#TWT/USDT Long

#TWT

The price is moving in a descending triangle for 1 D

We now have a successful penetration of this triangle upward

The broken trend was retested

We have oversold conditions on the MACD indicator

Entry price is 1.1455

First target 1.1734

Second target 1.2210

Third goal 1.2629

Fourth goal: 1.3105

Cryptocurrency Market Analysis: TWT Coin📈 The TWT coin has reached a buying point, and it's becoming evident to us observers that accumulation or position building is taking place near the support level. I have already partially entered a position and will be awaiting a potential impulse.

📊 TWT is a token associated with the Trust Wallet platform, which provides secure storage for cryptocurrencies and facilitates easy blockchain navigation. The coin reflects the popularity and support of this platform, while also offering opportunities to participate in the Trust Wallet ecosystem.

⚙️ Technical analysis shows that TWT is near a support level, which may indicate potential price strengthening. Now is the time when investors are considering the possibility of entering positions.

❗️ Please be aware that this is only a general analysis and not financial advice. When making investment decisions, it's important to conduct your own research and consult with experts.

💡 Nonetheless, the TWT coin has caught my interest, and I have decided to enter a position, anticipating future growth. I will be closely monitoring price movements and sharing any new discoveries with you.

🔔 If you are interested in receiving more analytical information and updates about the cryptocurrency market, subscribe to our channel.

I will buy TWT for $1.Hello everyone! I would like to share my opinion on the TWT coin. Recently, I started to explore this project and I think that TWT is a very interesting coin that is worth having in your portfolio. Currently, the coin is in an upward trend, which indicates its potential for growth.

I decided to buy some TWT and the main volume I placed in the area that I marked on the chart. I am sure that there is a good product and a team of developers behind the coin who are working to improve Trust Wallet. In addition, the project has prospects for development in the future.

If you are also interested in TWT, I recommend finding a good entry point and not forgetting to control your portfolio. Remember that any investments have their own risks, so it is not worth investing more than you can afford to lose.

I wish everyone successful investments and success in the world of cryptocurrencies!

Bullish Reversal Setup on Weekly ChartTrust Wallet Token (TWT) has consistently bounced off the 55-period EMA on the weekly chart and is currently trading near this level. The recent bullish crossover of the TTM Squeeze indicator and the increasing buying pressure suggest a potential trend reversal to the upside. If the price can break above the resistance level, we could see a strong move higher in the coming weeks. Keep an eye on this setup as TWT may offer a profitable trading opportunity in the near future. As always, make sure to use proper risk management techniques and adjust your position sizes accordingly.

I will buy TWT for $1Hello everyone) A very interesting TWT coin and you should definitely keep it in your portfolio) Who holds it well, but not for those who bought above $2 (Idea for investors). I just bribed a little and threw the bulk of the volume in the zone that I marked on the chart) There is a good product and a good team behind the coin) There is a prospect, now the most important thing is to find a good entry point)

Financial Wave. TWTRTWTR - Twitter

Musk's purchase of Twitter caught the world's attention, and we can't ignore it either.

Our priority scenario looks very optimistic for TWTR. Growth in wave (3) may bring TWTR prices to new highs: the first intermediate target is $100. We believe that the key levels are $57.40 and $68, and breaking these marks will confirm our view that TWTR. A price drop below $32.30 cancels the upside scenario.

TWTUSDT - It went up 111% in 2 days.Against the background of the collapse of the exchange FTX, the value of the virtual currency Trust Wallet Token rose by 111%. Quotes of this instrument rose to $2.34 per coin. A growing number of users have found trust in TWT to securely store their virtual assets. Within 24 hours the volume of trades with this instrument grew by 251%.

After breaking through the resistance level of 1.6, impulse movement is expected to form a support level in the price range of 1.6 - 1.8. In this range, we can expect a buyer test and continuation of growth.

If you liked the idea, please like it. That's the best "Thank you!" for the author 😊

P.S. Always do your own analysis before a trade. Put a stop loss. Fix profits in installments. Withdraw profits in fiat and please yourself and your

your loved ones.

Translated with www.DeepL.com (free version)

$TWTRI've charted on a weekly, the major suppy and demand zones to be aware of while trading this stock. I would be looking at an upward trend for this one. Theres a new sheriff in town and he's looking to make the company profitable as opposed to the current model of government sponsored propaganda. He could turn things around. Happy hunting folks

TWTR Twitter Buyout PriceIf you haven`t considered to buy an Option Strangle in order to profit from both up and down movements of the stock, when i wrote about this opportunity:

or previously, when Elon Musk took a 9.2% stake in Twitter:

Then you should know that he agreed to his original buyout proposal to Twitter amid litigation in chancery courts.

There is still 5% upside from the price today to the buyout price agreed.

Looking forward to read your opinion about it.

TWTR Musk Walks Out On $44 Billion BuyoutWhat i really believe is happening is Elon Musk wants a better price for Twitter, in the $44-45 area instead of the initial $54.50.

And he will get it. The earnings won`t be strong, we could even see revisions.

My buy area is between $31 and $34 and the buyout price $44.

i think you can win both ways if you play an option strangle with 6 months expiration date.

Looking forward to read your opinion about it.

TWTR ma ribbon & cloud support; big move coming if BO downtrendTWTR is currently at a very important junction. There is the cloud & a convergence of moving averages giving strong support.

Moving averages ma50 x 150x 200 x100 with price holding ma50 in the last few days. If you draw a downtrend line from recent tops, price is crawling exactly on the line

trying to breakout.

Price may still consolidate & further constrict the Bollinger Band before BO.

not trading advice

How will TWTR’s price react to court saga?Twitter Inc . (NYSE: TWTR ) is on track to closing August on the red as billionaire Elon Musk finds new reasons to back out of his $44 billion deal to take over the social media company.

The company closed Aug. 30 just below $40.00. Over the last 30 days, the company peaked at $44.99, much lower than Musk's $54.20 per-share offer.

Amid the ongoing takeover debacle, shares of the company have taken a beating and investors are watching for buying or selling opportunities with Twitter's shares ahead of the Oct. 17 court hearing that will determine whether Musk is forced to proceed with the acquisition.

Impact of the proposal

Tesla's (NASDAQ: TSLA ) chief executive agreed to acquire Twitter in April, with shares trading back then at a roughly 10% discount to the offer price.

In May, Musk put the deal on temporary hold, raising concerns over spam accounts on the platform that he said were not accounted for in the computation of the buyout bid.

When the billionaire formally terminated the agreement in July, it sent Twitter's shares further down, with stocks tumbling to a four-month low on July 11.

Since then, TWTR has found buying support, maybe because investors believe that Musk cannot legally pull out of his market altering, unsolicited, an unconditional bid for twitter . Even so, downward pressure is building on twitters share price as the court case develops. As of writing, TWTR has retracing to the 50% level between its July low to its August high.

On Aug. 26, Deleware judge Kathaleen McCormick ordered Twitter to provide Musk with more data on how it calculates bot and fake accounts on its platform in the lead up to the Oct. 17 court hearing. McCormick mandated the company to produce information regarding 9,000 accounts it analyzed for authenticity as part of an audit at the end of 2021, London's Financial Times reported.

The data could strengthen Musk's claims and deal another blow to the social media company, especially after its former head of security, Peiter Zatko, claimed that he raised concerns about severe shortcomings in Twitter's handling of users' personal data, including running out-of-date software. Bloomberg reported, citing Zatko, that company executives also withheld information about breaches and lack of protections for user data.

Only loss in sight?

For Twitter , the deal has already incurred $33 million in expenses and the uncertainties arising from the court drama had caused a decline in its revenue. And even if it did see the deal push through, it will be left in a worse position than before the offer was made, Further, the entire saga has taken a toll on employee morale and retention on the social media platform.

Meanwhile, similar damage could be brought upon Tesla . The automotive company's shares, which Musk was using to support his buyout bid, have halved between early April at the onset of the deal and in late May at the start of Musk's attempts to pull out. Although the shares have started showing signs of recovery, Musk and his shareholders would have significantly overpaid for Twitter based on its current market value.

Right now, everyone is just waiting for the October court decision that will determine whether the companies will deal with the aftermath together or separately.

TWTR UP 14% after bullish signal - Ready for more 🚀TWTR dumped 13.62% (purple price range) after the bearish Supertrend Ninja signal (red vertical line on the background). Then the price pumped 14.61% (green price range) after the bull Supertrend Ninja - Clean signals (green vertical line on the background). TWTR is forming Leg C with a possible bull run to around to 70 USD (1.618) or 55 USD (1.0). Which is about 82% (orange price range) possible gain.

TWTR is about to break out of the Ichimoku Cloud , which is considered bullish . The RSI is starting to warm up for a bullrun at 71. RSI Brown at 103. If we take a look at the Average Directional Index ( ADX DI) its in the bullish zone, and pointing upwards. Currently TWTR is above its Upper Bollinger Band , Band Basis 20 Period SMA . And above the LSMA as well. A bullish trend is likely to happen.

Price and the RSI are still forming a higher low. Which is a bullish sign as well. Let the GAINS begin !!

Remember to always take profits and use proper risk management!

Thank you for reading.

Namasté 🙏

Disclaimer: Ideas are for entertainment purposes only. Not financial advice. Your own due diligence is highly advised before entering trades. Past performance is no guarantee of future returns.

What Indicators Do I Like To Use:

I am using the "Supertrend Ninja - Clean", which is a trend-following indicator (Green and red vertical lines on the background). When the background of the candlestick closes green (vertical line). It indicates a possible bullish (up)trend. And red for possible downtrends.