UAMY Liquidity GrabI only like this for a small position. There is a pretty low probability that it will drop to this point, but they arent currently mining silver and could see a sell off happen because of global depression before reaching new ATH after they start silver production. Its very possible this bounces at the 0.056 level, but I am willing to miss out if that happens.

Just a little bit of spaghetti thrown at the wall

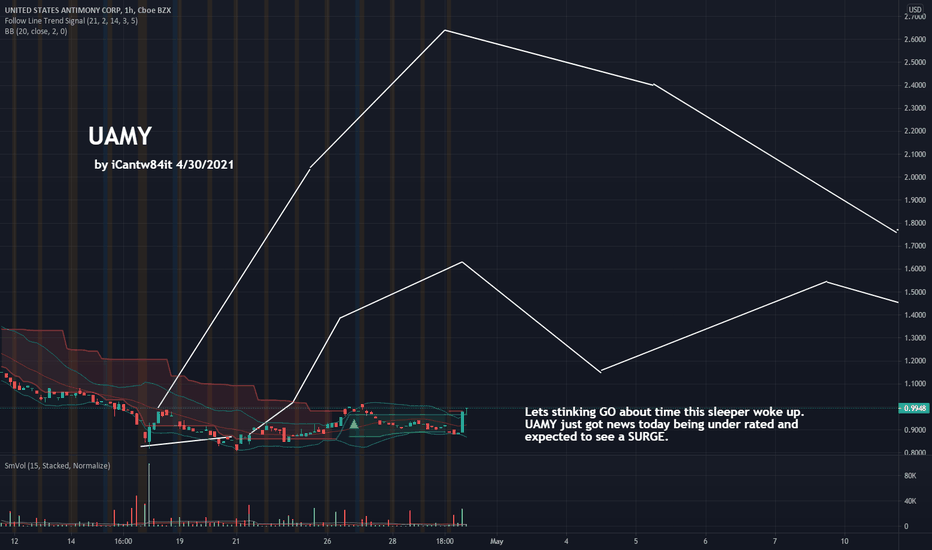

UAMY

$UAMY Reversal Rare earth metal needs for batteries - ammunition production.

They are only American-licensed antimoney smelter

After breakdown - good consolidation between 0.36 - 0.45 range.

Seems ready to breakout.

Volume is creeping up slowly with one day last week showing 3 x the average volume.

Recent insider buys @ 0.45 Jul 18, 2022 Buy 65000 Bardswich Lloyd United States Antimony Corp.

Currently Broke SMA50,100 Next possible resistance is SMA100 0.5169

Holding EMA Clouds really well

I'm long UAMY

UAMY - Fundamental catalysts and bullish chartBullish Thesis for UAMY:

1. UAMY share price has historically followed the raw price of Antimony. The last period that it traded in a similar price per metric ton was 2011-2012, in which the shares price traded in the $2-4 range on average. In 2021, the share price only briefly exceeded the $2 mark.

2. China is the world leading exporter of antimony and there is currently a supply shortage (along with global shipping issues due to covid), further driving up the price www.metalbulletin.com

3. Antimony is a critical element of many items, an in particular battery technology ( EV sector), and flame retardents, brake pads, and now alloys for CARBON CAPTURE as well. As part of the infrastructure deal, the carbon capture sector is benefitting with a ton of recent market interest (stocks like CEI and ENG are examples). Demand for antimony should continue to rise with the proliferation of EV's and pollution reduction legislation

4. UAMY has a subsidiary called Bear River Zeolite, which manufactures a chemical used for many pollutants, including CARBON CAPTURE and METHANE removal (worse than CO2) www.bearriverzeolite.com

5. UAMY has seen more volume in the past year than at anytime in it's history. Since peaking in March, it has been consolidating in the $0.80-1.10 range ever since, while the high price of raw antimony has remained high.

6. The current share price is sitting on a volume shelf support level

Risks -

1. If prices of raw antimony were to drop, the price would fall based on historical behavior. Unlikely in the near term due to high market demand

2. 50 day SMA just crossed under the 200 day SMA (death cross)

UAMY - UP 70% OVER 90 DAYS. CAN IT SUSTAIN?United States Antimony Corp. engages in the exploration, production and sale of precious metals. It operates through the following segments: United States Antimony Operations, Mexican Antimony Operations and United States Zeolite Operations. The company was founded by John C. Lawrence in 1969 and is headquartered Thompson Falls, MT.

SHORT INTEREST

235.6K 07/31/19

P/E Current

58.56

P/E Ratio (with extraordinary items)

82.00

P/E Ratio (without extraordinary items)

47.93

UAMY Fakeout....Possible Breakout Next WeekSelling being absorbed was followed by a decent accumulation period with regard to duration, and this was followed by a fakeout. The breakout was strong in terms of price, but the volume didn't back up the move. Price retraced the next day.

The close this week has the UAMY with some some bullish candles in terms of both price and volume, with deep lower wicks. I could see a bullish opening next week, and this would be a signal to hop on board to the long side for some short term gains. Wait for the signal though...nothing is certain yet.