Can Tencent salvage Ubisoft's sinking ship?Ubisoft’s stock pumped 35% couple of days ago following a Bloomberg report suggesting that Tencent may either acquire the company or take it private

Although the French gaming company didn’t confirm or deny the speculation, it did state that it’s considering "all strategic options" for the benefit of its stakeholders and will notify the market when necessary

If Tencent proceeds, it would mark another significant acquisition in a wave of major gaming deals over recent years:

- Activision Blizzard acquired by Microsoft for $69 billion in 2023.

- Zynga acquired by Take-Two for $12.7 billion in 2022.

- ZeniMax Media acquired by Microsoft for $7.5 billion in 2021.

- Savvy Games acquired by Scopely for $4.9 billion in 2023.

- Bungie acquired by Sony for $3.7 billion in 2022.

- Glu Mobile acquired by EA for $2.4 billion in 2021.

- Keywords Studios acquired by EQT for $2.4 billion in 2024.

Ubisoft’s valuation sits at just $2 billion, nearly 90% below its peak in 2021! The stock fell by more than 40% in September alone, so this recent surge is only a brief reprieve. Given its diminished value, a potential buyer offering a premium wouldn’t necessarily be a massive win.

So, how should we interpret this news, and what can we anticipate for future gaming M&A activity? Let’s break it down.

Key Points

1.Ubisoft’s Challenges

2.Potential Buyers

3.IP Gold Rush

4.Future of Gaming M&A

1. Ubisoft’s Challenges

Ubisoft has faced setbacks including canceled games, delays, and a dip in quality in the post-pandemic era. Let’s take a look at the fiscal year 2024, which ends in March.

Consider this metric reflects the total amount spent by users within a period, covering game sales, in-game purchases, subscriptions, and downloadable content (DLC). It’s an important measure of business performance, with net bookings recognized as revenue over time, depending on content delivery and user engagement

Key takeaways:

Digital-first: 86% of Ubisoft's net bookings come from digital sales (premium, free-to-play, and subscriptions). It was 12% in 2013, illustrating the transformative past decade.

Far behind on mobile: Ubisoft has trailed its peers, with only 7% of revenue coming from mobile. In contrast, nearly half of the industry’s revenue comes from smartphones.

Margins improved after cost-cutting: Digital games are a high gross margin business, particularly with the back catalog (title released in previous years) making up nearly two-thirds of net bookings. Targeted restructurings impacted FY23, making the short-term margin trend misleading. Ubisoft laid off 1,700 employees between September 2022 and March 2024, roughly 6% of its workforce.

Short-lived turnaround: FY23 was a challenging year, with Net bookings collapsing by 18% with the underperformance of Mario + Rabbids: Sparks of Hope and Just Dance 2023. In FY24, Net bookings rebounded sharply, growing 34% with the successful release of Assassin’s Creed Mirage and The Crew Motorfest.

FY25 Collapses in a Week: After the underperformance of Star Wars Outlaws (released at the end of August and originally expected to be a blockbuster) and the delayed launch of Assassin’s Creed Shadows from November to February, Ubisoft revised its FY25 net bookings forecast down to €1.95 billion, a 16% decline year-over-year (compared to the "solid growth" expected earlier). The company now anticipates barely breaking even on an adjusted basis.

The decision to delay Assassin’s Creed Shadows just weeks before its scheduled release was influenced by the poor reception of *Star Wars Outlaws*. However, the three-month delay might not be enough to resolve concerns over game quality or criticisms from the Japanese community regarding historical and cultural inaccuracies.

But that’s not all!

In addition to these financial and operational difficulties, Ubisoft has faced allegations of a toxic workplace. Several former executives from the *Assassin’s Creed* studio were arrested as part of an investigation into sexual assault and harassment.

This situation mirrors the downfall of Activision Blizzard in the months leading up to its acquisition by Microsoft, which leads us to potential buyers for Ubisoft.

2. Potential Buyers

Ubisoft remains a family-run company, largely overseen by its founders.

The latest annual report reveals the following voting rights:

- The Guillemot family controls 20.5%

- Tencent owns 9.2%

In September, minority shareholder AJ Investments claimed it had gained backing from 10% of shareholders and called for Ubisoft to be sold or taken private, estimating a fair value of €40 to €45 per share. With shares currently trading at €13, this seems highly optimistic.

So, who are the likely candidates for a Ubisoft buyout?

Key Players:

-Tencent: Already a significant shareholder, Tencent could increase its stake or seek majority control. As the largest gaming company globally by revenue, Tencent has a history of acquisitions, such as its purchase of Finnish publisher Supercell (*Clash of Clans*) for $8.6 billion in 2016. However, Tencent's aggressive expansion has drawn regulatory scrutiny, especially in the US and Europe, which could complicate any attempt to acquire majority control of Ubisoft.

Guillemot Family: The founding family might be interested in reclaiming greater control of Ubisoft and steering it in a new direction. To finance the buyout, they could collaborate with a private equity firm or a strategic investor. However, given Ubisoft's current size and the significant cost associated with a buyout, it could be difficult for the Guillemot family to pursue this path on their own.

Other Potential Investors: Private equity firms or strategic investors within the gaming sector might also join a buyout consortium. These investors could be drawn to Ubisoft’s valuable intellectual property (IP) and see potential for a turnaround under new leadership.

Gaming Companies: Besides Tencent, the largest gaming revenue players in 2023 are highlighted in the visual.

-Apple and Google: Although both tech giants have been expanding into gaming, acquiring Ubisoft seems unlikely given their current antitrust scrutiny.

-NetEase, EA, and TakeTwo: These companies would find an Ubisoft acquisition to be a straightforward studio consolidation. NetEase, in particular, might find it appealing to broaden its console and PC presence in the West, but Tencent’s involvement could complicate this.

-Sony and Microsoft: As first-party publishers, both would benefit from boosting their subscription services with exclusive content. They’ve aggressively acquired studios in recent years. Given that the Activision Blizzard deal was approved, there’s no reason a Ubisoft acquisition couldn’t pass as well. In their latest fiscal year, gaming accounted for 32% of Sony’s revenue and less than 9% of Microsoft’s.

3. IP Gold Rush

In the gaming industry, intellectual property (IP) is crucial. Iconic franchises like *Call of Duty*, *Mario*, and *Grand Theft Auto* are multi-billion-dollar assets that significantly impact a company’s future. As a result, many companies are eager to acquire established IPs or gain access to the teams behind them.

Why is IP so valuable?

-Lower risk: Developing a new AAA game can cost hundreds of millions and take years, with no guarantee of success. Acquiring a popular IP allows companies to tap into an existing fanbase and reduces the risk of failure.

-Brand power: Consumers are more inclined to purchase games with familiar characters, worlds, or studios behind them. Well-known creators like Hideo Kojima (*Metal Gear*) and Hidetaka Miyazaki (*Elden Ring*) are just as significant.

-Content scalability: Famous IPs can generate revenue through sequels, spin-offs, and licensing deals. Large publishers have the infrastructure to maximize returns across multiple channels.

This strategy isn’t unique to gaming. Media giants follow similar patterns:

-Amazon’s acquisition of MGM: In 2021, Amazon acquired MGM for $8.5 billion, gaining access to franchises like *James Bond* to enhance its Prime Video content.

-Disney’s acquisition of Lucasfilm and Marvel: These acquisitions have delivered massive returns through movies, TV series, and licensing opportunities.

Why now?

-Consolidation pressure: Subscription services and cross-platform gaming are driving consolidation. Big companies want to secure valuable IPs to differentiate their services and attract loyal customers. Meanwhile, smaller studios are more open to selling early to avoid competing in an increasingly crowded and capital-intensive market.

-Value in ownership: Owning IPs in gaming allows companies to create expansive worlds and engage players long-term through updates, expansions, and live services. This keeps players coming back and generates recurring revenue, which is harder to achieve in video content.

-Cross media expansion: Popular games can expand into movies, TV series, or theme parks. For instance, *The Last of Us* became a hit HBO show, and Sony is developing TV adaptations for Horizon Zero Dawn and God of War. This leads to more revenue, a broader audience, and long-lasting IP appeal.

The Ubisoft Angle

Ubisoft’s IPs, like *Assassin’s Creed*, *Far Cry*, and *Tom Clancy’s Rainbow Six*, have significant potential for future growth, despite recent struggles. However, realizing that potential might require new leadership or a fresh strategy, which a new owner could provide.

Even though Ubisoft faces challenges, its strong portfolio might attract various buyers. For the right acquirer, Ubisoft's problems could represent a chance to buy low and rework its creative direction.

As more studios seek to hedge their risks in this changing industry, we can expect more mergers and acquisitions (M&A) in the future.

4. The Future of Gaming M&A

The gaming industry is constantly evolving, and several trends are fueling a surge in mergers and acquisitions:

-Mobile-first: Mobile gaming is the largest and fastest-growing segment, making companies with a strong mobile presence attractive. Examples include Playrix (Gardenscapes,Homescapes) and Scopely (MONOPOLY GO!,Stumble Guys)

-Cross-platform: Cross-platform play is becoming the standard, and companies with expertise in this area are in high demand. Unity and Epic Games play vital roles with their popular game engines, while major studios are also building in-house solutions.

- Cloud gaming: Still in its early stages, cloud gaming has the potential to revolutionize how games are played. Companies with cloud infrastructure are becoming more valuable, with leaders like Microsoft (Game Pass Ultimate), Sony (PlayStation Plus Premium), and NVIDIA (GeForce Now) pushing the trend.

-Metaverse: Beyond AR/VR, virtual worlds like *Roblox* and *Fortnite* have created immersive, social spaces that keep players engaged beyond traditional gameplay. Companies developing these experiences are attractive targets for firms looking to capitalize on this trend.

-Web3 & Blockchain: Web3 games enable decentralized ownership and in-game economies powered by blockchain. This trend lets players own and trade digital assets, opening new revenue streams and drawing interest from companies exploring the intersection of gaming and crypto.

-AI driven studios: AI is already influencing game development, and its role will only grow. Companies with AI expertise, particularly in game design and player behavior analysis, are becoming highly sought after. As AI reduces development costs, budgets could shift towards live services and marketing.

The Big Picture

The gaming industry is consolidating, with major players acquiring valuable studios and IPs. While there will always be space for indie games—especially as AI lowers the barrier to entry—industry consolidation will likely strengthen the top companies and leave less room for those in the middle.

If a company like Ubisoft, valued at over $12 billion in 2021, is struggling to survive on its own, the future looks bleak for many smaller studios

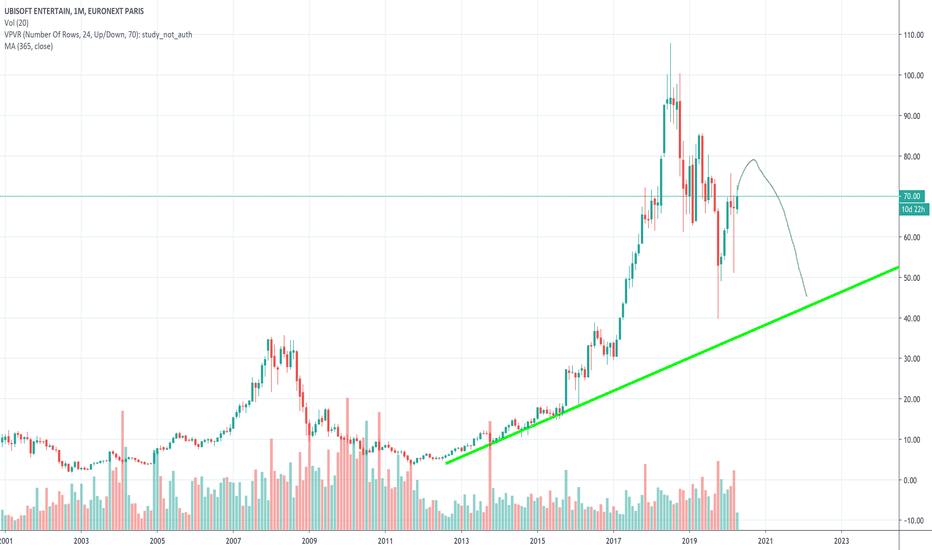

UBI

Ubisoft Entertainment SA / UBIUbisoft Entertainment aka ubi "bug" is a french video game publisher headquartered in Saint-Mandé with development studios across the world. Its video game franchises include Assassin's Creed, Far Cry, For Honor, Just Dance, Prince of Persia, Rabbids, Rayman, Tom Clancy's, and Watch Dogs. Ubisoft was one early investors in web3 technologies and projects too

last year was a terrible year for ubi because not only they didn't succeed with their franchise like farcry 6 but also they entered the bear market while they were working on their bigger projects like AC. “We are clearly disappointed by our recent performance,” said Ubisoft Chief Executive Yves Guillemot. “We are facing contrasted market dynamics as the industry continues to shift towards mega-brands and everlasting live games, in the context of worsening economic conditions affecting consumer spending.”

2023 is a big year for ubi and they are going to publish some of their best games like Assassin's Creed Mirage, Tom Clancy’s The Division Heartland and skull and bones

ubi stock now in Accumulation phase and its next targets are 21, 23 and 25

Fixed and Basic Income During Recessionary TimesThe talk of economists these days seem to be "Cash is King" (esp USD) vs "Cash is Trash". While it's true that a lot of people are liquidating their assets now in favor of dollars, given that our economies are interconnected more now than ever before, this might only last for a very short period of time.

While the market is likely to go into panic mode soon (the top-earners are finally getting a *tiny* taste of what people below them have been going through for years) it might help to take a step back and look at the bigger picture since most of the problems with the economy right now are existential, not technical.

Sort of a throwback to my #YangGang days with Andrew Yang, but UBI would have been pretty nice to have right about now. Yes, UBI does help alleviate poverty, but it also helps stabilize economies and labor markets during difficult transitions as well - that's what it was designed to do originally, and it is a brilliant idea that is literally good for *everyone*.

As stock/asset prices start to plummet, everyone is talking about moving their money to "fixed-income" sources now, to help stop the "bleeding". One of the silver linings of the recession is that there seems to be higher demand for labor, which could potentially increase wages and stabilize the economy that way - but people do need time to adjust and learn new skills to find new work. UBI does both in a simple and elegant way.

One of the big criticisms of UBI was that it would cause inflation since it would bring up the costs of everything. It's ironic to see how inflation became the talk of the town now despite the opposition coming from both sides of the political spectrum. Purchasing power is relative - the way to look at UBI from a budgeting standpoint is that you're dedicating a % of your total funds toward stabilizing the economy, which - again - should be good for everyone.

Hindsight is 20/20 and unfortunately we're now forced to work with what we did (and didn't) do thus far. Many economists - including major ones - have been eyeing cryptocurrencies as a potential "safe haven" during the market crash that's likely to continue well into 2023-24. How likely is it for people to turn to crypto during trying times?

Staking rewards are currently outperforming bank interest rates and may become more appealing over time, while crypto projects based around the concept of UBI may start to gain favor as the top-earners realize that these models are in their own interest, too. (It's a big *if*, but UBI-tokens might be the thing that ETH needs to revive its lackluster performance post-merge, imho.) Most investors are running towards cash for safety now but if that fails too, there will be no options left. That's when crypto may finally see its day - time will tell.

www.theguardian.com

ETH's "Burn" Model and its Relationship with Politics/CharitiesIn today's inflationary economy where money printing reigns supreme, the idea of "burning" money to maintain a currency's worth stands out as counterintuitive and different. It's also highly illegal - creating your own money supply (counterfeit) or destroying them are usually both felony offenses in most fiat systems right now.

In a way the ability to control a currency's money supply is the biggest draw of crypto on a fundamental level. What happens when we give that power to the people instead of relying on the government to do it for us? When the recession hits later this year, people are going to have a lot of time to ponder that question further.

Vitalik Buterin, to his credit, paved the way towards a "burn charity" model. The "fairest" way to redistribute wealth isn't to start a nonprofit or charity - it's for people to simply destroy their wealth and remove it from the ecosystem. This makes everyone else's money worth a little bit more as a result, always in favor of those who have less.

In a way, it functions like an Universal Basic Income, raising the economy from the bottom up, as Andrew Yang claimed during his US presidential run in 2020. (Vitalik supports UBI too btw.) It is the "fairest" way to redistribute wealth.

The "burn charity" model gets interesting when applied to politics and sociology because it highlights the fundamental problems with human nature in a very clear way. If the end goal is to destroy money supply, it explains why people might get appealed to violent ideas such as "eat the rich" or the destruction of private property - it is striving towards that same idea of redistribution of wealth through the destruction of money in itself. (Luckily in crypto, we can do this in a peaceful way, which politicians should be talking more about, imo.)

On the flip side, fiat has always been against "burn charities" -- you can't create nor destroy fiat money (not that there's a strong will to do that right now by anyone) and the problem with redistribution through taxation is that the government can't be trusted to handle the money in a responsible way. (A "fair" government would take money they seized/collected and simply destroy them, not keep them, imo.)

All of these ideas seem outlandish and radical to our sensibilities right now, which might explain the reasons why good ideas like UBI has had trouble passing in political arenas, despite its popular appeal. People intuitively know that it's a good thing, but often can't explain why. But maybe the idea of "burn charities" might get us a little closer to what we want. Couldn't hurt, either way.

And crypto is the ideal place to experiment with these ideas that are untenable in the real-world due to political realities right now. But I hope that the #Web3 folks will see the opportunity that's there and push the envelope further - it may be our only hope, after all. 🙏

twitter.com

Ubisoft Analysis - Double TopDouble Top formation and completion

The question is where does price go from here?

Price may recover along the 1/1 Gann line, which has previously been a resistance area for price

Or it may recover at the red line plotted which has been a strong pivot point for price

Its all based on the strength of the double top

UBI long idea by bluepiplong in levels and following price to target ...

leave me your like and comment's about my analyze on the posts ....

UBI BANCA /SHORT - 1ST TARGET 2.70, 2ND 1.80UBI BANCA /SHORT -

1ST TARGET 2.70 euro

2ND 1.80 euro

See u soon guys with new trading ideas,

Simone

The Gaming Trade - Video Game and Esports Stocks - September 2.0The Gaming Trade

The gaming trade tracks gaming & esports stocks. With a combination of technical and fundamental analysis I attempt to provide the best ways to profit off of these companies in the stock market. My style is a blend of classical charting, candlestick reading, trend trading and a bit of price action. My decisions are based on how the daily, weekly & monthly charts display the current status of the stock. I will do my best to provide insight on profit taking points and breakouts on my Twitter account: @TheBegonis - I use no leverage in this tracking account.

9/16/18

AMD: Current Price: $32.72 ( first article in September $25.17)

Earlier this month I wrote about AMD and noted the Bull Flag on the 4 hour that could take the stock to $30 -- Well it hit it. After a couple days of profit taking, the stock keeps on rolling. The Monthly and Weekly charts show no sign of slowing down either. We are in a little bit of chop on the daily but unless price closes below $25.61 on the weekly this could continue to climb.

Daily:

Weekly:

Monthly:

ATVI: Price $81.27 ( First article in September: $72.10)

Well... Last time I said we were in for some chop, until price closed "above$75.53 on the weekly and the Monthly closes above$75.40." DID WE. Price shot up 11% since then. Price met the previous green candle high around $74 and volume pushed the stock bullish again. Right now price seems to be rounding over on the daily as it hits the previous high around $81.50. Price could pull back a bit on the daily as it loads up for another attempt at the top of the channel. The weekly Stochastic RSI signals that momentum is on the side. Take profits should we reach the top of the channel around $85.

Daily:

Weekly:

Monthly:

EA: Price $114.27 (First article in September: $113.41)

Electronic Arts still looks to be in trouble. So far it seems that a descending wedge is forming on the Weekly and that means prices will continue to fall before any turn up. In the short term we may have a pop to the $118 area seen on the daily to confirm the resistance line of the wedge. But a move down is likely to follow. We may not find true support until the $92 area seen on the Weekly where a lower trend line can be theorized and the Weekly 200SMA (and Monthly 50SMA) would meet. If Price closes below $106.23 on the Monthly, EA will be trending down.

Daily:

Weekly:

Monthly:

HEAR: Price $18.91

Turtle Beach went on a tear this year starting in May (No doubt to the rise of steaming, esports and the explosion of Fortnite). Right now, the run is out of gas. Price is channeling down but we might see a short term bounce as we are at the support of the channel and testing the top of the ignition candle. Look for a possible short term bounce to the $22 area, but this would be a counter-trend move, so if you do, trade careful. If Price closes below $16.53 we will continue going down.

Daily:

Weekly:

Monthly:

MSFT: Price $113.37

Microsoft continues to chug along. Despite some chop of the daily chart it is at an all-time high. The chop should continue on the daily but this looks like it will continue rolling.

Daily:

Weekly:

Monthly:

NVDA: Price $276.43

Nvidia is very choppy on the weekly and daily charts but is otherwise slowly and surely trending up. Price would have to breach $239.63 before I would show any real concern for the stock. HOWEVER, price does seem to be leveling off based on the weekly, so upside may be limited.

Daily:

Weekly:

Monthly:

SNE: Price $59.44

Like so many stocks I am seeing in the market, Sony is starting to show signs of going parabolic. In other words, price may continue to rise and it may rise fast. Price gapped up and is testing a high we haven't seen since 2007. It is a bit of a ways to go before reaching the highs of '99/2000 but the next area we could see is the $84-85 area -- All three major charts are bullish.

Daily:

Weekly:

Monthly:

TCEHY: $Price 41.35 (First article in September Price $43.14)

I love Tencent but this is just painful. Price continues to try to break down from the descending channel. (Daily) That $36 area I mentioned last time could still be support but I think this is going to be slog down to the $30 area where the Weekly 200SMA is trending.

Daily:

Weekly:

Monthly:

TTWO: Price $134.11

TakeTwo continues to operate within the rising channel and price is chopping on the daily. At the moment there isn't a good entry and no reason to exit.

Daily:

Weekly:

Monthly:

UBI: Price $95.68

Ubisoft is in a bit of a precarious position. Price is flat. The Daily and Weekly are trading sideways with a slight downtrend. Price fought back bullish last week on the Weekly. It needs to confirm by closing past the next two targets of $97.02 & $99.52 to really resume a bullish move. Price is stagnant at the top of the monthly but it would only be in danger if it closed below $79.60.

Daily:

Weekly:

Monthly:

ZNGA: Price $4.02 (First article in September Price $4.16)

This looks like it should be covered by Ted Allen on Chopped. Two weeks ago it sabotaged all the momentum it was gaining and went choppy. Price seems to be turning back upwards but it needs to clear $4.23 on the weekly if it is going to re-gain that momentum. It doe seem that it will hit that $4.55 PT... eventually.

Daily:

Weekly:

Monthly:

Thank you!

Ubi Banca is a short. 1st target at 2.90. Second around 2.60Ubi Banca has broken a positive trendline. It is now moving downwards. 2.90 is a natural first target, Second one at 2.60

UBI - WAIT FOR BREAK OUT LONGwe can see clearly a triple bottom on this stock and also a long divergence. the idea is to entry only over the break out of the level 3,32. THE r/r total is good.

UBI - TRIPLE BOTTOM, WAIT FOR BREAK OUT LONGwe can see clearly a triple bottom on this stock and also a long divergence. the idea is to entry only over the break out of the level 3,32. THE r/r total is good.