USDJPY 4Hour TF - August 10th, 2025🟦 USDJPY 4H Analysis

📅 August 10, 2025

Top-Down Trend Bias:

• Monthly – Bullish

• Weekly – Bearish

• Daily – Bullish

• 4H – Bearish

USDJPY is consolidating inside the 147.500 zone. Higher timeframes remain mixed, with bullish monthly/daily trends but a bearish weekly and 4H structure, making this a key decision area.

🔍 Key Zone: 147.500

This zone is both a structural support and a potential breakout base. The reaction here will set the short term tone.

✅ Scenario A: Bullish Breakout (Blue Path)

1.If price breaks and holds above 147.50

2.Look for continuation into 151.500 resistance zone

3.Aligns with the monthly and daily bullish bias

⚠️ Scenario B: Bearish Breakdown (Orange Path)

1.If price closes below 147.500 zone

2.Watch for retest + rejection to confirm downside continuation

Target: 145.00 support zone

This setup aligns with the bearish weekly and 4H bias.

🧠 Final Notes

• HTF momentum is split, confirmation at the zone is critical

• Blue path favors trend continuation on higher timeframes

• Orange path keeps short term sellers in control

Uj

ujThe dollar index (DXY00) on Monday added to last Friday’s losses and fell by -0.38%. The dollar moved lower Monday on negative carryover from last Friday’s weaker-than-expected US payroll and ISM manufacturing reports, which sent T-note yields lower and bolstered speculation that the Fed may cut interest rates as soon as next month.

USDJPY 4Hour TF - August 3rd, 2025🟦 USDJPY 4H Analysis Bullish Idea

📅 August 3, 2025

🔹 Top-Down Trend Bias:

• Monthly – Bullish

• Weekly – Bearish

• Daily – Bullish

• 4H – Bearish

USDJPY has retraced sharply from local highs, breaking down into prior support near 147.50. Short term structure has shifted bearish, but higher timeframes still lean bullish making this a key reaction zone to monitor.

🔍 Key Zone: 147.00 – 147.50

This zone sits at a prior key support zone. How price reacts here will determine whether the pair resumes its bullish leg or continues deeper.

✅ Scenario A: Bullish Rejection (Blue Path)

1.If price holds above 147.00–147.50 and prints bullish confirmation

2.Look for continuation toward 151.50

Target: 151.50 (next clean resistance zone)

This setup aligns with the HTF bullish trend. Clean break of structure and bullish reactions are needed for confirmation.

⚠️ Scenario B: Bearish Breakdown (Orange Path)

1.If price breaks and closes below 147.500 zone

2.Watch for lower high + retest rejection

Target: 145.00 support zone

This is a lower probability counter trend continuation but is possible if price action presents the needed confirmations.

🧠 Final Notes

• Price is at a decision point, wait for Price action confirmation

• HTF bias leans bullish, but 4H structure must shift back up

• Trade with structure, not against it

USDJPY UPSIDE The dollar index (DXY00) on Tuesday rose by +0.22% and posted a 5-week high. The dollar has carryover support from Monday following the EU-US trade deal that is seen as favoring the US. Also, expectations for the Fed to keep interest rates unchanged at the end of Wednesday's 2-day FOMC meeting are supportive of the dollar. The dollar extended its gains after the US Jun advance goods trade deficit unexpectedly shrank, a supportive factor for Q2 GDP, and after July consumer confidence rose more than expected.

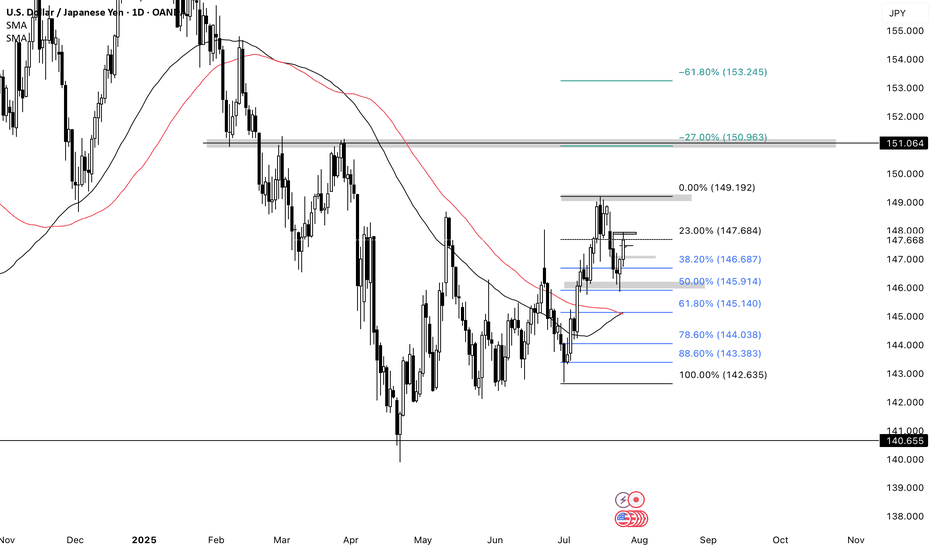

USDJPY – DAILY FORECAST Q3 | W31 | D29 | Y25📊 USDJPY – DAILY FORECAST

Q3 | W31 | D29 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

OANDA:USDJPY

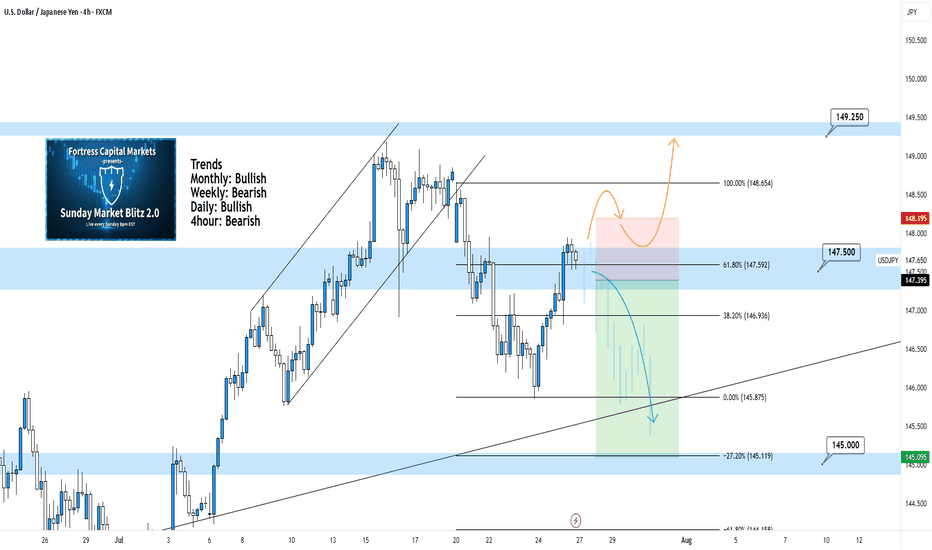

USDJPY 4Hour TF - July 27th, 2025USDJPY 7/27/2025

USDJPY 4Hour Neutral Idea

Monthly - Bullish

Weekly - Bearish

Daily - Bullish

4Hour - Bearish

We’re getting some mixed signals going into this week on UJ but it does look primarily bearish, especially after the move last week.

Currently price action is resting at 147.500 and we’re waiting to see if it will hold as resistance.

Here are two potential ways price action could play out for the week ahead:

Bearish Continuation - This is the most likely based on the context clues of last week. We’re clearly bearish and that lines up with the DXY bias at the moment.

For us to spot a confident short position on UJ we would need to see some bearish conviction coming off our 147.500 zone. We could see this happen after some consolidation or immediately so be cautious and be patient.

Bullish Reversal - This is the only bullish set up I'd be interested in if it plays out. We need to be convinced price action will move higher so I would need to see a significant push above 147.500 resistance with new structure in the form of higher low above. I’d look to target higher toward key levels of resistance if this happens.

USDJPY BULLISHUJ closed bullish last week so I’ll continue looking for buys this week. There was a daily double bottom & 50% Retracement on the daily timeframe. I would like for price to either break the H4 resistance, form a HL then look for buys. Or price could retrace and form a HL the I’ll look for buys towards daily resistance @149.190 then my next TP will be 151.00

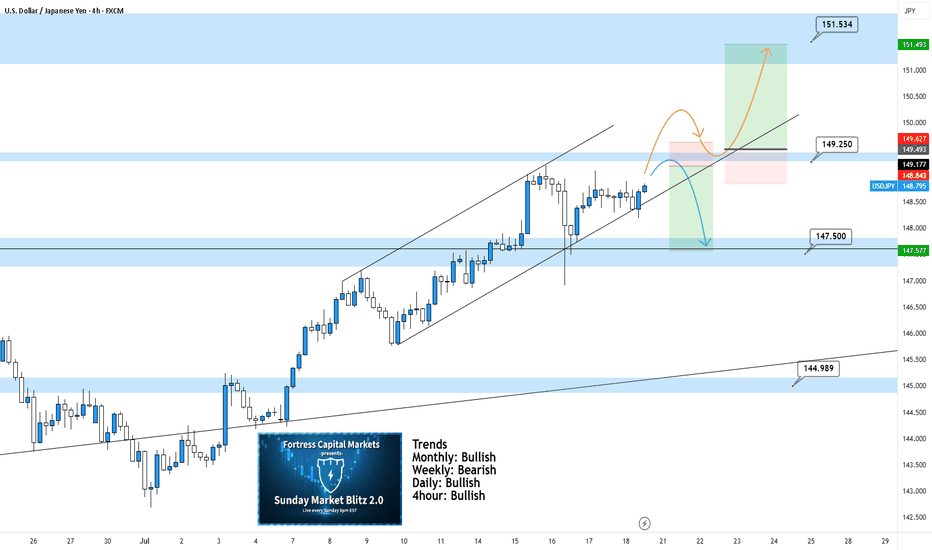

USDJPY 4Hour TF - July 20th,2025USDJPY 7/20/2025

USDJPY 4Hour Neutral Idea

Monthly - Bullish

Weekly - Bearish

Daily - Bullish

4Hour - Bullish

UJ is looking better than a couple weeks ago and at least we can spot some decent setups for the week ahead. These are NOT perfect setups but we have two scenarios that we are ready for if price action shows it is ready too. Here are the two scenarios we’re looking at for the week:

Bullish Continuation - We can see UJ in a nice 4hour channel but we are currently seeing a bit of flat price action. For us to consider UJ long setups again we would need to be convinced. Look for a break above our 149.250 zone with a confirmed higher low above. This would be enough to consider longs and target higher toward key levels of resistance.

Bearish Reversal - If price action continues to stall, this bearish setup will become more and more likely. Ideally, we want to see some strong rejection from our 149.250. If this happens look to target lower toward 147.500.

USDJPY LONG & SHORT – DAILY FORECAST Q3 | D15 | W29 | Y25💼 USDJPY LONG & SHORT – DAILY FORECAST

Q3 | D15 | W29 | Y25

📊 MARKET STRUCTURE SNAPSHOT

USDJPY is currently reaching for a key higher time frame supply zone, looking for price action to show weakness at premium levels. Structure and momentum are now aligning for a short opportunity backed by multi-timeframe confluence.

🔍 Confluences to Watch 📝

✅ Daily Order Block (OB)

Looking for Strong reaction and early signs of distribution.

✅ 4H Order Block

Break of internal structure (iBoS) confirms a short-term bearish transition.

✅ 1H Order Block

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

🏁 Final Thoughts from FRGNT

📌 The structure is clear.

The confluences are stacked.

Let execution follow discipline, not emotion.

USDJPY LONG & SHORT – WEEKLY FORECAST Q3 | W29 | Y25

💼 USDJPY LONG & SHORT – WEEKLY FORECAST

Q3 | W29 | Y25

📊 MARKET STRUCTURE SNAPSHOT

USDJPY is currently reaching for a key higher time frame supply zone, looking for price action to show weakness at premium levels. Structure and momentum are now aligning for a short opportunity backed by multi-timeframe confluence.

🔍 Confluences to Watch 📝

✅ Daily Order Block (OB)

Looking for Strong reaction and early signs of distribution.

✅ 4H Order Block

Break of internal structure (iBoS) confirms a short-term bearish transition.

✅ 1H Order Block

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

🏁 Final Thoughts from FRGNT

📌 The structure is clear.

The confluences are stacked.

Let execution follow discipline, not emotion.

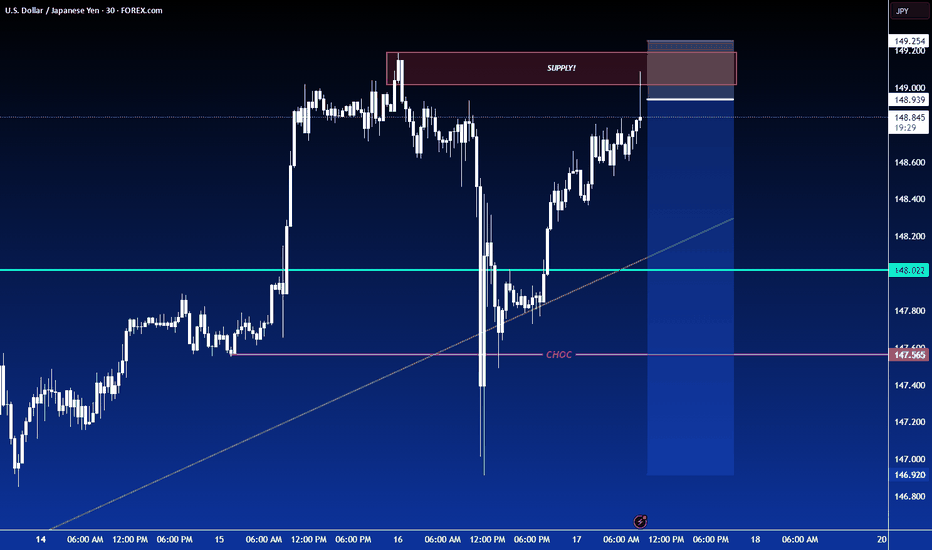

LONG ON USD/JPYUSD/JPY has given us a CHOC (change of character) from down to up.

It has engineered sell side liquidity right above a demand zone.

I expect price to sweep sell side liquidity, tap into the demand zone then take off to the upside.

looking to catch 150-250 pips on UJ. (Economic News could set this trade on Fire!)

USDJPY Long potential setupWhat's going on?

USDJPY – Reload Zone Marked. If They Take Me Out, I’ll Be Waiting Lower.

Discipline means you don’t chase. You wait where the market must return.

Currently in 2 buys, one is an added position, then I moved my stop in from the purple line— but if those get wicked out, I’m hunting the next key demand zone just beneath 144.10. Where we'll have a textbook spring setup!

🧠 What I See:

We're forming a potential micro accumulation structure.

If the current position gets taken out, I’ll reload lower at the spring aligned with the prior reaction low + liquidity sweep zone.

🎯 Next Area of Interest:

Zone: 144.00 – 144.10

📌 Target Remains:

144.76 → 145.36

1.618 extension aligns with supply inefficiencies & range completion

---

> “Stop loss isn’t failure. It’s recon. The second entry — that’s where pros feast.”

I’m not trading emotion. I’m trading plan + precision + execution.

WHO LOVES A STRONG JPY ( YEN )BASKET FORECAST Q2 W22 Y25WHO LOVES A STRONG JPY ( YEN )BASKET FORECAST Q2 W22 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

✅The JPY Basket tracks the overall strength of the JPY against a weighted average of other currencies.

✅It can be used as an indicator of YEN strength which can be a tool for analysing and potentially hedging for or against the Index.

✅ Pairs to watch - GBPJPY, USDJPY EURJPY, CADJPY, AUDJPY

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

USDJPY: This Pattern Shows Global Reversal USDJPY is on the brinks to trigger global reversal to the downside

as large Head & Shoulders reversal pattern has been built on the chart

Bearish Trigger is on the Neckline breakdown

Target is on 117 (height of the Head below Neckline)

Massive drop is expected

It matches the area (blue trendline) where the breakout to upside occured

Invalidation is above the Right Shoulder

USDJPY SELLSPrice is currently in an AOI for sells. Price gapped up so I'd hold off on sells until price forms bearish structure on the lower timeframes. Once price resumes bearish structure, look for sells towards 140.500. If price breaks above H1 resistance, I'd look for price to push towards 145.

USDJPY LONG FORECAST Q2 W15 D11 Y25USDJPY LONG FORECAST Q2 W15 D11 Y25

Happy Friday Traders, It has been a week of sitting on capital. Being cautious, awaiting for breaks of structures at key areas and not not getting dragged into trades that do not fully present themselves. The clues have been there. The carrot has been continually dangled however as risk managers... You know how the saying goes.

We stay true to our trading plan.

We hold firm with what we know works.

We are aware of our market edge.

We know our "perfect" set up does present itself.

with that said, we are dynamic! We do of course entertain the "Imperfect" setup. We simply approach with caution.

USDJPY LONG FORECAST Q2 W15 D11 Y25

15' of course, bearish start to the Friday. Perhaps we are asking a lot from UJ today but let's see if we can break 15' structure before taking a deeper look.

Bigger picture, We are in a weekly order block in the long direction so all shorts are OFF until further notice.

Best of Luck Traders.

Continue to manager your capital.

FRGNT X