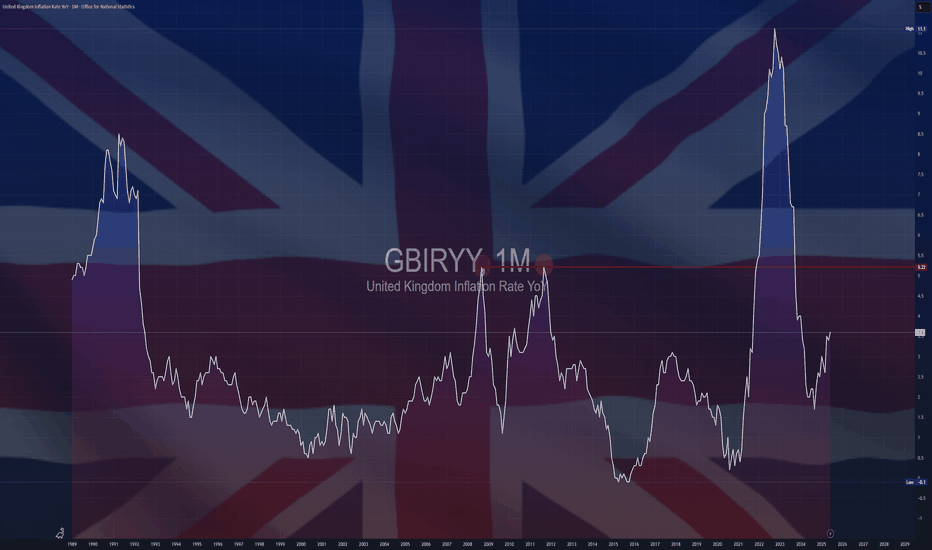

$GBIRYY - U.K Inflation Rises to a 2024 High (June/2025)ECONOMICS:GBIRYY

June/2025

source: Office for National Statistics

- The annual inflation rate in the UK rose to 3.6% in June, the highest since January 2024, up from 3.4% in May and above expectations that it would remain unchanged.

The main upward pressure came from transport prices, mostly motor fuel costs, airfares, rail fares and maintenance and repair of personal transport equipment.

On the other hand, services inflation remained steady at 4.7%.

Meanwhile, core inflation also accelerated, with the annual rate reaching 3.7%.

UK

Jobs vs politics: GBPUSD caught in crossfire Two major stories are developing on either side of the Atlantic.

ADP reported a 33 k fall in June private payrolls (consensus +95 k). It is the third straight miss and sets the tone for Thursday’s early Non-Farm Payroll (NFP) release, brought forward because of the 4 July holiday.

In the UK, speculation is growing around the position of Chancellor Rachel Reeves after an emotional appearance in Parliament. Prime Minister Keir Starmer declined to confirm whether she would remain in the role, sparking questions over the government’s fiscal direction.

The political uncertainty helped accelerate the sell-off in GBPUSD, which has fallen sharply from recent highs near 1.38. The latest candles show a long lower wick around 1.3600, indicating that buyers are attempting to defend the area. If this support fails to hold, the next downside target lies near 1.3485–1.3500, which acted as a base for the late-June rally.

$GBIRYY - U.K Inflation Rate Accelerates (April/2025)ECONOMICS:GBIRYY

April/2025

source: Office for National Statistics

- The annual inflation rate in the UK jumped to 3.5% in April, the highest since January 2024, from 2.6% in March and above forecasts of 3.3%.

The main upward pressure came from higher electricity and gas prices after the Ofgem price cap increase, while new Vehicle Excise Duty on electric cars lifted transport costs, and food inflation also picked up.

Meanwhile, core inflation accelerated to 3.8%, the highest in a year.

Can FTSE100 keep the momentum all the way to the all-time high?The FTSE:UKX bulls continue to show resilience and push the index higher. But the big question is, can we see a move all the way to the current all-time high?

Let's dig in...

MARKETSCOM:UK100

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

GBPUSD - Bearish Pressure Soon!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈As per our last GBPUSD analysis, it rejected the $1.27 - $1.28 support zone and has been trading higher.

This week, GBPUSD is approaching the upper bound of its rising wedge pattern marked in red.

Moreover, the blue zone around $1.34 is a strong resistance and previous weekly high.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper red trendline and resistance.

📚 As per my trading style:

As #GBPUSD retests the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

$GBINTR -BoE Cuts Rates as Expected (May/2025)ECONOMICS:GBINTR

May/2025

source: Bank of England

- The Bank of England cut the Bank Rate by 25 basis points to 4.25%,

matching expectations but revealing a split 5–4 vote.

Two policymakers favored a deeper 50 bps cut, while two others wanted to hold at 4.5%.

It was the fourth cut since August 2024, amid concerns over slowing growth linked to Trump-era tariffs.

USA-UK: Trade Agreement and Impact

Hello, I am Trader Andrea Russo and today I want to talk to you about the meeting that will take place today, May 9, 2025, between the USA and the UK. The announcement of a new trade agreement between the United States and the United Kingdom by Donald Trump has immediately attracted the attention of global investors. Its economic scope could have significant repercussions on the main currencies, in particular on the GBP/USD pair.

The components of the agreement and the reactions of the markets

According to initial information, the agreement aims to strengthen trade relations between Washington and London, simplifying regulations on goods and services, reducing duties and incentivizing bilateral investments.

Immediate impact on the pound (GBP)

The GBP/USD pair has shown an initial reaction of volatility, with investors evaluating the details of the new agreement. If the agreement leads to greater economic stability and growth in the United Kingdom, the pound could benefit from a bullish trend in the short term. However, some analysts warn that the pound could suffer from more in-depth negotiations in the future, especially if the deal puts renewed pressure on UK financial markets.

The US dollar and the Fed’s monetary policy

The deal comes amid economic uncertainty in the US, with the Federal Reserve monitoring inflation and growth. If bilateral trade between the US and UK were to expand significantly, it could have a positive effect on the dollar’s strength, even against other currencies.

Economic sectors involved and impact on FX

The deal could affect several sectors:

Energy and raw materials: If trade in natural gas or oil between the two countries increases, it could have an impact on commodity futures and therefore on currencies linked to these markets, such as the CAD and AUD.

Technology and financial services: Expanded cooperation between technology and financial firms could attract investment on Wall Street and support the dollar.

Manufacturing and Exports: If the UK manages to secure favorable export terms, the pound could see increased demand in Forex.

Outlook

In the short term, the deal could lead to increased volatility in GBP/USD as investors await further details. In the long term, much will depend on the economic policies that follow the deal and the effects on the trade balances of the two countries.

Forex market analysts will continue to monitor investor reaction and future statements from the governments involved.

$GBIRYY - U.K CPI (March/2025)ECONOMICS:GBIRYY 2.6%

March/2025

source: Office for National Statistics

- The annual inflation rate in the UK slowed to 2.6% in March 2025 from 2.8% in February and below market and the BoE's forecasts of 2.7%.

The largest downward contributions came from recreation and culture (2.4% vs 3.4%), mainly games, toys and hobbies (-4.2%) and data processing equipment (-5.1%). Transport also contributed to the slowdown (1.2% vs 1.8%), largely due to a 5.3% fall in motor fuel prices.

In addition, prices rose less for restaurants and hotels (3%, the lowest since July 2021 vs 3.4%), mostly accommodation services (-0.6%); housing and utilities (1.8% vs 1.9%); and food and non-alcoholic beverages (3% vs 3.3%).

In contrast, the most significant upward contribution came from clothing and footwear (1.1% vs -0.6%), with prices usually rising in March as spring fashions continue to enter the shops.

Compared to the previous month, the CPI edged up 0.3%, slightly below both the previous month’s increase and expectations of 0.4%.

Annual core inflation slowed to 3.4% from 3.5%.

XAU/USD Outlook: Gold's Bullish Momentum Strengthens 📌 XAU/USD Analysis: Gold on a Strong Bullish Momentum Amid Economic Optimism 📈💰

✨ Overview:

Gold (XAU/USD) is currently demonstrating significant bullish momentum, driven by improved global economic sentiment. The recent 90-day tariff suspension among major global economies and hints from the recent FOMC meeting about potential rate cuts later this year are fueling investor optimism.

📊 Technical Analysis:

🔹 Key Resistance Levels:

3,146

3,162

3,168

🔸 Key Support Levels:

3,096

3,078

3,066

3,052

📈 Moving Averages Analysis:

MA 13 (Short-term): Clearly supports bullish momentum, offering buy signals as price sustains above this MA.

MA 34 (Medium-term): Supporting bullish sentiment with prices comfortably above.

MA 200 (Long-term): Reinforces the robust long-term bullish outlook with price consistently trading above this level.

🚀 Trading Strategy & Recommendations:

BUY Strategy (Preferred Scenario):

Entry Zone: 3,094 – 3,096

Stop Loss: 3,090

Take Profit Levels: 3,100 | 3,104 | 3,108 | 3,112 | 3,116 | 3,120

SELL Strategy (Cautious Approach):

Entry Zone: 3,164 – 3,166

Stop Loss: 3,170

Take Profit Levels: 3,160 | 3,156 | 3,152 | 3,148 | 3,144 | 3,140

🌍 Fundamental Context:

Positive Market Sentiment: The global economic outlook has turned favorable due to tariff suspensions and strong performance in equity markets.

Interest Rate Outlook: Recent signals from the FOMC regarding possible interest rate cuts are providing further support for gold’s upward trajectory.

⚠️ Risk Management:

Emphasize caution when engaging in short positions, given the prevailing bullish conditions.

Always implement strict stop-loss measures and maintain risk-to-reward ratios of at least 1:2.

Avoid over-leverage and ensure trades are sized appropriately.

💡 Conclusion & Final Thoughts:

Gold remains strongly bullish, backed by both technical indicators and a positive fundamental backdrop. Traders are encouraged to focus primarily on buy opportunities near significant support levels and remain alert to potential trend reversals at key resistance zones.

🗨️ Engage with Us:

What are your current strategies for gold? Share your insights and views in the comments section below! 💬👇

GBPCHF PoV - BUY POINT 1.07000???The GBP/CHF exchange rate has shown a significant bearish trend, especially after breaking the support at 1.110. Currently, the pair is heading towards the 1.07 area, indicating sustained selling pressure.

One possible cause of this movement could be related to tariff issues and the economic uncertainties associated with them. Trade policies, including tariffs, can significantly affect currencies as they impact expectations about economic growth and international trade. Recent news about the introduction or tightening of tariffs between the UK and other countries may have contributed to a negative sentiment toward the British pound, strengthening the Swiss franc as a safe-haven currency.

To fully understand the reasons behind the current trend of GBP/CHF, it's essential to monitor the latest economic and political news, especially those related to trade policies and the UK's international relations. A close examination of economic data and political developments can provide clearer insights into the future outlook for this currency pair.

GBPUSD Holds Below 0.618 Fibonacci RetracementFollowing the DXY's decline, the British pound surged back above the trendline connecting lower highs between 2014 to 2021, aligning with a key resistance at the 0.618 Fibonacci retracement of the downtrend between the September 2024 high (1.3434) and the January 2025 low (1.2099) at 1.2945.

Current Market Setup:

RSI on the 3-day time frame is now overbought, aligning with the inverted head and shoulders target formed by the RSI trend near oversold levels, reinforcing reversal potential.

Further downside risks persist, with market sentiment hinging on growth data, trade war developments, and US inflation figures.

Key Levels to Watch:

A decisive close above 1.2850 could pave the way toward 1.3020, 1.3160, and 1.34.

Failure to hold gains could trigger a pullback toward key support zones at 1.28, 1.27, and 1.2570.

Key Events This Week:

US CPI

UK GDP

Trade War Developments

- Razan Hilal, CMT

UK HOUSE PRICES: RELENTLESS UPTRENDIn January 2025, the latest figures reveal that UK house prices have risen by 0.7%, pushing the average price to a staggering £299,238, a new all-time high. For the mainstream media, the narrative of an impending house price crash has been a constant refrain over the past two years, fueled by the belief that prolonged high interest rates would spell disaster for the housing market.

Indeed, these elevated interest rates have significantly hindered the natural upward trajectory of house prices, which typically rise in response to inflation, a growing population, and a persistent shortage of new housing construction.

The current stagnation in UK house prices resembles a pressure cooker, building up energy that is bound to release in a dramatic surge. The government’s ongoing strategy of printing money to appease voters will inevitably flow into asset prices, leading to inflation in these markets, much like the consumer price inflation we’ve already witnessed.

The government finds itself in a bind, compelled to continue this money printing to meet the electorate's demands for free money and to manage an ever-growing debt burden. As the debt increases, so does the need for borrowing to service it. This cycle makes it increasingly challenging for the UK to lower long-term borrowing rates, especially compared to the US, which still holds sway over the global financial landscape.

UK house prices are gradually regaining momentum following the fallout from the Liz Truss debacle, a situation she seems to remain blissfully unaware of, despite the havoc her brief six-week tenure as Prime Minister wreaked on the British economy.

The financial landscape was nearly sent tumbling into chaos, prompting the Bank of England to step in with an unprecedented commitment to purchase UK Government Bonds. The economy is so fragile that the UK is now compelled to invest in US government bonds to shore up its financial system against the spectre of another crisis reminiscent of the Truss era under Labour. We were perilously close to a financial meltdown!

Currently, UK house prices are inching towards a potential increase of around 10% per year, indicating a modest upward trend rather than a frenzied housing boom, while also avoiding the catastrophic price drop that the media seems to obsess over.

Ultimately, average house prices in the UK are set to rise, irrespective of government actions or economic conditions. Therefore, those considering the purchase of a standalone house should act without hesitation, as flats and new builds present more complicated challenges—flats can become a logistical nightmare, and new developments might be situated in flood-prone areas, among other concerns.

UK Employment and Inflation Numbers Ahead; GBP/USD Drifting ArouWhile the UK is evading US tariffs for now, its economy continues to face a somewhat undecided future, with taxes on business set to increase in April and a lingering drag from the elevated interest rates.

However, this week’s focus shifts to a rather busy slate of economic data in the UK. Regarding tier-1 metrics, I will largely focus on Tuesday’s employment figures for December 2024 and the January CPI inflation (Consumer Price Index) report on Wednesday. The data comes on the heels of last week’s better-than-expected GDP (Gross Domestic Product) numbers for December 2024.

BoE: ‘Gradual and Careful’ Approach

You will recall that the Bank of England (BoE) recently cut the Bank Rate by 25 basis points (bps) to 4.50% – which did not raise too many eyebrows – and the BoE Governor signalled a ‘gradual and careful’ approach to easing policy. However, the 7-2 MPC vote split (Monetary Policy Committee) caused a stir. BoE member Catherine Mann – a known hawk – joined Swati Dhingra (dove) and voted to cut the Bank Rate by 50 bps.

The central bank also released updated quarterly projections revealing an upward revision to inflation and weaker GDP, and it forecasted that the Bank Rate would remain higher for longer. Inflation is expected to rise by 2.8% in Q1 25 (versus 2.4% in the previous forecast) and increase by 3.0% in Q1 26 (versus 2.6% in the previous forecast), followed by inflation cooling back to the BoE’s 2.0% target in 2027. GDP growth is now expected to grow by 0.4% in Q1 25 (down from 1.4% in the prior forecasts), with economic activity predicted to grow by 1.5% in Q1 26. The BoE also estimates that the Bank Rate will remain around 4.5% in Q1 25 but likely fall to 4.2% in Q1 26, against previous forecasts for 3.7%. Markets are currently pricing another 57 bps worth of cuts this year (little more than two rate cuts).

UK Employment and Inflation Data Eyed

UK employment numbers will be released tomorrow at 7:00 am GMT and are expected to show unemployment ticked higher to 4.5% between October to December 2024, up from 4.4% in November. In terms of wages, both regular pay and pay that includes bonuses are forecast to increase by 5.9% on a year-on-year basis (YY), up from 5.6%. However, while market participants will widely watch the jobs report, which can prove market moving, it is essential to remember the validity of the survey’s data remains in question.

Wednesday welcomes the January CPI inflation data at 7:00 am GMT, which is expected to reveal increasing price pressures across key measures. Headline YY CPI inflation is forecast to increase by 2.8% (from December’s reading of 2.5% ), consistent with the BoE’s updated forecasts. The current estimate range is between a high of 2.9% and a low of 2.4%. YY core CPI inflation – excluding volatile food, energy, alcohol, and tobacco items – is estimated to have increased by 3.7%, up from 3.2% in December (estimate range between 3.8% and 3.3%). Regarding services inflation, the YY print is anticipated to rise by nearly a whole percentage point to 5.2%, compared to December’s reading of 4.4%. A rise in price pressures, particularly data that meets or exceeds upper estimates, could prompt investors to pare back rate-cut bets this year. This also places the central bank in a somewhat difficult position, given that it not only reduced the Bank Rate last week, but two MPC members also voted for an outsized 50 bp reduction.

GBP/USD: Monthly Bullish Engulfing Formation?

The monthly chart shows price is on the verge of pencilling in a bullish engulfing pattern from support at US$1.2173 (textbook engulfing patterns focus on the real bodies, not the upper and lower shadows). Monthly resistance demands attention overhead at US$1.2715, with a break of this barrier likely paving the way north for further outperformance towards another layer of monthly resistance coming in at US$1.3111.

Interestingly, buyers and sellers are squaring off at resistance from US$1.2608 on the daily timeframe. The supply area directly to the left of current price (red area) was weak (as noted in a previous piece I posted), with technical buying gathering steam from retesting trendline resistance-turned-support, extended from the high of US$1.3428.

If inflation comes in broadly higher than expected, this will likely underpin a bid in the GBP/USD (British pound versus the US dollar) and perhaps pull the currency pair beyond current daily resistance towards the monthly resistance mentioned above at US$1.2715, closely shadowed by another layer of daily resistance at US$1.2752.

Written by FP Markets Market Analyst Aaron Hill

$GBIRYY -U.K Inflation Rate (December/2024)ECONOMICS:GBIRYY

December/2024

source: Office for National Statistics

-Annual inflation rate in the UK unexpectedly edged lower to 2.5% in December 2024 from 2.6% in November, below forecasts of 2.6%. However, it matched the BoE's forecast from early November.

Prices slowed for restaurants and hotels (3.4%, the lowest since July 2021 vs 4%), mainly due to a 1.9% fall in prices of hotels.

Inflation also slowed for recreation and communication (3.4% vs 3.6%) and services (4.4%, the lowest since March 2022 vs 5) and steadied for food and non-alcoholic beverages (at 2%). Meanwhile, prices decreased less for transport (-0.6% vs -0.9%) as upward effects from motor fuels and second-hand cars (1%) partially offset a downward effect from air fare (-26%).

Also, prices rose slightly more for housing and utilities (3.1% vs 3%). Compared to November, the CPI rose 0.3%, above 0.1% in the previous period but below forecasts of 0.4%.

The annual core inflation rate also declined to 3.2% from 3.5% and the monthly rate went up to 0.3%, below forecasts of 0.5%.

$GBINTR -U.K Interest RatesECONOMICS:GBINTR

(December/2024)

source: Bank of England

The Bank of England left the benchmark bank rate steady at 4.75% during its December 2024 meeting,

in line with market expectations, as CPI inflation, wage growth and some indicators of inflation expectations had risen, adding to the risk of inflation persistence.

The central bank reinforced that a gradual approach to removing monetary policy restraint remains appropriate and that monetary policy will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further.

The central bank will continue to decide the appropriate degree of monetary policy restrictiveness at each meeting.

$GBIRYY -U.K CPI (November/2024)ECONOMICS:GBIRYY

(November/2024)

source: Office for National Statistics

- The annual inflation rate in the UK edged up for a second month to 2.6% in November 2024 from 2.3% in October, matching forecasts.

It is the highest inflation rate in eight months,

with prices rising at a faster pace for recreation and culture (3.6% vs 3% in October),

mostly admission fees to live music events and theaters and computer games;

housing and utilities (3% vs 2.9%), particularly actual rents for housing; and food and non-alcoholic beverages (2% vs 1.9%).

In addition, transport prices fell much less (-0.9% vs -1.9%) as upward effects from motor fuels and second-hand cars were partially offset by a downward effect from air fares.

Meanwhile, services inflation was steady at 5%.

Compared to the previous month, the CPI edged up 0.1%, less than 0.6% in October and matching forecasts.

The core CPI rose 3.5% on the year from 3.3% in October but below forecasts of 3.6%.

On the month, core prices stalled.

$GBINTR -B.o.E Cuts RatesECONOMICS:GBINTR

(November/2024)

source: Bank of England

-The Bank of England lowered its key interest rate by 25 bps to 4.75%, in line with expectations, following a hold in September and a quarter-point cut in August.

The U.S Fed ECONOMICS:USINTR is also expected to cut rates by 25bps today, following a larger 50bps reduction in September.

Traders are keen for signals on future policy, particularly after Trump’s re-election.

GBPAUD -UK will continue its economic growth?!The GBPAUD currency pair is above the EMA200 and EMA50 in the 4H timeframe and is moving in its upward channel. In case of upward correction, we can see the supply zone and sell within that zone with appropriate risk reward.

The International Monetary Fund (IMF) has forecast that Asia’s economy will grow by 4.6% in 2024 and by 4.4% in 2025. Downward price pressures from China could impact countries with similar export structures and lead to trade tensions.

The UK Debt Management Office (DMO) plans to auction £59.2 billion in conventional long-term government bonds in the fiscal year 2024-2025. According to the DMO, the net issuance of government bonds for this fiscal year is projected to reach £296.9 billion.

Meanwhile, the Office for Budget Responsibility (OBR) has indicated that the previous government did not provide all necessary information, and if it had, their spring budget forecast would have been significantly different.

OBR forecasts suggest that the consumer price index (CPI) will reach 2.6% in 2025 (compared to the 1.5% forecast in March), 2.3% in 2026 (March forecast 1.6%), 2.1% in 2027 (March forecast 1.9%), 2.1% in 2028 (March forecast 2.0%), and 2.0% in 2029.

The forecasts also project GDP growth of 2.0% in 2025 (March forecast 1.9%), 1.8% in 2026 (March forecast 2.0%), 1.5% in 2027 (March forecast 1.8%), 1.5% in 2028 (March forecast 1.7%), and 1.6% in 2029.

Reeves, the UK Chancellor, stated that there will be more plans aimed at boosting economic growth. Yesterday, the UK sold £2.25 billion in bonds maturing in 2053, with a bid-to-cover ratio (B/C) of 3.15, up from the previous 3.08. The average yield on these bonds was 4.831%, higher than the previous yield of 4.735%.

GBPUSD - UK is on the verge of an important economic decisioThe GBPUSD currency pair is located between EMA200 and EMA50 in the 4H timeframe and is moving in its medium-term bullish channel. In case of correction due to the release of today's economic data, we can see demand zone and buy within zone with appropriate risk reward. If the upward trend continues, this currency pair can be sold within the specified supply zones

The UK budget is set to be announced today, Wednesday, October 30, 2024. Analysts at Commerzbank predict that if the budget combines austerity measures with long-term investment optimism, it could positively impact the pound and bolster the UK’s long-term growth potential.

The government faces the challenge of stimulating investment to address years of underfunding in the public sector. The difficulty lies in the fact that the UK has been spending beyond its income in recent years, which has complicated its financial situation.

Meanwhile, prices in UK stores have fallen at their fastest rate in over three years. However, the budget announcement by Finance Minister Rachel Reeves could help inflation rebound. The annual store price index has decreased to 0.8%, marking the weakest level since August 2021. Food prices have risen by 1.9%, and clothing prices have also increased for the first time since January. Data shows that consumer inflation fell to 1.9% in September.

On the other hand, in the U.S., Professor Jeremy Siegel from the Wharton School believes the Federal Reserve may choose to hold rates steady next week if the October non-farm payroll (NFP) report proves very strong. Siegel notes that if the labor market report is robust, many FOMC members may conclude that it’s time to pause. He also predicts that the rate-cutting cycle will include three to four rate reductions, but long-term rates are likely to remain high. In August, Siegel advocated for an emergency 75 basis-point rate cut by the Fed.

$GBIRYY -U.K CPI (September/2024)ECONOMICS:GBIRYY 1.7%

source: Office for National Statistics

-Annual inflation rate in the UK fell to 1.7% in September 2024, the lowest since April 2021, compared to 2.2% in each of the previous two months and forecasts of 1.9%.

The largest downward contribution came from transport (-2.2% vs 1.3%), namely air fares and motor fuels.

Fares usually reduce in price between August and September, but this year this was the fifth largest fall since monthly data began in 2001.

Also, the average price of petrol fell to 136.8 pence per litre compared to 153.6 pence per litre in September 2023.

In addition, prices continued to fall for housing and utilities (-1.7% vs -1.6%) and furniture and household equipment (-1% vs -1.3%) and cost rose less for recreation and culture (3.8% vs 4%) and restaurants and hotels (4.1% vs 4.3%).

Meanwhile, services inflation slowed to 4.9%, the lowest since May 2022, from 5.6% in August. On the other hand, the largest offsetting upward contribution came from food and non-alcoholic beverages (1.9% vs 1.3%).

If Sep CPI slows, GBPUSD could fall further

The UK's September Claimant Count Change rose to 27.9K, surpassing the market expectation of 20.2K. The UK unemployment rate in August dropped to 4.0%, the lowest level since last April. Attention now turns to the UK's September CPI results, with the market expecting a decrease to 1.9% from the previous 2.2%. If the CPI slows down, it could lead to increased expectations of further rate cuts by the BoE, putting pressure on the pound.

GBPUSD showed sluggish consolidation between 1.3030-1.3100 for eight consecutive trading days. The price briefly tested the support at 1.3050, awaiting further price triggers for a rebound. If GBPUSD fails to hold the support at 1.3050, the price may fall further to 1.2960. Conversely, if GBPUSD breaches both EMAs and the resistance at 1.3250, the price could gain upward momentum to 1.3435.

GBP Ready to React to UK Inflation Dip? UK inflation is forecast to dip below the key 2.0% threshold this week, according to economists monitoring the country’s inflation.

For the exact date and time of these major economic events, import the BlackBull Markets Economic Calendar to receive alerts directly in your email inbox.

Morgan Stanley analysts anticipate a larger-than-expected decline, driven by falling airfares and hotel prices—key components of services inflation. This metric is under close scrutiny by the Bank of England ahead of its next rate decision on November 7.

GBP/USD is approaching a potential critical support level at the September low of 1.3000, a price point that could test the series of lower highs established since April. This area also served as resistance back in July.

On the upside, the next resistance is eyed at 1.3250—a level where we saw the pair drop off a cliff at the beginning of October and faced resistance in august.

GBPJPY H4 - Short Signal GBPJPY H4

For those that watched the market analysis and live charting video, you would have seen us discuss GBPJPY and the 195 psychological price/sell zone. We have since seen this zone tested and subsequently rejected. How much mileage this setup has... I don't know, but if we can break 194.500, we should see a send lower.

A break and candle close around or below 194.500 is important, breaking this H4 and H1 consolidation, EUR and LON session could certainly be enough to drive this setup where is needs to go.