Diversified Gas & Oil - Longterm Hold - ISA Investment Possibly?Industry Sector - Energy, not exploration (so plus point).

Rough Technical - Presently support 96p and resistance around 110 - 120p, though the stock ranks low for general momentum and quality. Present Presently 103p at 20200116. Price peaked at 125p in Jul 18 and 19. I am thinking of entry between 90-100p. Jan 2020 it is trading on future earnings of 8 thimes, which is average for the industry, though the sales growth has been phenomenal, so this could be a cheap share if the sales growth continues.

History - Came to market in 20170203 at around 55p, gas and oil producer. The Company is engaged in conventional natural gas and crude oil production in the Appalachian Basin of the United States. The Company owns and operates over 7,500 conventional natural gas and crude oil wells in Pennsylvania, West Virginia and Ohio. The Company's daily production is approximately 60,000 barrels of oil equivalent per day, which consists of approximately 26,000 million cubic feet (mcf) per day of natural gas and 475 barrels of oil per day. The Company operates over 3,000 wells in Ohio on approximately 164,000 leased acres in multiple counties along the I-75 corridor. The Company operates approximately 235 conventional wells in the West Virginia state and holds over 6,500 acres of leasehold. The Company operates over 4,000 wells and approximately 863,000 leasehold acres, in Pennsylvania, over multiple counties.

Accounts trade in dollars - so currency risk, as I am based in UK

Income - First dividend was at 5%, next dividend is forecast to be 9%. Div cover is over 7 times. Next Ex-Div date is 20200305 at 3.5 USX (2.5p UK) - though early to estimate, looks like 2 dividends a year March and September, though last year was 3 dividends.

Share liquidity - Heavily buying back shares from the market, directors have shares at around £1M at around 107p, In April 2019, Diversified Gas & Oil announced a maiden share buyback scheme of up to 54.3m shares representing some 7.8% of the company’s outstanding share cap. The move is essentially a call on the relative merits of buying back stock versus using excess cash after dividends for further acquisitions.

DGOG suffered a "bear attack" in Jan 2018 and Directors bought to support. 3 month volume is over 700k, so passed my personal threshold of 120k. 49% of shares are held by investors with less than 5% holdings (this is good for liquidity and price discovery).

Cashflow - Really only 2018 to see, sales income $201M, after admin etc.. $87.7M, Negative CF of -$767M (acquisitions) (this was funded from issuing stock of $426M and debt of £304M, plus retained cash). Overall retained cashflow was neg $13M, was Poss $24.9M year before. So early for this company which has been around 6 years.

Profit / Loss - Again only 2018 to view due to age of company. Revenue $290M, GP $140M, Op Profit $287M, Net ProfitBT $201M. Diluted EPS is 22.4p

BS - Nothing too awkward net assets are $749M. Tough it flags on my bankruptcy checker at cautious.

Proposed Listing upgrade - In September, the AIM-listed firm announced plans to move from the small caps to the premium segment of London’s main market after the publication of its full-year results for this year, to be released during the first quarter of 2020.

As part of the preparations for the main market, the company has completed a tender process to sign-up with a ‘big four’ accounting and auditing firms, for the fiscal year to end 31 December 2020. If it moves to the main market, then ETF's will be buying the share eventually (though AIM ETF's (which are smaller) will be selling.

The main Risk - Shale Gas - DGOG is heavily into the "dirty energy", not the cheapest to extract and is dependent on gas prices. For shale oil (not gas) the break even point is supposed to be somewhere around $40 per barrel, though it has been reported that that price is for the best sites, the horizontal sites are around $60 per barrel, with some rumoured to be $90 per barrel. This basically means that some shale oil sites are left idle when the oil price drops. I assume this will be the case for shale gas if gas prices fall low enough, at the time of writing (Jan 2020) the present gas price is $21.00, basically the lowest gas has been since 2016, 2012, 2009, 2002. So presumable shale gas producers must be running on tight margins. So this is the main risk.

I n the UK an ISA is like a mix between the US a 401K and IRA - but with softer tax rules.

I do not have a position as yet, but I am considering it - so please add comments if you like.

UK

Whitbread - Premier level to get inn? (Sorry!)Buy Whitbread (WTB.L)

Whitbread PLC is a United Kingdom-based company, which owns and operates hotels and restaurants. The Company is organized into a single business segment, Premier Inn. Premier Inn provides services in relation to accommodation and food both in the United Kingdom and internationally.

Market Cap: £6.38Billion

Whitbread moved sharply higher on the result of the election before Christmas as the price gapped higher. The shares have corrected lower in recent days to close the gap at 4654p and fresh buyers emerged. The shares are now breaking higher from a flag/pennant pattern on the daily chart, which suggests a continuation higher will be seen in the short term. The formation has a measured move target at 5940p, which is roughly 24% above the current price.

Stop: 4550p

Target 1: 5100p

Target 2: 5940p

Target 3: 6680p

Travis Perkins - Supplying profits and building accounts?Buy Travis Perkins (TPK.L)

Travis Perkins plc is a United Kingdom-based product supplier to the building, construction and home improvement markets. The Company operates through segments, which include General Merchanting, Plumbing & Heating, Contracts and Consumer.

Market Cap: £4.07Billion

Travis Perkins has completed an inverse head and shoulders bottom pattern on the weekly chart as prices advanced above 1495p. The shares gapped higher on the outcome of the general election in the UK, rising sharply towards 1841p. The shares have consolidated in recent weeks to close the gap created at 1544.5p and we have now seen a break higher from a wedge pattern. This suggests there will be a continuation higher in price over the coming days and weeks.

Stop: 1495p

Target 1: 1830p

Target 2: 2000p

Target 3: 2330p

Weak UK data, EUR/JPY sales and market sentimentAs we announced, this week is extremely full of various kinds of macroeconomic statistics. As yesterday's UK data showed, one should prepare for surprises and most likely with a “-” sign.

Data on GDP (-0.3% with a forecast of 0%) and industrial production in the UK (-1.2% with a forecast of 0%) justified the worst fears of experts.

The only positive point of yesterday's statistics on Britain was the data on the trade balance (and even then rather conditionally). The deficit was expected at -11.800 billion pounds, but in fact, it was at around 5.256 billion pounds.

In connection with such data, the support test of 1.2970 was more than logical. Nevertheless, the inability of the bears against such a fundamental background to take the level is symptomatic in itself. We refer to our recommendation to buy the pound, which so far has not lost its relevance. And the barrier between bulls and bears loomed even more clearly.

So while the pound is paired with the dollar above 1.2960-1.29970, its purchases, even against the backdrop of weak macroeconomic data, remain relevant. But if the pair goes lower, and against the backdrop of another portion of weak data (inflation statistics for the UK will be published on Wednesday and retail sales data on Friday), this will clearly indicate that the initiative is in the hands of bears.

Otherwise, the markets continue to monitor what is happening in Iran, await the signing of the first phase of agreements between the US and China and try to think exclusively positively, which can be seen in the dynamics of gold, the Japanese yen, and the US stock market. We already habitually maintain a moderate negative, as we try to look a little further than the time horizon of 2-3 days. And therefore, the purchase of safe-haven assets remains relevant to us.

In particular, the pair EUR/JPY entered very interesting places for sales. Also, intraday oil purchases from current prices look very attractive. Of course, with small stops, since the markets are now set to sell, but at the same time, potential profits definitely outweigh the number of risks expended.

What could trigger a rally in safe haven assets? At least reporting season in the USA. Weak financial results (especially the dynamics of profits) of companies in the overshot market can lead to a massive exodus from risky investments in gold and the Japanese yen.

GBPCHF Long IdeaHi everyone I had an idea on going long on GBPCHF, here is my analysis:

Its obviously not news if I tell you that on Thursday the UK Parliamentary Elections will take place, which predicts a Tories majority, which is seen as bullish for the market.

For CHF, CHF is known to be a ''safe haven'' in Europe, so it would make sens shorting it against the GBP.

I am open to any opinions in the comments below, we are all here to help each other out and learn!

EURJPY Short IdeaHi everyone, here is a small idea I have: EURJPY Short.

JPY in my opinion is getting a little bit stronger considering the tensions that are a little bit rising with the US-China Trade War. Also, JPY has released some good numbers these past couple of days, like GDP, etc. so in my opinion JPY is Strong.

EUR in my opinion is a little bit neutral, I don't see anything good or very bad for them, so I would say EUR is neutral.

I am open to other opinions, so please comment if you have any other opinions or ideas on this trade.

Once 4p broken target 6.5p slice LT - 10p+ SWING TRADEQuite a similar setup to EML which I'm heavily invested as well.

placing was done at 3p so cashed up with several assets to head into 2020 with 2 of them being producing assets.

Very bullish in this company with BoD having skin-in-the-game Ex-Tullow Oil people.

Aiming for 6.5p for a slice but long term this company is set to embark in becoming a mid-cap company.

watch this space!!!

Accumulating at lows!!

Morrisons Supermarket Share Price To Increase 3%The recent gap down will be filled in the next few days, giving the opportunity for investors to take a long position for some quick profits on this UK supermarket brand.

Hypothetical UK Election Trade ...Election results come in...

(for which party will be in government). which results in a rise or fall in GBP

due to it's significance (in this instance it was seen as a good result and GBP rose).

-We know there is going to be volatility, so we can profit regardless of whether the

price goes up or down as when the price reaches certain points (A if price rises and

B if price falls) it will trigger a trade which will cancel the other one

-Can be executed on many pairs/ stocks if large results are due.

-Eliminates bias with OCO order.

--(DISCLAIMER) Set TP and Trigger point on major support resistance,

you don't want to trigger then go the opposite direction!!

Straddle Trades can be good for profiting regardless on where the price goes (in times of high volatility) and you could have made some good profits here, this could be replicated for trades such as EUR/GBP, Non farm payroll, US Elections etc... and are also known as OCO (One Cancels the Other) orders

BT Group - Filled the gapBuy BT Group (BT.A.L)

BT Group plc is a communications services company. The Company is engaged in selling fixed-voice services, broadband, mobile and television products and services, as well as various communications services ranging from phone and broadband to managed networked information technology (IT) solutions and cyber security protection.

Market Cap: £18.96Billion

BT has broken out of a channel pattern on the daily chart. The shares recieved a boost following the Conservative win in the General Election and the shares gapped higher. We have now seen that gap get filled, which should attract fresh buying interest.

Stop: 181.6p

Target 1: 212p

Target 2: 230p

Target 3: 265p

Ibstock - Building momentum brick by brick.Buy Ibstock (IBST.L)

Ibstock plc is a United Kingdom-based company, which is engaged in manufacturing of clay bricks and concrete products. The Company's segments are the UK and the US. The Company's principal products include clay bricks, brick components, concrete stone masonry substitutes, concrete fencing, pre-stressed concrete products and concrete rail products.

Market Cap: £1.01Billion

Ibstock shares are trading in a short-term uptrend, which topped out around 265p. The break of resistance at 239p was met with fresh buying interest before profit taking set in. The corrective move lower in recent days has seen the shares retest the breakout level at 239p. A bullish flag/pennant pattern has also formed, which suggests higher price will be seen in the short term. The first target is the resistance at 266p, with the ultimate target up at 305p.

Stop: 235p

Target 1: 266p

Target 2: 275p

Target 3: 305p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

FOOTSIE 100 POTENTIAL SELL!GOOD AFTERNOON TRADERS, ITS GOOD TO BE BACK! HERE WE HAVE A POTENTIAL SELLING OPPORTUNITY ON THE UK STOCKS. THE CURRENT DAILY PRICE ACTION IS A BEARISH ENGULFING AND IF FINISHES THIS WAY WILL CONFIRM ENTRY BUT I'D STILL LIKE MORE FROM CANDLES FOR A STRONGER CONFIRMATION. IT HAS MULTIPLE CONFLUENCES FROM A TECHNICAL STANDPOINT TO BACK UP THE SELL AND ACCOMPANIED WITH A GREAT RR. FROM A FUNDAMENTAL STANDPOINT UK STOCKS HAVE BEEN RALLYING AND HAS HAD A LOT OF BULLISH MOMENTUM PARTICULARLY IN THIS STOCK. SUCH AN IMPULSIVE MOVE UPWARDS IMPLIES A LOT OF VOLUME AND BULLISH STRENGTH SO TAKE IT EASY WITH THIS ONE AND USE UNDER 1% RISK AS COULD STILL CONTINUE TO RISE.

Europe is “disappointing”, we trade with oscillatorsMonday turned out to be a relatively calm day for the foreign exchange market. The euro and the pound could not reach Friday's peaks, due to the weak macroeconomic statistics.

For example, in Germany, the PMI in the manufacturing sector fell to its lowest level in the last couple of months and amounted to 43.4. This confirms that the largest eurozone economy is experiencing serious problems. Recall, any index value below 50 means that activity in the manufacturing sector is declining.

Germany is not an exception. Weak data came from both France and the UK. According to PMI, manufacturing activity in Britain is at its lowest level over the last 7 years. The PMI in the manufacturing sector in the UK came out at 47.4 pips (analysts expected 49.2).

In general, the lack of growth of the euro and the pound against the background of such data is quite logical.

On the other hand, this is not a reason to refuse to buy EURUSD and GBPUSD. All we need is statistics on industrial production in the United States come out weak. Well, for the pound it would be nice if the data on the labour market did not disappoint.

In general, today we are not expecting any revelations and strong directional movements. In our opinion, the best trading tactics for today is oscillatory trading. So we trade with RSI or Stochastic or you can choose another one.

Once again, we draw attention on extremely attractive positions for sales of the Russian ruble.

ridethepig | UK Elections [LIVE COVERAGE] UK Election Chartbook

With longs already getting nervous ahead of the exit polls, let's get started by digging deeper on the political side first...For all those tracking and trading the main event this evening we have only two realistic scenarios in play which makes capital flows easier to track:

=> A Tory majority which will deliver the Johnson/May deal with a hard brexit via Irish sea border and less activity with the EU (70% odds).

=> A Labour minority government with a helping hand from Lib Dems et al, here we can expect a second referendum in 2020 with a choice between a soft exit or remain (28% odds).

Any further gridlock in Parliament is currently sitting at <2% and does not remain in play. This would dramatically short-circuit GBP as markets will be caught out of position.

UK markets pricing a Conservative majority as a " positive resolution " to Brexit is complacent and allows us an opportunity to capture those out of position and mis-pricing UK market access beyond 2020. To date we have traded a tremendous amount of conjecture around the Brexit chapter, yet many are quickly to forget we are yet to trade the "fact" leg.

This next chart indicates the sense of division in Britain, a fragmented society which also highlights the stupidity to have such a referendum on a complex topic. The UK is not like Swiss for example having referendum after referendum, rather it is a representative democracy. Yet sadly we are seeing a corruption of democracy via media manipulation swerving public opinion.

For example, those who remember Cameron's premiership will remember the government was at the time asking for public to remain while they were pursuing policies of austerity (decreasing consumer confidence) and served to have more damage than good. The silent revolution or protest vote (all cleverly calculated) unlocked Pandoras box with a People vs Establishment narrative:

In any case, a ruthless Downing Street (with the help of Cambridge Analytica and co) have a free pass to do what they want and say what they want with scandal after scandal yet the masses remain on mute simply wanting to " get brexit done " ... bitterness in the public will last for a very long time and history will mark the collapse of the Crown, a fall that will stretch decades turning little England into a house of economic bondage.

A quick review of the UK Election Opinion Polls :

Survation: CON: 45% (+3) LAB: 31% (-2) LDEM: 11 (-) BREX: 4% (+1) GRN: 2% (-2), 05 - 07 Dec Chgs. w/ 30 Nov

BMG: CON: 41% (+2) LAB: 32% (-1) LDEM: 14% (+1) GRN: 4% (-1) BREX: 4% (-), 04 - 06 Dec Chgs. w/ 29 Nov

YouGov: CON: 43% (+1) LAB: 33% (-) LDEM: 13% (+1) BREX: 3% (1) GRN: 3% (-1), 05 - 06 Dec Chgs. w/ 03 Dec

Deltapoll: CON: 44% (-1) LAB: 33% (+1) LDEM: 11% (-4) BREX: 3% (-) Chgs. w/ 30 Nov

Panelbase (Scotland): SNP: 39% (-1) CON: 29% (+1) LAB: 21% (+1) LDEM: 10% (-1), 03 - 06 Dec Chgs. w/ 22 Nov

Exit polls will start at 10pm (GMT) via SKY/ITV/BBC. Usually the exit poll is very accurate so it is highly likely we will be able to clear the knee jerk flows quickly unless there is a major surprise. We can draw a tree below to showcase the forward walk with Brexit:

- UK Elections (we are here) => Conservative majority => No transition extension (most likely scenario)

or,

- UK Elections (we are here) => Hung parliament => Second referendum (least likely scenario)

On the macro side, I have widely covered segments on growth, inflation and policies in the Telegram and in previous ideas in the archives (see attached). A major round of fiscal easing is coming, this will artificially keep growth supported in the short-term however the output gap will not close. Inflation will once again tick above target, however not via a robust consumer as many predict but rather via supply side constraints and uncertainty. The BOE will remain sidelined till 2H20 and provide a decent profit taking opportunity for our macro short positions.

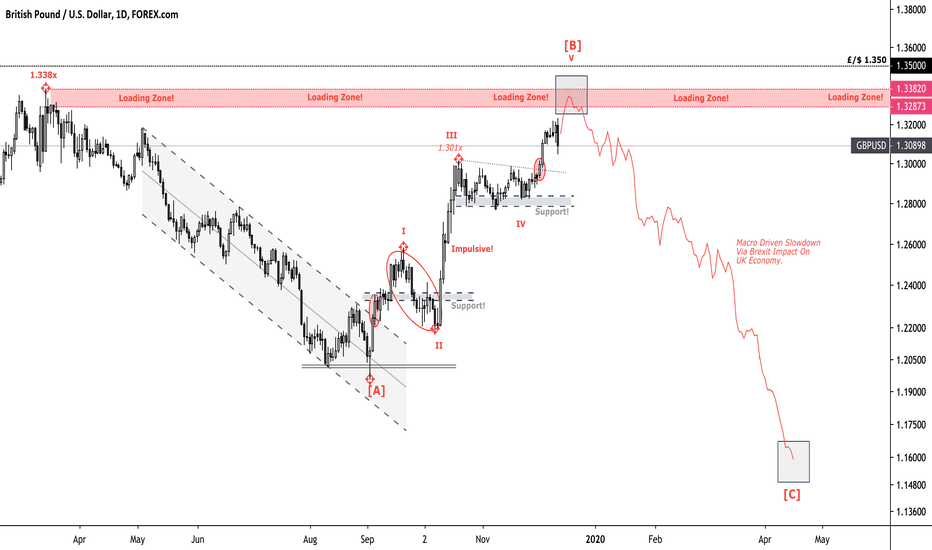

For the technical flows we are tracking the infamous 1.35xx psychological resistance. This is a great level to track for macro positions in 2020 on the sell side. Here I am tracking for a leg from 1.35xx => 1.15xx via Tory majority and the Brexit fact impact leg. A quick recap of the same levels we traded here live on tradingview earlier in the year. We are sitting at the same levels as before which we were loading into and traded a +/- 2000 tick swing !!!

Here I am becoming increasingly bearish on UK outlooks with either scenario. In my books Johnson will win by a country mile and we will immediately be able to trade the final flush in Pound (stage two of our rumour/fact impact legs). Populism is spelling danger across the global economy and shows no signs of abating.

...Best of luck to all those on the sell side and looking to increase exposure across portfolios. As usual thanks for keeping your support coming with likes and comments !!!

GBPAUD TRADING OPINION AND PLANPotential space for lower in my opinion and as the chart we can see price breaking lower the ascending trendline and support 1.93076 should indicate bearish in power. Boris Johnson and his friends are amending the Brexit bill to NOT allow further extensions. This means that, once the government has set a deadline, the U.K. must stick to it with or without a trade deal with the EU. On the other hand the so-called Phase One trade deal between Washington and Beijing has been “absolutely completed,” a top White House adviser said on Monday, adding that U.S. exports to China will double under the agreement which provided some positive vibe in comdolls sentiment which I think will help Aussie on this trade at the moment.

Brexit FUD is over. Labour party worse result since 1935!I am so proud of the UK. In the 1930s they rejected the growing populism in the world, and in 2019 they did the same.

All the propaganda, all the demonizing, and the forces of anti-freedom still lost, but a huge margin!

And if europe falls, we shall go on to the end. We shall fight in France, we shall fight on the seas and oceans, we shall fight with growing confidence and growing strength in the air, we shall defend our island, whatever the cost may be. We shall fight on the beaches, we shall fight on the landing grounds, we shall fight in the fields and in the streets, we shall fight in the hills; we shall never surrender.

The short sellers got scammed hard. "Oh no the GB economy will collapse if they leave". Those shorts have started to burn.

Their will be suckers rally, which I intend to join.

But I see the pound going up in general (different pairs may have different results at least the GBP against the EURO will I am nearly certain, continue to skyrocket).

Bears are getting their faces ripped off...

The perfect move would look like this:

We need a desperate attempt by GBP bears to get filled at a high RR in a high probability area.

What is good for us, on tradingview, Boris Johnson said he wanted the UK to be a world leader in tech innovations and finance.

They totally understand and support what we do, and want more of it.

I think the UK is going to be pretty safe from extremism as it has always been.

I wonder what deal they're going to get and how things will be for Ireland, and what will happen in Scotland, for some reason alot want to stay in the EU.

The experiment is about to fall apart, they should at least wait a few years before making emotional decisions...

There are so many medium sized and small countries in europe but a huge block like what it become is too much.

Different cultures languages etc... Did they think they could create something like the United States?

Germany Austria and Hungary could merge, maybe a little more, and being bigger like this would make them more relevant, Belgium the Netherlands and Luxembourg could merge to not be as small, Denmark Sweden Norway maybe Finland, Estonia Latvia Lithuania could merge.

I think it would be beneficial to them to make unions of 3 to 5 countries, rather than have all these tiny places, who knows or cares about Slovenia seriously?

Instead of 35 irrelevant countries in Europe, it could be a place with a few large federations or unions.

Right now to me Europe is: UK - Portugal - Spain - France - Italy - Germany - Poland - Ukraine - Romania - Greece - (Sweden) - (Turkey) - (Maghreb) - (Russia) - The Rest

In () the places that are peripherical to "main" europe.

Europe maybe made sense right after WW2, but this does not make as much sense anymore (also, we built a huge empire around germany to keep their conquest ambitions tamed?).

Europe is too ambitious and makes little sense. It's so big that it doesn't work and no one outside of it takes it really seriously. The place could have around a dozen merged states instead of 35+ and they would all have a certain importance, it would make european countries more relevant and recognizable, China would speak to the Polish Lithuanian commonwealth and take them seriously, but you think they care about Latvia and Belarus? Does anyone in the USA Or SEA have any clue Belarus even exists?

Poland + Lithuania + Latvia + Estonia + Belarus + Ukraine have a combined population of 100 million and a GDP of 900 billion, close to 1 trillion, which could bring them to the table with the big boys. They would actually be in the top 20 and a force to be reckoned with not some collection of "third world dumps".

But by themselves even the biggest ones - Poland and Ukraine - bring smile to people, no one takes them seriously.

Poland lmao, it's even a joke in west europe to call someone Polish.

Europe has to fall for european countries to grow together and bloom? Because why consider some alliances if you can just join europe.

Would also be nice to be able to trade some relevant (and uncorrelated) currencies because mini currencies like the Polish Zloty let me tell you they suck!

And low liquidity, high spreads... The currency doesn't even move by itself according to its own country economy...

We live in an open world, earth is much bigger than europe, so tiny countries do not make much sense anymore. This doesn't mean they should go for the complete extreme with an union of 25 countries that speak different languages...

As usual, people are only able to think in extremes, and it failed. AS IT ALWAYS DOES. Good riddance. Long live the queen.