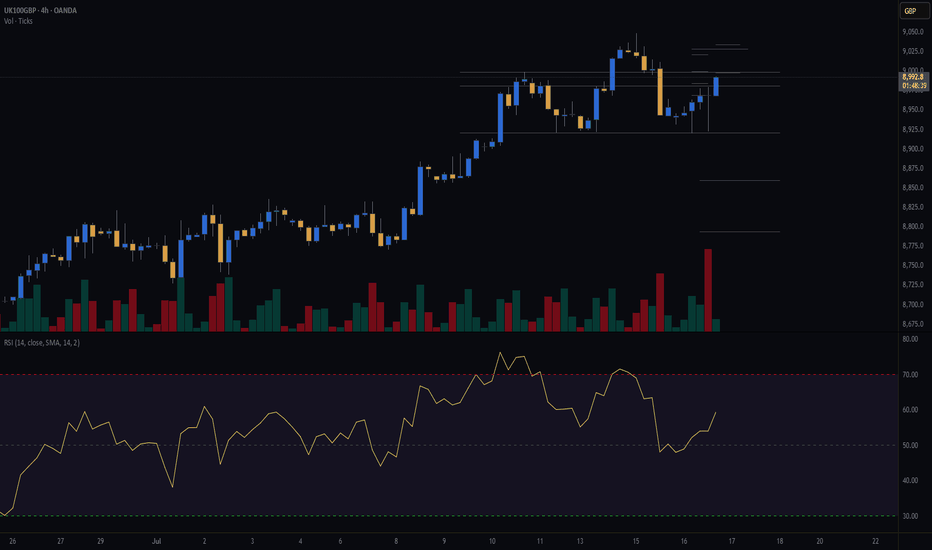

Uk100_sell

UK100 - Short Term Sell Idea Update!!!Hi Traders, on March 20th I shared this idea "UK100 - Expecting The Price To Drop Lower Further"

I expected the price to drop lower further. You can read the full post using the link above.

Price dropped lower further as expected!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

UK100GB ShortThis index is forming a rising flag, which might be an indication of a potential bearish momentum.

Also, according to the clients' sentiment, the majority of traders are buying the index - 72%, and I anticipate that the price might move in their favor.

My entry point is 7400, my stop loss at 7480, and my TP at 7230, as my R: R for this trade is 1:2.

Note, risk only 1% of your account.

UK300GBPThere is a head and shoulder pattern likely to form. I am waiting for the price to break out at the support zone, then retest it so that we can have a go ahead to place our position.

I anticipate that the price might continue with the bearish momentum.

My intended entry point is 7600, SL at 7630 and TP at 7500, thus R:R is 1:3.

UK100 to stall at previous resistance?UK100 - 24h expiry

Previous support located at 7550.

Previous resistance located at 7600.

Trend line resistance is located at 7630.

A higher correction is expected.

Risk/Reward would be poor to call a sell from current levels.

We look to Sell at 7630 (stop at 7660)

Our profit targets will be 7530 and 7525

Resistance: 7600 / 7630 / 7650

Support: 7550 / 7530 / 7500

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

UK100 to start a selloff?UK100 - 24h expiry -

We are trading at overbought extremes.

Short term MACD has turned negative.

A break of 7800 is needed to confirm follow through negative momentum.

Short term bias has turned negative.

We look for losses to be extended today.

We look to Sell a break of 7799 (stop at 7838)

Our profit targets will be 7701 and 7681

Resistance: 7835 / 7860 / 7880

Support: 7809 / 7780 / 7750

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

UK100 SHORT IDEAPrice has rejected main resistance level, 4H candle just closed as bearish engulfing so I'm expecting to price comes down to the previous low level since the main pattern on Daily and weekly are channel UP I believe it will touched there and bounced back up.

UK100 SHORT INCOMING WEEKLYHi there,

UK100 has reached the BIG RESISTANCE LEVEL.

Every time UK100 reached that level, it has ALWAYS got sold down.

It may RETEST the resistance level for a 3RD time then SHORT.

The MARKET is currently at A DOUBLE TOP.

TIME FRAMEE = WEEKLY

kind regards

Looking for a nice short on UK100Looking to see if we can get a continuation from the previous move on 04/20.

I'm already short @ 6931.95 SL @ 6971.81 and TP @ 6591.71

Will see how it plays out.

ridethepig | Positional Play in UK Equities 📌 UK Equities remain vulnerable with Brexit & Covid in play.

(Similar representation for those tracking the moves in S&P, NQ, DJIA and etc...)

(1) Firstly challenge the view that Rishi's stimulus produces an immediate effect and anything more than a spring mattress; the furlough scheme is incredibly expensive and weighing heavy despite being totally justified.

(2) Recognise the idea that we are in a dead-cat-bounce in Equities broadly and that the UK is particularly exposed to these corrections which is key in positional swings! With this said, I struggle to find positives in the UK and in doing so prevents exposure on the bid. In order to bring interest in UK Equities I would need to see the current lows swept and in the event of a no-deal Brexit then we can see as low as 3579.x.

(3) Keep to the strategy - avoid getting soft hands and closing out too early (out of fear of missing the rally) and try rather to operate with a sense of calm and tranquility.

(4) Aim for total destruction of UK assets in the coming year, sadly the individual mobility of almost every sector will be affected from the political suicide.

(5) Get used to observing the complacency and "sell on rallies"; do not let an emotional retail approach be decisive.

(6) Remember what is important for Positional swings ... we are not attacking, or even defending, but remaining nimble with the capital outflows, rather like meandering water.

Thanks as usual for keeping the feedback coming 👍 or 👎

UK100 - If you like big money moves UK100 delivers?When UK100 moves, it moves Big - Big Losses - Big Wins. Is your psychology right for this pair? Well it time to 'mine for diamonds' (Fib ABCD patterns). We hit a deposit. So let's fill our buckets and get out of here!! Let's see what pattern forms at this area of interest 'C'. Then, we will see if it tunnels over to 'D'. Remember - You only need a small chunk out of UK100, don't stay in too long til it starts to bite back.

Lets try something new...UK100 Short trade setupNormally I only trade Forex pairs and it has been a while since I last traded any indexes. But I was strolling through markets and saw this opportunity so I analyzed quick and opened a short trade @7216.

My quick analysis

The Market has reversed at the end of July and stayed in a Down Trend ever since. Now we can clearly see Resistance @7305 so that gives us a nice opportunity to go short and aim for a Lower Low. In this setup I used the Fibonacci Retracement tool to look for a TP level and found one @6992 (fib 0.618). The Market is already down -0.47% while writing this text so I don't know if there will be a good window of opportunity for long. My StopLoss is set @7336 I don't know what to expect of the duration for this trade but I have patience and confidence.

Lets wait and see what happens!