Bullish momentum to extend?UK100 is reacting off the pivot which has been identified as a pullback support and could rise to the pullback resistance.

Pivot: 8,462.50

1st Support: 8,326.30

1st Resistance: 8,722.80

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Uk100long

Bullish continuation?UK100 has reacted off the pivot and could potentially rise to the 1st resistance.

Pivot: 8,462.50

2st Support: 8,326.30

1st Resistance: 8,626.49

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bullish rise?UK100 has bounced off the pivot which acts as a pullback support and could rise to the 1st resistance which aligns with the 78.6% Fibonacci retracement.

Pivot: 7,969.75

1st Support: 7,696.99

1st Resistance: 8,465.81

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

UK100 - ANOTHER ROUND OF ENTRYTeam, last week and this week we were correct about Trump's plan on tariff,

Market dump and pump

but last night, we expect the pull back from profit taking

The current price is 7864 is considered a buy with support

Remember to set your stop loss

Target at 7915-25 - 30% volume reduce

Target at 7945-50 - another 30% volume reduction

and above that is 40%

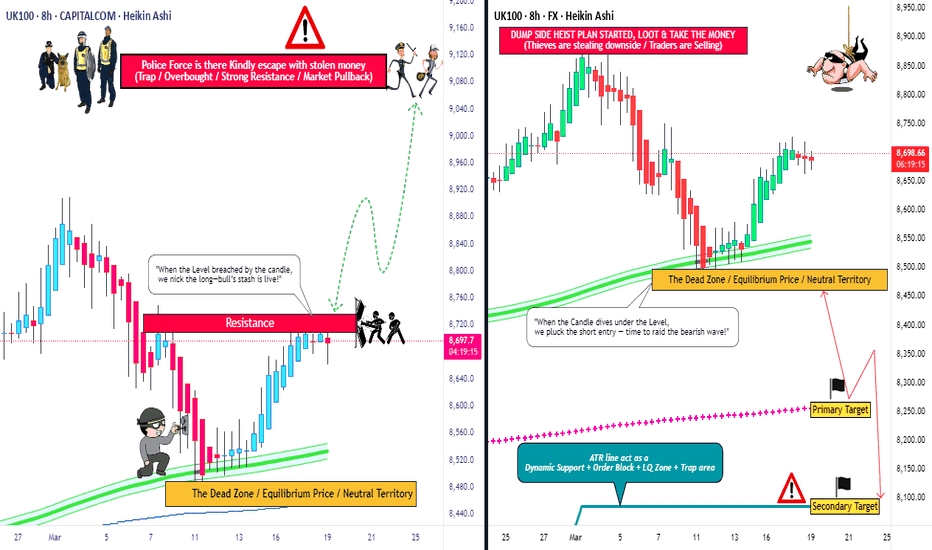

UK100 "FTSE 100 INDEX CASH" Heist Plan (Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the UK100 "FTSE 100 INDEX CASH" market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸"Take profit and treat yourself, traders. You deserve it!"💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

🏁Buy entry above 8760

🏁Sell Entry below 8450

📌However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

🚩Thief SL placed at 8600 (swing Trade Basis) for Bullish Trade

🚩Thief SL placed at 8700 (swing Trade Basis) for Bearish Trade

Using the 4H period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Bullish Robbers : TP 9080 (or) Escape Before the Target

🏴☠️Bearish Robbers : Primary TP - 8250 (&) Secondary TP - 8100 (or) Escape Before the Target

UK100 "FTSE 100 INDEX CASH" Market Heist Plan is currently experiencing a neutral trend,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Bullish bounce?UK100 has bounced off the pivot and could rise to the 1st resistance.

Pivot; 8,460.55

1st Support: 8,314.59

1st Resistance; 8,913.87

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bullish bounce off pullback support?UK100 has bounced off the pivot which is a pullback support and could rise to the 1st resistance which is also a pullback resistance.

Pivot: 8,538.25

1st Support: 8,442.68

1st Resistance: 8,743.14

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

UK100 (FTSE)-Weekly forecast, Technical Analysis & Trading IdeasMidterm forecast:

8380.25 is a major support, while this level is not broken, the Midterm wave will be uptrend.

Technical analysis:

A trough is formed in daily chart at 8611.20 on 02/21/2025, so more gains to resistance(s) 8854.99, 9000.00, 9100.00 and more heights is expected.

Take Profits:

8664.21

8765.00

8854.99

9000.00

9100.00

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

UK100 (FTSE)-Weekly forecast, Technical Analysis & Trading IdeasMidterm forecast:

8380.25 is a major support, while this level is not broken, the Midterm wave will be uptrend.

Technical analysis:

A trough is formed in daily chart at 8006.10 on 12/20/2024, so more gains to resistance(s) 8833.83, 9000.00, 9100.00 and more heights is expected.

Take Profits:

8664.21

8765.00

8833.83

9000.00

9100.00

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

Made in England.. FTSE 100 Triangle BreakoutFinally the long term triangle pattern in blue chip UK stocks has broken - and the weekly chart for the FTSE 100 index is looking very positive.

The breakout weekly candle is a long one with a close right near the highs - showing bulls are well in control of the market.

We can see the triangle break in more granular detail on the daily chart with the break confirmed on Thursday and a strong follow-through move on Friday.

Support is found first at the former all time high (8450-8475) then back at the broken trendline from the triangle pattern.

These support levels define our risk - the price back inside the triangle will inform us the breakout has failed - this time at least.

But if things move as we expect, using the height of the triangle pattern as a price objective from the breakout point, the UK 100 could reach 9,000.

But - as always - that’s just how the team and I are seeing things, what do you think?

Share your ideas with us - OR - send us a request!

Comments welcome :)

cheers!

Jasper

The material provided in this article is for information purposes only and should not be understood as trading or investment advice. Any opinion that may be provided on this page does not constitute a recommendation by Trading Writers and has not been prepared in accordance with the legal requirements designed to promote investment research independence. If you rely on the information on this page, then you do so entirely at your own risk.

UK100 (FTSE)-Weekly forecast, Technical Analysis & Trading IdeasMidterm forecast:

8380.25 is a major support, while this level is not broken, the Midterm wave will be uptrend.

Technical analysis:

The ascending flag taking shape suggests we will soon see another leg higher.

A trough is formed in daily chart at 8006.10 on 12/20/2024, so more gains to resistance(s) 8664.21, 8765.00, 9000.00 and more heights is expected.

Take Profits:

8083.43

8183.03

8242.89

8380.25

8485.05

8664.21

8765.00

9000.00

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

UK100 - shall we enter before the UK MARKET openingTeam, the market is heavily sold off last night

that is the reason why we found an opportunity to enter some long-term position

LONG/BUY UK100 at 8098-8105

adding more at 8076-85

STOP LOSS at 8030 extension to 8015

Target 1 at 8136-45 - please take some partial and bring stop loss to BE

Target 2 at 8165-76

Target 3 at 8193-8215

Bullish bounce?UK100 is falling towards the pivot that aligns with the 61.8% Fibonacci retracement and could bounce to the 1st resistance.

Pivot: 8,191.43

1st Support: 8,140.90

1st Resistance: 8,284.80

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Falling towards overlap support?UK100 is falling towards the pivot and could bounce to the 1st resistance which is a pullback resistance.

Pivot: 8,199.44

1st Support: 8,071.06

1st Resistance: 8,404.02

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

UK100 - WHAT SHOULD WE DOTeam, with the UK100, we killed 2-3 times yesterday.

let be very careful today,

we are looking to enter long UK100 at 7682-86

and would consider adding more 7960-7976 ranges,

STOP LOSS at 7920-26

Our target 1 - 8005-8015

Target 2 at 8036-45

Target 3 at 8076-84

Once it hits our first target, please take some PARTIAL and bring stop loss to BE.

UK100 - TIME TO ENTRYTeam, apologies for late post

We should send out earlier to entry LONG UK at 8030 ranges

however never too late.

Here are some rules and strategy for the UK

entry now at 8030-8040 ranges

add more at 8016-8006

double up at 7960-7976

STOP LOSS BETWEEN 7915-32

Remember to have some room for stop loss, you can reduce the volume.

Target 1 at 8076-86

Target 2 at 8105-8115

Target 3 at 8135-65

Please note: take some partial at 1st target and bring stop loss slowly

UK100 - SHOPPING TIME IS OVERTeam, yesterday we went long UK with target hit

as Today, I expect the downtrend hit toward 8080-65

So please enter slowly with RISK MANAGEMENT

Our target is 8096-8115 - TAKE SOME PARTIAL and bring stop loss to BE.

Target 2 at 8132-46

Target 3 at 8178-96

We play our STOP loss far away at 8035, if it hit stop loss RE-ENTER again. with another 30 points stop loss

UK100 - it has been a whileTeam, with the UK100, we have not been trade since last week

we want to want for the RATE announcement

today 25% basic points is off the market

ENTER long/buy at 8150-55

We will consider add more at 8115-30

We need to move our stop loss far so we can move back once it it hit our first target like 8080-8065

Target 1 at 8180-82 - once it hit our target - take partial and bring stop loss to BE

Target 2 at 8225-40

Target 3 at 8245-65

Remember to enter slowly with RISK management.

UK100 PREPARTION AND TIME TO KILLTeam, yesterday's market was very volatile, but we managed to make some profit and set our stop loss at BE.

Today, we will have our entry at the current market price at 8155-62

We will add more at 8130-35 - WHY? We could see (markets marker) trying to spike down to hit stop loss and then moving back quickly, so we want to catch that.

So our stop loss will be at 8115

Our Target 1 - 8186-88

Target 2 at 8206-12

Target 3 at 8232-46

We are expecting this week or next week; the price should be back toward the 8260-8320 ranges.

NOTE: Once the price hits our first target of 8186-88, bring the stop loss to 8145 or BE. We will be booking 50% profit at this level.

UK100 - lets KILL THE BEAST againTeam, yesterday's market was very volatile, but we managed to make some profit and set our stop loss at BE.

Today, we will have our entry at the current market price at 8155-62

We will add more at 8130-35 - WHY? We could see (markets marker) trying to spike down to hit stop loss and then moving back quickly, so we want to catch that.

So our stop loss will be at 8115

Our Target 1 - 8186-88

Target 2 at 8206-12

Target 3 at 8232-46

We are expecting this week or next week; the price should be back toward the 8260-8320 ranges.

NOTE: Once the price hits our first target of 8186-88, bring the stop loss to 8145 or BE. We will be booking 50% profit at this level.