"UK Oil Spot/ BRENT" Energy Market Heist Plan (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

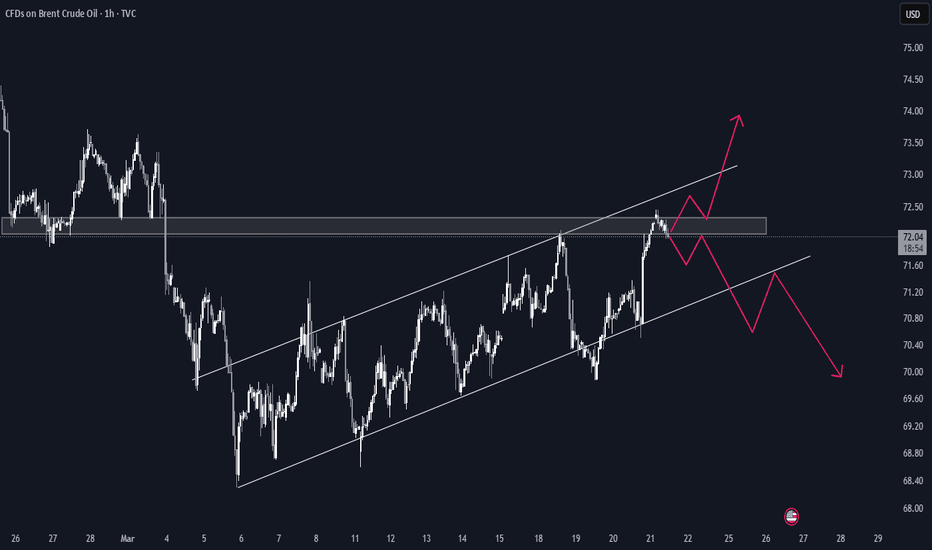

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "UK Oil Spot/ BRENT" Energy Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (68.500) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (64.000) Day/Scalping trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 72.200

💰💵💴💸"UK Oil Spot/ BRENT" Energy Market Heist Plan (Day / Scalping Trade) is currently experiencing a bullishness🐂.., driven by several key factors.☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Ukoilforecast

"UK oil / Brent" Energy Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "UK oil / Brent" Energy Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (65.500) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (61.500) Scalping/Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 70.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸🛢"UK oil / Brent" Energy Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets & Overall Score... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"UK oil / Brent" Energy Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "UK oil / Brent" Energy market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 77.00

Sell Entry below 74.00

However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

-Thief SL placed at 75.30 (swing Trade Basis) for Bullish Trade

-Thief SL placed at 75.70 (swing Trade Basis) for Bearish Trade

Using the 2H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

-Bullish Robbers TP 81.50 (or) Escape Before the Target

-Bearish Robbers TP 71.30 (or) Escape Before the Target

📰🗞️Fundamental, Macro Economics, COT data, Sentimental Outlook:

🛢️"UK oil / Brent" Energy market is currently experiencing a Neutral trend (there is a higher chance for Bearishness)., driven by several key factors.

🔥 Fundamental Analysis

The global oil market is experiencing a slight imbalance, with supply exceeding demand. OPEC has agreed to extend production cuts, which may help stabilize the market. However, US shale oil production is expected to continue growing, potentially putting downward pressure on prices. Global economic growth is expected to slow down, which may reduce demand for oil.

🔥 Macro Economics

The global economy is facing headwinds, including inflation, interest rate hikes, and geopolitical tensions. This may lead to reduced demand for oil and a potential decrease in prices.

🔥 COT Data

Commercial Traders: Net short 55,000 contracts

Non-Commercial Traders: Net long 30,000 contracts

Trend: Commercial traders are increasing their net short positions, indicating a potential bearish trend. Non-commercial traders are decreasing their net long positions, also indicating a potential bearish trend.

🔥 Sentimental Analysis

70% of client accounts are long on UKOIL, indicating a bullish sentiment among traders. However, some analysts predict a potential bearish trend due to supply and demand imbalances.

🔥 Technical Analysis

The short-term trend is bearish, while the long-term trend is neutral. A head and shoulders pattern is forming, which may indicate a potential reversal. The key trading level is at 7685, 20 Day Moving Average level.

🔥 Geopolitical Analysis

Middle East tensions, US-Iran relations, and global trade agreements are affecting the oil market. The conflict in Ukraine and potential sanctions on Russia may disrupt global oil supply flows.

🔥 Inventory and Storage Analysis

US crude oil inventories are at average levels, indicating a balanced market. However, global oil storage levels are high, indicating a surplus of oil.

🔥 Seasonal Analysis

Oil prices tend to be higher during the winter months due to increased demand. The calendar spread is in contango, indicating a surplus of oil.

🔥 News and Events Analysis

The market is awaiting the Federal Reserve's crude oil data, which may shed more clarity on the near-term trend. OPEC meetings and US economic data are also expected to impact the market.

🔥 Quantitative Analysis

Statistical models indicate a high probability of a price decline. Machine learning algorithms predict a potential bearish trend.

🔥 Intermarket Analysis

Oil prices are highly correlated with the US dollar index. There is a divergence between oil prices and the S&P 500, indicating a potential reversal.

🔥 Overall Outlook

The UKOIL market is expected to experience a bearish trend in the short term, driven by supply and demand imbalances, geopolitical tensions, and technical indicators. However, the long-term trend remains neutral, with potential for a reversal. Traders should be cautious and monitor market developments closely.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"BRENT / UK OIL SPOT" Energy Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "BRENT / UK OIL SPOT" Energy market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (74.500) then make your move - Bearish profits await!"

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high or low level should be in retest.

Stop Loss 🛑: Thief SL placed at 78.800 (swing Trade) Using the 4H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many orders you have to take.

Target 🎯: 71.000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

"BRENT / UK OIL SPOT" Energy market is currently experiencing a Neutral trend (there is a higher chance for Bearish)., driven by several key factors.

🟠Corporate Traders:

Fundamental Analysis: Bullish, citing growing demand for oil and supply constraints.

Macro Economics: Bullish, expecting a global economic recovery to drive oil demand.

Sentimental Analysis: Bullish, with 58% of corporate traders holding long positions.

COT Report: Bullish, with corporate traders holding 100,219 long contracts.

🔴Investor Traders:

- Fundamental Analysis: Neutral, citing uncertainty around global oil demand and supply.

- Macro Economics: Neutral, expecting a slow global economic recovery to impact oil demand.

- Sentimental Analysis: Neutral, with 50% of investor traders holding long positions and 50% holding short positions.

- COT Report: Neutral, with investor traders holding 40,109 long contracts and 35,219 short contracts.

🟤Hedge Fund Traders:

- Fundamental Analysis: Bearish, citing rising US oil production and global supply concerns.

- Macro Economics: Bearish, expecting a global economic slowdown to impact oil demand.

- Sentimental Analysis: Bearish, with 60% of hedge fund traders holding short positions.

COT Report: Bearish, with hedge fund traders holding 80,109 short contracts.

🟢Institutional Traders:

- Fundamental Analysis: Bearish, citing rising US oil production and global supply concerns.

- Macro Economics: Bearish, expecting a global economic slowdown to impact oil demand.

- Sentimental Analysis: Bearish, with 62% of institutional traders holding short positions.

COT Report: Bearish, with institutional traders holding 120,000 short contracts.

🟡Overall Outlook:

- Bearish: 55%

- Bullish: 25%

- Neutral: 20%

Based on the comprehensive analysis, the outlook for Brent UKOIL Spot Commodity CFD is bearish, with a target price of around $62-$65 per barrel.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤗

UKOILSPOT "Brent Crude Oil" Energies Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical analysis🔥, here is our master plan to heist the UKOILSPOT "Brent Crude Oil" Energies market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a bull trade at Pullback,

however I advise placing Multiple Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low & high level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest low level.

Goal 🎯: 78.437

80.000

Scalpers, take note : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

Brent / UK CRUDE OIL Energy Market Heist Plan on Bullish Side🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical analysis🔥, here is our master plan to heist the Brent / UK CRUDE OIL Energy market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a bull trade anywhere,

however I advise placing Multiple Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low & high level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest low level.

Goal 🎯: 75.500

Scalpers, take note : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

UKOIL/Brent Crude Oil Energies Market Heist Plan on Bearish SideOla! Ola! My Dear Robbers / Money Makers & Losers, 🤑💰

This is our master plan to Heist UKOIL / Brent Crude Oil Energies Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Short entry. Our target is Near the Green Zone that is High risk Dangerous level, market is oversold / Consolidation / Trend Reversal / Trap at the level Bullish Robbers / Traders gain the strength. Be safe and be careful and Be rich 💰.

Entry 👇 📉: Can be taken Anywhere, What I suggest you to Place Sell Limit Orders in 15mins Timeframe, Recent / Nearest High Point entry should be in pullback.

Stop Loss 🛑: Recent Swing High using 1H timeframe

Attention for Scalpers : Focus to scalp only on Short side, If you've got a money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

Brent Crude (UK Oil) moving lower this week**Monthly Chart**

Brent Crude (spot) - UKOil, last month's candle closed lower after testing the previous month's key reversal, this indicated that UKOil is going to continue its move lower. This month's candle which is still active, has opened from the bearish closed candle of May and started moving lower. However, the pair is moving within a long-term range as per the monthly timeframe.

**Weekly Chart**

Last week candle opened lower. However, it paused around the 77 level, the previous demand zone then moved higher to the 82 level (round number) and rejected it. Therefore, the expectation as per the weekly chart that the move will be bearish for this week. The next target to be tested is the monthly low around the 72 level.

**Daily Chart**

As per the daily, the price tested the relative equal lows on the daily and started moving higher. However, due to NFP last Friday, the price started moving lower after testing the FVG (or IPA) candle around 82 level and then started moving lower.

For this week, I would like to see more price action to provide a good setup to sell this UKOil and move it to test the 72 level given the change in market structure in the lower timeframes.

UKOIL (Brent) Technical Analysis - VideoIn my previous post, I shared my analysis on Brent crude oil. Here's a video explaining the reasoning behind my trade idea:

Currently, Brent is trading within a daily range-bound channel. It's pushing against the upper boundary, which hints at a possible retracement to test previous lows. Interestingly, historical data over the past decade suggests that March tends to be a bearish period for Brent.

Disclaimer: Remember, this analysis is based on technical factors and should not be seen as direct financial advice. Trading commodities is inherently risky. Before making any trades, always consult with a qualified financial professional and carefully consider your own risk appetite.

UKOIL (Brent) Technical AnalysisBrent crude oil is presently confined within a daily range-bound channel. The price is currently testing the upper bounds of the range, suggesting a potential retracement to retest previous lows. This analysis incorporates a seasonal perspective – historical data over the past decade indicates a tendency for Brent to experience declines during the month of March.

Disclaimer: This analysis offers a technical viewpoint and does not constitute direct financial advice. Trading commodities carries inherent risk. Always consult a qualified financial professional and carefully evaluate your individual risk tolerance before making investment decisions.

BRENT UKOil Trade IdeaA recent bullish trend is evident in BRENT UKOil on the 4-hour time frame, marked by the development of higher highs and higher lows. My approach involves anticipating a retracement into the 50-61.8% Fibonacci zone, creating a favorable discounted entry point. It is essential to emphasize that this analysis is merely an educational idea and should not be interpreted as financial advice.

UKOil Brent Technical Analysis And Trade IdeaIn this video, we embark on a comprehensive analysis of UKOil, with a specific focus on the prevalent bearish sentiment observed in the 1-month (1M) and 1-week (1W) timeframes. Notably, our charts reveal that Brent has approached a critical support level, a pivotal juncture. Throughout this presentation, we delve into the fundamental tenets of technical analysis, encompassing essential components such as evaluating the current market trend, price dynamics, market structure, and other indispensable aspects of technical analysis. As we progress through the video, we meticulously scrutinize a potential trading opportunity in Brent Oil.

It is imperative to stress that the insights shared in this content are exclusively intended for educational purposes and should not be misconstrued as financial advice. Participating in the foreign exchange market trading carries a significant level of risk. Therefore, it is vital to prudently incorporate robust risk management strategies into your trading plan to navigate these challenges effectively.

Need a low pump up! As it shows white trend line is strong support from early days 1860 and I do not think it will break another time (except new COVID disaster) , so we should face a bit move up trend maybe to make double top and then come back to support trend line for another confirmation not to far ( maybe less than 1 year ) and then how knows a huge pump up with strong break on its historical top resistance price 147 maybe!?

I myself accept this scenario instead of break down the very long term white trend line and see lower price around 40 or even lower ?! How do you think???

DeGRAM | UKOIL short opportunityUKOIL reached a support zone after a sell off.

The market made a false break from the accumulation zone.

Bulls tried to push the price higher but failed, which means bears took control.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

DeGRAM | UKOIL short opportunityUKOIL is bearish on 4H timeframe.

Price action is consolidating between 104$ - 92$ price points.

If price rejects the level by creating a false break then we can look for shorting opportunity.

------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

DeGRAM | UKOIL short opportunityUKOIL has attempted to break through the resistance zone roughly at $100 - 99 price level.

Price action created double top and failed make a new high.

We might see a sell off from psychological level of 100$.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

DeGRAM | UKOIL short at confluent zoneUKOIL is pulling back to the resistance zone after making a shallow new low.

This indicates that we might see a deeper retracement.

We are considering selling at the confluent zone of 100-102, which was tested multiple times before.

Look left, the structure leaves clues.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!