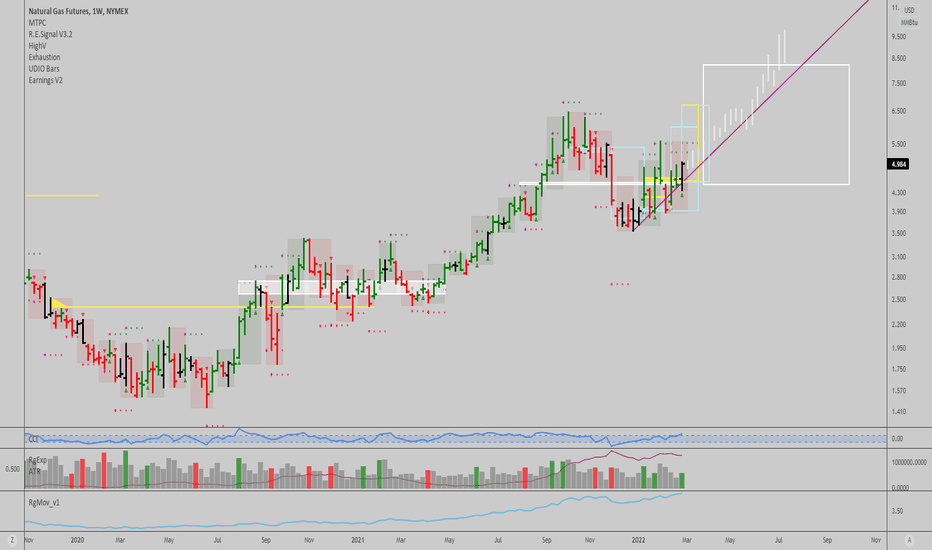

UNG | Its Time to Load | LONGThe fund invests primarily in futures contracts for natural gas that are traded on the NYMEX, ICE Futures Europe and ICE Futures U.S. (together, "ICE Futures") or other U.S. and foreign exchanges. The Benchmark Futures Contract is the futures contract on natural gas as traded on the New York Mercantile Exchange that is the near month contract to expire, except when the near month contract is within two weeks of expiration.

UNG

NATURAL GAS🔥 breakoutNG1! broke down out of the raising wedge (yellow) and I expect further downside. It will prolly not be in straight line, pullbacks along the way expected. Actually now we are sitting at the support zone 7.78 - 7.55, so bounce up or sideways before next leg down is possible. Target being the support zone 6.46-5.95 and potentially the lime uptrendline.

Also there is a upward channel (blue) on the log scale:

Will we test the channel lower edge?

Let me know in the comments how much has your gas bill risen if you already pay new price.

Check my other stuff in related ideas.

Please boost🚀, comment🗣️, follow me✒️, enjoy📺!

⚠️Disclaimer: I'm not financial advisor. This is not a financial advice. Do your own due dilingence.

NATURAL GAS🔥 to $4.6?Please 1st of all click the boost 🚀 button if you want me to post more ideas and follow me to support my work! It's absolutely for free.

Wassup guys?! After my NG short call (two months ago) and reaching it's target I think the drop may not be over yet. I can imagine price is going to test support cluster created by major uptrendline (lime), horizontal support 4.75-5.95, and the yellow trendline. The former support zone 6.46-5.95 now acts as resistance at it seems to me that the upside pullback from the low 4.75 to 7.22 is running out of steam. Closer look (4h)...

...reveals local triangle (yellow) which is just about to break one way or the another. My bet is to the downside breakout.

I wouldn't go long as long as the major downtrendline (red) holds.

Let me know your thoughts in the comment section.

Check my other stuff in related ideas.

Please boost🚀, comment🗣️, follow me✒️, enjoy📺!

⚠️Disclaimer: I'm not financial advisor. This is not a financial advice. Do your own due dilingence.

Natural Gas Going Higher?Gas problems will get worse and Europe will unfortunately be the most affected. Europe's dependence on third countries for gas extraction will, in my forecast, lead to an increase in the price of gas. The price of gas will reach about $13-14 before we reach an extreme and change direction. My target for the UNG ETF is $50 in the next 3-4 months.

Ultra Short Term and Mid Term view of NATURAL GAS NG UNGTickers: NG1!, UNG

Short term view: We are finding weak support at $4.90 level on NG, or $17.50 on UNG.

We are in overall BEAR BIAS MARKET (even with the short term uptrend in the larger equities and bond market) so we will retain the retracement from the SELLERS perspective.

We find a strong case to take profit at $5.20 (NG1!) or $18.15 (UNG)

TP1: $5.20 (NG1!) / $18.15 (UNG)

TP2: $5.35 (NG1!) / $18.80 (UNG)

There is a possibility if the market exuberance continues, we can consider a mid-term view of NG

MIDTERM VIEW :

SHORT TERM VIEW:

LNG Natural Gas Energy Play LongAMEX:LNG

LNG having trended down with the fall in the price of natural gas is now sitting in the support zone.

I anticipate an up-trending retracement to potentially as up as the resistance zone.

Rising relative volume and rising relative strength lend support to a reversal as does

the consolidation in the price of natural gas after a recent fall.

As a swing long trade the stop loss is below the support zone with the first target of about $ 160 or a 50% retracement

and the final target at $ 167 before resistance.

$UNG: Next leg up in Nat Gas pricesI think we may see a rapid advance in Nat Gas here, the technical setup in $UNG paves the way for a 18.4:1 reward to risk potential trade. I'm long equity here, but you could trade this with options, or an equivalent fund in the EU or UK (if you're EU based). Futures or options on futures are also an option, but more complicated to execute with maximum efficiency. I suggest you explore this if you're more experienced, and able to determine which strategy to use to maximize RR and performance vs capital allocated to this idea.

Best of luck,

Ivan Labrie.

XNGUSD ready to reverse recent downtrend LONGGLOBALPRIME:XNGUSD

XNGUSD a few weeks back downtrended afer breaking the neckline of a head and shoulders pattern down to

the support of a double bottom formed in early August. Volume profiles are added to the 30 minute chart.

I see an uptrend retracement of the recent downtrend and accordingly the following:

Stop Loss at 7.64 just below the recent swing low

Target 1 8.59 the bottom of the high volume areas and near the Fib 0.382

Target 2 8.84 just under the Fib 0.50

Target 3 9.15 just under the POCs of the volume profiles and the neckline of the head and shoulders pattern.

Fundamentals: decreasing DXY will cause a relative rise in commodities; winter is coming storage of compressed NG

is underway and increasing demand.

All is all, this forex pair is ready for a long trade.

Nat gas back to the 5'sFirst wave looks finished and now the C part of the ABC looks like it has started. Expect a swift move down to 5.50 (lower weekly BB area), but I think it would be a long term buy from there. Keep in mind however, there is steep monthly bear divergence now on this chart and the possibility that this is a long term top must be kept in mind. Either way, 5.50 should act as support in both cases.

BOIL beginning a round bottom reversal LONGAMEX:BOIL

BOIL a triple leveraged ETF based on natural gas as a commodity and its futures

on the 15-minute chart has begun a round bottom reversal into an uptrend. The AO / Candle indicator

confirms this as does the curve of the accumulation /distribution indicator. Fundamentally, natural gas price

is rising especially with the DXY dollar value in a mild correction. Winter heating season is upcoming and the energy

crisis in Europe accelerating with Russia shutting down ( for now only ?) its remaining active pipeline.

Right now long BOIL looks to be an excellent setup.

$NFG gas industry leader near breakoutNational Fuel Gas Co l is a diversified energy organization headquartered in Western New York that operates an integrated collection of natural gas and oil assets across four business segments: exploration and production, pipeline and storage, gathering, and utility.

The stock is in a confirmed uptrend and has formed a cup & handle with a buy point at $73.

Investors Business Daily gives a Relative Strength rating of 92 and Ranks the stock first in its industry.

AMEX:UNG had a really bad day yesterday which could affect NYSE:NFG and the rest of the industry.

I'll let the price guide me. If it breakouts with heavy volume I'll buy. If not, then I won't buy. Simple.

BOIL Leverage 3X Natural Gas ETF Cup and Handle LONG AMEX:BOIL

BOIL is showing a cup and handle pattern at present

lending increased probability of a bullish continuation

that could yield a 50% price rise over the 45-day width of

the cup. Macro and fundamental factors support ongoing

natural gas price escalations including the supply issues

in Europe, the heat wave from climate change causing

and so on. The cup and handle on a relatively long time

frame increases both its reliability and the time period

for which the pattern to play out.

Commodities are back, $UNG near breakoutThe natural gas ETF is forming a cup & handle with pivot buy at $31.60. This behavior signals a comeback for stocks in the gas industry.

Some of them are NASDAQ:NFE , which I was stopped out in June. NYSE:VET and AMEX:LNG . These 4 are in the top of my watchlist.

All are in confirmed uptrends and leading the sector. Several oil stocks also look good but I think that they are just following the gas stocks. I say this as the oil ETF AMEX:USO isn't as near of a new high as AMEX:UNG .

Look for stocks with gas exposure.

BOIL / GUSH RATIO- Leverage 3X Natural Gas ETFsAMEX:BOIL

BOIL is the #X leveraged ETF for Natural Gas while KOLD is it inverse.

On this 30M chart I setup the ration between BOIL and KOLD.

This is to find precise swing entries without a lot of work for those only trading part time like myself.

At the highs, BOIL has peaked relative to KOLDAccordingly, this is the time to exit BOIL and enter a position

on KOLD. Conversely, when the ratio is at an inflection bottom, a trader should exit KOLD

and enter a BOIL position.

This chart shows several patterns including:

a double or triple top which may breakdown as there is a newer cup and handle potentially breaking

out above the handle in continuation of the prior uptrend. It the present chart, the Bollinger Band basis line

the uptrending of its boundaries and the MACD all favor the probability of an uptrend., the spot markeri

All in all, I am waiting to buy BOIL since natural gas is being liquified and shipped to Europe to

make electric power to supply to air conditioner for the long hot summer. XNGUSD has had dramatic

action in the past couple of months, all good for BOIL's price action.

Three evening stars or three-bar plays marked with red down arrows.

If not in a position at present, the chart should be observed for the cup and handle pattern completion

towards a resumption of the uptrend. IF so, a BOIL position could be entered.

If it fails the triple top controls the price action and

a KOLD position could be entered.

This chart demonstrates the importance of looking for patterns to help guide

higher probability setup.

$RRC, cup & handle with a explosion gap pivot play Range Resources Corp is in the exploration and production of AMEX:USO and AMEX:UNG in the US.

It was recentlty feature in IBD and got me interested because its good looking cup & handle. Today managed to breakout with a gap. This gap should act as resistance.

As the market still needs to prove itself, I won't buy this breakout but the breakout from today's high with a stop loss just below yesterday's high. This strategy is called Explosion Gap Pivot. It uses the gap range as support.

$NGAS: Natural gas can go 90% higher from hereIt's clear Nat Gas can gain traction fast here, I'm long since yesterday, via $UNG shares. Looking to add an options position here, since weekly charts are now bullish, I pre-emptively took a trade based on a daily signal, speculating on the weekly and eventually monthly kicking off. I commented about it in the Key Hidden Levels chatroom here and offered it to my clients as a signal as well.

With last night's shelling of a nuclear plant, escalation seemed likely, and the next step could be to enact sanctions on natural gas exports, which could deal a blow to supply and create a dramatic move to the upside as a side effect. Fundamentals aside, reward to risk and probability are on our side, so it's a good idea to get some decent exposure here.

Cheers,

Ivan Labrie.

UNG - why didn't I dare to buy?UNG is really a leader that has fundamental reasons to be one.

But let's look at it technically- It was a inverted head and shoulders.

And there was an attempt to break the shoulder, but we got a strong reaction.

Was it possible to start a position there? I think it really MUST have been.

So, the price is gone, let's wait for more setups.