ETHFI Breakout Loading? Targets Up to $1.67!$ETHFI/USDT Analysis

Price is currently trading around a key resistance zone after a strong recovery from recent lows. While momentum looks bullish, the resistance has not been broken yet — making this a crucial level to watch.

A clean breakout and candle close above this zone could confirm a potential rally toward the next targets.

🎯 Upside Targets (if breakout confirms):

TP1: $0.881

TP2: $1.291

TP3: $1.677

📌 For now, stay patient. Let the price action confirm before entering — this zone could act as a rejection point if bulls fail to push through.

DYOR, NFA

Unichartz

UMA Trendline Shattered! What’s Next for Bulls?BINANCE:UMAUSDT has broken above the key trendline resistance and is now testing a minor resistance zone.

If a candle closes decisively above this marked zone, we could see a parabolic upside move in the coming sessions.

This breakout structure, paired with strong momentum, makes it a setup worth watching closely.

DYOR, NFA

$HBAR Near Key Resistance: Will the Bull Flag Explode?CRYPTOCAP:HBAR is trading within a bull flag on the 2-day chart, holding just below a key resistance zone that was previously support. The 100 EMA is also acting as a dynamic barrier here.

A breakout above $0.188 with strong volume could trigger the next bullish leg.

But if resistance holds, a short-term pullback might follow.

DYOR, NFA

Trend Shift Alert: $PEPE Closes Above Resistance + EMACRYPTOCAP:PEPE has closed above the 50 EMA after reclaiming a key resistance zone, previously acting as support. This breakout is a strong technical signal suggesting a trend reversal may be in play.

RSI is climbing and currently sits near 63, indicating increasing buying strength but not yet overbought.

If price holds above the reclaimed zone and the 50 EMA, it could trigger a continued move upward toward previous highs.

DYOR, NFA

ONDO/USDT Reversal Setup – Targeting Mid S/R Zone NextLSE:ONDO has broken above the key descending trendline, signaling a potential shift in momentum. The price is now heading toward the mid S/R zone, which will be a critical level to watch.

Currently, ONDO shows strong upside potential as it trades within a broader sideways range. If bulls maintain control, we could see a continuation toward the upper resistance zone.

Momentum is building — eyes on the next move.

DYOR, NFA

WIF Bulls Charge After Breakout – Can It Hit $2?SEED_WANDERIN_JIMZIP900:WIF has broken above the descending trendline, a key structure that had been capping price for several weeks. This breakout, paired with today’s nearly +10% surge, suggests bullish momentum is building.

The price is now approaching the 50 EMA, which may act as short-term resistance. A clean breakout and close above this level could trigger a strong upside move toward higher zones, as marked on the chart.

Targets remain open toward $0.80, $1.30, and possibly $1.97 if momentum holds.

DYOR, NFA

SEI Trend Reversal? Breakout + Higher Low ConfirmedNYSE:SEI has broken above the key descending resistance line, signaling a shift in momentum after an extended downtrend. The price also rebounded strongly from the support zone marked in the chart, forming a clear higher low.

Currently, SEI is pushing through a critical zone where support previously flipped into resistance, now testing the 50 EM as the next challenge.

If the price can hold above this zone and close with strength, the next leg up could target $0.30–$0.50, as shown on the chart.

DYOR, NFA

SUI Breaks Key Trendline – Bullish Reversal in MotionCRYPTOCAP:SUI has broken above the descending resistance line, confirming a trend reversal after weeks of downward movement. This breakout came after price bounced from a strong support zone, establishing a higher low structure.

The breakout is also supported by a move above the 50 EMA, adding strength to the bullish case.

DYOR, NFA

Bitcoin Cash Bounces from $309 – Eyes on $500 and BeyondSET:BCH is showing a strong reversal from the long-term ascending support trendline, holding above a key zone around $309. This bounce aligns with a historical support level and confirms buyer interest.

The structure remains intact within a descending wedge, with a potential upside move toward the long-term resistance near $480–$500. As long as price holds above $309, momentum favors bulls, and a breakout could lead toward the $600–$1,200 zone mid-term.

DYOR, NFA

AUDIO Breakout Alert: Parabolic Move Loading?SEED_DONKEYDAN_MARKET_CAP:AUDIO has successfully broken above the long-term descending resistance line, signaling a strong shift in momentum. However, the price is currently facing rejection from the upper marked resistance zone.

If AUDIO manages to close decisively above this zone, it could trigger a parabolic upmove, opening the path for a significant rally. Watch closely for confirmation — this breakout could be the beginning of something big.

DYOR, NFA

This Chart Screams Strength — Are You Positioned?The total crypto market cap is currently showing a very strong technical setup. It’s holding firm at a major long-term rising trendline, which has historically acted as a launchpad for massive bullish moves across the market. Additionally, the 100 EMA is providing solid support, further reinforcing this zone as a key demand area.

We’re also seeing a bottomed-out Stochastic RSI, now starting to curl upward — a classic early signal of momentum shifting back to the bulls. Although the market is still sitting just below the long-term resistance line, this type of structure often leads to strong breakouts once confidence returns.

If this trendline support continues to hold and the market cap begins pushing back toward the $3 trillion mark, we could see a major surge in altcoin strength. Historically, this is when altcoin capital rotation picks up and narratives gain momentum. Overall, the crypto market is flashing strength — and this might just be the calm before a powerful altcoin rally.

Thanks for reading! Please do like and follow us for more updates.

BTC in Tight Range: Calm Before the Storm?$BTC/USDT is consolidating within a tight range (highlighted in the blue box) for the past 8 days. This looks like a strong accumulation phase, suggesting that the next breakout could be explosive.

Watch for a decisive move above the range for confirmation.

DYOR, NFA

Reversal Pattern in Play – Will AVAX Flip Bullish?CRYPTOCAP:AVAX is showing signs of a potential reversal after forming a double bottom near the $17 zone. It’s currently testing a key resistance trendline along with a minor horizontal resistance around $19.50–$20.50.

A successful breakout and close above this zone could trigger bullish momentum toward $22+. However, rejection here may lead to another dip back toward support.

Price action is tightening, so a decisive move is likely soon.

DYOR, NFA

INJ at Key Support – Will History Repeat?INJ/USDT Weekly Chart Analysis

INJ is currently trading at a crucial technical level, touching the strong rising support line of a long-term ascending channel. Historically, this trendline has acted as a reliable base for strong upward reversals.

The Stochastic RSI is also deeply oversold, similar to the levels seen during previous bottoms in early 2022 and early 2023 — both of which led to significant rallies.

If the support holds, INJ could be poised for another upward move toward the key resistance line of the channel.

However, a breakdown below this support would invalidate the structure and could lead to further downside.

Crucial Zone Ahead: Will TAO Confirm a Bullish Reversal? TAO/USDT Daily Chart Analysis

Trend Line Breakout:

The chart shows a successful breakout above a long-term descending trend line, indicating a potential shift in momentum from bearish to bullish.

Fakeout Rejection:

A previous attempt to break above the trend line resulted in a fakeout and strong rejection, but this recent move looks more decisive.

Key Resistance Cleared:

The price has clearly broken above a key resistance level, suggesting renewed buying pressure. However, confirmation is still needed.

Current Price Action:

Price is now hovering above the trend line and testing the local resistance zone.

Watch for a breakout confirmation and retest of the marked zone (approx. $265–$275) to validate further upside movement.

Next Targets:

If the breakout holds, potential upside targets could be the previous high resistance zones between $305–$335.

📌 Strategy Tip:

Wait for a daily candle close above the marked zone for confirmation. If it fails, we could see a pullback into the local support range near $270–$290

Sellers Trapped! AUD/USD Flips Structure to BullishAustralian Dollar / U.S. Dollar (AUD/USD)

📆 Timeframe: 1-Day (1D)

📈 Technical Breakdown:

1. Sideways Consolidation Zone

The price has been consolidating within a clear horizontal range.

This range is defined by upper resistance and lower support zones, with several rejections confirming the boundaries.

2. Downtrend Resistance Line Broken

A long-standing resistance trendline has been breached to the upside.

This breakout suggests a potential trend reversal or continuation rally if price holds above.

3. Seller Trap Identified

There was a strong liquidity sweep below the support zone, labeled “Sellers Got Trapped.”

This is a classic liquidity grab, where shorts were likely triggered before price reversed sharply upward.

4. EMA 50 as Dynamic Support

Price has reclaimed the 50 EMA (0.62701), indicating a shift in short-term momentum towards the bulls.

If the price remains above this moving average, it could act as a dynamic support in the near term.

5. RSI (Relative Strength Index) at 57.62

RSI is in bullish neutral territory, suggesting there’s still room for upward momentum before overbought levels (>70).

No bearish divergence is currently visible.

✅ Bullish Outlook:

Breakout above resistance trendline ✅

Recovery above EMA 50 ✅

Seller trap below range ✅

RSI supports further move ✅

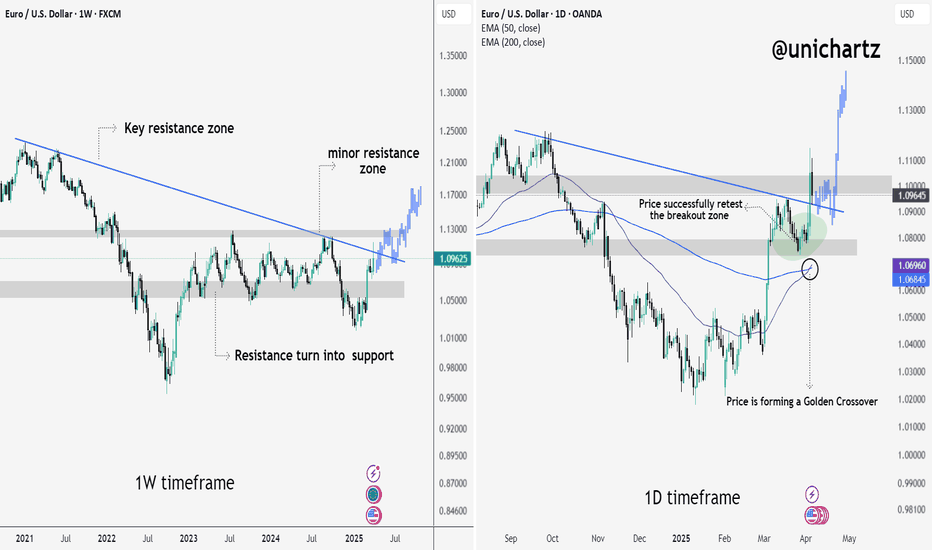

EUR/USD – Golden Crossover & Breakout Confirmation (Multi-T.F)EUR/USD is showing strong bullish signs across both the weekly and daily timeframes, suggesting a potential macro trend reversal in the making. After being trapped below a long-term descending trendline for nearly two years, price has not only broken out but also successfully retested the breakout zone — a key validation for trend continuation.

On the daily chart, a Golden Crossover is now forming, which historically precedes major uptrends in forex pairs. Combined with reclaiming key structural levels and building higher lows, EUR/USD could be positioning for a powerful upside move in Q2 2025.

Let’s dive into the multi-timeframe analysis to understand why this setup could be one of the cleanest trend reversals on the board.

1W Timeframe – Macro Breakout in Progress

EUR/USD has officially broken out of a long-standing descending resistance trendline. This breakout occurred from a structurally important zone that had acted as a ceiling for over 2 years.

📌 Key Observations:

🔹 Price reclaimed and held above the key resistance zone, turning it into strong support.

🔹 Minor resistance zones lie ahead, but structure favors further upside.

🔹 Projection shows potential continuation toward 1.16+ if momentum sustains.

1D Timeframe – Bullish Retest + Golden Cross Forming

Zooming into the daily chart, we see:

✅ A successful retest of the breakout zone, which held as support (bullish confirmation).

✅ Price is now forming a Golden Crossover – where the 50 EMA is crossing above the 200 EMA. This is typically seen as a strong bullish signal in trending markets.

📌 What’s Bullish:

Clean breakout ✔️

Retest with strength ✔️

Momentum crossover ✔️

EUR/USD is now in a strong bullish structure, backed by a confirmed breakout on the weekly and a golden crossover on the daily. If price holds above 1.09, we may see continued upside toward 1.13–1.16 levels in the coming weeks.

Thank you for reading and supporting @unichartz. If you found this analysis helpful, don’t forget to like, follow, and share! 💙

EUR/JPY Eyes Breakout — Can Bulls Push Through Resistance?EUR/JPY Weekly Chart Analysis

EUR/JPY is holding strong above a rising trendline that’s acted as support since 2022. The pair recently bounced from a key support zone and is now testing a major resistance area.

A breakout above this zone could trigger a bullish continuation, while rejection may lead to another pullback toward the trendline.

Key Levels:

Support: 153.5–155.0

Resistance: 163.5–165.0

Watch for: Weekly close above resistance for bullish confirmation.

Structure remains bullish as long as the trendline holds.

USDT Dominance Drops – Altcoin Surge Incoming?

USDT.D has broken below the rising support line and is currently testing the grey-marked support zone. If this support fails to hold, we could see a sharp decline toward the mid support/resistance zone.

Such a move would likely trigger a strong upside in altcoins as capital rotates out of stablecoins.

$SOL Weekly Bounce from Dynamic Support – Watch for BreakoutCRYPTOCAP:SOL is holding above a key rising trendline that has acted as strong support since 2021. After a successful retest near $95–$100, SOL bounced sharply and is now trading above $120.

This move also confirms a reclaim of a previous resistance-turned-support zone. As long as it holds, SOL could aim for $145 and above.

DYOR, NFA

ONDO Range Play: Breakout Confirmed, Eyes on $1.20+ONDO/USDT – 2D Chart Analysis

ONDO has broken above a falling trendline while continuing to trade within a broader sideways range. The breakout occurred near the mid S/R zone around $0.90–$0.95, which is now acting as a potential pivot level.

The price is attempting to reclaim momentum after a period of lower highs and sideways compression. A sustained move above the mid-range could open the path toward the upper resistance zone near $1.20–$1.30. However, if the breakout fails and price falls back below $0.90, it may revisit the lower range support around $0.70.

This is a key zone to watch for continuation or rejection.

DYOR, NFA

$BCH Rebounds Strongly – Is a Breakout Toward $540 Coming?SET:BCH is showing a strong bullish reversal from a key ascending trendline on the weekly chart. After retesting the support zone near $250, the price bounced with 9% gains, signaling renewed interest. The structure forms a symmetrical triangle, and BCH is now eyeing resistance near $309. A breakout could target the $440–$540 zone.

This move aligns with Bitcoin’s current consolidation at higher levels. If BTC remains strong in Q2 2025, BCH could follow with further upside. Holding the $225–$250 support is crucial to maintain this bullish setup.

DYOR, NFA

POPCAT at the verge of Breakout $POPCAT/USDT is forming a falling wedge on the daily chart, a bullish reversal pattern. Price recently bounced from the descending support and is now approaching the minor resistance zone near $0.21.

A breakout above the resistance trendline could signal a trend reversal and trigger upside momentum. RSI at 45.93 is rising, supporting the bullish bias. Confirmation above the wedge is key for further upside.

DYOR, NFA