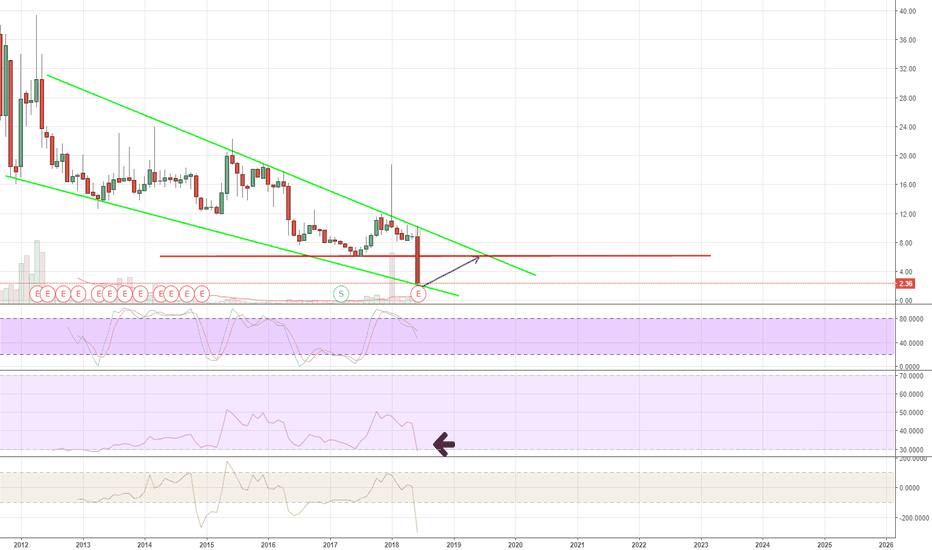

if it closesupon11.56it may go to 14.71if it closes upon the 11.56 level it may go to 14.51->14.71 : I'm super bullish on the UNI pROMESSING PROJECT ^_^

Unicorn

Vaccibody is now public company listed on Euronext MerkurVACCIBODY ENTERS INTO WORLDWIDE LICENSE AND COLLABORATION AGREEMENT WITH GENENTECH, A MEMBER OF THE ROCHE GROUP, TO DEVELOP INDIVIDUALIZED NEOANTIGEN CANCER VACCINES

Vaccibody enters into worldwide, exclusive license and collaboration agreement with Genentech to develop VB10.NEO, individualized neoantigen cancer vaccines

OCTOBER 1, 2020

VACCIBODY LISTS ON OSLO STOCK EXCHANGE’S MERKUR MARKET

Vaccibody Lists on Oslo Stock Exchange’s Merkur Market

OCTOBER 7, 2020

Bullish flag: UNI/USDT about to move (up?)Possible descending triangle on whole chart, or also a little cup and handle forming. In any case UNI seems to stabilize near 4.4/4.5.

The volume is decreasing, the Bollinger bands are getting narrow, it seems that distribution period is over.

If there's not another breakout upwards, we could go back below $4.

This is just an idea (my first one btw), let's see how it move afterwards. I started a LONG position at $4.4.

NET - MOMENTUM TRADE SLINGSHOTCLOUDFLARE (NET) met expectations 2 days ago on my previous post and broke out from a Blue Sky Set-Up. It paused yesterday for profit taking and is currently set-up again to continue it's move to hit a round number target. Needham just raised its price target to 38, a mere 3% away from it's current price. NET is a clear beneficiary of the shift to work from home and e-commerce on increased demand for cybersecurity. The company provides an integrated cloud-based security solution to secure a range of combination of platforms, including public cloud, private cloud, on-premise, software-as-a-service applications, and Internet of Things (IoT) devices.

Current set-up is a slingshot which could potentially result to another Bullish Marobozu similar to the breakout candle. Possibilities are: (1) it pauses for another day (today) with low volatility or (2) continue its range expansion and hit 38-40. Pauses can extend to three days with tightening ranges and decreasing volume indicating a healthy profit taking before proceeding to make an explosive move which is otherwise referred to as a Boomer Set-Up. Best approach to prevent early participation if explosive breakout doesn't materialize is to buy at the break of the yesterdays high supported by volume acceleration. This can clearly observed and managed on the 15-minute chart.

NET : SLINGSHOT TO BOOMER SET UPCLOUDFLARE (NET) met breakout expectation from a Blue Sky set-up and is currently on a pause currently on Slingshot Set-up to potentially continue its range expansion. Needham just raised its price target to 38, a mere 3% away from its current price. NET is clearly a beneficiary to the work from home and e-commerce shift with increasing demand for cybersecurity. The company provides an integrated cloud-based security solution to secure a range of combination of platforms, including public cloud, private cloud, on-premise, software-as-a-service applications, and Internet of Things (IoT) devices.

On technical analysis, a Slingshot set-up is a brief healthy profit taking with very little volatility which could result to another range expansion similar to the Bullish Marubozu breakout candle 2 days ago. If the expansion doesn't materialize today, the ranges can get tighter for 2 more days which could be a springboard to the potential expansion (Boomer Set-Up). To avoid opportunity cost, it's best to buy at the break of yesterdays high supported by volume acceleration. Price action is best observed and managed on the 15-min chart for ease of execution. Trade duration is as little a few hours to a day. If position is ahead and does not hit price target, sell half to protect gains and trail stop the balance on the 5-day EMA to minimize weekend risk.

As always, risk first and profit second. Be aware of your risk profile and only risk what you can afford to lose.

TTD BLUE SKY BREAKOUT to SLINGSHOTTTD went through a 10 day consolidation after breaking out from 316 to 370.

Currently set up for a potential slingshot to hit 400. Price is looking strong holding its footing above the

10 day EMA.

Fundamentals are showing accelerating revenues and expanding margins due to its resilience to the pandemic

and mostly benefiting from the shift to work from home and e-commerce. One of the few high growth stocks

that's taking a slice of Facebook and Google market share in advertising. With revenue growth of 37% YoY and

top margins of 76% compared to sector median of 7.24%, this is definitely one for the long haul.

Let me know your thoughts and best of luck on your trades.

TEZOS: $1.46 | the ONE to rule em all at $500bn cap | $720organic and well positioned product validated through early birthpains in 2017 and

just like that came out of nowhere as deemed to be a game changer among the rest

could be the GOOGLE FB in the iT industry obliterating the rest of players

-

a $500bn cap should be at par with DOWs FANG super stocks

TEZOS: $720 a moment to look forward

Time to make decisions I still like this unicorn to be long, but... yeah I can see this pulling back significantly. Ignoring MS analyst and valuing this at 110 in one year. I like the bounce off this MS dip low point and stay within the general trend lines. If we close below the 132 area, I will have concerns until I can find support levels and do not believe the trend lines will hold. I think there will be a bounce off every support if we track this way, however they might not be sustained.

**Long the stock, stop around 132

Long term, awesome... short term, no thanks40% down since the unicorn IPO... It is not ready yet, tough to say when Space Travel will be ready to pop. For right now, I suppose a gradual add over the next decade will get you to a super unicorn valuation if you trust Richard Branson to beat Elon Musk. This is a fun stock that has been a massive loser.

**accumulating a position... wasting capital and money

Short Term Inflection PointDecision time for RUKU to break out of a long term trend higher or to return to its bounds. The acceleration of the price after the last drop was "appropriate" IMO, however this is still a company that loses money and is in high and ever growing competition. Tough spot to make a choice, I wouldn't hate a straddle... however this strategy is expensive.

**Unicorns do not question valuations, $18.5b

**I am long

MATIC - Beast sponsored by Binance and CoinbaseWhat could go wrong ? The biggest players in the market are backing it.

I don't really like the project it self, but I like the companion.

Matic marketcap is at 29M today. I bet this can fly to at least 290M over to 1B+

CoinBase Ventures.

Unicorn AIM VCT - Long On 29 January 2019 the Company announced that it had launched an offer to raise up to £15 million (with an over-allotment facility for up to a further £10 million) through the subscription of up to a maximum of 25 million ordinary shares of 1p each (“the Offer"). Full details of the Offer are contained in a prospectus

Full Report : www.unicornaimvct.co.uk

We see good things from this in the past from there figures and they are expected to continue to do well.

CRTX Strong watch potential unicorn 2020Please bear with me (or bull with me in a year) as I am new to this. I am new to investing and have been following biotech IPOs recently. I am just starting to learn technical analysis so I will have to update this later when there is more data to analyze and when I learn how to do that. Also disclaimer: I have an MD background but do not have any stake in this company yet.

All information contained in this post about the company is available on the company site.

GAIN trial: 500 subjects, each studied for 4 months, enrolling right now. This likely will not be published until Late 2019 at the very earliest based off of my experience in medical research as an MD. My optimistic guess is by mid 2020 it will be submitted, published mid to late 2020. If there are serious drug complications this would likely push back their timeline, but if things go extremely well its not unheard of to stop the blinding and begin treating everyone with the study drug (this would be a sign to me to buy like its going out of style.) After they prepare and submit a NDA, the FDA has 60 days to review it. I think the earliest this drug hits the market if it goes through is 2021.

The premise of the drug is based off of a newly demonstrated theory on the nature of Alzheimer's disease. According to the Texas Department of Health and Human services, 5.8 million Americans have Alzheimers. This represents the current American market. With an aging boomer population the incidence and prevalence will likely increase. Sciences Advances Jan 2019 "porphyromonas gingivalis in Alzheimer's brains: Evidence..." convinced me that amyloidosis is a result of bacterial colonization of the brain in older people, and Dr. Moir and Dr. Tanzi of Mass General posted similarly on AlzForum. Cor388 is the only gingipain inhibitor being developed that I could find online.

So they have the only drug in development, its in phase 2/3 right now. Reuters on success rates for study drugs - basically the problem is that Phase 2 results predict phase 3 and FDA approval, and we only have phase 1 info. Its still risky, but I think the upside of having a monopoly on a new class of drug is high enough to warrant the risk. If they show this drug can improve rather than just slow the progression of Alzheimer's, they will have a drug that does something that no other Alzheimer's treatment has ever done before. -That is why this is a potential unicorn.- The effect on public AND market psychology would be astounding.

That being said, after the new IPO hype wears off and we get some quarterly loss reports, price will likely drop BEFORE drug trial results come out, and if they're good (as I expect them to be) we should see either a bubble form or a rocket ship take off. Pre-phase 2/3 results represents my best window for entry for a long term investment.

OMG to the MOONDid we all forget about OMG?

Get this purchase volume up and we're all going to goddamn Mars.

Not advice. In fact, I'm probably wrong. However, 1.25 OMG is a steal.

Buy or don't. I'm just here to say things.

RENN Descending Channel RNN is very oversold on the monthly and daily charts. It is trading in a decending channel and if price respects the channel it should test $6. It has a large gap to fill from $3.20 to $6. RENN is trading at 1/10 it recent $10billion valuation per Softbank. finance.yahoo.com