$USPCEPIMC -U.S PCE Prices Rise (June/2025)ECONOMICS:USPCEPIMC

June/2025

source: U.S. Bureau of Economic Analysis

- The US PCE price index rose by 0.3% mom in June, the largest increase in four months, and in line with expectations, led by prices for goods.

The core PCE index also went up 0.3%, aligning with forecasts.

However, both the headline and core annual inflation rates topped forecasts, reaching 2.6% and 2.8%, respectively.

Meanwhile, both personal income and spending edged up 0.3%.

Unitedstates

$USINTR -Feds Leaves Rates Steady (July/2025)ECONOMICS:USINTR

July/2025

source: Federal Reserve

- The Federal Reserve held rates steady at 4.25%–4.50% for a fifth straight meeting, defying President Trump’s demands for cuts even after positive GDP growth .

Still, two governors dissented in favor of a cut—the first such dual dissent since 1993.

Policymakers observed that, fluctuations in net exports continue to influence the data, and recent indicators point to a moderation in economic activity during the first half of the year.

The unemployment rate remains low, while Inflation somewhat elevated.

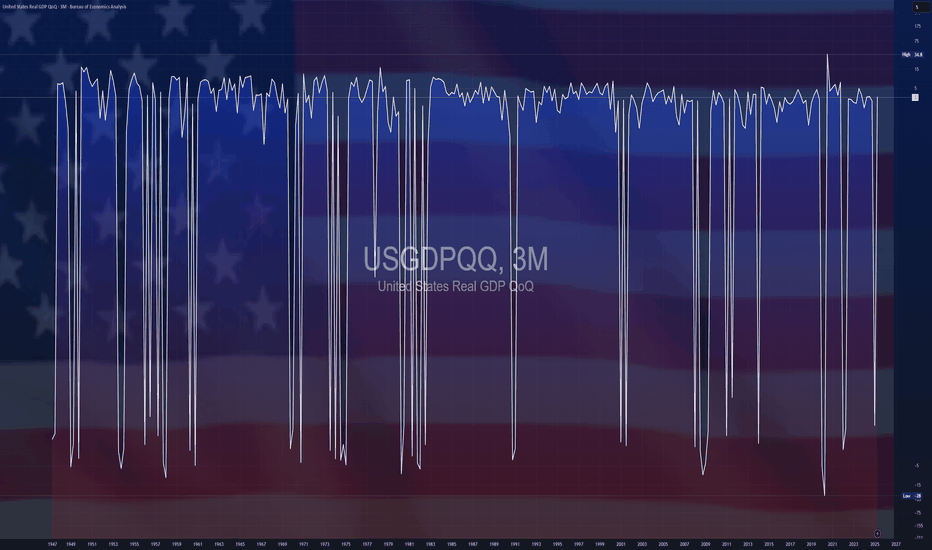

$USGDPQQ -U.S Economic Growth Outpaces Forecasts (Q2/2025)ECONOMICS:USGDPQQ 3%

Q2/2025

source: U.S. Bureau of Economic Analysis

- The US economy grew at an annualized rate of 3% in Q2 2025,

sharply rebounding from a 0.5% contraction in Q1 and exceeding market expectations of 2.4% growth, largely driven by a decline in imports and a solid increase in consumer spending.

However, the gains were partly offset by weaker investment and lower exports.

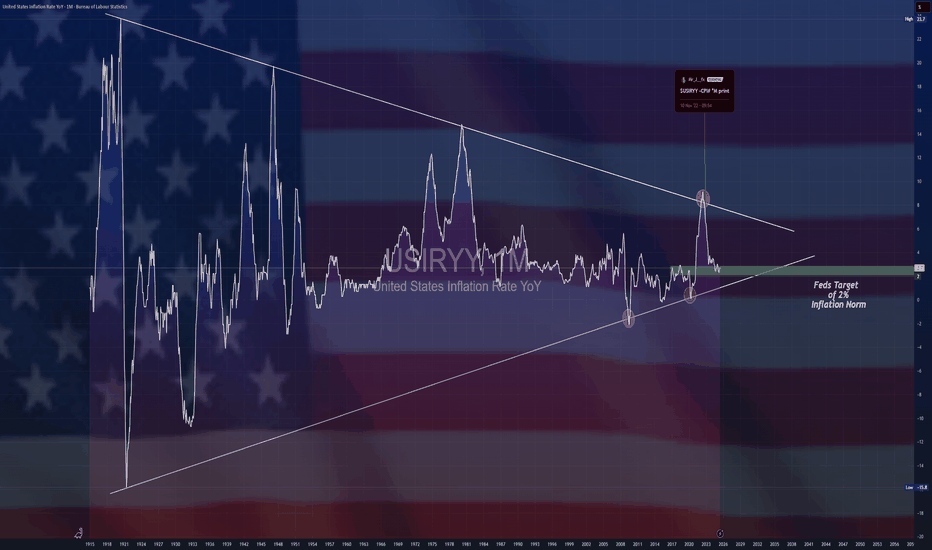

$USIRYY -U.S Inflation Rate Seen Rising for 2nd Month (June/2025ECONOMICS:USIRYY

June/2025

source: U.S. Bureau of Labor Statistics

- The annual inflation rate in the US likely accelerated for the second consecutive month to 2.7% in June, the highest level since February, up from 2.4% in May.

On a monthly basis, the CPI is expected to rise by 0.3%, marking the largest increase in five months.

Meanwhile, core inflation is projected to edge up to 3% from 2.8%. Monthly core CPI is also anticipated to climb 0.3%, up from 0.1% in May, marking its sharpest increase in five months.

$USINTR -Fed Keeps Rates Uncut (June/2025)ECONOMICS:USINTR

June/2025

source: Federal Reserve

- The Federal Reserve left the federal funds rate unchanged at 4.25%–4.50% for a fourth consecutive meeting in June 2025, in line with expectations, as policymakers take a cautious stance to fully evaluate the economic impact of President Trump’s policies, particularly those related to tariffs, immigration, and taxation. However, officials are still pricing in two rate cuts this year.

#UNI/USDT#UNI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 7.78.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 7.85

First target: 8.19

Second target: 8.53

Third target: 8.85

$USIRYY -U.S CPI Below Expectations (May/2025)ECONOMICS:USIRYY 2.4%

(May/2025)

source: U.S. Bureau of Labor Statistics

- The annual inflation rate in the US increased for the first time in four months to 2.4% in May from 2.3% in April, though it came in below the expected 2.5%.

Prices rose slightly more for food, used cars and new vehicles but shelter cost slowed and gasoline prices continued to decline.

Meanwhile, the annual core inflation rate held steady at 2.8%.

On a monthly basis, both headline and core CPI increased by 0.1%, falling short of market expectations.

$USPCEPIMC -U.S Core PCE (April/2025)ECONOMICS:USPCEPIMC

April/2025

source: U.S. Bureau of Economic Analysis

-The core PCE price index in the US, which excludes volatile and energy prices and is Federal Reserve's chosen gauge of underlying inflation in the US economy,

went up 0.1% from the previous month in April of 2025.

The result was in line with market expectations.

From the previous year, the index rose by 2.5% to slow from the 2.7% jump from March, the softest increase since March of 2021.

United Airlines Holdings, IncKey arguments in support of the idea.

International routes continue to experience high demand. While the U.S. domestic market is in a less favorable position, especially the low-cost carrier (LCC) segment, the company is benefiting from foreign tourists. However, it's worth noting that the U.S. Travel Association (USTA) reports the opposite: demand from U.S. citizens for domestic tourism remains strong. We expect the situation in domestic flights to improve by summer 2025. During the reporting period, United emphasized that its premium offerings continue to drive revenue growth, with demand from American tourists for international flights remaining stable.

Our 12-month forecast maintains the possibility of a positive surprise for the company. UAL’s pricing power is generally stronger than that of competitors, allowing the company to maintain a high level of revenue per passenger mile and profit margins.

Progress in tariff negotiations has given a strong boost to the stock. Currently, UAL shares are trading above their 200-day moving average with an RSI near overbought levels. However, if political progress continues, this momentum could persist. The 2-month target price for UAL is $97, and we recommend setting a stop loss at $72.8.

The 2-month target price for UAL is $97. We recommend setting a stop loss at $72.

Joby Aviation, Inc.Key arguments in support of the idea:

Over the past quarter, Joby Aviation has made meaningful progress toward certification of its electric air taxi. The company has now completed 62% of Stage 4, advancing 12 ppts in just one quarter. Engineers successfully conducted piloted transition flights, and a series of fault-tolerance tests—where batteries, tilt mechanisms, and even half of the engines were deliberately shut off—ended in safe landings, showcasing the robustness of Joby’s safety systems.

Progress on the certification front is complemented by tangible manufacturing achievements. Five fully functional flight prototypes have already been assembled, with each new unit being produced faster, more efficiently, and at lower cost. Scaling efforts are supported by a strong strategic partnership with Toyota, which plans to invest up to $500 million this year to help Joby refine its production processes. The company’s order backlog stands at approximately 1,500 units.

Joby is looking beyond California for operations. A pilot service is scheduled to launch in Dubai in spring 2026, with the first vertiports already under development. Test flights are expected to begin by mid2025. Simultaneously, a MoU has been signed with Virgin Atlantic, paving the way for future service networks in London and Manchester.

Joby’s monetization strategy is highly flexible—ranging from direct aircraft sales and defense contracts to joint ventures and proprietary passenger routes in partnership with Delta, Uber, and Virgin. The company currently holds $813 million in cash and has a disciplined 2025 spending plan of $500–540 million.

While Archer Aviation (ACHR) didn’t surprise with its latest report, its stock still saw impressive gains. We believe Joby could follow suit—especially given the overlap in their operational zones, as Joby’s stock typically reacts to competitor moves with a slight delay. Investors are beginning to price in the upcoming launch of eVTOL commercial operations, which could periodically trigger strong upward momentum in the stock. Technically, the chart also shows signs of an "inverse head and shoulders" formation.

2-month target price for JOBY is $8.50. We recommend setting a stop loss at $6.10.

XAUUSD SHORTIt's a beautiful setup , as we see here gold is going down since 6TH of may and it forms a bearish channel , it just tested the lower high of the channel and a resistance . I'm waiting for the market to break and retest the trendline beneath it , then i'll take a short position targeting this support level

$USIRYY - U.S Inflation Rate Unexpectedly Slows (April/2025)ECONOMICS:USIRYY

April/2025

source: U.S. Bureau of Labor Statistics

- The annual inflation rate in the US eased to 2.3% in April, the lowest since February 2021, from 2.4% in March and below forecasts of 2.4%.

Prices of gasoline fell at a faster pace and inflation also slowed for food and transportation.

Compared to the previous month, the CPI rose 0.2%, rebounding from a 0.1% fall in March but below forecasts of 0.3%.

Meanwhile, annual core inflation rate steadied at 2.8% as expected, holding at 2021-lows.

$USINTR -Fed Keeps Rates Unchanged (May/2025)ECONOMICS:USINTR

May/2025

source: Federal Reserve

- The Federal Reserve kept the funds rate at 4.25%–4.50% range for a third consecutive meeting as officials adopt a wait-and-see approach amid concerns about the effects of President Trump’s tariffs.

Policymakers noted that uncertainty about the economic outlook has increased further and that the risks of higher unemployment and higher inflation have risen.

Stellantis N.V.Key arguments in support of the idea

The company's shipments are projected to recover in the latter half of the year.

STLA's valuation appears significantly lower compared to its industry peers

Investment Thesis

Stellantis N.V. Stellantis N.V. (STLA), a leading global automotive manufacturer, stands as a dominant force in both North American and European markets. The company boasts a diverse and comprehensive portfolio of automobile brands, encompassing renowned names such as Jeep, Fiat, Peugeot, Maserati, Dodge, Opel, and Chrysler. Ranking among the top five automakers worldwide in passenger car shipments, Stellantis derives approximately 45% of its total revenue from its sales in North America.

Last week, the White House signaled a policy shift by announcing the easing of tariffs for the automotive industry, providing a potentially positive catalyst for automaker stocks. On April 3, the U.S. imposed a 25% tariff on the importation of foreign-manufactured automobiles. This measure will be extended to include similar duties on imported auto parts beginning May 3. The Big Three, namely Ford, General Motors, and Stellantis, produces a portion of its vehicles and several auto parts for the U.S. market in Canada and Mexico. Consequently, these companies

have experienced significant stock declines since the beginning of the year, attributable to the new tariffs. Notably, while three out of every five cars sold by Stellantis in the U.S. are assembled domestically, approximately 20% of their components are imported and thus subject to the 25% tariff. Last Tuesday, President Donald Trump unveiled relaxed tariffs on auto parts, permitting U.S. automakers to reclaim up to 3.75% of the car’s total cost at retail for previously paid duties. This tariff relief could substantially aid Stellantis in recuperating most of its tariff expenses. If 20% of all components in automobiles produced in the region are subject to the 25% tariff, the effective tariff cost on the total vehicle will be 5%, of which 3.75% can be reimbursed. Thus, without any immediate alterations to their supply chains—which they currently have no plans to modify—the duty on a U.S.- manufactured vehicle effectively reduces to 1.25% of its final retail price. While closures and suspensions of certain production sites are inevitable, the overall impact of these duties is less severe than anticipated just weeks prior. It is our assessment that these Big Three automobile manufacturers possess the resilience and strategic capability to navigate and adapt to the newly imposed tariff environment.

Stellantis is strategically realigning its model portfolio, signaling a potential recovery in its market share. In the first quarter of 2025, the automaker unveiled three new models and is poised to introduce an additional ten models aimed at the U.S. and European markets by year's end. This comes despite a 9% y/y decline in shipments during the first quarter. However, the company has managed to bolster its market share in Europe, a trend attributed to the invigorated product lineup. We anticipate that this revitalization will enable Stellantis to achieve a 7.8% y/y increase in shipments during the second half of the year, reaching 2.8 million units. Nonetheless, first-half shipments are expected to remain subdued, a development largely anticipated by current consensus estimates.

STLA shares remain notably undervalued within the automotive sector, presenting a more economical option compared to its peers. Currently, Stellantis is trading at a 2024 EV/EBITDA multiple of 1.4x, significantly lower than the median figure of 3.8x for the six largest U.S. automakers by market share. This year, the company is confronting a "double whammy" of challenges. In addition to contending with the potential financial burden of tariffs, Stellantis has also been grappling with substantial inventory levels—a repercussion of its waning pricing competitiveness. Despite these hurdles, we view this as a strategic opportunity to initiate a long position. It is anticipated that the automotive giant will navigate the emerging challenges of 2025 effectively.

Our target price for the Company is set at $11.3, with a "Buy" recommendation. To mitigate any potential downside risks, we suggest setting a stop-loss at $8.7.

Post-Report Sell-Off Seen as UnwarrantedSupporting Arguments

The market's reaction to the Q1 report was excessively negative

The stock possesses fundamental upside potential driven by a high revenue growth rate

The technical analysis indicates a probable rebound

Investment Thesis

GeneDx (WGS) specializes in delivering precise medical diagnostic results, leveraging exome and genomic testing to accurately diagnose genetic disorders. The company exclusively generates its revenue within the United States.

The recent GeneDx report significantly exceeded market expectations, yet the market's reaction was starkly negative. In our assessment, this presents a promising acquisition opportunity for WGS. Revenue for the first quarter of 2025 surpassed consensus estimates by 9.6%, also resulting in a substantial positive EPS surprise. The company has revised its full-year 2025 revenue guidance upwards by a median of $12.5 million, now projecting between $360 million and $375 million. This adjustment accounts for an anticipated $3 million to $5 million in revenue from the prospective acquisition of Fabric Genomics. The net increase in the guidance aligns closely with the value realized from the first-quarter surprise.

The only potentially contentious aspect of the report is the recorded 0.5% q/q decline in testing volumes within the largest revenue-generating segment, exome and genome sequencing. This trend has not been observed in this segment before. However, a seasonal dip in Q1 testing volumes is typical within the laboratory industry. This decline is primarily driven by a reduced number of working days in the first quarter and heightened diagnostic demand in Q4, as patients seek to maximize their insurance benefits before year-end. Historically, the low base effect coupled with GeneDx's robust sequential growth has counterbalanced unfavorable seasonal trends in Q1. Additionally, in the latest quarter, management cited the California wildfires as a possible negative influence on testing volumes. Consequently, we believe this testing dynamic does not warrant the marked downtrend seen in the price of WGS, especially given the upgraded guidance and the expansion of the product portfolio, both of which are poised to drive revenue growth over the next three years.

WGS stock is fundamentally undervalued. The GeneDx peer group has maintained a trading average of a 6.8 EV/Sales multiple over the past three years. We regard this figure as an appropriate target for GeneDx. Presently, the 2026 EV/Sales multiple stands at 5.6. We believe that sustained robust revenue growth over the next three years provides ample opportunity for valuation appreciation from the existing levels. Utilizing comparative valuation metrics, we project a target price for WGS shares at $87 over the next two months, accompanied by a "Buy" recommendation.

To mitigate risks, we advise establishing a stop-loss at $58. From a technical standpoint, a robust short-term support zone is identified within the range extending from $60 to the 200-day moving average.

$USPCEPIMC -U.S PCE Inflation Slows as Expected (March/2025)ECONOMICS:USPCEPIMC -U.S PCE Inflation Slows as Expected (March/2025)

ECONOMICS:USPCEPIMC

March/2025

source: U.S. Bureau of Economic Analysis

-The personal consumption expenditure price index in the US was unchanged in March from February 2025, the least in ten months, and following a 0.4% rise in each of the previous two months, in line with expectations.

Prices for goods fell 0.5%, after a 0.2% increase in February and prices for services went up 0.2%, easing from a 0.5% rise.

Meanwhile, the core PCE index, which excludes volatile food and energy prices, was also unchanged, compared with forecasts for a 0.1% increase.

Separately, food prices rose 0.5% (vs a flat reading) while prices for energy goods and services dropped 2.7% (vs 0.1%).

Finally, the annual PCE rate decreased to 2.3%, the lowest in five months, and the annual core PCE inflation also eased to 2.6%.

$USGDPQQ -U.S Economy Unexpectedly Contracts in Q1/2025ECONOMICS:USGDPQQ

Q1/2025

source: U.S. Bureau of Economic Analysis

-U.S economy shrank 0.3% in Q1 2025, the first contraction since Q1 2022,

versus 2.4% growth in Q4 and expectations of 0.3% expansion, as rising trade tensions weighed on the economy.

Net exports cut nearly 5 percentage points from GDP as imports jumped over 40%. Consumer spending rose just 1.8%,

the weakest since mid-2023, while federal government outlays fell 5.1%, the most since Q1 2022.

$USIRYY -United States CPI (March/2025)ECONOMICS:USIRYY

(March/2025)

source: U.S. Bureau of Labor Statistics

- The annual inflation rate in the US eased for a second consecutive month to 2.4% in March 2025, the lowest since September, down from 2.8% in February, and below forecasts of 2.6%.

Prices for gasoline (-9.8% vs -3.1%) and fuel oil (-7.6% vs -5.1%) fell more while natural gas prices soared (9.4% vs 6%).

Inflation also slowed for shelter (4% vs 4.2%), used cars and trucks (0.6% vs 0.8%), and transportation (3.1% vs 6%) while prices were unchanged for new vehicles (vs -0.3%).

On the other hand, inflation accelerated for food (3% vs 2.6%).

Compared to the previous month, the CPI decreased 0.1%, the first fall since May 2020, compared to expectations of a 0.1% gain.

The index for energy fell 2.4%, as a 6.3% decline in gasoline more than offset increases in electricity (0.9%) and natural gas (3.6%).

Meanwhile, annual core inflation eased to 2.8%, the lowest since March 2021, and below forecasts of 3%.

On a monthly basis, the core CPI edged up 0.1%, below expectations of 0.3%.

Driven Brands Holdings: Dominating North America's Auto ServicesKey arguments in support of the idea.

A potential rise in U.S. car prices may positively impact the company’s sales.

DRVN is expanding its footprint in the essential automotive services market, simultaneously reducing its car wash segment with more cyclical sales.

Investment Thesis

Driven Brands Holdings Inc. (DRVN) is the largest automotive services company in North America, operating an increasing network of approximately 5,200 franchise, independently owned businesses operated by the company across 49 U.S. states and 13 other countries. The company has a footprint in all major automotive service areas, catering to both retail and commercial customers. Its main business segments include car maintenance and repair, express car wash, bodywork and paint services.

U.S. car import tariffs, introduced in March, support the trend of an increasing average age of cars on U.S. roads and may lead to higher car prices. These factors may contribute positively to DRVN’s revenue growth. On April 3, a 25% tariff on cars imported to the U.S. will take effect, and by May 3, equivalent tariffs on automotive components will be implemented. These tariffs may disrupt automakers’ production processes due to a reconfiguration of production chains. Only half of the 16 million new cars sold annually in the U.S. are produced domestically, while other autos could be subject to these tariffs. Production disruptions may result in price increases for both new and used cars. Many consumers may delay purchasing new cars, opting instead to spend more on maintaining their current vehicles. The new factors support the general long-term trend to an increasing average age of cars on U.S. roads. In 2000, the average vehicle age in the U.S. was 8.9 years; it has now grown to 12.6 years and continues to rise annually. Despite this, the total number of vehicles on U.S. roads is also steadily increasing at an average annual rate of about 1% over the past two decades. Combined with the new tariffs, the overall growth of the automotive aftermarket is likely to boost DRVN’s revenue in the upcoming years.

Driven Brands continues successfully shifting its focus to essential automotive services. After 2023, the company began reducing its ownership of standalone car washes while expanding its Take 5 Oil Change locations. Take 5 Oil Change provides rapid oil change services within 10 minutes, allowing drivers to remain in their cars. In March, reports have indicated that Driven Brands plans to sell its Take 5 Car Wash chain. We suppose this deal will accelerate the expansion of the Take 5 Oil Change segment and enable the company to allocate some proceeds toward debt reduction, potentially decreasing debt service expenses by up to 20%.

The valuation of DRVN stock, compared to its peers, shows potential for growth. DRVN’s valuation corresponds to 14 projected earnings for 2025, aligning with the average valuation among U.S. car dealers. Nonetheless, DRVN’s potential for revenue growth in the coming years is anticipated to surpass that of its peers. In the last three quarters alone, the Take 5 segment has demonstrated a sequential revenue increase of 10%, accounting for about 60% of the company’s total sales.

We suppose that Driven Brands Holdings Inc. (DRVN) shares may exhibit positive momentum in the near term.

The target price for DRVN shares over a two-month horizon is $19.90, with a “Buy” rating. We suggest setting a stop-loss at $15.50.

$USPCEPIMC -U.S Core PCE Inflation Rises More than ExpectedECONOMICS:USPCEPIMC

(February/2025)

source: U.S. Bureau of Economic Analysis

- The US PCE price index rose by 0.3% month-over-month in February, maintaining the same pace as the previous two months.

The core PCE index increased by 0.4%, the most since January 2024, surpassing the forecast of 0.3% and up from 0.3% in January.

On a year-over-year basis, headline PCE inflation remained steady at 2.5%, while core PCE inflation edged up to 2.8%, above the expected 2.7%.

#UNI/USDT#UNI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 5.50.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 6.20

First target: 6.75

Second target: 7.28

Third target: 7.92

$USINTR - U.S Interest Rates (March/2025)ECONOMICS:USINTR

March/2025

source: Federal Reserve

- The Fed keep the funds rate unchanged at 4.25%-4.5%,

but signaled expectations of slower economic growth and rising inflation.

The statement also noted that uncertainty around the economic outlook has increased, but officials still anticipate only two quarter-point rate reductions in 2025.

$USPCEPIMC -U.S Price Index (January/2025)ECONOMICS:USPCEPIMC 0.3%

(January/2025)

source: U.S. Bureau of Economic Analysis

- The US Personal Consumption Expenditures (PCE) price index increased by 0.3% month-over-month in January 2025, the same pace as in December, and in line with expectations.

Prices for goods increased 0.5%, following a 0.1% rise in December and prices for services rose at a slower 0.2%, after a 0.4% gain in the previous month.

Meanwhile, the core PCE index, which excludes volatile food and energy prices, rose 0.3%, slightly above the 0.2% gain recorded in the previous month, and also matching forecasts.

Food prices went up 0.3%, higher than 0.2% in December while cost of energy eased (1.3% vs 2.4%). On a year-over-year basis, headline PCE inflation eased to 2.5% from 2.6%, marking its first slowdown in four months. Similarly, core PCE inflation declined to 2.6%, its lowest level in seven months, from an upwardly revised 2.9%.