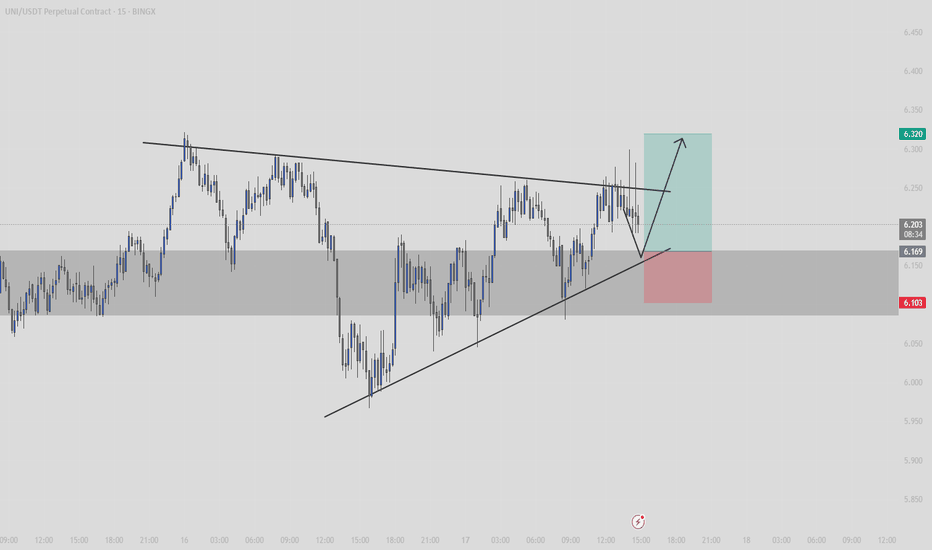

UNIUSDT: A Massive Bullish Move Loading… or a Trap?Yello, Paradisers! Is UNIUSDT finally gearing up for a major breakout, or is this just another fake move before a deeper correction? Let’s break it down.

💎UNIUSDT is currently trading within a descending channel, increasing the probability of an upcoming bullish move. The key support zone is holding strong, and we might be witnessing the early signs of a double-bottom formation—a classic reversal pattern.

💎However, confirmation is everything in trading. To increase the probability in our favor, we need to see: Bullish divergence, Bullish I-CHoCH (Internal Change of Character), Bullish reversal patterns such as a W-pattern or inverse head and shoulders from our support zone.

💎If UNIUSDT retraces further, we expect a bounce from the strong support zone—but again, we must wait for clear bullish confirmations before taking any positions.

💎The invalidation level? If price breaks and closes candle below the strong support zone, the entire bullish setup gets invalidated. In that case, we wait patiently for better price action before considering any new trades.

🎖Patience and discipline are key, Paradisers. Many traders will get trapped in bad positions, but those who wait for the right confirmations will be the ones making money. Trade smart & stick to high-probability setups only.

MyCryptoParadise

iFeel the success🌴

Uniusdt

UNI – Long Spot Trade Setup Following Breakout and RetestUniswap (UNI) has recently broken out of resistance and successfully retested it as support, forming a strong bullish structure. If Ethereum (ETH) continues upward, UNI is likely to benefit from correlated momentum, potentially kicking off a larger rally.

🔹 Entry Zone:

$5.46 – $5.95 (post-breakout retest zone)

🎯 Take Profit Targets:

🥇 $7.50 – $8.00

🥈 $10.00 – $10.50

🛑 Stop Loss:

$4.10

Should You Invest in Uniswap $UNI Crypto Right Now?Grab your popcorn, or whatever you vibe with—because today I will analyze Uniswap. Yep, the decentralized trading protocol that lets you swap tokens like Pokémon cards, but without asking mom for permission.

So, what is Uniswap? Simple. It’s like the vending machine of the crypto world. Wanna swap your Ethereum CRYPTOCAP:ETH for some Shiba Inu? Go ahead. No sign-up. It’s peer-to-peer, decentralized.

Remember those juicy monthly demand levels at $3.868 and $4.750 we discussed at the Set and Forget Trading Community? Yeah, those weren't just random numbers pulled from a bingo machine. That’s where big buyers stepped in, creating a supply and demand imbalances. Translation: There were way more people wanting to buy than sell, which made the price go UP. Magic? No. Just basic market dynamics, people.

And guess what? Those levels played out beautifully. Buyers showed up, price popped, and if you were patient, you got paid. If you weren’t… well, you can enjoy your bag of regrets.

Now, here’s where it gets interesting. The daily timeframe is now trending UP. We’ve officially seen the creation of a fresh imbalance at $5.19. That’s our new price level for buying Uniswap. But are we buying right now? NOPE.

Because here’s the golden rule of trading and investing: Patience is key. I know, I know—it’s boring. Waiting feels like watching paint dry… but on the blockchain. But trust me, the market doesn’t care about your feelings or my feelings.

We're waiting for price to pull back into $5.19, where the last big buyers left a footprint the size of a crypto whale. When will it get there? We don't know. THEN we’ll look to repurchase. Not before.

So remember—Uniswap is a beast in the DeFi world. Supply and demand is your best friend. And above all, don’t chase the pump. Let it come to you. Like a well-trained dog… or a well-behaved altcoin.

Uniswap Perfect Bullish Chart With New ATH Potential Late 2025Uniswap has a chart with perfect symmetry. It is a beautiful chart, well organized, and it shows a very strong potential for a new All-Time High to be hit later this year or in early 2026.

The market bottom happened in November 2020 for UNIUSDT. This bottom low marked the start of the 2021 bull market which is clearly visible on the chart.

The bull market in 2021 produced a wave totaling 2,462% growth, that's more than 25X.

The same low/level/support that was activated in November 2020 and launched the previous bull market wave was again activated in June 2022. This low marked the 2022 bear market bottom and from this point a long-term consolidation period (sideways market) developed, with higher highs and higher lows.

There was a major low in August 2024 and the last one, April/May 2025. The current low can be equated to something similar to November 2020, from this point on, we will not see small waves as in the past three years but a major bull market. Like 2021 but much bigger. It will be huge.

A new All-Time High is not only possible but very easy for this pair, very easy...

The action will push prices beyond what is shown on this chart.

Timing is great. Prices are great. This is an easy buy and hold.

After you buy, the market will grow for months and months and months before peaking. You can't go wrong with bottom prices. The time to buy is now, when prices are low.

Namaste.

UNI Uniswap Breakdown. Support Hit but is there More Downside?🔎 I'm currently analyzing UNI/USDT (Uniswap paired with Tether) and observing a clear bearish trend 📉 on the daily timeframe. Price has recently tapped into a key support zone 🟦, and we’re now seeing a short-term retracement from that level.

However, with Bitcoin currently overextended ⚠️ and showing signs it may pull back, there's a strong possibility that UNI could continue to drop if BTC rolls over. Correlation plays a major role here. 📊

In this video, I break down essential elements of the chart:

📌 Market Structure

📌 Price Action

📌 The prevailing Trend

📌 Key Support & Resistance Zones

You'll also hear my personal take on a potential trade setup — if price action continues to unfold in line with the criteria discussed.

📚 This content is for educational purposes only and is not to be considered financial advice. 🚫💼

UNI Price Action Breakdown. Support Hit but is there More Downside?

Short-Term Short Position UNI/USDT🔥 UNI/USDT – Approaching Key Short Zone

Uniswap (UNI) has formed a rising wedge structure after rebounding from local lows. Price is now nearing a critical short zone around 5.762 – 5.804, where sellers could potentially step in if UNI fails to break above with conviction.

🟣 Zone to Watch

“Possible Short Zone” (in purple) — a high-probability entry area for short trades given the overhead resistance and wedge convergence.

🔴 Entry Points:

Entry 1: ~5.762 (initial level)

Entry 2: ~5.804 (upper boundary)

📉 Momentum & Setup

Chart Formation: The rising wedge often suggests bullish exhaustion; a decisive break below wedge support can signal a bearish shift.

Volume Consideration: Look for a sell-volume uptick or a clear rejection around 5.70 – 6.2 to confirm the short setup.

🟢 Take-Profit Zones

✅ TP1: ~5.549

✅ TP2: ~5.315

✅ TP3: ~4.957

✅ TP4: ~4.244 (Extended downside if momentum persists)

❌ Invalidation Level: 6.265+

(A strong close above this level indicates a bullish breakout from the short window.)

🧠 Narrative

This setup highlights a possible bearish retest, as UNI’s rebound has propelled price into a narrowing wedge near major resistance. Should buyers fail to push beyond 5.70, aggressive sellers may anticipate a correction. A volume-backed rejection here could see UNI retrace to lower support levels.

🎲 Market Context

Monitor broader crypto sentiment and Bitcoin’s performance; strong market momentum could negate the bearish bias, while a market-wide pullback may accelerate downside.

📌 Risk Management

Position Sizing: Adjust to your risk tolerance and never overexpose.

Stop-Loss: Place it above 6.265+ to avoid unexpected breakouts.

Remain flexible and reevaluate if price action shows continued strength above the wedge.

UNI Trade Setup - Strength After Liquidity SweepUNI has swept underside liquidity and is now holding strong. If price consolidates above $7, we’ll be looking for local lows to form, setting up a medium-term move higher as broader markets push into resistance.

🛠 Trade Details:

Entry: Around $7 zone

Take Profit Targets:

$10.50 – $11.00 (First Target)

$14.50 – $15.00 (Extended Target)

Stop Loss: Daily close below $5.5

Waiting for market confirmation before positioning for the next leg up! 📈🚀

#UNI/USDT#UNI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 5.50.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 6.20

First target: 6.75

Second target: 7.28

Third target: 7.92

TradeCityPro | UNIUSDT Ready to Break the Trend Line👋 Welcome to TradeCityPro Channel!

Let's analyze and review one of the best crypto DeFi projects and projects that have good income in the crypto space!

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

In the weekly time frame, we are witnessing a deep correction of this coin and the situation is not very good and these events are also due to the recent negative news in the market, but we experienced a 68 percent drop!

We have now reached an important support which is 5.599 and in terms of price it is really a good price for the yoni but I don't have any suggestions to buy it right now because it is a very strong downtrend and we need to form a structure!

Even if we need to lose a percentage of the movement, we will lose it so that we can enter with the momentum and we do not need to buy a step like the others and for now we will watch for a purchase, but to exit after the level of 4.051, I will exit myself

📈 Daily Timeframe

The same thing is happening on the daily time frame and after being rejected from 18.664 and not reaching this price ceiling, we went for a price correction and formed a box between 12.830 and 15.264

After breaking the bottom of this box, we started a downward movement and I had a bounce to this support and I went to continue the fall and now we have reached the important support of 5.617 and we are probably going to go for a time range and form a box

Currently, it is expected that we will go for a range and form a price structure and we must consider that sellers are no longer willing to sell and have been on it for a few days This is the support level and it is not a good level to buy at the moment, but if we form a box after it breaks, we can buy.

⏱ 4-Hour Timeframe

On the four-hour time frame, this recent decline is also clearly visible on the chart and has even caused us to form a downward trend line of the retracement type.

I should mention that trend lines are divided into two categories: retracement and continuation. Continuing trend lines are those that continue our main trend after the trend line breaks and usually we do not need a trigger to trade it, but retracement trend lines are trend lines that change our main trend and to open a position with them, I myself wait for the trend line to break and a confirmation trigger!

📈 Long Position Trigger

with the above explanation, after the trend line and trigger 6.287 break, we can open a risky long position, but if this happens, by forming a higher bottom and top after breaking that top, we will have a much better trigger and we are more confident that the trend will continue

📉 Short Position Trigger

our task is completely specific, and after breaking 5.721, we can open our position, and we can also continue to do the same with each rejection from this trend line and get confirmation for the position if the volume increases, but our main trigger will still be 5.721

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Uniswap will reach 150$Technical Analysis of Uniswap Chart

Overall Trend and Structure:

The chart shows a multi-phase trend: an initial upward move in mid-2024, a consolidation phase with lower highs and lower lows forming a descending pattern, and a sharp bullish breakout in early 2025 (around March 2025).

The recent steep upward movement suggests strong buying pressure, potentially indicating a breakout from a corrective pattern (e.g., descending triangle or wedge).

Key Trendlines and Levels:

Descending Trendline: The orange descending trendline connects the lower highs during the consolidation phase, acting as resistance. The price breaking above this trendline in early 2025 is a bullish signal, suggesting the end of the corrective phase.

Horizontal Support/Resistance: The orange horizontal line near the middle of the chart likely served as support during consolidation (possibly around $10–$12 on an adjusted scale). The breakout above this level reinforces bullish momentum.

Recent Surge: The vertical orange line on the right indicates a rapid price increase, potentially pushing UNI from the $10–$12 range to $15–$20 (adjusted from the $16,000,000 mark on the y-axis, assuming a $0–$30 scale).

Candlestick Patterns and Momentum:

The candlesticks show volatility, with green candles dominating the recent surge, indicating strong bullish momentum. Red candles during consolidation suggest profit-taking or selling pressure that has now been overcome.

The steepness of the rise suggests high volume or a catalyst (e.g., news, DeFi adoption, or Ethereum ecosystem developments), though volume data isn’t visible.

Potential Technical Patterns:

The chart resembles a descending triangle or wedge breakout. A descending triangle typically signals a bearish continuation, but an upward breakout (as seen here) can indicate a reversal to a bullish trend, especially if supported by volume.

The breakout above the trendline suggests a potential target measured by the height of the triangle base (e.g., if the base is $5 wide, add $5 to the breakout point, targeting $20–$25).

Support and Resistance Levels:

Support: The broken trendline and horizontal line (now support) around $10–$12 are critical. A pullback to retest this level would be a common post-breakout behavior.

Resistance: The next resistance might be at the recent high (e.g., $20) or a psychological level like $25, based on historical UNI peaks (e.g., its all-time high of $44.97 in May 2021).

Overbought conditions could emerge if the rally continues unchecked, warranting caution.

Market Context and Sentiment:

Uniswap, as a leading DeFi protocol, benefits from Ethereum’s ecosystem growth, protocol upgrades (e.g., Uniswap v4 or Unichain), and increasing DeFi adoption. The recent surge might reflect such developments in early 2025.

Web-based price predictions for March 2025 vary widely: averages range from $6.30 to $12.69, with highs up to $13.58–$25.75, suggesting the chart’s surge aligns with an optimistic scenario. Posts on X indicate mixed sentiment, with some noting bearish pressure earlier in March (-30% reported) but others highlighting bullish potential if demand zones hold.

The chart’s bullish breakout contrasts with some bearish technical indicators (e.g., RSI oversold at 34.69 noted on X), suggesting a possible short-term correction after the rapid rise.

Interpretation and Outlook

Bullish Case: The breakout above the descending trendline and horizontal support signals a strong bullish reversal. If momentum continues, UNI could target $20–$25 in the near term, supported by DeFi growth and market sentiment. A retest of $10–$12 as support would confirm the breakout’s validity.

Uniswap will reach $135Timeframe : Weekly chart

Price Levels:

The current price is not explicitly labeled, but the chart shows a range from approximately $4 to $6.32 (based on the visible y-axis and the latest candlestick).

The price action spans from a low near $4 in late 2022 to a peak around $6.32 in early 2025, with a correction phase labeled.

Trend Overview:

2022-2023: The price starts around $4 and experiences a gradual uptrend with some volatility, consolidating between $4 and $5 for much of this period.

2024: A sharp upward move occurs, peaking near $6.32, followed by a correction phase.

Early 2025: The price is in a consolidation or correction phase, with the latest candlesticks showing a slight recovery.

2. Key Patterns and Annotations

Descending Triangle:

The chart features a descending triangle pattern, similar to the Ethereum chart you shared earlier.

Upper Resistance: A horizontal resistance line around $6.32 (the recent peak).

Lower Support: A descending trendline (sloping downward) that the price has been testing, currently near $4.50-$5.00.

The price is approaching the apex of the triangle, suggesting an impending breakout (upward or downward).

Correction Phase:

The chart labels a "Correction" phase after the peak at $6.32, where the price retraced to the $4.50-$5.00 range.

This correction likely reflects profit-taking or broader market pressure after the rally.

Breakout Prediction:

An upward arrow is drawn, indicating a potential breakout to the upside, possibly targeting the $6.32 resistance again or higher. This suggests optimism for a significant upward move.

3. Support and Resistance Levels

Support:

The $4.50-$5.00 level appears to be a strong support zone, as the price has bounced multiple times in this range during the correction.

If this support breaks, the next level could be around $4.00 (a psychological and historical support from 2022-2023).

Resistance:

The $6.32 level is a key resistance, marking the recent high. A break above this could signal a continuation of the prior uptrend.

Intermediate resistance might be around $5.50-$6.00, a prior consolidation zone.

4. Volume and Momentum (Not Visible but Inferred)

Volume bars are not clearly visible, but typical behavior suggests:

Volume likely increased during the rally to $6.32 and decreased during the correction as selling pressure eased.

A breakout would need a volume spike to confirm, especially if the price breaks above the descending trendline (around $5.50-$6.00).

Momentum indicators (e.g., RSI or MACD) could help determine if the price is oversold or showing bullish divergence, supporting a reversal.

5. Potential Scenarios

Bullish Breakout:

If UNISWAP breaks above the descending trendline (around $5.50-$6.00) with strong volume, it could confirm the breakout.

The target might be the $6.32 resistance, representing a ~20-25% move from the current $5.00 level, or potentially higher if momentum carries it past the prior peak.

This aligns with the upward arrow and suggests accumulation by larger players (e.g., whales) during the correction.

Bearish Breakdown:

If the price fails to hold the $4.50-$5.00 support and breaks below, it could signal a bearish continuation.

The next support at $4.00 could be tested, potentially leading to further downside.

Consolidation:

If the price remains within the triangle (between $4.50 and the descending trendline), it might continue to consolidate until a catalyst (e.g., market news, volume surge) triggers a move.

TradeCityPro | Deep Search: In-Depth Of Uniswap👋 Welcome to TradeCity Pro

Today, we have a Deep Research on the Uniswap project. In this analysis, I will fully review this project. First, let's go over the project's details, and then I'll analyze UNI technically.

🔍 What is Uniswap?

Uniswap is a decentralized exchange (DEX) operating on the Ethereum blockchain that allows users to swap ERC-20 tokens without relying on traditional order books. Instead, it uses an Automated Market Maker (AMM) model, where liquidity providers add funds to pools and earn trading fees.

Uniswap was founded by Hayden Adams and launched in 2018. Since then, it has gone through multiple upgrades, with Uniswap V3 being the most recent version, offering improved capital efficiency.

🗝 Key Features:

Decentralized & Permissionless: No central authority controls trading.

Liquidity Pools: Users provide liquidity and earn a share of trading fees.

AMM Model: Uses the x*y = k formula to maintain price balance.

Non-Custodial: Users retain control over their assets.

No Listing Fees: Anyone can list tokens, unlike centralized exchanges.

🔍 UNI Token Overview

UNI is the governance token of Uniswap, allowing holders to vote on protocol upgrades and treasury decisions.

🔹Tokenomics

Total Supply: 1 billion UNI

Inflation Rate: After September 2024, a 2% perpetual annual inflation will be introduced.

Circulating Supply: UNI is released gradually over 4 years.

Current Circulating Supply: About 550M UNI

🔹Token Allocation

Governance: 45% - 450M UNI

Team: 21.3% -212.66M UNI

Investors: 18%- 180.44M UNI

Community Token Distribution:15%- 150M UNI

Advisors: 0.69%- 6.9M UNI

Now that we have reviewed the project, let’s move on to the chart to analyze it from a technical perspective.

🔹Uniswap’s Evolution: V1, V2, V3

Uniswap V3 Innovations

-Concentrated Liquidity: LPs can set price ranges for providing liquidity.

-Multiple Fee Tiers: Traders can select different fee levels (0.05%, 0.3%, 1%).

-Capital Efficiency: More precise liquidity allocation for better returns.

—

🔒Token Unlock & Vesting Schedule

Current Unlock Progress

- Unlocked: 55% (549.94M UNI)

- Untracked: 45% (450M UNI)

- Locked: 0% (All tokens are being tracked or unlocked)

—

🔹Vesting Schedule

Group - Vesting Duration - Unlock

Team : 47 months (ended Aug 2024) -2.08% monthly

Investors: 47 months (ended Aug 2024)- 2.08% monthly

Community Distribution:Fully unlocked- 100% at TGE

Advisors: 47 months- 2.08% monthly

⚠️Important: The untracked 450M UNI tokens can be unlocked at any time, making them a potential source of market volatility.

—

Uniswap Governance & DAO

The Uniswap DAO allows token holders to participate in protocol decisions.

Governance Process:

1) Proposal Submission – Requires 25,000 UNI votes to enter deliberation.

2) Consensus Check – Needs 50,000 UNI votes to proceed.

3) Final Governance Vote – 40M yes-votes required for approval.

Uniswap DAO Treasury

$1.6 Billion worth of assets.

Previously largest DAO, now second (behind BitDAO).

—

❗️Security & Risks

🔹Security Measures

1) Smart Contracts Audited – Regular security reviews.

2) Decentralized Governance – Protocol updates are voted on by UNI holders.

3) Non-Custodial – Users always control their own funds.

🔹Risks

1)Ethereum Gas Fees – High network congestion leads to expensive swaps.

2) Impermanent Loss – LPs may lose value if token prices shift.

3) Governance Risks – Power concentrated among whales.

4) Smart Contract Exploits – DeFi platforms remain high-risk targets.

🖼NFT Expansion – Uniswap Acquires Genie

Uniswap acquired Genie, an NFT marketplace aggregator, to integrate NFT trading into its ecosystem.

🔹Genie Features:

-Aggregates NFTs from multiple marketplaces.

-Batch NFT purchases in one transaction (reducing gas fees).

-Plans for USDC airdrops to early Genie users.

Uniswap had previously launched NFT-backed Unisocks (2019), linking real-world assets to NFTs.

—

👛Best UNI Wallets

MetaMask

Trust Wallet

Ledger

Coinbase Wallet

SafePal

Solflare

OKX Wallet

—

💲Uniswap Team & Key Investors

Hayden Adams: Founder & CEO

Mary-Catherine Lader: COO

Marvin Ammori: CLO

💵Major Investors

Coinbase Ventures

Defiance Capital

Paradigm

ParaFi Capital

Delphi Digital

💰Total Funding Raised: $188.80M

🎯Uniswap's 2025 Roadmap and UNI Token Developments

In early 2025, Uniswap introduced Uniswap v4, marking a pivotal evolution in its protocol. This version emphasizes developer flexibility through the integration of "hooks," modular plugins that allow for tailored functionalities such as dynamic fees and automated liquidity management. These enhancements position Uniswap v4 as a versatile platform for DeFi developers, fostering innovation and adaptability within the ecosystem.

Unichain: Uniswap's Layer-2 Scaling Solution

To address scalability and transaction efficiency, Uniswap launched Unichain, its proprietary Layer-2 solution, on January 6, 2025. Built on the OP Stack, Unichain aims to deliver faster transactions and reduced fees, enhancing the overall user experience. The mainnet launch follows a successful testnet phase that processed over 50 million test transactions, underscoring its readiness for broader adoption.

—

🔹Several reputable platforms for creating liquidity pools

Uniswap

Pancakeswap

Raydium

Shibaswap

Biswap

MDEX

Balancer

Thena

Quickswap

Defiswap

Honeyswap

Warden

—

🔹Certik: 94.28

📈On-Chain Analysis of UNI

Analyzing Uniswap’s on-chain data, we observe key trends in profit and loss positioning, whale activity, and network engagement:

Around the $7.40 price level, approximately 39.55 million UNI tokens are in a loss position, indicating a potential resistance zone. Meanwhile, support levels remain weak due to a lower volume of profitable tokens.

Large transactions show slight spikes during price declines, suggesting a lack of strong buying interest from major investors.

Whales hold 51% of the total supply, making their trading activity crucial. Currently, addresses with holdings between 100 million to 1 billion UNI and 10 million to 100 million UNI are engaging in selling, adding downward pressure on price.

Network activity, including active and new addresses, is on a declining trend, signaling reduced user engagement and transaction volume.

Based on on-chain metrics, there is no significant buying pressure or demand at the moment, raising concerns over short-term price recovery.

📊Uniswap TVL Analysis

Since early December, Uniswap's Total Value Locked (TVL) has shown a slight increase, rising from 1.72 million ETH to 1.94 million ETH. However, this growth remains considerably lower compared to the levels observed in 2021, reflecting a slower pace of liquidity accumulation.

Now that we have reviewed the project, let’s move on to the chart to analyze it from a technical perspective.

📅 Weekly Timeframe

In the weekly timeframe, we observe a long-term range-bound trend with a slight upward slope. Currently, the price is experiencing a downward move, with the primary support at 5.841.

💫 If this level breaks, the price may continue declining, and the next key support is at 4.025. On the other hand, if RSI does not drop below 38.74 and the price holds above 5.841, we can have more confidence in a potential price increase.

🎲 In this scenario, the key resistance levels are 11.638 and 18.794. The main trigger for buying is the breakout of 18.794, and the major sharp price movement will occur after breaking the ATH resistance at 42.92.

🔽 The critical support level that should not be lost is 4.025, as breaking below this level could result in a sharp bearish movement, and in that case, we will use Fibonacci tools to determine the bearish targets.

📅 Daily Timeframe

Now, let’s move to the daily timeframe for a more detailed view.

🔍 As seen in this timeframe, after price consolidation below 12.559, the second corrective wave has begun, and the price has currently fully retraced the previous bullish wave, reaching 6.670.

📉 If this level breaks, the next key supports are 5.556 and 4.025, with 4.025 overlapping with the 1.5 Fibonacci extension.

⚡️ If the price finds support at the current level, an appropriate trigger for a long position would be the breakout of 43.54 in RSI, which can serve as a momentum confirmation. Once RSI breaks this level, we can look at lower timeframes to define a precise entry trigger.

🔽 On the other hand, if RSI enters the Oversold zone, the likelihood of breaking 6.670 or even 5.556 increases.

🛒 For a spot buy, the current valid trigger is a breakout of the $10 level, which is the last local high in this timeframe. The exact number for this breakout level will be determined based on price action and its reaction when it approaches the area.

💥 If the price experiences further decline and establishes new highs and lows, the spot buy entry should be based on the breakout of the newly formed high in the downtrend.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

UNI Trade Setup: Key Support RetestUNI has pulled back into a primary support zone at $7.20, a critical area for bulls to hold. A bounce from this level could trigger upside momentum, while a breakdown could invalidate the bullish structure.

🛠 Trade Details:

Entry: Around $7.20

Take Profit Targets:

$9.00

$10.00

$13.00

Stop Loss: Daily close below $6.50

If buyers step in strongly at support, UNI could stage a significant recovery. Keep an eye on market conditions! 🚀

UNISWAP aims for an all-time highOn the monthly chart we see a very strong green candle, which hints about the further growth of not only UNISWAP but all altcoins in general! I just want to say that this is an undervalued project that has everything ahead of it. I would expect a price in the area of 1.618 Fibonacci levels, which corresponds to about 70$ per coin.

Horban Brothers.

UNI is at a bottom!BINANCE:UNIUSDT

UNI is at a bottom right now! if we use Fibonacci retracement on the chart, we can understand that the price is at a great support. and we shall wait for it to ascend to the 61.80 line.

once a support,now becomes a resistance. the 61.80 was a support a few days back but now It's a Resistance.if the price breaks the line,It can become a support once again!

⚠️ Disclaimer:

This is not financial advice. Always manage your risks and trade responsibly.

👉 Follow me for daily updates,

💬 Comment and like to share your thoughts,

📌 And check the link in my bio for even more resources!

Let’s navigate the markets together—join the journey today! 💹✨

UNIUSDT Perpetual Swap Contract (4H - OKX) AnalysisUNIUSDT Perpetual Swap Contract (4H - OKX) Analysis

1. Trend Analysis

Overall Bearish Trend:

UNI has been in a strong downtrend, forming lower highs and lower lows.

The price is still below EMA 50, EMA 100, and EMA 200, confirming bearish momentum.

A Break of Structure (BOS) occurred earlier, reinforcing the downtrend.

Potential Reversal Signals:

The price bounced off the demand zone (around 10.22 USDT) and is attempting a recovery.

It is now testing EMA 20, and if it can break above EMA 50, a short-term reversal may be confirmed.

A successful break of 12.158 USDT (TP1) could push price higher towards EMA 50 and 100.

2. Key Resistance & Support Levels

Resistance Levels:

12.510 USDT (EMA 50 & local resistance) → Immediate resistance that UNI must break to continue higher.

13.302 - 13.590 USDT (EMA 100 & Fib 0.618) → If price reaches here, expect stronger resistance.

14.680 - 15.037 USDT (Fib 0.786 & EMA 200) → A major resistance zone. If broken, UNI could enter a bullish trend reversal.

Support Levels:

11.098 - 10.922 USDT (Demand Zone & Previous Bounce Area) → Strong support where buyers stepped in.

10.22 USDT (Entry Level from Demand Zone) → If price retests this level, it must hold to prevent further downside.

9.066 USDT (SL Level) → If UNI breaks below this level, further downside is expected.

3. Risks & Concerns

Low Volume on Bounce:

The price has bounced, but volume remains weak, meaning this could be a short-lived recovery.

UNI needs a strong volume breakout above EMA 50 to confirm a bullish reversal.

Bearish Market Structure Still in Play:

Even if UNI moves higher, it remains in a downtrend unless it clears 13.590 USDT (EMA 100).

A rejection at 12.510 USDT could lead to another move downward.

EMA Resistance Overhead:

UNI is facing multiple moving average resistances (EMA 50, EMA 100, EMA 200).

If price struggles to break EMA 50 at 12.510 USDT, selling pressure may return.

4. Trading Strategy

✅ Long Scenario (If Bullish Breakout Occurs):

Entry: If price holds above 12.158 USDT (TP1 level).

Target 1: 12.510 USDT (EMA 50 Resistance)

Target 2: 13.302 - 13.590 USDT (EMA 100 & Fib 0.618)

Target 3: 14.680 - 15.037 USDT (EMA 200 & Fib 0.786)

Stop-Loss: Below 10.922 USDT (Demand Zone)

✅ Short Scenario (If Price Rejects at Resistance):

Entry: If UNI fails to break 12.510 USDT (EMA 50 Resistance)

Target 1: 11.707 - 11.098 USDT (Local Support Zone)

Target 2: 10.922 - 10.220 USDT (Demand Zone Retest)

Target 3: 9.066 USDT (Extended Downside)

Stop-Loss: Above 12.750 USDT to prevent being stopped out on a breakout.

5. Summary & Outlook

📌 UNI has bounced from a demand zone but still faces strong resistance at 12.510 USDT.

📌 A breakout above 12.510 USDT could signal a short-term bullish move towards EMA 100 (13.590 USDT).

📌 Failure to break resistance may lead to another drop towards 10.922 USDT or lower.

🔎 Recommendation:

Watch price action near 12.510 USDT—if it breaks with volume, it could be a long setup.

If rejection occurs, look for short opportunities back to 10.922 USDT.

Let me know if you need further adjustments! 🚀📊

Can #UNI Bulls Maintain this Current Bullish Momentum or Not? Yello, Paradisers! Is #UNI about to start a bullish rally, or will another rejection send it tumbling lower? Let’s break down the latest #UNIUSDT setup:

💎#Uniswap is forming a falling wedge pattern on an 8-hour timeframe, a well-known bullish reversal structure. The recent bounce from the descending support and several liquidity sweeps at the descending support suggest buyers are stepping in, but the real test lies ahead. #UNI must break the above key resistance to confirm a trend shift.

💎The critical resistance zone sits at $14.8. A breakout above this level with strong momentum could trigger a sharp rally toward the $18–$20 range, where significant selling pressure may emerge. However, failure to clear resistance could lead to further consolidation inside the wedge or another pullback.

💎Support remains strong at around $10.1, with additional demand at $8.5. If # UNI holds above these levels, we could see a gradual push higher. The buyers have already tested these levels, and they held. You can watch for the strong volume and 50-EMA to confirm growing demand at these levels.

💎However, if a candle closes below the $8.5 support zone, it would invalidate the bullish scenario, exposing #UNIUSD to a potential drop toward the $7 region or lower.

Stay focused, patient, and disciplined, Paradisers🥂

MyCryptoParadise

iFeel the success🌴