UPL

Interesting days coming for #UPLNext week will be interesting. There are actually two wedges formed. I'm hoping for a nice pop either Mid-End Next week, or possibly the following Monday.

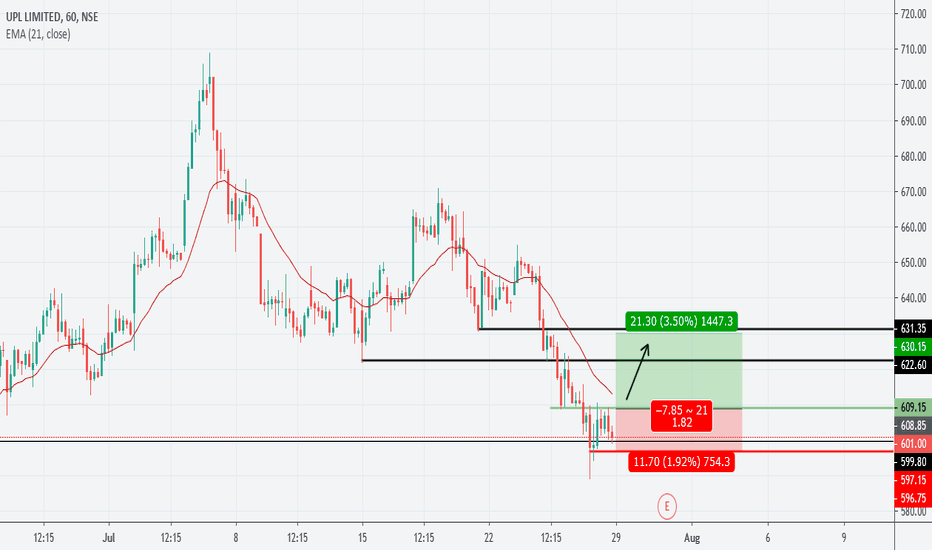

Third Time is a charm? #UPLWithin the next few days UPL will challenge the 50MA or be pushed back down to the .15-.16 area.

I suspect if it pushes the 50MA it will be quick. On July 5th it gapped above the 50MA, but what is better about this time is that the 200MA is closer. If it can gap up high enough perhaps the 200MA can provide some support. I am tempted to hang on to this stock closer to Winter time to see what it does when people are using more Natural Gas etc. for heating their homes. If it gaps high enough I might just sell.

I suspect if it gaps up in the next few days it will not be permanent and will fall back before Winter demand.

For 7/19/2019 #UPLThe volume has gone to virtually nothing. Onlything saving UPL from bottom again is another pump and dump, and that would only be temporary.

The upper "info line" is the 200MA. The 20MA crossed over the 50MA. I can see a slight increase but if it comes anywhere near the 50MA it will get beat back down to the bottom most likely. The Stoch is oversold, but if you go back before the pump it was trending there for about 2 weeks so I can't except that to be very informative of a turn around. Good luck!

Forgive the lines #UPLIt makes sense why it popped back down now as I added the 200MA. If I were to guess the stock will move down and retest the .20 cent area. Otherwise, back to .15ish cents it is. With any luck (not looking so hot) there is a pump at .20 and it breaks out past .27 and past the 200MA. Just a heads up if you're holding! Good Luck!

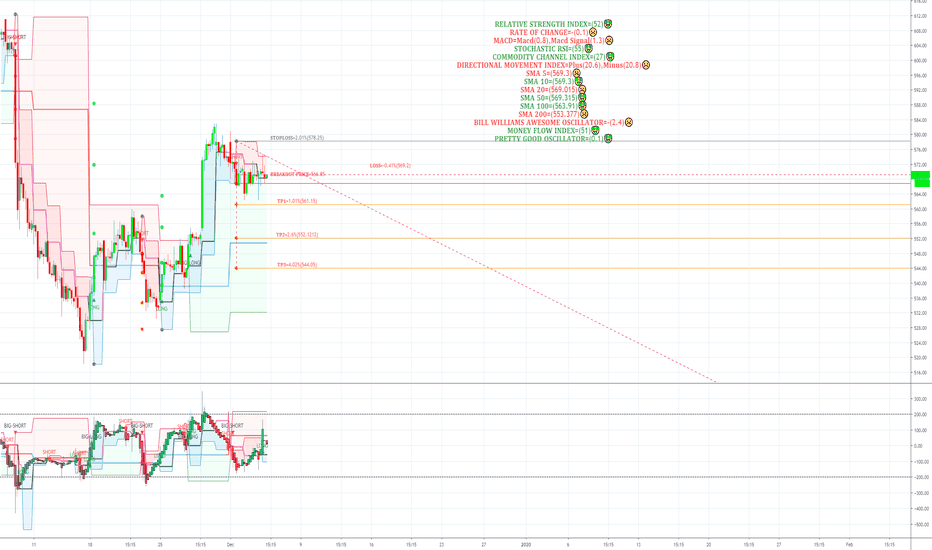

7/17/2019 Will Decide #UPLI think tomorrow will really decide where UPL goes. The volume on the previous high was massive, with an equally massive sell-off. The 2hr Stoch-RSI looks poor, but the Daily and Weekly Stoch look like something might change.

Here are the two outcomes I have come up with:

A) The buyers/sellers from the last pump saw how quickly the stock moved when they bought and want another pump. There is a high possibility they will pop it up and it stays on the trend after consolidating.

B) The volume doesn't recover and another sell-off, testing the .15 level as bottom.

Unfortunately, I own this stock before a confirmed breakout so I'm hoping for A.... Good Luck!

True test for UPL to get above the MA #UPLIt looks like the price and MA are on a crash course. Unfortunately for me, my broker site switched from "Limit Order" above MA to "Buy" on the trade tab. So I purchased before confirmed Break Out. Worst case it goes down to .20 and we see a nice bounce. Volume looks good as well as the MACD. Fingers crossed for my bank account.

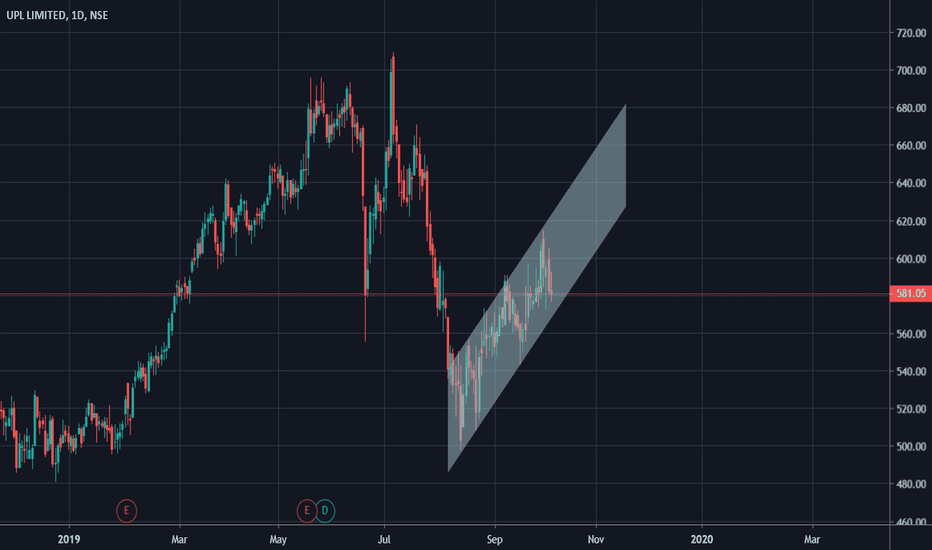

Mixed feelings on #UPLSo, looking at UPL I have very mixed feelings about the stock.

It could go one of two ways:

1) Looking at the hanging man candlestick it would appear bearish for 3 reasons: a) That .26 area is the last

downtrend hold line (which it fell through). b) Opening the 5th July it hit the same prior support and fell back down.

it eventually jumped above it as trading went on (good). c) Hanging man suggest sell-offs at the close (5th July). Resistance at .30 was major (also another prior support area).

2) The good news? July 3rd the volume on down was low. Volume at close could have been higher, but compared to previous lows/highs it isn't overly suggestive. Additionally, the good news is the stock is still well above the 50MA and 200MA with both trending upward. If I were to guess the 50MA will hold support considering that as of right now there is nothing suggesting the 50 will cross back over the 200.

NOT TRADING ADVICE: In my opinion, though opening low, the stock will find support at .26 for another run at .31 . I see nothing indicating that the stock will drop within the next few days. Downside is that Natural Gas (though in a "boom" atm) are extremely volitile because of market disruption by Environmentalists and Emerging "Green" Tech. This stock would be a good swing or day trade but nothing to throw a party over in the long term. Chances are it will probably top out at about .50-.55 cents. If it finds support at .31 that is nearly 50% profit if you buy in near there (NOT ADVICE).