Building Long Position in UPROBased on my technicals, UPRO begun trading at a discount level after last Friday's close (weekly candle). I look at price in a specific format using the RSI indicator.

Price trading below 50 level = discount , price about 50 = premium. So currently UPRO is at a discount for my liking and I've begun investing some capital here.

Current upside to previous highs is about 20% ROI, so if price continues to head bearish I will continue to DCA (dollar-cost average) down and lower my cost-basis.

UPRO

SPX ETF TRADING CHART 2025Happy New Year! Here' is the chart I will be swing trading SPX ETFs showing with TV scripts so you don't have to code. I use the DAILY MES1! price chart and position in the aftermarket or premarket with an SPX ETF. Here is what I do. After the close --- 1. Golden Cross (50SMAX200SMA) shows the "trend". Only trade with the "trend" (only long since April 2023!). 2. Use Accurate Swing ("7") to enter the trade. 3. Exit the Trade when MES price CLOSES below HMA ("16")

SP500 - the best time to LONGIn this analysis, I used several leading indicators - commitment of traders index (CFTS), insiders (Form 4 SEC ) and the greed and fear index (CNN Business).

In commitment of traders index I period 19 - it's a middle of 13 (quarter) and 26 (half year). In practice, it is this period that provides the best results (not only on sp500, but also on other instruments). Historically, the chart shows how well this leading indicator performs.

At the moment, we have not yet seen a direct signal to buy, but the fact is that we receive a signal with a slight delay (a week), and it is quite possible that we are actually already in the buy zone. And it is quite possible that we will still go to the previous volume zone (around 3600).

Next indicator is Insiders data. The chart clearly shows that each increased number of insider buying (more than 150) leads to a subsequent increase of the market. Now the indicator reached 180, so we expect the sp500 index to start growing.

Greed and Fear Index is one of the best leading data. And he also shows just perfect results on history! Current values from 7 to 15 are an indicator of extreme fear, and values below 10 start all the longest trends.

I do not set the levels where the sp500 index will reach, as they will be dictated by the market, and leading indicators will show a reversal. And only there I will close long positions in order to get the maximum profit from the growing trend.

P.S. On the chart, for reasons unknown to me, the arrows for insiders and the fear index moved a little - I hope this will not interfere with understanding the idea.

S&P 500: Bulls & Bears Have 1 Level In Mind To Start The WeekLet me just put it out there, 4654. If we hold there, we have a solid chance of heading towards 4705. Below and it's 4550.

That's how I see it. How I or you play it (i.e. short or long) will be dependent upon market conditions. There are no absolutes, but if you know the levels where prices can react, you are that much further ahead of the game.

Dave

UPRO Long Swing- Are we heading back upEntered swing trade on UPRO today:

UY signal for UPRO last Friday, with a nice dip intraday to provide a buying opportunity. Weak closed but finished with a BUY sign.

SELL on first red heiken ashi candle.

TP1 @ 3%/$88.31 (25% of position)

TP2 @ 5%/$90.23 (25% of position)

TP3 @ 7%/$91.95 (25% of position)

Strategy Statistics from backtest since UPRO conception (no take profits)

Win%: 56.7%

Avg Win: 4.79%

Avg Loss: 3.16%

R:R: 1.52

UPRO Long Swing TradeBUY signal for UPRO last Friday, with a nice dip intraday to provide a buying opportunity. Weak closed but finished with a BUY sign.

SELL on first red heiken ashi candle.

TP1 is about 3% or $89.68, where I'll take of 25% of the position if that is hit.

TP2 @ 5%/$91.42 (25% of position)

TP3 @ 7%/$93.16 (25% of position)

Strategy Statistics from backtest since UPRO conception (no take profits)

Win%: 56.7%

Avg Win: 4.79%

Avg Loss: 3.16%

R:R: 1.52

UPRO - Bigger View - Down to Fib .236 / $55On shorter timelines there is upside, I hope. Backing out until I could see a clear pattern, on the daily timeline looks like we're on the start of leg C down after a nice 5 Wave up

A .236 retracement would have us bounce around $55.43

Sadly, I did my long term homework after the fact and missed the peak. Expecting to get SL'ed out and lose on a long UPRO position.

Pundits all shouting Bull, and I bit post election, but that's not what the trends show me. The numbers say S&P500 down for a bit (About 6% SPX/18% UPRO).

*NOT FINANCIAL ADVICE - NOT A FINANCIAL ADVISOR*

Long UPRO on the weekly. Stop loss under $45The SPX had tons of momentum before Corona Virus took ahold, which will have an effect on earnings for a few quarters. Look for the market to fully price in these concerns shortly and the rise should continue, especially quickly for this leveraged fund. Target $90

SPX: 2800 still holdingUntil SPX cash closes below 2800, trend is still up. I see both bull and bear cases possible. I'm still leaning bullish as everyone is calling for a bear market or lower low just like Dec bottom, everyone was calling for a retest but we went on to make new aths. CB's will keep easing like or not, and companies are buying back their stocks aggressively. Again, at this point it could go either ways, so if you're a swing trader, it's best to wait and see what happens this coming week. Close above 2960 should eliminate the bear case imho, close below 2800 and we go much lower

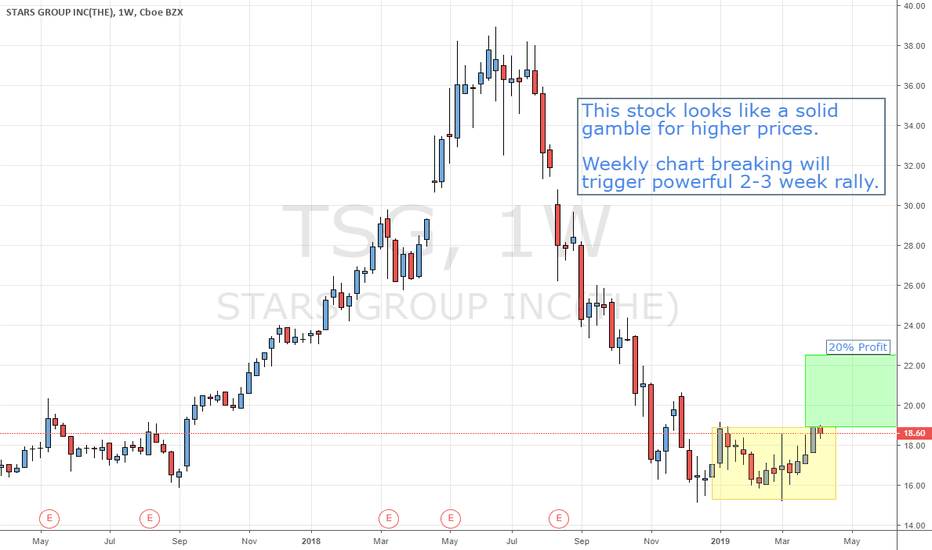

$iwm $tsg $tna VIDEO ANALYSIS powerful 2-3 week rally Any Day.Bit money has been moving into these stop options looking for higher prices in the next 10 days!

This stock looks like a solid gamble for higher prices.

Weekly chart breaking will trigger powerful 2-3 week rally.