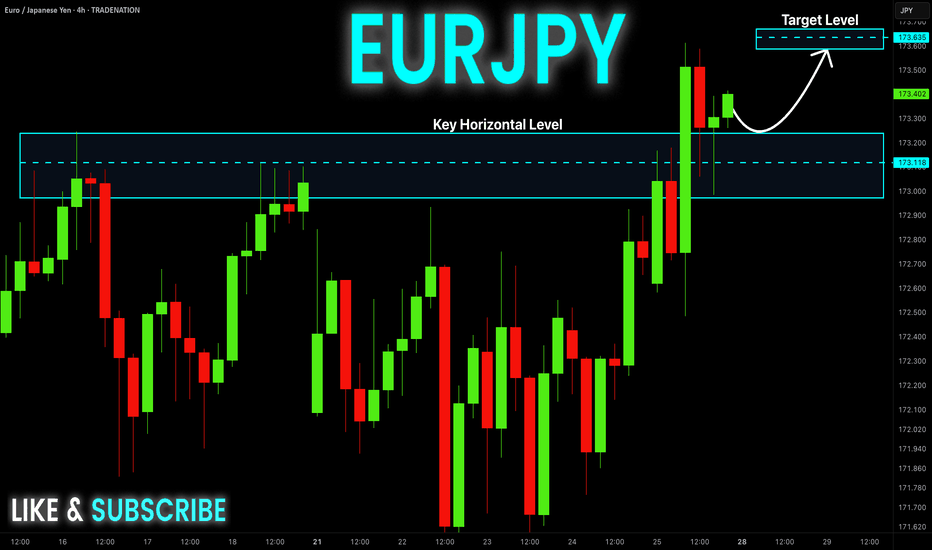

EUR-JPY Local Long! Buy!

Hello,Traders!

EUR-JPY is trading in an

Uptrend and the pair made

A breakout, a retest and

A bullish rebound from the

Horizontal support of 173.200

So we are bullish biased and

We will be expecting a

Further bullish move up

On Monday!

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Uptend

GOLD WILL KEEP GROWING|LONG|

✅GOLD is trading in a

Strong uptrend along the

Rising support line and the price

Is now making a bullish breakout

Of the key horizontal level

Of 2786$ which reinforces our

Bullish bias and makes us expect

A further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

GOLD BREAKOUTThis is is a very interesting GOLD break which was looking more probable than the sell I showed testing. In fact, I emphasize the need to risk some pips and I came back today to ask us to secure our capital despite the fact that 1810-1812 two was looking like the retest area.

from what I am seeing, 1875 looks like the next major resistance and once we break that ZONE, we are on our way to test testing 1904- 1916.

I rest my case for now. gold is really looking more bullish. I will come back if I notice any sign of change in the market structure.

I got into a buy trade in 1838 and still riding this to 1865 though I can see 1872 - 1875 as a probable next resistance. I don't want o leave any money on the table in the market as I do not own the market. I have my position secure already at 1855. I have promised to always pay myself with little.

I hope you'll do the same.

Gold is very interesting.

TenX Pay vs Bitcoin Could Be ReversingTenX Pay clearly trending downwards, while moving within the descending channel. Although recently price bounced off the lower trendline of the descending channel and went up from 7523 to 14785 satoshis, resulting in a 96% growth in just 3 days.

On a corrective wave down, PAY/BTC found the support at 76.4% Fibonacci retracement level, that is 9k satoshis area. So far the support has been rejected and if it holds price could start moving upwards, and perhaps result in a trend reversal.

Obviously it is far too early to speak of the trend reversal, but the current price does present a very interesting buying opportunity. Nonetheless, if TenXPay will go below 8900 satoshis support, the downtrend continuation could take place, resulting in further decline, perhaps down to the 5k satoshis level.

VEN ProposalVEN is in an uptrend and should continue to hold. If we hit either green area's we should see big movements

LSK/BTC Volume Analysis Prediction 2/7/2018The coin is stronger than other coins on the market.

We have break out of the trend line and strong resistance level 2400.

Strong buy priority.

Trade recommendation:

Entry point: 2350 (buy limit), 2501 (buy stop).

Stop: 1980

Target1: 2800

Target2: 3000

Target3: 3600

Glossary of terms

Point of Control (P O C) – The price level for the time period with the highest traded volume .

Value Area (V A) – The range of price levels in which a specified percentage of all volume was traded during the time period. Typically, this percentage is set to 70% however it is up to the trader’s discretion.

Balance - Accumulation Area.