XAUUSD Strong Support zone at 3312 buyers area 📊XAUUSD 1H Forecast

As you know, XAUUSD had a major drop recently, but now it's reaching a key demand zone at 3312 — a strong buyers' area

Price is reacting bullish from this level, and we're looking for upward continuation

📌Target Zones:

3355 – Supply Zone

3400 – Resistance Level

3430 – Bearish Order Block (Watch for reaction)

🕒Outlook:

Strong buying pressure is building from 3312, and momentum is shifting upward.

We remain bullish toward supply and resistance zones — watching closely at 3430 OB for any signs of rejection

*👋Regards From Expert Team*

Uptrend

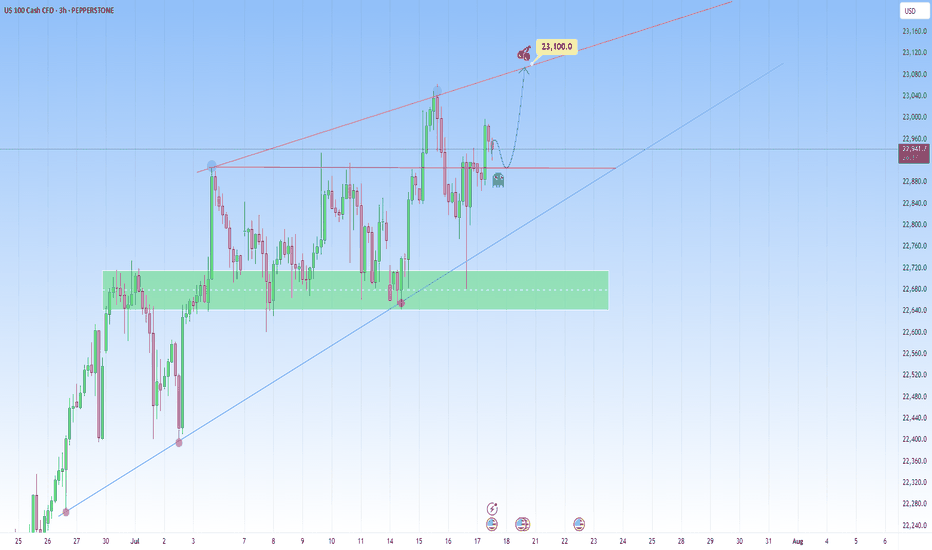

NAS100 Bigger Picture. Uptrend to be resumedLooking at the current structure through the lens of a trend trading approach, what we saw on NAS100 is more than a simple price bounce, it’s a trend continuation trading within a high-volatility environment. As price is approaching a key resistance level, how price is behaving around this dynamic trendline will be key.

This recent retracement and rejection happening near what we can call a demand zone cluster, was confirmed by a beautiful bounce off the support range. And right now price is respecting the upper and lower bounds nicely.

What happens next? Price is showing signs of bullish exhaustion, but the higher-timeframe structure supports a continuation.

My projected target is towards the upper resistance line, that’s my 23,100 zone as shown.

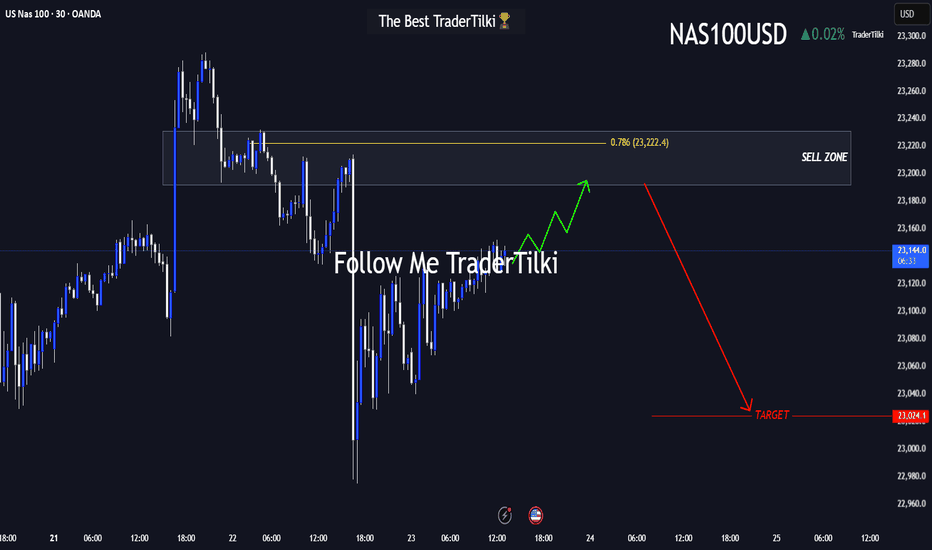

The US100-Nasdaq Playbook: Prime Sell Zone Approaching!Hey friends 👋

I’ve prepared a fresh US100-NASDAQ analysis for you all. Nothing makes me happier than seeing us grow and profit together.

📌 Once price reaches the 23,192 – 23,231 zone, I plan to enter a **Sell** trade from that area.

🔐 Feel free to set your stop-loss based on your personal margin and risk tolerance.

🎯 My target level is: **23,024**

Every single like from you means the world to me—it’s my biggest motivation to keep sharing high-quality analysis 🙏

Huge thanks to everyone who supports with their likes 💙

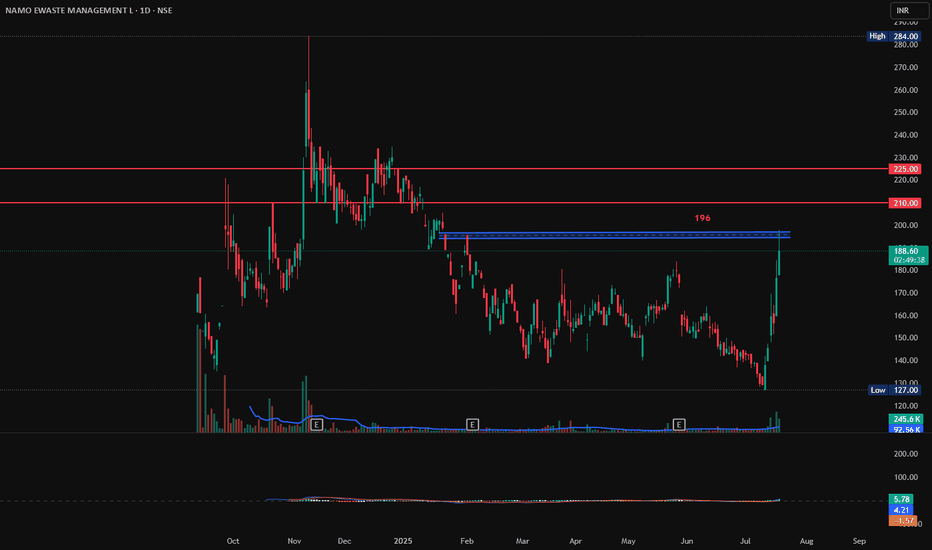

NAMO EWASTE MANAGEMENT, Long, Breakout, 1DNAMO EWASTE MANAGEMENT has gain 6% today with good volumes. If it breaks and sustains 196 with Bullish candlestick patterns like Bullish Engulfing, Hammer & Inverted Hammer, Piercing Line, Morning Star, Three White Soldiers, Tweezer Bottoms or Bullish Harami, then there are good chances for it to go further up from here. First target will be 210 and second target 225.

Entry: 196 (on Bullish candlestick pattern)

Target1: 210

Target2: 225.

SL: 185

QBTS bull flag dailyBetter look at quantum computing ticker QBTS bull flag on the daily timeframe. Previous post looked at the weekly timeframe to highlight the bullish momentum. Lots of retail money piled into this one in the last few months, a breakout of this bull flag will likely be followed by a parabolic move.

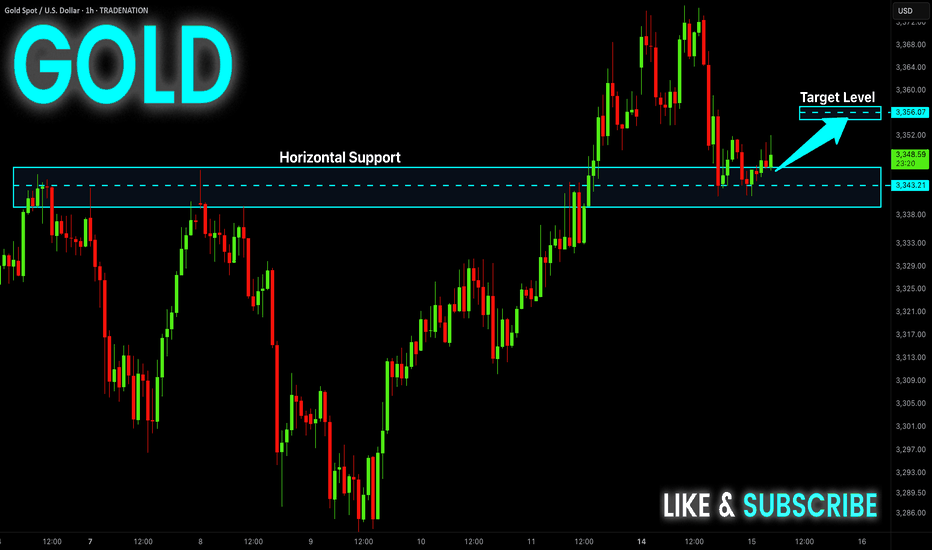

GOLD Local Rebound Ahead! Buy!

Hello,Traders!

GOLD made a retest of

The horizontal support

Level of 3343$ and as

We are locally bullish

Biases we will be expecting

A local bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD SWING LONG|

✅GOLD is trading in a strong

Long-term uptrend along the

Rising support line so we are

Bullish biased and after the price

Breakout of the local opening wedge

We we will be expecting a

Further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BTC Bulls, this one is for you ;)As most of you know, I’ve been bullish on Bitcoin for quite a while now. And today, I want to show you exactly which resistance levels I’m watching if the breakout continues.

On the weekly BTC/USDT chart, I’ve marked out five key upside targets, all based on Fibonacci extension levels — not just random lines, but technical zones that often attract serious reaction from the market.

Let’s break them down:

🔸 Target 1 — $124K

This lines up with the 141.4% Fibonacci extension and also happens to match the projected move of a textbook Cup & Handle pattern. It’s the first big checkpoint.

🔸 Target 2 — $137K

Here we’ve got the 227.2% Fib level — a classic continuation zone if momentum remains strong.

🔸 Target 3 — $145K

Next up is the 241.4% extension, where we could see some heavier resistance and price interaction.

🔸 Target 4 — $155K

One of the strongest zones on the map. Why? Because it merges four separate Fibonacci extensions in one cluster. A real decision point.

🔸 Target 5 — $167K

And the final target (for now) — the 261.8% extension. If BTC gets here, it’ll be a major event.

🎯 My View:

This isn’t hopium. These levels are based on market structure, Fibonacci math, and historical behavior. As always, I’ll adjust based on price action, but these are the areas I’m preparing for.

DRBHCOM - The LOW is getting HIGHER !DRBHCOM - CURRENT PRICE : RM0.815

The stock made a HIGHER LOW recently - this may consider as a half portion of new uptrend is completed. A breakout above RM0.930 will form the higher high structure - which confirm the new uptrend phase.

For short term trading purposes, short term traders may anticipate to buy if the stock breakout nearest resistance of RM0.830 - which will give an entry point at RM0.835. So this is a pending breakout stock. Nearest target will be RM0.870 and RM0.910. While support will be RM0.795. Take note also that MACD give a bullish hint.

ENTRY PRICE : RM0.835

TARGET : RM0.870 and RM0.910

SUPPORT : RM0.795

Notes : If the stock breakout RM0.930 in the future, it is a sign of strong bullish momentum (strong uptrend). So at that particular time, trend follower traders may anticipate to buy at RM0.935 - RM0.940.

AMAZON Will Keep Growing! Buy!

Hello,Traders!

AMAZON is trading in an

Uptrend and the stock made

A breakout and retest of the

Key horizontal support

Of 218$ and is going up again

So we are bullish biased

And we will be expecting

A further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

$SNAP -- accumulation $8 into $9. big move brewing into earningsHello, extensive chart here: Daily and Weekly. Looking at this name I like the setup here. The Daily and Weekly chart shows strength in this area, $8 to $9 with heavy accumulation and support. The Weekly chart shows about 13 weeks of this bottoming area with tons of buying from previous years as well. NYSE:SNAP has earnings July 25th and I will be looking to enter $10 calls with a date of 8/15. The premiums could spike just into earnings since it is a popular name to play around that time and it has plenty of daily volume. The SMA and EMA on the weekly honestly is my target -- it is a big sell zone. We are in the liquidity area and have been. Will be starting a position on these contracts this coming week. This name should see $10 with relative strength but my first target is mid $12 before earnings. I would like to shed some contracts into the earnings date and see if we can make an extra buck or two on profited contracts so when earnings comes it can be a risk free stress free play.

WSL.

EUR-JPY Will Keep Growing! Buy!

Hello,Traders!

EUR-JPY is trading in an

Uptrend and the pair broke

The key horizontal level

Of 169.814 and the breakout

Is confirmed so after a potential

Retest of the support cluster

Of the rising and horizontal

Support lines below we will

Be expecting a bullish continuation

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD-USD Very Strong Uptrend! Buy!

Hello,Traders!

AUD-USD is trading in a

Very strong uptrend and

The pair broke a key horizontal

Level around 0.6540 which

Is now a support and we

Are already seeing a rebound

So we are bullish biased

And we will be expecting

A further move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Sideways ChannelLooks like today we have bounced off the midpoint of this channel. Yesterday we dropped, today we rise!

Overall, this looks like a very neutral position. Potential for a short gain here up to previous highs with a bounce back down to lows.

No one can predict how long we will stay in this channel, but the breakout or breakdown will be very bold and very loud in one direction.

As a trend trader, I am looking to a breakup potential right now. If I had to be in a position, it would be long.

EURUSD – 2 Potential Intraday Setups (5-Min Chart)Chart Overview:

This 5-min EURUSD chart shows two example trade setups aligned with the main uptrend. These are shared purely for learning how to recognize and plan structured entries.

(Details are being shown in m5 chart- if this in not working for you please follow to be able to see it- as it is a private idea)

🔹 Example Trade 1 – 3rd Touch of Triangle Support

✅ Context:

Price retested the lower boundary of a broad triangle/wedge for the third time—often a strong area for reactive buys in an uptrend.

✅ Plan Concept:

Entry: Reversal signal on the 3rd touch.

Stop: Below the signal bar low.

Target: Mid to upper wedge area (or TP2).

🔹 Example Trade 2 – Breakout of Descending Flag

✅ Context:

After bouncing off trendline support, price formed a descending flag consolidation.

✅ Plan Concept:

Entry: Break and close above flag resistance.

Stop: Below the strong breakout candle.

Target: Extension toward recent highs (or TP2).

💡 Important:

These examples are not signals and not executed trades—they illustrate a possible planning process for traders studying price action strategies.

💡 Why These Matter:

Both setups align with the primary uptrend, use clear structure for risk placement, and rely on confirmation before entry.

🔹 Note:

These are educational examples only, not trade signals.

💬 Do you study similar setups? Share your charts and thoughts!

Thanks for your attention and your time...

Follow for more setups

#EURUSD #Forex #TradingEducation #PriceAction #IntradayTrading #BreakoutTrading #TechnicalAnalysis #LearnTrading #TradingView

US100 BULLISH BREAKOUT|LONG|

✅US100 is going up

Now and the index made a bullish

Breakout of the key horizontal

Level of 22,222 and the breakout

Is confirmed so we are bullish

Biased and we will be expecting

A further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Review and plan for 27th June 2025Nifty future and banknifty future analysis and intraday plan.

Swing trade.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

EUR_USD BULLISH BREAKOUT|LONG|

✅EUR_USD is going up

Now and the pair made a bullish

Breakout of the key horizontal

Level of 1.1630 and the breakout

Is confirmed so we are bullish

Biased and we will be expecting

A further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BALAJI AMINES PURE REVERSAL ON CHART.Balaji Amines Ltd. is a leading Indian chemical manufacturing company, primarily engaged in the production of methylamines, ethylamines, and their derivatives, along with specialty chemicals and pharma excipients. It holds a strong position in the aliphatic amines segment and is even the sole producer of certain specialty chemicals in India.

INVERSE HEAD & SHOULDER BREAKOUT AND CONSOLIDATION AT PULLBACKS SHOWS STRONG MOMENTUM FOR UPWARDS

A breakout above 1486 could trigger momentum toward 1524 and beyond towards 1775-1906

On the downside, keep an eye on support near 1330–1358.