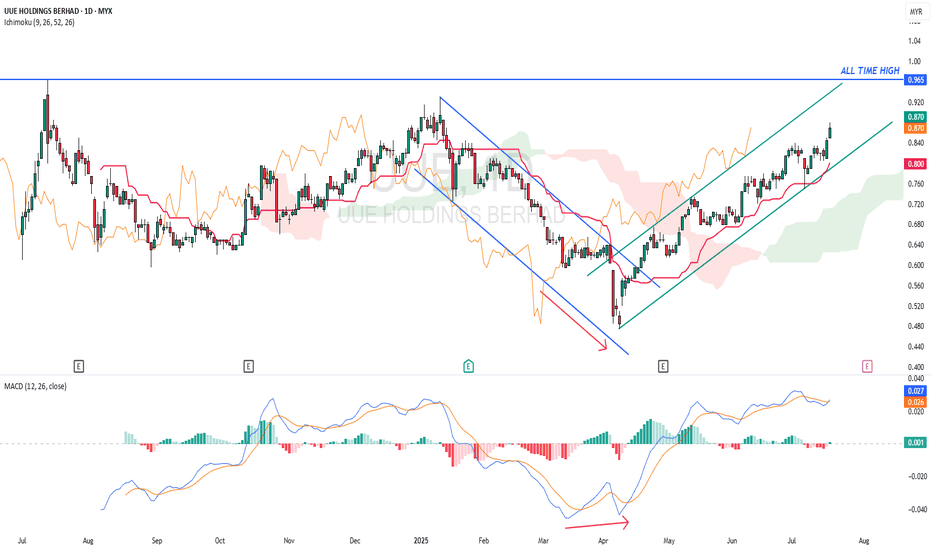

UUE - Potential hit All Time High ?UUE - CURRENT PRICE : RM0.870

The downtrend from January 2025 to April 2025 had changed to uptrend after the stock broke out the descending channel. Take note that there was a bullish divergence in MACD before the breakout of channel.

ICHIMOKU CLOUD traders may take note that the KIJUN SEN is rising steadily and CHIKOU SPAN also moving above candlesticks - indicating stock is uptrending. Today's closing price is higher than previous day's close suggesting a bullish breakout buy signal. A close below the KIJUN SEN may indicate a trend reversal (KIJUN SEN acts as support level).

ENTRY PRICE : RM0.865 - RM0.870

TARGET PRICE : RM0.930 , RM0.965 and RM1.03

SUPPORT : KIJUN SEN (cutloss if price close below KIJUN SEN)

Uptrending

AUMAS - Positive corelation with GOLD price movement ?AUMAS - Current price : RM0.890

AUMAS is bullish as the share price is above 50-day EMA. Note that the price breakout ICHIMOKU CLOUD on 31 JANUARY 2025 with high trading volume.

Gold future price surge to new high due to uncertainty and weak global sentiment. AUMAS is engages in gold mining business in Malaysia. The share price have a positive corelation with gold price movement. As such, i expect the share price may move higher in the upcoming session.

ENTRY PRICE : RM0.890

TARGET : RM0.980 (+10%)

STOP LOSS : RM0.820 (-7%)

Notes : The company was formerly known as Bahvest Resources Berhad and changed its name to AuMas Resources Berhad in December 2024. AuMas Resources Berhad was incorporated in 2004 and is headquartered in Tawau, Malaysia.

GBPSGD makes a reclaim of the Daily 200EMA, up 0.24% today..

This is one to watch as a potential trade in the near future.

This is because GBP has had a solid run this week against the Singapore dollar and has finally reclaimed the 200 EMA which is most significant on the Daily chart. It should be very supportive of future price rise next week so long as its price can solidify and remain above the 200 today.

TGT - Analysis on recent strong moves - what we need to move upWelcome back to the trading floor traders! Our favorite place to be...

On Target, we are likely going to need some further liquidity to be built for the bulls to continue moving this up the way they have been - if this is the case, it will happen using our teal and orange controlled selling algorithms.

First we will look for yellow strong buying continuation to hold price and attempt a retest of our $153 high - but a break of yellow and we are then looking for confirmation of sell-side tapering via our teal channel.

Note: $150 is a strong level that could give us a reaction and quick bounce but in order for new highs to continue to be created we will need to continue to use our controlled selling algos to do that.

Keep you posted here as price develops!

Also please join me at market open (9:30 AM EST) where I will be trading live on stream here on TradingView and taking trades, analyzing charts, and having fun with our awesome community.

Happy Trading :)

🚀How to Profit from AUD/JPY’s Bullish TrendFrom our AI screener, it shows the currency Japanese yen is turning to weak side after over bought last week.

Moreover, AUD and NZD is going to strong side.

Based on Technical analysis in higher time frame we found AUDJPY and NZDJPY has a new trend to upside.

💰Here we sharing the buy limit order levels of AUDJPY for the week as shown on the chart.

💹News about Japanese Yen recently which may be one of the reason make JPY become weaker since last week.

In November 2023, the annual inflation rate in Japan fell to 2.8% from 3.3% in the previous month, which is the lowest it has been since July 2022. This was mainly due to a decrease in food prices, which rose by 7.3% compared to 8.6% in October. Additionally, the cost of transport, housing, furniture & household utensils, clothes, culture & recreation, and miscellaneous items also decreased. However, fuel and light prices fell for the 10th consecutive month, due to a decrease in electricity and gas prices. Education prices remained unchanged, while healthcare prices increased slightly. The core inflation rate also decreased to 2.5%, the lowest in 16 months, from 2.9% in October. Consumer prices fell by 0.1% on a monthly basis, the first drop since February, after a 0.7% gain in October.

📈Navigating the Uptrend📍 Understanding an Uptrend

An upward trend provides investors with an opportunity to profit from rising asset prices. Selling an asset once it has failed to create a higher peak and trough is one of the most effective ways to avoid large losses that can result from a change in trend. Some technical traders utilize trendlines to identify an uptrend and spot possible trend reversals. The trendline is drawn along the rising swing lows, helping to show where future swing lows may form.

Moving averages are also utilized by some technical traders to analyze uptrends. When the price is above the moving average the trend is considered up. Conversely, when the price drops below the moving average it means the price is now trading below the average price over a given period and may therefore no longer be in an uptrend.

While these tools may be helpful in visually seeing the uptrend, ultimately the price should be making higher swing highs and higher swing lows to confirm that an uptrend is present. When an asset fails to produce higher swing highs and lows, it means that a downtrend could be underway, the asset is ranging, or the price action is choppy and the trend direction is hard to determine. In such cases, uptrend traders may opt to step aside until an uptrend is clearly visible.

📍 Key Takeaways

🔹 Uptrends are characterized by higher peaks and troughs over time and imply bullish sentiment among investors.

🔹 A change in trend is fueled by a change in the supply of stocks investors want to buy compared with the supply of available shares in the market.

🔹 Uptrends are often coincidental with positive changes in the factors that surround the security, whether macroeconomic or specifically associated with a company's business model

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

Power of Inside Bar - Cingniti TechInside Bars if used wisely, can give us astonishing results in Trading.

Let's understand this scenario.

Stock Name - Cigniti Tech

After 20th Feb 2023, on D TF, this counter merely had any move! More or less it had inside Bars with totally squeezed close prices compared to earlier close. if you observe, closing prices are getting squeezed day by day with drying up sales volume. This indicates sellers are loosing control & buyers ay pitch in!

Following are reasons for my Long view -

1. Stock is in Up Trend.

2. Stock prices are above 200 EMA

3. 10 & 20 EMAs are above 200 EMA.

4. RSI has crossed 55

5. Nifty IT index is in uptrend, so sectors is booming.

So my entry would be on crossover of high of 7th Feb. Same setup & logic can be applied while entering stock on 3rd March, as its crossing previous high of 2nd march for a quick move on upside.

DID YOU INVEST IN XRP?If your answer is "Yes". Congrats to you, by next uptrending between Altcoins vs Bitcoin, your money will be doubled. HOW?! In short. Let's say, you bought $1k of XRP at 30 cents ( 1000 / 0.3 = 3333.33 XRP ). After next halving of Bitcoin on May 2020, Bitcoin will reach $15k at least and the reward of miners will be decreased to 6.25 Bitcoins. This will reverse the game from the downtrend of Altcoins vs Bitcoin to the uptrend of Altcoins vs Bitcoin with double increase in value of USD. I'm not saying "Hype" but every Altcoin will try to be survived after the halving of Bitcoin and that's normal to keep the main investors in safe side. So, if you does sell your XRP / BTC or / USD at that time, you will get double profit $2k or 6666.66 XRP.

If your answer is "No". You can set buy orders like what I did in GOOD TIME TO BUY BITCOIN!

NEXT UPTREND WILL BE 60 CENTS FOR XRP.

DECIDE AND TRY TO MANAGE YOUR WALLET WITHOUT LOSING. HAPPY TRADING ;)

SOLANA WILL BULLISH TO 40$ as we can see in the chart, in the volume profile the price is under the VALUE AREA, and from the stoch RSI it's in over sold trying to go up again and always the price try stay in the value area especially in the Point of control, but in the MACD, it's still not confirmed yet, me personally I'm waiting the lines to cross each other and I'll make the call and i'll sell at 40$

First Real Reversal 4 AAVE? This guy... Anybody seeing this? This is going places and that little red line in the middle can be called resistance. Soon, the line will have a new name, lets just call it support. This thing has been working on a come-back since it began losing to the quick profits of those enlightened. However, today is not yesterday, and this guy is no baby anymore so the crawling looks like is about to change in a short time now, IMO of course. I guess I can keep this to myself but how can a person enjoy a win if he's got nobody to share them with! Don't even get me started on UNI, or BTC on the path to greatness. BTC coming back from that last DT then ranging the way it did and followed by the slow up-trend it's been on? Looks like that one got smart. Other folks , the ones who pay attention to facts and not news fueled by the greedy, they know whats coming. Trust nobody, ever, don't even trust yourself! Confirm these things through hard work and patience. That will be the ONLY way to consistent growth! Mark those words because if you do, you will come back and say thank you after you actually implement those key factors of trading vs. dumb money! Don't give your hard earned money to people who are your peers, but they worked hard at finding the answers to this game. Don't be fickle and don't stop learning because complacency is no better than trading from a news release. The chart tells you everything, not what you want it to, but sometimes, it DOES! And this was just me telling everyone about a dream I had, don't do anything I said on account of me saying it. I wasn't even here! Don't gamble, it's dangerous kids, get a job and a wheel, and some debt on the side... Cheers!

XAUUSD MAY HIT 1845-1847 AREA Dear Traders,

For this that have been following my Gold analysis very closely, you would recall that I shared an idea at the close of the weekly candle which opened on the 6th of December 2020, where i mentioned that the weekly candle closed as "DOJI" and at the end of four consecutive weekly downtrend for Gold and signaling to us the high probability of a reversal to the upside, which actually happened after a retest of 1782-1784 area closing the following weekly candle bullish as opposed to bearish candle the previous week.

We also saw a convincing daily close above 1808 on the 30th of December 2021 and closure above 1829 on the 31st of December closing the last weekly candle in the year 2021 bulling making it the second consecutive weekly candle that closed bullish after the "DOJI" candle I referenced about 3 weeks ago.

With this, we might see a retest of between 1808- 1812, if 1832 - 1834 area is rejected before a retest of 1845 - 1847 area. if the rejection persist into New Your Trading Session Open Monday 3rd of January 2022, then I have the suggestion below:

Buy Gold at 1808

SL: 1800

TP1: 1834:

TP2: 1845

Happy Trading

URA- D1 - DOUBLE BOTTOM IN PROGRESS !MEDIUM / LONG TERM BUYING OPPORTUNITY WITH A STRONG STORY BEHIND !!!

BUY AT CURRENT LEVEL AND ADD ON DIPS.

MEDIUM/LONG TERM TARGET : $ 37.05 - $ 55.68 - $ 70.73

DAILY (D1) :

Yesterday's price action triggered a potential double bottom formation in progress coupled with a RSI bullish divergence.

In addition, the daily closing price (@24.30) is above the Tenkan-Sen (@ 24.14)

An upside breakout of $25.85 (double bottom trigger level) & 38.2% Fib retracement, would activate this ongoing formation (DB) in opening the door for a technical target of $ 29.27,

which is also, by the way, roughly the top level of the daily clouds resistance area.

WEEKLY (W1) :

Recent price action from the top ($31.60) is an healthy consolidation move in a broad bull trend still in place.

Indeed, the primary uptrend support line is still intact and is also coinciding with the weekly clouds support area.

In addition, the 61.8% Fibonacci retracement @ 22.72 has been filled (with an intraweek low @ 22.43.

A weekly closing above KS and Mid Bollinger Band, respectively @ 24.42 and 24.52 would add further support for further upside towards, firstly the TS, currently ƒ 27.02 ahead of 29.27

technical double bottom target above mentioned.

Interesting to note that the 29.27 level coincides also with the middle of the long black candle which triggered this consolidation move.

A weekly closing above 29.27 would be seen as a very positive signal, calling for a retest of former high @ 31.60 ahead of higher level

MONTHLY (M1) :

Uptrend intact, above the monthly clouds, above the Kijun-Sen and the Mid Bollinger band.

Watch the Lagging line which after having broken the clouds is again inside the clouds.

A new upside breakout of the clouds would also add further support for higher levels.

As you can see on this monthly chart, there is plenty of space to the upside and my strategic technical target

are the following :

Target 1 : 31.60

Target 2 : 37.05

Target 3 : 55.68

Target 4 : 70.73

For your information, there is also another vehicle investment in this URANIUM theme and on my view it is the best one :

Strategy Certificate sur U3O8 RENAISSANCE Portfolio

Sous-jacent: U3O8 RENAISSANCE Portfolio

Catégorie de produit ASPS/EUSIPA Tracker Certificates (1300)

ISIN: CH0441692628 /Valor: 44169262

Last price (December 15th 2021)

$ 1879.31 - $ 1898.29

Ironman8848 & Jean-Pierre Burki

$KP3R/BUSD 8h (Binance Spot) Ascending channel trendingkeep3r.network looks good for bullish continuation after retesting 50MA support.

Risk/Reward= 1:1.75 | 1:3.5 | 1:6.4

Expected Profit= +29.12% | +58.49% | +106.74%

Possible Loss= -16.69%

Fib. Retracement= 0.618 | 1.117 | 1.764

Margin Leverage= 1x

Estimated Gain-time= 3 weeks

Current Price:

392.70

Entry Zone:

390.30 - 355.76

Take-Profit Targets:

1) 481.66

2) 591.20

3) 771.21

Stop Targets:

1) 310.78

Happy Days are Here Again!Irrational Exuberance! Bad news is good, good news is gooder!

The gaps tell all. Measured move from the runaway gap ought to end up around 388 +/- 2 pips.

There must be and certainly will be a pullback from a last exhaustion gap, may gap up sometime 1-3 Nov.

Fed minutes on 3 Nov may be catalyst for pullback. Likely pivots shown, 1/3 speedline most likely, given extreme fearless bullishness.

Can bull anywhere anytime from pullback to any of the levels shown. Not even attempting to guess where this might occur, get ready!

Final ATH TBD, might come in Dec for Santa Rally IMO. Would be a 5th of V EW, a monster. The subsequent break in 2022 will be spectacular...

Not advice, just A TOOLUSE TUTORIAL... REMEMBER THE TREND IS UR FRIEND TILL THE END AT THE BEND! GLTA!!