US

Bearish flag on VmwareVMware - Short Term - We look to Sell at 111.95 (stop at 115.15)

The medium-term bias remains bearish. Trading within the Wedge formation. Prices are extending lower from the bearish flag/pennant formation. We have a Gap open at 111.95 from 02/11/2022 to 03/11/2022. The preferred trade is to sell into rallies.

Our profit targets will be 96.19 and 91.55

Resistance: 111.95 / 114.41 / 118.68

Support: 103.55 / 102.53 / 96.19

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

SPX - The decisive moment lies aheadThe market remains complacent even though the two-day meeting of the FED is set to commence today, and central bankers are expected to raise interest rates by 75 basis points tomorrow. Despite that, however, we remain bearish and believe the reality will sink in after the FOMC, and the rally will cease. Indeed, we believe the market will progress deeper into the second phase of the bear market, which has been confirmed by the weak earning season for the third quarter of 2022.

Although with that being said, we would not be surprised to see one more push to the upside as an initial reaction to the FED decision, with investors again seeking to buy stocks at a discount and looking for a reversal in monetary policies. Regardless, we do not backtrack on our price targets at 3 500 USD and 3 400 USD.

Illustration 1.01

Illustration 1.01 shows the daily chart of SPX and two simple moving averages. It also depicts previous bear market rallies and the current one. At the moment, the SPX remains down almost 19% from its all-time-high value.

Technical analysis - daily time frame

MACD is bullish; we will pay close attention to whether it can hold above 0 points; if not, it will be very bearish. RSI and Stochastic are bullish. DM+ and DM- are bullish as well. Overall, the daily time frame is bullish.

Technical analysis - weekly time frame

RSI and MACD are neutral. Stochastic is slightly bullish. DM+ and DM- are bearish. Overall, the weekly time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

LUNCBUSDMost likely LUNCBUSD remain in Buy for more years or even touch 0.5 or more so, so according to technical analysis i will give very big profit

US100For the method and strategy I used, this was a long trade but still easily manageable and highly profitable. With how this played out, we got to see that US30, US500 & US100 are not the same but have few similar characteristics. They all volatile, influenced heavily by fundamentals and easily misunderstood. My hate of overnight trades wants me to close, but rather I am letting my trade hit one of my exit points. SL has been moved into profit with more than enough breathing room.

Tomorrow we try again.

US Oil is going down as we expected... about $80Hello guys

As we said in the recommendation 4 days before it @usoil is expected to go down, and it will continue to go down... Take advantage of this opportunity

...you won't lose after knowing me

USOIL : OIL ⛽️

STOP LOSE ⛔️ : 88

TP ✅ : 82

TP 2 ✅ : 77

Good luck

SNP500 Short Term Short Idea!Help me keep on posting by clicking on BOOST! (it's like "liking")

This expectation is a framework to look for a potential trading setup; I don't just execute based on these levels, I always wait for confirmations on lower timeframes

This Analysis was done using my complete Strategy which includes:

- Smart Money Concepts

- Multi Timeframe Liquidity and Market Structure

- Supply And Demand

- Auction Theory

- Volume Analysis

- Footprint

- Market Profile

- Volume Profile

- WYCKOFF (IS THE KING)

- ETC

CRUDE OIL TRADE ENTRYIn the crude oil we have strong level of resistance where price close on friday and sort of rejecting from 84.87 level and we also have 200 ema at 87.91 so this zone is very strong and oil need high volume to break this area and after this we have a strong trend line resistance to upside and price rejecting multiple time from this level also so i am looking selling entry from the current price if oil break its support to downside than we expect price come to yellow zone to fill the gap area and if price break to upside than we looking short from the selling close from the trend line for the target of yellow zone becoz crude oil have a very big gap and price need to fill this gap must/

Dizzy Lizzie's demise has not helped the PoundSo, in a week in which dizzy Lizzy resigns and the UK faces its second Tory leadership contest, I find myself starting to yearn for a return by Boris Johnson – I freely admit that I cannot stand him, but surely anybody would be better than nobody? We may have seen a minor rally by the FTSE and pound on her resignation, but this looks to be short lived, let’s take a look what the charts have to say….

With GBP/USD still capped by its 55-day ma at 1.1488, the bearish trend remains firmly entrenched and attention remains on the 1.0923 12th October low and the 1.0356 all-time low charted in September. So the prospect of a new leader has been met with a good dash of sangfroid – it certainly has not done enough to reverse the recent slide of the poor Pound.

Sterling’s weakness cannot be attributed to the mess in Westminster alone, it is of course the mighty US Dollar, which has been the main contributing factor.

While one might think that the US Dollar has not done much over the past 6 weeks but hold sideways, it has in fact been going sideways in a contracting range. This range is easily identifiable as a potential symmetrical triangle…why is this important? Because it looks mature, and the US Dollar Index looks ready to break out of the range bordered by 113.40 and 111.60. While you have to wait for the range break to confirm direction, it is worth pointing out that symmetrical triangles are more likely to be continuation patterns than reversal ones. Above 113.40 lies the 114.75 September peak.

As for EUR/USD, where are we here? Well still in the same old boat – it remains under pressure and fairly subdues below its 2022 downtrend, which offers resistance at 0.9959. Again we can spot a potential symmetrical triangle and this one will break down should .9675 give way. This would leave the recent low at .9536 back under the spotlight.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

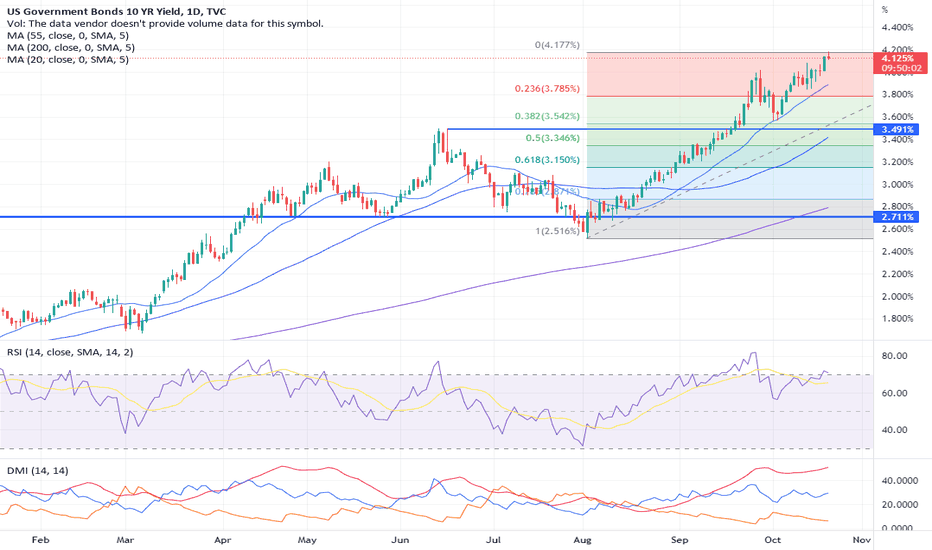

US 10Y yield convergence of resistance levels around 4.19/20We have a convergence of levels around the 4.19/4.20 zone of the chart, it is a long term double Fibonacci retracement and represents significant lows seen in 1998 and 2001.

Will be quite interested to see if the market pauses here in order to consolidate sharp gains that have been pretty relentless since August.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

DXY USD dollar going down to 110.05 or 108.30USD ELLIOTT WAVE FORECAST... : This X wave (yellow) had reached the golden fib and the intermediate C (pink) reached the 123%.. only one more possible target at 113.57. If the $ is reversing here, we most expect a retracement at least around 110.045, but 108.29, 107.25 and 105.51 are also possible. Other possible targets are 107.25 and 105.51.

Phase 3 For OIL PirceThis is the seconded biggest update for oil this month !

You need a big pocket to go with the flow on this one, money management will be your biggest enemy and greed your second.

We have 85$ is the mid road for oil and 120$ the highest it can get !

Target Is 68$ for our next idea and politics is our enemy !

i recommend to open a position after an update or after the correction ! (WE can see 90$ before a drop)

Don't be greedy or you will swim in red and cry a river of poorness !

This an update to help you see the path only, I don't recommend anything

For Low And greedy People (75% Loser - 25% Winner) :

SL : 88$

-------------------------

Tp1 : 78$

Tp2 : 77$

Long Term And Big pocket user + Low Risk :

SL1 : 88$

SL2 : 112$

------------------------

TP1 : 75$

TP2 : 64$

SP-500 : We are already in a recession!We see a leading expanding diagonal. The target zone of five waves intersects with the support line of the higher timeframe. Wave rules are complied. Further, we expect a rollback towards the resistance line - wave B and a subsequent correction - wave C.

A potential black swan that could happen would most likely be due to Russia's nuclear war blackmail.

Best regards,

EXCAVO

FED EMERGENCY ANNOUNCEMENT - WHAT TO EXPECTAfter being criticized for being slow to recognize inflation, the Fed has embarked on its most aggressive series of rate hikes since the 1980s. From near-zero in March, the Fed has pushed its benchmark rate to a target of at least 3%. At the same time, the plan to unwind its $8.8 trillion balance sheet in a process called “quantitative tightening,” or QT — allowing proceeds from securities the Fed has on its books to roll off each month instead of being reinvested — has removed the largest buyer of Treasurys and mortgage securities from the marketplace.

“The Fed is breaking things,” said Benjamin Dunn, a former hedge fund chief risk officer who now runs consultancy Alpha Theory Advisors. “There’s really nothing historical you can point to for what’s going on in markets today; we are seeing multiple standard deviation moves in things like the Swedish krona, in Treasurys, in oil, in silver, like every other day. These aren’t healthy moves.”

For now, it is the once-in-a-generation rise in the dollar that has captivated market observers. Global investors are flocking to higher-yielding U.S. assets thanks to the Fed’s actions, and the dollar has gained in strength while rival currencies wilt, pushing the ICE Dollar Index to the best year since its inception in 1985.

“Such U.S. dollar strength has historically led to some kind of financial or economic crisis,” Morgan Stanley chief equity strategist Michael Wilson said Monday in a note. Past peaks in the dollar have coincided with the the Mexican debt crisis of the early 1990s, the U.S. tech stock bubble of the late 90s, the housing mania that preceded the 2008 financial crisis and the 2012 sovereign debt crisis, according to the investment bank.

The dollar is helping to destabilize overseas economies because it increases inflationary pressures outside the U.S., Barclays global head of FX and emerging markets strategy Themistoklis Fiotakis said Thursday in a note.

The “Fed is now in overdrive and this is supercharging the dollar in a way which, to us at least, was hard to envisage” earlier, he wrote. “Markets may be underestimating the inflationary effect of a rising dollar on the rest of the world.”

In this video we analyse the two possible outcomes from the FED.

Source: Bloomberg