US 10Y TREASURY: NFP sank yields Although the previous week was full of important US macroeconomic data, including the FOMC meeting, still the weaker than expected NFP data impacted significantly the US Treasuries market. The 10Y US benchmark yields were holding around the 4,3% level during the week, however, weak NFP data pushed yields strongly to the downside, closing the week at the level of 4,22%. The support line at 4,2% was also tested at Friday's trading session. As per current sentiment, investors are now anticipating two rate cuts till the end of this year, one in September and another one in December by 25bps. Odds for September rate cut stand at 85% since Friday.

The week ahead will be a reflective one on financial markets, as there are no important data to be released. In this sense, markets will digest both this week's posted economic data as well as macro projections from the latest FOMC meeting. Some upward corrections are possible, at least till the level of 4,3%.

US10Y

US 10Y yield: Triangular Consolidation, next 6-7%I’ve spotted a well-known triangular pattern forming on the US 10-year Treasury yield.

This appears to be the development of a large Wave 4.

Wave E of Wave 4 may still be unfolding.

Watch to see if it holds above the Wave C low at 3.9%.

A breakout above resistance near 4.7% would confirm the pattern.

The target zone is set between the 38.2% and 61.8% retracement levels of Waves 1 to 3,

highlighted with a blue box between 6% and 7%.

Could tariffs cause a major spike in yields—or will something else trigger it?

Share your thoughts in the comments below.

US 10Y TREASURY: FOMC week During the previous week investors were digesting the latest macro data aiming to set expectations for the forthcoming FOMC meeting, which is scheduled for Wednesday, July 30th. The 10Y Treasury yields were moving between 4,32% and 4,44%, closing the week at 4,38%. The drop in yields during the second half of the week was impacted with a trade deal between the US and Japan. Negotiations with the EU are taking place during the weekend in Scotland, whose outcome will be known at the start of the week ahead.

Regardless of trade negotiations, the week ahead will bring a lot of currently important US macro data, as well as the FOMC meeting. Current expectations with 95% odds is that the Fed will keep interest rates unchanged in July. Also, it is expected that Fed Chair Powell will inform the public about the latest Feds members view on the US economic developments. In case of any information that the market still has not priced, the higher volatility will take place. For the week ahead, there is both probability for a further modest relaxation in yields, at least till the level of 4,35%, and also potential for testing of 4,4% for one more time.

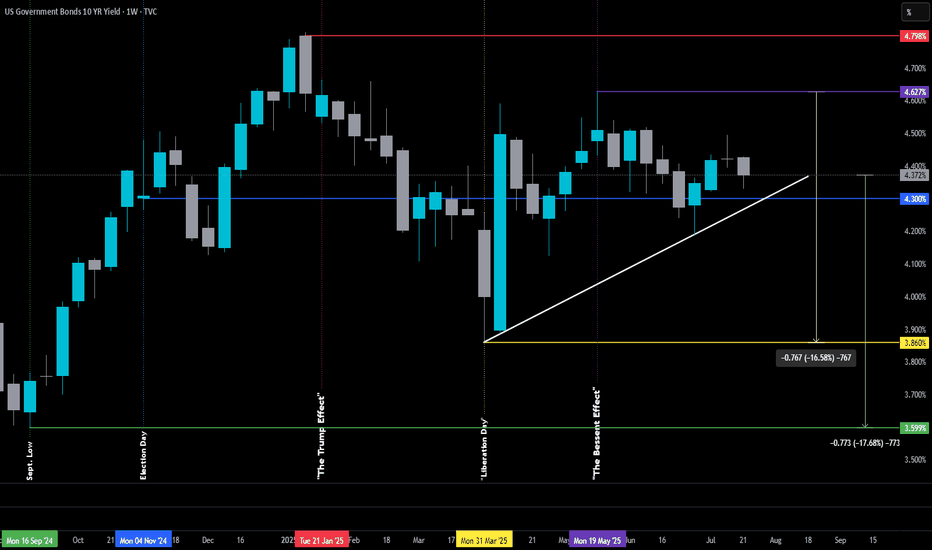

The Bessent Effect: Part I-Challenge the FedThe Bessent Effect: Part I-Challenge the Fed

Originally posted on June 30th, 2025, but it was removed by a moderator — I misinterpreted the posting guidelines (I tend to read a little too deep between the lines sometimes).

For context, the original version didn’t include the White or Green lines.

June 30th post:

The 10-year Treasury yield is the heartbeat of commercial lending — it’s what sets the tone for everything from real estate financing to economic sentiment. And interestingly, it’s now hovering right around the same level it was on Election Day 2024 (Blue Line), which feels like a lifetime ago in policy terms.

So what’s happened since then? Quite a bit.

Yields peaked the week before Inauguration Day (Red Line), then began a steady decline — until we were hit with what can only be described as "Liberation Day Tariff Whiplash."

The tariffs, announced in early April (Yellow Line), spooked the markets — particularly the ever-watchful Real Money Investors (think central banks, pension funds, and the ruthless whales). Their reaction? A spike in the 10-year, as they scrambled to reassess risk and reposition.

Plot twist: Trump’s unleashing of Scott Bessent.

Since stepping into the role of Treasury Secretary, Bessent has taken the reins of U.S. economic diplomacy. By late May (Purple Line), he was already deep in talks at the G7 meeting in Banff, hashing out trade dynamics and currency cooperation with global finance leaders. And — perhaps not so coincidentally — since then, the 10-year has been on the decline again, even as the Fed remains firm in its refusal to cut rates.

Here’s the big takeaway: there's a strong chance we could see rates — the ones that actually move the real estate market and reflect how the “real players” feel — drift back down to their pre-tariff levels. That is, before Tariff Derangement Syndrome set in. And probably before they shoot back up to the peaks we saw just as Trump returned to the White House.

In short: the 10-year might be hinting that the worst isn't over — but we could be in for a stretch of green pastures before we hit the next storm.

US 10Y TREASURY: June data cools rate cut hopesThe US inflation and jobs data shaped investors sentiment during the previous week, where 10Y US Treasury yields eased as of the end of the week. The US inflation remains relatively steady and in line with expectations, with 0,3% increase in June or 2,7% y/y. The producers price Index was holding at 0% in June, while the University of Michigan inflation expectations also eased to 4,4% for the year and 3,6% for a five years inflation expectations. June Retail Sales surprised the market with a 0,6% increase for the month.

At the start of the week, 10Y yields reached their highest weekly level at 4,49%, and took a downturn during the second part of the week. The lowest weekly level reached was 4,41% on Friday. As US macro data remains relatively robust, the current market expectations for a rate cut in July are almost diminished. Traders now expect any rate cuts to be delayed to September or later. As per CME FedWatch Tool, odds for September rate cut slipped from 70% down to current 50%. As the week ahead does not bring any currently significant macro data, it could be expected that also 10Y Treasury yields could have a relatively calmer week. It will be used for digesting current macro data and to gear up for the last week of July, when the next FOMC meeting is scheduled.

US 10Y TREASURY: tariff tensions rattle bonds During the previous week there has not been important US macro data scheduled for a release, however, news regarding tariffs has been the ones which shaped investors sentiment and also, US bond yields. It was indeed a no-clear-direction trading week when it comes to 10Y Treasury benchmark yields. The week started with a strong move to the upside, from 4,32% up to 4,39, then there was a push back, while yields ended the week at 4,41%. News regarding tariffs were the ones that shaped Friday's sentiment on the market.

Saturday brought news that the US Administration is implementing tariffs of 30% on goods imports from Europe and Mexico. This information is still not reflected in market yields, but will certainly be with the start of the trading week on Monday. Aside from tariffs news, the week ahead brings some important US macro data, like June inflation, PPI and University of Michigan Consumer Sentiment on Friday, implying that another volatile week is ahead.

US 10Y TREASURY: September rate cut?Jobs data posted during the previous week shaped investors sentiment. The JOLTs job openings in May reached the level of 7.769M, higher from market forecast of 7,3M. The main impact on the market came from the NFP data for June, with 147K new jobs, above market expectations of 110K. At the same time, unemployment fell to 4,1% in June. Strong jobs data significantly decreased market expectations that the Fed might potentially cut interest rates at July's FOMC meeting. Current odds still hold for September's cut.

A “higher for longer” is again wording used by market participants. The 10Y Treasury yields adjusted to that expectation by increasing yields from 4,2% toward 4,33% as of the end of the week. In a week ahead, there are no currently significant US macro data scheduled for a release. In this sense, it could be expected a short relaxation of the 10Y yields, where levels between 4,3% and 4,8% could be shortly tested.

US 10Y TREASURY: jobs data aheadThe Fed's favorite inflation gauge was posted during the previous week, which impacted some higher volatility in the U.S. Treasury yields. The Personal Consumption Expenditure index ended May by 0,1% higher from the previous month, bringing the index to the level of 2,3% on a yearly basis. The core PCE remained a bit elevated with 0,2% in May and 2,7% for the year. Still, both figures were in line with market expectations, which was the main reason for 10Y U.S. Treasury benchmark yields drop to the level of 4,25% at the end of the week, from 4,40% where the week started.

A drop in inflation figures are increasing market expectations that the Fed might cut interest rates in September. However, a week ahead might bring again some higher volatility in the U.S. Treasury yields as the major jobs data will be posted. For the week ahead the JOLTs Job Openings, the Non-farm Payrolls and the June unemployment will be posted. Considering Fed's dual mandate, bonds market participants will be closely watching these data.

Price of fiscal profligacy: US10Y vs DE10Y vs CH10Y Today I will go unconventional in my analysis and look at the yields of 3 major economies with 3 different fiscal trajectories. Today we look at the 10Y Yield of US, Germany and Switzerland. 3 different countries with different Fiscal and Monetary policies off late.

The TVC:US10Y after touching the highs of 5% in Oct 2023 has been in a downward trend making new lower highs and lower lows but within the downward slopping channel sweeping the upper bound and the lower bound. Recently, touching the higher bound of the channel at 4.5%, since then it has reversed its course and gone down. On 26th May my article on TVC:US10Y and TVC:DXY forecasted 4.6% as the upper bound for the $US10Y. TVC:US10Y and TVC:DXY Divergence and correlation breakdown for TVC:US10Y by RabishankarBiswal — TradingView . We recently got rejected at 4.51%. So, the obvious direction for TVC:US10Y is lower with 3.5% as the lowest target.

Now switching gear to $DE10Y. The German Bunds are doing the reverse. They are making a series of new higher highs and higher lows. With increasing yields on the TVC:DE10Y and fiscal indiscipline on the part of German govt this is going to rise in the medium to long term.

Then we finally look at the Swiss 10Y which might touch ‘Negative’ in the near term. The Swiss central bank is on the path to reduce the rates to negative in Sept 25 meeting. The TVC:CH10Y at 0.45% brings back the memory of negative rates. But with global flight to safety and a fiscally conservative government the TVC:CH10Y is in huge demand hence pushing down the yields.

Verdict : TVC:US10Y ↘ between 4.3% - 3.5%, TVC:DE10Y ↗ between 2% - 3%, TVC:CH10Y TVC:US10Y ↘ between 0.5% - (- 0.25%)

Dollar Bullish Correction To $103 - $105While we expected to see some Dollar upside in Q2, the economy was in such a bad state that the Dollar could not hold its value. Since the start of 2025 the Dollar is down 12% and this is only the beginning.

I believe we will see more downside in the future. But for the coming quarter there is a chance for the Dollar to get some breathing space & recover in the short term. Overall, the trend of the Dollar remains bearish, so what we want to keep an eye on is small pumps (short term recovery) into price zones which will allow us to short the Dollar back down.

I want to see a dip lower towards $96 - $94 before sellers lose bearish momentum. If this move takes place, then we can slowly see buyers step back into the market & start pushing back to the upside. Once price hits our ‘Supply Zone’ of $103 again, it’ll give us a more clear indication of what the Dollar will do next; whether that’s a longer term uptrend or a continuation to the downside.

Dollar Index Bearish to $96 (UPDATE)I posted this DXY sell thesis yesterday for you all while price was still at $97.70. Since then sellers have taken out the previous Wave 3 low, creating a new daily low today at $96.90📉

We still have more downside yet to come towards our $96.60 target. So, use this 'DXY Sell Thesis' to help you with your trading, so once you can use this as a confluence to buy inverse correlated markets

US 10Y TREASURY: digesting FOMC ahead of PCEThe central event for financial markets during the previous week was the FOMC meeting. The Fed decided to hold interest rates at current levels, but two rate cuts till the end of this year are still on the table. This was in line with market expectations. Still, the Fed Chair Powell shortly commented on the potential for higher inflation in the coming period, as a reflection of implemented trade tariffs of the US Administration. The Fed is expecting to see it reflected in the inflation figures in the future period, but they will continue to be data-driven when deciding on interest rates.

Due to the FOMC meeting, the 10Y Treasury benchmark was moving with a higher volatility during the week, as was expected. The nervousness regarding Fed's next move on interest rates was high for some time in the past. The 10Y yields started the week around the 4,5% while ending it at 4,37%. The PCE data are scheduled for a release in the week ahead. If there are no surprises with the data, it could be expected that 10Y yields will have a relatively calmer week, with further relaxation in yields, moving above the 4,3% level.

US 10Y TREASURY: eyes FOMC projections The US inflation data were posted during the previous week, showing that the inflation continues to slow down, with 0,1% in May. Also, the University of Michigan Consumer Sentiment data are showing decreasing inflation expectations for this year at 5,1%, from previously posted 6,6%, while the five year expectation eased to the level of 4,2%. However, the unrest on markets was imposed by new Middle East tensions, which were also reflected in the Treasury yields during the previous week. The 10Y yields started the week at 4,5%, and closed it at 4,4%. The lowest weekly level was at 4,3% on Friday, but the Middle East unrest pushed the yields toward the 4,4%.

The week ahead brings the FOMC meeting and Feds macro projections, which is scheduled for Wednesday, June 18th. It is widely expected that the Fed will leave rates unchanged at this meeting, while the odds are increased for a rate cut in September. Certainly, the day of the FOMC meeting will bring some increased volatility, considering investors sensitivity to the Fed's narrative and especially projections. The next supporting level for the 10Y yields stands at 4,2%. However, considering the current unstable geopolitical scene as well as the FOMC meeting, there is also an equal probability for 10Y yields to test higher grounds, around the 4,5% level, but not higher from it.

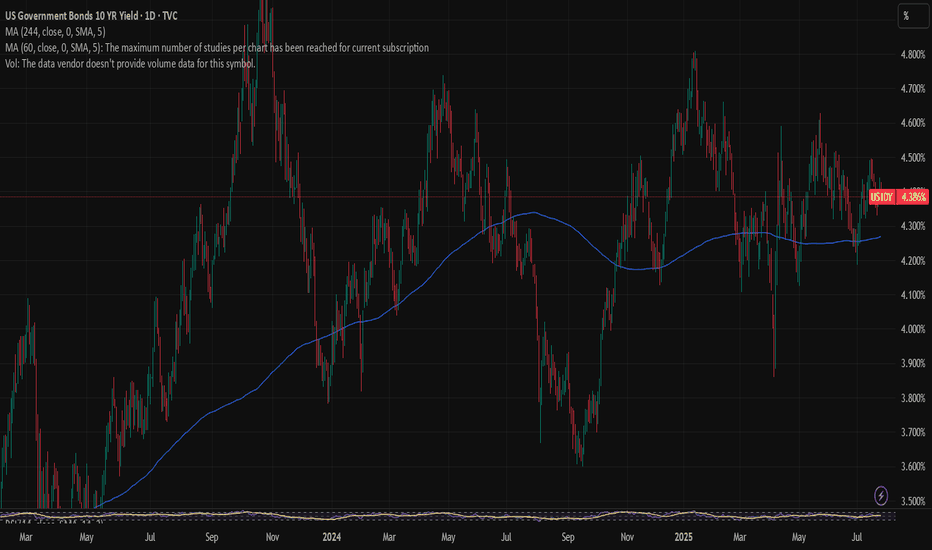

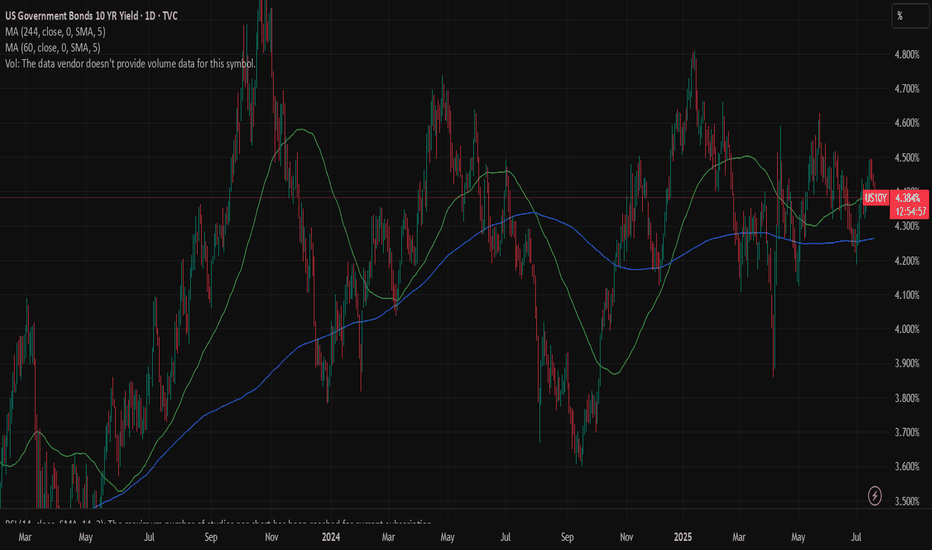

US10Y Big downside potentialThe U.S. Government Bonds 10YR Yield (US10Y) has been since last week on a 1D MA50 (blue trend-line) rebound, consistently rising since the April 04 Low (Support 1). The presence of the Lower Highs trend-line just above it, puts strong selling pressure long-term.

As a result, either now or upon a Lower Highs contact, we expect the US10Y to turn bearish and Target 3.860% (Support 1).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

US10Y (10-Year Treasury Yield) Weekly TF 2025

📊 Chart Context

Current Yield: \~4.50%

Current Structure: Consolidation below major Fibonacci resistance, with multiple breakout and breakdown paths marked by confluence zones.

📉 Key Technical Observations

Bullish Scenario – Yield Rally (Rate Hike Cycle / Inflation Surprise)

TP1 (5.0%): 0.00% Fib level, psychological resistance.

TP2 (6.10%): 38.2% Fib + -27% extension zone.

TP3 (7.70%–7.91%): Major Fib confluence (-61.8% & 48.60% projection)

Bearish Scenario – Yield Drop (Rate Cuts / Recession)

Support 1 (3.91%): 23.6% Fib retracement, key structural demand.

Support 2 (3.22%): 38.2% retracement

Support 3 (2.74%): 48.6%

Support 4 (2.12%): 61.8%

Support 5 (1.33%): 78.6%

Forecast Scenarios (Based on Arrow Colors & Pathways):

Red Boxes & Zones: Critical Resistance / Reaction Zones

These are strong confluence levels that may trigger pullbacks before continuation.

Green Arrows – Bullish Projection with Pullbacks

Scenario A: Price may rally toward the 5.0% TP1 zone but experience a temporary pullback before continuing toward the 6.10% TP2 zone.

Scenario B: After a short-term correction near 6.10%, if bullish momentum sustains, yield may spike toward the 7.70–7.91% TP3 zone.

These movements reflect a stair-step advance with corrective legs between key levels — bullish macro outlook with intermittent risk events.

Pink Arrows – Bearish Pullbacks & Correction Phases:

Scenario A: Initial rejection from current zone (~4.5%) may send yields down to the 3.91% support confluence.

Scenario B: If support at 3.91% fails, yields may further retrace to 3.22% or 2.74%, activating the lower fib retracement zones.

After stabilizing in these zones, a rebound may begin and realign with the broader bullish structure.

These pink arrows suggest that even in bullish macro cycles, the market may correct deeply before resuming its ascent.

Macro & Fundamental Context:

1.Fed Pivot Dynamics: With inflation cooling and unemployment ticking higher, markets price in possible Fed rate cuts by late 2025.

2.Bond Demand Outlook: Recession fears and de-risking scenarios trigger massive flows into long-term Treasuries, pulling yields lower.

3.Global Liquidity Conditions: Lower yields = increased liquidity = favorable conditions for crypto, gold, and risk assets.

4.Hawkish Risk: Any oil shock or CPI surprise can pause or reverse easing expectations, pushing yields up.

Effects on Gold & Crypto (as scenarios play out):

↗ If US10Y Yields RISE to 6% or 7.7% (TP2/TP3)

* Gold: Likely to suffer due to rising real yields; institutional demand weakens.

* Crypto: Bearish; risk assets sell off amid higher opportunity cost and tighter liquidity.

* Dollar (DXY): May strengthen, applying more pressure on gold & crypto.

* Strategy: Favor defensive positioning. Look for shorting rallies or hedge exposures in BTC, ETH, and high-beta alts.

↘ If US10Y Yields FALL toward 3.2% to 2.1% (Support 2–4):

* Gold: Bullish. Lower yields reduce holding costs and boost safe-haven appeal.

* Crypto: Bullish. Liquidity rotation into high-risk assets often follows easing cycles.

* DXY: Likely to weaken, further supporting BTC and altcoins.

* Strategy: Look to accumulate crypto during dips. Gold may offer breakout opportunities.

Rangebound Near 4.5% (Current Zone):

* Gold: Mixed; capped upside until clear direction emerges.

* Crypto: Ranges or whipsaws. Watch for breakout signals from BTC.D and TOTAL3.

* Strategy: Stay cautious. Monitor DXY and macro events for confirmation.

Related Reference Charts

TOTAL3 – Altcoin Market Cap Weekly

BTC.D – Bitcoin Dominance Weekly

US 10Y TREASURY: will the Fed cut?The jobs market data were in the spotlight of investors during the previous week. The major impact came from the non-farm payrolls posted on Friday, which was better than anticipated with 139K new jobs added. The jobs market in the US continues to hold strongly, which impacts investors anticipation of potential Fed's rate cut during the course of this year. Namely, as the Fed has a dual mandate of keeping inflation at targeted level and exercising full employment, the stronger jobs market might impact Fed's decision to hold reference interest rates at current levels for a longer period of time. The CME FedWatch tool is currently anticipating 100% odds that the Fed will hold interest rates steady at their June meeting. The FOMC June meeting is scheduled for 17th-18th.

The jobs data triggered a strong reaction on the US Treasury market. The 10Y US benchmark yields were pushed to the upside on Friday, from 4,32% on Thursday up to 4,50% on Friday. Usually, after such a strong spike in prices or yields on the market, there is time when the market will consolidate, in which sense, there is a probability that yields will ease to some extent during the week ahead. Still, the market nervousness might continue to the lower extent until the FOMC meeting.

Story behind EURUSD chart and US10Y and DE10Y risk premiumLet’s have a look at the Currency and Bond markets today after an eventful last few weeks in both markets. After Moody’s downgrade of the US Gov bonds the markets look seemingly quiet. There has been no sudden spike in the US10Y. But it makes lot of sense to look beneath the hood and compare the Bond and the currency markets. Today we are looking into the 2 largest currency pairs, i.e. FX:EURUSD and the largest bond markets i.e. US10Y and German 10Y.

It is astounding to observe how the Fib retracement levels from the peak and troughs in the FX:EURUSD and TVC:US10 - TVC:DE10Y charts coincide. Both indicators at @ 0.618 Fib levels. As anyone would expect when the FX:EURUSD makes new highs the diff between TVC:US10Y and TVC:DE10Y hits new highs as investors long the FX:EURUSD chart and in that way hedge the risk in the TVC:US10Y without going short TVC:US10Y which will then adversely affect the investors portfolio. Institutional investors have been unwinding the long position in the TVC:US10Y by going long EUR, YEN and CHF in the currency markets without explicitly selling the US10Y.

Going back to the charts, what can we expect in the medium to long term? In my expectation both the charts can reach 0.786 Fib level and subsequently the 1.0 Levels. This will take the FX:EURUSD from 1.13 to 1.18 by the end of 2025 and then to our long-term target of 1.25. If those levels hold onto in the currency markets, then the risk premium of TVC:US10Y over TVC:DE10Y which is denoted in the chart by TVC:US10Y - TVC:DE10Y will go from 1.9% to 2.1% and then top out at 2.3%. May be this is the way USD will lose some of its market share as world reserve currency status.

Verdict: USD Reserve currency status weakening. Buoyant FX:EURUSD marching towards 1.25. TVC:US10Y - TVC:DE10Y can reach 2.3%.

US 10Y TREASURY: eased inflation expectationsTrade tariffs continue to gain a lot of investors attention, but they are slowly turning to actual macro data and inflation expectations in the future period. Uncertainty over the future impact of imposed trade tariffs of the US Administration is still present, but it becomes evident that investors are becoming tired of reactions on tweets, and are much more switching attention to actual data. The University of Michigan Consumer Sentiment final data for May, posted during the previous week, showed moderately decreased inflation expectations for the period of next five years. Data showed that US consumers are expecting five years inflation at the level of 4,2%, which was also below market estimate of 4,6%.

The 10Y US Treasury yields eased a bit during the previous week, currently testing the 4,4% level. The starting weekly point was at 4,53%. Considering the relatively significant drop during the week, there is some probability for the short reversal during the week ahead, at least till the level of 4,5%. It should also be considered that the week ahead macro data will put in focus jobs data and NFP, which might imply a bit higher volatility.

$US10Y and $DXY Divergence and correlation breakdownRecent weeks we might have missed some underlying churn in the market dynamics. Recently there has been a clear visible divergence in TVC:US10Y and TVC:DXY in midst of all the noise about the tariffs. Usually with rising TVC:US10Y yield the US Dollar index TVC:DXY rises with it as visible in the chart below. In this blog we have been following the downward slopping channel in the TVC:US10Y and the yield has remained within this tight range of the channel. In our last blog on 02 May 25 we called for a lower TVC:US10Y @ 4%. Seems that call was incorrect and I was wrong. But in this space, we have been asking for a lower $DXY. The TVC:DXY chart is making lower highs and lower lows and in a verge of a breakdown.

So we have higher TVC:US10Y which is capped to the upside @ 4.6% visible from the upper end of the downward slopping channel and we have TVC:DXY making lower lows but the correlation is broken in the recent weeks as shown in the daily chart below. This kind of unpredictable market behavior it’s difficult to forecast equity market direction. TVC:US10Y seems to create headwind for equities but the lower TVC:DXY is good for risk assets like CRYPTOCAP:BTC , SP:SPX and $QQQ. Hence this push and pull will keep the markets range bound for now.

Verdict : TVC:US10Y currently at top of the range, downside more likely ; TVC:DXY continues to struggle and in penalty box.

US 10Y TREASURY: heading higherTrade tariffs once again shaped market sentiment during the previous week. The US Administration announced the intent for introduction of 50% tariffs on goods imported from the European Union, which should become effective from 1st July this year. Market immediately reacted to this news, bringing US equities lower, and surging US treasuries. Another news that hit the market and impacted negatively US yields was that the US House of Representatives adopted a tax and spending bill, which is expected to add trillions of US Dollars to the US debt, as analysts are noting. The US has already been downgraded twice by rating agencies, last week by Moody’s, due to high concerns over the sustainability of the US debt.

The 10Y US benchmark reached the highest weekly value at 4,62%, but eased as of the end of the week to the level of 4,50%. This type of swings in the Treasury yields will most probably continue in the coming period. The market is currently extremely sensitive to fundamentals and any news regarding trade tariffs.

GOLD Regains Above 3'300, since US stocks "Relief Rally" is OverGold prices recently surged above $3,300 per ounce due to a confluence of geopolitical, economic, and monetary factors driving strong safe-haven demand:

Heightened geopolitical tensions, particularly the Israel-Hamas conflict and ongoing US-China trade disputes, have increased uncertainty, prompting investors to seek Gold as a secure store of value amid instability.

The US dollar's weakness, nearing a three-year low, has further boosted gold's appeal for holders of other currencies, making Gold relatively cheaper and more attractive globally.

What is most important also, U.S. stock rally has overed recently its tedious 10-Day winning strike (fortunately which finished not at all the history peaks). That's why investors may be turning back to tried-and-true assets like Gold.

Central banks, notably China’s, have been consistently buying gold to diversify reserves away from the US dollar, supporting prices significantly. China increased its Gold reserves for the 17th consecutive month, signaling sustained institutional demand.

Additionally, gold-backed exchange-traded funds (ETFs) have seen record inflows, reflecting growing investor interest beyond traditional buyers.

Market expectations of Federal Reserve interest rate cuts later in 2025 have also played a key role. Lower interest rates reduce the opportunity cost of holding non-yielding gold, enhancing its investment appeal amid inflation concerns and economic growth uncertainties.

This combination of geopolitical risk, a weaker dollar, central bank purchases, and anticipated monetary easing has propelled gold prices to historic highs, with forecasts suggesting further gains toward $3,500 per ounce.

--

Best #GODL wishes,

@PandorraResearch Team 😎

US 10Y TREASURY: US downgradeThere is no rest for US Treasuries. The minute the trade tensions between the US and China were settled, at least for the period of 90 days, a new storm hit the market throughout rising concerns over the sustainability of the US debt. At least as this sustainability is perceived by the rating agency Moody’s, which downgraded the US sovereign rating by one notch late Friday. This news had an negative impact on the investors sentiment, but the most volatility in the US Treasury yields occurred in an after-hours trading on Friday, when the news hit the market.

Regardless of the news about US sovereign downgrade, the higher volatility was evident also during the previous week. The highest surprise came from the University of Michigan inflation expectations, which reached 7,3% for this year and 4,6% in a period of five years. This was higher from the previous estimate and certainly was a reflection of the imposed trade tariffs between the US and China. The highest weekly level of the 10Y US benchmark was 4,54%, however, yields are ending the week at the level of 4,44% in an after-hours trading on Friday. For the week ahead, there is no significant macro data scheduled for a release, however, the volatility might continue, especially on Monday. The reaction on a downgrade news might impose some increase in yields, until the market finds the new equilibrium level. On the opposite side some modest relaxation is also probable, around 4,0%-3,8% level.