Russell2000 Key Trading LevelsKey Support and Resistance Levels

Resistance Level 1: 2194

Resistance Level 2: 2210

Resistance Level 3: 2227

Support Level 1: 2154

Support Level 2: 2135

Support Level 3: 2113

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Us2000

US2000 H4 | Bearish dropBased on the H4 chart analysis, we could see the price drop lower from the sell entry to the downside.

Sell entry is at 2,224.89, which is a pullback resistance.

Stop loss is at 2,280.47, a swing high resistance.

Take profit is at 2,163.99, which is an overlap support that is slightly above the 61.8% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

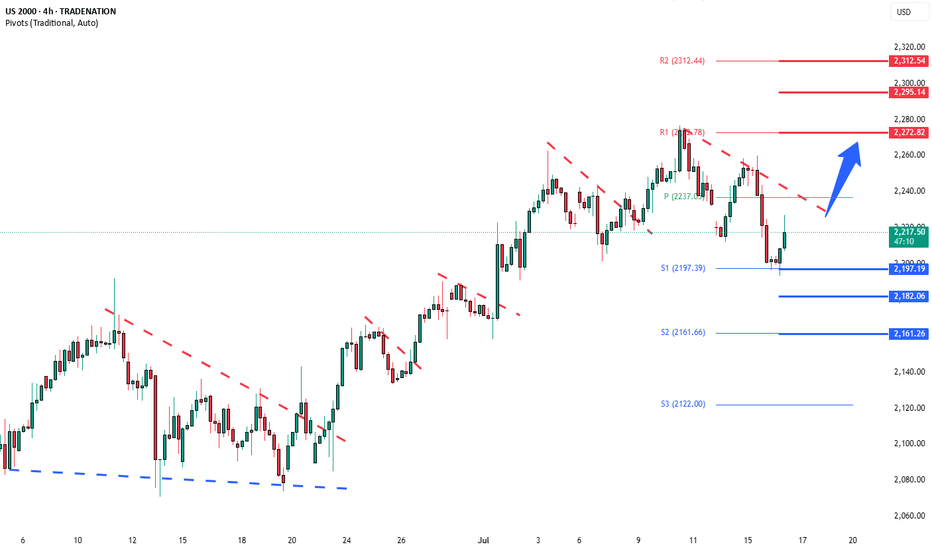

Russell2000 sideways consolidation supported at 2232Key Support and Resistance Levels

Resistance Level 1: 2278

Resistance Level 2: 2300

Resistance Level 3: 2318

Support Level 1: 2232

Support Level 2: 2213

Support Level 3: 2193

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Russell2000 Bullish continuation supported at 2232.60Key Support and Resistance Levels

Resistance Level 1: 2278.80

Resistance Level 2: 2299.70

Resistance Level 3: 2318.30

Support Level 1: 2232.60

Support Level 2: 2213.00

Support Level 3: 2193.00

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

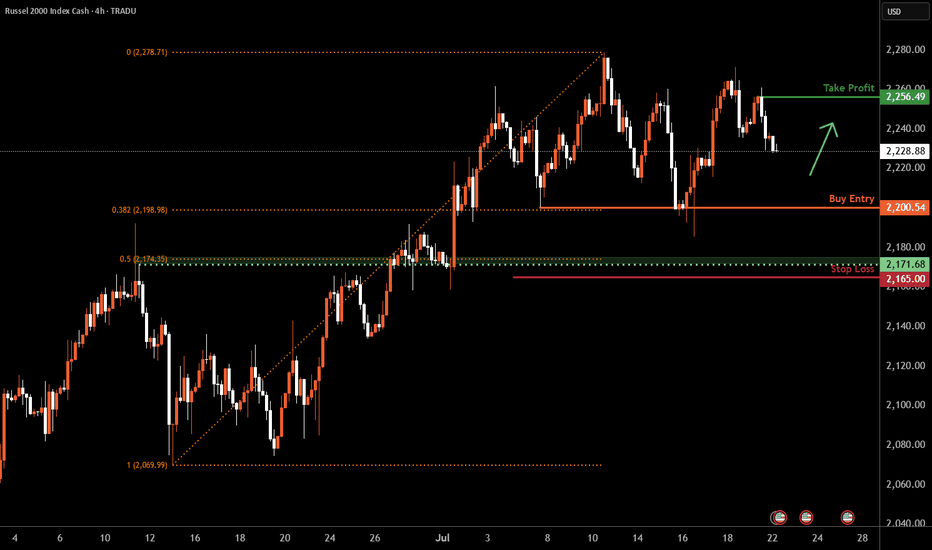

Russell 2000 H4 | Falling toward a multi-swing-low supportThe Russell 2000 (US2000) is falling towards a multi-swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 2,200.54 which is a multi-swing-low support that aligns with the 38.2% Fibonacci retracement.

Stop loss is at 2,165.00 which is a level that lies underneath an overlap support and the 50% Fibonacci retracement.

Take profit is at 2,256.49 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

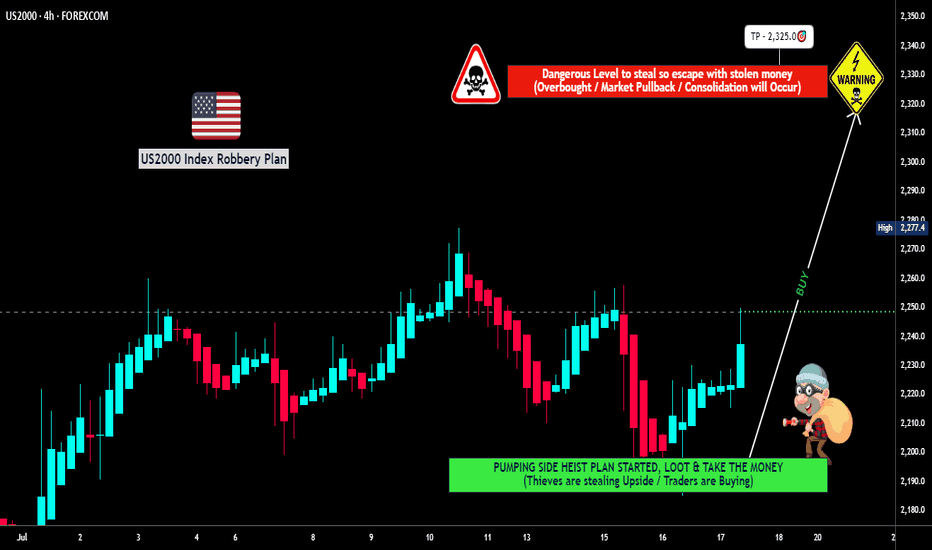

"US2000 THIEF TRADE: SWIPE & ESCAPE BEFORE BEARS!"🔥💰 "RUSSELL 2000 HEIST" – THIEF TRADING STYLE (BULLISH LOOTING IN PROGRESS!) 💰🔥

🚨 ATTENTION, MARKET ROBBERS & MONEY MAKERS! 🚨

(Thief Trading Strategy – High-Reward, Low-Risk Escape Plan!)

🎯 MISSION: US2000 / RUSSELL 2000 INDEX

(Current Market Status: Bullish Heist in Progress!)

🔓 ENTRY POINT: "THE VAULT IS OPEN!"

"SWIPE THE BULLISH LOOT AT ANY PRICE!" 🏦💨

Pro Thief Move: Use Buy Limit Orders (15-30min TF) near recent swing lows/highs for sneaky pullback entries.

Advanced Heist Tactics: Layered DCA entries (multiple limit orders) for maximum stealth & profit.

🛑 STOP-LOSS (ESCAPE ROUTE):

SL @ Nearest Swing Low (4H TF – 2200.0)

Risk Management Tip: Adjust SL based on your loot size (position sizing) & number of orders.

🏴☠️ TARGET: 2325.0 (OR ESCAPE BEFORE THE BEARS CATCH YOU!)

Scalpers Alert! 🚨 Only LONG-side scalp – if you’re rich, go all-in. If not, join the swing heist & use Trailing SL to lock profits!

💥 WHY THIS HEIST WILL WORK:

✔ Bullish Momentum Fueling the Rally

✔ Weak Bears Trapped Near Resistance

✔ Smart Money Accumulating Before Breakout

✔ Institutional Flow & Macro Trends Aligned (Check COT Report & News!)

📰 THIEF’S NEWS ALERT:

🚨 Beware of High-Impact News! (Avoid new trades during volatility.)

🚨 Use Trailing SL to Protect Your Loot!

💖 SUPPORT THE HEIST SQUAD!

👉 SMASH THAT "LIKE" & "BOOST" BUTTON! 👈

(More heists = More profits for all!)

🎭 DISCLAIMER:

This is NOT financial advice – just a Thief Trading Strategy! Trade at your own risk. Market conditions change fast, so stay sharp!

🚀 NEXT HEIST COMING SOON… STAY TUNED, ROBBERS! 🤑

Russell2000 corrective pullback supported at 2197Key Support and Resistance Levels

Resistance Level 1: 2270

Resistance Level 2: 2295

Resistance Level 3: 2313

Support Level 1: 2197

Support Level 2: 2180

Support Level 3: 2160

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Russell 2000 H4 | Potential bounce off a swing-low support?The Russell 2000 (US2000) is falling towards a swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 2,210.84 which is a swing-low support that aligns closely with the 38.2% Fibonacci retracement.

Stop loss is at 2,155.00 which is a level that lies underneath an overlap support and the 50% Fibonacci retracement.

Take profit is at 2,276.04 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

"US2000 Technical Play: Long Entry at Key Support"RUSSELL 2000 BULLISH BREAKOUT STRATEGY

*(High-Probability Swing Trade Setup on RUT/US2000)*

TRADE EXECUTION PLAN

ENTRY STRATEGY

Preferred Entry: Wait for pullback to 2170 support zone (15M/30M charts)

Confirmation Entry: Valid breakout above 2170 resistance (1H closing basis)

Order Placement: Use limit orders near support or stop orders above resistance

RISK PROTOCOLS

Stop Loss Placement: 2130 (swing low on 3H/4H timeframe)

Position Sizing: Maximum 1-3% risk per trade

Key Reminder: Strict risk management is essential for long-term success

PROFIT TARGETS

Primary Objective: 2230 resistance level

Alternative Approach: Trail stop loss if momentum weakens prematurely

Scalping Note: Focus exclusively on long-side opportunities in current market conditions

MARKET ANALYSIS

Technical Factors: Emerging higher low pattern, strengthening momentum

Fundamental Drivers: Supportive environment for small-cap equities

Sentiment Indicators: Retail positioning suggests room for upside

IMPORTANT WARNING

News Event Protocol: Avoid trading during high-impact announcements

Position Management: Adjust stops accordingly during volatile periods

Trading Discipline: No new entries when major news is pending

TRADING PSYCHOLOGY NOTE

This swing trade requires patience and discipline. Wait for proper confirmation signals before execution and maintain strict risk parameters throughout the trade duration.

ENGAGEMENT REQUEST

If you find this analysis valuable, please like and follow for more trade ideas. Share your perspective in the comments section.

(Disclaimer: This content is for educational purposes only. Trading involves substantial risk.)

NEXT MARKET ANALYSIS COMING SOON

Russell 2000 H4 | Falling toward a swing-low supportThe Russell 2000 (US2000) is falling towards a swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 2,210.84 which is a swing-low support.

Stop loss is at 2,155.00 which is a level that lies underneath an overlap support and the 50% Fibonacci retracement.

Take profit is at 2,278.39 which is a resistance that aligns with the 127.2% Fibonacci extension.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Russell2000 uptrend continuation supported at 2200Key Support and Resistance Levels

Resistance Level 1: 2270

Resistance Level 2: 2295

Resistance Level 3: 2320

Support Level 1: 2200

Support Level 2: 2190

Support Level 3: 2170

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Go Russel - Strong upside for the small fry to 2,506First analysis ever done on the Russell 2000.

And the reason is because there is MAJOR upside to come for the first time in a LONG time.

So why now?

🧨 1. Rate Cuts = Small-Cap Lifeline

Small-cap stocks love lower interest rates — and the Fed's softening tone is a green light for upside.

💥 2. Breakout Setup After Long Chop

The US2000 has been stuck in a sideways range — now it's building energy for a potential breakout.

🏦 3. Regional Banks Bouncing

Regional financials (big weight in US2000) are showing signs of life — that’s a major boost to the index.

🧠 4. Under the Radar = Big Move Potential

While everyone’s chasing Nasdaq and S&P, smart money is quietly positioning in small caps before the crowd catches on.

📊 5. Economic Resilience Helps the Little Guys

US economy staying stronger than expected = tailwind for smaller domestic-focused businesses in the Russell 2000.

Cup and Handle

Price> 20 and 200MA

Target 2,506

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Russell2000 bullish breakout supported at 2167Key Support and Resistance Levels

Resistance Level 1: 2225

Resistance Level 2: 2240

Resistance Level 3: 2255

Support Level 1: 2167

Support Level 2: 2150

Support Level 3: 2134

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Russell 2000 H4 | Falling toward a pullback supportThe Russell 2000 (US2000) is falling towards a pullback support and could potentially bounce off this level to climb higher.

Buy entry is at 2,163.07 which is a pullback support that aligns with the 23.6% Fibonacci retracement.

Stop loss is at 2,130.00 which is a level that lies underneath an overlap support and the 50% Fibonacci retracement.

Take profit is at 2,215.08 which is an overlap resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Russell2000 key trading levelsKey Support and Resistance Levels

Resistance Level 1: 2170

Resistance Level 2: 2195

Resistance Level 3: 2242

Support Level 1: 2074

Support Level 2: 2050

Support Level 3: 2000

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Russell 2000 H1 | Pullback resistance at 61.8% Fibo retracementThe Russell 2000 (US2000) is rising towards a pullback resistance and could potentially reverse off this level to drop lower.

Sell entry is at 2,112.73 which is a pullback resistance that aligns closely with the 38.2% and 61.8% Fibonacci retracements.

Stop loss is at 2,135.00 which is a level that sits above the 50% and 78.6% Fibonacci retracements and a pullback resistance.

Take profit is at 2,071.60 which is an overlap support that aligns with the 78.6% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

RUSSELL: Short term consolidation before ATH test.Russell is technically neutral on its 1D outlook (RSI = 55.323, MACD = 20.400, ADX = 20.042) as for the whole month of May it is trading sideways inside the 1D MA50 and 1D MA200. April's bottom and the subsequent RSI DB rebound, is very much like the October 27th 2023 bottom. The rebound that was followed, also had the index consolidate between the 1D MA50 and 1D MA200 and soon after it resumed the uptrend to cross above the R1 level (prior High) before pulling back to the 1D MA50 again. Based on that we remain bullish on Russell, aiming for the R1 (TP = 2,470).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Russell 2000 INTRADAY bullish consolidation supported at 1970Key Support and Resistance Levels

Resistance Level 1: 2133

Resistance Level 2: 2175

Resistance Level 3: 2240

Support Level 1: 1970

Support Level 2: 1910

Support Level 3: 1840

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

US2000 / RUSSELL2000 Index Market Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the US2000 / RUSSELL2000 Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red zone area. It's a Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (1960) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the nearest/swing low level Using the 2H timeframe (1840) Day / Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 2100 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸US2000 / RUSSELL2000 Index Market Heist Plan (Swing/Day Trade) is currently experiencing a Bullish trend.., driven by several key factors.☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Future trend targets with Overall outlook score... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"US2000/Russel" Index Market Bullish Robbery (Swing Trade Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US2000 / Russel 2000" Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 3H timeframe (1888.0) Day/Swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 2111.0 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸"US2000 / Russel 2000" Index Money Heist Plan is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Future trend targets with Overall outlook score... go ahead to check 👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Russell 2000 - C wave to complete correction?I have been bearish on the Russell for a long time. nothing has changed. the wave count is getting clearer... at least for now.

price action as of late has been like watching paint dry on the wall, still waiting for a catalyst... coming soon, i believe.

this count would only be invalidated with a sustained break above resistance zone.

**minor change from my previous charts - i have simplified the wave counts from a (WXYZ) to (ABC).

US2000 Indices Heist: Steal the Market’s Hidden Profits! **🚨 Attention, market bandits & profit thieves!** 🏴☠️💸

The **US2000 Indices** are ripe for the taking—here’s your **Thief Trading Plan** to loot the charts like a pro! 🕵️♂️📉📈

This strategy blends **killer technicals** with **smart fundamentals** to lock in gains. Ride the bullish wave 🚀 but stay alert—the **Red Zone** is where overbought traps lurk, and bears might ambush! 🐻 Secure your profits before the market turns!

---

**🔑 Entry Signals: Strike Like a Thief!**

- **Bullish Ambush (Long)**: Enter on pullbacks near **Pullback Zone 1 (2060.00)** or **Pullback Zone 2 (1980.00)**. 🎯

- **Bearish Blitz (Short)**: Jump in if price breaks **below 2040.00**—ride the drop! 📉

- **Set an alert!** 🔔 Catch breakouts in real-time.

---

**🛑 Stop Loss Tricks: Protect Your Loot!**

- **Buy Stops**: Confirm breakout first! Place stops at **1980.00 (Zone 1)** or **1910.00 (Zone 2)**.

- **Adjust based on risk & lot size—stay sharp, not reckless!** ⚡

---

**🎯 Profit Targets: Cash Out & Celebrate!**

- **Bullish Thieves**: Aim for **2200.00** or exit early if momentum fades.

- **Bearish Raiders**: Target **1980.00** for quick steals.

- **Scalpers**: Stick to **long-side scalps**—big players swing, small traders trail stops!

---

**📜 Market Intel: Why This Heist Works!**

The **US2000** is surging bullish! 🐂 Fueled by **COT data, macro trends, sentiment shifts & intermarket flows**—check the links for deep dives! 🔍📊

---

**🚨 Trading Alert: News Can Wreck the Heist!**

- **Avoid new trades during news!** 📰

- **Use trailing stops** to lock profits on open trades. 🔐

---

**🔥 Support the Heist—Hit Boost & Join the Profit Gang!**

With **Thief Trading**, every day’s a new robbery opportunity. Stay alert for the next big steal! 🤑💨

**See you in the markets, bandits!** 🤝🎭