Dow Jones INTRADAY reaction to China Tariffs HikeKey Support and Resistance Levels

Resistance Level 1: 41100

Resistance Level 2: 42170

Resistance Level 3: 42800

Support Level 1: 37554

Support Level 2: 36620

Support Level 3: 35125

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

US30

US30: Will the Channel Hold? Trading the Intraday StructureUS30 1-Hour Analysis - Potential Trading Setup

Technical Outlook — 11 April 2025

Current Market Condition:

US30 on the 1-hour timeframe is currently trading within a short-term ascending channel, showing a recent test of the upper trendline. The price is now exhibiting signs of potential bearish pullback within this channel.

Potential Trading Setup:

Bearish Pullback Setup (Primary Scenario):

Entry: Look for confirmation of bearish rejection from the upper ascending channel trendline. This could be in the form of bearish candlestick patterns (e.g., bearish engulfing, pin bar) on the 15-minute or 30-minute timeframe after testing the channel top.

Stop Loss: Place a stop loss above the high of the rejection candle or above the upper channel trendline to protect against a potential channel breakout.

Take Profit Targets:

TP1: The middle of the ascending channel (currently around 40,600).

TP2: The lower trendline of the ascending channel (currently around 40,300 - 40,400).

Potential TP3: If the channel breaks down, the next support zone around 39,800 - 39,900.

Rationale: Trading within an ascending channel often involves buying at the lower trendline and selling at the upper trendline. The recent rejection at the channel top provides a potential short opportunity for a pullback towards the lower trendline.

Bullish Breakout Setup (Lower Probability, Requires Strong Confirmation):

Entry: Consider a long entry only upon a strong and sustained break above the upper ascending channel trendline (around 41,000). Look for strong bullish candlestick patterns and increasing volume on the breakout.

Stop Loss: Place a stop loss below the low of the breakout candle or below the upper channel trendline after it has been broken.

Take Profit Targets:

TP1: Previous swing highs or resistance levels above the channel (refer to the chart for specific levels).

Rationale: A breakout from the ascending channel could signal a continuation of bullish momentum, but requires strong confirmation to avoid false breakouts.

If you found this analysis valuable, kindly consider boosting and following for more updates.

Disclaimer: This content is intended for educational purposes only and does not constitute financial advice.

DOW JONES: High volatility but clear picture long term.Dow Jones turned bearish on its 1D technical outlook (RSI = 40.021, MACD = -1063.380, ADX = 32.380) as it is correcting brutally yesterday's gains on uncertainty regarding the 90-day pause of tariffs. We can't overlook however the fact that yesterday's rebound happened on the 1W MA200 and at the bottom (HL) of the Bullish Megaphone. The very same sequence of events unfolded during the last big U.S.-China trade war that bottomed in December 2018. First a Channel Down bottomed on the 1W MA200 and started the Bullish Megaphone that bottomed on the 2018 trade war.

Both trade war corrections were -19% and if what follows replicates the 2019 rise, then we are up for a +35% rally. Potential TP = 49,000.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Trade Idea: US30 Short ( MARKET ) Daily Chart (Macro View):

• Bearish divergence: RSI is at 47.38 and turning down — no strong bullish momentum.

• Recent bounce is sharp but came after a massive drop, suggesting a dead cat bounce or retracement.

• MACD remains heavily bearish (-836), showing underlying weakness despite the current bounce.

• Price recently rejected a key resistance near 40,850, aligning with previous support-turned-resistance levels.

15-Min Chart (Medium-Term):

• RSI is at 78.76 — overbought territory.

• Price surged parabolically, forming potential exhaustion.

• MACD shows very high positive values (672.341), usually precedes a correction.

• Potential bearish divergence between price and MACD.

3-Min Chart (Entry Timing):

• Price has stalled at the top, consolidating after an extreme spike.

• MACD and RSI are curling down.

• Ideal for timing a short entry.

⸻

Trade Idea: SHORT US30

• Entry: 40,850 (current resistance zone + psychological level)

• Stop Loss: 41,200 (above key recent highs / invalidation of setup)

• Take Profit: 39,450 (near broken structure & moving average support on lower timeframes)

Risk-to-Reward Ratio (RRR):

• Risk: 350 points

• Reward: 1,400 points

• RRR: 4:1 (excellent)

⸻

Fundamental Context (Supporting the Short Bias):

• Dow is rebounding amid broader market uncertainty (e.g., Fed rate trajectory, inflation prints).

• No strong economic catalyst justifying a sustained breakout to new highs — suggests technical bounce rather than trend reversal.

• Rising yields or a hawkish Fed outlook could reintroduce selling pressure.

FUSIONMARKETS:US30

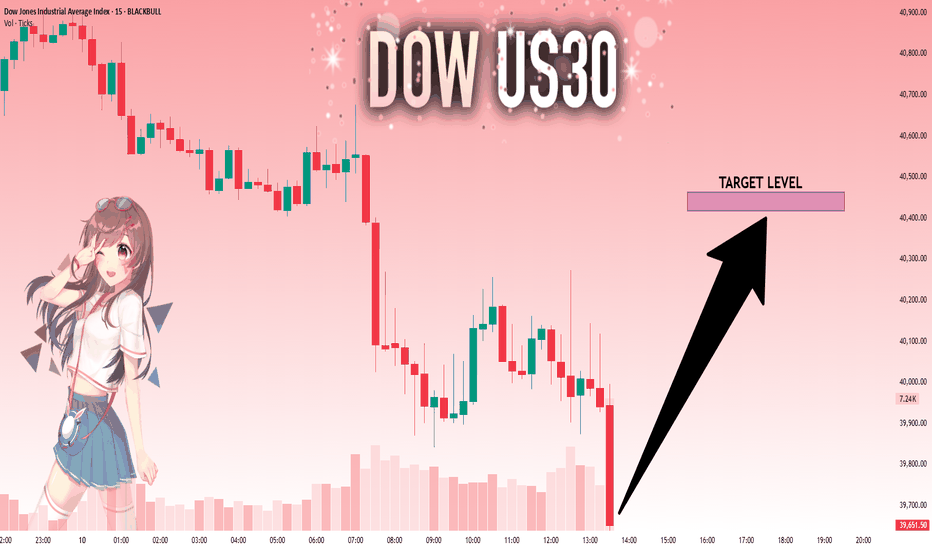

US30: Target Is Up! Long!

My dear friends,

Today we will analyse US30 together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 39,680.80 will confirm the new direction upwards with the target being the next key level of 40,416.97 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

US30: Downtrend vs. Support Battle - What's Next?US30 Daily Analysis

Technical Outlook — 10 April 2025

Current Market Condition:

US30 is currently in a defined downtrend on the daily timeframe, characterized by a series of lower highs and lower lows. The price has recently broken down from a potential bearish wedge pattern and is trading below key moving averages.

Key Technical Highlights:

Clear bearish structure evident with consecutive lower highs and lows.

Price has broken down from a potential bearish wedge formation, suggesting further downside.

Trading below the 50-day and 200-day Exponential Moving Averages (EMAs), indicating bearish momentum.

Key Support Zones identified around $37,000 - $37,500 and $35,800 - $36,200.

Key Resistance Zones located around $42,000, $45,000, and $47,800 - $48,000.

Momentum oscillator (MACD or similar) showing bearish momentum.

Possible Scenarios:

Bearish Scenario (High Probability):

If price remains below the descending trendline (around $40,000 - $41,000) and fails to reclaim the $37,500 level, expect bearish continuation.

A confirmed break below the $37,000 - $37,500 support zone could lead to targets at the $35,800 - $36,200 support zone.

Confluence of the bearish trendline and moving averages adds to the potential selling pressure.

Bullish Scenario (Invalidation Level):

A break and sustained trading above the descending trendline and the $42,000 resistance level could signal a potential short-term pullback towards higher resistance levels around $45,000.

Strong bullish reversal signals within the $37,000 - $37,500 support zone could also indicate a potential bounce.

Important Note:

Be aware of any upcoming economic data releases that could impact US indices and cause volatility.

Wait for clear candle confirmations at key levels before initiating trades.

Implement robust risk management strategies, including appropriate stop-loss placement.

If you found this analysis valuable, kindly consider boosting and following for more updates.

Disclaimer: This content is intended for educational purposes only and does not constitute financial advice.

Dow Jones INTRADAY oversold bounce back Key Support and Resistance Levels

Resistance Level 1: 41100

Resistance Level 2: 42170

Resistance Level 3: 42800

Support Level 1: 37554

Support Level 2: 36620

Support Level 3: 35125

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

DOW JONES INDEX (US30): Bearish More From Resistance

It looks like US30 is returning to a bearish trend again.

I see a strong bearish sentiment after a test of a key daily resistance.

The price formed an inverted cup and handle pattern and we see

a strong bearish imbalance with London session opening.

Goal - 39.685

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

US30 — Support Holding or Further Drop? Key Levels To WatchUS30 (Dow Jones) — 4H Chart

Price is currently hovering around a key support zone near 37,000 after a strong bearish impulse.

Scenarios I'm Watching:

▸ Bullish Scenario:

If the support zone holds and price reclaims 37,500 — I would look for price to retest the 38,300-38,800 zone.

A clean break and hold above 39,500 could open doors towards the 40,000-41,000 resistance area.

▸ Bearish Scenario:

If price fails to hold this support, and breaks below 36,850 — I expect further downside towards the next key supports:

35,800

34,500

33,000

Trading Plan:

Waiting for clear price action confirmation at this support zone.

Will avoid trading in the middle of the range — prefer breakout or retest setups.

Levels marked on chart for clarity.

If you found this analysis valuable, kindly consider boosting and following for more updates.

Disclaimer: This content is intended for educational purposes only and does not constitute financial advice.

DOW 104% TARIFFS on China activated. Can the market be saved?Dow Jones (DJIA) is almost on its 1W MA200 (orange trend-line) and earlier today President Trump activated 104% duties on Chinese imports. This is far from being an encouraging development especially after Monday's attempt for the market to recover.

Most of the gains were lost yesterday and today it is a wait-and-see game in anticipation of the market reaction on the opening bell of Wall Street.

From a long-term technical perspective however, Dow is on a huge buy level that we've only seen another 4 times since the Housing Bubble bottom in March 2009. That buy level consists of two conditions: price touching the 1W MA200 and the 1W RSI hits (or comes extremely close to) the 30.00 oversold limit.

As you can see that has happened last time on September 19 2022 (Inflation Crisis bottom), March 09 2020 (COVID crash), August 24 2015 (China slowdown, Grexit) and August 08 2011 (first correction since 2009 Housing Crisis). The situation most similar to the current, is the COVID crash as it was the fastest drop to the 1W MA200 and 1W RSI to 30.00.

Despite the brutal correction, it took the market 'only' 43 weeks (301 days) to reach again the 0.786 Fibonacci retracement level. That is the top of the Blue Zone of the Fibonacci Channel Up that started on the March 2009 Housing bottom. The Blue Zone, consisting of the 0.786 - 0.382 Fib range, is important as it has dominated the multi-year bullish trend and contained the price action inside it, with only a few occasions diverging outside of it.

The longest it took Dow to reach the 0.786 Fib again after such correction was 110 weeks (770 days) and that interestingly enough happened two out of the four times. Practically reaching the 0.786 Fib constitutes a Cycle Top.

So essentially, despite the uncertainty and panic, the market is technically on a Support level that in 16 years we've only seen another 4 times, that's once every 4 years, which is a fair sample of a Cycle size. As a result, assuming stability comes to the world through trade deals (and why not Rate Cut announcements), we may see Dow reaching its 0.786 Fib again (and make new ATH) the fastest by February 02 2026, hitting 49000 and the longest by May 17 2027, hitting 56000 roughly.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDCAD IS DRROPPING. DETAILED TECHNICAL AND FUNDAMENTALSUSDCAD is currently trading around 1.4200 after a clean retest of a previously broken support zone, which has now turned into a strong resistance level. Price action is confirming the bearish structure as we see a gradual yet consistent drop from the highs of 1.4540. With the rejection seen from the supply zone and recent lower high formation, momentum is shifting further in favor of the sellers. I am now targeting 1.3800 for the next key level, aligning with both technical confluence and fundamental sentiment.

Technically, the structure is clear: we had a failed breakout above 1.4450, followed by a decisive bearish engulfing move. The market then completed a textbook retest at the 1.4340–1.4450 supply zone before resuming the downside move. The current formation on the 12H chart shows a lower low and lower high sequence intact, signaling a trend continuation to the downside. The highlighted zones also provide ideal reward-to-risk setups for continuation traders.

From a fundamental perspective, the Canadian dollar is gaining strength due to rising oil prices, with WTI crude now climbing back above the $85 mark. This directly supports the loonie given Canada’s oil-export-driven economy. Meanwhile, US economic uncertainty around upcoming CPI data and shifting Fed rate cut expectations continue to weigh on the dollar’s upside momentum. Additionally, recent risk-on sentiment in global markets is pushing flows into commodity-linked currencies like CAD.

With technicals and fundamentals aligning, I remain firmly bearish on USDCAD. As long as price remains below the 1.4340 resistance, I’m looking for continuation toward the major demand zone near 1.3830–1.3800. This setup offers a clean 1:3+ risk-to-reward profile, and I will be scaling in further on bearish confirmations as the market progresses.

US30 I Bullish Bounce Based on the D1 chart analysis, the price is approaching our buy entry level at 36,516.88, a pullback support.

Our take profit is set at 40,052.43, a pullback resistance.

The stop loss is placed at 34,049.36, an overlap support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Trade Idea : US30 Short ( SELL STOP )Technical Analysis Summary:

Daily Chart:

• Trend: Strong bearish breakdown; significant drop below support.

• MACD: Deeply negative, suggesting strong bearish momentum.

• RSI: Oversold at 18.48, indicating exhaustion but not yet reversal.

15-Minute Chart:

• Trend: Clear downtrend continuation.

• MACD: Bearish crossover sustained.

• RSI: Approaching oversold (29.81), but still trending down.

3-Minute Chart:

• Trend: Momentum is slowing down but still bearish.

• MACD: Negative, bearish crossover.

• RSI: Around 33, indicating potential short-term bounce, but no bullish divergence.

⸻

Fundamental Insight:

• The broader US30 index has reacted to strong macroeconomic headwinds (possibly higher-for-longer interest rates, weak earnings, or geopolitical tensions).

• No signs of dovish reversal or major catalyst for a sharp recovery.

⸻

Trade Idea: SHORT POSITION

Entry: 37070 (current price zone—ideal entry on slight retracement)

Stop Loss (SL): 37320 (above minor resistance and recent local high)

Take Profit (TP): 36350 (strong daily support area and psychological level)

Risk-Reward Ratio (RRR):

• Risk: ~270 points

• Reward: ~700 points

FUSIONMARKETS:US30

Hanzo | US30 15 min Breaks – Will Confirm the Next Move🆚 US30

The Path of Precision – Hanzo’s Market Strike

🔥 Key Levels & Breakout Strategy – 15M TF

🔥 Deep market insight – no random moves, only calculated execution.

☄️ Bearish Setup After Break Out – 38600 Zone

Price must break liquidity with high volume to confirm the move.

🩸 15M Time Frame Confluence

————

CHoCH & Liquidity Grab @ 39610

Key Level / Equal lows Formation - 37750

Strong Rejection from 39280 – The Ultimate Pivot

🔥 1H Time Frame Confirmation

Twin Wicks @ 37700 – Liquidity Engineered

Twin Wicks @ 38300 – Liquidity Engineered

☄️ 4H Historical Market Memory

——

💯 2024 – Bearish Retest 38000

💯 2024 – Bearish Retest 37600

👌 The Market Has Spoken – Are You Ready to Strike?

Dollar Index Bullish to $111.350 (UPDATE)Since yesterday's Dollar update, price has moved according to our arrow. We saw a small dip down overnight & now buyers have once again pushed price back into the grey zone.

We are expecting price to remain within this grey zone, seeing it flip from a resistance zone into support. Once price closes above this zone, we'll have extra confirmation that Dollar buyers are ready to push price even higher🚀

TRADE IDEA: US30 LONG ( BUY LIMIT )

Daily Chart:

• RSI: At 24.33, it’s in oversold territory — potential for a reversal.

• MACD: Strong bearish momentum, but the histogram may be bottoming out, signaling a potential bullish divergence forming.

• Price Action: Testing key support zone near 38300, which was previously a resistance-turned-support area.

15-Minute Chart:

• RSI: At 60.68, indicating early bullish momentum.

• MACD: Bullish crossover recently occurred; histogram rising — confirming short-term upward trend.

• Price Action: Clear bounce from recent lows with higher highs and higher lows forming.

3-Minute Chart:

• Momentum clearly shifting up.

• Price moving above short-term moving average, showing intraday strength.

⸻

Fundamental Context:

• US economic data has recently shown mixed signals, but dovish Fed tone and potential rate cuts in the near future favor equity indices recovery.

• No major bearish macro headlines present at this time to sustain the steep drop.

⸻

Trade Parameters:

• Entry: 38,390 (current price zone, confirming strength above local consolidation)

• Stop Loss (SL): 38,000 (below recent lows and psychological level)

• Take Profit (TP): 39,190 (previous supply zone, daily EMA resistance area)

• Risk: 390 points

• Reward: 800 points

• RRR: 2.05:1

FUSIONMARKETS:US30

Dow Jones INTRADAY oversold bounce back Dow Jones INTRADAY oversold bounce back

Key Support and Resistance Levels

Resistance Level 1: 40617

Resistance Level 2: 42165

Resistance Level 3: 44073

Support Level 1: 37555

Support Level 2: 36620

Support Level 3: 35125

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

WHY XAUUSD IS BULLISH ?? TECHNICAL AND FUNDAMENTALSXAUUSD is currently trading around the key psychological level of 3000, and as expected, price action has just completed a textbook retest of the previous breakout zone. The support level near 2960–2980 has held strongly, giving gold the momentum it needs for the next leg up. Price has reacted with a clear bullish bounce from this demand zone, confirming the structure and setting up for a potential continuation toward the 3100 target.

From a technical perspective, we’re seeing a classic bullish continuation move. The previous impulse to the upside was followed by a correction phase, which respected the support area now acting as a launchpad. This bounce, combined with strong candle formations on the 12H and daily charts, suggests bulls are regaining control. Volume is gradually increasing, aligning with the anticipated breakout from the recent consolidation.

On the fundamentals side, the gold market remains well-supported. Recent macroeconomic data shows inflationary pressures are still lingering, while expectations for Federal Reserve rate cuts later in the year continue to weigh on the US dollar. Geopolitical tensions and increased central bank gold accumulation are adding further demand for safe-haven assets like gold. These drivers remain bullish catalysts as long as uncertainty stays elevated and real yields remain low.

With price holding above 3000 and a strong structure in place, I expect continuation toward 3100 in the near term. This is a high-probability setup supported by both technicals and fundamentals. I’ll be closely watching for higher lows and continuation signals above 3020 for additional confirmation. Risk management remains key, but the market structure strongly favors further upside.

Falling towards pullback support?Dow Jones (US30) is falling towards the pivot and could bounce to the 50% Fibonacci resistance.

Pivot: 37,575.10

1st Support: 36,424.90

1st Resistance: 39,614.90

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

DOW JONES Will the 1week MA200 save the day?Dow Jones / US30 almost reached its 1week MA200 today and immediately rebounded.

Last time it approached it so closely was on October 23rd 2023 and last it crossed under it was September 19th 2022.

The most recent was the first higher low of the 3 year Channel Up and the latter was the bottom of the last bear market.

The 1week RSI hasn't been this low since June 13th 2022, which was again a near 1week MA200 test that caused an immediate rebound to the 1week MA50 before the rejection to the eventual bear market bottom.

As long as the 1week MA200 holds and closes the candles over it, we expect the Channel Up to start a near bullish wave like post October 2023.

Target 45200 (same as the March 2024 rally) which is around the All Time High.

Follow us, like the idea and leave a comment below!!