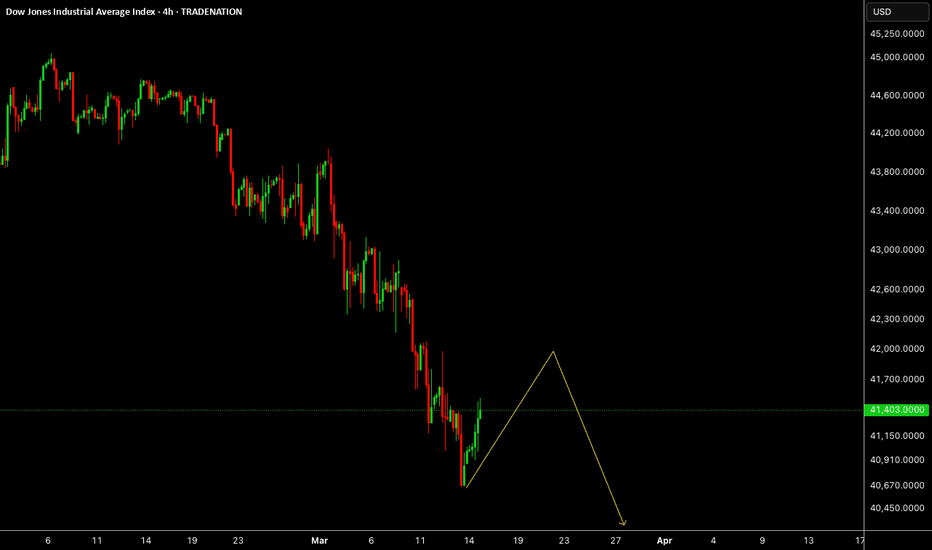

US30 (Dow Jones) 4H Analysis – Bearish Outlook Ahead?Trend Analysis:

🔸 The market is in a downtrend since early February.

🔸 Lower highs and lower lows indicate strong bearish momentum.

🔸 A recent break below support suggests further downside pressure.

📌 Key Support & Resistance Zones:

🟣 Resistance Zone (~41,500 - 41,300):

🔺 Price tried to retest but failed = Bearish signal 🚫

🟣 Support Zone (~40,000 - 39,800):

🔻 A minor support area before the next big level.

🔵 Major Target (38,821):

👉 If price keeps falling, it could reach this level 🔽

📊 Price Action & Prediction:

✅ Pullback to resistance → 🚀 Bears defending!

❌ If rejection holds → 📉 Drop expected towards 38,821.

🚦 A break above resistance? Trend might shift!

📌 Trading Idea:

🛑 Short below resistance if rejection holds.

🚀 Long only if resistance breaks convincingly.

⚠️ Stay cautious! Watch for confirmations 📊🔍

Us30analysis

US30 1HR // 17 March AnalysisWe can see that BLACKBULL:US30 is in a downtrend on the 1HR timeframe.

The price is near the our trendline and has touched our area of resistance around the 41500.00 once. Looking for the price to approach the area of resistance as well as trendline and show a good rejection for potential sells.

A good target would be the 40750.00 area.

DISCLAIMER: This analysis is purely for personal reference and record keeping and should be taken as educational material only, NOT FINANCIAL ADVISE. I will not be responsible for profits or loses due to this analysis.

Bullish bounce?Dow Jones (US30) has bounced off the pivot and could rise to the 1st resistance which is a pullback resistance.

Pivot: 40,928.39

1st Support: 40,177.61

1st Resistance: 42,282.48

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

US30; Heikin Ashi Trade IdeaPEPPERSTONE:US30

In this video, I’ll be sharing my analysis of US30, using my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

"US30 / DJI" Indices Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US30 / DJI" Indices Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (44200) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 42200 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

"US30 / DJI" Indices Market is currently experiencing a Bearish trend., driven by several key factors.

🟣Fundamental Analysis

Earnings: Q4 2024 EPS growth strong (e.g., 16.9% for S&P 500 proxies)—bullish, but US30 firms face tariff uncertainty.

Rates: Fed at 3-3.5%, no cuts signaled—real yields ~1% (10-year Treasury 3.8%) pressure equities—bearish.

Inflation: PCE 2.6% (Jan 2025)—persistent inflation supports Fed stance, bearish for stocks.

Growth: U.S. consumer spending wanes (Schwab)—mixed, neutral impact.

Geopolitics: Trump tariffs (25% Mexico/Canada, 10% China)—short-term volatility, long-term bullish for U.S. firms.

🟤Macro Economics

Federal Reserve Policy: The Federal Reserve has been raising interest rates to combat inflation, which has led to a strengthening of the US dollar.

US Economy: The US economy has been showing signs of slowing down, with GDP growth rates decreasing.

Global Economy: The global economy has been experiencing a slowdown, with many countries experiencing recession.

⚪Commitments of Traders (COT) Data

Speculators: Net long ~55,000 contracts (down from 65,000)—cooling bullishness.

Hedgers: Net short ~60,000—stable, locking in gains.

Open Interest: ~125,000 contracts—steady global interest, neutral.

🔴Market Sentimental Analysis

Bullish Sentiment: Some analysts believe that the US30 will break above the resistance at 45,000 and continue rising.

Bearish Sentiment: Many investors expect a correction, with a potential target of 42200.

Risk Aversion: The market is experiencing risk aversion, with investors seeking safe-haven assets.

🔵Positioning Analysis

Long Positions: Some investors are holding long positions in US30, expecting a breakout above 45,000.

Short Positions: Many investors are holding short positions in US30, expecting a correction.

🟠Quantitative Analysis

Technical Indicators: The 14-day Relative Strength Index (RSI) is at 45, indicating a neutral sentiment.

Moving Averages: The 21-day Simple Moving Average (SMA) is at 44,404, providing resistance for US30 prices.

🟡Intermarket Analysis

DXY: 106.00—USD softness aids equities—bullish.

XAU/USD: 2910—gold rise signals risk-off, bearish for US30.

NDX: ~20,000, tech softening—correlated pressure on US30—bearish.

Bonds: U.S. 10-year 3.8%—yield stability neutral.

🟢News and Events Analysis

Federal Reserve Meeting: The Federal Reserve is scheduled to meet on March 15-16, with investors expecting a potential rate hike.

US Economic Data: The US economic data, including the Non-Farm Payrolls report, is being closely watched for its impact on US30 prices.

🟣Next Trend Move

Bullish Trend: Some analysts believe that the US30 will break above the resistance at 45,000 and continue rising.

Bearish Trend: Many investors expect a correction, with a potential target of 42,200.

🔴Overall Summary Outlook

Bullish Outlook: Some analysts believe that the US30 will break above the resistance at 45,000 and continue rising.

Bearish Outlook: Many investors expect a correction, with a potential target of 42,200.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Us30 Reversal /Re entry 📝 US30 (Dow Jones) - Bearish Outlook | 1H Chart 📉

🔹 Market Bias: Bearish

🔹 Key Zones:

Sell Entry: 40,850 - 41,100 (Retracement to resistance)

Stop Loss (SL): Above 41,250 (Beyond liquidity grab zone)

Take Profit (TP):

TP1: 40,500 (First support)

TP2: 40,250 (Key demand zone)

TP3: 39,920 (Final target)

🔹 Analysis:

Price is trading below the 50 & 200 EMA → Downtrend intact 📉

Lower highs & lower lows → Bearish market structure

Potential fakeout before the drop, especially around high-impact news at 4 PM SAST ⚠️

🔹 News Event Consideration:

If data is weak → US30 likely continues dropping 📉

If data is strong → Possible short-term spike before reversal 🔄

🔹 Risk Management:

Be cautious of stop hunts & manipulation before the news.

If price breaks above 41,250 & holds, reconsider bearish bias.

🚀 Trade smart, manage risk, and stay updated on market sentiment!

#US30 #DowJones #StockMarket #TechnicalAnalysis #Trading #PriceAction #Forex #Indices

Falling towards pullback support?Dow Jones (US30) is fallling towards the pivot and could boucne to the 1st resistance.

Pivot: 41,777.16

1st Support: 40,202.56

1st Resistance: 43,339.19

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

US30 Setup: 50% Fib & Imbalance in Focus for a Potential Short.The US 30 Dow Jones index is under pressure 📉 but is currently hovering around a significant previous support level. I’m watching for a retracement into a four-hour imbalance as a potential opportunity to go short. Additionally, I’m looking for the retrace to align with the equilibrium point, which is the 50% Fibonacci level of the current price swing from high to low 📊. For this trade, the price must stay within the imbalance zone and avoid breaking the high. If there’s a clear break of structure near the imbalance point of interest, I plan to sell 🔻. This is not financial advice. 🚨

Bearish drop?Dow Jones (US30) is rising towards the pivot which acts as an overlap resistance and could drop to the pullback support.

Pivot: 43,026.07

1st Support: 42,138.59

1st Resistance: 43,672.97

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

US30 (Dow Jones) Probability Analysis – March 4, 2025

Market Structure Across Multiple Timeframes (M15, M30, H1, H4, D1)

Key Observations (Multi-Timeframe Analysis)

1️⃣ 15-Minute (M15)

Price has dropped from the PDH (Previous Day’s High) and is now consolidating around the PWL (Previous Weak Low).

Liquidity sweep at PDH led to a sharp decline.

Equilibrium at 43,500 could act as a mid-range resistance if price retraces.

Potential bounce or breakdown from the 43,200 demand zone.

2️⃣ 30-Minute (M30)

Price has fully retraced from the premium zone near 44,300.

PDH (43,800) is confirmed as a strong resistance, leading to a bearish structure.

The next key zone is around 43,000 - 42,900 (liquidity zone).

If price holds above 43,200, a short-term rally could occur toward 43,500.

3️⃣ 1-Hour (H1)

Major bearish BOS (Break of Structure) confirms bearish sentiment.

Equilibrium at 43,500 aligns as a potential resistance zone.

If price breaks below PWL (43,100), next support sits around 42,900 - 42,850.

A retracement to 43,500 - 43,600 could give a short entry.

4️⃣ 4-Hour (H4)

Price is in the Discount Zone after a significant sell-off.

Previous premium zone (44,200) rejected price, leading to a shift in momentum.

If price holds above 43,200, a retracement could be seen towards 43,500.

If price breaks 43,100, a move to 42,850 is expected.

5️⃣ Daily (D1)

Major liquidity grab from the 44,200 supply zone confirms bearish sentiment.

Price is currently testing support around 43,200.

Failure to hold this level could lead to a further decline toward 42,900 - 42,700.

A retracement toward 43,500 - 43,800 could be a shorting opportunity.

1️⃣ Bearish Entry Plan (Short Position)

Entry Criteria (Short)

Ideal Entry Zone: 43,500 – 43,600 (Equilibrium & Lower High).

Confirmations Needed:

Rejection from 43,500 - 43,600 with strong bearish candles.

Break of structure (BOS) on M15/M5 confirming bearish intent.

Liquidity grab near equilibrium before dropping.

Entry Trigger

If price retraces to 43,500 and fails to break above, enter short.

Stop Loss (SL)

Above 43,700 (recent lower high).

Take Profit (TP)

First TP: 43,200 (current demand zone).

Final TP: 42,900 (strong demand zone).

📉 Risk-to-Reward (R:R) → 1:4 or higher.

2️⃣ Bullish Entry Plan (Long Position)

Entry Criteria (Long)

Ideal Entry Zone: 43,100 – 43,200 (PWL & Demand Zone).

Confirmations Needed:

Bullish reaction at 43,100 - 43,200 without breaking lower.

Higher low formation on M15 or M5.

Strong bullish candle confirmation.

Entry Trigger

If price rejects 43,100 and shows bullish strength, enter long.

Stop Loss (SL)

Below 42,900 (next liquidity zone).

Take Profit (TP)

First TP: 43,500 (Equilibrium retest).

Final TP: 43,800 (Bearish Breaker Level).

📈 Risk-to-Reward (R:R) → 1:3 or higher.

3️⃣ Neutral Strategy (Wait for Confirmation)

If price remains between 43,100 – 43,500, avoid trading.

Wait for either a bearish rejection (short) or a demand hold (long).

Break below 43,100 confirms shorts, while strong demand at 43,200 could give a long opportunity.

Trading Plan Summary

Setup Entry Zone SL TP1 TP2 R:R

✅ Short 43,500 – 43,600 Above 43,700 43,200 42,900 1:4+

🚨 Long 43,100 – 43,200 Below 42,900 43,500 43,800 1:3+

Final Thoughts

Bearish Bias: If price rejects 43,500 - 43,600, expect a drop to 42,900.

Bullish Bias: If price holds above 43,100 - 43,200, expect a bounce to 43,500 - 43,800.

Wait for confirmations before entering trades.

US30 sellOverall Trend:

The overall trend has been bullish, but there has been a breakout below the ascending trendline.

The price is currently retracing towards support zones.

Key Levels:

Main Resistance: Range between 45,208 - 45,300 (upper red zone)

Main Support: Range between 44,300 - 44,500 (lower red zone)

Important Mid-Level: Around 44,866

Trading Scenario:

After hitting resistance, the price has started a correction.

The highlighted green area marks a potential entry zone.

📉 Trading Signal:

🔹 Enter Short Position:

If the price pulls back to the 44,600 - 44,700 area and shows signs of bullish weakness, a short position could be considered.

🔹 Stop Loss:

Above the resistance zone at 45,208 (e.g., around 45,300)

🔹 Take Profit:

First level at 44,300

Second level at 43,663 (shown on the chart)

Third level at 43,140 if the downtrend continues

🔹 Risk Management:

The risk-to-reward ratio for this trade seems reasonable. Reassess the trade if the price breaks above 44,866.

✅ Conclusion:

Currently expecting a bearish correction, but if reversal candles or weakness in sellers are observed at support levels, there might be a chance for a trend change.

US30 Dow Jones Equal Lows & Structure Shift - Is This Reversing?The US30 is showing key signs that could point to a potential reversal. 🔄 On the 4-hour timeframe, we can see equal lows 🟢 that have been tested three times, followed by a liquidity sweep 💧 and a sharp rally 🚀—indicating possible accumulation by larger market participants.

For confirmation of a Dow Jones bullish reversal, we’ll need to see a pullback forming a higher low 🔽 and then a break in market structure to the upside 📊. In this analysis, we dive into potential price action scenarios based on specific conditions outlined in the video 🎥. If these conditions are not met, the setup will be invalidated ❌.

⚠️ This is for informational purposes only and should not be considered financial advice. 💼

US Wall St 30Dow Jones Market Analysis

Introduction

Hello dear traders! In this analysis, we will examine the status of the Dow Jones chart in the one-hour timeframe.

Technical Analysis

The Dow Jones chart is currently in a bearish phase, but it has provided us with a bullish confirmation. Based on this, we can hold a buy position (Buy Position) until the one-hour liquidity.

Key Levels

Liquidity 1H: 44662.2

Secret Order Block: 44792

Ideal Time to Buy with Confirmation: 43783

Conclusion

My analysis is very simple and straightforward so that you can easily utilize it. Considering the mentioned key levels, you can make your trading decisions.

Wishing you all success!

Fereydoon Bahrami

A retail trader in the Wall Street Trading Center (Forex)

Risk Disclosure:

Trading in the cryptocurrency market is risky due to high price volatility. This analysis is solely my personal opinion and should not be considered financial advice. Please do your own research. You are responsible for any profits or losses resulting from this analysis.

US Wall St 30Hello dear traders!

This is an updated analysis of Dow Jones. Please note that since you may not have enough information about smart money and liquidity, let me put it simply for you: Whenever this trend line breaks, you can set the stop loss above this trend line and determine your target based on your strategy.

A scalper trader utilizes positions and always has a fixed risk to maintain a consistent outcome, and should never use unreasonable risk because the market is continuously changing. What matters is that we are winning.

Yesterday, I was waiting for the price to reach the Secret Order Block zone, but when my trade entered a good profit, I closed it and didn't feel the need to hold the trade until the very end. So, this is the cleverness of a trader in how to use analysis to their advantage. The previous zone seemed to be ineffective for a significant drop, so I have replaced this updated analysis with the previous one.

Key Points

Resistance (1.H): 77943

Secret Order Block: 44994

Wishing you all success!

Fereydoon Bahrami

A retail trader in the Wall Street Trading Center (Forex)

"US30/DJ30" Indices CFD Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US30/DJ30" Indices CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (44,000.0) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 44,600.0 (swing Trade Basis) Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 43,000.0 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

"US30/DJ30" Indices CFD Market is currently experiencing a Bearish trend., driven by several key factors.

⚪Fundamental Analysis

The US30 index is influenced by the overall performance of the US economy, including GDP growth rate, inflation, and interest rates. Currently, the US economy is experiencing a moderate growth rate, with a slight increase in inflation.

🔴Macroeconomic Analysis

The Federal Reserve has maintained a hawkish stance, with interest rates expected to remain high in the short term. This has led to a strengthening of the US dollar, which may impact the US30 index.

🟢COT Data Analysis

The Commitments of Traders (COT) report shows that commercial traders are net short, while non-commercial traders are net long. This indicates a potential trend reversal.

🟡Sentimental Analysis

Market sentiment is slightly bearish, with 55% of traders holding short positions.

🟤Positioning Data Analysis

Institutional traders are holding short positions, while corporate traders are holding long positions. Banks are maintaining a bearish stance.

🔵Market Sentiment

- Institutional Traders: 60% bearish, 40% bullish

- Hedge Funds: 70% bearish, 30% bullish

- Retail Traders: 55% bullish, 45% bearish

🟣Overall Outlook

The US30 index is expected to remain volatile in the short term, with a slight bearish bias due to the hawkish stance of the Federal Reserve. However, the index's movement will largely depend on the overall performance of the US economy and global economic trends.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩