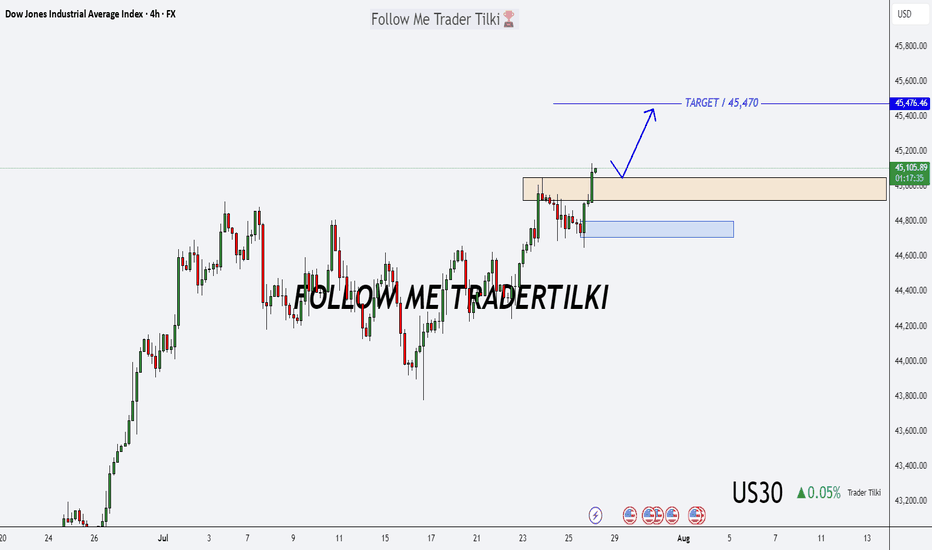

US30 Forecast: Target Locked, Buy Zones in Sight!Good morning friends ☀️

I've prepared a fresh analysis for US30 (Dow Jones).

My current target is 45,470. Even if the price dips to 45,050 or 44,800, I fully expect it to reach that 45,470 mark.

These levels represent strong buying zones and powerful retest regions—don’t forget that.

Every like from you is my biggest source of motivation to keep posting these insights. 💬📊

Big thanks to everyone supporting with a thumbs-up.

Us30long

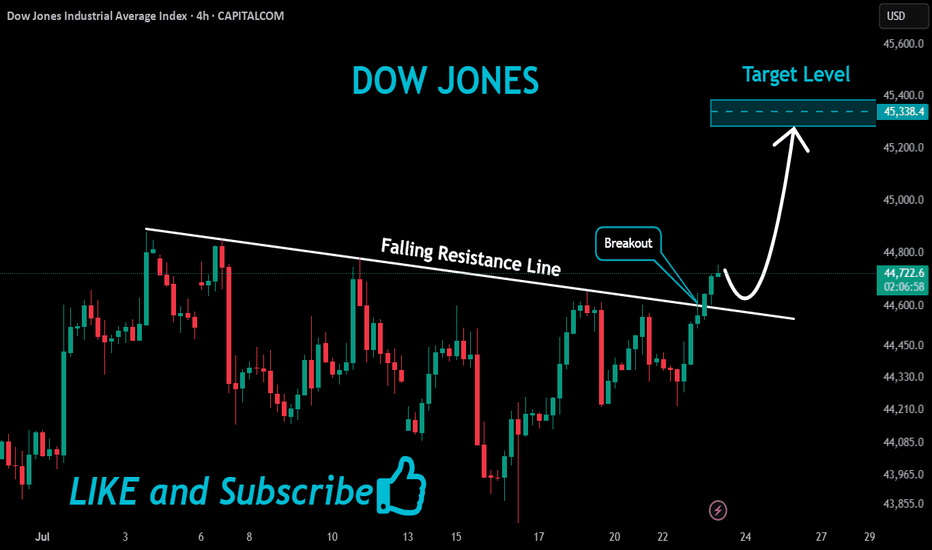

US30 Massive Bullish Breakout!

HI,Traders !

#US30 is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation !

Comment and subscribe to help us grow !

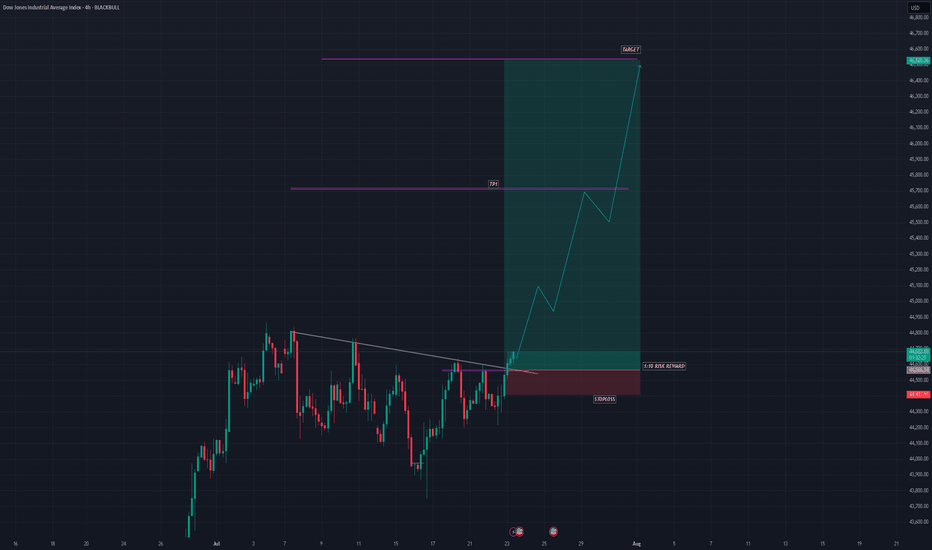

US30 SHOWING A GOOD UPWARD MOVE WITH 1:10 RISK REWARDUS30 SHOWING A GOOD UPWARD MOVE WITH 1:10 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follows good risk reward

please dont use more than one percentage of your capital follow risk reward and tradeing rules

that will help you to to become a better trader

thank you

Bottom in for bonds, flight to safety trade coming soon $100+If we look at the chart of TLT, you can see that we're forming a bottoming reversal pattern.

We had a spike low down to $83 back to the middle of May and have now reclaimed the structure. I think that move marked the bottom.

I think it's very likely that bonds spike in the near future, if they can make it over the $92 resistance level, then I think price will see continuation and likely break the pattern finding the first resistance at that $101 level.

That said, I think this is the start of a larger move higher in bonds that will take us all the way up to the top resistance levels over the course of the next few years before the move is done and we start the long term trend in rates higher.

US 30 Potential longUS30 – Wyckoff Spring Setup for NY Session | Intraday Execution Play

Price rallied in the London session with rising volume and structure breaks —

Now we’re anticipating a classic Wyckoff spring scenario just ahead of NY open.

📍 Key Expectations:

Sweep of intraday support around 43,482

Strong buyer reaction (spring confirmation)

Expansion into the 43,600+ zone — possible 1.5R+ continuation

⚠️ Volume buildup + stop placement below prior structure make this zone ripe for a fakeout → reversal.

I’m watching for a quick flush below the line → wick rejection → engulfing confirmation to trigger longs.

This is a trap trade — smart money baits shorts, I’m betting they get squeezed.

🔫 Entry: On confirmation after spring

📉 Invalidation: Below the spring low

🎯 Target: 43,610 zone and trailing after break of 43,570

Let them walk into the trap. Then pull the trigger.

US30 on Track for 43KHappy Monday, traders.

Here’s my latest analysis and trade idea for US30. Since April 6th, US30 has been in a strong bull run, breaking above the descending weekly trend line while continuing to print higher highs and higher lows.

Although price action has shown some uncertainty since May 22nd, the bigger picture remains bullish it’s just noise. The trend is intact, and we’re now pushing back above the 50 EMA.

Currently, US30 is forming a wedge between two descending trendlines I’ve marked on the chart. I expect some consolidation within this structure, with a potential pullback into my entry zone.

From there, I’m anticipating another short-term push higher, with a target in the Golden Zone between 43,100 and 43,400 . My entry range is between 42,179 and 42,481 , with a stop-loss just below the current swing low at 41,980.

I expect this move to develop sometime within the next couple weeks.

What do you think will it play out? Let me know in the comments.

PEPPERSTONE:US30

US30 Long Opportunity US30 shows strong bullish confluences at the opening of the week, currently testing the resistance level at 42,900. Price is above above the 50 SMA and favors bullish momentum per the RSI above 55.

Potentially retracement towards the break and retest level at 42,400 where we could see a potential continuation of the bullish trend after the market collects enough liquidity.

This is support by fundamentals of the day being the cease fire between Iran-Israel. investor more comfortable taking risks and stepping back into the indices.

US30 H4 AnalysisUS30 Showing a bullish Flag to 42,762. If it breaks this zone, Most probably can fly upto 44,000 and higher. Trading Analysis from 23-06-25 to 27-06-25. Take your risk under control and wait for market to break support or resistance on smaller time frame. Best of luck everyone and happy trading.🤗

US30 Potential Rebound from Key Support Zone

US30 Potential Rebound from Key Support Zone 🚀📊

📉 Analysis Overview:

The US30 (Dow Jones Index) is currently testing a major support zone near the 41,800–41,900 range, a level that has held firm multiple times in the past (highlighted with green arrows and orange circles). This area has acted as a demand zone, leading to strong bullish reactions previously.

🔍 Key Technical Highlights:

🔸 Support Zone: Clearly respected at ~41,800. Price is once again bouncing here.

🔸 Resistance Zone: Around 43,250–43,500. This area has acted as a ceiling, where price struggled to break through.

🟢 Reversal Indicators: Multiple successful defenses of the support zone suggest accumulation and possible bullish reversal.

📈 Target Projection: If support holds, the price may rally toward the target zone near 43,496.4, as shown by the purple arrow.

📌 Conclusion:

As long as the 41,800 support holds, US30 shows bullish potential toward the 43,500 resistance. A break below this zone would invalidate the bullish scenario and shift focus back to the lower support near 41,250.

🛑 Risk Management Tip: Watch for confirmation candles and volume before entering long positions. Always set a stop-loss below the support zone.

DOW30/US30 - ACTIVE TRADE - PROFITABLE SET UP TRADETeam,

today I have provide LIVE trading today provide you i did a good trade for

NAS100, DOW30 AND DAX30 - in real LIVE trading

OK, I prefer to SET UP my limit order today only. Remember, the market will be very volatile in the next 4 hours.

I expect the RATE should cut 25 points at least. Why

the employment data come out remain the same

inflation last week look under control

Retails is poorly come out today

The FED does not care about the America, they just care about taking advantage of America.

Lets now focus on the SETTING BUY LIMIT ORDER

I order small volume at 41975-42075

However I will double up at LIMIT BUY ORDER

The 1st target are looking at 4227542300

Target 2 - 42575-42675

REMEMBER - IF IT DOES NOT HIT YOUR ENTRY, JUST WALK AWAY.

US30 – Bearish Setup Below Resistance Zone US30 – Bearish Setup Below Resistance Zone 🚨🟥

The US30 index is exhibiting signs of bearish momentum after repeated rejections from the key resistance zone near 43,200. Let's break down the technical picture:

🔍 Technical Analysis

📌 Resistance Zone (🟥 43,200 area)

Price was rejected twice from this resistance (marked by red arrows), showing strong seller presence.

Bearish candlesticks followed each touch, confirming exhaustion near this level.

📌 Support Zone (🟦 40,800 area)

The area around 40,800 has acted as a strong demand zone in the past (highlighted with green arrows and orange circles).

Price might revisit this area if current bearish structure continues.

📌 Intermediate Support (🟪 41,828)

This level serves as short-term support.

If broken, it could accelerate the decline toward the major support.

📌 Market Structure

Lower highs forming after each bounce indicate weakening bullish strength.

A potential bearish breakout pattern is forming (highlighted by the projected path).

📈 Conclusion & Trade Outlook

Bias: Bearish 📉

Trigger: Break below 41,828 support

Target: 40,800 zone

Invalidation: Break and close above 43,200 resistance

US30 Long OpportunityUS30 had a break out to the upside from $42560 and we are not seeing a potentially retracement to the break and retest level where we can expect a further jump to the upside. Seeing bullish structure on the 15 min and higher timeframes with confluence at the breakout.

Price is currently above the 50 SMA on all timeframes above the 15min and momentum is bullish per the RSI trading above the 55 level, adding to the bullish confluence

Looking to the ride the bullish wave from $42560 to $42920 where currently resistance level is sitting

DOW/US30 - PATIENLY WAITING FOR THE ENTRY - DO NOT RUSHTeam, we are already entry LONG NAS100 EARLIER.

But with the DOW, be patience

- waiting for 42000-419600 - will be our first entry ranges

Then if market continue to fall further - this is our back up entry at 41480-41220 - DOUBLE UP to kill the market

OK, i did follow Israel and Iran story

I have spent 4-6 hours research and analyzing the market.

I prefer to carefully entry the market. I want to ensure my continue winning.

Sometimes if it not in the trading setup - DO NOT TRADE.. that part of the risk management

Check out my new video how I did not lose a single trade last 90 days

A lot of videos NEVER show their history trade, always show win this win that.. but no show the statement or data. But I provide real account, real data.

Look forward to provide you more trades in coming.

DOW/US30 - TIME FOR RECOVER DURING UK MARKET OPENINGTeam, very sad day to see Israel missle flying

We can only hope the world in peace

We are now finding opportunity to entry LONG DOW/US30

Please set your target 1 and 2 ranges

Make sure take 50-70% at first target and bring stop loss to BE

then second target

Please review the chart carefully and pricing target

Good luck.

US30 potential long setupsMulti-Timeframe Market Analysis — Bullish Continuation Potential

3-Month Timeframe

• October 2023: Price broke all-time highs.

• Bullish order block established at $37,250; price rallied to $45,000.

• Strong retracement followed to the $39,000 region—bullish orders filled.

• Current trend: Structure remains bullish with institutional support evident.

Monthly Timeframe

• Post-ATH liquidity collected at $41,750; retested in January with insufficient momentum.

• Price returned to $45,000 before retracing to $38,000.

• Strong bullish response from $38,000 leading into April and May.

• Price now trades above $41,750. A monthly close above this level signals further upside.

• Watch for a three-pin pattern—if confirmed, high probability of a break above previous monthly highs.

• Next target: $45,000 liquidity zone.

Weekly Timeframe

• Double bottom formation aligned with higher timeframes.

• Bullish accumulation at $41,250 drove price to $42,000, followed by a close above that level.

• Immediate resistance at $44,000, where previous bearish orders were concentrated.

• Last week ended with a bearish candle; this week opened with strong bullish momentum from $41,250.

• This timeframe supports a bullish bias, contingent on follow-through above key levels.

Daily Timeframe

• Bullish structure in alignment with monthly and weekly.

• Strong order flow noted at $41,250, enabling a break and close above $42,000.

• Next daily target: $42,800; key resistance: $42,881.

• Anticipate a possible retracement to $42,000 for further accumulation before continuation higher.

4H Timeframe

• Intraday price action highlights Friday’s retracement to $41,250 during NY session—bullish orders filled.

• Monday opened bullish; momentum slowed at $42,000 with brief retracement.

• Tuesday's NY session: 3-pin bullish pattern at $42,000, followed by a bullish close.

• Current price movement appears to be a retracement for more long orders.

• No actionable setup at the moment; monitoring for a clean 4H close above $42,350.

1H Timeframe

• Price encountered resistance at $42,350, a known liquidity region.

• Break and close above $42,300–$42,350 range confirms short-term bullish pressure.

• Awaiting next 4H candle to assess validity of long setup.

• Maintaining a neutral stance short-term; prepared to act on bullish confirmation.

________________________________________

Conclusion:

Very mindful of FOMC meeting minutes today and I am waiting to see what price action will occur after. Market structure across all major timeframes remains bullish. Pending a monthly close above $41,750 and a potential three-pin formation, the technical outlook favors continued upside. Patience remains key—await confirmation for optimal long entries.

"US30/DJI" Index Market Bullish Robbery (Swing Trade Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US30/DJI" Index Market Heist. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk YELLOW MA Zone. It's a Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 3H timeframe (39200) Day/Swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 42400

💰💵💸"US30/DJI" Index Money Heist Plan is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Future trend targets with Overall outlook score... go ahead to check 👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DOW/US30 - PERFECT TIME FOR LONG ENTRYTeam, i hope you all making millions on SHORT BOTH SETUP UK100 AND GER30 today

However there is no perfect time to entry LONG DOW/US30 now

please follow the guideline and entry..

target 1st is 150-200 points

2nd target between 300-500 points.

we expect this swing will take tomorrow and next day for the recovery.