DOW/US30 - PERFECT TIME FOR LONG ENTRYTeam, i hope you all making millions on SHORT BOTH SETUP UK100 AND GER30 today

However there is no perfect time to entry LONG DOW/US30 now

please follow the guideline and entry..

target 1st is 150-200 points

2nd target between 300-500 points.

we expect this swing will take tomorrow and next day for the recovery.

Us30long

DOW/US30 - PLEASE FOLLOW THE STRATEGY ACCORDINGLYTeam, two are set up on LONG position for DOW/US30.

if you have seen my video, how I trade and how much I made, you would notice the difference.

With strategy 1, you make 10-15% profit on your capital, depending on how much risk you take. Please add your entry slowly. Do not trade plan one aggressively.

also, follow the target range accordingly, make sure trail stop loss to BE once the first target is reached and take 50% partial

With strategy 2, if the market allows, this is where we would kill the market. But we need to be patient. As you can see, in the last 2-3 days, I did not trade the DOW/US30 because I prefer to enter at a certain level and price action.

Please follow the plan accordingly; once it hits target 1, take 30% and bring stop loss to BE

I hope you understand my strategy. Let's make millions together.

US30 Breakout from Symmetrical Triangle – Bullish Targets EyedUS30 (Dow Jones) has successfully broken out of a symmetrical triangle consolidation pattern, signaling a shift toward bullish momentum. The breakout is occurring after a strong recovery from April lows, with higher lows supporting upward price pressure.

🔹 Chart Structure:

Symmetrical triangle with a clean breakout above descending resistance.

Series of higher lows indicating accumulation.

Bullish breakout confirmed with price pushing above the 40,580 zone.

🔑 Key Levels:

Current Price: 40,586

Breakout Confirmation Level: 40,580

Immediate Resistance/TP1: 42,762

Major Resistance/TP2: 43,924

Support Zone: 38,950

Invalidation/Stop Level: Below 38,950

✅ Bullish Confluence Factors:

Breakout of symmetrical triangle pattern

Higher lows indicate bullish strength and accumulation

Momentum shift visible on lower timeframes

Positive correlation with improving US equity market sentiment

Anticipation of dovish Fed tone could boost equities

🧠 Fundamental Context:

Market is cautiously optimistic ahead of FOMC this week; dovish stance expected due to recent soft economic indicators.

Earnings season tailwinds and lower bond yields support index gains.

Ongoing political and tariff-related headlines may cause volatility, but technical breakout remains in focus.

💡 Trade Idea:

Bias: Bullish

Entry: On successful retest of 40,580 or continuation above 40,600

TP1: 42,762

TP2: 43,924

Stop Loss: Below 38,950

📌 Note: Watch for pullbacks to triangle resistance-turned-support. FOMC and US macro data releases midweek can impact momentum.

US30 Trading Into Major Resistance - Look For Dow Jones Retrace🔍 US30 Analysis: At the moment, I'm watching the US30 as it looks overextended 📈 and is trading into previous highs. 🧱 If you look left on the chart, it's approaching a key resistance level on both the weekly and daily timeframes.

I’m expecting a potential retracement 🔁 and monitoring for a bearish break of structure on the 30-minute timeframe ⏱️ as a possible setup for a counter-trend short 📉 — aiming for the imbalance zone visible on that timeframe.

📏 Drawing a Fibonacci retracement from the recent swing low to high, the 50% equilibrium 🔄 lines up perfectly with the imbalance area, adding confluence to the idea.

📚 This is shared for educational purposes only and should not be considered financial advice 💼.

DOW/US30 - what the expectation from the marketTeam, last week we kill the market

I have prepare for the next week strategy

We currently have some small volume position long at this stage

and will add more if the market down to next level,

However, we expect some recovery at this stage.

Strategy:

TARGET 1 - 39266-39335

TARGET 2 - 39375-39467

TARGET 3 at 39600-39929

TARGET 4 at 40.400-41400 - run with mini volume and hold.

DOW/US30 - RETAIL DATA AND POWELL SPEECHTeam,

The market has been a roller coaster due to the Trump Tariff plan

. We are in an entry long position now but with small volume only.

The current for US30 price is 40248

We are using a swing stop loss at 40120

Once the price reaches above 40300, bring stop loss to BE

the data consensus shows that 700% retail increase is more than last month.

this will likely support the market. Also, Trump's tariff plan would improve exports and bring down the DOLLAR.

Therefore, if you are risking a trade 1R buts 5R as a reward

Please assess your risk and make the decision.

NOTE: However, if the price drop toward 39800-39200, I will double and triple my money on long position

will get our money back easily.

Every trade you enter requires a risk and reward

ask yourself and analyst carefully

We can easily get 40300 then bring stop loss to BE for target the range above

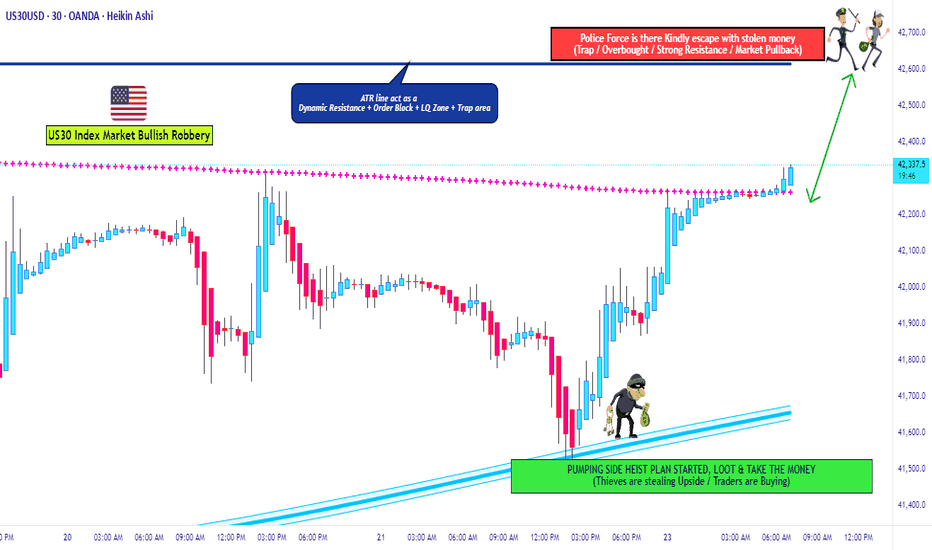

"US30/DJ30" Indices Heist Plan (Scalping / Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the US30/DJ30 Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 30m timeframe (42000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 42630 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"US30/DJ30" Index CFD Market Heist Plan (Scalping / Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

US30 longHere is why:

All the timeframes (3M, M,W and D) are showing very bullish signs after the recent downfall we have seen in price due to political factors. However, there is no clear targets in those timeframes as of now.

However, there is a distinct target on the 4H timeframe.

The target is at 42,980.

The reason is we saw price collecting a lot of orders at 41,500 and the next major liquidity point is at 42,980.

So basically, all price is doing is collecting orders in order to reach that target.

We know this to be true because we have seen bullish indications in the way price has been collecting orders between the consolidation region of 42,660 and 42,500.

Yesterday, price broke above that region, however, orders that were made at the time were not enough for price to reach the target of 42,980.

Price went all the way to 42,300 to collect more orders in order to go and hit the 42,980 liquidity region.

Currently, I am waiting for price to form any sort of bullish confirmation for me to buy.

The best signs for that is for price to retrace to 42,500, where I will look to buy to the next liquidity region at 42,650.

Dow Jones at trendline support: Will it bounce to 44,812$?CAPITALCOM:US30 is undergoing a corrective pullback after forming a double top near the upper boundary of the ascending channel. The rejection from this resistance zone triggered increased selling pressure, driving the price back toward the lower boundary of the channel, where buyers are now looking to step in.

If buyers step in and defend this support, we could see a move toward the midline of the channel, with the next key target at 44,812. Holding above this level would reinforce the bullish trend structure and increase the probability of continuation toward the upper boundary of the channel.

However, a failure to hold trendline support could weaken the bullish outlook, leading to a potential breakdown and further downside pressure. Price action near this critical zone will be key in determining the next directional move.

Traders should monitor candlestick formations and volume for confirmation. As always, managing risk effectively is essential when trading this setup.

If you have any thoughts on this setup or additional insights, drop them in the comments!

US30 LongTarget at 45,273 have still not been met.

Price has kept collecting orders at in order to reach that target.

Two weeks ago we saw price tank heavily in an attempt to collect orders at an liquidity region.

This region seems to be at 43,100 daily liquidity level.

Price hit that daily level and then we saw a sudden surge of buy momentum, indicating that price is going high.

Price has broken structure on the daily and 4 hour timeframes, indicating that price will continue going upwards.

Due to the monthly and weekly candlestick closures, I can tell that price is due to retrace lower before going upwards.

I expect price to retrace lower forming an obvious liquidity region before I buy.

US30 sellOverall Trend:

The overall trend has been bullish, but there has been a breakout below the ascending trendline.

The price is currently retracing towards support zones.

Key Levels:

Main Resistance: Range between 45,208 - 45,300 (upper red zone)

Main Support: Range between 44,300 - 44,500 (lower red zone)

Important Mid-Level: Around 44,866

Trading Scenario:

After hitting resistance, the price has started a correction.

The highlighted green area marks a potential entry zone.

📉 Trading Signal:

🔹 Enter Short Position:

If the price pulls back to the 44,600 - 44,700 area and shows signs of bullish weakness, a short position could be considered.

🔹 Stop Loss:

Above the resistance zone at 45,208 (e.g., around 45,300)

🔹 Take Profit:

First level at 44,300

Second level at 43,663 (shown on the chart)

Third level at 43,140 if the downtrend continues

🔹 Risk Management:

The risk-to-reward ratio for this trade seems reasonable. Reassess the trade if the price breaks above 44,866.

✅ Conclusion:

Currently expecting a bearish correction, but if reversal candles or weakness in sellers are observed at support levels, there might be a chance for a trend change.

US30 I Potential Pull Back and More Growth Welcome back! Let me know your thoughts in the comments!

** US30 Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

US30 I Bullish continuation but opportunity for pullbackWelcome back! Let me know your thoughts in the comments!

** US30 Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

Falling towards 50% Fibonacci support?Dow Jones (US30) is falling towards the pivot which has been identified as an overlap support and could bounce to the 1st resistance which is an overlap resistance.

Pivot: 41,604.84

1st Support: 40,023.54

1st resistance: 43,3309.76

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Potential bullish rise?Dow Jones (US30) has reacted off the pivot and could potentially rise to the 1st resistance which is a pullback resistance.

Pivot: 42,239.75

1st Support: 41,800.58

1st Resistance: 42,858.37

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

US30 I Potential Long Opportunity Welcome back! Let me know your thoughts in the comments!

** US30 Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

US30 longThis analysis highlights key patterns and price levels observed on the weekly, daily, and four-hour (4H) timeframes, supporting a bullish outlook. The discussion focuses on the significance of untested formations, rejection patterns, and accumulation zones that signal potential market moves.

1. Weekly Analysis

M Formation Neckline Retest: The M formation observed on the weekly timeframe has not been retested at its neckline of 43,500, leaving room for potential upward movement.

Three-Pin Rejection Pattern: Price remains below the high of the three-pin pattern formed earlier, and a break above this level would confirm bullish momentum.

Daily Target: A double bottom has formed, indicating that price could aim for the daily target of 43,680.

2. Four-Hour (4H) Timeframe Insights

Bullish Pattern Formation: The 4H chart reveals a bullish setup, with price approaching a strong resistance zone at 43,700.

Accumulation Phase: The presence of two doji candles suggests ongoing order accumulation, signaling potential market movement.

Entry Strategy: I am monitoring the following levels for possible entries, depending on how the next 4H candlestick closes:

42,450

42,670

The alignment of weekly, daily, and intraday confluences supports a bullish outlook. My strategy involves waiting for confirmation from the next 4H candlestick closure before executing trades at the identified entry levels. Patience and precision are key to leveraging this setup effectively.

US30 LongThis analysis focuses on the interplay of weekly and intraday confluences, which collectively point towards a potential bullish scenario. A detailed breakdown of the price movements and key levels is provided to support the thesis.

1. Weekly Confluences

Unmet Target: The price has yet to reach its anticipated target of 45,300, indicating unfulfilled market objectives.

Order Collection Observation: A significant retracement suggests an attempt to collect orders within a specific price region.

The first notable level was 43,500, corresponding to a prior body closure. Price broke through this level and moved downward.

The second key region, 42,100, showed a rejection pattern characterized by a three-pin formation.

Pattern Analysis: An "M" pattern is apparent, signaling that the price may retest its neckline at 43,500.

2. Four-Hour Timeframe Insights

Rejection and Momentum: The price rejected the 42,100 weekly level with strong bullish momentum, forming a bullish setup with a target of 42,600.

Order Collection Confirmation : Despite the bullish target not being achieved, the retracement implies another round of order collection, this time within the 42,328 daily level.

Conclusion and Thesis:

The evidence points to a bullish outlook. While the price is gathering momentum and confirming its intentions, I will wait for clear intraday confirmations before entering the market. Patience at this stage will ensure alignment with the larger trend and reduce exposure to potential false moves.