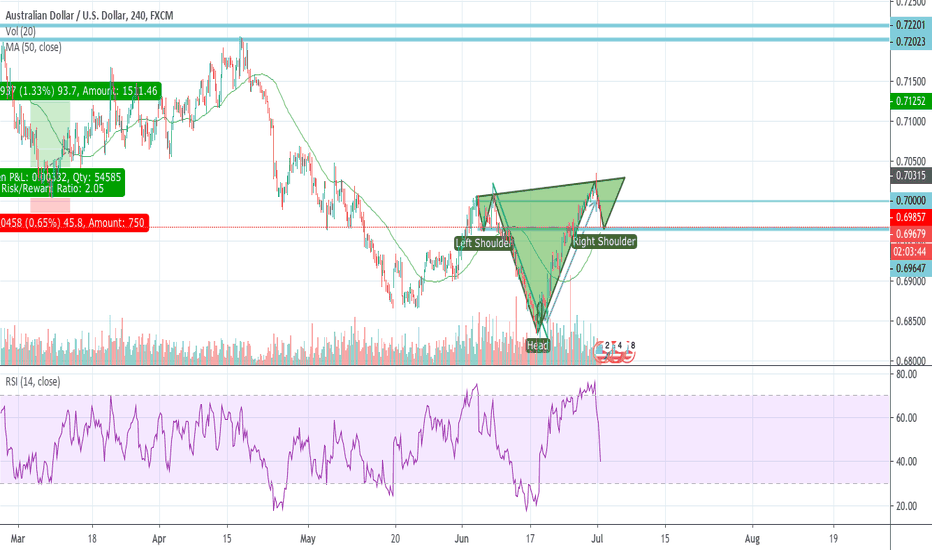

AUDUSD forecast

The RBA lists a number of risks that require lower interest rates.

Market-based expectations suggest market participants have not fully priced the October cut.

The pair may have reached the buy peak

The Australian Central Bank at its September meeting strongly signaled that interest rate cuts could be expected next month (October 1)

Minutes of the meeting mentioned the main economic problems: slowdown in employment growth and weaker wage growth.

These grim remarks were accompanied by many external risks, including trade wars. In the meantime, interest traders see an approximate 33% chance of a cut in interest rates next month, so I think it is possible for AUDUSD to visit lower levels in the coming days.

Technically, the pair looks like bulls have run into an obstacle

Usadollar

EURUSD forecastMy last analysis on this pair was right and now EURUSD reached 1.11 support/resistance zone. With this move the price has broke out the H4 chart downtrend line and arrived to 38.2% fibonacci zone. On this level the RSI is high(70%), so i think the price don't break this resistance for first try, so we can wait a little reduction before the breakout. If the breakout will happen the next support/resistance is at fibonacci's 50% (1.116)

USDCHF flash crashThe Swiss franc swooned almost 1 percent at the start of Asian trade Monday as thin liquidity caused by a Japan holiday led to a mini recurrence of the “flash crash” that roiled FX markets early last month.

The Swissie slid from 1.0004 per dollar around 7 a.m. in Tokyo to as weak as 1.0096, the lowest since November, within a matter of minutes before almost as suddenly reversing the move to trade 0.2% stronger on the day. The round trip created a trading range for Monday of almost 110 pips, about double this year’s daily average of 56.

The move was a smaller cousin of the whiplash that saw the yen jump almost 8 percent against the Australian dollar early on Jan. 3, when Japanese markets were nearing the end of a week-long New Year holiday break.

“Lack of liquidity is a common factor in these events,” said Rodrigo Catril, a senior foreign-exchange strategist at National Australia Bank Ltd. in Sydney. “Traders and strategists now have Japan holiday calendars printed in a big font at their desk!"

Catril said the move may have been initially triggered by a data entry error that set off a cascade of computer trades based on pre-entered algorithms.

One client who had a short position on USD/CHF had earlier entered instructions to buy back the currency pair if it rose and the transaction was triggered at 1.0070, according to a sales trader who asked not to be identified. When the trader called the client to inform them the level had already dropped back to 1.0020.

“It’s like a mini flash crash,” said Eleanor Creagh, a strategist at Saxo Capital Markets in Sydney. “It’s a combination of low liquidity and Japan on public holiday that’s driven the move.”