USD

XAUUSD - Possible top formation on gold ?XAUUSD probably topped as I expected around 3200 - 1 fib extension from low 1046 to high 2075 and higher low 1614 (started to short at the precedent low 3157)

big daily bearish divergence on RSI as well

maybe double bottom in 1 or 2 weeks then will go all down till september thats my forecast

daily POC/and back to 0.618 fib extension is my target ~ 2500 (around -20% move)

____

any new ATH could bring gold to next fib extension at around 3850

Cheers

USDCAD Selling not over yet.Last time we looked at the USDCAD pair (March 21, see chart below), we got the most optimal sell entry that easily hit our 1.4000 Target:

As the price broke below its 1D MA200 (orange trend-line) having made a significant correction since the February 03 High, we believe there is more selling to be made at least on the short-term.

That is because the Higher Lows Zone that started on the May 2021 market bottom, hasn't yet been tested and since December 2023, the market always broke inside it before rebounding.

As a result, we expect a new rejection on the 1D MA200, delivering a 1.38200 Target.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Gold Hits New ATH Amid Escalating US–China Tensions📌 Gold Hits New ATH Amid Escalating US–China Tensions: How Far Can It Go? 🧨📈

Gold has reached another all-time high (ATH) as geopolitical tensions between the United States and China intensify. Markets have become incredibly sensitive, reacting sharply to political rhetoric and economic policy shifts from the world’s most powerful leaders.

As investors grow increasingly uneasy, gold continues to serve its role as a safe haven — but the real question now isn't whether gold will rise, but rather: how high can it go?

🌍 Geopolitical Sensitivity at its Peak

A single tariff threat or retaliation can trigger gold to surge by $30–$50.

Conversely, a pause in policy or a diplomatic “cool down” can cause price to drop hundreds of points.

In this environment, political narratives are driving markets more than technical setups.

This is one of those rare moments where fundamentals and news flow completely overshadow traditional chart signals. Even textbook candle confirmations are losing reliability — clean bullish closures are often followed by equally strong bearish rejections.

📊 Key Levels to Watch

Support Zones:

3,280 / 3,268 / 3,258 / 3,240 / 3,230

Resistance Zones:

3,292 / 3,302 / 3,310/ 3330

⚙️ Trading Zones

🔽 Sell Zone:

Entry: 3,330 – 3,332

SL: 3,336

TP: 3,325 → 3,320 → 3,315 → 3,310 → 3,300

📈 Buy Zone #1:

Entry: 3,270 – 3,268

SL: 3,264

TP: 3,274 → 3,278 → 3,282 → 3,286 → 3,290 → 3,300

📈 Buy Zone #2:

Entry: 3,240 – 3,238

SL: 3,234

TP: 3,245 → 3,250 → 3,255 → 3,260 → 3,264 → 3,268 → 3,274 → 3,280 → OPEN

⚠️ Final Thoughts & Risk Advisory

With geopolitical tensions rising and volatility surging, trading gold requires extra caution. Avoid chasing momentum blindly — even strong confirmations can flip without warning.

This is a market driven by emotions, news headlines, and global uncertainty, not just technicals. Always stick to your trading plan, and more importantly: respect your SL/TP at all times.

💬 How are you approaching gold in this macro environment? Share your views below – are you holding long or fading the rallies? 👇👇👇

USD/JPY(20250416)Today's AnalysisMarket news:

U.S. import prices fell 0.1% in March from the previous month, the first month-on-month decline since September last year.

Technical analysis:

Today's buying and selling boundaries:

143.10

Support and resistance levels

144.08

143.72

143.48

142.72

142.48

142.11

Trading strategy:

If the price breaks through 143.10, consider buying, the first target price is 143.48

If the price breaks through 142.72, consider selling, the first target price is 142.48

AUDUSD Discretionary Analysis: Recovery Mode ActivatedIt’s that feeling when the engine’s been cold for a while, but now it’s starting to rev. AUDUSD is flashing signs it wants to push up — not in a rush, but with purpose. I’m seeing strength building, like it’s getting ready to climb. Recovery mode’s not just activated — it’s already in motion. I’m calling for upside here. If it plays out, I’ll be riding the move. If not, hey, I’ll wait for the next setup. But right now? I like the long.

Just my opinion, not financial advice.

Bullish bounce?The Swissie (USD/CHF) is falling towards the pivot and could bounce tot he 1st resistance.

Pivot: 0.8179

1st Support: 0.8125

1st Resistance: 0.8273

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish drop?The Fiber (EUR/USD) is rising towards the pivot and could drop to the 1st support.

Pivot: 1.1369

1st Support: 1.1147

1st Resistance: 1.1471

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish drop off multi swing high resistance?AUD/USD has reacted off the resistance level which is a multi swing high resistance and could drop from this level to our take profit.

Entry: 0.6386

Why we like it:

There is a multi swing high resistance.

Stop loss: 0.6447

Why we like it:

There is an overlap resistance level.

Take profit: 0.6265

Why we like it:

There is a pullback support level that lines up with the 23.6% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bearish drop?EUR/USD has reacted off the support level which is a pullback support and could drop from this level to our take profit.

Entry: 1.1304

Why we like it:

There is a pullback resistance level.

Stop loss: 1.1371

Why we like it:

There is a pullback resistance level.

Take profit: 1.1160

Why we like it:

There is a pullback support that is slightly below the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Gold Wave 5 Bull Complete?! (4H UPDATE)Today & yesterday's price action is the slowest movements we've seen in the market in the past few weeks, which in my eyes is a positive sign. It means Gold has either or is close enough to topping in the next week or two, after which we should see a bearish market sentiment kick in.

POI 1: $3,147📉

POI 2: $3,060📉

Markets are hugely volatile, so we need to monitor minor areas for any potential reversals or continuation of trends.

After CAN CPIs, it's time to prepare for BoC rate decisionLooking at the CPI numbers that came out, we are noticing some weakness in the CAD right now. This weakness may spill over into tomorrow's trading, as the BoC is expected to keep the rates unchaged.

Let's dig in!

FX_IDC:USDCAD

MARKETSCOM:USDCAD

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

USD/CAD Breakout Pattern (15.04.2025)The USD/CAD pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 1.4034

2nd Resistance – 1.4131

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

DXY aka usd 15 Apr 2025Price is ranging within a triangle, a break below will confirm the wave count.

Following the move down from a triangle, it suggest the move down is completed and a reversal at least for the short term will proceed next.

Waiting for the break and move lower and a rejection bounce to suggest a bottom is in.

Will long usdjpy, short eurusd gbpusd etc when the above comes true

Good luck.

Gold Market Outlook: Key Risks and Opportunities Ahead 📌 Gold Market Outlook: Key Risks and Opportunities Ahead 💰📉

🔍 Current Trend and Short-Term Risk

Gold continues to exhibit strong bullish momentum, although minor corrections remain possible in the short term. A key driver for sustaining the uptrend will be the strength of buyers at support zones like 3196 and 3204.

However, if the market fails to hold above 3135, we could see a deeper retracement. In such a case, a drop toward the 311x region could offer an attractive buying opportunity — particularly if bullish price reactions are confirmed near that level.

🧭 Key Levels to Watch

3135 Support: A break below this zone with strong momentum could signal potential bearish continuation. Any move toward 311x should be closely monitored for a bullish reversal setup.

311x Zone: If price pulls back to this range and we observe reaction or rejection, it could present a high-probability buy opportunity to rejoin the broader uptrend.

🌍 Impact of a Quiet News Week

With no major economic releases on the calendar, market direction will likely be determined by volume flows and price action near key technical zones. Areas such as 3195, 3204, and 3245 will be pivotal in shaping short-term sentiment.

Traders should remain attentive to how price behaves around these levels, especially during London and New York sessions where most volume is concentrated.

🛠️ Tactical Plan for the Week

Asian & European Sessions Focus: Look for momentum plays or reaction signals at key intraday support levels (e.g. 3196). Sharp pullbacks may offer buy setups with solid risk/reward ratios.

Sell Scenarios at Resistance: If price breaks above 3245 with weak follow-through and fails to hold, that could provide an opportunity for tactical short entries — but only with confirmation via volume or rejection patterns.

Stick to Your Plan: Despite the current volatility, it’s critical to adhere to your strategy. Avoid emotional trades, always manage risk, and respect your TP/SL levels.

💡 Conclusion

Gold remains in a strong upward trend with active buyers around key support zones. While short-term pullbacks are expected, they could offer new opportunities to scale in.

Stay patient, trade with discipline, and let the market offer confirmation before committing to a position. Even in a quiet news environment, well-prepared traders can take advantage of high-quality setups by focusing on structure and risk management.

Bearish reversal off overlap resistance?The Silver (XAG/USD) is rising towards the pivot and could reverse to the 1st support which has been identified as a pullback support.

Pivot: 32.73

1st Support:31.25

1st Resistance: 33.51

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bullish bounce off pullback support?The Bitcoin (BTC/USD) has bounced off the pivot and could potentially rise to the pullback resistance.

Pivot: 83,260.07

1st Support: 80,469.31

1st Resistance: 88,484.86

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

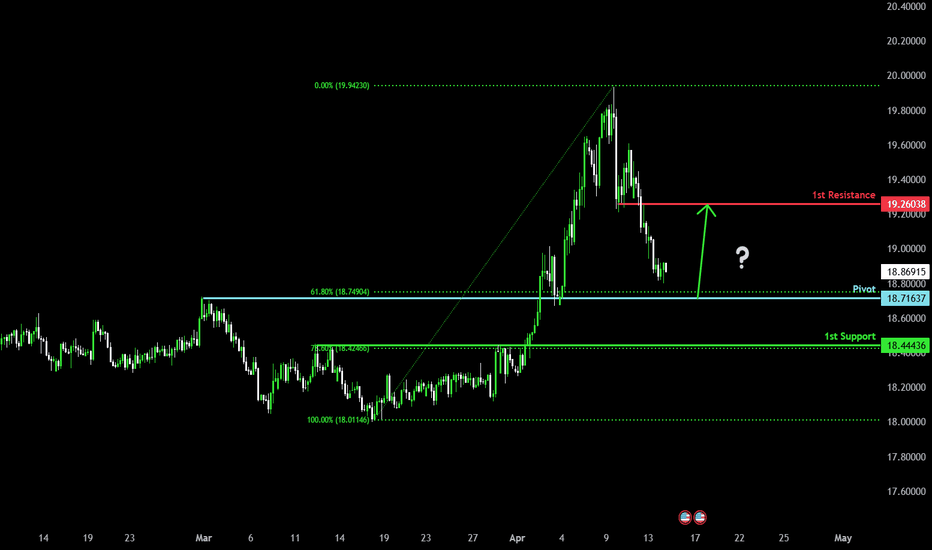

Bullish bounce?USD/ZAR is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 18.71637

1st Support: 18.44436

1st Resistance: 19.26038

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

How low Can the Dollar Go? And What It Could Mean for EUR/USDThe US dollar index has handed back all of its Q4 gains with traders betting that Trump's trade war will do more damage than good to the US economy. I update my levels on the US dollar index and EUR/USD charts then wrap up market exposure to USD index futures.

Bullish continuation?XAU/USD is falling towards the support level which is a pullback support that is slightly above the 38.2% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 3,156.20

Why we like it:

There is a pullback support level that is slightly above the 38.2% Fibonacci retracement.

Stop loss: 3,083.60

Why we like it:

There is a pullback support level that aligns with the 50% Fibonacci retracement.

Take profit: 3,242.52

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bullish bounce?EUR/USD is falling towards the support level which is a pullback support that lines up with the 61.8% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.1141

Why we like it:

There is a pullback support level that lines up with the 61.8% Fibonacci retracement.

Stop loss: 1.0949

Why we like it:

There is a pullback support level.

Take profit: 1.1425

Why we like it:

There is a pullback resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.