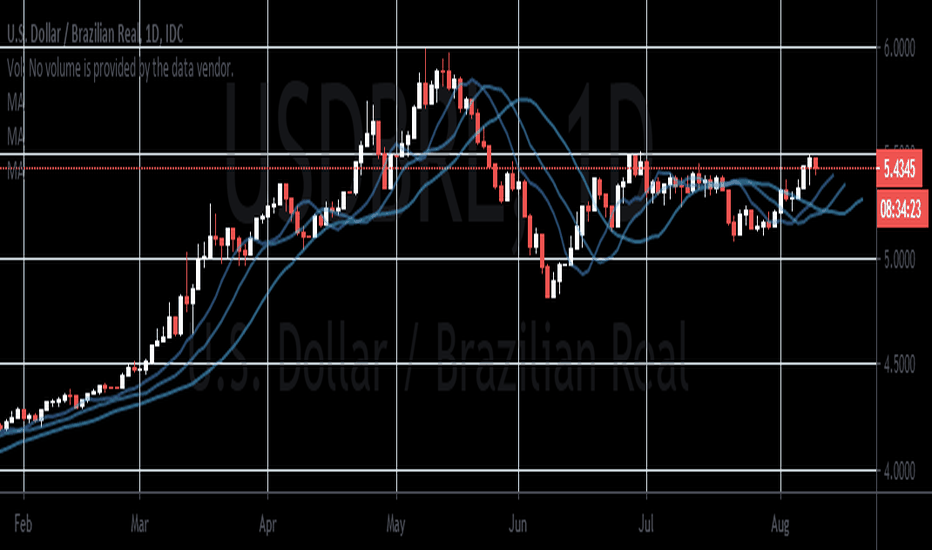

USDBRL Climbs for 8 Straight DaysOne of the most liquid Emerging Market currency crosses, $USDBRL, is advancing for an eight straight trading session through Thursday. This is the longest unbroken bull run for the exchange rate since September 2014.

It's impressive that it is advancing in today's session given the Dollar is under pressure of its own, but it seems general risk aversion is the stronger force.

A retreat in emerging markets can definitely be a risk response, but perhaps there is more persistence to the belief that central banks will normalize regardless of a little market turbulence than previously believed.

USDBRL

USDBRL Is this an early Buy Signal for Coffee?The USDBRL pair has been trading within a steady 2-decade long Channel Up, which is well displayed on this 1W chart. As you see last time it formed a 1W Death Cross (MA50 crossing below the MA200) after a Higher High, it dropped significantly and that was still a fairly early buy signal on Coffee (KC) on a long-term 5-year horizon.

At the moment USDBRL hasn't made a new High in more than 1 year and the 1W MA50 (blue trend-line) is rolling over. Can this be a very early buy signal on Coffee before confirmation comes by the 1W Death Cross? It would appear that way and in our opinion that is an excellent long-term buy opportunity on Coffee futures.

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

!! Donations via TradingView coins also help me a great deal at posting more free trading content and signals here !!

🎉 👍 Shout-out to TradingShot's 💰 top TradingView Coin donor 💰 this week ==> fract

--------------------------------------------------------------------------------------------------------

American currency most likely to appreciate against BRLIn this chart we can see the demand growing gradually, even finding a resistence in 5.85, this moving has formed a triangle, and when it break up the target will be in 6.89! The clear accumulation can preventing us from taking stops! By another way if we see a closure under the ascendent line the price will enter into a lateralization or even make a reversal! Good Trades! Thank you for your attention!

Price of the dollar vs Brazilian Real BRL. Update 1 March 2021

Probability 1. Ranges from 5.34 BRL to 5.62 BRL

Probability 2. It rises quickly to 5.85 BRL, and then if it manages to consolidate at that price 6.2 BRL.

Probability 3. It falls to 5.28 BRL, with subsequent fall to 4.85 BRL. Less likely scenario.

Brazilian real is a buy here. Buy a basket of EMFX vs the USD Coming into the new year, the reflationary trade was working quite well. In January, we saw a period of heightened volatility that stressed emerging markets. Brazil was no exception. That said, the weak dollar trend looks likely to resume in the next few months, after the positioning shake-out that we saw in January. Many hedge funds are still on the sidelines and scared to commit capital to risk-assets. They will be forced to do so in March when performance benchmarks come out. EMFX and commodity exporters should continue to perform strongly as the US pursues the largest stimulus package in history. Recently, the USD looks on the verge of breaking out to the upside, though I would much rather fade this move with a tight stop. In Brazil specifically, the likelihood of Selic rates being raised increases the chance of currency appreciation. There are no real organic sellers above 5.40. The risk/reward is for the BRL to rally significantly from here.

A peek into the sugar's futureAccording to Investopedia , Brazil is top leading sugar producer globally. So , we take a look at its currency; USDBRL and discovered that since Jan 2020, it has appreciated against the USD for more than 50%. This trend should continue towards the rest of 2020 and likely the first half of 2021 too.

That being the backdrop, then we can assume sugar price to continue going higher, breaking the 15.78 price resistance soon. I am bullish on sugar !

ridethepig | BRL for the Yearly Close📌 BRL for the Yearly Close

This diagram illustrates the LT map for those in BRL and tracking Brazil for good opportunities into 2021. According to my INR maps, again a very similar cycle count which is decisive for profit taking:

The BRL now has the attacking position at the highs after completing a multi decade 5 wave cycle from 1.50 towards 6.00. But here is the weakness, we are already seeing profit taking as the USD enters into a structural decline, we have yet to mention the advantage Brazil has with particular focus on the agriculture side.

The correct ways to play this in equities also come from companies like $ALTA which was one of the first gold mining companies to capture the 2020 flows in Brazil. It is reaching an initial target to that in the expectations, now add BRL appreciation to the mix and you can see how we arrive at the 600% targets:

A very good luck to those looking for opps in Brazil, the currency is not afraid of the flank attack and note anyway that you can capture value on Brazilian exports into countries like USD and MXN. Just note how nearest support at 4.63x is -10% from here and the extension below at 3.9xx is -23% from current levels, both are in play for 2021.

Thanks as usual for keeping the feedback coming 👍or 👎

The Brazilian real gets bombarded by multiple fundamentalsThe Brazilian real doesn’t stand a chance against the US dollar’s new-found strength and the USD/BRL trading pair is one a steep climb towards its resistance level. It’s broadly expected that the prices would eventually reach their highest ranges as the Brazilian real gets bombarded by multiple fundamentals, preventing it from defending itself against the power of bullish investors. See, the US dollar remains as the world’s most chosen currency despite the hurdles it has faced this pandemic, this strains the confidence of bearish investors. However, it’s worth noting that the prices also have a potential for a steep plunge once it hits that resistance line as the US dollar as it also faces major turbulences. Meanwhile, the alarming number of daily deaths and cases in Brazil is raising concerns in the market. And to add more negativity for bearish investors, the performance of the emerging markets against major currencies isn’t helping the Brazilian real’s cause.

The massive number of coronavirus cases in BrazilThe bullish trend for the US dollar to Brazilian real exchange rate was reignited back in late July and is expected to remain strong even until earlier September. Looking at it, the risk appetite in the market should have already helped the cause of the Brazilian real. However, despite the regenerating risk appetite, it remains vulnerable against most major currencies, not just the US dollar. Perhaps the massive number of coronavirus cases in Brazil has sparked a great concern for the country’s currencies. Not only that, but the Brazilian president himself has been under intense scrutiny for months and is now the center of another controversy. Jair Bolsonaro is facing online criticism after he unsuccessfully tried to snuff out some questions about his family’s financial conditions even going as far as saying that he wants to punch a journalist’s face. The controversy involves the president’s wife, Michelle Bolsonaro, and Fabrício Queiroz over corruption.

Prices are on track to climb towards their higher resistance levThe US dollar is currently seen working hard to force the Brazilian real past its initial resistance level this Tuesday. The trading pair has been awfully bullish in the past few weeks despite the major stumbles of the US dollar. Prices are on track to climb towards their higher resistance level, reaching ranges last seen in May 2020. The surge should help the bullish investors maintain their dominance, buoying the 50-day moving average further against the 200-day moving average. The US dollar has gained traction as investors tune in closely on the trade tensions between the United States and China and the stalemate in the US Congress over the massive fiscal stimulus. Just yesterday, the White House and US Congressional leaders expressed their interest to resume their discussions on a stimulus program that would save the US economy. Meanwhile, Beijing ordered sanctions on some US Republican lawmakers, intensifying the tension between the two parties.

The USD/BRL trading pair is still on an uptrendDespite the alarming weakness of the US dollar in the global market, the USD/BRL trading pair is still on an uptrend. That means that the Latin American currency is significantly weaker and that prices could soon hit their resistance in the second half of the month. According to one analyst, the broader appreciation of the pair could actually force a profit-taking sell-off once it reaches the resistance level. The greenback is severely struck by multiple fundamentals including political and economical risks. However, most experts believe that it will stand against the test of the coronavirus pandemic, but it will get weak. In the past, the Brazilian real has benefitted from the improvements in the foreign and domestic markets. Now, the currency is seen struggling to buoy itself as Brazil sees an uncontrollable surge in coronavirus cases, the rate might not be as high as America’s, it’s still forcing the economic slump to get even deeper.

The US dollar is seen trading strong against the BRL todayThe US dollar is seen trading strong against the Brazilian real today despite its broader weakness in the global market. In fact, the US dollar is seen dropping to its 2-day lows just today. So, why does the US dollar to Brazilian real exchange rate continues to rise? The answer is simple. Investors are really alarmed by the number of coronavirus cases and deaths in the Latin powerhouse. This is driving the demand for safe-haven currencies such as the US dollar by local traders. The risk sentiment in the market has been fluctuating the past sessions, now it was reported that China’s coronavirus vaccine is showing impressive signs. CanSino Biologics reportedly developed the vaccine and the Chinese military recently received the approval to use it. The clinical trials of the said drugs found that it was safe to use, and it showed efficacy to the patients. China currently has eight candidates for the coronavirus race which still has a long way to go.