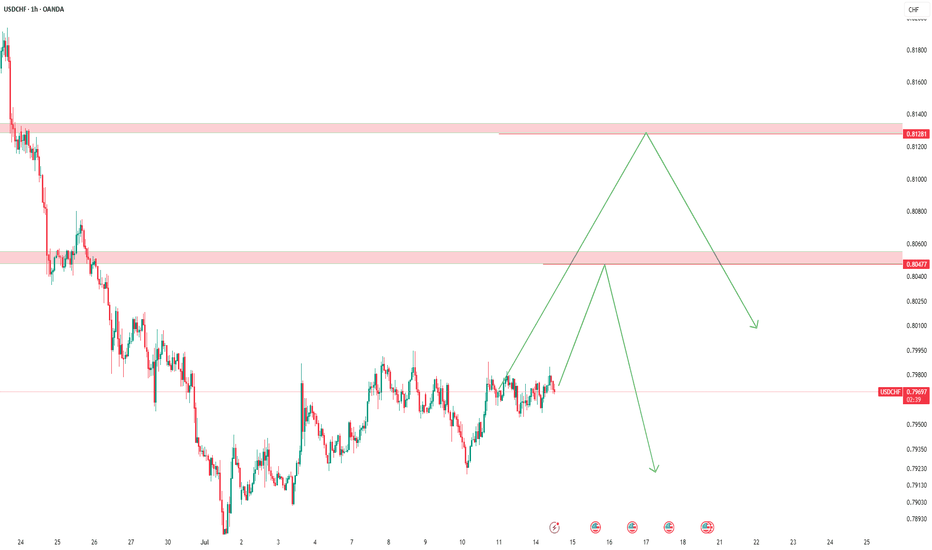

USDCHF – Two Levels, One PlanWe’re watching two key resistance zones for a potential short.

If the first level holds and gives a signal, we’ll short from there.

If that level breaks, we may switch to a short-term buy up to the next level.

Once price reaches the second resistance, we’ll be ready for another sell opportunity.

No predictions — just following the flow.

USDC

Recently Circle launched native USDC & CCTP on $SEIThis enables fast, low-cost stablecoin transfers on the efficient L1 blockchain, boosting liquidity and institutional adoption

This news made me curious about the chart

The price itself is reclaiming and holding a critical HTF level while breaking the bearish structure

The RSI above the 50 level is signaling a regaining of the bullish momentum

Perfect alignment to grab some for the longterm portfolio

Binance Blinked! High level of USDC volume across Binance..Binance has for many years tried their own versions of buying US debt with USD made from selling a stablecoin of their own. This has been squashed nearly every time and has most likely hindered the flow on binance itself.

It seems binance may have blinked. USDC has been flooding into Binance this year maintaining often very high levels of relative volume. This flow is overall better than if neither party capitulated. Must be careful of different streams of volume fragmenting both bullish and bearish data. While USDT is seeing all time highs its market share is falling with the wider adoption of stablecoins on chain and in traditional finance.

All this is occuring as stablecoin regulation is being passed in the US www.tradingview.com and Dimon says NYSE:JPM will be buying COINBASE:BTCUSD for clients soon

Steibles dominance: USDT.D+USDC.DThe graphic shows Kryptan blood and tears - in red variant. And bullish crypto - triumph in blue!

I am of course counting on the blue variant, as:

1)There has been no normal bulls with the fall of bitcoin dominance.

2)The American newly elected tech team hasn't shown anything meaningful except loud populist statements and family memes.

3)Stimulus with rate cuts, QE, M2 and other liquidity releases haven't really kicked in yet

So I'm waiting for an epic risk on and exit pamp!

Translated with DeepL.com (free version)

USDT the big rebound - The Rise from the Ashesin my newest finding i will tell you about USDT rise from the Ashes

as you can see we build a very volume heavy low

corresponding to a low in March and a really good rebound is about to happen

be prepared for heavy downturns in the crypto market

as always, just my opinion and looking for ppl who share thougths on it

no trading advice

USDT Dominance + USDC Dominance 1WIMPORTANT!

CRYPTOCAP:USDT Dominance + CRYPTOCAP:USDC Dominance

These two dominances show us the cash position in the market. This is the crudest expression.

With the rise of this chart, we can see that there is an increase in cash transitions in the market or hot money inflows to the market.

In my previous post, I shared information that there may be a movement from the bottom to the falling trend line (red) above. Because this possibility was much higher. The reason was that it made a double bottom formation, supported by the rising trend line (green) and also pointed to a harmonic pattern.

With the OB level on the daily chart, the price retreated with the falling trend line (red) acting as resistance. With its retracement, the upward movement on the BTC side was realised. Because as it is known, this chart works in inverse correlation with the BTC chart.

If this chart continues its upward movement, that is, if it breaks the falling trend line and provides a movement towards 11% levels, then we can see much deeper declines on the BTC side.

Let me add one more comment to overlap here;

On the BTC side, I have been emphasising that I have an expectation of $123k - $130k for the first batch for a long time. So if this chart moves one round lower than these levels, to the bottom of the rising trend line (green), it is possible to see the levels I mentioned on the BTC side. Then again, the dominance chart will now move upwards and may cross the red line, which is the falling trend line, and move towards 11% levels.

Of course, there are other OB resistances on the route, and a pre-bullish retest will probably do. This gives misleading information that the decline on the BTC side is over.

If BTC really returns from the level I mentioned above and moves as I explained in this chart, there may not be a second spring in the market until it reaches 11% levels.

PENDLE RWA Bullish Chart prediction 2025Pendle has been excellent in 2024. The project is delivering and moving to the Top 50 is possible.

Given its market cap to be sitting around $600M only, means it can have the same upside as AAVE as PENDLE is RWA and tokenization for LINK and Axelar. If you don’t hold PENDLE in your portfolio, you can enter at $4.

Future Potential: Pendle's real-world asset (RWA) tokenization offers new opportunities for investment and liquidity. By bridging traditional finance with blockchain, PENDLE could become a key player in the evolving financial landscape.

Latest News: Pendle Expands Tokenization Services to New Markets

Usual Labs, the firm behind the DeFi protocol Usual, altered the code for its bond-like USD0++ token, reducing its fixed price from $0.995 to $0.87, causing chaos among DeFi apps that treated USD0 and USD0++ as equal in value.

The change, which Usual claims was announced and planned since October, caught many investors and developers off guard, leading to criticism over poor communication.

The price adjustment has disrupted DeFi integrations, with users of protocols like Pendle potentially facing losses due to the devaluation of USD0++ principal tokens.

USD0 is a stablecoin pegged to the dollar and backed by real-world assets, while USD0++ is a staked version locked for four years, previously redeemable at a one-to-one ratio for USD0.

Usual has updated its documentation to reflect the $0.87 redemption floor, but a conditional exit allowing one-to-one redemption for USD0 is expected next week, requiring users to forfeit some accrued yields.

Concerns remain about the profitability of holding USD0++ until maturity, with industry figures like Aave's Stani Kulechov warning of potential long-term losses.

An additional argument for the alt season.Hi. I'll duplicate someone else's observation that a ‘bad cross’

of EMA 200 and EMA 50 has formed on the weekly chart of

the total dominance of USDT and USDC. And it was back in December.

This is a very good argument for TOTAL3 to start getting its share

of capitalisation in 2025.

Gosh, how many conditions are required. Market, political, sentiment, etc.

Support around 97461.86 is the key

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

When USDT is moving sideways, USDC seems to be leading the coin market in the short term by gapping up.

For the altcoin bull market to start, BTC dominance must remain below 55.01 or show a downward trend.

USDT dominance is expected to touch around 2.84 at the most.

If it touches around 2.84 and starts to rise, the coin market is expected to turn into a downtrend.

If USDT dominance rises above 4.97, a sharp decline is expected in the coin market.

After that, the trend of the coin market is expected to be determined depending on whether it is supported or resisted around 4.97.

-

(NAS100USD 1D chart)

The point to watch is whether NAS100USD can rise above the support zone and be maintained.

The high point boundary zone is likely to be applied as a resistance zone, but if it breaks through upward, it is likely to create a new upward wave.

--------------------------------------

(BTCUSDT 1D chart)

If it receives support near 97461.86, it is expected to turn into a short-term uptrend.

However, USDT must show a gap-up trend.

If not, it will fall again.

You should also check if the BW and DOM indicators rise above 0 and if the candle's Body color turns green.

Confirming support is a tedious and difficult task that requires checking the movement for at least 1-3 days.

-

The point of interest is whether it can receive support near 101947.24 around January 10, the next volatility period.

If it falls, it is important to see whether it supports the important support and resistance area of 93576.0-94742.35.

-

Thank you for reading to the end. I hope you have a successful transaction.

--------------------------------------------------

- Big picture

I used TradingView's INDEX chart to check the entire range of BTC.

(BTCUSD 12M chart)

Looking at the big picture, it seems to have been in an upward trend since 2015.

In other words, it is a pattern that maintains a 3-year upward trend and faces a 1-year downward trend.

Accordingly, the upward trend is expected to continue until 2025.

-

(LOG chart)

Looking at the LOG chart, you can see that the upward trend is decreasing.

Accordingly, the 46K-48K range is expected to be a very important support and resistance range from a long-term perspective.

Therefore, I expect that we will not see prices below 44K-48K in the future.

-

The Fibonacci ratio on the left is the Fibonacci ratio of the uptrend that started in 2015.

That is, the Fibonacci ratio of the first wave of the uptrend.

The Fibonacci ratio on the right is the Fibonacci ratio of the uptrend that started in 2019.

Therefore, this Fibonacci ratio is expected to be used until 2026.

-

No matter what anyone says, the chart has already been created and is already moving.

It is up to you how to view and respond to it.

Since there is no support or resistance point when the ATH is updated, the Fibonacci ratio can be appropriately utilized.

However, although the Fibonacci ratio is useful for chart analysis, it is ambiguous to use it as a support and resistance role.

The reason is that the user must directly select the important selection points required to create the Fibonacci.

Therefore, it can be useful for chart analysis because it is expressed differently depending on how the user specifies the selection point, but it can be seen as ambiguous for use in trading strategies.

1st: 44234.54

2nd: 61383.23

3rd: 89126.41

101875.70-106275.10 (when overshooting)

4th: 134018.28

151166.97-157451.83 (when overshooting)

5th: 178910.15

-----------------

Next Volatility Period: Around January 10

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(USDT 1D chart)

USDT is maintaining a gap downtrend.

The gap downtrend is a sign that funds have flowed out of the coin market.

(USDC 1D chart)

I think that the price defense is being done in the short term because USDC is maintaining a gap uptrend.

If USDT continues to maintain a gap downtrend and USDC moves sideways or gaps down, the coin market may fall significantly, so be careful when trading.

-----------------------------------------

(BTCUSDT 1D chart)

USDT is showing an upward trend while maintaining a gap downtrend.

It is likely that this is the last upward movement before the downtrend, so you should think about how to respond to the downtrend.

In order to turn into a short-term uptrend over time, it needs to be supported in the 95863.11-97461.86 range or higher.

If not, it will eventually fall.

-

USDT is one of the important stablecoins that support the coin market.

Since USDT is a stablecoin used worldwide, it is a fund that has a big impact on the coin market.

-

93576.0, 94742.35 are important support and resistance points.

Therefore, if the price can be maintained around 93576.0-94742.35, the coin market is expected to show a large increase when USDT shows a gap increase.

If it falls below the 92792.05 point and shows resistance,

1st: 87.8K ~ 89K

2nd: M-Signal on the 1W chart

You should check for support near the 1st and 2nd above.

-

Even if it rises above the 93576.0-94742.35 section and shows support, it must rise above the 101947.24-106133.74 section, which is the high point boundary section, to continue the upward trend.

If not, it will fall again, and at this time, the 93576.0-94742.35 section will play an important role as support and resistance.

-

As I mentioned earlier, the key is whether it can develop into a movement to form a bottom section.

To do that, it needs to meet the HA-Low indicator.

Since the next volatility period is expected to be around January 10 (January 9-11), we need to see if the HA-Low indicator is generated after the volatility period.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Big picture

I used TradingView's INDEX chart to check the entire section of BTC.

(BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(LOG chart)

Looking at the LOG chart, you can see that the upward trend is decreasing.

Accordingly, the 46K-48K range is expected to be a very important support and resistance range from a long-term perspective.

Therefore, we expect that we will not see prices below 44K-48K in the future.

-

The Fibonacci ratio on the left is the Fibonacci ratio of the uptrend that started in 2015.

In other words, it is the Fibonacci ratio of the first wave of the uptrend.

The Fibonacci ratio on the right is the Fibonacci ratio of the uptrend that started in 2019.

Therefore, it is expected that this Fibonacci ratio will be used until 2026.

-

No matter what anyone says, the chart has already been created and is already moving.

How to view and respond to this is up to you.

When the ATH is updated, there are no support and resistance points, so the Fibonacci ratio can be used appropriately.

However, although the Fibonacci ratio is useful for chart analysis, it is ambiguous when used as support and resistance.

This is because the user must directly select the important selection points required to create Fibonacci.

Therefore, since it is expressed differently depending on how the user specifies the selection points, it can be useful for chart analysis, but it can be seen as ambiguous when used for trading strategies.

1st : 44234.54

2nd : 61383.23

3rd : 89126.41

101875.70-106275.10 (Overshooting)

4th : 134018.28

151166.97-157451.83 (Overshooting)

5th : 178910.15

-----------------

Whether the bottom section will be formed is the key

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

Happy New Year.

-------------------------------------

(USDT 1D chart)

USDT appears to have turned into a gap downtrend.

If it does not rise quickly, the coin market is expected to show a sharp decline.

(USDC 1D chart)

Fortunately, USDC is maintaining a gap uptrend, so there seems to be a possibility of price defense to some extent.

However, since USDC has a lower influence on the coin market than USDT, if USDT maintains a gap downtrend, the coin market is expected to eventually show a decline.

What we need to do is check the stop loss point of the coin (token) we currently hold rather than increasing new transactions and think about how much we should cut loss.

(BTCUSDT 1D chart)

The point to watch is whether the movement of BTC is as updated last time.

If the HA-Low indicator is created, it means that the current wave is finished and a new wave is starting, so whether there is support is an important key.

There is a possibility that the HA-Low indicator will fall after being created and show a stepwise downtrend, but the fact that the HA-Low indicator was created means that it is ultimately forming a bottom section, so it is a time to buy.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- Big picture

I used TradingView's INDEX chart to check the entire section of BTC.

(BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(LOG chart)

Looking at the LOG chart, we can see that the increase is decreasing.

Accordingly, the 46K-48K range is expected to be a very important support and resistance range from a long-term perspective.

Therefore, we do not expect to see prices below 44K-48K in the future.

-

The Fibonacci ratio on the left is the Fibonacci ratio of the uptrend that started in 2015.

That is, the Fibonacci ratio of the first wave of the uptrend.

The Fibonacci ratio on the right is the Fibonacci ratio of the uptrend that started in 2019.

Therefore, this Fibonacci ratio is expected to be used until 2026.

-

No matter what anyone says, the chart has already been created and is already moving.

It is up to you how to view and respond to it.

Since there is no support or resistance point when the ATH is updated, the Fibonacci ratio can be appropriately utilized.

However, although the Fibonacci ratio is useful for chart analysis, it is ambiguous to use it as a support and resistance role.

The reason is that the user must directly select the important selection points required to create the Fibonacci.

Therefore, it can be useful for chart analysis because it is expressed differently depending on how the user specifies the selection point, but it can be seen as ambiguous for use in trading strategies.

1st: 44234.54

2nd: 61383.23

3rd: 89126.41

101875.70-106275.10 (when overshooting)

4th: 134018.28

151166.97-157451.83 (when overshooting)

5th: 178910.15

-----------------

Example of Interpretation of USDT, USDC, BTC.D, USDT.D

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

Trading Strategy

-------------------------------------

(USDT 1D chart)

USDT is a stable coin that has a great influence on the coin market.

Therefore, the gap decline of USDT is likely to have a negative impact on the coin market.

Since the gap decline means that funds have flowed out of the coin market, it can be interpreted that funds have currently flowed out through USDT.

(USDC 1D chart)

USDC cannot help but have a lower influence on the coin market than USDT.

The reason is that USDC markets are not operated in all exchanges around the world.

In other words, USDC can be seen as having limitations compared to USDT as an American investment capital.

Therefore, the gap increase of USDT is likely to have a short-term impact on the coin market.

----------------------------------

(BTC.D 1D chart)

You can refer to BTC dominance to choose which side (BTC, Alts) to trade in the coin market.

Since the rise in BTC dominance means that funds are concentrated on BTC, it can be interpreted that Alts are likely to gradually move sideways or show a downward trend.

For this interpretation to be meaningful, USDT dominance must show a downward trend.

(USDT.D 1D chart)

Because the decline in USDT dominance is likely to result in a rise in the coin market.

Therefore, if USDT dominance rises, it may be a good idea to pause all trading and take a look at the situation.

-

You can roughly figure out whether funds are flowing into or out of the coin market with USDT and USDC.

You can roughly figure out which direction the funds in the actual coin market are moving with BTC dominance and USDT dominance.

As I am writing this, BTC dominance is rising and USDT dominance is falling, so it is better to trade BTC rather than Alts.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

USDT vs USDC The Last Rush- Everything is in the chart.

- So my own deduction ( and only my own ) is : " Actually BTC not dipped so much "

- They pushed it hard, many peoples turned their BTC and Altcoins to USDT/USDC for safety.

- BTC is still not yet considered as a reserve like Gold in case of crises, peoples still scare and back really fast to the old paper money system when panic is around.

- i will link following this post a PAXG/BTC Chart to show what happened when BTC dipped.

- just look at indicators and you will clearly understand how much stables coins pushed high and Mooned/Marsed in the red " Overbought " Zone.

- Results : TheKing is still around 20k.

- that said, we can notice that USDC is gaining much more interests than USDT, just because USDC (Circle) is backed by cash and short-term U.S. government bonds as collateral.

- after the "LUNA-UST" Crash peoples started to fear and they are right, so they turned their Stables to USDC.

- in near future, USDC will gains more dominance on USDT and the next Dip could results in an Equal Dominance ( 3.80% - 3.20% )

i hope this post help to understand the situation, be H4ppy and St4y S4fe !

Happy Tr4Ding !

USDT depegged today but Why?About 12 hours ago, whale"0x3356" created a new address to deposit 52.52M USDC and borrowed 40M USDT on Aave and Compound then he started depositing 40M USDT into Coinbase and Kraken 6 hours ago, USDT started depegging after whale"0x3356" deposited USDT to exchanges

and whale"0x3356" withdrew 25M USDC from Coinbase 4 hours after depositing USDT.

then about 5 hours ago, 2 whales sold a total of 9.6M USDT at a similar time after USDT depegged, CZSamSun shorted USDT on AaveV2 4 hrs ago,Whale"0xd275" started to borrow USDC from Aave and Compound and buy USDT for arbitrage after CZSamSun shorted USDT

USDT started back to the peg, but due to multiple FUDs, whales keep dumping USDT

USDT further depegged..

pro traders trade coins

legends trade stable coins

The Coin Market is Different from the Stock Market

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

The coin market discloses a lot of information compared to the stock market.

Among them, it discloses the flow of funds.

Most of the funds in the coin market are flowing in through USDT, and it can be said that it currently manages the largest amount of funds.

Therefore, unlike the stock market, individual investors can also roughly know the flow of funds.

Therefore, you can see that it is more transparent than other investment markets.

-

USDT continues to update its ATH.

You can see that funds are continuously flowing into the coin market through USDT.

USDC has been falling since July 22 and has not yet recovered.

The important support and resistance level of USDC is 26.525B.

Therefore, if it is maintained above 26.525B, I think there is a high possibility that funds will flow in.

If you look at the fund size of USDT and USDC, you can see that USDT is more than twice as high.

Therefore, it can be said that USDT is the fund that has a big influence on the coin market.

USDC is likely to be composed of US funds.

Therefore, if more funds flow in through USDC, I think the coin market is likely to develop into a clearer investment market.

But it is not all good.

This is because the more the coin market develops into a clearer investment market, the more likely it is to be affected by the existing investment market, that is, the watch market.

This is because large investment companies are working to link the coin market with the coin market in order to make the coin market an investment product that they can operate.

In order for the coin market to be swayed by the coin-related investment product launched in the stock market, more funds must flow into the coin market through USDC.

Otherwise, it is highly likely that it will eventually be swayed by the flow of USDT funds.

Therefore, USDC is likely to have a short-term influence on the coin market at present.

-

As mentioned above, the most important thing in the investment market is the flow of funds.

The flow of funds in the coin market can be seen as maintaining an upward trend.

Therefore, there are more and more people who say that there are signs of a major bear market these days, but their position seems to be judging the situation from a global perspective and political perspective.

As mentioned above, the funds that still dominate the coin market are USDT funds, which are an unspecified number of funds.

Therefore, I think that the coin market should not be predicted based on global perspectives and political situations.

The start of the major bear market in the coin market is when USDT starts to show a gap downtrend.

Until then, I dare say that the coin market is likely to maintain its current uptrend.

------------------------------------

(BTCUSDT 1D chart)

The StochRSI indicator is approaching its highest point (100), and the uptrend is reaching its peak.

Accordingly, the pressure to decline will increase over time.

-

(1W chart)

The StochRSI indicator is also in the overbought zone on the 1W chart.

-

(1M chart)

On the 1M chart, the StochRSI indicator is showing signs of entering the overbought zone, but it is not expected to enter the oversold zone due to the current rise.

The movement of the 1M chart should be checked again when a new candle is created.

-

You can see that the StochRSI indicator on the 1M chart is the most unusual among the three charts above.

In the finger area on the 1M chart, the StochRSI indicator was in the overbought zone, but it is currently showing signs of entering the oversold zone.

Therefore, you can see that the current movement is different from the past movement.

Therefore, I think it is not right to predict the current flow by substituting past dates.

------------------------------------------

I wrote down my thoughts on the recent comments from famous people who say that the coin market will enter a major bear market along with the stock market.

-

Have a good time. Thank you.

--------------------------------------------------

- Big picture

It is expected that the real uptrend will start after rising above 29K.

The section expected to be touched in the next bull market is 81K-95K.

#BTCUSD 12M

1st: 44234.54

2nd: 61383.23

3rd: 89126.41

101875.70-106275.10 (overshooting)

4th: 134018.28

151166.97-157451.83 (overshooting)

5th: 178910.15

These are points where resistance is likely to be encountered in the future. We need to see if we can break through these points.

We need to see the movement when we touch this section because I think we can create a new trend in the overshooting section.

#BTCUSD 1M

If the major uptrend continues until 2025, it is expected to start by creating a pull back pattern after rising to around 57014.33.

1st: 43833.05

2nd: 32992.55

-----------------

The key is whether it can rise above 61K

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

(BTCUSDT 1D chart)

It was created using the Trend-Based Fib Extension tool based on the candlestick of the selected point used when drawing the parallel channel.

Therefore, from a short-term trend perspective, you can see that the area around the right Fibonacci ratio 0.618 (59369.59) ~ 0.5 (60650.13) is an important support area.

-

Therefore, the key is whether it can maintain the price by rising above 61099.25 after October 11.

If not, and it falls, it is possible that it will finally touch the M-Signal indicator on the 1M chart.

Currently, the M-Signal indicator on the 1M chart is rising around 52K.

The expected crossover area is expected to be around 56K (56150.01-56950.56).

-

(Chart under test)

If the M-Signal on the 1W and 1D charts breaks through the convergence area (1), it is expected to create a new rising wave.

If not, we need to check whether there is support in the area (2).

-

BW v1.0 indicator's BW is an indicator that comprehensively evaluates DMI, OBV, and MACD.

The interpretation method is

1. The horizontal line created by touching the 100 point becomes the trading reference line.

2. When it falls below the 80 point, the high point section is displayed.

3. The position is switched around the 50 point.

4. When it rises above the 20 point, the low point section is displayed.

5. The horizontal line created by touching the 0 point becomes the trading reference line.

2, 3, 4. are likely to have volatility, so the corresponding lines are the sections that must be responded to.

In other words, they correspond to the time when split trading is conducted.

---------------------------------------

The point to watch is whether USDC can be maintained above 26.153B as the gap decline decreases.

The important support and resistance area for USDC is 32.435B.

If the selling volume of BTC confiscated by the US government decreases and USDT gaps up, I think the coin market is likely to show an upward trend.

If not, it may not be able to digest the selling volume and lead to further decline.

----------------------------------------

(NAS100USD 1D chart)

We need to check whether there is support near 20313.8.

Since the StochRSI indicator has entered the overbought zone, even if it rises, it will eventually fall.

At this time, the point of interest is whether it can receive support near 20313.8.

The most important support zone at the current location is 19582.6.

----------------------------------------

The chart consisting of parallel channels and Fibonacci ratios is a chart for chart analysis.

Therefore, if your trading strategy is not properly established when trading with the support and resistance points confirmed by the Fibonacci ratio, you need to be careful because the transaction may proceed in the wrong direction.

Therefore, you must mark the support and resistance points on the 1M, 1W, and 1D charts.

-

The chart that has been used since the past is the chart that shows the support and resistance points drawn on the 1M, 1W, and 1D charts.

I think the support and resistance points shown on this chart are the most accurate among the charts I am introducing.

However, it is difficult to see because it is too complex a chart to use for publishing as an idea.

-

I am testing whether I can trade with the trend, momentum, and market strength by comprehensively evaluating MACD, DMI, and OBV.

I am testing it for use on time frame charts below 1D charts.

When using it on time frame charts below 1D charts, you can disable indicators corresponding to 2 and 4 and use it.

-

Have a good time.

Thank you.

--------------------------------------------------

- Big picture

It is expected that the full-scale uptrend will start when it rises above 29K.

The next expected range to touch is 81K-95K.

#BTCUSD 12M

1st: 44234.54

2nd: 61383.23

3rd: 89126.41

101875.70-106275.10 (overshooting)

4th: 134018.28

151166.97-157451.83 (overshooting)

5th: 178910.15

These are points that are likely to receive resistance in the future.

We need to check if these points can be broken upward.

We need to check the movement when this range is touched because it is thought that a new trend can be created in the overshooting range.

#BTCUSD 1M

If the major uptrend continues until 2025, it is expected to start forming a pull back pattern after rising to around 57014.33.

1st: 43833.05

2nd: 32992.55

-----------------

Why Aerodrome Finance (AERO) Will Be A Top 20 CryptocurrencyAfter diving deep into Aerodrome's whitepaper and dApp, it's become crystal clear that AERO is destined to become a top 10-20 market cap token. The fundamentals and long-term prospects are so strong that, honestly, if it doesn't reach that point, I would be shocked. Here's why:

1. Massive Liquidity and Total Value Locked (TVL)

AERO has an insane amount of liquidity and demand, and it's only growing:

Aerodrome's TVL recently hit $1 billion, a massive milestone.

The BASE chain, which AERO is built on, has reached $2 billion in TVL for the first time ever.

AERO is currently ranked #32 in TVL across the entire crypto ecosystem—out of thousands of tokens.

It's only a matter of time before AERO climbs into the top 20, maybe even the top 10 or top 5 in terms of TVL.

This level of liquidity is crucial for several reasons:

It provides stability and reduces slippage for traders.

It attracts more users and projects to the ecosystem.

It demonstrates strong confidence from investors and users.

2. Innovative Tokenomics and Yield Generation

Aerodrome's tokenomics model is designed to encourage long-term holding and participation:

Users can lock AERO tokens for up to four years, receiving boosted rewards.

This lock-up mechanism could potentially create supply squeezes, driving up the token's value.

The protocol offers incredible yield options, making it more likely that users will continue to lock up their tokens.

With these crazy yield options, it's truly surprising that more people haven't caught on yet.

3. Strategic Position on the BASE Chain

Aerodrome's role as the largest DEX on the BASE chain provides several advantages:

BASE is one of the fastest-growing chains in crypto, with over 1.3 million active addresses—more than any other EVM chain, including Ethereum.

As the "unofficial token" of BASE, AERO is well-positioned to benefit from the chain's rapid growth.

BASE's low fees and high liquidity make it attractive for DeFi users, potentially driving more activity to Aerodrome.

4. The Coinbase Factor and Marketing Potential

The connection to Coinbase through the BASE chain is a game-changer:

Aerodrome is already listed on Coinbase, providing exposure to a large user base.

As Coinbase's layer-2 solution, BASE is likely to receive substantial marketing and development support.

When Coinbase decides to push BASE hard, AERO will be right at the center of it, benefiting from Coinbase's massive resources and marketing power.

5. Comparative Market Analysis

When comparing Aerodrome to other successful DEXes, the growth potential is enormous:

Uniswap, a leading DEX, hit a $20 billion market cap at its peak.

If Aerodrome were to achieve similar success, it could easily match or exceed this valuation.

6. Technological Innovation and Development

Aerodrome continues to innovate within the DeFi space:

The protocol has implemented advanced features like concentrated liquidity and multiple fee tiers.

Ongoing development and upgrades could further enhance Aerodrome's competitive edge.

The team's ability to adapt to market needs and introduce new features will be crucial for long-term success.

7. Community and Ecosystem Growth

A strong and engaged community is vital for any crypto project:

Aerodrome has been gaining traction on social media platforms and crypto forums.

The number of unique addresses interacting with the protocol has been steadily increasing.

Partnerships and integrations with other DeFi protocols could further expand Aerodrome's ecosystem.

8. Potential for Major Exchange Listings

As of now, AERO has yet to be listed on some of the largest cryptocurrency exchanges:

AERO is not currently available on major platforms like Binance and Bybit.

Listing on these exchanges could potentially provide a significant boost to AERO's liquidity and accessibility.

The increased exposure from major exchange listings often leads to heightened interest and trading volume.

Early adopters who invest before major exchange listings often stand to benefit the most from potential price appreciation.

9. Exclusivity to BASE Chain: A Strategic Advantage

Aerodrome's decision to remain exclusive to the BASE chain is a strategic move that could significantly benefit both the protocol and the chain:

By keeping the AERO token and protocol exclusive to BASE, Aerodrome helps drive users and liquidity directly to the BASE chain.

This exclusivity creates a symbiotic relationship: as Aerodrome grows, it naturally increases activity and adoption of the BASE chain.

Concentrated liquidity on a single chain can lead to better trading experiences, lower slippage, and more efficient price discovery for AERO.

10. AERO Price and Long-Term Potential

The potential for significant price appreciation is a key factor in AERO's appeal:

I can confidently say that getting AERO under $1 might look like a dream in the next 1-2 years.

Right now, it's sitting at $1.30, but I recommended it to my followers when it was under $0.10.

The upside potential here is enormous. I wouldn't be surprised if AERO does a 25x from its current price.

With all the data and liquidity I'm seeing, a price of $30 or even $50+ doesn't seem far-fetched at all.

Conservative estimates place potential future prices in the $20-$30 range, with some optimistic projections even higher.

Conclusion

This train is leaving the station, and it's only going to get bigger, bigger, and bigger. With all the liquidity, yield, and demand driving this token forward, AERO has quickly become my #1 favorite token in crypto, and I don't see that changing anytime soon.

While these projections are exciting, it's important to remember that the cryptocurrency market is highly volatile and unpredictable. Always conduct your own research and invest responsibly.

COINBASE:AEROUSD KUCOIN:AEROUSDT COINEX:AEROUSDT CRYPTO:AERODUSD GATEIO:AEROUSDT CRYPTOCOM:AEROUSD BYBIT:AEROUSDT.P BITGET:AEROUSDT GATEIO:AEROUSDT PHEMEX:AEROUSDT MEXC:AEROUSDT.P BYBIT:AEROUSDT.P

CRACKS ARE FORMING IN USDT DOMINANCE! THE END IS NEAR!USDT has completely dominated the stablecoin market for a long time now, but cracks are beginning to form in its foundation that could cause the whole structure to come crashing down. People are losing trust in USDT, even though the vast majority of trading platforms use it as the sole medium of exchange on their platforms. Competitors are turning up the heat in this market, and companies like Circle (USDC), which are fully audited, as well as newcomers like Ripple's RLUSD, could pose a serious challenge to USDT if it doesn't prove its reserves through regular audits and restore investor confidence.

I personally believe that USDT is a Ponzi scheme, similar to the Federal Reserve, which continuously counterfeits dollars by minting excess tokens, with nothing but faith backing them. I also believe that the time of USDT's dominance is coming to a swift end.

Once RLUSD is released and available for purchase to Wall Street and Main Street, I believe that the majority of stablecoin holders will switch from USDT to RLUSD, as Ripple is one of the most transparent and reputable companies within the crypto space. I am one of these people.

Good luck, and don't put all your eggs in one basket!

CRYPTO MARKET CRASH COMING THE WEEK OF SEPT. 9TH - 15TH.I believe there is a massive crash coming for the crypto markets during the week of September 9th through the 15th. Don’t ask how I came up with this prediction; it’s too complex to get into. I don’t know if the drop will be a massive red candle in a single day or if it will be a multi-day process to achieve these lows, but I’m predicting that the minimum price drop will be 33%, to 50% in most cryptos (less than two weeks away).

This may be the 'Black Swan' that we have been waiting for, and for some, this will be the scariest moment in crypto. For others, it will be the buying opportunity of a lifetime.

Key takeaways from this prediction:

- The overall crypto market will drop sometime between Sept. 9th through the 15th.

- Price drop will be between 33% and 50% in a 7 day timeframe.

- Drop may be quick, as in a single day, or it may be a process that takes the full week.

Keep some cash on the sidelines to purchase physical coins to add to your long-term crypto stack. This buying opportunity may last only hours, days or could extend to the full week; only time will tell.

Let the countdown begin. And yes, I know this is a bold prediction, but I wouldn’t be sharing it if I didn’t believe it was actually going to happen, and yes, I may be wrong.

Good luck!