USD/CAD Pulls Back After Hitting 1.4400FenzoFx— The USD/CAD pair hit 1.4400 but lost momentum, pulling back from resistance. Technically, USD/CAD may dip toward the 50-period SMA near 1.4330 before resuming its uptrend.

However, if USD/CAD drops below 1.4330, the bearish momentum may extend to the 1.4250 support, invalidating the bullish outlook.

Usdcadanalysis

USDCAD -Weekly Forecast,Technical Analysis & Trading Ideas

Technical analysis is on the chart!

No description needed!

OANDA:USDCAD

________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

It looks like a wedge!If you're not a chartist, then see it as a liquidity grab at the marked red dot.

We probably still have another 100 pips of leverage left, maybe more!

Remember that a crowded area is a liquidity-starved area.

Don't forget that patience pays off!

Apply your own strategy to find the entry, or here's a little setup; that's what I'm waiting for.

Keep It Simple!

Don't forget to follow me.

USD/CAD Bearish Trade Setup – Resistance Rejection & Target ProjUSD/CAD Bearish Trade Setup – Key Resistance & Target Projection

Analysis:

Timeframe: 30-minute chart

Current Price: 1.43248

Indicators:

EMA (200, Blue): 1.43024 (Key Dynamic Support)

EMA (30, Red): 1.43142 (Short-term trend)

Resistance Zone (Supply Area): 1.43300 - 1.43450

Support Level (Rejection Zone): 1.43085 - 1.43024

Trade Setup:

Entry Zone: Around the rejection level near 1.43142

Stop Loss: 1.43435 (Above the resistance zone)

Take Profit Target: 1.42355 (EA Target Point)

Projection:

Price is expected to reject the resistance zone, drop below the 200 EMA, and test the lower target at 1.42355.

If price confirms rejection at resistance, a short (sell) opportunity is valid.

A break above the stop-loss level could invalidate the bearish bias.

Conclusion:

Bearish momentum is anticipated if price respects the resistance zone.

Confirmation from price action (candlestick patterns) will strengthen the trade setup.

#USDCAD 4HUSDCAD (4H Timeframe) Analysis

Market Structure:

The price is currently trading within a well-defined downtrend channel and has reached the upper boundary, which is acting as strong resistance. Previous price action suggests that sellers have been active at this level, leading to potential bearish pressure.

Forecast:

A sell opportunity may arise if the price fails to break above the channel resistance and shows signs of rejection. If the resistance holds, further downside movement is expected within the channel structure.

Key Levels to Watch:

- Entry Zone: Consider selling near the channel resistance upon confirmation of bearish rejection.

- Risk Management:

- Stop Loss: Placed above the channel resistance to manage risk.

- Take Profit: Target lower levels within the channel, aligning with previous support zones.

Market Sentiment:

As long as the price remains within the downtrend channel and respects the resistance, the bearish trend is likely to continue. However, a breakout above the resistance may shift the market sentiment toward bullish movement.

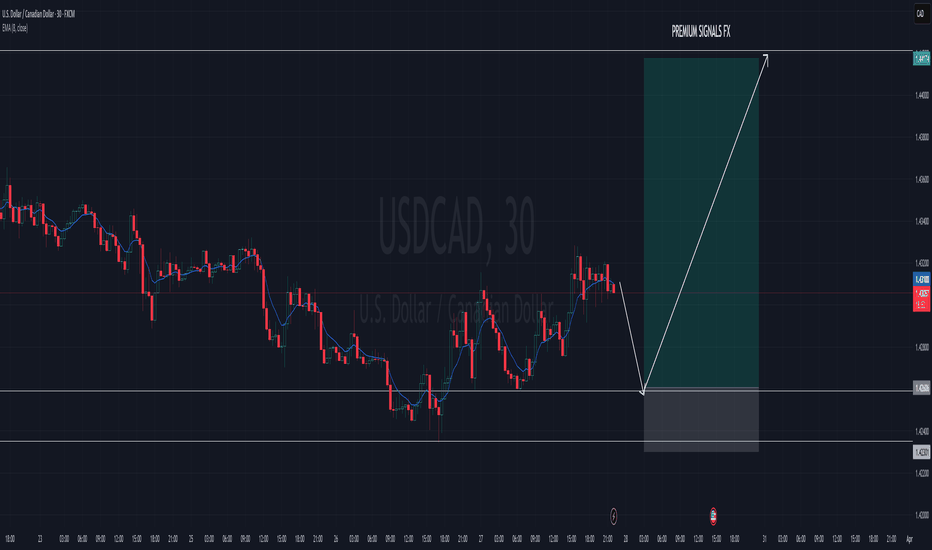

USD/CAD Very Near Buying Area , Are You Ready To Get 200 Pips ?This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

USD/CAD Bullish Setup: Key Support Holding for Potential Upside This chart represents a technical analysis of the USD/CAD currency pair on the 1-hour timeframe. Here's a breakdown of the key elements:

Key Indicators & Levels:

Exponential Moving Averages (EMA):

200 EMA (Blue Line): 1.43906 (Long-term trend indicator)

30 EMA (Red Line): 1.43859 (Short-term trend indicator)

Support & Resistance Zones:

Support Zone (Purple Area, Lower): Around 1.43658

Resistance Zone (Purple Area, Upper): Around 1.44500

Trade Setup:

Entry Point: Near 1.43753 (Current Price)

Stop Loss: Below 1.43658 (Red zone at 1.43158)

Take Profit Target: 1.45425 - 1.45433 (Blue zone)

Potential Trade Direction:

The price is expected to bounce from the support zone and move upwards.

A break above the resistance zone (~1.44500) would confirm bullish momentum.

The projected target is 1.45425 - 1.45433.

Conclusion:

Bullish Outlook: If the price respects the support zone and breaks above 1.44500.

Bearish Risk: If the price falls below 1.43658, the setup would be invalid.

EMA Perspective: The price is fluctuating around the 200 EMA, suggesting a potential trend shift.

Would you like a more detailed breakdown or any additional insights

USD/CAD - Harmonic Patterns and Momentum IndicatorsTechnical Analysis of USD/CAD - Harmonic Patterns and Momentum Indicators

Overview:

The USD/CAD chart illustrates price action on the hourly timeframe, incorporating harmonic patterns, Fibonacci retracements, and momentum indicators to identify potential reversal and continuation points. The presence of a Crab harmonic pattern suggests a critical turning point, while momentum oscillators provide additional confirmation.

**Harmonic Pattern Analysis:**

1. A **Crab harmonic pattern** is evident, with the price reaching the terminal point at approximately **1.44627**.

2. The **XA and BC Fibonacci extensions** align with key retracement levels, reinforcing the likelihood of a reversal at this zone.

3. The price has **rejected the high point**, indicating potential exhaustion of bullish momentum.

**Support and Resistance Levels:**

- **HOP (Harmonic Optimal Point):** **1.44627** - The potential completion zone of the Crab pattern.

- **XA Retracement:** **1.43968** - A key structural support level.

- **BC Level:** **1.43721** - A secondary support level for price continuation.

- **T2 (Target 2):** **1.42596** - A potential downside target if bearish momentum continues.

**Momentum Indicators:**

- **Stochastic RSI & Relative Strength Index (RSI):**

- The **Stochastic RSI** shows a recent overbought condition, followed by a decline, indicating potential bearish momentum.

- The **RSI also exhibits bearish divergence**, where price made a higher high while RSI formed a lower high, suggesting weakening bullish strength.

**Market Sentiment & Potential Trade Opportunities:**

- Given the rejection at **1.44627**, a **short position** could be considered if confirmation of further downside emerges.

- A break below **1.43968** could reinforce the bearish bias, with **1.42596** as a potential target.

- However, if the price finds support and rebounds, a bullish continuation could be anticipated, requiring further validation.

**Conclusion:**

The **Crab harmonic pattern, overbought momentum indicators, and Fibonacci confluence suggest a possible bearish reversal**. Traders should monitor **key support levels and momentum shifts** to determine whether the bearish scenario plays out or if buyers regain control. Risk management and confirmation signals are crucial before entering a trade.

USD/CAD Market Analysis: Potential Reversal from Resistance ZoneThe USD/CAD pair on the 15-minute timeframe is showing signs of a potential bearish reversal. The price has been in an uptrend, forming higher highs and higher lows while respecting a diagonal support trendline. However, it has now approached a key resistance zone around 1.43575, as marked by the M15 supply area.

The current price action suggests a rejection from this resistance, with wicks indicating selling pressure. If the price breaks below the ascending trendline, a further decline towards the 1.42794 support level is likely. The risk-to-reward setup favours short positions if confirmation of a bearish structure shift occurs.

Traders should monitor price action closely for a trendline break or a strong bearish engulfing candle to confirm the sell-off.

USD/CAD "The Loonie" Forex Market Money Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CAD "The Loonie" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / swing low level Using the 4H timeframe (1.44500) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.39500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read the Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook before start the plan.

USD/CAD "The Loonie" Forex Market is currently experiencing a bearish trend,., driven by several key factors.

1. Fundamental Analysis

Fundamental analysis evaluates the economic indicators of the United States and Canada that directly impact the USD/CAD exchange rate.

United States Economic Indicators:

GDP Growth: Forecasted at 2.0% to 2.5% for 2025, suggesting steady but slowing economic expansion.

Inflation: Stable at approximately 2.5% to 3.0%, with recent data showing no significant surprises.

Interest Rates: Currently at 4.50%, with the Federal Reserve potentially considering cuts later in 2025 if economic growth weakens.

Trade Balance: The US maintains a persistent trade deficit, though it remains manageable given the broader economic context.

Canada Economic Indicators:

GDP Growth: Projected at 1.0% to 1.5% for 2025, indicating moderate growth heavily tied to commodity exports.

Inflation: Around 2.0%, stable but sensitive to fluctuations in energy prices.

Interest Rates: Set at 3.0%, with the Bank of Canada (BoC) likely to hold steady or adjust slightly based on incoming economic data.

Trade Balance: Mixed, with oil exports being a critical driver of the Canadian Dollar (CAD).

Key Insight: The interest rate differential (4.50% in the US vs. 3.0% in Canada) currently supports the USD. However, declining oil prices—a key factor for Canada—and potential Fed rate cuts introduce uncertainty into the fundamental picture.

2. Macroeconomic Factors

Macroeconomic conditions provide a broader context for currency movements, encompassing global and country-specific trends.

Global GDP Growth: Expected to range between 3.0% and 3.3% in 2025, reflecting moderate global economic expansion.

US Economy: Exhibits signs of slowing growth, with the Federal Reserve adopting a cautious stance, potentially leading to rate cuts if economic conditions deteriorate.

Canadian Economy: Strongly influenced by commodity prices, especially oil, which has faced volatility due to global supply and demand dynamics.

Central Bank Policies: The Fed is in a wait-and-see mode, while the BoC remains data-dependent, with possible rate adjustments if inflation or growth shifts significantly.

Geopolitical Events: Trade tensions, including US-imposed tariffs, could pressure Canada’s economy, potentially weakening the CAD.

Key Insight: Macroeconomic factors present a mixed outlook. Moderate global growth supports risk assets, but trade tensions and central bank caution create uncertainty for USD/CAD.

3. Global Market Analysis

Global market conditions influence currency pairs through risk sentiment and economic interdependencies.

Equity Markets: US and global equity indices are range-bound, reflecting uncertainty and mixed economic signals.

Commodity Prices: Oil prices are under pressure, a bearish factor for the CAD given Canada’s role as a major oil exporter.

Currency Markets: The USD shows strength against some currencies but weakness against others, lacking a dominant trend.

Key Insight: Weak oil prices act as a headwind for the CAD, potentially pushing USD/CAD higher, though broader market uncertainty moderates this effect.

4. Commitment of Traders (COT) Data

COT data offers insights into the positioning of large traders, shedding light on market sentiment.

Large Speculators: Recent trends indicate a net short position on USD/CAD, suggesting bearish sentiment among big players.

Commercial Traders: Positioning is mixed, with some hedging activity reflecting uncertainty in the market.

Market Implications: The net short stance among speculators points to a bearish outlook, but it also raises the possibility of a crowded trade, increasing the risk of a short squeeze if the pair rallies.

Key Insight: Bearish sentiment prevails among large traders, aligning with technical signals, though the concentration of shorts could lead to volatility.

5. Intermarket Analysis

Intermarket analysis examines correlations between USD/CAD and other asset classes.

Oil Prices: A strong inverse correlation exists between USD/CAD and oil prices. Falling oil prices typically strengthen USD/CAD by weakening the CAD.

Commodity Currencies: USD/CAD often aligns with movements in other commodity-linked currencies like AUD/USD and NZD/USD.

Equity Markets: A risk-on environment (rising equities) can pressure the USD downward, while risk-off sentiment bolsters it.

Key Insight: Declining oil prices provide a bullish tilt for USD/CAD, but this is tempered by mixed risk sentiment across global markets.

6. Quantitative Analysis

Quantitative analysis employs technical indicators to assess price trends and momentum.

Moving Averages: The pair is trading below its 50-day and 200-day moving averages, signaling a bearish trend.

RSI (Relative Strength Index): At 45, the RSI is neutral but approaching oversold territory, hinting at potential downside exhaustion.

MACD (Moving Average Convergence Divergence): Positioned in negative territory, indicating bearish momentum.

Chart Patterns: A bear flag pattern has been noted, with a potential downside target near 1.3164, suggesting further declines.

Key Insight: Technical indicators predominantly point to a bearish trend, with the possibility of additional downside if key support levels are breached.

7. Market Sentiment Analysis

Market sentiment reflects the collective psychology of traders and investors.

Trader Sentiment: Surveys and positioning data indicate a bearish bias, with traders anticipating further declines in USD/CAD.

Expert Opinions: Analysts largely recommend selling the pair, citing both technical and fundamental weaknesses.

Social Media Trends: Discussions on platforms like X reveal mixed views, with some predicting a drop to 1.4000 and others warning of potential reversals.

Key Insight: Sentiment leans bearish, consistent with technical indicators and COT data, reinforcing expectations of a downward move.

8. Positioning

Positioning reveals how traders are aligned in the market, influencing potential price dynamics.

Speculative Positions: Likely net short, based on COT data and sentiment surveys, indicating widespread bearish bets.

Institutional Positioning: Mixed, with some institutions hedging against possible USD weakness.

Market Impact: The heavy short positioning could trigger volatility if the pair moves against the consensus, such as in a short squeeze scenario.

Key Insight: Bearish positioning dominates, heightening the risk of a sharp reversal if positive USD catalysts emerge.

9. Next Trend Move

The next likely price movement is derived from current data and market conditions.

Direction: Downward pressure is favored, driven by technical sell signals and bearish sentiment.

Key Levels:

Support: 1.4150; a break below could target 1.4000 or lower.

Resistance: 1.4500; a move above could signal a trend reversal.

Triggers: Upcoming economic data releases, central bank statements, or shifts in oil prices could catalyze the next move.

Key Insight: The next trend move is likely to test lower support levels, potentially reaching 1.39500 if bearish momentum continues.

10. Overall Summary Outlook

Overview: On March 6, 2025, with USD/CAD at 1.43000, the pair exhibits a bearish outlook. Technical indicators, bearish trader positioning, and market sentiment suggest downside risks. However, fundamental factors—such as declining oil prices and potential trade tensions—could provide some support for the pair. The market is at a pivotal point, with price action near key support levels likely to dictate the next direction.

Future Prediction

Trend: Bearish (Short-Term), with Potential for Reversal

Details:

Short-Term: The pair is poised to test support at 1.41500, with a possible decline to 1.39000 if this level breaks. This outlook is driven by technical weakness and bearish sentiment.

Risks: A reversal could occur if oil prices rebound or if US economic data exceeds expectations, potentially pushing the pair toward 1.39000.

Conclusion: The short-term forecast favors a bearish trend, supported by prevailing technical and sentiment signals. However, fundamental factors like oil prices and trade policies could cap downside or trigger a reversal, warranting close monitoring of upcoming data and events.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Trump’s Tariffs on Canada: USD/CAD Remains VolatileTrump’s Tariffs on Canada: USD/CAD Remains Volatile

We are witnessing a surge in market volatility (as reflected by the upward trend of the ATR indicator), influenced by the following factors, according to Reuters:

→ Trump’s Tariffs. On Tuesday, new 25% import duties on Mexico and Canada came into effect, while tariffs on Chinese goods were doubled to 20%.

→ Donald Trump’s first speech in Congress since taking office. In it, the US president made significant statements, including the announcement of new tariffs.

The US Dollar Index initially rose during Trump’s speech but later weakened to a three-month low. In theory, higher tariffs are positive for the US dollar. However, investors are looking beyond short-term safe-haven flows and are concerned about slowing US economic growth and the risk of stagflation.

Why Is Trump Imposing Tariffs?

Officially, US President Donald Trump is introducing tariffs on Canada to combat the "extraordinary threat" to US national security posed by uncontrolled drug trafficking.

However, according to Canadian Prime Minister Justin Trudeau, Trump’s tariffs are aimed at weakening Canada’s economy—or even pushing it towards collapse—so that the US could more easily annex Canadian territory.

Technical Analysis of USD/CAD

In our previous USD/CAD analysis, we highlighted key levels:

→ Resistance at 1.44600

→ Support at 1.43600

New chart data shows that bulls attempted to break through the 1.44600 resistance level, but the price failed to hold above the psychological barrier of 1.45000. Support at 1.43600 remains relevant for now.

Bulls may attempt another push upwards if the price retraces to the lower blue trendline. However, whether this scenario plays out will largely depend on the broader fundamentals related to Trump’s tariffs on Canada, Mexico, and China.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Trump’s Tariff Threat: USD/CAD Hits Three-Week HighTrump’s Tariff Threat: USD/CAD Hits Three-Week High

As we reported on 3 February, Trump’s tariffs pushed USD/CAD to a 22-year high.

However, a one-month tariff delay led to a sharp drop, sending USD/CAD to its 2025 low near 1.41550. As the end of the delay approaches, the pair has been climbing again since mid-February (as shown by the arrow).

Yesterday, President Trump confirmed that his proposed 25% tariffs on Mexican and Canadian goods will take effect on 4 March. This dashed hopes for another delay and triggered a breakout above the 1.43600 resistance level.

Technical Analysis of USD/CAD

Above current levels, key resistance lies at 1.44600, which has held firm since mid-December. However, drastic measures from Trump’s administration could drive further price movement within the blue-marked channel.

Expect volatility spikes ahead of Canada’s GDP release, scheduled for today at 16:30 GMT+3.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Short I opened a short position based on the following reasons:

1) Daily candle on the 13th Feb decisively broke and closed below the support line around 1.430 zone and created fair value gap.

2) The price retraced to the FVG area and closed below the area this morning (I am looking at 4H and 1H for this).

3) Both MACD and RSI in Daily and 4H are in the bear zone.

4) 4h MACD has just crossed in the bear zone and is moving to the downside.

5) 4H MACD is also showing hidden divergence which indicates the continuation of the down trend.

6) 4H EMA is below EMA 200 and the candle closed below EMA 21.

Entry price 1.4190

Stop Loss: 1.43 (just above EMA 200 in 4H. It is a general stop and I will move it soon if the price moves to the downside)

Profit target: 1.3975 (I might manually close it if the price struggles to go below 1.4000)

Risk: Reward is 1:1.65

WEEKLY MARKET OVERVIEW FOR MAJOR CURRENCY PAIRSWEEKLY MARKET OVERVIEW FOR MAJOR CURRENCY PAIRS

1️⃣ NDZUSDT

Overall, the weekly (W) and monthly (M) trends are in a SELL direction ⬇️

However, at the beginning of the week, W will correct upwards (BUY) before facing price resistance around 0.589 - 0.592, which is a potential SELL zone ⚠️

Setup:

✅ BUY at the beginning of the week using Rainbow MG3 indicator on H1 - D1

❌ SELL after price reacts at resistance using Rainbow MG3 on M15 - H4

📊 Projected chart attached

2️⃣ AUDUSDT

The overall trend on W and M is SELL, but D1 is currently correcting upwards 🔄

Setup:

✅ BUY H1 - D1 using Rainbow MG3 indicator

❌ SELL H1 - D1 using Rainbow MG3 indicator

🔁 Trade both directions based on Rainbow MG3 signals

📊 Projected chart attached

3️⃣ EURUSDT

✅ BUY H1 - D1 using Rainbow MG3 indicator

❌ SELL H1 - D1 using Rainbow MG3 indicator

🔁 Trade both directions based on Rainbow MG3 signals

📊 Projected chart attached

4️⃣ GBPUSDT

✅ BUY H1 - D1 using Rainbow MG3 indicator

❌ SELL H1 - D1 using Rainbow MG3 indicator

🔁 Trade both directions based on Rainbow MG3 signals

📊 Projected chart attached

5️⃣ USDCAD

Setup:

✅ BUY H1 - D1

📊 Projected chart attached

6️⃣ USDJPY

Setup:

❌ SELL H4 - W

📊 Projected chart attached

⚡ Trading Signals Confirmation

All trade setups require confirmation using the Rainbow MG3 indicator before execution ✅