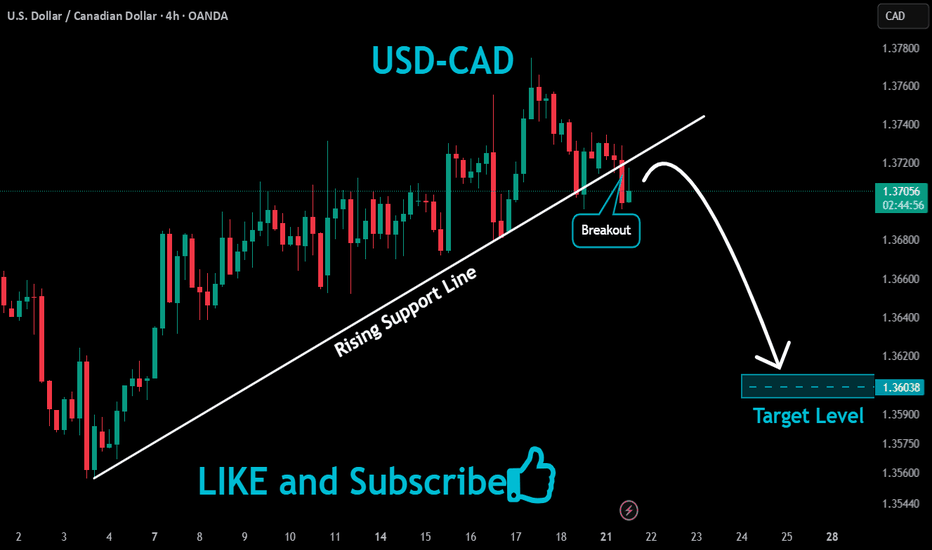

USDCAD SELLUSD/CAD rallies to 1.3680 as the market focuses on a hawkish Fed

The US Dollar extends its recovery for the second consecutive day, supported by strong US data. Upbeat US business activity and Jobless Claims support the Fed's "wait and see" rhetoric. In Canada, the weak Retail Sales data keep hopes for a BoC rate cut alive.

The year will be politically marked by Trump’s return to the White House. A Republican government is seen as positive for financial markets, but Trump’s pledge to cut taxes and impose tariffs on foreign goods and services may introduce uncertainty to both the political and economic landscape.

Canada’s political crisis peaked in late 2024 with a no-confidence vote against Prime Minister Justin Trudeau, leading to snap elections and a weakened Liberal minority government. Policy uncertainty and economic challenges dominate 2025’s outlook, raising concerns over market stability and investor confidence.

The BoC is set to continue easing interest rates through 2025, at least at a faster pace than the Fed is expected to, which could apply pressure on CAD’s already-rising rate differential.

SUPPORT 1.36991

SUPPORT 1.36739

SUPPORT 1.36495

RESISTANCE 1.37346

RESISTANCE 1.37455

Usdcadsell

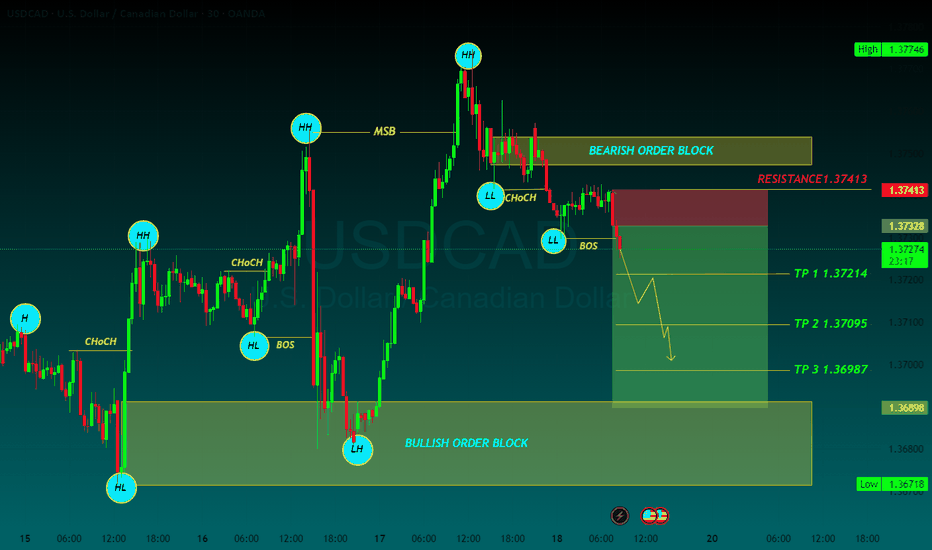

USDCAD SELLUSD/CAD retakes 1.3700, eyes multi-week top amid a broadly firmer USD

The USD/CAD pair attracts some dip-buying during the Asian session on Thursday and climbs further beyond the 1.3700 mark amid a broadly firmer US Dollar. Spot prices have now reversed the previous day's retracement slide from a three-week high and seem poised to appreciate further

The year will be politically marked by Trump’s return to the White House. A Republican government is seen as positive for financial markets, but Trump’s pledge to cut taxes and impose tariffs on foreign goods and services may introduce uncertainty to both the political and economic landscape.

Canada’s political crisis peaked in late 2024 with a no-confidence vote against Prime Minister Justin Trudeau, leading to snap elections and a weakened Liberal minority government. Policy uncertainty and economic challenges dominate 2025’s outlook, raising concerns over market stability and investor confidence.

The BoC is set to continue easing interest rates through 2025, at least at a faster pace than the Fed is expected to, which could apply pressure on CAD’s already-rising rate differentia

TP 1 1.37214

TP 2 1.37095

TP 3 1.36987

RESISTANCE 1.37413

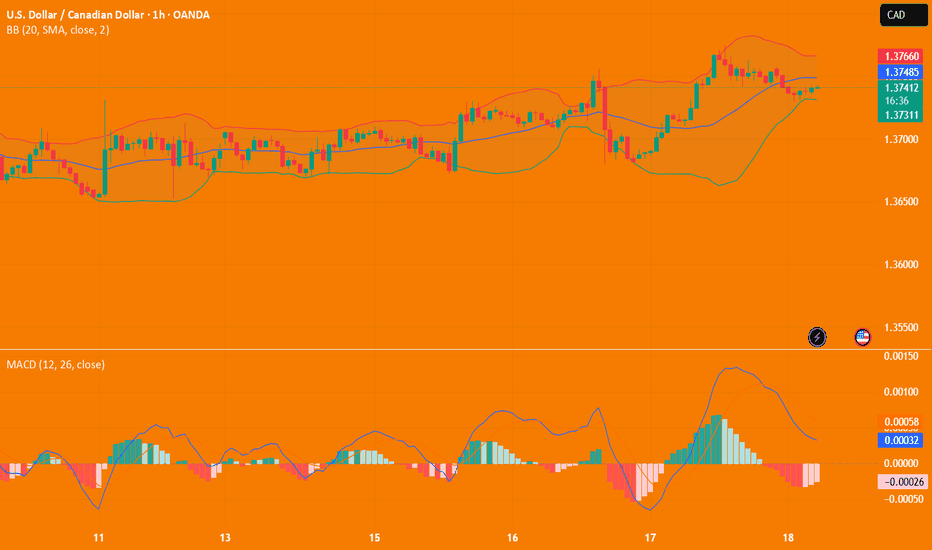

USD/CAD(20250718)Today's AnalysisMarket news:

① Kugler: It is appropriate to keep the interest rate policy stable for "a while".

② Daly: Whether to cut interest rates in July or September is not the most critical.

③ Bostic: It may be difficult to cut interest rates in the short term.

Technical analysis:

Today's buying and selling boundaries:

1.3735

Support and resistance levels:

1.3827

1.3792

1.3770

1.3700

1.3678

1.3644

Trading strategy:

If it breaks through 1.3770, consider buying in, the first target price is 1.3792

If it breaks through 1.3735, consider selling in, the first target price is 1.3700

USD /CAD) bearish reversal analysis Read The captionSMC trading point update

Technical analysis of USD/CAD pair on the 2-hour timeframe, suggesting that the price is likely to drop toward the support zone. Here's the detailed idea behind the analysis:

---

Chart Breakdown (2H – USD/CAD)

1. Resistance Zone (Yellow Box - Top):

Marked as a strong supply area where price has repeatedly been rejected (highlighted by red arrows).

Acts as a key zone where sellers are in control.

Also aligns with a descending trendline, reinforcing bearish pressure.

2. Support Zone (Yellow Box - Bottom):

This is the target point marked at 1.35387, which previously served as a demand zone.

The chart suggests this level as the next significant area where price might find buyers.

3. Trend Context:

Price is moving within a descending channel (black trendlines), confirming the overall downtrend.

The 200 EMA (1.36834) is acting as dynamic resistance, keeping price under pressure.

4. Projected Move (Blue Box):

Shows a potential drop of ~91 pips toward the support level.

A bearish wave is anticipated as per the black zigzag line on the chart.

5. RSI Indicator:

RSI is near neutral (49.02 and 49.70) — suggesting no overbought/oversold conditions, but confirming lack of bullish momentum.

RSI is aligned with price trending down.

Mr SMC Trading point

---

Summary:

Bias: Bearish

Entry Zone: Near current price or minor pullback (1.364–1.365)

Target: 1.35387 (support zone)

Invalidation: Break and close above resistance level / 200 EMA (~1.3685)

Trend: Downtrend within channel

---

Please support boost 🚀 analysis)

USDCAD Bearish Reversal Trade Setup – 3H Chart Analysis (June 26 Entry Zone: 1.37279 – 1.37554

🔹 Stop Loss: 1.37934

🔹 Target: 1.35278

🔹 Risk-to-Reward (RR): ~1:2.5

🧠 Technical Breakdown

Trend Overview:

Overall trend shows a downtrend from earlier June, followed by a corrective bullish move.

Price failed to sustain above the 200 EMA (blue line), indicating continued bearish pressure.

Trade Line Break:

A steep bullish trendline was broken, signaling a potential trend reversal or deeper pullback.

Bearish Rejection Zone:

The purple zone (1.37279 – 1.37554) acted as resistance.

Price formed a lower high and rejected this zone, confirming selling interest.

Entry Strategy:

Short entry is ideally within or just below the rejection zone.

Aggressive entry already in play at current market price (1.36909) after confirmation.

Target Zone:

Projected towards 1.35278, aligning with previous support and fib retracement zone.

Large purple support zone near the target suggests a potential reversal area.

⚠️ Risk Notes

Be cautious of USD volatility due to upcoming economic events (noted with icons on the chart).

Stop loss above previous swing high minimizes risk of fakeouts.

✅ Summary:

This is a bearish swing setup aiming for a significant drop toward 1.35278. The clean rejection from resistance and trendline break supports a high-probability short opportunity with favorable risk-reward.

USDCAD Analysis – Breaking the Chains, Eyeing 1.38+USDCAD Price broke out from a long descending channel, followed by two bullish continuation flags – classic breakout-retest pattern.

Price is now pushing above 1.3720, aligning with the 38.2% Fib level of the prior drop.

Next upside targets:

🔹 1.3833 (Fib 61.8%)

🔹 1.3913 (Fib 78.6%)

Clear stop level: below 1.3625 (channel breakout support)

Structure Bias: Bullish continuation. Clean breakout + consolidation = probable impulse toward 1.3830/1.39.

📊 Current Bias: Bullish

🔍 Key Fundamentals Driving USDCAD

USD Drivers (Neutral to Bullish):

Fed held rates, dot plot shows only 1 cut in 2025, but Powell's tone leaned dovish.

US Retail Sales + PPI were weak, but safe-haven USD demand persists due to geopolitical risks and equity volatility.

Market reassessing Trump election risk, Fed independence, and inflation stickiness.

CAD Drivers (Bearish):

Oil prices are volatile due to Middle East tensions, but weak demand caps upside.

Canada’s CPI softened, BoC already delivered a dovish cut earlier this month.

CAD under pressure due to dovish BoC outlook and fiscal concerns (gov't budget deficits expanding).

CAD is also suffering from reduced foreign investment flows.

⚠️ Risks to Watch

Oil price spikes (especially if Strait of Hormuz risk escalates) may boost CAD short-term.

A sharp reversal in DXY or Fed commentary shift toward aggressive easing.

Weak US data next week (Core PCE especially) could unwind USD momentum.

🗓️ Upcoming Events to Watch

US Core PCE (June 28) – critical inflation gauge for the Fed

BoC Business Outlook Survey

Oil Inventories + Global energy sentiment

Geopolitical: Israel–Iran updates and Canada’s fiscal signals

🏁 Which Pair Leads the Move?

USDCAD is leading commodity crosses as CAD weakness broadens. Watch USDCAD and GBPCAD for signs of CAD softness before others like AUDCAD/NZDCAD follow.

USD/CAD)) Bearish Trand analysis Read The captionSMC trading point update

Technical analysis of USD/CAD on the 3-hour timeframe, using Smart Money Concepts (SMC) and classic technical analysis. Here's a breakdown

---

Key Technical Insights:

Overall Trend:

The pair is in a clear downtrend, confirmed by:

Lower highs and lower lows

Price trading below the 200 EMA (currently at 1.37402)

Respect for the downtrend channel

---

Resistance Zones:

1. Upper Resistance Zone (~1.38400 – 1.38750):

Strong historical sell area (price sharply reversed here in late May)

2. Mid Resistance Zone (~1.36450 – 1.36750):

Price reacted twice here and dropped.

Aligns with the downtrend line and was recently tested again (red arrow).

---

Bearish Projections:

After the latest pullback into the resistance zone, price is expected to:

Reject the zone

Continue following the descending structure

Target marked around 1.35034, which coincides with:

Previous low

Lower boundary of the descending channel

Mr SMC Trading point

---

Chart Tools & Features Used:

Trendlines: Clearly marking the downtrend channel

200 EMA: Used as dynamic resistance

Fib-like measured move: Mirrored previous impulse moves (-1.61%) suggesting a symmetric drop

Arrows: Indicating reaction points from resistance

---

Conclusion:

Bias: Bearish

Invalidation: Break and hold above 1.36500 would weaken the bearish outlook.

Next Move: Potential sell setups on lower timeframe retests or bearish confirmations within the resistance zone.

Please support boost 🚀 this analysis)

USDCAD Bearish Bias: Beware Liquidity Traps & Reversal Risks.I'm currently keeping a close eye on USDCAD, which has been in a strong bearish trend. 📉

In this video, I explain how the market is unfolding across both the higher and lower timeframes, and why it’s critical to watch them in conjunction. On the lower timeframes, we often see a clean sequence of lower highs and lower lows, as the algos set up a seemingly a smooth trend. But traders should be cautious ⚠️

Why? Because on the higher timeframes, the market can easily pull back, triggering a liquidity hunt. This is often when the algorithm targets stop orders above recent highs, before resuming the trend 🧠💥

While my bias remains bearish, I'm also aware of the risk that the market could shift gears unexpectedly to run stops and shake out weak hands. This concept is fully broken down in the video — with examples of how to spot these traps and prepare accordingly 🎯

USDCAD Under Pressure: Chart Signals & Macro Forces Point South!The USDCAD pair is under clear pressure, as illustrated in this chart 📊. The visual structure highlights a persistent bearish trend, with price action consistently forming lower highs and lower lows. The chart is reinforcing the idea that sellers are dominating the market. Notably, the drawn arrow in the chart points toward previous higher timeframe lows, suggesting that these areas could be the next logical targets for price action if the current trend persists.

On the fundamental side, the US dollar has been weakened by dovish signals from the Federal Reserve and softer economic data, fueling expectations of potential rate cuts later this year 🏦. In contrast, the Canadian dollar has been buoyed by strong commodity prices—especially oil—and a relatively hawkish Bank of Canada. The bearish structure seen in the chart aligns with these macro drivers, as the CAD continues to benefit from both domestic strength and global demand for commodities.

Geopolitically, ongoing global trade tensions and shifting risk sentiment have further supported the Canadian dollar, as investors seek stability in commodity-backed currencies 🌍. The combination of these factors, as reflected in the chart, suggests that USDCAD remains vulnerable, and a move down to retest previous higher timeframe lows is a real possibility unless there’s a significant shift in the underlying fundamentals.

Traders should keep an eye on the key support zones highlighted in the chart, as these could provide clues for potential exhaustion or reversal in the current trend 🔎.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Please conduct your own research or consult a professional before making any trading decisions.

USD/CAD) Down Trand analysis Read The captionSMC trading point update

Technical analysis of USD/CAD (U.S. Dollar / Canadian Dollar) currency pair on the 2-hour timeframe, and it suggests a potential sell setup based on price action, key levels, and momentum indicators.

---

Chart Summary

Pair: USD/CAD

Timeframe: 2H

Current Price: 1.36432

EMA 200: 1.37436

Direction Bias: Bearish

Volume: 6.92K

Key Tool: EMA 200, RSI, Support/Resistance Zones

---

Technical Breakdown

1. Resistance Zone / Supply Area (~1.3680 - 1.3700)

The yellow box highlights a strong resistance zone.

Marked by three red arrows, where price has repeatedly rejected.

Indicates clear seller dominance in this area.

2. Break of Support Level

Price broke below the yellow support area and is now trading below it.

This signals a bearish breakout from a consolidation zone.

3. EMA 200 Trend Confirmation

EMA 200 (blue line) is sloping down.

Price is below the EMA, confirming bearish trend bias.

Acts as dynamic resistance.

4. Bearish Flag/Channel Break

A bearish flag or wedge pattern seems to have been broken downward.

The measured move (blue vertical line) suggests the projected drop.

---

Target Point

Target Price: 1.34951

This is based on the measured move from the resistance zone.

It aligns with the previous demand/support zone.

---

RSI (Relative Strength Index)

RSI (14) is 36.37, approaching the oversold zone.

This shows strong bearish momentum, but it also means price may stall or bounce slightly before continuing downward.

---

Trade Setup Idea

Entry: After confirmation of breakout below 1.3640

Stop Loss: Above 1.3700 (resistance zone)

Take Profit: 1.34951

Risk-to-Reward: ~1:2+

---

Risk Management & Caution

If price moves back into the yellow zone or breaks above 1.3700, the setup is invalidated.

Watch for high-impact news events (marked on the chart with U.S. flags) that may trigger volatility.

Mr SMC Trading point

---

Conclusion

This is a well-structured bearish idea based on:

Resistance rejections

Break of support

Downward EMA slope

Bearish RSI reading

It reflects strong downside potential toward 1.3495, offering a clean shorting opportunity for swing traders

Please support boost 🚀 this analysis)

USDCAD Price Rebounding from Key Support as CAD WeakensUSDCAD is showing signs of a potential reversal from key support around the 1.3700–1.3685 zone. The pair had been declining steadily but recent weakness in the Canadian Dollar — driven by soft economic data and oil market uncertainty — is starting to shift momentum back in favor of the U.S. Dollar. As long as support holds, there is room for a bullish continuation toward 1.3860 or higher in the near term.

Technical Analysis (4H Chart)

Trend Structure: After a strong impulsive drop earlier in May, USDCAD formed a rounded bottom near 1.3685, followed by a corrective bounce. The recent retracement toward the support area is forming a potential higher low setup.

Support Zone:

Primary Support: 1.3700–1.3685

This is a clean structure zone and previous demand level. Price tested this area on May 24–25 and rebounded sharply.

Resistance Zone:

Short-Term Target: 1.3849–1.3860

This is the next major horizontal resistance, and aligns with previous price congestion before the latest decline.

Price Projection:

The chart suggests a bullish wave may develop from the support zone, targeting the 1.3860 level. If broken, a further move toward 1.3920 (May swing high) is possible.

Invalidation Level:

A daily close below 1.3680 would negate the bullish bias and signal a deeper correction or trend continuation lower.

Fundamental Analysis

U.S. Dollar (USD) Drivers:

Q1 GDP second estimate shows steady but modest growth.

Consumer Confidence fell recently, capping upside for the USD short term.

The Fed remains cautious, signaling that inflation risks persist — keeping interest rates elevated, which supports USD.

U.S. Treasury yields have been stable to slightly higher, also helping support the dollar.

Canadian Dollar (CAD) Drivers:

Canada's balance of payments posted a larger-than-expected deficit in Q1 — a negative for CAD.

Oil prices, which heavily influence CAD, have been under pressure from global demand uncertainty.

Domestic demand is softening: flat retail sales and weak trade balance data reduce CAD appeal.

Bank of Canada is showing signs of policy caution, especially as inflation slows faster than in the U.S.

Conclusion

Outlook: Short-term bullish

USDCAD is likely to bounce from the 1.3700–1.3685 zone and retest 1.3849–1.3860 if CAD weakness continues.

Trade Plan (if trading):

Buy Zone: 1.3700–1.3685

Target: 1.3860

Stop Loss: Below 1.3680 (structure break)

The pair is fundamentally supported by CAD weakness and technically primed for a rebound — but confirmation from price action near support is critical.

Cautious Bulls Meet Trendline Test: USD/CAD Eyes FOMC CatalystCMCMARKETS:USDCAD OANDA:USDCAD USD/CAD extended its recovery for the third day, trading near 1.3833 on modest USD strength following upbeat U.S. data. However, fiscal worries and expectations of Fed rate cuts in 2025 may limit upside momentum. Traders are cautious ahead of the FOMC Minutes and U.S. PCE/GDP data, while firmer Canadian inflation and oil prices could support the CAD.

Technically, the pair remains within a broad downward channel and is now approaching key resistance at 1.3856, aligned with the descending trendline. A clear rejection here could spark a bearish continuation toward 1.3711 support. A breakout above 1.3937 would invalidate the bearish channel and suggest trend reversal.

Resistance : 1.3856 , 1.3937

Support : 1.3711 , 1.3809

AWAIT BOS FIRST!! USDCAD SHORT FORECAST Q2 W22 D29 Y25

🔥👀USDCAD SHORT FORECAST Q2 W22 D29 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

💡Here are some trade confluences📝

✅Daily Order block

✅HTF 50 EMA

✅Intraday bearish breaks of structure to be identified

✅15’ order block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

IN DEPTH HIGHER TIME FRAME ALIGNMENT!USDCAD SHORT FORECAST Q2 W2🔥👀USDCAD SHORT FORECAST Q2 W22 D26 Y25

IN DEPTH HIGHER TIME FRAME ALIGNMENT! 🔥👀

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Daily 50 EMA

✅4 Hour 50 EMA

✅15’ order block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

HTF ALIGNMENT USDCAD SHORT FORECAST Q2 W22 Y25USDCAD SHORT FORECAST Q2 W22 Y25

HIGHER TIME FRAME ALIGNMENT!

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

💡In depth trade confluences provided during the week 📝

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

USD/CAD(20250516)Today's AnalysisMarket news:

Fed Chairman Powell: The Fed is adjusting its overall policy-making framework. Zero interest rate is no longer a basic situation. The wording of underemployment and average inflation rate needs to be reconsidered. PCE is expected to drop to 2.2% in April.

Technical analysis:

Today's buying and selling boundaries:

1.3972

Support and resistance levels:

1.4020

1.4002

1.3990

1.3953

1.3941

1.3923

Trading strategy:

If the price breaks through 1.3972, consider buying, the first target price is 1.3990

If the price breaks through 1.3953, consider selling, the first target price is 1.3941