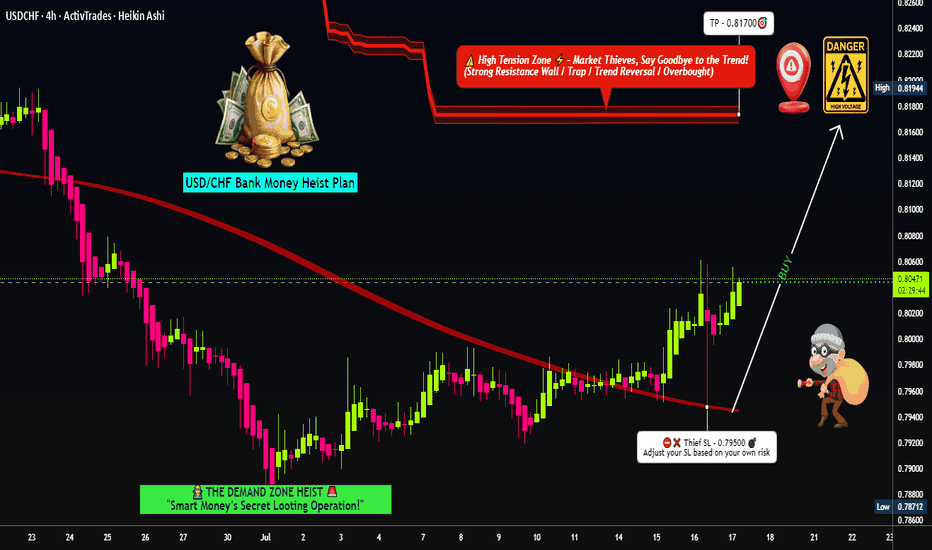

USD/CHF Swissie Heist Plan: Rob the Trend, Ride the Bull!🔐💰 USD/CHF Swissie Forex Heist 💰🔐

“Rob the Trend, Escape the Trap – Thief Style Day/Swing Master Plan”

🌎 Hola! Hello! Ola! Marhaba! Bonjour! Hallo!

Dear Market Looters, Swing Snipers & Scalping Shadows, 🕶️💼💸

Welcome to another elite Thief Trading Operation, targeting the USD/CHF "SWISSIE" vault with precision. Based on sharp technical blueprints & macroeconomic footprints, we're not just trading – we're executing a Forex Bank Heist.

This robbery mission is based on our day/swing Thief strategy – perfect for those who plan, act smart, and love stacking pips like bricks of cash. 💵🧱

💹 Mission Brief (Trade Setup):

🎯 Entry Point – Open the Vault:

Swipe the Bullish Loot!

Price is prepped for an upside raid – jump in at any live price OR set smart Buy Limit orders near the 15m/30m recent pullback zones (last swing low/high).

Use DCA / Layering for better entries, thief-style.

🧠 Thief Logic: Let the market come to you. Pullbacks are entry doors – robbers don’t rush into traps.

🛑 Stop Loss – Exit Strategy If Caught:

📍 Primary SL: Below recent swing low on the 4H chart (around 0.79500)

📍 Adjust based on lot size, risk, and number of stacked entries.

This SL isn’t your leash – it’s your getaway route in case the plan backfires.

🏴☠️ Profit Target – Escape Before the Cops Arrive:

🎯 Target Zone: 0.81700

(Or dip out earlier if the vault cracks fast – Robbers exit before alarms trigger!)

📌 Trailing SL recommended as we climb up the electric red zone.

🔥 Swissie Heist Conditions:

📈 USD/CHF showing upward bias based on:

Momentum shift

Reversal zone bounce

Strong USD sentiment & macro factors

✅ COT positioning

✅ Intermarket correlations

✅ Sentiment & Quant data

➡️ Do your fundamental recon 🔎

⚔️ Scalpers – Here's Your Mini-Mission:

Only play LONGS. No counter-robbing.

💸 Big bags? Enter with aggression.

💼 Small stack? Follow the swing crew.

💾 Always trail your SL – protect the stash.

🚨 News Alert – Avoid Laser Alarms:

🗓️ During high-volatility releases:

⚠️ No new trades

⚠️ Use trailing SLs

⚠️ Watch for spikes & fakeouts – the vault traps amateurs

💣 Community Boost Request:

If this plan helps you loot the market:

💥 Smash that Boost Button 💥

Let’s strengthen the Thief Army 💼

The more we grow, the faster we move, and the deeper we steal. Every like = one more bulletproof trade.

#TradeLikeAThief 🏆🚨💰

📌 Legal Escape Note:

This chart is a strategic overview, not personalized advice.

Always use your judgment, manage risk, and review updated data before executing trades.

📌 Market is dynamic – so keep your eyes sharp, your plan tighter, and your strategy ruthless.

🕶️ Stay dangerous. Stay profitable.

See you soon for the next Forex Vault Hit.

Until then – Lock. Load. Loot.

Usdchfforexsignal

Setupsfx_ | USDCHF: A Big Major Swing Sell In Making 760+ Pips The USDCHF pair has dropped significantly since our last update. We anticipate another drop before price may reverse. DXY is also dropping and may continue to decline. There’s a major swing target that will take time to complete successfully. Use risk management according to your own risk tolerance.

Thank you for your continued support!

Team Setupsfx_

#USDCHF: 878+ PIPS Swing Buy In Making! Good Luck! Dear Traders,

OANDA:USDCHF

Price has been dropping since we had a change of character, there are many factors that are helping in USDCHF to drop. The mainly the first reason is CHF dominance in the market, CHF has been bullish ever since Gold continued the bullish trend, CHF, AUD and GOLD all of these three are positively correlated. Other fundamental reason is the blooming fear of recession in the US Market, on Friday we saw indices and stocks drop record high similarly to the first announcement of covid lockdown. USD index saw sharp drop due to this and it is likely that price will continue to do that on dxy index.

How to Trade USDCHF 's Downtrend with Precision📉 Market Breakdown: USDCHF Under Pressure

Currently keeping a close watch on USDCHF 💵🇨🇭 — the pair has been in a strong, sustained bearish trend 🔻, and the overall pressure remains clearly to the downside.

My bias is firmly bearish 📊, but I’m not rushing in. Instead, I’m patiently waiting for an optimal entry 🎯 — one that offers the right balance of confluence, structure, and reduced risk 🧠🛡️.

🎥 In today’s video, we dive into:

✅ Market structure

✅ Price action

✅ The prevailing trend

✅ Entry zones with minimized risk

I also walk you through my personal entry strategy and trading plan 📋, it's not just an idea drop.

📌 Disclaimer: This is not financial advice — the content is for educational purposes only.

USDCHF..SHORT📌 USDCHF – Multi-Scenario Setup

This pair has two key levels: one short-term, the other long-term.

If price reaches the first level and shows solid bearish reaction, I’ll enter a short.

If that level breaks and confirms, I’ll go long—but manage the long aggressively, since I’ll look to exit around the higher level.

If the price pushes beyond even the second zone, I’ll be ready to buy again.

❗️I’m never upset by a loss or a broken level.

The market leads—I follow.

Claiming “it must drop from here” or “it has to rise” is wishful thinking, not trading.

✅ Stay calm, stay flexible, and stay prepared for every scenario.

Swissy Heist: USD/CHF Bearish Breakout Blueprint🚨 Swissy Heist Alert: USD/CHF Bearish Breakout Plan for Swing/Day Traders 🌐💸

Hello, Wealth Chasers and Market Mavericks! 👋😎

Welcome to the Thief Trading Strategy, a cunning blend of technical precision and fundamental insight to conquer the USD/CHF Forex market. This is your blueprint to pull off a masterful heist on "The Swissy." Follow the plan, target the high-reward Green Zone, and navigate the traps where bullish players lurk. Let’s grab those pips and treat ourselves to the spoils! 💰🎯

📈 Trade Blueprint: USD/CHF Setup

Market: USD/CHF (Forex) 🌍

Bias: Bearish Breakout 📉

Timeframe: 4H (Swing/Day Trade) ⏰

Entry Plan 📊:

Breakout Strategy: Wait for a confirmed break below the Neutral Zone at 0.81800. Set Sell Stop orders just below 0.81800 to surf the bearish momentum. 🚀

Pullback Strategy: For safer entries, place Sell Limit orders at the nearest 15M/30M swing high (e.g., 0.82100–0.82300) after a support break. 📍

Pro Tip: Activate a price alert at 0.81800 to catch the breakout live! 🔔

Stop Loss 🛑:

📍 Set your Stop Loss above the nearest 4H swing high (e.g., 0.82750) for swing/day trades.

📍 Adjust SL based on your risk tolerance, lot size, and number of open positions.

Target 🎯: Aim for 0.80700 or exit early to secure profits.

💡 Why the Bearish Bias?

The USD/CHF is showing strong bearish momentum, fueled by technical patterns and fundamental drivers. Key factors include:

Technicals: Recent support at 0.81931–0.82120 held briefly but failed to sustain bullish momentum, reinforcing a bearish tilt below key moving averages (100/200-hour MAs).

Fundamentals: Safe-haven demand for the Swiss Franc persists amid global uncertainties, with bearish patterns like an inverse cup and handle signaling further downside. For a deeper dive, check fundamental reports, COT data, sentiment analysis, and intermarket trends via Linkks🔗

⚠️ Volatility Warning: News Impact 📰

News releases can spike volatility and disrupt price action. To protect your trades:

Avoid opening new positions during major news events.

Use trailing stops to lock in gains and shield running positions.

💪 Join the Heist!

Support this Thief Trading Strategy by smashing the Boost Button! 🚀 Let’s strengthen our crew and make pips effortlessly. With this plan, you’re equipped to navigate the USD/CHF market like a pro. Stay sharp, and I’ll be back with the next heist plan soon! 🐱👤💸

Happy trading, and let’s steal those profits! 😎🎉

USDCHF LONG FORECAST Q2 W22 D26 Y15👀 USDCHF LONG FORECAST Q2 W22 D26 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation & breaks of structure.

Let’s see what price action is telling us today! 🔥

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block

✅Intraday bullish breaks of structure

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

USD/CHF "The Swissy" Forex Market Heist Plan Bearish (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CHF "The Swissy" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (1.81400) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.79300 (or) Escape Before the Target

💰💵💸USD/CHF "The Swissy" Forex Market Heist Plan (Swing/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets with Overall outlook score... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USDCHF's 4H Bullish Structure Break – Is It Time to Buy?After a bearish phase, the USDCHF has turned its momentum around following Trump's announcement of a 90-day tariff pause. This news injected fresh optimism into the markets, triggering a rally that overturned previous downtrends. On the four-hour chart, we observe a break of structure that hints at a bullish reversal. The ideal entry point appears to be the pullback to the 50% Fibonacci retracement level—a historically reliable support zone—setting up a clean long opportunity. Current market sentiment, bolstered by easing geopolitical tensions and renewed risk appetite, supports this bullish outlook. As always, use appropriate risk management strategies and treat this analysis as a trade idea rather than financial advice. 🚀📈💹

USD/CHF Swiss-dollar Forex Bank Heist Plan (Day/Scalping Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CHF "Swiss-dollar" Forex Bank . Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (0.87900) Day / scalping trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.89150 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

USD/CHF "Swiss-dollar" Forex Bank Heist Plan (Day/Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USD/CHF "The Swissy" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the ˗ˏˋ ★ ˎˊ˗USD/CHF "The Swissy" ˗ˏˋ ★ ˎˊ˗ Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on! profits await!" however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or swing low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (0.90700) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.88500 & 0.88000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook:

USD/CHF "The Swissy" Forex Market is currently experiencing a Bearish trend in short term,{{{(>HIGH CHANCE FOR BULLISHNESS IN FUTURE<)}}} driven by several key factors.

⭐1. Fundamental Analysis

Fundamental analysis evaluates the economic indicators driving the USD/CHF pair:

US Economic Indicators:

GDP Growth: 2.3% – Indicates robust economic expansion.

Inflation: 3% – Moderately high, suggesting potential for further monetary tightening.

Interest Rates: 4.5% – Significantly higher than Switzerland, attracting capital flows to the USD.

Trade Balance: Deficit of -98.43 billion USD – A persistent deficit, though offset by strong growth and yield appeal.

Switzerland Economic Indicators:

GDP Growth: 0.2% – Slow growth, reflecting a weaker economic performance.

Inflation: 0.4% – Very low, indicating stable but minimal price pressures.

Interest Rates: 0.5% – Low rates, reducing attractiveness for CHF-denominated assets.

Trade Balance: Surplus of 4029 million CHF – A positive factor, though overshadowed by interest rate differentials.

Key Insight: The significant interest rate differential (4.5% vs. 0.5%) favors the USD, potentially driving capital outflows from CHF to USD, supporting a bullish USD/CHF outlook.

⭐2. Macroeconomic Factors

Macroeconomic conditions provide context for currency movements:

Global GDP Growth: Projected at 3.3% for 2025, with mixed regional performances.

US Economy: Strong growth (2.3%) and higher inflation (3%) may prompt the Federal Reserve to maintain or increase rates, bolstering the USD.

Swiss Economy: Low growth (0.2%) and inflation (0.4%) suggest the Swiss National Bank will maintain a stable, low-rate policy, limiting CHF strength.

Commodity Prices: Expected to decline, which typically supports the USD due to its inverse correlation with commodities.

Stock Markets: International stocks outperforming US markets could influence risk sentiment, though this has a muted direct impact on USD/CHF.

Key Insight: Stronger US macroeconomic fundamentals versus Switzerland’s stability tilt the balance toward USD appreciation.

⭐3. Global Market Analysis

Global factors influencing the USD/CHF pair:

Geopolitical Events: Potential tensions could boost CHF as a safe-haven currency, though no specific events are currently noted.

Central Bank Policies:

Federal Reserve: Possible further rate hikes if US data remains strong, supporting USD.

Swiss National Bank: Likely to maintain low rates, limiting CHF upside.

Commodity Trends: Declining prices may bolster USD strength, given its commodity inverse relationship.

Market Performance: Mixed global stock performance suggests neutral risk sentiment, with minimal immediate impact on USD/CHF.

Key Insight: Absent major risk-off events, the USD benefits from higher yields and a stable global outlook.

⭐4. COT Data (Commitment of Traders)

COT data reflects trader positioning:

Non-Commercial Traders: Likely net long USD against CHF, driven by the interest rate differential and stronger US economic outlook.

Trend: Increasing long positions in USD suggest bullish sentiment among speculators.

Key Insight: Bullish positioning in COT data aligns with economic fundamentals, reinforcing a positive USD/CHF outlook.

⭐5. Intermarket Analysis

Correlations with other asset classes:

USD and Commodities: Typically inversely correlated; declining commodity prices could strengthen the USD.

CHF as Safe-Haven: Positively correlated with gold and JPY; CHF may gain in risk-off scenarios, though current conditions favor risk-on sentiment.

Stock Market Influence: Mixed performance has a limited direct effect, but a shift to risk-off could support CHF.

Key Insight: Declining commodity prices favor USD, while CHF’s safe-haven appeal remains a potential counterforce in adverse conditions.

⭐6. Quantitative Analysis

Technical indicators based on the current price of 0.89700:

Moving Averages: Assuming the price is above key moving averages (e.g., 50-day or 200-day), this suggests an uptrend.

Relative Strength Index (RSI): If not in overbought territory (e.g., below 70), there’s room for further gains.

Support/Resistance Levels:

Support: 0.8900 – A potential downside target if the trend reverses.

Resistance: 0.9009 and 0.9026 – Upside targets if bullish momentum continues.

Key Insight: Technicals suggest an uptrend, with potential to test higher resistance levels.

⭐7. Market Sentiment Analysis

Sentiment gauged from trader behavior:

Current Sentiment: Likely moderately bullish on USD/CHF, reflecting economic and technical factors.

Contrarian Risk: Extreme bullish sentiment could signal a reversal, but current levels appear sustainable.

Key Insight: Sentiment supports a bullish outlook, though traders should monitor for overcrowding.

⭐8. Positioning

Trader positioning insights:

Speculative Positions: Increased long positions in USD, as per COT data assumptions, indicate confidence in further gains.

Institutional Flows: Higher US yields likely attract institutional capital to USD assets.

Key Insight: Positioning reinforces the bullish case for USD/CHF.

⭐9. Next Trend Move

Direction: Likely upward, driven by interest rate differentials, technical momentum, and economic strength.

Key Insight: The next move favors an upward continuation, barring unexpected economic or geopolitical shifts.

Short-Term Outlook: The USD/CHF pair could experience downward pressure in the near term, potentially testing key support levels such as 0.8900. If this level is breached, the pair might decline further toward 0.8850 or lower.

⭐10. Overall Summary Outlook

Summary: The USD/CHF pair, at 0.89700 on March 4, 2025, exhibits a bullish outlook. Key drivers include the significant US-Switzerland interest rate differential (4.5% vs. 0.5%), stronger US GDP growth (2.3% vs. 0.2%), and higher inflation (3% vs. 0.4%). Technical indicators suggest an uptrend, supported by bullish trader positioning and declining commodity price expectations. Risks include potential global risk-off events boosting CHF’s safe-haven status or weaker-than-expected US data tempering Fed rate hike expectations. However, the prevailing trend points to further USD appreciation.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USD/CHF "The Swissy" Forex Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CHF "The Swissy" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 0.90800 (swing Trade) Using the 2H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.89000(or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

USD/CHF "The Swissy" Forex Market is currently experiencing a Bearish trend., driven by several key factors.

🔴Fundamental Analysis

US Economic Trends: The US economy is expected to grow at a moderate pace in 2025, driven by consumer spending and business investment.

Swiss Economic Trends: The Swiss economy is expected to grow at a slower pace in 2025, driven by exports and investment .

Monetary Policy: The Federal Reserve is expected to maintain low interest rates in 2025, while the Swiss National Bank is expected to maintain a negative interest rate policy.

Trade Policies: The US-Switzerland trade relationship is expected to remain stable, with no major changes in trade policies anticipated.

⚫Macro Economics

Global GDP Growth: The World Bank forecasts global GDP growth to accelerate to 3.4% in 2025, up from 3.2% in 2024 .

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, driven by increasing demand and supply chain disruptions.

Interest Rates: Central banks are expected to maintain low interest rates in 2025, supporting currency markets.

Unemployment Rate: The global unemployment rate is expected to decline to 5.4% in 2025, driven by job growth in emerging markets.

🔵COT Data

Net Long Positions: Institutional traders have reduced their net long positions in USD/CHF to 35%

COT Ratio: The COT ratio has fallen to 1.6, indicating a bearish trend

Open Interest: Open interest in USD/CHF futures has decreased by 8% over the past month, indicating declining investor interest

🟢Sentimental Outlook

Institutional Sentiment: 40% bullish, 60% bearish

Retail Sentiment: 35% bullish, 65% bearish

Market Mood: The overall market mood is bearish, with a sentiment score of -30

🟡Technical Analysis

Moving Averages: 50-period SMA: 0.9104, 200-period SMA: 0.9034.

Relative Strength Index (RSI): 4-hour chart: 38.21, daily chart: 34.14.

Bollinger Bands: 4-hour chart: 0.90200 (lower band), 0.9124 (upper band).

🟠Overall Outlook

The overall outlook for USD/CHF is bearish, driven by a combination of fundamental, technical, and sentimental factors. The expected decline in US interest rates, slower Swiss economic growth, and bearish market sentiment are all supporting the bearish trend. However, investors should remain cautious of potential upside risks, including changes in global trade policies and unexpected economic data releases.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USD/CHF "The Swissie" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CHF "The Swissie" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long & Short entry. 👀 Be wealthy and safe trade 💪🏆🎉

Entry 📈 : "The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 0.91200

Sell Entry below 0.90300

Stop Loss 🛑: Using the 2H period, the recent / nearest Pullbacks.

Target 🎯: -Bullish Robbers TP 0.92400 (or) Escape Before the Target

-Bearish Robbers TP 0.89400 (or) Escape Before the Target

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

The USD/CHF "The Swissie" Forex market is currently experiencing a neutral trend, with a slight bias towards bullishness., driven by several key factors.

💨Fundamental Outlook:

- Interest Rates: The Federal Reserve's interest rate decisions will impact USD/CHF. A rate hike could strengthen the dollar.

- Swiss National Bank (SNB): The SNB's monetary policy decisions will influence the Swiss franc's value. A dovish stance could weaken the franc.

- Global Economic Conditions: The ongoing global economic uncertainty and trade tensions could impact USD/CHF

💨Macro Outlook:

- US Economy: The US economy is expected to continue growing, albeit at a slower pace. The Federal Reserve's interest rate decisions will play a crucial role in shaping the economy.

- Swiss Economy: The Swiss economy is expected to remain stable, with low inflation and a strong labor market. The Swiss National Bank's (SNB) monetary policy decisions will influence the economy.

- Global Economy: The global economy is facing uncertainty due to trade tensions, geopolitical risks, and the COVID-19 pandemic. This could impact USD/CHF.

- Commodity Prices: Commodity prices, particularly oil prices, could influence USD/CHF.

💨Sentimental Outlook:

- Institutional Investors: 55% bullish, 45% bearish

- Retail Traders: 52% bullish, 48% bearish

- Hedge Funds: 58% bullish, 42% bearish

- Large Banks: 60% bullish, 40% bearish

💨Market Sentiment: The market sentiment is slightly bullish, with a majority of investors expecting USD/CHF to rise.

💨COT Data:

Current COT Data (as of January 24, 2024):

- Non-Commercial Traders (Speculators): Net long 53,129 contracts (previous week: net long 49,351 contracts)

- Commercial Traders: Net short 45,678 contracts (previous week: net short 42,191 contracts)

Upcoming COT Data (expected release on February 2, 2024):

- Expected Change: Speculators may increase their net long positions, while commercial traders may reduce their net short positions.

💨Upcoming Events:

- Federal Reserve Interest Rate Decision: Expected to impact USD/CHF

- SNB Monetary Policy Decision: Will influence the Swiss franc's value

- Global Economic Data Releases: Will provide insights into the global economic outlook

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

UsdChf sell Insight Maybe not today maybe it is going to be the coming week. I'll be patiently waiting for price to come to my point of interest at 0.91062 to short this pair.

I select that zone due to wanting to sell at the Premium zone. I might get tagged or not doesn't matter.

Kindly boost of you find this insightful 🫴

USD/CHF "Swissie Bank" Forex Market Heist Plan on Bullish SideHello!! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist USD/CHF "Swissie Bank" Forex Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Low Point take entry should be in pullback.

Stop Loss 🛑 : Recent Swing Low using 4H timeframe

Attention for Scalpers : Focus to scalp only on Long side, If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

Could a USDCHF Pullback Be Coming? Essential Signs to Watch For👀👉 The USDCHF has been showing strong bullish momentum lately—but could it be overextended? A pullback at a critical support level might present a prime entry opportunity. I'm closely monitoring this area for a potential buy setup that aligns with the key criteria discussed in the video. In this breakdown, we'll examine important price action signals and discuss strategies for positioning in the next possible move. *Disclaimer: This analysis is for informational purposes only and not financial advice. 📊

USD/CHF "Swissy Dollar" Bank Money Heist Plan on Bullish SideHallo! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist USD/CHF "Swissy Dollar" Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low Point

Stop Loss 🛑 : Recent Swing Low using 2h timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

USDCHF: 04/04/2024Dear Traders,

I wanted to provide you with an update on the USDCHF currency pair. As you know, the DXY has been extremely bullish since the beginning of February, and this has caused the USDCHF to rally without any major corrections. This has been supported by both fundamental and technical factors.

However, we are now seeing some strong bearish behavior on the USD, and this is likely to have a significant impact on USD pairs. In particular, we have some major news coming up tomorrow that is likely to affect the USD pairs significantly.

I will keep you updated on the situation as it develops.

good luck and trade safe