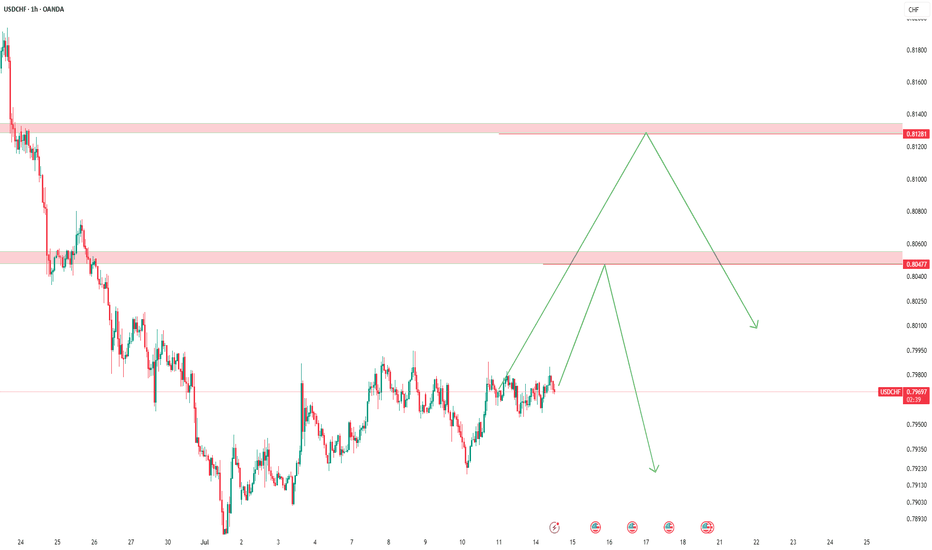

USDCHF – Two Levels, One PlanWe’re watching two key resistance zones for a potential short.

If the first level holds and gives a signal, we’ll short from there.

If that level breaks, we may switch to a short-term buy up to the next level.

Once price reaches the second resistance, we’ll be ready for another sell opportunity.

No predictions — just following the flow.

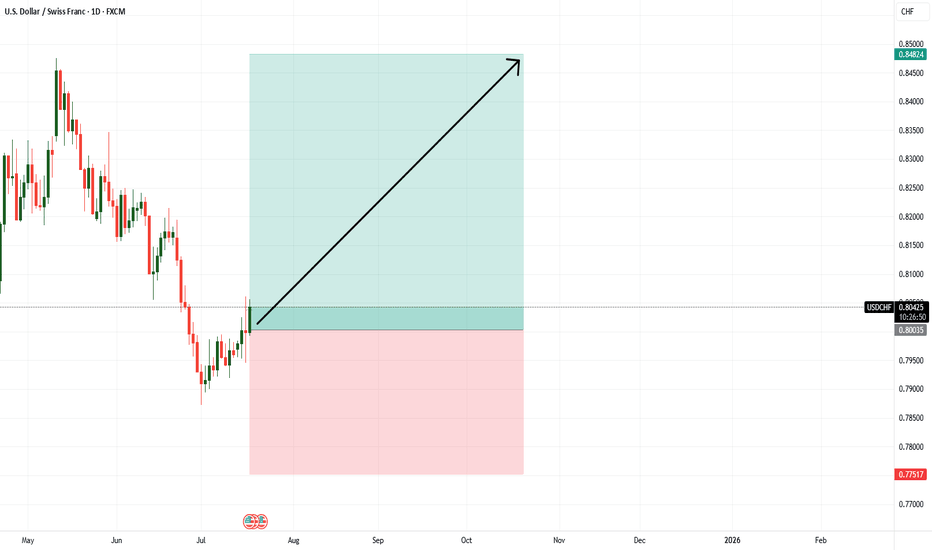

Usdchflong

FX Wars Episode 6 - The return of the USDA simple idea, which I will gradually fill with life:

The USD returns and with it the claim to its FX throne.

Act 1:

📊🔮🇺🇲 US retail sales, which will be published today at 14:30, will be higher than consensus expectations.

🟡-> the US consumer is alive and well and will continue to keep the US economy afloat.

Further acts will follow ✅️

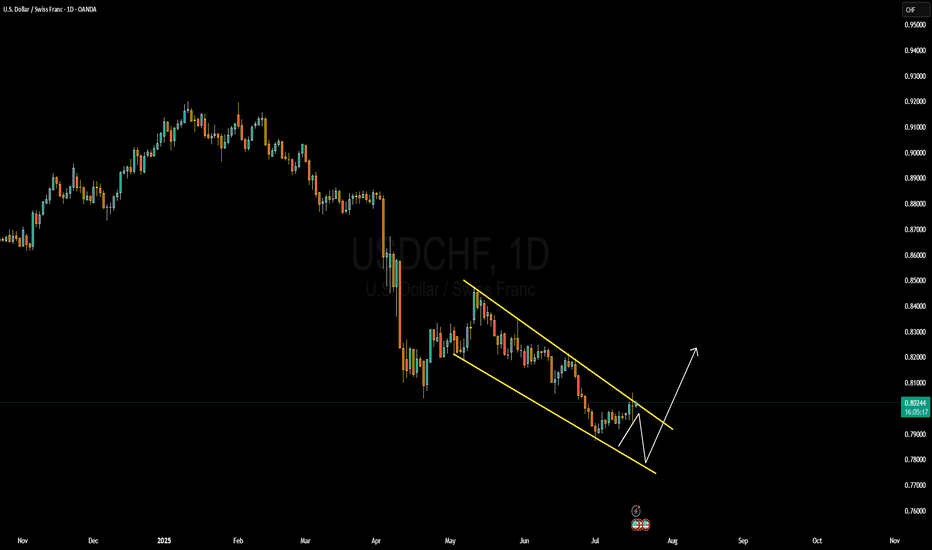

USDCHF Forming Descending ChannelUSDCHF is currently moving within a well-defined descending channel on the daily timeframe. The structure has been respecting this pattern for several months, and we are now approaching a potential breakout zone. Price recently tapped the midline of the channel and showed early signs of bullish rejection. I'm closely monitoring this pair as it builds momentum for a possible bullish reversal, either from a deeper retest at the lower channel boundary or directly breaking above the upper trendline.

On the fundamental side, today's shift in sentiment around the US dollar is quite clear. After a series of weaker US inflation reports and growing market anticipation of a Fed rate cut, USD has come under pressure. However, the Swiss franc is also showing signs of weakness, especially after the Swiss National Bank became the first major central bank to cut interest rates earlier this year and is likely to remain dovish through the remainder of 2025. This monetary policy divergence creates space for USDCHF to rally as investors price in a potential stabilization or rebound in the dollar.

Risk sentiment also plays a role here. With global equities slightly pulling back and geopolitical tensions simmering, safe haven demand is mixed. While CHF typically benefits in risk-off environments, the lack of recent SNB hawkishness gives USDCHF bulls a clearer edge, especially if US data stabilizes or improves.

Technically, I’m anticipating a potential false break to the downside before a sharp bullish wave toward 0.8300 and beyond. Momentum indicators are flattening, and with volume starting to pick up on bullish candles, this setup has potential. I’ll be looking to add further confirmation as price approaches the lower trendline or breaks out with clean structure. Keep a close eye — this setup could turn into a strong profit opportunity in the coming days.

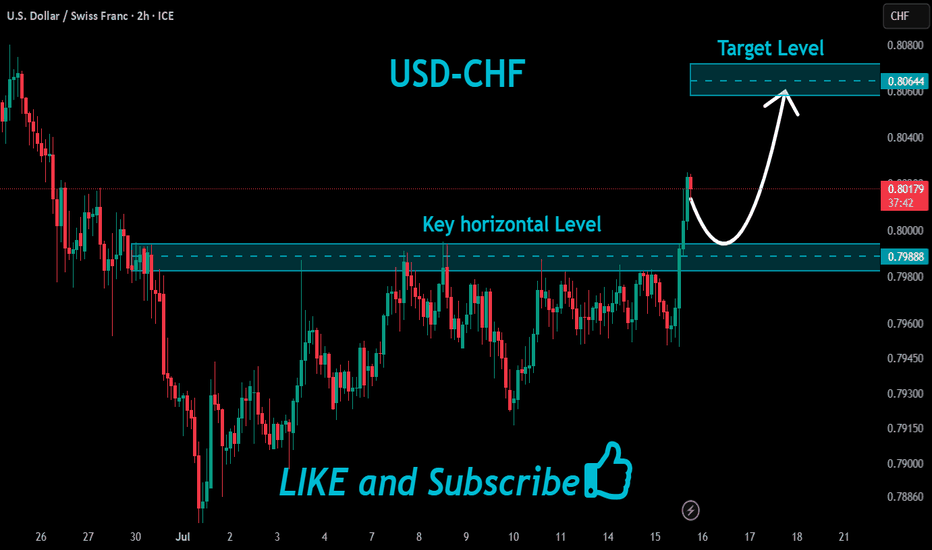

USD/CHF Breakout Done , Long Setup Valid To Get 100 Pips !Here is my opinion on USD/CHF , We have a clear breakout and the price now above my support area , i`m waiting the price to go back to retest it and then give me any bullish price action and i will enter a buy trade , the reason for cancel this idea , if we have a daily closure again below my area.

USDCHF – Reversal Setup Building Above 0.79 SupportUSDCHF has broken out of its steep downward channel and is now forming a potential bullish reversal base above the key support zone at 0.7940–0.7870. Price action suggests momentum could be shifting in favor of the bulls, with upside targets sitting at 0.8100 (Fibonacci 38.2%) and 0.8210 (previous resistance and 61.8% retracement).

🔍 Technical Structure:

Clean descending channel now broken.

Price holding above May–June lows, forming a potential higher low.

First target: 0.8100 zone.

Final target: 0.8210 resistance.

Stop: Below 0.7870 structure low.

🧠 Fundamentals:

USD Outlook: Bullish tilt as Fed members push back against early cuts. Markets eye July 11 CPI, which could confirm inflation stickiness and reinforce USD strength.

CHF Outlook: Weak bias, as the SNB has turned more dovish. With safe-haven demand easing and growth outlook softening, CHF is losing favor across the board.

Global sentiment: Risk appetite improving as geopolitical concerns (e.g., Strait of Hormuz, Iran) temporarily ease—removing upward pressure on CHF.

⚠️ Risk Factors:

A surprise drop in U.S. CPI this week could shift USDCHF sharply lower.

Renewed geopolitical tensions may revive CHF demand suddenly.

Fed speak and yields must remain supportive for this structure to play out.

🔁 Asset Dynamics:

USDCHF tends to lag behind DXY and USDJPY. Watch those pairs for confirmation. It can also follow moves in US10Y yields and react inversely to Gold volatility (safe-haven flow shifts).

✅ Trade Bias: Bullish

TP1: 0.8100

TP2: 0.8210

SL: Below 0.7870

Event to Watch: 🇺🇸 U.S. CPI – July 11

📌 If CPI confirms sticky inflation, USDCHF could rally toward the upper retracement zones quickly. Watch for confirmation candles near breakout.

USDCHF LONG TERM UPUSDCHF Live Trading Session/ USDCHF analysis #forex #forextraining #forexHello Traders

In This Video USDCHF HOURLY Forecast By World of Forex

today USDCHF Analysis

This Video includes_ (USDCHF market update)

USDCHF Analysis today | Technical and Order Flow

#usdjpy #usdchftechnicalanalysis #usdjpytoday #gold

What is The Next Opportunity on USDCHF Market

how to Enter to the Valid Entry With Assurance Profit?

This Video is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts.

Disclaimer: Financial Trading Has Large Potential Rewards, But Also Large Potential Risk. You must be aware of the Risk and Be Welling to Accept Them in order to Trade the Financial Market . Please be Carefully With Your Money.

We are talking about future market, anything can Happen,Markets are Always like that.dnt Risky more Than 2% of your account

Now you can join with our "vip premium" service

Join us and let's make trading together

#USDCHF: 878+ PIPS Swing Buy In Making! Good Luck! Dear Traders,

OANDA:USDCHF

Price has been dropping since we had a change of character, there are many factors that are helping in USDCHF to drop. The mainly the first reason is CHF dominance in the market, CHF has been bullish ever since Gold continued the bullish trend, CHF, AUD and GOLD all of these three are positively correlated. Other fundamental reason is the blooming fear of recession in the US Market, on Friday we saw indices and stocks drop record high similarly to the first announcement of covid lockdown. USD index saw sharp drop due to this and it is likely that price will continue to do that on dxy index.

USDCHF Analysis – "Dollar Trying to Break Free from Downtrend"USDCHF is breaking out from a multi-week descending channel.

Structure shows a potential trend reversal from the June 12th low.

First bullish leg may target the 23.6% Fib level at 0.8266, followed by an extended move toward 0.8355.

Key resistance: 0.8266 and 0.8355 (Fib levels)

Stop loss: around 0.8093–0.8056 zone (previous support and breakout base)

Structure Bias: Bullish breakout after prolonged downtrend – confirmation depends on sustained move above 0.8200

📊 Current Bias: Cautiously Bullish

🧩 Key Fundamentals Driving USDCHF

USD Side (Mildly Bearish to Neutral):

FOMC held rates, Dot Plot showed only one cut expected for 2025, but Powell’s tone was less hawkish.

US Retail Sales soft, and PPI/CPI showed signs of inflation cooling.

Recent risk-off sentiment (Middle East, oil spikes, equity volatility) supports the USD.

Trump commentary and 2025 election anticipation bring long-term uncertainty.

CHF Side (Strong but potentially weakening):

SNB held rates steady, with cautious tone—no urgency to hike again.

Safe-haven flows still support CHF, but waning inflation and stronger global equity market might reduce CHF appeal.

SNB has hinted at FX intervention readiness, which could weaken CHF if necessary.

⚠️ Risks That May Reverse or Accelerate Trend

False breakout risk if 0.82 fails to hold → deeper pullback toward 0.8090

Stronger CHF demand on geopolitical fear (Israel–Iran, Ukraine)

Unexpectedly weak US data this week or renewed Fed dovish talk

🗓️ Important News to Watch

US: Core PCE, GDP revision (June 27), jobless claims

CHF: Swiss CPI, SNB FX intervention chatter

Risk sentiment: Iran/Israel tensions, equity volatility, Trump Fed commentary

🏁 Which Asset Might Lead the Broader Move?

USDCHF could mirror sentiment across CHF pairs—if risk-on resumes and CHF weakens across the board (EURCHF, NZDCHF also rallying), USDCHF may accelerate higher.

"USD/CHF Breakout - Real Deal or Trap?"🏦 SWISS BANK HEIST: USD/CHF BULLISH LOOT GRAB 🚨

(Professional Money Snatching Strategy)

🦹♂️ Attention All Market Bandits!

(Hola! Oi! Salut! Hallo! Ahlan!) 🎭💰

🔥 Thief Trading Intel Confirmed!

The USD/CHF "Swissy" vault is ready for cracking! Our bullish robbery plan targets 0.84500 - but we must escape before the bears (police) set their trap!

🔓 ENTRY: CRACKING THE SAFE

"0.82800 MA is the vault door!"

✔ Option 1: Buy Stop above MA (breakout play)

✔ Option 2: Buy Limit at swing low (15m/30m pullback)

🔔 Pro Tip: Set alerts - real thieves never miss their heist!

🚨 STOP LOSS: POLICE EVASION PLAN

📍 Thief SL: 0.81900 (below 3H swing low)

⚠️ Warning: No SL before breakout! You'll trigger the alarms!

💎 TARGET: ESCAPE WITH THE LOOT

🎯 Primary Take: 0.84500

💰 Scalpers: Long-only! Trail SL like a getaway car!

📊 MARKET CONDITIONS

⚖️ Neutral Trend (but bullish potential brewing!)

🔍 Key Intel Needed: COT reports, macro data, CHF safe-haven flows

🌐 Full Briefing: Bi0 linkss 👉🔗 (don't go in blind!)

🚦 RISK MANAGEMENT PROTOCOLS

• ❌ Avoid trading during news events

• 🔒 Always use trailing stops

• 💣 Position size = your explosive potential

🦾 SUPPORT THE SYNDICATE

💥 SMASH THAT BOOST BUTTON!

💬 Comment your heist results below!

🔔 Next robbery coming soon - stay tuned!

🤑 Remember thieves: Book profits before the Swiss police arrive!

USDCHF ACCUMULATION AND DISTRIBUTION AT THE STRONGEST SUPPORTRepeated liquidity sweeps (marked with arrows) indicate smart money absorbing sell pressure.

Consolidation is happening after a significant downtrend, suggesting potential reversal.

The volume stays steady — no major breakdowns or explosive exits.

What you see here is a textbook accumulation phase forming on the USD/CHF chart — not just because of the sideways structure, but due to the repeated liquidity sweeps and smart money behavior around a long-term support level.

🔹 Major Support:

The yellow horizontal line marks a critical support level, originally established on April 21, 2025. Price has respected this level repeatedly, making it a strong base.

🔹 Liquidity Sweeps:

Multiple deep wicks below support (highlighted by blue arrows) are signs of stop-loss hunting, where price dips below key levels only to sharply recover. This is classic smart money accumulation behavior.

🔹 Volume Profile:

Volume remains stable throughout the consolidation zone — no significant exit volume, which suggests this is not distribution.

🔹 Failed Breakdowns:

Every time price breaks the range low, it’s met with quick rejections and reversals, absorbing selling pressure instead of following through → further validation of accumulation.

🔹 Historical Significance:

The concerning part? The next major support on this pair isn’t until August 8, 2011 — over a decade back! That makes this level extremely critical to hold.

USD/CHF At Perfect Place For Buy , 250 Pips Easy To Get !Here is my opinion on USD/CHF , The price at support area that forced the price to go up last time more than 500 pips , so it`s a very strong Area to buy it again from the same support cuz it`s the lowest place the price can go up from it , and we can targeting 250 pips .

USDCHF LONG FORECAST Q2 W26 D24 Y25 14:00GMTUSDCHF LONG FORECAST Q2 W26 D24 Y25 1400GMT

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Daily order block

✅15' order block

✅Intraday breaks of structure

✅4H Order block

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

USDCHF - TIME FOR RECOVERYTeam, USDCHF has been selling off last few days

Time to make AMERICAN greater again, lolz

This price is good for entry

Please ensure once it hit your 1st target, bring STOP LOSS TO BE

Always take 50-70% from your current volume

TODAY, we short AUS200 target hit

also DAX short also hit.

Now, lets focus on USDCHF!

USDCHF weekly accumulation phase for bullish reversal#usdchf 21st weekly bar is a key reversal bar, made a new low closed towards high. 16th June weekly inside bar range confined within the range of the previous previous bar i.e. did not make high or low by the previous bar. need a lot of patience for good profit in usdchf long position reason trend is quite bearish. market takes time to neutralize the trend and to reverse it. 0.8137-0.8120 is 4h demand zone within the weekly chart. 0.8220-0.8250 need to break to the upside for further confirmation of trend change.

USD/CHF Buy🎯 Long Entry Strategy

🔸 Standard (Conservative) Breakout Entry

Entry: 0.8255 (daily close above key compression + reclaim zone)

Stop Loss: 0.8120 (below 0.8150 structure + most recent wick low)

Target 1: 0.8300 (minor resistance)

Target 2: 0.8900 (major weekly resistance)

Target 3 (Optional Hold): 0.9150 (weekly swing high)

✅ Best if you want confirmation. Higher probability but less RR.

🔸 Aggressive Limit Entry (Inside Range)

Entry: 0.8155 (retest of support zone)

Stop Loss: 0.8040 (below April + June wick lows)

Target 1: 0.8300

Target 2: 0.8900

Target 3: 0.9150

⚠️ Best for RR, but higher chance of drawdown or stop-out.

USD/CHF Very Near Buying Area , Let`s Get This 200 Pips !Here is my opinion on USD/CHF , The price very near support area that forced the price to go up last time more than 500 pips , so it`s a very strong Area to buy it again if the price give us a good bullish price action , and we can targeting 250 pips .

USDCHF: Up for a ride?What we just saw on USDCHF is a classic move that catches many traders off guard:

Price swept the Previous Day’s Low (PDL)

That’s where most retail traders get stopped out.

It’s also where smart money often steps in.

Break of Structure (BOS) followed immediately

A clean shift in direction.

Momentum flipped bullish.

Fair Value Gap (FVG) below

That’s likely where price will return to rebalance.

If price respects that zone, the next destination?

The liquidity resting above.

This is one of those setups that reminds me:

It’s not about catching every move. It’s about understanding why the move happened.

Let’s see how it plays out.