USDCNH

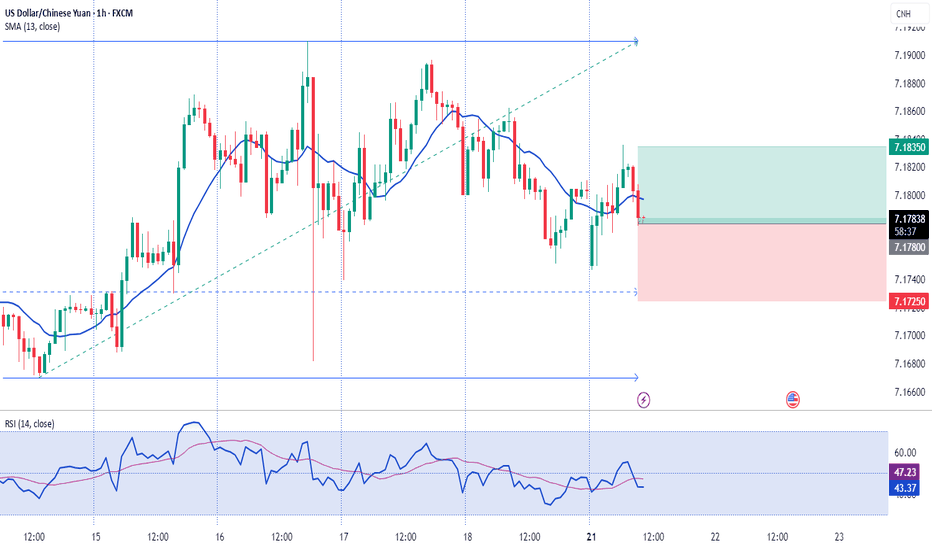

29.06.2025 #USDCNHBUY 7.16250 | STOP 7.14850 | TAKE 7.17950 | The US dollar is likely to rise against the yuan amid political factors and the publication of data on business activity in the non-manufacturing sector (PMI) in China. Technically, the pair has approached and is consolidating around medium-term support levels.

USD/CNH coiling for a breakdown?Over the past several days, the USD/CNH has been coiling inside a tight range, awaiting direction from the oil market. Well oil prices collapsed, and down went the dollar and up went risk assets. The net impact on the yuan was positive. The USD/CNH pair has weakened a little bit more today. If it can take out support at 7.1700 on a daily closing basis then this could potentially pave the way for more technical selling towards 7.1500 initially, ahead of potentially lower levels next. But if risk appetite sours again, or we otherwise see a breakout above the bearish trend line, then in that case all bearish bets would be off the table again.

By Fawad Razaqzada, market analyst with FOREX.com

USDCNH Tests Key Pattern Resistance on PBOC’s Loose Yuan FixThe trade war between China and the U.S. is escalating, and the Chinese yuan is starting to feel the pressure. After the U.S. raised tariffs to a total of 54%, China responded with a 34% increase of its own. Now, Trump has threatened an additional 50% tariff hike if China doesn’t withdraw its retaliation.

It appears unlikely that either side will back down at this stage, and the trade war is set to intensify further.

In addition to retaliating, China is also preparing to defend its economy. According to several news reports, Beijing is planning to frontload stimulus measures aimed at boosting domestic consumption, subsidizing exporters to cushion the blow from reduced U.S. trade, and supporting stock market stability. The People’s Bank of China will likely play a central role in this effort, using tools such as rate adjustments and daily yuan fixings.

The latest yuan fixing came in above 7.20, the highest level since 2023. With this looser fixing and ongoing trade war pressure, USDCNH is pushing higher. The ascending triangle formation which typically breaks to the upside is also supporting bearish bets on the yuan.

If China proceeds with a small and controlled devaluation, as many expect, a breakout from this triangle pattern is likely.

The potential target for the breakout could align with one of the parallel lines of the lower boundary of the formation, which are currently around 7.61 and 7.75, and gradually rising. With time, a move toward 7.80 is well within reach by the end of the year.

Elliott Waves SHows That Gold Is Turning South For Corrective ReGold started the year bullish with a strong extended leg to the upside close to 3k, but the move looks impulsive and may have found a temporary top near 2950. The reversal this week is coming from an ending diagonal, with the price now attempting to break the lower trendline support of the bullish channel. This suggests gold could be entering a corrective wave 4, likely unfolding in three waves. For those looking to join the trend, it’s better to wait for a deeper correction and a retest of lower support in this wave four pullback. Supports are at 2864 and 2789

At the same time, keep an eye on USD/CNH—if it pushes higher now for wave four, to retest its 2022 highs, gold could remain sideways for a while. In such case the new opportunities to rejoin the gold uptrend may come after USD/CNH completes its recovery from the 2024 lows, possibly around 7.40.

GH

USD/CNH Chart Sees Spike in Volatility Due to TariffsUSD/CNH Chart Sees Spike in Volatility Due to Tariffs

In response to the Trump administration's 10% tariff on Chinese goods, Beijing vowed to challenge the decision at the World Trade Organization.

Moreover, Chinese authorities have:

→ imposed retaliatory tariffs of 15% on US coal and liquefied gas, and 10% tariffs on oil and agricultural machinery;

→ launched an investigation into Google for potential anti-competitive practices.

These recent developments have triggered a spike in volatility for the Chinese yuan against the US dollar. As the USD/CNH chart shows today, the ATR indicator is at its highest level since early November, when Trump celebrated his election victory.

On 9 January, in our analysis of the USD/CNH exchange rate, we noted:

→ the importance of the 7.35 level, which had acted as resistance for several months;

→ according to Wang Tao, chief economist at UBS China, the yuan may weaken to 7.6 per dollar by the end of 2025 if the Trump administration imposes higher tariffs.

Today's technical analysis of the USD/CNH chart shows:

→ the rate is supported by the lower boundary of an expanded ascending channel (shown in blue);

→ the 7.35 level continues to act as resistance (as indicated by the red arrow).

Thus, at the beginning of February 2025, we may witness the formation of a narrowing triangle (shown by the black lines), and a breakout could lead to a significant trend movement. How realistic this assumption is largely depends on how the ongoing tariff conflict between the US and China develops.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Why dips appear favourable for AUD/USD bullsTrump's reluctance immediately sign an executive order to implement tariffs on China has allowed the yuan to rise against the US dollar. And where the yuan goes, AUD/USD tends to follow these days. And give AUD/USD has already seen an extended move to the downside, some bullish mean reversion is surely due.

The weekly RSI reached oversold ahead of a false break of the 2022 low, and a bullish divergence also formed on the daily RSI. A higher low has formed on prices, and I suspect AUD/USD is due at least one more leg higher.

Bulls could seek dips towards 0.621 or the 10/20-day EMAs in anticpation of a move up towards the August low, a break above which brings 65c into view near the high-volume node (HVN) from the decline from September to January.

Matt Simpson, Market Analyst at City Index and Forex.com

USD/CNH Near Key Resistance: 2025 OutlookUSD/CNH Near Key Resistance: 2025 Outlook

As shown by today’s USD/CNH chart:

→ the pair is trading around 7.35 yuan per US dollar;

→ historically, this level has acted as resistance, pushing the exchange rate lower in autumn 2022 and autumn 2023, as bulls briefly broke above but failed to sustain gains.

The current approach to this resistance level is partly driven by expectations of US President-elect Donald Trump’s policies, which in 2025 may include imposing trade tariffs and adopting measures likely to strengthen the USD further.

According to Reuters:

→ China holds approximately $3 trillion in foreign exchange reserves, giving it ample power to defend the yuan;

→ Wang Tao, Chief Economist at UBS for China, expects the USD/CNH rate to remain controlled near 7.4 yuan per dollar during the first half of 2025. However, if high tariffs are introduced by Trump’s administration, the yuan could weaken to 7.6 per dollar by the end of 2025.

Technical analysis of the USD/CNH chart reveals:

→ price fluctuations are forming a large contracting triangle, with higher lows in 2023 and 2024 indicating stronger demand;

→ an upward trend structure, highlighted in blue, emerged in late 2024;

→ a grey arrow points to the trend direction calculated using linear regression.

Thus, in early 2025, another attempt at a bullish breakout above 7.35 may occur, though resistance from bears could cause short-term pullbacks towards the lower blue trend line. Given Wang’s bullish outlook and supporting technical signals, it is reasonable to expect bulls to gain control of the 7.35 level during 2025.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

This is why AUD/USD bears need to watch USD/CNHBets are back on for the RBA to cut, with markets having now fully priced in three 25bp cuts beginning in April. Weak GDP was the culprit, which leaves the Aussie susceptible to further weakness should incoming data continue to deteriorate. However, Aussie bears may also need to factor the yuan into the equation.

USDCNH: Triangle Pattern Targets 8.03 Consolidation on the weekly chart has shaped the well-known Triangular pattern (yellow).

Watch the breakout of the upside barrier around 7.3650 for confirmation.

The target is located at the height of the widest part of Triangle added to the upside of the pattern. It's 8.03 CNH/$1

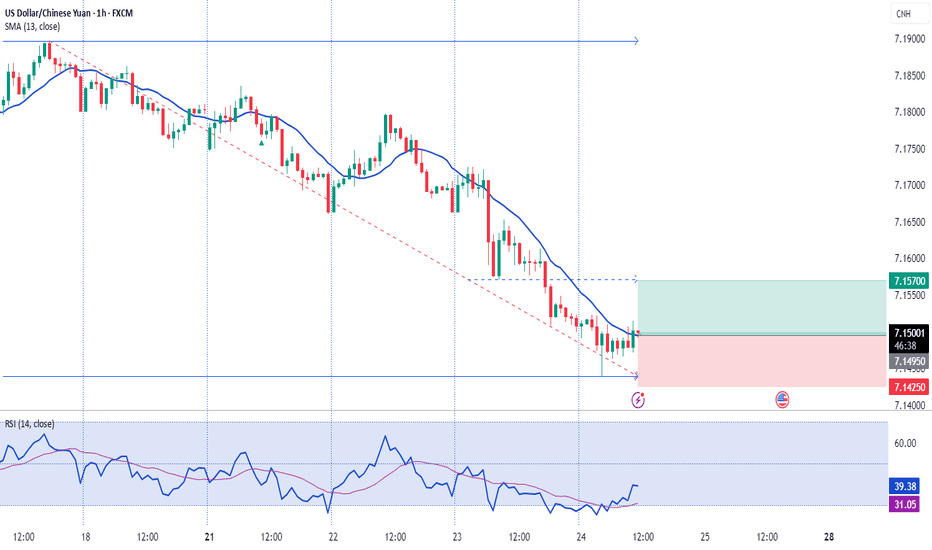

USDCNH - Technical Analysis [Long Setup]🔹 USDCNH Analysis on 1HR chart

- The current Trend is Bearish

- Bullish divergence is present

- If HH is break we will take long position

🔹 Trade Plan

- Entry Level = 7.10808

- Stop Loss = 7.09450

- TP1 = 7.12170

- TP2 = 7.13520

🔹 Risk Management

- First TP is 1:1

- Second TP is 1:2

🔹 How to Take Trade?

- Only risk 2% of your portfolio

- Take 1% risk entry with 1:1 RR

- Take 1% risk entry with 1:2 RR

Like and subscribe to never miss a new idea! ✌🏼

Shorting USDCNH: Seizing the Opportunity Amidst Long Position...🚨 Shorting USDCNH: Seizing the Opportunity Amidst Long Position Surge 🚨

In this video, I explain why I'm shorting USDCNH due to a significant return of large long positions that we haven't seen in a long time. The 60-day bullish run seems to be over, and we're anticipating a potential drop.

Key points covered:

Analysis of the surge in long positions and its implications

Why the recent 60-day bullish trend is likely ending

Insights into the expected drop and its potential speed

Strategic approach to shorting USDCNH in this unique market scenario

While no one, including myself, can predict exactly how long this drop will last, I believe it will be quick. Join me as I break down the current market dynamics and share my strategy for capitalizing on this potential drop.

Don't forget to like, comment, and subscribe for more trading insights and expert analysis. Let's navigate this market opportunity together! 🚀💹 And remember to hit the Boost Button on this video to support our Trading View community!

Disclaimer: Forex trading involves significant risk and is not suitable for every investor. Carefully consider your financial situation and risk tolerance before entering any trade. Always perform your own research and seek advice from a licensed financial advisor if needed.

Just a quick note on the outlook for Chinese yuan futures...Exploring the "Condor" : A Look at the Chinese Yuan Futures

In the realm of option trading, the term "Condor" refers not to a bird of prey, but to an intricate options strategy known for its non-directional nature. This strategy, aptly named after the wide-winged condor, involves positioning four options at once, aiming to profit from low volatility in the underlying asset. The essence of the Condor strategy lies in its ability to limit both gains and losses, creating a balanced risk-reward scenario for traders who anticipate movement and price consolidation before expiration date in certain market range.

Recently, a significant portfolio was recorded on the CME exchange, with an expiration date set for October 4, 2024. This portfolio is noteworthy not only for its size but also for the expectations of its owner. The belief is that the price of the Chinese yuan futures will hover between 7.25 and 7.45, a range.

The implications of this portfolio are manifold. For one, it reflects a sentiment that could influence other traders' strategies and market expectations. Additionally, it highlights the importance of understanding options strategies like the Condor, which can be pivotal in navigating the Forex market, especially when dealing with currencies like the Chinese yuan.

As we look ahead, we will undoubtedly keep a close eye on this portfolio, analyzing its performance from the yuan's impact. Forex Traders might (better say "should") consider this a bellwether for future movements, making it a focal point for those looking to gauge market sentiment.

USD/CNH: BofA’s Caution, JPM’s WarningsUSD/CNH: BofA’s Caution, JPM’s Warnings

Bank of America (BofA) has expressed caution about betting against the US dollar in the face of recent improvements in sentiment towards China's economic policy stimulus. Recent policy actions by China have sparked optimism, leading to a weakening of the USD. However, BofA advises against making hasty financial moves based on these developments alone.

BofA believes that the effectiveness of Chinese Economic policies in stimulating significant new economic activity remains uncertain. Investors are encouraged to wait for more definitive signs of a sustained recovery in China's credit and property sectors before making significant currency moves.

Just last month, BofA expressed a bearish outlook on several Asian currencies, including the Chinese yuan, South Korean won, Taiwan dollar, Thai baht, and Vietnamese dong. BofA anticipated sustained depreciation pressures on the yuan into the second half of the year due to several factors particularly due to the delayed easing by the Federal Reserve.

On the other side, Jamie Dimon, the CEO of JPMorgan Chase, has been continuing his warnings at the JPMorgan Global China Summit in Shanghai. Dimon suggested that the chance of stagflation in the US—a period of stagnant economic growth combined with high inflation—is higher than most people think. Last week, he did not rule out the possibility of a hard landing for the US economy.

Ascending Triangle Points Towards Yuan Devaluation This SummerNote: the technical indicators show a TTM squeeze ready on EVERY TF except Monthly, which is about to happen shortly by this summer - which means a massive move will happen. BOJ will blow up this summer and will devalue against the dollar forcing China to devalue to stay export competitive. I see a 50% devaluation - which will have the opposite effect on everyone else. If China devalues, that means they invite inflation into their economy, which forces deflation throughout the whole world. This will push up the dollar and blow up everyone else's currency. I see the dollar TVC:DXY going to 140-160+ before it too blows up. Of course this implosion will be blamed on some external false flag event - while the FED trots out CBDC's via DigitalID anchored to social credit scores that allows the FED to effectively use negative interest rates via social credit scores and time value of the credits. Gold and silver really won't matter because people will be looking for food.

A stronger yuan could spell trouble for USD/JPYA downtrend has formed on USD/CNH since it failed to retest the 2022 high in September. Since then, a lower high, aggressive selloff and a bearish continuation pattern (rising wedge) has formed on the daily chart. The rising wedge projects a downside target towards the cycle lows ~7.1.

If the yuan continues to depreciated (lower USD/CNH), it could prompt other Asian currencies such as the Japanese yen to also depreciate, in order to remain competitive with trade. And as USD/JPY is approaching 152 - a level it failed to test due to BOJ intervention (and subsequent concerns of another intervention) - there's a reasonable chance that USD/JPY may struggle to break above 152.

For now, USD/CNH looks ripe for a move lower given the double top / rising wedge around the 50% retracement level, and bearish momentum picking up. Bears could have a stop above the cycle highs and target the lows around 7.1. But if the Fed begin to drop dovish clues further out, it could also break below 7.1 and head for 7.0.

CNY! Happy Chinese New Year! PEPPERSTONE:USDCNH

Oh, I cannot contain my excitement for this year's Chinese New Year of "Dragon"! 🐉 I mean, who wouldn't be absolutely thrilled to experience the exact same joyous celebrations as last year? And guess what? The depreciation trend of CNY? Oh, it's not going to miraculously reverse itself, not a chance! It's almost as if the Chinese government's awe-inspiring market manipulation is gracefully reaching its magnificent climax. And of course, we can all look forward to those enchanting SWAP contracts being wrapped up right on schedule after Chinese New Year. It has become such a charmingly predictable tradition, hasn't it? Like clockwork, year after year. 🙃

Now, if I gaze into my mystical crystal ball, I foresee a breathtaking future for the Chinese New Year. In the short term, hold onto your hats as the price pirouettes within the thrilling range of 7.21 and 7.17. 🧐 But wait, there's more! In the mid term, it will be up to 7.36, the peak in last year. Long term, prepare yourselves for a heart-stopping ascent to the dizzying heights of 7.78 to 7.81.🧐 Of course, we couldn't possibly fathom it going any higher than that. Why, you ask? Well, it's an absolute enigma why the mother country would ever contemplate lowering the rate of the son, especially when the HKDUSD stands at a jaw-dropping 7.8. It's like an intricate puzzle wrapped in a perplexing riddle, don't you think? 🤭

Yes, the macroeconomic world is teetering on the edge of its seat, eagerly awaiting the news that will come to the rescue of the oh-so-precious property market! I mean, what else could possibly save the day? Whispers and rumors abound about lower interest rates, an astonishing metamorphosis of the 5% public housing policies into a mind-boggling 30%, and let's not forget the grand abolishment of Xi's policy, "house is for living but not for making money". 🤭 Oh, but that's not all! Hold onto your hats as only newly planned developments are bestowed the privilege of borrowing money. Isn't it just splendid? But wait, there's more excitement brewing! Brace yourselves as the government magnanimously increases their securing guarantee for property lending. 🍒 Can you even begin to fathom the magnitude of this? We're talking trillions upon trillions of USD equivalent CNY being injected into the market. It's like a magical elixir that will undoubtedly solve all the property market woes. What could possibly go wrong under Xi's visionary policy? 😛

Ladies and gentlemen, get ready for a spectacular show this year. It's going to be one for the books! What are we waiting for? Wish all luck with you.

HAPPY LUNAR NEW YEAR! 😛

USDCNH: Expect Further Decline USDCNH continues on its downtrend after being rejected off previous dynamic support level around 7.16 zone that now serves as resistance.

Potential short term rebound to 7.125 (R1) that would be a good entry for short position with a downside target level around 7.062 (S1).

Yuan Retreats from Multi-year Highs on Strong Economic Data The US dollar index hit its highest level since early March this week, but the yuan is one of the few currencies to rise against the USD over the period.

This was facilitated, among other things, by strong economic data published today:

→ Industrial production growth in August amounted to +4.5% in annual terms (expected +3.9). This is the strongest progress in 1 month since autumn 2022.

→ Retail sales in August increased by 4.6% year on year (expected +3.0%).

The chart shows that after a multi-year high (B) of about USD 7.36 per yuan set on September 8, the rate has retreated sharply. That is, sales of dollars (B→C) for yuan increased. And the sharp increase in A→B is completely leveled out. This is a bearish sign, indicating that the bulls have completely retreated.

Now the price is near the median line of the channel. Here one can expect support, which is also strengthened by the level of 7.275, which previously served as resistance.

Let’s say that if a rebound C→D occurs (its probability is indicated by the long lower shadows on the candles on September 14-15), then by its dynamics it will be possible to judge the sustainability of the initiative that the bears have taken. If the rebound is 50% of the momentum (B→C), this will confirm the change in sentiment to bearish, and then we can expect that sellers will be able to put pressure on the rate so that it will decline to the lower border of the channel.

And then the picture will be even more bearish, because a head-and-shoulders pattern will form on the chart along the 0-B-D vertices. Provided the positive news background regarding the Chinese economy continues, we will be able to witness the formation of a stable bearish trend in favor of the yuan.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USD/CNH looks set for its next leg higherUSD/CNH remains in a soliud uptrend on the daily chart and, after consolidating around the June highs and forming a bullish hammer at 7.25, the swing low appears to be in. A bullish range expansion day broke the bearish resistance line, and bulls could seek to enter upon any pullbacks towards yesterday’s low for a tigher long entry.

The bias remians bullish above Last weej’s hammer low, and we could now be heade for 7.35 or the 2022 high.

A small bulish hammer has also formed on the 1-hour chart. A conservative target projected from the recent leg higher suggests 7.32 for bulls, whilst if we use the run up from 7.27 it projects a target atound 7.34.

USD/CNH Extends Gains Amid Firmer US Dollar and Geopolitical...USD/CNH Extends Gains Amid Firmer US Dollar and Geopolitical Tensions

The USD/CNH currency pair has been making significant strides, extending its gains for the fifth consecutive day during the Asian session on Friday. Trading around 7.3530, the pair is now approaching the resistance confluence at 7.3590. Simultaneously, the onshore Yuan (CNY) has reached a 16-year high at 7.3462 against the US Dollar (USD). These developments underscore the current strength of the USD, which has been bolstered by a consistent stream of positive economic data from the United States.

Firm USD Supported by Upbeat Economic Data

The recent performance of the USD can be largely attributed to the string of encouraging economic indicators emerging from the US. Notably, on Thursday, the release of data revealed that as of September 1, Initial Jobless Claims in the US had decreased to 216,000, a notable drop from the previous figure of 229,000. These numbers defied market expectations, which had anticipated an increase to 234,000. Furthermore, US Unit Labor Costs for the second quarter (Q2) surged to 2.2%, up from the previous reading of 1.6%, contrary to the expectation that they would remain unchanged.

These impressive economic figures have lent support to the USD, instilling confidence among investors and traders. As a result, the USD has continued to gain strength, influencing its performance against various other currencies, including the Chinese Yuan.

Geopolitical Tensions in Focus

In addition to the currency market dynamics, geopolitical developments are also impacting the USD/CNH pair. The upcoming G20 leaders' summit in New Delhi, scheduled to commence this Saturday, has garnered significant attention. US President Joe Biden is set to participate in the event, but notably absent from the guest list is Chinese President Xi Jinping.

Xi Jinping's decision not to attend the summit raises questions about the state of US-China relations. The absence of both leaders at a crucial global forum signifies the persisting strain in their bilateral relationship. It's worth noting that this comes amid ongoing tensions surrounding issues like trade, technology, and human rights, further complicating diplomatic efforts between the two superpowers.

The exclusion of China's top leadership from the summit may contribute to the prevailing geopolitical uncertainty, and the market will closely monitor any developments that could impact the global economic landscape.

Conclusion

The USD/CNH's recent winning streak, driven by a stronger US Dollar and reinforced by positive economic data, highlights the ongoing shifts in the currency market. As the pair approaches key resistance levels, traders and investors will closely watch for potential breakout opportunities. Simultaneously, the geopolitical backdrop, marked by the absence of President Xi Jinping at the G20 summit, adds an extra layer of complexity to the situation, underscoring the intricacies of global diplomacy and their potential influence on currency markets.

Our preference

The upside prevails as long as 7.26750 ( 78.6% Fibo ) is support.