USDCNY

USD/CNY - Even a hare will bite when it is cornered.

Hi, today we are going to talk about Yuan Renminbi and its current landscape.

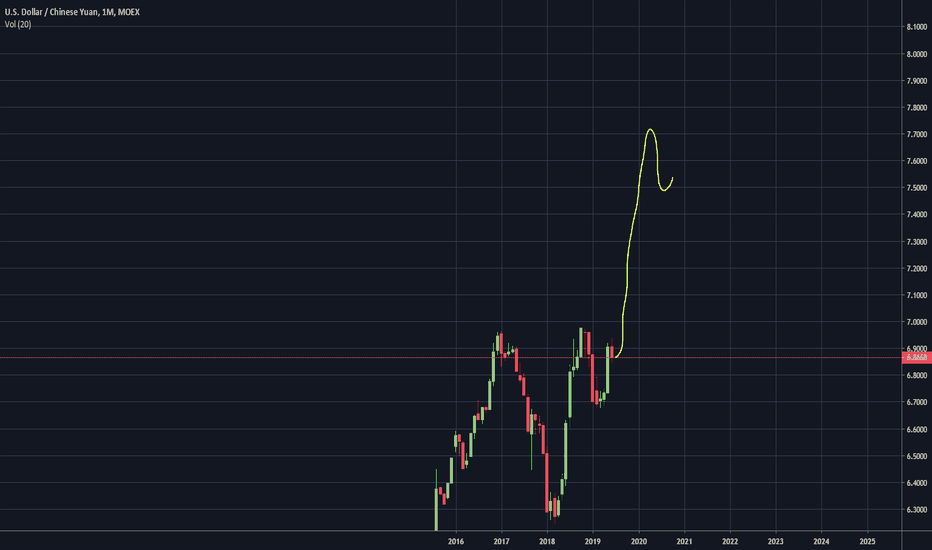

We have a Double Top Breakout on USD/CNY with Volume and could bring the Yuan Renminbi to a dramatic devaluation against the US Dollar. Trough this daily chart, we can observe that China's central bank - (PBOC) had to remove or loosen the grip on it, allowing the currency fluctuation and their free precification by the market, without strong barriers programed by the PBOC.

Thank you for reading and leave your comments if you like.

$CNY: Moving higher$CNY is higher than the initial breakout which caused mass panic among the macro tourists on TV. Instead all eyes are on the hapless Fed Chair who shall be known as the man who crashed equities markets. Equity markets will get spooked regardless whatever Powell decide to do. A hold means money's too tight, a full blown rate cut program means an acknowledgment that fundamentals are in the gutter. Jackson Hole is just another step closer to the end game which the bond markets have been signalling for ages. Wakey wakey for folks still buying equities.

Back to the USDCNY, it is a breakout so it is going to go higher. As previously mentioned, the bid ask spread between the US and China in this trade war is too far apart and the FX is an adjustment mechanism to the tariffs especially when the Chinese have been keeping the RMB artificially STRONG .

Is fear in Yuan driving Bitcoin Bull runs??As a result of the trade war and trumps latest tweet China is currently devaluing the yuan. It's now above 7yuan/usd.

I imagine this might promt some chinese millionaires to want to buy BTC due to fear. I'm seeing some correlation in when there is fear in the Chinese Yuan through devaluation.

Is this causing a Bitcoin bullrun?

The circled section conflicts with this however some periods show strong correlation.

The hypothesis is that wealthy Chinese nationals are seeing the devaluation of there currency and buying up large amounts of Gold and Bitcoin.

This might be obvious to some people but I thought I'd share a chart

ReunitOfAmericaFromIsolationRerepublicOfChinaFromDemodernizationThe re-united states of America from the isolationism and the re-republic of China from the de-modernizationism.

Some questions about EU zone money policy.

1; devaluation of Euro for export to China and USA, that trend should've been over in 2015, and should've turned to hike in Euro. Now with Chinese poverty and USA changing, the ECB have huge problems from hike too late. (market is crashing)

2; the more LITRO is on the desk, which is a poison and drugs, using again will cause Brexit second vote, and still quit with China collapse.

3; the USA-EU trade war is getting worse, there's no co-operation among big central banks since 2015. (the soft war)

4; the ECB is in a uncharted territory where is negative, which is they shouldn't be there.

5; history must be respected and they don't.

6; commodity markets prices are sabotaged by mathematic negative model.

7; negative money policy has been proved is a failure in the multi-region economic zone, like China and Eu zone, they're too big to balance the poverty. (imagine Italy quit, budget conflict with France)

8; negative money policy is only proved in the island like Japan and single land like Switzerland.

9; multi-region money police without a single budget, which is called ECB's design has an huge structural flaw.

Last meal for traders, before the night.

let's serve, now......

MACRO USD/CNH ANALYSISWith the trade war tension building up and de-escalation no where to be seen. China government has started depreciating YUAN to counteract against Donald Trump's Tariff. 7 is a easy target( tariff 25% ). We will see more upside unless a resolution has been made. There is a high probability that we will see record high in usd/cnh.

USDCNY Blown Out and Moving HigherAs the trade tension heats up between the US and China, global traders have been putting pressure on the USDCNY.

On a technical basis,the RSI and MACD are strongly trending higher, indicating strong momentum higher for the USDCNY. Further, with the ADX firmly in trend, there are no signs of the rally in USDCNY slowing down.

If trade talks worsen or even fall apart, expect the USDCNY to move to 6.92.

Hong Kong Dollar Strengthens on Rate SpikeThis is an excerpt from MACRO BRIEF: Hong Kong Dollar Strengthens on Rate Spike originally published March 10, 2019.

The short-HKD trade is nearly consensus, which reminds me of the short-yuan trade a few years ago that was largely snuffed out by the PBOC.

Problem here, though, is the HKMA's attempts to draw in HKD inflows have been superficial at best. Additionally, with China likely continuing using Hong Kong as a dollar ATM it is hard to estimate how long the strength would last.

The 3.7 sigma move has pulled in quite a bit but still remains extended. 7-day ROC saw its largest spike since December when the HIBOR 1M and 3M futures converged.

We'll continue to monitor the situation, but prolonged elevation of rates could be a problem considering that Hong Kong's economy is strongly interest rate sensitive with banking assets and domestic credit to public sector as a percentage of GDP at well over 200 percent.

To access original charts and commentary on this blog post click here .

USDHKD and the "problem" emerging market countries in 20182018 saw a rolling bear market in emerging markets, with a lot of EM currencies getting crushed vs. the dollar. Why has everyone forgotten about this? The issues are systemic, and the buy-down of the USDHKD peg only kept the eurodollar market functioning for long enough to forestall some further pain. Now that the peg has been hit again, we are starting to yet again, see renewed emerging market problems.

USDHKD PEG and the Chinese Currency..Unsurprisingly, right as the USDHKD Peg hit it's 7.85 limit, China lost its ability to prop up the Yuan, and the Yuan started to fall once again. This is further confirmation that the Yuan is subject to dollar pressure, and Hong Kong is China's "release valve" for dollar funding pressures. When the peg gets hit, the CCP has a difficult time keeping the RMB afloat.

Tides May Turn for USDCNHJust minutes ago, Reuters reported that Lightheizer and Mnuchin are going to Bejing for talks. However, trade war detente is now not on the table until June. Trump threatens to keep tariffs on if China won't hold up their end of the deal on intellectual property. Honestly its not looking good. It is difficult to tell if this trend will continue to go negative and if Trump holds an all out assault in the trade war against everyone and anyone he can get his hands on. This may be the world we live in by the end of 2019. Who knows. But clearly, the talks are no longer going as well as we once thought and also let's keep in mind how Trump walked away from Kim Jong Un in Hanoi. This is what we are trending towards now which would be quite detrimental to markets in spite of Trump's desire for a deal which is quite strong and in spite of his sensitivity towards the stock markets which we also know he is quite sensitive to as well. However in the end, in order for these negotiations to go well Trump needs at least the idea that he can create a positive message at the end.

That's the fundie picture. I'll much more briefly talk technicals. Overall, we are trending towards oversold with the USD even though the momentum is still trending in that direction. If you like my analysis, read some more words and check out some more charts here: www.anthonylaurence.wordpress.com

Take Two, and Call Me In the Morning - Dr. CopperCopper is in trouble as ongoing data out of China (and broader APAC/ASEAN nations). Just moments ago, South Korea's first 10-days of exports contracted 19.1 percent YoY and imports dropped 15.4 percent. South Korea is a global bellwether for economic growth and the first of the Asian countries to report.

Quantitatively, we'd short copper at the TACVOL range top which is available to premium members.

Here are the current near- and intermediate copper ranges that update daily. Effectively, short or sell at the top, buy or cover at the bottom.

Near-term: 2.97/2.57

Intermediate: 3.03/2.57

The 20-week z-score is 2.12 which indicates it is more than two deviations from the mean. A healthy pull back is in the works.