USDDKK

USD/DKK 1:4 Risk Reward Short? Long Term OutlookUSD

- Quant Scores shifted against USD by 10 points

- Building permits less than forecast showing a potential slowdown in approved housing

- Supported by a negative result in housing starts which can affect many other factors of growth such as jobs and money supply

- Consumer Confidence heavily lower than forecast suggesting the US consumers are less confident in the outlook, this can mean consumers keep their pockets tight and don't spend as much in the economy

- Manufacturing index suggesting a big slowdown in manufacturing after missing forecast by 2

USDDKK: Double buy opportunity on 1D/1W.The pair is on a strong long term Channel Up on 1W (RSI = 56.469, MACD = 0.047) trading on its Higher Low zone (Highs/Lows = 0.0000). Naturally, 1D is now neutral (RSI = 51.144, Highs/Lows = 0.0000), trading on its own Channel Up Higher Low, pricing a break upwards. The latter gives a buy signal with TP = 6.7000 (Higher High). The 1W Channel Up gives a buy signal if the H/H sequence on the lower resisting trend line (~6.72100) breaks upwards (TP = 6.87400).

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

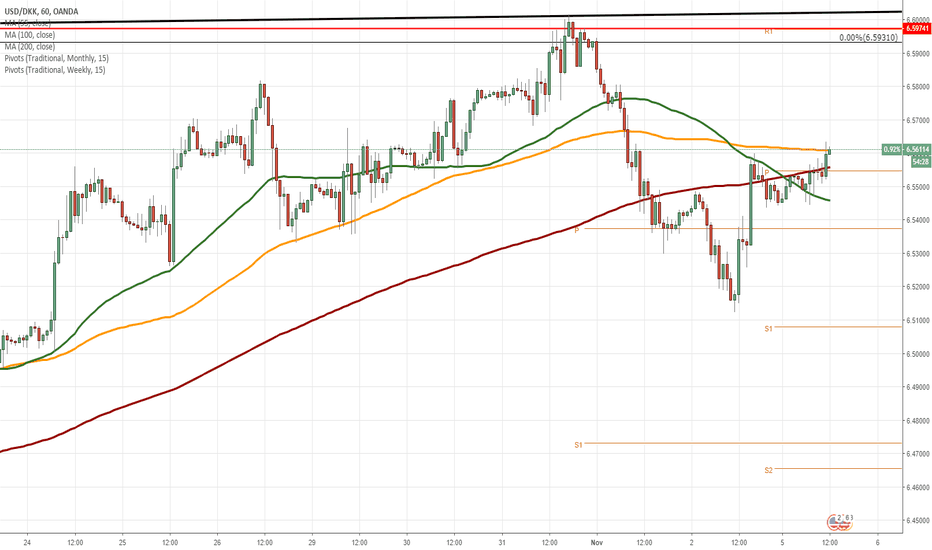

USD/DKK 1H Chart: Previous forecast at workThe previous forecast worked, and the USD/DKK currency pair has reached the upper boundary of a long-term ascending channel located circa 6.6000.

As apparent on the chart, the exchange rate reversed south from the upper channel line at the beginning of November. From a theoretical point of view, it is expected that the pair goes downwards. A potential target is the Fibonacci 23.60% retracement at 6.4443.

However, technical indicators for the long run suggest that bullish momentum should continue to prevail. In this case, it is likely that the pair re-tests the upper channel line in the nearest future. If given channel does not hold, a breakout north occurs within the following sessions.

USD/DKK 1H Chart: Bulls likely to prevailThe US Dollar has been appreciating against the Danish Krone after the currency pair reversed from the lower boundary of a long-term ascending channel at 6.3200.

Currently, the exchange rate is trading in a short-term ascending channel as well. It is expected that the pair will breach the junior trend and will aim for the upper boundary of the senior channel located circa 6.6000. An important level to look out for is the 2018 high at 6.5691.

It is the unlikely case that some bearish pressure still prevails in the market, the US Dollar should not exceed the 100– and 200-period SMAs (4H), currently located near 6.4140.

USD/DKK 1H Chart: Bulls likely to prevailThe US Dollar is appreciating against the Danish Krone in a short term ascending channel. This gradual increase in price began when the rate reversed from the 6.3600 mark.

Currently, the rate is being supported by the 55– and 100-hour SMAs on the 1H time-frame. It is expected that the rate eventually gathers the necessary momentum to breach the junior channel.

However, it should be taken into account that the pair is pressured by the 200-hour SMA at 6.4126 and this advance might not be immediate.

An important level to look out for is the monthly R1 at 6.4312.

Reaction from 50 weekly Fib retracementPrice was pushed off weekly 50 Fibonacci level forming a shooting star on daily. Half of the move already took place and this is how far we can short on hourly after Fib extension (there is cloud support on 4 hours | weekly | monthly and daily tenkan-sen at that extension).

New bullish leg initiated. Long.USDDKK has preserved the long term Channel Up on 1W (RSI = 69.995, MACD = 0.069, Highs/Lows = 0.1019, B/BP = 0.3423) as it broke the previous consolidation on 1D to the upside. As you see on the chart there are recurring patterns on 1D (Channel Up after Rectangle) so the pair will now most likely print a Channel Up (RSI = 67.432, ADX = 34.541) on 1D towards the next Monthly Resistace = 6.69018. Our long's TP is 6.67021.

USD/DKK 1H Chart: Pair below major resistanceThe US Dollar has appreciated substantially against the Danish Krone during the past two months. This 8.35% surge was guided in an ascending channel. Following a reversal from the senior channel at 6.46 last week, the Greenback breached the junior pattern and several important support levels along the way, including the 100-period (4H) and 200-hour SMAs.

The high positioning of technical signals on the 4-hour and 1-day charts points to further decline within the following week. The nearest downside target should be the 200-day SMA, the monthly S1 and the 23.60% Fibonacci retracement near 6.22.

Meanwhile, the following 24 hours could show a slight price movement north, setting the monthly PP as the most probable target for bulls.

USD/DKK 1H Chart: Greenback trades in line with patternUSD/DKK has been trading in an ascending channel for the last five weeks, thus breaching a dominant senior channel along the way in early May. The latest test of this junior pattern occurred on Monday when the pair reversed from the weekly S1 and the senior channel near 6.21.

From theoretical point of view, the pair might still realise the existing upside potential until the upper boundary of this medium-term channel and the weekly R3 at 6.3670. Even though technical indicators are currently located in the overbought territory, technical signals for the following session are still bullish.

If looking from the weekly perspective, the US Dollar is expected to reverse from the 6.36 area and begin edging lower until the bottom channel line somewhere in the 6.28/30 range.

USD/DKK 4H Chart: Ascending triangle dominatesThe US Dollar has been trading in a long-term descending channel against the Danish Krone in force since late 2016. The pair’s neat movement in this channel was disrupted in January when a reversal to the upside occurred without the pair reaching its bottom boundary.

The Greenback has since been moving in a slight up-trend, but it has nevertheless failed to overcome the 6.1169 mark. As a result, an ascending triangle was formed.

If looking at the pair’s movement during the past few weeks, the Greenback has reversed from the trend-line, breached the senior channel and has been gradually moving towards its four-month high of 6.1169. It is likely that the current bullish momentum prevails during the following weeks and pushes the rate for new highs. A possible target for the following week or two could be the 6.20 area.

USDDKK bearish trend with SL and TPIt is update to me previous idea about this pair. Similar patter appeared on the chart on 4h chart. GAP's lime rectangles are based on the weekly chart and are acting as strong support areas. Pair is trading below 200 ema which is good bearish signal. USDDKK -0.14% is trading in channel for time being and my TP is set based on it.

I will be watching this pair if it will reach one of the borders of the channel.

USDDKK bearish trend It is update to me previous idea about this pair. Similar patter appeared on the chart on 4h chart. GAP's lime rectangles are based on the weekly chart and are acting as strong support areas. Pair is trading below 200 ema which is good bearish signal. USDDKK is trading in channel for time being and my TP is set based on it.

I will be watching this pair if it will reach one of the borders of the channel.

Greenback is getting some strength against danish kroneI see an initial sign of dollar getting some strength. As you can see here from weekly chart of USDDKK, a RSI divergence is now observed, indicating the bull is about to take control. And if you pull the Fibonacci extension tool, current price is testing the 0.382 support line, which seems to be a short term resistance observed on week of 8th December 2014. If the retracement indeed happened, I would target the profit to be somewhere around 6.2 level, which was the previous resistance line.

Trade with care and only enter the trade when you see a clear signal.