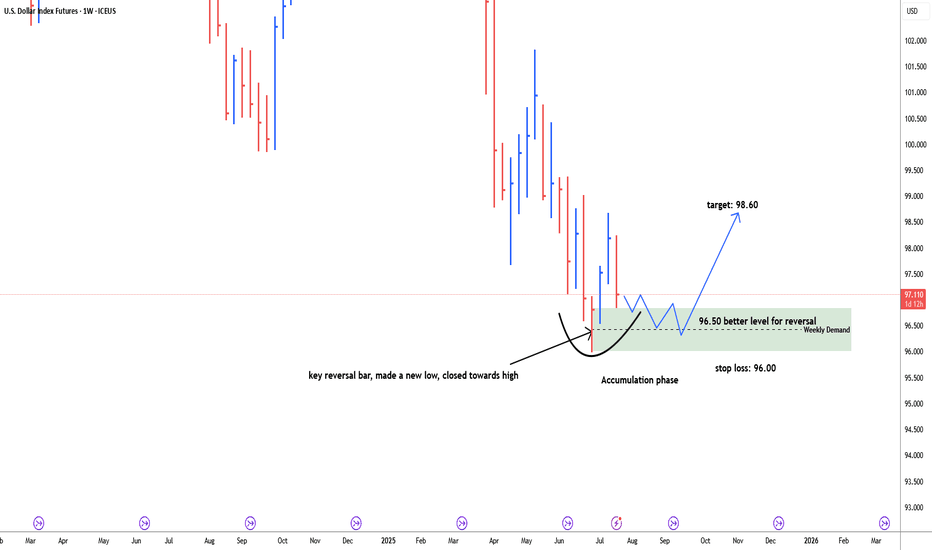

USD Dollar index possbile bullish reversal#usddollarindex, last weekly bar of the month of June is key reversal bar, made a new low and closed towards high. price retracing back down to test weekly demand zone. discount zone of demand is 96.50. possible bullish reversal target: 98.60. Stop loss below 96.00. price need time to build energy for bullish momentum. 96.50-96.00 is more secure level for long.

Usddollaranalysis

USD Dollar weekly key reversal bar, sign for bulish reversallast weekly bar of the Month of August is weekly key reversal bar, made a new low & closed off the high. current week price pulled back to its 0.618% & 0.70% fib level. last fib level expecting before rally up is 0.79% which is 100.68. last and extreme level may touch 100.50 as well. if price breaks & closes below the 100.50 then it can go down further. but key reversal is indication for buying now. resistance levels are 102.30 & 102.50.

USD DOLLAR possible reversal for 102.50USD Dollar hit the 100.50 price level which is strong support area of last 8 months. 28th December 2023. this is quite strong support area which should fight to hold and reverse price upside to the 102.50. Buying zone 100.50, stop loss: 100.20, target: 102.50. Trend is quite bearish, reversal trade takes time to digest supply for long. If USD Dollar holds that strong support then might see fall in gold, eur and other currencies as well.

DXY doesn't look too happy below 100Last week the US dollar index (DXY) closed at a 15-month low and beneath 100 for the first time since April 2022. Yet subsequent price action has seen a lack of conviction form bears, allowing prices to form a double bottom just above the March 2022 high and close with a Spinning Top doji yesterday.

Given US yields are showing signs of stability (and hinting at a move higher themselves), it seems reasonable that the US dollar is due a corrective bounce over the near-term which brings 100.5 and the April low into focus for bulls.

A break beneath the March 2022 high invalidates the bearish bias, but this could be raised to the recent swing lows if we see a decent break (or daily close above) 100.

US-DOLLAR (DXY) at Support!..AnalysisHey tradomaniacs,

DXY (US-DOLLAR-INDEX) is currently re-testing the primary trendline aswell as support-zone.

Question is will it hold or not? I can tell you it is tricky due to the new expectations the market prices in in uncertain times.

What do we need for a bullish US-Dollar?

1. Risk-Off in stocks

2. Rising Yields / Falling Bonds

Fundamentals:

So far the market has reacted to different circumstances such as the Ukrain-War but first and foremost the inflation and the answer of our Central Banks.

The market has never seen such a shift in monetary policy and multiple rate-hikes in this dimension. This is of course very concering as the Central Banks (Drug Dealer) takes away all the drugs (liquidity) the market is addicted to.

Since the Corona-Rally is based on money-print-waves aswell as low rates it was more than clear that we get a bear-rally with the annoucement of Biden to fight inflation, no matter what it takes. (Ofc as it was his promis to biden to get a second period)

However, now we have a scenario where the world is getting concerned about all the rate-hikes and their impacts. The first very critical situation appeared in the UK where Central Banks were forced to adjust the monetary policy.

Now we have seen a lower rate-hike in Australia...this could become a "trend" of the CBs as they could take a step back and wait for the impact of recent rate-hakes.

Trends like that can be quickly priced in the market...

Yesterdays ISM-Results from the USA caused a pump in stocks as the market begins to bet the FED won`t come up with such high rate-hikes as announced to support the obviously slowing down economy. This is again a BET against the FED and Jeromes statements. I guess the market will look at the NFPs this week to evaluate whether it is more likely to get the promised rate-hikes or not.

A decent job-market could give the market the impression that rate-hikes as planned are possible and we see a rising US-Dollar.

A worse job-market could confirm the markets expectations (as economy aswell as jobmarket suffers) and we see a falling US-Dollar.

Technically a great spot to go long but as long as SPX&Co continue to move up we will see a weaker US-Dollar.

In Mid-term I expect the US-Dollar to rise again as recession is coming closer and closer (See Yield-Cuves).

What do you think?

USD Dollar forming double top?#usddollar, 15th Key reversal bar, next Insurance bar indication for short dollar. 105.55-60 resistance level for previous fall. High probability to hold this support to form double top. price may go rise up a little to catch stop losses of short traders. Target is 103.00.

USD DOLLAR suspect bearish for 102#USDDOLLAR, usd dollar monthly key reversal bar made a new high closed off the low. weekly bar 16th-20th May formed two bar reversal for bearishness ahead. 13th May daily bar is a key reversal bar confirmed with next bar down a insurance bar. 104.40-70 supply area for short. stop loss above 105.10 which is 13th May high.