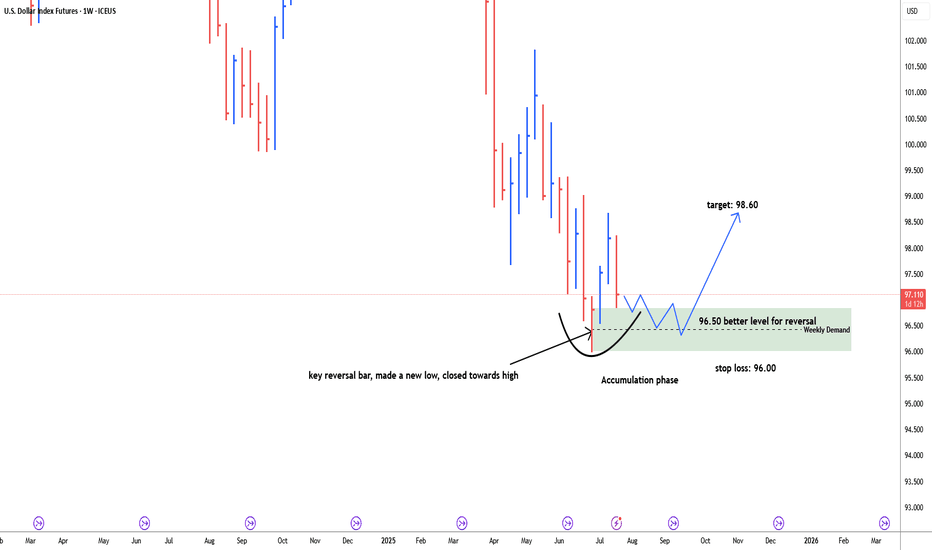

USD Dollar index possbile bullish reversal#usddollarindex, last weekly bar of the month of June is key reversal bar, made a new low and closed towards high. price retracing back down to test weekly demand zone. discount zone of demand is 96.50. possible bullish reversal target: 98.60. Stop loss below 96.00. price need time to build energy for bullish momentum. 96.50-96.00 is more secure level for long.

Usddollarindex

DXY UPDATED w/ Eurozone Interest Rate & U.S. Jobless Claims originally posted here . 102.500 DXY in the coming weeks?

The Eurozone has opted to keep interest rates stable at 3.65%, signaling a wait-and-see approach to current economic conditions.

Meanwhile, U.S. jobless claims have come in 3,000 lower than expected, reflecting a stronger U.S. labor market.

This divergence in data is likely to put pressure on EUR/USD, with the U.S. dollar gaining strength from robust employment figures while the Euro remains steady amid unchanged monetary policy. I’ll be watching for potential bullish DXY into the next trading sessions.

USD Dollar weekly key reversal bar, sign for bulish reversallast weekly bar of the Month of August is weekly key reversal bar, made a new low & closed off the high. current week price pulled back to its 0.618% & 0.70% fib level. last fib level expecting before rally up is 0.79% which is 100.68. last and extreme level may touch 100.50 as well. if price breaks & closes below the 100.50 then it can go down further. but key reversal is indication for buying now. resistance levels are 102.30 & 102.50.

USD DOLLAR possible reversal for 102.50USD Dollar hit the 100.50 price level which is strong support area of last 8 months. 28th December 2023. this is quite strong support area which should fight to hold and reverse price upside to the 102.50. Buying zone 100.50, stop loss: 100.20, target: 102.50. Trend is quite bearish, reversal trade takes time to digest supply for long. If USD Dollar holds that strong support then might see fall in gold, eur and other currencies as well.

DXY doesn't look too happy below 100Last week the US dollar index (DXY) closed at a 15-month low and beneath 100 for the first time since April 2022. Yet subsequent price action has seen a lack of conviction form bears, allowing prices to form a double bottom just above the March 2022 high and close with a Spinning Top doji yesterday.

Given US yields are showing signs of stability (and hinting at a move higher themselves), it seems reasonable that the US dollar is due a corrective bounce over the near-term which brings 100.5 and the April low into focus for bulls.

A break beneath the March 2022 high invalidates the bearish bias, but this could be raised to the recent swing lows if we see a decent break (or daily close above) 100.

The US dollar as a sheep in wolf's clothingThe printed money supply in the world is currently fed into the systems, consequence high inflation. Supply chains are healing but this might take some months until we're back in the game. Since the FED has no interest in sending the global economy into chaos, interest rate hikes will come to light again in the coming months and even interest rate cuts from 2023. Dollar is king but the revolution is right around the corner.

This is just an idea, note that this is not a recommendatin to invest or to trade with US dollars.

DXY US DOLLAR INDEX DISASTER !!!!!Daily playing in ascending broadening wedge with losing momentum continuously in the past couple of days loosing the trendline support 105.259 will be more downside for DXY here to major support levels 94.92 to 94.25 which causes disaster in all other markets. It might be the start of the continuation of the bear market. As every other major market is approaching major resistances.

Dollar Market Profile & Consensus 07/25/2022Short Sell into Long Buy to End The Week

I use the US DOllar as a tool to have a perspective on how the rest of the market should react to its direction.

I only trade 10 pairs every week outside of crypto which I only trade 3 pairs. I trade correlative pairs to manipulate the market, have more opportunities to make profit and lastly to stack the odds in my favor.

Correlative Pairs:

US30 + NAS100

USDZAR + USDMXN

XAUUSD + XAGUSD

GBPUSD + EURUSD

GBPJPY + EURJPY

---- CRYPTO CORRELATIVE PAIRS------

BTCUSD + ETHUSD + XRPUSD

USD DOLLAR suspect bearish for 102#USDDOLLAR, usd dollar monthly key reversal bar made a new high closed off the low. weekly bar 16th-20th May formed two bar reversal for bearishness ahead. 13th May daily bar is a key reversal bar confirmed with next bar down a insurance bar. 104.40-70 supply area for short. stop loss above 105.10 which is 13th May high.

DXY (US-DOLLAR) about to move UP? hey tradomaniacs,

Remember this Chart? 👉

The DXY (US-DOLLAR-INDEX) is currently re-testing a strong support-zone after a fakeout.

Often a classic preparation for another move upwards which is why I`m holding trades.

Watch this support-zone closely❗️👊 Also keep in mind that we will get to see the FOMC-Meeting today, which could be hella hawkish!

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me

US Dollar Index (DXY)Recently you have seen or heard a lot about DXY and its impact on the market. So what is US Dollar Index (DXY)

The US Dollar Index is used to measure the value of the dollar against a basket of six world currencies - Euro, Swiss Franc, Japanese Yen, Canadian dollar, British pound, and Swedish Krona. That means if DXY goes up the other currency value goes down and vice-versa.

Bitcoin is also inversely related to US Dollar Index (DXY) means if DXY goes up then BTC and crypto market price dumps and if DXY goes down then BTC and crypto market price pumps.

DXY formed a double bottom on the weekly chart and now almost completed the pattern. The major resistance for DXY is 94.785 and if DXY breaks above this resistance then we see a heavy sell-off (dump) in the crypto market. Although this is weekly major resistance so we expecting a reversal from this resistance that gives some space for BTC and crypto market rally.

⚠️Keep an eye on DXY. The next 2 weeks are very crucial for BTC

USD (DXY) is Strong, for now....Looking at the US Dollar Index (DXY), USD is showing strength, breaking structure to the upside. It has entered a 4H bearish OB, and we are going to monitor it behavior here. Will it reverse soon? There is huge potential for that to happen. Price may show weakness in the next 48hrs, but for now, I would play the xxxUSD pairs to USD strength.