Gold May Find Support From These Various FactorsGold May Find Support Amid Concerns Over U.S. Debt Sustainability, Economic Weakness, and Renewed Geopolitical Tensions

Gold prices are holding steady today, near $1,353 per ounce in spot trading, in what is expected to be a low-liquidity session due to the early closure of U.S. markets. This follows three consecutive days of gains.

The yellow metal’s subdued movement comes as markets await key labor market data that may offer further insight into the health of the U.S. economy, especially after the recent shock from ADP figures.

Gold continues to find support from several underlying factors that could sustain its upward trend this week. These include rising uncertainty around the long-term sustainability of U.S. public finances and the risk of renewed conflict in the Middle East.

Concerns over U.S. fiscal stability have intensified following the introduction of the “One Big Beautiful Bill Act,” which combines tax cuts with spending reductions. In an opinion article for The New York Times , former Treasury Secretaries Robert Rubin and Lawrence Summers warn of the bill’s potentially severe consequences, including persistently high interest rates, reduced business confidence, falling investment, and the risk of a financial shock that markets may struggle to absorb. This could also leave the economy more vulnerable to economic and geopolitical threats.

Such risks may erode investor confidence in U.S. government debt, potentially boosting gold’s appeal as a safe-haven asset even in an environment of elevated bond yields and prolonged high interest rates.

On the geopolitical front, the specter of renewed escalation in the Middle East looms, and this time, the consequences could be more severe. Amid conflicting reports and statements regarding the extent of the damage to Iran’s nuclear facilities, both sides appear to be preparing for the possibility of renewed hostilities.

Diplomatic efforts remain stalled, and hardline voices continue to call for a return to conflict. In an opinion piece for The New York Times, former National Security Advisor John Bolton described negotiations with Iran as ineffective and dangerous, calling instead for regime change and the use of force.

While previous rounds of conflict have not caused lasting damage to the global economy or energy supply chains, a new round may prove more disruptive. According to Reuters , Iran has reportedly loaded naval mines onto vessels, raising fears that it may attempt to close the Strait of Hormuz.

Such a move would cross a critical threshold and turning a contained conflict into one with global economic implications. The Strait of Hormuz handles over one-fifth of the world’s crude oil and liquefied natural gas exports.

However, Iran may avoid this step as long as its own oil exports continue flowing through the strait, as was the case during the last conflict in June.

On the trade front, there is growing optimism about the potential for new agreements that could ease tensions that have disrupted global supply chains and threatened U.S. and global economic growth. This optimism follows President Trump’s announcement of a trade deal with Vietnam.

There is also hope that progress can be made with China. Recent reciprocal steps, that involve the easing of restrictions on rare earth exports by China and some relaxation of U.S. technology export controls, suggest that the de-escalation agreed upon earlier in Switzerland could hold, potentially laying the groundwork for a broader trade agreement.

Samer Hasn

Usdebt

Deposits All Commercial Banks & US DebtWhen a politician and their buddy start spouting nonsense about the US debt spiraling out of control, but then insist that tax cuts are great because they’ll create jobs, and all that money will somehow trickle down to the rest of us, magically boosting tax revenue to "make up" for the lost funds.

Especially when that same politician was re-elected bc inflation & the economy were just so horrible, promising he would come in and save the day bringing prices down again with more tax cuts because they worked so great the first time around.

That's the extreme right. What about the extreme left #MMT?

#MMT is just as bad as MAGAs! They will tell you deficits are great! Deficits add to our savings! Deficits make us all richer! It's accounting, they say! it has to be that way! Except for the little fact that it's not based on empirical evidence.

So the next time some B.S. Artist tells you their little version of a fictional money story, you will know what reality is since 2018. You will have seen this chart with your own eyes and cannot unsee it! No matter what you do, no matter what side you lean politically, it's irrelevant.

Public debt since the tax cuts have grown exponentially, while the private sector deposits have lagged to the point they have stagnated completely since 2021. Barely rising 6%.

Defunding CIA, FBI, USAID, Dept of Education etc.. will do absolutely nothing to make up for all the lost tax revenue since 2018 and the next tax cuts to follow. In fact, when we enter a recession, the deficits will explode even higher as tax revenues collapse and social and economic stabilizers (if there are any left) kick in. Then what?

Don't shoot the messenger!

Trump's Tariff Wars : Why It Is Critical To Address Global TradeThis video, a continuation of the Trump's Tariff Wars video I created last week, tries to show you why it is critically important that we, as a nation, address the gross imbalances related to US trade to global markets that are resulting in a $1.5-$1.8 TRILLION deficit every fiscal year.

There has been almost NOTHING done about this since Trump's last term as President.

Our politicians are happy to spend - spend - spend - but none of them are worries about the long-term fiscal health of the US. (Well, some of them are worried about it - but the others seem to be completely ignorant of the risks related to the US).

Trump is raising this issue very early into his second term as president to protect ALL AMERICANS. He is trying to bring the issue into the news to highlight the imbalances related to US trade throughout the world.

When some other nation is taking $300B a year from the us with an unfair tariff rate - guess what, we need to make that known to the American consumer because we are the ones that continue to pay that nation the EXTRA every year.

Do you want to keep paying these other nations a grossly inefficient amount for cheap trinkets, or do you want our politicians and leaders to take steps to balance the trade deficits more efficiently so we don't pass on incredible debt levels to our children and grandchildren?

So many people simply don't understand what is at risk.

Short-term - the pain may seem excessive, but it may only last 30, 60, 90 days.

Long-term - if we don't address this issue and resolve it by negotiating better trade rates, this issue will destroy the strength of the US economy, US Dollar, and your children's future.

Simply put, we can't keep going into debt without a plan to attempt to grow our GDP.

The solution to this imbalance is to grow our economy and to raise taxes on the uber-wealthy.

We have to grow our revenues and rebalance our global trade in an effort to support the growth of the US economy.

And, our politicians (till now) have been more than happy to ignore this issue and hide it from the American people. They simply didn't care to discuss it or deal with it.

Trump brought this to the table because it is important.

I hope you now see HOW important it really is.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

US DEBT Outpacing Private Credit 2 to 1Money has been around for over 10,000 years!

Money is a derivative of private sector(PS) asset/labor producing.

Money is not a derivative of Gov

Gov borrowing money from the PS with interest to buy money without interest is a recipe for economic disaster.

Gov spending currently is over 40% of GDP annually. It used to be under 10%

Gov debt benefits the few while socializing those liabilities onto the backs of the many.

The many will not realize this is happening until it is too late. The few will sell their bonds, take their money, and move it overseas, collapsing the currency's value, and leaving the many to pay for the debt with taxation, austerity and inflation. (even hyperinflation)

The more Gov borrows to deficit spends the more it has to deficit the closer we get to the point of no return.

That's what this chart is showing you. The direction we are heading.

US Debt Exploding Relative To Real GDPUS debt has risen more than 90% since 2016, with no meaningful increase in economic growth inflation-adjusted (Real terms) meaning we pay more for goods and services showing a higher nominal GDP.

As you can see in the chart the economy used to grow faster than debt and even outpaced debt in 70s, 80s and 90's.

As I have shown before on tradingview, The annual US Gov't spending as a percentage of annual GDP is now 45% and it has been even higher.

My question to you is this. next recession when Real GDP falls and politicians tell you we have to increase deficits and spending to "stimulate" the economy. How much higher will the debt go relative to real GDP?

USD/JPY Analysis: Fundamental and Technical Outlook FX:USDJPY The recent price action in USD/JPY, characterized by a significant break through the upper pitchfork boundary with substantial momentum and volume, suggests an important moment for the currency pair. This technical development aligns with several fundamental factors influencing both the U.S. dollar and the Japanese yen.

Technical Analysis:

Breakout Confirmation: The breach of the upper pitchfork boundary indicates strong bullish momentum. However, to validate this move, it's essential to observe whether the price can sustain above this level or if it will retest and potentially fall back into the previous channel.

Key Support and Resistance Levels:

Support: The 150 level serves as a critical support. A decline below this threshold could signal a return to the long-term consolidation range between 80 and 150, which persisted for 27 years prior to 2022.

Resistance: If the price reclaims the upper channel, we may see the continuation of the uptrend with huge momentum.

Fundamental Analysis:

Bank of Japan Hawkish Stance: The BOJ has recently adopted a more hawkish tone, hinting at potential policy tightening. Governor Kazuo Ueda has indicated progress toward sustained wage-driven inflation, suggesting that interest rate hikes could be on the horizon.

Japanese Intervention: Japan’s Finance Minister has expressed concerns over excessive yen depreciation, hinting at possible intervention if the yen weakens too much. This stance aims to prevent the yen from falling to levels that could harm the economy by increasing import costs.

Federal Reserve's (Fed) Dovish Shift: In contrast, the U.S. Federal Reserve appears to be concerned with the current economical development, especially about the unemployment level, with discussions around more potential rate cuts emerging. This dovish outlook is influenced by concerns over rising U.S. debt levels and a slowing economy.

U.S. Debt: The U.S. is grappling with escalating debt, with the debt-to-GDP ratio nearing 100%. This situation is reminiscent of the economic conditions preceding the DotCom Bubble from 2000, raising concerns about potential economic instability. Not mentioning that the US credit card debt is record high.

More to read about this:

nypost.com

www.wsj.com

www.marketwatch.com

www.cnbc.com

Outlook:

The convergence of these technical and fundamental factors suggests that USD/JPY may not revisit recent highs in the near term. Instead, the pair could stabilize within the 140-150 range as the market seeks equilibrium amid contrasting monetary policies and economic conditions in the U.S. and Japan.

Risk Management:

Given the inherent volatility and unpredictability of forex markets, it's crucial to implement robust risk management strategies. Market dynamics can shift rapidly, and while current analyses provide a framework, they are not guarantees of future performance. Always conduct thorough research and remain adaptable to changing market conditions.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Always perform your own analysis before making trading decisions.

TLT +50% Every Time This Happens and It's Happening NowTLT/SPX Monthly RSI (8 Period Close)

It makes sense to analyze the most common institutional portfolio allocation (Equities and Bonds) rather than Equities or Bonds separately. Most investors focus on Fed Funds, unemployment, the business cycle, rates, to analyze the bond market. But those metrics are poorly correlated to returns at best. When you focus on allocation, as in Bonds plus Equities, you start making some progress. That's exactly what this chart represents; where the money is going and when. Hint: it's going into Bonds. Soon.

BBOT (Bonds Blast Off Time) is here

How will the market react after the next US election?How will the market perform if either Biden or Trump wins? That should be an easy question to answer, as we can track the market performance on the first day each became President of the United States.

Micro E-Mini Nasdaq Futures and Options

Ticker: MNQ

Minimum fluctuation:

0.25 index points = $0.50

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

$USDEBT: Indebt Tokenomics $USDEBT, launched in May 2023, represents a unique blend of crypto technology and humor. Created by a global team of blockchain enthusiasts and meme aficionados, this crypto meta-meme takes a satirical stance on the current financial system, with a particular focus on the escalating US debt crisis. Beyond a simple digital asset, $USDEBT is a potent symbol that distills the term "US Debt" into a token emblematic of global financial challenges.

The team behind $USDEBT perceives it as more than a cryptocurrency. They envision it as an innovative development in the world of crypto memes, a domain where humor and satire meet technology to instigate meaningful discourse about traditional monetary systems. In line with the decentralization principle of cryptocurrency, $USDEBT seeks to morph liquidity pools into a dynamic platform for meta-memes, bringing about a revolution in the crypto meme landscape.

$USDEBT Purpose

$USDEBT is more than a mere token – it's a social and financial commentary on global economic systems. Through humor and innovative technology, it aims to drive the evolution of crypto memes and foster constructive discussions on national debt. This unique blend of humor and technology underscores the transformative potential of blockchain.

$USDEBT Tokenomics

$USDEBT is fundamentally a community-driven project, reflecting the team's commitment to decentralization and transparency. The project's roadmap outlines two phases. The first targets the expansion of the $USDEBT community, listing on major cryptocurrency platforms, and stimulating meme creation around $USDEBT. The second phase involves community consultation to determine future directions for $USDEBT's growth and development.

Among the team's proposed ideas are the establishment of a $USDEBT Decentralized Autonomous Organization (DAO) and the creation of a MemeExchange. Further creative endeavors include designing a mascot and formulating the concept of the 'Gang of Six Characters', with the community being the critical sixth member.

Storms are Brewing: Is your Portfolio Weatherproof? Risk strikes when least expected. Optimism peaks before a downturn strikes. Chart below shows remarkable spike in articles mentioning soft-landing before recession hits. Human brain is engineered to think linearly.

Anything non-linear tricks the mind. Recession is non-linear which muddles up investor estimates of recession, its timing and impact.

Count of Soft-landing Articles & US Recession (Source: Bloomberg )

The US Federal Reserve in its fight against inflation has lifted rates by an unprecedented 525 basis points since the start of 2022.

Yet the American economy, US corporations, and the US consumer are remarkably resilient. Non-Farm Payrolls last week came strong. When the Fed is tightening its levers to slow the economy, nothing seems to stop its rise. What explains this anomaly?

Three words. Monetary Policy Transmission.

Monetary policy transmission takes time, lulling many to believe that consumers and corporates are resilient. When in fact, they are yet to face the consequence of constrained credit markets which will manifest itself in myriad ways from reduced availability of financing, high cost of funding, and rising bankruptcies, just to name a few.

This paper is set in two parts. First part describes monetary policy transmission. Part two dives into storms forming in the horizon. The paper concludes with a hypothetical trade set-up using CME Micro S&P 500 Options to defend portfolios from deepening polycrisis.

Despite the risk narratives, a soft landing may still be possible. However, the combined impact of Fed’s hawkish stance, rising geopolitical tensions, continuing auto workers strike, tightening of financial conditions, and elevated oil prices & yields renders the likelihood of a soft landing, super slim.

Narratives around the soft-landing aside, CTAs have dumped nearly USD 40 billion worth of S&P 500 futures positions marking the fastest unwind on record over the last two weeks as reported by Goldman Sachs.

PART 1: MONETARY POLICY TRANSMISSION

Monetary policy operates with long and unpredictable lags. Monetary Policy Transmission is the process through which a Central Bank’s decisions impact the economy and the price levels. The flow chart below schematically describes the downstream impact of quantitative tightening.

Monetary Policy Transmission Takes Time (Source: ECB )

Changes made to official interest rates affect markets in diverse ways and at distinct stages. Central bank's interest rate decisions impact the markets in the following seven ways:

1. Banks and Money Markets: Rate changes directly affect money-market rates and, indirectly, lending and deposit rates.

2. Expectations: Expectations of future rate changes influence medium and long-term interest rates. Monetary policy guides expectations of future inflation.

3. Asset Prices: Financing conditions and market expectations triggered by monetary policy cause adjustments in asset prices and the FX rates.

4. Savings & investment decisions : Rate changes affect saving and investment decisions of households and firms.

5. Credit Supply: Higher rates increase the risk of borrower default. Banks scale back on lending to households and firms. This may also reduce consumption and investment.

6. Aggregate demand & prices: Changes in consumption and investment will change the level of domestic demand for goods and services relative to domestic supply.

7. Supply of bank loans: Changes in policy rates affect banks’ marginal cost for obtaining external finance differently, depending on the level of a bank’s own resources/capital.

The mechanism is characterized by long, variable, and indefinite time lags. As a result, it is difficult to predict the precise timing of monetary policy actions on economy and inflation.

For some sectors, monetary policy transmission can take as long as 18 to 24 months. In other words, the full force of the Fed’s 525 basis points spike since 2022 will not be felt until early 2024. Added to that, the Fed may not be done hiking yet.

Probabilities of Rate Anticipation in Prospective Fed Meetings (Source: CME FedWatch Tool )

PART 2: STORMS ARE FORMING

Not one but three major storms are brewing in parallel, namely (1) Worsening Geo-politics, (2) US Sovereign Risk Fears, and (3) Tightening Financial Conditions. One or more of them could unleash havoc, sending financial markets into a tailspin.

1. WORSENING GEO-POLITICS

Adding to the geopolitical conflict between Russia and Ukraine, Hamas attack on Israel over the weekend has elevated geo-political tensions. If counter strikes escalate to a wider region impacting Strait of Hormuz, then oil prices could spiral up sharply, sending shocks across financial markets.

Oil prices lost steam last week. That doesn’t guarantee lower prices. Eerily, this month marks 50-year anniversary of oil emergency in 1973 which led to oil prices spiking 3x back then.

The US Strategic Petroleum Reserves are at a 40-year low. The reserves are at 17-days of consumption compared to an average of 34-days consumption observed over the last thirty years.

2. US SOVEREIGN RISK FEARS: The US government is facing multiple challenges of its own. The government narrowly avoided a shutdown and has kicked the problem can down the road only by six weeks. Long before investors take relief, the shutdown fear will resurface again.

Add to that is the rising US debt levels. With a debt burden of USD 33 trillion, the government debt is forecasted to reach USD 52 trillion by 2033.

With rates remaining elevated, a substantial chunk of US Government debt will be directed towards interest payments. Is there a risk of US debt default?

To compensate for that risk, bond yields are climbing. The 10-Year treasury yields rose to 16-year high of 4.6%. With jobs market remaining solid, the data-driven Fed might have to keep the rates higher for longer.

The futures market implies a probability of 42% for a rate hike during the Fed’s December meeting. Any further hikes can tip the recovering housing market back into crisis due to exorbitant mortgage rates. High yields also cost it dearly for firms to borrow.

3. TIGHTENING FINANCIAL CONDITIONS: Dwindling liquid assets, resumption of student loan repayments, stringent lending practices atop heavy debt burden on US Corporates are collectively weighing down on investor sentiments.

Student Loan Repayments: After 3.5 years of loan servicing holidays, millions of students will resume student loan repayments. Bloomberg estimates that these repayments can shave 0.2% to 0.3% off US GDP.

Depleted Savings: Strength of the US Consumers will be put to stress tests. Extra savings from pandemic stimulus checks have been depleted to below pre-pandemic levels for low-income categories. Consumer strength could turn into weakness in the coming weeks.

Inflation Adjusted Liquid Asset Holdings by Income Group (Source: US Fed and Bloomberg Calculations )

Stringent Lending Standards: The Fed’s Senior Loan Officer Opinion Survey (SLOOS) on Bank Lending Practices points to 50% of the banks imposing stringent criteria for commercial & industrial loans. Lending conditions are at levels last seen during 2008 global financial crisis. Impact of this will be felt in Q4 when business will be stifled from access to funds.

Tightening Standards of Commercial & Industrial Loans (Source: July 2023 SLOOS Survey )

Corporate Debt Burden: Years of extremely low cost of funding have tempted US corporates into a debt binge. With rates rising, the debt burden is getting heavier on corporate balance sheets, cash flows, and profitability as reported by Bloomberg. Leverage ratios are rising. Interest coverage ratios are falling. Average Free Cash Flow to Debt ratios are plunging.

Debt burden amid rising rate environment is hurting US Blue Chips (Source: Bloomberg Intelligence )

HYPOTHETICAL TRADE SETUP

Against the backdrop of these risks, this paper posits a hypothetical back spread with puts to gain from sharp index moves. Unlike a long straddle, this option strategy delivers (a) outsized gains when markets plunge, and (b) limited downside risk if market remains flat or rises despite the risks.

This strategy involves selling one unit of at-the-money puts to finance purchase of two units of out-of-the-money puts. This strategy can be executed either for net positive premium or net negative premium depending on the choice of strikes.

Specifically, the hypothetical trade illustration is built around CME Micro Monthly S&P 500 Options expiring on 29th December 2023 (EXZ3). The strategy involves (a) selling 1 lot of EXZ3 at a strike of 4400 collecting a premium of USD 655 (131.16 index points x 1 lot x USD 5/index point), and (b) buying 2 lots of EXZ3 at a strike of 4300 paying a premium of USD 950 (95.041 index points x 2 lots x USD 5/index point).

The hypothetical trade involves a net debit of USD 295 (58.922 index points * USD 5/index point). This trade breaks even when S&P 500 (a) falls below 4141, or (b) rises above 4400.

Pay-off from Back Spread with Puts Trade Strategy (Source: CME QuikStrike )

Summary pay-off from this trading strategy is illustrated in the table below.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

The Precarious Rally Might be Stalling? Day 1S&P 500 INDEX MODEL TRADING PLANS for WED. 08/02

As we published in our earlier trading plans: "The question on everybody's mind - whether they are a bull or a bear or a bystander - is: "How long can this rally continue?". And, nobody knows - or, can know - the answer, of course. But, as long as there are doubters, the rally will still have some steam left in it - mostly feeding on short squeezes".

Earnings notwithstanding, the U.S. downgrade by the ratings agencies could have the potential to stall the bull. But, the bears should be cautious about jumping the gun, yet. There is a potential for sudden spikes up to squeeze the shorts in the near term. Might be risky to stay short while the index is above 4500.

The previously stated level of 4575-4580 is now the main resistance level, with 4500 the immediate support.

Aggressive, Intraday Trading Plans:

For today, our aggressive intraday models indicate going long on a break above 4550, 4520, 4506, or 4491 with an 8-point trailing stop, and going short on a break below 4545, 4527, 4516, 4502, or 4487 with a 9-point trailing stop.

Models indicate no explicit long exits, and explicit short exits on a break above 4530 or 4537. Models also indicate a break-even hard stop once a trade gets into a 4-point profit level. Models indicate taking these signals from 11:16am EST or later.

By definition the intraday models do not hold any positions overnight - the models exit any open position at the close of the last bar (3:59pm bar or 4:00pm bar, depending on your platform's bar timing convention).

To avoid getting whipsawed, use at least a 5-minute closing or a higher time frame (a 1-minute if you know what you are doing) - depending on your risk tolerance and trading style - to determine the signals.

Positional Trading Plans:

Our positional models indicate going short on a break below 4515 with a 16-point trailing stop. If models open a short and survive into the close, models indicate continuing the trailing stop which will be effective overnight (see the overnight exposure explanation below for positional trading plans).

By definition, positional trading models may carry the positions overnight and over multiple days, and hence assume trading an index-tracking instrument that trades beyond the regular session, with the trailing stops - if any - being active in the overnight session.

(WHAT IS THE CREDIBILITY and the PERFORMANCE OF OUR MODEL TRADING PLANS over the LAST WEEK, LAST MONTH, LAST YEAR? Please check for yourself how our pre-published model trades have performed so far! Seeing is believing!)

NOTES - HOW TO INTERPRET/USE THESE TRADING PLANS:

(i) The trading levels identified are derived from our A.I. Powered Quant Models. Depending on the market conditions, these may or may not correspond to any specific indicator(s).

(ii) These trading plans may be used to trade in any instrument that tracks the S&P 500 Index (e.g., ETFs such as SPY, derivatives such as futures and options on futures, and SPX options), triggered by the price levels in the Index. The results of these indicated trades would vary widely depending on the timeframe you use (tick chart, 1 minute, or 5 minute, or 15 minute or 60 minute etc.), the quality of your broker's execution, any slippages, your trading commissions and many other factors.

(iii) These are NOT trading recommendations for any individual(s) and may or may not be suitable to your own financial objectives and risk tolerance - USE these ONLY as educational tools to inform and educate your own trading decisions, at your own risk.

#spx, #spx500, #spy, #sp500, #esmini, #indextrading, #daytrading, #models, #tradingplans, #outlook, #economy, #bear, #yields, #stocks, #futures, #inflation, #recession, #earnings, #usrating, #ratingdowngrade, #usdowngrade, #usratingdowngrade

USDebtCeilingCrisis.ComLet’s make some noise for the 11th hour party people. Bipartisan talks between US President Biden and House Republicans over the debt ceiling crisis have finally come to a resolution. Well, in theory at least since there is the small matter of Congress having to vote on it later this week. US lawmakers might balk at the idea that this is an 11th hour deal since the much touted ‘hard deadline’ of the 1st of June has now moved to the 5th of June. Any chances we could see that pushed forward by a few more days in the event of further brinkmanship during the Congressional vote on the deal?

Make no mistake. Regardless of the real hard deadline before the US technically defaults on its public debt, this will have been an 11th hour deal. The thing with 11th hour deals whether they’re related to business, divorce settlements, ransom/hostage negotiations or drug deals is that they tend to be equally bad for both parties but at least everyone walks away equally disappointed. A deal as critical as the one needed to tackle the debt ceiling crisis should have been done and dusted well before this game of chicken ended in both parties swerving just before the head on collision.

The US debt ceiling issue is a bubble. The limit has been lifted 78 times since 1960 and is quite the magician’s trick. Raising the limit each time a ceiling is reached and then kicking the issue into the long grass until the next time negotiations need to take place is dangerous enough but the way in which this current deal has been tentatively reached has created micro tears in this bubble and only time will tell if the bubble bursts at some point in the not- too-distant future. Even a smooth run through Congress later this week will be short-term relief for markets as the possibility of a crash depends on the extent of any liquidity leaving the system and where exactly that liquidity drain comes from as soon as the US Treasury turns on the T-bill tap to full blast after a confirmed deal.

These are exciting times for FX traders as we trade the bull runs, the bear runs and the crashes. Keep yourself educated and informed at all times. And remember that whenever you go to the market, be careful out there.

BluetonaFX

Will the U.S. default on their debt?eather the US default on their debt or raise their debt ceiling; it’s a bad thing either way for the US Dollar & economy;

US DEFAULTS🩸:

⭕️They fall into a deep recession

⭕️Roughly 7.8 million jobs will be lost

⭕️Unemployment rate doubles to 8%

⭕️Crime rate/poverty increases

⭕️Stocks & Bonds will be sold off/401(K) effected. Financial markets crash

⭕️Social security payments delayed

US RAISES DEBT CEILING💸:

⭕️More money printed out of thin air

⭕️Inflation sores even higher

⭕️Interest Rates keeping getting hiked higher

⭕️More mortgage defaults, so more homes get seized

⭕️Banks hand out less personal/business loans, along with mortgages

⭕️USD strengthens, which is a bad thing as more countries will refuse to do business with them

⭕️More bank failures

As a result, we will see an outflow of institutional investments away from equities, with an inflow of investments into commodities like Gold & Silver.

Navigating The American Debt Ceiling DramaSome people create their own storms. And then get upset when it starts to rain. US Debt Ceiling drama is akin to a soap opera that never ends.

Debt ceiling issue is not new. Why bother now? Political polarisation in the US has got to unprecedented levels. The showmanship could tip over into a political nightmare. It could send economic shockwaves with impact deeply felt both within US and well beyond its shores.

Many politicians seemingly are so pulled away from reality that their fantasies aren’t working. Wishing away a problem out of its existence is not a solution.

The Debt Ceiling is here. US defaulting on its debt is highly unlikely. Scarily though, the probability of that occurrence is non-zero.

This paper looks at recent financial history surrounding prior debt ceiling episodes. Crucially, it delves into investor behaviour and their corresponding investment decisions across various asset classes.

When uncertainty looms large, straddles and spreads arguably deliver optimal hedging and investment outcomes.

A SHORT HISTORY OF DEBT CEILING. WHAT IS IT? HAS IT BEEN BREACHED BEFORE?

The US debt ceiling is a maximum cap set by the Congress on the debt level that can be issued by the US Treasury to fund US Government spending.

The ceiling was first introduced in 1917 to give US Treasury more flexibility to borrow money to fund first world war.

When the US government spends more money than it brings in through taxes and revenues, the US Treasury issues bonds to make up the deficit. The net treasury bond issuance is the US national debt.

Last year, the US Government spent USD 6.27 trillion while only collecting USD 4.9 trillion in revenue. This resulted in a deficit of “only” USD 1.38 trillion which had to be financed through US treasury bond issuance.

This deficit was not an exception. In fact, that’s the norm. The US Government can afford to and has been a profligate borrower. It has run a deficit each year since 2001. In fact, it has had budget surplus ONLY five (5) times in the last fifty (50) years.

If that wasn’t enough, the deficit ballooned drastically from under USD 1 trillion in 2019 to more than USD 3.1 trillion in 2020 and USD 2.7 trillion in 2021 thanks to massive pandemic stimulus programs and tax deferrals.

This pushed the total US national debt to a staggering USD 31.46 trillion, higher than the debt ceiling of USD 31.4 trillion.

The limit was breached! So, what happened when the ceiling was broken?

Not that much actually. When the ceiling is broken into, the US Congress must pass legislation to raise or suspend the ceiling. Congress has raised the ceiling not once but 78 times since 1970.

The decision is usually cross-partisan as the ceiling has been raised under both Republicans and Democrats. It was last raised in 2021 by USD 2.5 trillion to its current level.

Where consensus over raising the ceiling cannot be reached, Congress can also choose to suspend the ceiling as a temporary measure. This was last done from 2019 to 2021.

Since January, the Treasury has had to rely on the Treasury General Account and extraordinary measures to keep the country functioning.

Cash balance at the Treasury remains precariously low. Its operating balance stood close to nearly USD 1 trillion last April but now hovers around USD 200 billion.

Such reckless borrowing! Yet US continues to remain profligate. How?

Global investors have confidence in the US Government's ability to service its debt. Despite the increasing debt, the US Government continues to pay investors interest on its bonds without a miss.

Strong economic growth and its role as a global economic powerhouse assuages investor concerns over a potential default.

Additionally, where Treasury does not have adequate operating cash flow, it leans on a credit line from the Federal Reserve (“Fed”). The dollar’s strength and reserve status contribute to the US Government’s creditworthiness and vice-versa.

The Fed is also the largest holder of US government debt. It holds USD 6.1 trillion as of September 2022 (20% of the overall debt). The share of government debt held by the Fed surged to current levels from just above 10% during the pandemic due to massive purchases of treasury bills by the Fed as an emergency stimulus measure.

GROWING US DEBT IS BECOMING A SOURCE OF CONCERN

US debt has ballooned during the pandemic. It is deeply concerning for multiple reasons. Key among them is the risk of default. Although debt has increased significantly, GDP growth during this period has been tepid due to pandemic restrictions stifling economic activity.

As such the ratio of national debt to GDP, a measure of the US’s ability to pay back its loan has also skyrocketed. This increases the risk that the US Government may fail to service its debt.

A US Government default would lead to surging yields on treasury bonds and crashing stock prices. It would also call into question its creditworthiness limiting future borrowing potential.

A default will also have far-reaching economic consequences threatening dollar hegemony which is already being challenged on multiple fronts.

Another concern is the rising cost of servicing the debt. Servicing the debt is the single largest government expense. Interest payments on debt this year are expected to reach USD 357.1 billion or 6.8% of all government expenditure.

Additionally, with the Fed having raised interest rates with no stated intention of pivoting in 2023, the interest rate on US public debt, which is currently at historical lows, will also rise.

DEBT CEILING BREACH AGAIN. SO WHAT? LOOKING BACK IN TIME FOR ANSWERS.

There has been more than one occasion when political disagreements resulted in Congress delaying the raising of the debt limit.

In 2011, political disagreements pushed the government to the brink of default. The ceiling was raised just two (2) days before the estimated default deadline (the “X-date”).

Despite the raise, S&P lowered its credit rating for the United States from AAA to AA+ reflecting the effects that political disagreements were having on the country’s creditworthiness.

This played out again in 2013 due to same political disagreements. Thankfully, for investors, the effects of the 2013 crisis on financial markets were not as severe.

Flash back. Equity markets initially dropped after the debt ceiling was reached and investors worried that the disagreements would not be resolved in time. In July 2011, markets started to recover as both parties started to work on deficit reduction proposals.

Then on July 25th, just eight (8) days before the borrowing authority of the US would be exhausted, Credit Default Swaps on US debt spiked and the CDS curve inverted as participants feared that a deal would not be reached in time. This led equities sharply lower.

On August 2nd, a bill raising the ceiling was rushed through both the House and the Senate. Following this S&P lowered US credit rating from AAA to AA+ citing uncontrolled debt growth. Equity prices continued to drop even after the passage of the bill.

Commodities showed similar price behaviour heading into the passage of the bill. However, unlike stocks, gold and silver prices rallied after August 2nd.

The USD weakened against other currencies before the passing of the bill but recovered after August 2nd.

Treasury yields trended lower but spiked during key events during this period. Short-term treasury yields remained highly volatile. Following crisis resolution, yields plunged sharply.

US DEBT CEILING CRISIS AGAIN. WHAT NOW IN 2023?

The US reached its debt ceiling again in January 2023 and yet another debt crisis. 2013 is repeating itself again as lawmakers disagree over whether to raise the ceiling further or bring the budget under control.

The Congressional Budget Office (CBO), a non-partisan organization, has estimated that the US could be at a risk of default as early as June 1st.

Republicans disagree with the Biden administration. They seek budget cuts to reduce annual deficits while Democrats want the ceiling to be raised without any conditions tied to it.

This crisis is exacerbated by rising political polarisation in the US. Not just metamorphically, the Republicans and Democrats are at each other’s throat.

A study by the Carnegie Endowment for International Peace found that no established democracy in the recent past has been as polarised as the US is today. This raises the risk that Congress gets into a stalemate.

Moreover, the house is only in session for 12 days in May. After the law is passed in Congress it must also pass through the Senate and the President. The availability of all three overlap on just seven (7) days, the last of which is the 17th of May. This means that lawmakers have just 3 days (from May 12th) to reconcile their differences before the US is put at risk of default.

POSITIONING INVESTMENT PORTFOLIOS IN DEBT CRISIS WITH X-DATE IN SIGHT

What’s X-date? It refers to the date on which the US Government would have exhausted all its options except debt default.

The X-date could arrive as early as June 1st. There is a small chance that it could arrive in late July or early August. The US Government collects tax receipts in mid-June. If the US Treasury can stretch until then it will have enough cash to last another six weeks before knocking against the debt ceiling again.

The current crisis has been brewing. Equity markets remain sanguine. But near-term treasury yields have started panicking. Short term yields have spiked. The difference in yield on Treasury Bills that mature before the likely X-date (23/May) & after it (13/June) has shot up.

Muted equity markets create compelling opportunity for short sellers. In the same vein, it also presents buying opportunities when debt ceiling is eventually lifted.

When up or down is near impossible to predict, an astutely crafted straddle or time spread can save the day.

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

USA $31.4T Debt: How will this affect BTC and Stocks?❗ WARNING ❗ You're about to read an unpopular opinion...

Over the past few days, we've seen bullish price action across nearly all markets. Infact, this is the first time since 2013 that Bitcoin has closed so many green dailies consecutively. This entire market reversal seemed a bit sudden, and many claimed "bull trap". (I'm a believer in the Macro, so when it comes to pure charting without fundamentals, longing was the way to go over the past few days, no argument on this).

However, another interesting this happened today - the U.S. government hit its $31.4 trillion borrowing limit TODAY, amid a standoff between the Republican-controlled House of Representatives and President Joe Biden's Democrats on lifting the ceiling (which could lead to a major economic crisis in a few months). Suddenly, I thought to myself, the entire reversal seems even more suspicious. Now here's my unpopular opinion : What if this is part of an elaborate plan to eliminate some of the debt? The world is dependent on the dollar, if the US financial system is in trouble, so is most of the world. Everything is just too interconnected at this point. Across the giants of investment world, there are rising concerns about unsettling markets and risking a recession. Senate Republican leader Mitch McConnell predicted that the debt ceiling would be lifted sometime in the first half of 2023 under conditions negotiated by Congress and the White House.

According to Reuters, the White House is refusing to negotiate with Republicans on raising the debt ceiling because it believes that the majority of them will eventually back off their demands, as a growing group of investors, business groups and moderate conservatives warn of the dangers of edging towards a default. The high-stakes deadlock is widely expected to last for months, and could come down to the last minute as each side tests the other ahead of June when the U.S. government might be forced to default on paying its debt. A default means being unable to pay. Because U.S. debt is considered the bedrock of the global financial system, due in part to its stability, a default could shake economies across the world. Americans could also face a recession, including higher unemployment, and the stock and bond markets would likely plunge. Today, a government that defaults may be widely excluded from further credit; some of its overseas assets may be seized; and it may face political pressure from its own domestic bondholders to pay back its debt.

Today on Twitter, Elon Musk said openly that even if the government taxes every billionaire by 100%, it wouldn't even make a notable dent. According to him, the only way to make a notable dent in this debt is to tax the citizens even more. But what about the markets, the whales, the insider trading between banks, governments and large corporations ?? Trading markets is a multi trillion dollar industry. To make it more practical, the total value of global equity trading alone was 41.8 trillion U.S. dollars in the third quarter of 2021. We know that the Total cryptocurrency market is currently standing just under 1T. I'm unable to find data on the total worldwide value of the commodity market, if you do please comment below with your source. It is estimated that the total amount of money in the world is a couple of quadrillion. Whatever that means. Suddenly, 30 Trillion seems pale in comparison.

Furthermore, investment options go far beyond just stocks, cryptocurrency and commodities. Some of the other less frequently discussed options include:

1. High-yield savings accounts

2. Certificates of deposit (CDs)

3. Money market funds

4. Government bonds

5. Corporate bonds

6. Mutual funds

7. Index funds

8. Exchange-traded funds (ETFs)

9. Dividend stocks

10. Real estate

Now imagine, scooping off a bit of cream from the top?? You wouldn't need to necessarily wipe out an entire market, but a good 20% to 30% drop across markets and Bob's your uncle ! The money machine carries on until next time it's overspent. Hike interest rates. Increases taxes. Inflation. Liquidate markets. Repeat cycle.

So the point that I'm trying to get at is this - remember tot take profits. Nothing wrong with taking a hedge to manage your risk during these uncertain economic times. I personally won't be surprised if there's some major "news event" that sends the markets into a overnight flashcrash soon. I could be totally wrong, in fact I would prefer to be wrong in this case.

What are your thoughts on this?

_______________________

📢Follow us here on TradingView for daily updates and trade ideas on crypto , stocks and commodities 💎Hit like & Follow 👍

We thank you for your support !

CryptoCheck

Fed pivot indicatorThis chart is essentially proxy for the acceleration rate of interest expense for the US government, and has been a reliable indicator of fed pivot for 30+ years as the fed has ensured the US doesn't enter a debt death spiral.

To keep this line 'inbounds' they need the middle of the curve to fall ~75bp between now and the 24th

Or maybe they'll allow a brief spike above, and given the length of that chart, maybe 'brief' can be a number of months

But as far as what would be normal fed behavior, we're at the tightening limit for interest rates

twitter.com

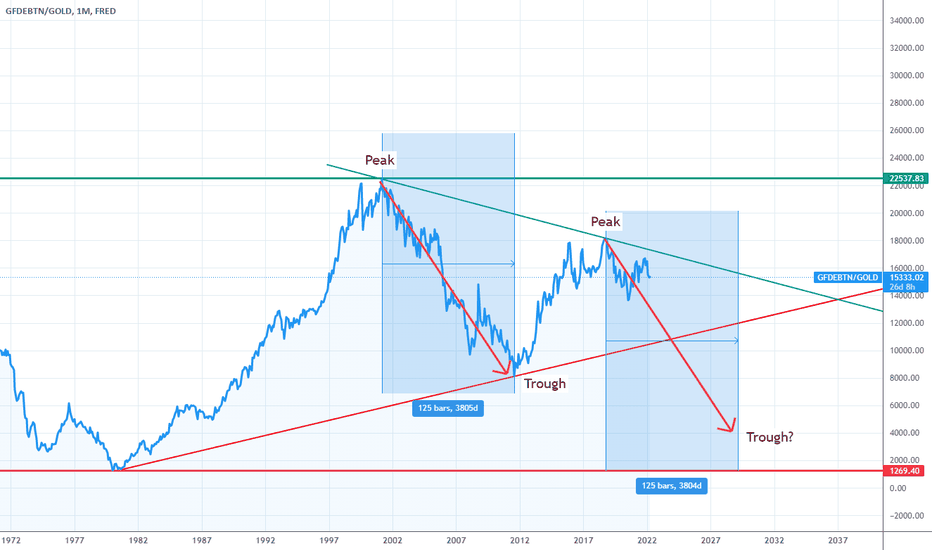

US Debt divided by Gold The US debt to Gold ratio looks to be topping.

The lower this ratio, the more US debt is covered by gold and generally means a rally in the price of gold.

When this ratio breaks the minor diagonal support line, the major support line will be the next target and gold will see gains not seen since the late 1970's.